Académique Documents

Professionnel Documents

Culture Documents

US Internal Revenue Service: I1045 - 1995

Transféré par

IRSDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

US Internal Revenue Service: I1045 - 1995

Transféré par

IRSDroits d'auteur :

Formats disponibles

Processing the Application

Department of the Treasury The IRS will process this application

Internal Revenue Service within 90 days from the later of:

● The date you file the complete

Instructions for Form 1045 application; or

● The last day of the month that

includes the due date (including

Application for Tentative Refund extensions) for filing your 1995 income

tax return (or, for a claim of right

Section references are to the Inter nal Revenue Code unless otherwise noted. adjustment, the date of the overpayment

under section 1341(b)(1)).

Paperwork Reduction When To File Before processing certain cases

involving abusive tax shelter promotions

Act Notice File Form 1045 within 1 year after the

end of the year in which the NOL,

and before paying refunds, the IRS will

We ask for the information on this form reduce refunds of investors when

unused credit, or claim of right appropriate, and will offset deficiencies

to carry out the Internal Revenue laws of adjustment occurred, but only on or

the United States. You are required to assessed under provisions of section

after the date you file your 1995 return. 6213(b)(3) against scheduled refunds

give us the information. We need it to When an NOL carryback eliminates or

ensure that you are complying with resulting from tentative carryback

reduces a general business credit in an adjustments under section 6411(b). See

these laws and to allow us to figure and earlier year, you may be able to carry

collect the right amount of tax. Rev. Proc. 84-84, 1984-2 C.B. 782 and

back the released credit 3 more years. Rev. Rul. 84-175, 1984-2 C.B. 296.

The time needed to complete and file See section 39 and the instructions for

this form will vary depending on The processing of Form 1045 and the

Form 3800, General Business Credit, for payment of the refund requested does

individual circumstances. The estimated more details on credit carrybacks.

average time is: not mean the IRS has accepted the

If you carry back the unused credit to items carried back to previous years as

Recordkeeping 26 min. tax years before the 3 years preceding correct. If it is later determined from an

Learning about the the 1995 tax year, use a second Form examination of the tax return for the

law or the form 31 min. 1045 for the earlier year(s). Also, file the year of the carryback that the claimed

second application within 1 year after deductions or credits are due to an

Preparing the form 6 hr., 57 min. the 1995 tax year. To expedite overstatement of the value of property,

Copying, assembling, processing, file the two Forms 1045 negligence, disregard of rules, or

and sending the together. substantial understatement of income

form to the IRS 58 min. tax, you may have to pay penalties. Any

If you have comments concerning the Where To File additional tax will also generate interest

accuracy of these time estimates or compounded daily.

File Form 1045 with the Internal

suggestions for making this form We may need to contact you or your

Revenue Service Center where you are

simpler, we would be happy to hear from authorized representative (for example,

required to file your 1995 income tax

you. You can write to the Tax Forms your accountant or tax return preparer)

return.

Committee, Western Area Distribution for more information so we can process

Center, Rancho Cordova, CA Caution: Do not mail Form 1045 with

your 1995 income tax return. your application. If you want to

95743-0001. DO NOT send the form to designate a representative for us to

this address. Instead, see Where To File contact, attach a copy of your

below. What To Attach

authorization to Form 1045. For this

Attach copies of the following, if purpose, you may use Form 2848,

General Instructions applicable, to Form 1045 for the year of

the loss or credit:

Power of Attorney and Declaration of

Representative.

Purpose of Form ● If you are an individual, pages 1 and 2

of your 1995 Form 1040, and Schedules Disallowance of the

Form 1045 is used by an individual, A and D (Form 1040).

estate, or trust, to apply for: ● All Schedules K-1 you received from Application

● A quick refund of taxes from the partnerships, S corporations, estates, or This application for a tentative carryback

carryback of a net operating loss (NOL) trusts that contribute to the loss or adjustment is not a claim for credit or

or an unused general business credit. credit carryback. refund. Any application may be

● A quick refund of taxes from an ● Any application for extension of time disallowed if it has material omissions or

overpayment of tax due to a claim of to file your 1995 income tax return. math errors that cannot be corrected

right adjustment under section ● All Forms 8271, Investor Reporting of within the 90-day period. If it is

