Académique Documents

Professionnel Documents

Culture Documents

US Internal Revenue Service: F1040as2 - 1996

Transféré par

IRSDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

US Internal Revenue Service: F1040as2 - 1996

Transféré par

IRSDroits d'auteur :

Formats disponibles

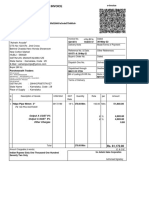

Department of the Treasury—Internal Revenue Service

Schedule 2

(Form 1040A) Child and Dependent Care

(98) Expenses for Form 1040A Filers 1996 OMB No. 1545-0085

Name(s) shown on Form 1040A: First and initial(s) Last Your social security number

- -

You need to understand the following terms to complete this

schedule: Qualifying Person(s), Dependent Care Benefits,

Qualified Expenses, and Earned Income. See Important Terms on

page 51.

Part I Persons or Organizations Who Provided the Care—You MUST complete this part.

(a) Care provider’s (b) Address (number, street, apt. no., (c) Identifying (d) Amount paid

1 name city, state, and ZIP code) number (SSN or EIN) (see page 52)

$ , .

$ , .

(If you need more space, use the bottom of page 2.)

2 Add the amounts in column (d) of line 1. 2$ , .

3 Enter the number of qualifying persons cared for in 1996 ©

No © Complete only Part II below.

Did you receive

dependent care benefits? Yes © Complete Part III on the back now.

Caution: If the care was provided in your home, you may owe employment taxes. See the

instructions for Form 1040A, line 27, on page 27.

Part II Credit for Child and Dependent Care Expenses

4 Enter the amount of qualified expenses you incurred and

paid in 1996. DO NOT enter more than 2,400 for one

qualifying person or 4,800 for two or more persons. If you

completed Part III, enter the amount from line 25. 4 $ , .

5 Enter YOUR earned income. 5 $ , .

6 If married filing a joint return, enter YOUR SPOUSE’S earned

income (if student or disabled, see page 52); all others, enter

the amount from line 5. 6 $ , .

7 Enter the smallest of line 4, 5, or 6. 7$ , .

*6S25AAA1*

8 Enter the amount from Form 1040A, line 17. 8 $ , .

9 Enter on line 9 the decimal amount shown below that applies to the amount on

line 8.

If line 8 is— Decimal If line 8 is— Decimal

But not amount But not amount

Over over is Over over is

$0—10,000 .30 $20,000—22,000 .24

10,000—12,000 .29 22,000—24,000 .23

12,000—14,000 .28 24,000—26,000 .22

14,000—16,000 .27 26,000—28,000 .21

16,000—18,000 .26 28,000—No limit .20

18,000—20,000 .25 9 3.

10 Multiply line 7 by the decimal amount on line 9. Enter the result. Then, see page

53 for the amount of credit to enter on Form 1040A, line 24a. 10 $ , .

For Paperwork Reduction Act Notice, see Form 1040A instructions. Cat. No. 10749I 1996 Schedule 2 (Form 1040A) page 1

1996 Schedule 2 (Form 1040A) page 2

Part III Dependent Care Benefits—Complete this part only if you received these benefits.

11 Enter the total amount of dependent care benefits you received for 1996. This amount

should be shown in box 10 of your W-2 form(s). DO NOT include amounts that were

reported to you as wages in box 1 of Form(s) W-2. 11 $ , .

12 Enter the amount forfeited, if any. See page 53. 12 $ , .

13 Subtract line 12 from line 11. 13 $ , .

14 Enter the total amount of qualified expenses incurred in 1996

for the care of the qualifying person(s). 14 $ , .

15 Enter the smaller of line 13 or 14. 15 $ , .

16 Enter YOUR earned income. 16 $ , .

17 If married filing a joint return, enter YOUR SPOUSE’S earned

income (if student or disabled, see the line 6 instructions); if

married filing a separate return, see the instructions for the

amount to enter; all others, enter the amount from line 16. 17 $ , .

18 Enter the smallest of line 15, 16, or 17. 18 $ , .

19 Excluded benefits. Enter here the smaller of the following:

● The amount from line 18, or

● 5,000 (2,500 if married filing a separate return and you were required to enter your

spouse’s earned income on line 17). 19 $ , .