1341(b)(1). Tax Shelter Registration Number, disallowed in whole or in part, no suit

Note: An NOL may be carried back 3 attached to your 1995 return. may be brought in any court for the

years and forward 15 years. However, recovery of that tax. But you may file a

● Any other form or schedule from

you may elect to carry forward a 1995 regular claim for credit or refund before

which the carryback results, such as

NOL instead of first carrying it back by the limitation period expires, as

Schedule C or F (Form 1040), or Form

attaching a statement to that effect to explained on page 2 under Form 1040X

3468, Form 3800, etc.

your 1995 tax return filed on or before or Other Amended Return.

● All forms or schedules for items

the due date (including extensions).

refigured in the carryback years, such as

Once you make the election, it is

Form 6251 or Form 3468. Excessive Allowances

irrevocable and the carryforward is Any amount applied, credited, or

limited to 15 years. Be sure to attach all required forms

listed above, and complete all lines on refunded based on this application that

Form 1045 that apply to you. the IRS later determines to be excessive

Otherwise, your application may be may be billed as if it were due to a math

disallowed. or clerical error on the return.

Cat. No. 13666W

Form 1040X or Other computing the NOL deduction. See Pub. This includes:

Amended Return 536 for the special rules. Attach a ● The special allowance for passive

computation showing how you figured activity losses from rental real estate

Individuals can get a refund by filing the carryback. activities.

Form 1040X, Amended U.S. Individual ● Taxable social security benefits.

Income Tax Return, instead of Form Line 1b—Carryback of ● IRA deductions.

1045. An estate or trust may file an

amended Form 1041, U.S. Income Tax Unused General Business ● Excludable savings bond interest.

Return for Estates and Trusts. Generally, Credit ● Medical expenses.

you must file an amended return no later If you claim a tentative refund based on ● Personal casualty and theft losses.

than 3 years after the due date of the the carryback of this credit, attach a ● Miscellaneous deductions subject to

return for the applicable tax year. detailed computation showing how you the 2% limit.

If you use Form 1040X or other figured the credit carryback, and a ● Itemized deductions subject to the

amended return, follow the instructions recomputation of the credit after you overall limit of section 68.

for that return. Attach a computation of apply the carryback. Make the ● The phaseout of the deduction for

your NOL on Schedule A (Form 1045) recomputation on Form 3800 for the tax personal exemptions.

and, if applicable, your NOL carryover year of the tentative allowance. However, figure your charitable

on Schedule B (Form 1045). Complete a If you filed a joint return (or separate contributions deduction without regard

separate Form 1040X or other amended return) for some but not all of the tax to any NOL carryback.

return for each year for which you years involved in figuring the unused Any credits based on or limited by the

request an adjustment. credit carryback, special rules apply in tax must be refigured using the tax

The procedures for Form 1040X differ computing the carryback. See the liability as determined after you apply

from those for Form 1045. The IRS is Instructions for Form 3800. Attach a the NOL carryback.

not required to process your Form computation showing how you figured See Pub. 536 for more information

1040X within 90 days. However, if we do the carryback. and examples.

not process it within 6 months from the

date you file it, you may file suit in court. Line 2a—Tax Year

If we disallow your claim on Form Line 11—Net Operating Loss

1040X, you must file suit no later than 2 If the year of the loss, unused credit, or Deduction After Carryback

years after the date we disallow it. overpayment under section 1341(b)(1) is

other than the calendar year 1995, enter In column (b), enter as a positive

the required information. number the NOL from Schedule A, page

Additional Information 2, line 25. If the NOL is not fully

For more details on net operating losses, absorbed in the 3rd preceding year, first

Line 9 complete Schedule B on page 3. Then,

get Pub. 536, Net Operating Losses.

If an NOL carryback eliminates or on line 11, column (d), enter the NOL

reduces a prior year foreign tax credit, deduction from Schedule B, line 1,

Specific Instructions you cannot use Form 1045 to carry the column (b). In column (f), enter the NOL

released foreign tax credits to earlier deduction from Schedule B, line 1,

Address years. Also, if the released foreign tax column (c).

P.O. box.—If your post office does not credits cause the release of general

deliver mail to your home or office and business credits, you cannot use Form Line 13—Deductions

you have a P.O. box, show your box 1045 to carry the released general

business credits to earlier years. Instead, Individuals.—For columns (a), (c), and

number instead of your home or office (e), enter the amount shown on, or as

address. file Form 1040X or other amended return

to claim refunds for those years. For previously adjusted for, Form 1040, line

Foreign address.—If your address is 34. If you used Form 1040A, enter the

outside the United States or its details, see Rev. Rul. 82-154, 1982-2

C.B. 394. amount from line 19. If you used Form

possessions or territories, enter the 1040EZ, enter the amount from line 4

information on the line for “City, town or (line 5 in 1993) if you checked the “Yes”

post office, state, and ZIP code” in the Lines 10 through 28— box. If you checked the “No” box for

following order: city, province or state, Computation of Decrease in 1992, enter $3,600. If you checked the

and the name of the country. Do not Tax “No” box for 1993, enter $3,700 if single

abbreviate the country name. Include the ($6,200 if married). If you checked the

postal code where appropriate. Enter in columns (a), (c), and (e) the “No” box for 1994, enter $3,800 if single

amounts for the applicable carryback ($6,350 if married).

Line 1a—Net Operating Loss year as shown on your original or

amended return. If the return was

Figure your net operating loss (NOL) on examined, enter the amounts Line 17—Income Tax

Schedule A, page 2. determined as a result of the For columns (b), (d), and (f), refigure your

You must carry the entire NOL back to examination. tax after taking into account the NOL

the 3rd tax year before the loss. Any Computation of deductions, credits, carryback. Include on this line any tax

loss not used in the 3rd year is carried and taxes when the NOL is fully from Forms 4970 and 4972. Attach an

to the 2nd, and then the 1st preceding absorbed.—In refiguring your tax for the explanation of the method used to figure

year. Any loss not applied in the 3 year to which the NOL is carried and your tax and, if necessary, a detailed

preceding years can be carried forward fully absorbed, any income or other computation. For example, write “Tax

up to 15 years. Special rules apply to deduction based on, or limited to, a Rate Schedule—1992” if that is the

the part of an NOL related to any percentage of your adjusted gross method used for that year. You do not

specified liability loss, including product income generally must be refigured on need to attach a detailed computation of

liability losses. See section 172(b)(1)(C) the basis of your adjusted gross income the tax in this case.

for details. determined after you apply the NOL

If you filed a joint return (or a separate carryback.

return) for some but not all of the tax

years involved in figuring the NOL

carryback, special rules apply in

Page 2

Line 18—General Business Schedule A—Net ● Gain on the sale or exchange of

business real estate or depreciable

Credit Operating Loss (NOL) property.

In columns (b), (d), and (f), enter the total Complete and file this schedule to ● Your share of business income from a

of the recomputed general business determine the amount of your NOL that partnership or an S corporation.

credits. Attach all Forms 3800 used to is available for carryback or carryover. For more details on business and

redetermine the amount of general nonbusiness income and deductions,

business credit.

Line 9—Nonbusiness see Pub. 536.

Line 19—Other Credits Deductions

See your tax return for the carryback These are deductions that are not Schedule B—Net

year for any additional credits such as connected with a trade or business. Operating Loss

the earned income credit, credit for child They include the following:

and dependent care expenses, credit for ● IRA deduction. Carryover

the elderly or the disabled, foreign tax ● Deduction for payments on behalf of a Complete and file this schedule to

credit, etc., that will apply in that year. If self-employed individual to a Keogh determine the amount of your net

there is an entry on this line, identify the retirement plan or a simplified employee operating loss deduction for each

credit(s) claimed. pension (SEP) plan. carryback year and the amount to be

● Self-employed health insurance carried forward if not fully absorbed in

Line 22—Recapture Taxes deduction. the carryback years.

● Alimony. If your NOL is more than the taxable

Enter the amount shown on your Form income of the earliest year to which it is

1040, line 49. ● Itemized deductions are usually

nonbusiness, except for casualty and carried, you must figure the amount of

theft losses, and any employee business the NOL that is to be carried to the next

Line 23—Alternative tax year. The amount of the NOL you

expenses.