20 Taxable benefits. Subtract line 19 from line 13. Also, include this amount on Form

1040A, line 7. In the space to the left of line 7, print “DCB.” 20 $ , .

*6S25AAA2*

To claim the child and dependent care credit, complete

lines 21–25 below, and lines 4–10 on the front of this schedule.

21 Enter the amount of qualified expenses you incurred and paid in 1996. DO NOT

include on this line any excluded benefits shown on line 19. 21 $ , .

22 Enter 2,400 (4,800 if two or more qualifying persons). 22 $ , .

23 Enter the amount from line 19. 23 $ , .

24 Subtract line 23 from line 22. If zero or less, STOP. You cannot take the credit.

Exception. If you paid 1995 expenses in 1996, see the line 10 instructions. 24 $ , .

25 Enter the smaller of line 21 or 24 here and on line 4 on the front of this schedule. 25 $ , .

1996 Schedule 2 (Form 1040A) page 2

Vous aimerez peut-être aussi

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsD'Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsPas encore d'évaluation

- US Internal Revenue Service: F1040as2 - 1994Document2 pagesUS Internal Revenue Service: F1040as2 - 1994IRSPas encore d'évaluation

- US Internal Revenue Service: F1040as2 - 1997Document2 pagesUS Internal Revenue Service: F1040as2 - 1997IRSPas encore d'évaluation

- Economic & Budget Forecast Workbook: Economic workbook with worksheetD'EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetPas encore d'évaluation

- US Internal Revenue Service: F1040as2 - 1992Document2 pagesUS Internal Revenue Service: F1040as2 - 1992IRSPas encore d'évaluation

- Schedule 2 Child and Dependent Care Expenses For Form 1040A FilersDocument2 pagesSchedule 2 Child and Dependent Care Expenses For Form 1040A FilersIRSPas encore d'évaluation

- US Internal Revenue Service: f2441 - 1991Document2 pagesUS Internal Revenue Service: f2441 - 1991IRSPas encore d'évaluation

- US Internal Revenue Service: f8863 - 2004Document3 pagesUS Internal Revenue Service: f8863 - 2004IRSPas encore d'évaluation

- F 8863Document2 pagesF 8863Laki RakiPas encore d'évaluation

- Solution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, HigginsDocument2 pagesSolution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, Higginsa882650259Pas encore d'évaluation

- US Internal Revenue Service: f8826 - 2002Document2 pagesUS Internal Revenue Service: f8826 - 2002IRSPas encore d'évaluation

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax Returnmarxvera158Pas encore d'évaluation

- US Internal Revenue Service: f8863 - 2002Document3 pagesUS Internal Revenue Service: f8863 - 2002IRSPas encore d'évaluation

- US Internal Revenue Service: f6251 - 1996Document1 pageUS Internal Revenue Service: f6251 - 1996IRSPas encore d'évaluation

- US Internal Revenue Service: f6251 - 1997Document2 pagesUS Internal Revenue Service: f6251 - 1997IRSPas encore d'évaluation

- Complete A Separate Part III On Page 2 For Each Student For Whom You're Claiming Either Credit Before You Complete Parts I and IIDocument2 pagesComplete A Separate Part III On Page 2 For Each Student For Whom You're Claiming Either Credit Before You Complete Parts I and IIYum BuckerPas encore d'évaluation

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnPas encore d'évaluation

- Additional Child Tax Credit: Schedule 8812Document1 pageAdditional Child Tax Credit: Schedule 8812Ishfaq Ali KhanPas encore d'évaluation

- US Internal Revenue Service: f8861 - 2002Document3 pagesUS Internal Revenue Service: f8861 - 2002IRSPas encore d'évaluation

- US Internal Revenue Service: f8826 - 2000Document2 pagesUS Internal Revenue Service: f8826 - 2000IRSPas encore d'évaluation

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)api-173610472Pas encore d'évaluation

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipPas encore d'évaluation

- US Internal Revenue Service: f8826 - 1991Document2 pagesUS Internal Revenue Service: f8826 - 1991IRSPas encore d'évaluation

- Additional Child Tax Credit: Schedule 8812Document1 pageAdditional Child Tax Credit: Schedule 8812Jack MiguelPas encore d'évaluation