Minimum Tax ● Standard deduction if you do not

may carry to the next year, after

A carryback of an NOL may affect your applying it to an earlier year(s), is the

itemize. excess, if any, of the NOL carryback

alternative minimum tax. Use Form 6251 Do not enter business deductions on

to figure this tax, and attach a copy if over the modified taxable income of

line 9. These are deductions that are that earlier year. Modified taxable

there is any change to your alternative connected with a trade or business.

minimum tax liability. income is the amount figured on line 7

They include the following: of Schedule B.

● State income tax on business profits. Note: If you carry two or more NOLs to

Line 24—Self-Employment ● Moving expenses. a tax year, you must deduct them, when

Tax ● Deduction for one-half of figuring modified taxable income, in the

Do not adjust the self-employment tax self-employment tax. order in which they were incurred. First,

because of any carryback. ● Rental losses. deduct the NOL from the earliest year,

● Loss on the sale or exchange of then the NOL from the next earliest year,

Line 25—Other Taxes business real estate or depreciable and so on. After you deduct each NOL,

property. there will be a new, lower total for

See your tax return for the carryback modified taxable income to compare

year for any other taxes not mentioned ● Your share of a business loss from a

partnership or an S corporation. with any remaining NOL.

above, such as tax on an IRA, that will

apply in that year. If there is an entry on ● Ordinary loss on the sale or exchange

this line, identify the taxes that apply. of section 1244 (small business) stock. Line 2

● Ordinary loss on the sale or exchange The NOL carryback from the 1995 tax

Line 29—Overpayment of of stock in a small business investment year or any later tax year is not allowed.

company operating under the Small However, net operating losses, otherwise

Tax Under Section 1341(b)(1) Business Investment Act of 1958. allowable as carrybacks or

If you apply for a tentative refund based ● Loss from the sale of accounts carryforwards, occurring in tax years

on an overpayment of tax under section receivable if such accounts arose under before 1995, are taken into account in

1341(b)(1), enter it on this line. Also, the accrual method of accounting. figuring the modified taxable income for

attach a computation that shows the ● If you itemized your deductions, the earlier year.

information required in Regulations casualty and theft losses are business

section 5.6411-1(d). deductions even if they involve Line 4—Adjustments to

Signature

nonbusiness property. Employee Adjusted Gross Income

business expenses such as union dues,

If you entered an amount on line 3, you

Individuals.—Sign and date Form 1045. uniforms, tools, and educational

must refigure certain income and

If Form 1045 is filed jointly, both expenses are also business deductions.

deductions based on adjusted gross

spouses must sign. income. These are:

Estates.—All executors or Line 10—Nonbusiness ● The special allowance for passive

administrators must sign and date Form Income Other Than Capital activity losses from rental real estate

1045. activities.

Trusts.—The fiduciary or an authorized

Gains

This is income that is not from a trade or ● Taxable social security benefits.

representative must sign and date Form

business. Examples are dividends, ● IRA deductions.

1045.

annuities, and interest on investments. ● Excludable savings bond interest.

Do not enter business income on For purposes of figuring the

line 10. This is income from a trade or adjustment to each of these items, your

business and includes the following: adjusted gross income is increased by

● Salaries and wages. the amount on line 3. Do not take into

● Rental income. account your 1995 NOL carryback.

Generally, figure the adjustment to each

Page 3

item of income or deduction in the order recomputed deductions and losses from line 4 of Schedule B, do not use the

listed above and, when figuring the the deductions and losses previously amount on line 19 as your adjusted

adjustment to each subsequent item, claimed, and enter the difference on gross income for refiguring charitable

increase adjusted gross income by the line 5, Schedule B of Form 1045. contributions. Instead, figure adjusted

total adjustments you figured for the Modified adjusted gross income. For gross income as follows:

previous items. However, a special rule purposes of figuring miscellaneous 1. Figure the adjustment to each item

applies if you received social security itemized deductions subject to the 2% that affects and is based on adjusted

benefits AND deducted IRA limit, modified adjusted gross income is gross income in the same manner as

contributions. Use the worksheets in figured by adding the following amounts explained in the instructions for line 4 of

Pub. 590, Individual Retirement to the adjusted gross income previously Schedule B, except do not take into

Arrangements (IRAs), to refigure your used to figure these deductions: account any NOL carrybacks when

taxable social security benefits and IRA 1. The amount from line 3, Schedule B figuring adjusted gross income. Attach a

deductions under the special rule. of Form 1045, and computation showing how the

Enter on line 4 the total adjustments 2. The exemption amount from Form adjustments were figured.

made to the listed items. Attach a 1041, line 20. 2. Add lines 3, 9, and 18 of Schedule

computation showing how the For purposes of figuring casualty or B to the total adjustments you figured in

adjustments were figured. theft losses, modified adjusted gross 1 above. Use the result as your adjusted

income is figured by adding the amount gross income for refiguring charitable

Line 5—Adjustment to from line 3, Schedule B of Form 1045, to contributions.

Itemized Deductions the adjusted gross income previously For net operating loss carryover

used to figure these losses. purposes, you must reduce any

Individuals.—Skip this line if, for all 3 contributions carryover to the extent

preceding years, you did not itemize your net operating loss carryover on

deductions or line 3 is zero or blank. Line 8—Net Operating Loss

line 8 is increased by any adjustment

Otherwise, complete lines 9 through 33 Carryover made to charitable contributions.

and enter the amount from line 33, or Enter the amounts from line 8, columns

line 12 of the worksheet below,

whichever applies, on line 5.

(a) and (b), on line 1, columns (b) and (c), Line 33

respectively. Carry forward to 1996 the

Estates and trusts.—Recompute the amount on line 8, column (c). If Schedule B (Form 1045), line 11, is

miscellaneous itemized deductions more than $105,250 for 1992 ($52,625 if

deducted on Form 1041, line 15b, and married filing separately), more than

any casualty or theft losses claimed on

Line 20 $108,450 for 1993 ($54,225 if married

Form 4684, line 18, by substituting If, for any of the preceding years, you filing separately), or more than $111,800

modified adjusted gross income (see entered an amount other than zero on for 1994 ($55,900 if married filing

below) for the adjusted gross income of line 18 and you had any items of income separately), complete the worksheet

the estate or trust. Subtract the or deductions based on adjusted gross below.

income and listed in the instructions for

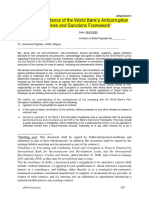

Itemized Deductions Limitation Worksheet—See the Line 33 Instructions (keep for your records)

1992 1993 1994

1. Add the amounts from Schedule B (Form 1045),

lines 14, 20, 25, and 30, and the amounts from

Schedule A (Form 1040), lines 8, 12, 18, and 25;

(lines 9, 14, 27, and 28 for 1994)

2. Add Schedule B (Form 1045), lines 14 and 25;

Schedule A (Form 1040), line 11 (line 13 for 1994);

and any gambling losses included on Schedule A

(Form 1040), line 25 (line 28 for 1994)

3. Subtract line 2 from line 1. If the result is zero or

less, STOP HERE; enter the amount from line 33

of Schedule B (Form 1045) on line 5 of Schedule

B (Form 1045)

4. Multiply line 3 by 80% (.80)

5. Enter the amount from Schedule B (Form 1045),

line 11

6. Enter $105,250 for 1992 ($52,625 if married filing

separately); $108,450 for 1993 ($54,225 if married

filing separately); $111,800 for 1994 ($55,900 if

married filing separately)

7. Subtract line 6 from line 5

8. Multiply line 7 by 3% (.03)

9. Enter the smaller of line 4 or line 8

10. Subtract line 9 from line 1

11. Total itemized deductions from Schedule A (Form

1040), line 26 (line 29 for 1994) (or as previously

adjusted)

12. Subtract line 10 from line 11. Enter difference here

and on line 5 of Schedule B (Form 1045)

Printed on recycled paper

Page 4

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Criminal Time Track - ScientologyDocument112 pagesCriminal Time Track - ScientologyBridget HuntPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Articles of Incorporation TemplateDocument2 pagesArticles of Incorporation TemplatePaola Morales100% (1)