- AdamDocument2 pagesAdamtnt4101Pas encore d'évaluation

- US Internal Revenue Service: f6251 - 2000Document2 pagesUS Internal Revenue Service: f6251 - 2000IRSPas encore d'évaluation

- US Internal Revenue Service: f5884 - 2003Document3 pagesUS Internal Revenue Service: f5884 - 2003IRSPas encore d'évaluation

- U.S. Individual Income Tax Return 1040A: Filing StatusDocument3 pagesU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyPas encore d'évaluation

- US Internal Revenue Service: f5884 - 2002Document3 pagesUS Internal Revenue Service: f5884 - 2002IRSPas encore d'évaluation

- US Internal Revenue Service: f6251 - 1995Document1 pageUS Internal Revenue Service: f6251 - 1995IRSPas encore d'évaluation

- US Internal Revenue Service: f8874 - 2003Document3 pagesUS Internal Revenue Service: f8874 - 2003IRSPas encore d'évaluation

- US Internal Revenue Service: f8859 - 1997Document2 pagesUS Internal Revenue Service: f8859 - 1997IRSPas encore d'évaluation

- US Internal Revenue Service: f8884 - 2003Document4 pagesUS Internal Revenue Service: f8884 - 2003IRSPas encore d'évaluation

- 2021 Form 1040-NRDocument2 pages2021 Form 1040-NRvalentynad74Pas encore d'évaluation

- US Internal Revenue Service: f8826 - 1992Document2 pagesUS Internal Revenue Service: f8826 - 1992IRSPas encore d'évaluation

- US Internal Revenue Service: f8882 - 2003Document3 pagesUS Internal Revenue Service: f8882 - 2003IRSPas encore d'évaluation

- Resume of Srpeak4Document2 pagesResume of Srpeak4api-25647173Pas encore d'évaluation

- US Internal Revenue Service: f8826 - 1999Document2 pagesUS Internal Revenue Service: f8826 - 1999IRSPas encore d'évaluation

- Installment Agreement RequestDocument2 pagesInstallment Agreement Request0scarPas encore d'évaluation

- US Internal Revenue Service: f8801 - 2001Document4 pagesUS Internal Revenue Service: f8801 - 2001IRSPas encore d'évaluation

- US Internal Revenue Service: f8861 - 1998Document3 pagesUS Internal Revenue Service: f8861 - 1998IRSPas encore d'évaluation

- US Internal Revenue Service: f8815 - 1996Document2 pagesUS Internal Revenue Service: f8815 - 1996IRSPas encore d'évaluation

- Sample Tax Return Robb Stark:: Robb's Swarthmore Account Information: 2012 13 2013 14Document5 pagesSample Tax Return Robb Stark:: Robb's Swarthmore Account Information: 2012 13 2013 14Andrew BookerPas encore d'évaluation

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changesgolcha_edu532Pas encore d'évaluation

- BilndDocument3 pagesBilndxabehe6146Pas encore d'évaluation

- US Internal Revenue Service: f8844Document4 pagesUS Internal Revenue Service: f8844IRSPas encore d'évaluation

- US Internal Revenue Service: f8815 - 1993Document2 pagesUS Internal Revenue Service: f8815 - 1993IRSPas encore d'évaluation

- f1040x PDFDocument2 pagesf1040x PDFAlexPas encore d'évaluation

- US Internal Revenue Service: f8814 - 1997Document2 pagesUS Internal Revenue Service: f8814 - 1997IRSPas encore d'évaluation

- US Internal Revenue Service: f8844 - 1994Document3 pagesUS Internal Revenue Service: f8844 - 1994IRSPas encore d'évaluation

- US Internal Revenue Service: f8861 - 2003Document3 pagesUS Internal Revenue Service: f8861 - 2003IRSPas encore d'évaluation

- F 1040 NRDocument5 pagesF 1040 NRsrao_919525Pas encore d'évaluation

- Income Tax Return For Single and Joint Filers With No Dependents LabelDocument2 pagesIncome Tax Return For Single and Joint Filers With No Dependents LabelNEKROPas encore d'évaluation

- US Internal Revenue Service: f8801 - 2000Document4 pagesUS Internal Revenue Service: f8801 - 2000IRSPas encore d'évaluation