- Circular On Action Plan For Updation of Changes in Webland For Freehold of Assigned LandsDocument4 pagesCircular On Action Plan For Updation of Changes in Webland For Freehold of Assigned LandsKiranmai Nallapu100% (4)

- Powell Recording About More Than Email. Roswell Daily Record. 09.09.12.Document2 pagesPowell Recording About More Than Email. Roswell Daily Record. 09.09.12.Michael CorwinPas encore d'évaluation

- Cases On Vicarious LiabilityDocument21 pagesCases On Vicarious LiabilityDavid Adeabah Osafo100% (2)

- Lopez RealtyDocument5 pagesLopez RealtyGhee MoralesPas encore d'évaluation

- Letter of Acceptance PDFDocument3 pagesLetter of Acceptance PDFZahidur RahmanPas encore d'évaluation

- LTFRB PUJ Extension PetitionDocument7 pagesLTFRB PUJ Extension PetitionDiazPas encore d'évaluation

- Camitan vs. FidelityDocument2 pagesCamitan vs. FidelityPMV50% (2)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSPas encore d'évaluation

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSPas encore d'évaluation

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSPas encore d'évaluation

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSPas encore d'évaluation

- Crim I DigestsDocument7 pagesCrim I DigestsBinkee VillaramaPas encore d'évaluation

- Karnataka Lifts Act, 1974Document9 pagesKarnataka Lifts Act, 1974Latest Laws TeamPas encore d'évaluation

- Resume of 9/11 Commission Staffer Barbara GreweDocument3 pagesResume of 9/11 Commission Staffer Barbara Grewe9/11 Document ArchivePas encore d'évaluation

- Sample Offer Letter TemplateDocument2 pagesSample Offer Letter TemplaterustamhasbullahPas encore d'évaluation

- Ciron Vs Guttierez PDFDocument15 pagesCiron Vs Guttierez PDFAnonymous F8TfwgnhPas encore d'évaluation

- Grama Sabhaward Sabha of Special Categories - Operational ManualDocument66 pagesGrama Sabhaward Sabha of Special Categories - Operational Manualy220285Pas encore d'évaluation

- Distribution of Legislative Powers Between Union and States in IndiaDocument9 pagesDistribution of Legislative Powers Between Union and States in IndiaÁdàrsh MéhèrPas encore d'évaluation

- Special Power of Attorney Know All Men by These PresentsDocument1 pageSpecial Power of Attorney Know All Men by These PresentsRochelle VelezPas encore d'évaluation

- 4Document48 pages4Amanda HernandezPas encore d'évaluation

- Property Aug 17, 2015 DigestDocument5 pagesProperty Aug 17, 2015 DigestJacquelyn AlegriaPas encore d'évaluation

- seizureDocument10 pagesseizureTin Tin0% (1)

- Lesson 5: Spot/Check/ Accosting and ProceduresDocument46 pagesLesson 5: Spot/Check/ Accosting and ProceduresPaolo MercadoPas encore d'évaluation

- Chapter 2 - Subsidiary LegislationDocument34 pagesChapter 2 - Subsidiary LegislationAnonymous F3chS82LPas encore d'évaluation

- Definition and FeaturesDocument4 pagesDefinition and FeaturesnayakPas encore d'évaluation

- 27Document1 page27mumbai khabarPas encore d'évaluation

- International Sponsorship AgreementDocument27 pagesInternational Sponsorship AgreementKennethAwoonor-RennerPas encore d'évaluation

- CA affirms RTC ruling ordering MIAA to refund DPRC excess rental paymentsDocument10 pagesCA affirms RTC ruling ordering MIAA to refund DPRC excess rental paymentsSheraina GonzalesPas encore d'évaluation

- Legal Chart Prabhu231082010Document18 pagesLegal Chart Prabhu231082010vakilarunPas encore d'évaluation

- ISIS Position PaperDocument3 pagesISIS Position Paperdharmoo123Pas encore d'évaluation

- Reorganizing National Space Development SystemDocument172 pagesReorganizing National Space Development SystemGEORGE ANTHONY LOAYZA ZU�IGAPas encore d'évaluation

- Permission Slip - Halloween Night PartyDocument1 pagePermission Slip - Halloween Night Partyapi-3102338Pas encore d'évaluation