- Empowerment Zone and Renewal Community Employment Credit: OMB No. 1545-1444 FormDocument4 pagesEmpowerment Zone and Renewal Community Employment Credit: OMB No. 1545-1444 FormIRSPas encore d'évaluation

- US Internal Revenue Service: f8845 - 1997Document3 pagesUS Internal Revenue Service: f8845 - 1997IRSPas encore d'évaluation

- 941 1st QTR 2010Document2 pages941 1st QTR 2010Larry BartonPas encore d'évaluation

- US Internal Revenue Service: f8801 - 1999Document4 pagesUS Internal Revenue Service: f8801 - 1999IRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSPas encore d'évaluation

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSPas encore d'évaluation

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Lecture 3 Quiz - SchoologyDocument4 pagesLecture 3 Quiz - Schoologylinkin soy0% (1)

- GHFHDocument8 pagesGHFHnicahPas encore d'évaluation

- Pay Slip - 604316 - Nov-22Document1 pagePay Slip - 604316 - Nov-22ArchanaPas encore d'évaluation

- I 1040Document214 pagesI 1040Brian GohackiPas encore d'évaluation

- HotelTaxInvoice HTL4U9YDNA PDFDocument2 pagesHotelTaxInvoice HTL4U9YDNA PDFNandani PatelPas encore d'évaluation

- Lecture 3 EstateDocument21 pagesLecture 3 EstateYanPing AngPas encore d'évaluation

- Salary Slip OctDocument1 pageSalary Slip OctJoshua GarrettPas encore d'évaluation

- W2 Hyatt PLaceDocument5 pagesW2 Hyatt PLaceJuan Diego Velandia DuartePas encore d'évaluation

- Formst 1Document3 pagesFormst 1arulantonyPas encore d'évaluation

- TAXATION 2 Chapter 13 Input VATDocument2 pagesTAXATION 2 Chapter 13 Input VATKim Cristian MaañoPas encore d'évaluation

- CombinepdfDocument19 pagesCombinepdfYashodhaPas encore d'évaluation

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaPas encore d'évaluation

- Consolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Document8 pagesConsolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Renjie XuPas encore d'évaluation

- MCIA-Rules 2017Document58 pagesMCIA-Rules 2017geniusganyPas encore d'évaluation

- Invoice 7101329Document1 pageInvoice 7101329pari maheshwariPas encore d'évaluation

- Rutendo KamukonoDocument3 pagesRutendo KamukonoHazel ChatsPas encore d'évaluation

- Annual Premium Statement: Naresh KumarDocument1 pageAnnual Premium Statement: Naresh Kumarnaresh29122Pas encore d'évaluation

- K S Hegde Hospital 5th Dec BillDocument1 pageK S Hegde Hospital 5th Dec BillJonty ArputhemPas encore d'évaluation

- City of Pasig V RepDocument1 pageCity of Pasig V Repcha chaPas encore d'évaluation

- W 2Document1 pageW 2Raj SharmaPas encore d'évaluation

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomPas encore d'évaluation

- Income From House PropertyDocument3 pagesIncome From House PropertySneha PotekarPas encore d'évaluation

- Pay Slip Components: Australian Concert and Entertainment Security Pty LTDDocument2 pagesPay Slip Components: Australian Concert and Entertainment Security Pty LTDGaro KhatcherianPas encore d'évaluation

- Solved April Company Has Five Salaried Employees Your Task Is To PDFDocument1 pageSolved April Company Has Five Salaried Employees Your Task Is To PDFAnbu jaromiaPas encore d'évaluation

- Accounting Voucher 1Document1 pageAccounting Voucher 1Sadiq SultanPas encore d'évaluation

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZAPas encore d'évaluation

- Chapter 16 Practice Problems Solution Manual 2020Document29 pagesChapter 16 Practice Problems Solution Manual 2020James SeelosPas encore d'évaluation

- ACCA ATX Paper Sep 2018Document16 pagesACCA ATX Paper Sep 2018Dilawar HayatPas encore d'évaluation

- IIT-D EV BrochureDocument2 pagesIIT-D EV BrochureKarthick FerruccioPas encore d'évaluation

- 2Document2 pages2Sayantan BhattacharyaPas encore d'évaluation