Académique Documents

Professionnel Documents

Culture Documents

US Internal Revenue Service: I8390 - 1993

Transféré par

IRS0 évaluation0% ont trouvé ce document utile (0 vote)

18 vues2 pagesThe time needed to complete and file this form will vary depending on individual circumstances. If two or more mutual companies own at least 80% of the stock of a single life insurance company, each mutual company must include its share of each item from the subsidiary. Any life insurance company failing to file on time or provide all information requested may be subject to penalties under section 7203 and other penalties.

Description originale:

Titre original

US Internal Revenue Service: i8390--1993

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe time needed to complete and file this form will vary depending on individual circumstances. If two or more mutual companies own at least 80% of the stock of a single life insurance company, each mutual company must include its share of each item from the subsidiary. Any life insurance company failing to file on time or provide all information requested may be subject to penalties under section 7203 and other penalties.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

18 vues2 pagesUS Internal Revenue Service: I8390 - 1993

Transféré par

IRSThe time needed to complete and file this form will vary depending on individual circumstances. If two or more mutual companies own at least 80% of the stock of a single life insurance company, each mutual company must include its share of each item from the subsidiary. Any life insurance company failing to file on time or provide all information requested may be subject to penalties under section 7203 and other penalties.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

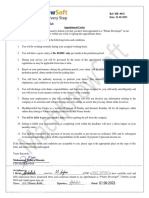

Department of the Treasury

Internal Revenue Service

Instructions for Form 8390

Information Return for Determination of Life Insurance

Company Earnings Rate Under Section 809

Paperwork Reduction Act Notice.—We ask status is figured as of the last day of the tax Attachments.—If you need more space,

for the information on this form to carry out year. Proper accounting must be made for attach additional sheets. Each attachment

the Internal Revenue laws of the United changes in affiliation during a tax year. If two must show the corporation’s name and

States. You are required to give us the or more mutual companies own at least 80% identifying number, as well as the required

information. We need it to ensure that you are of the stock of a single life insurance information, and must follow the format of the

complying with these laws and to allow us to company, each mutual company must include form.

figure and collect the right amount of tax. its share of each item from the subsidiary

The time needed to complete and file this (referred to in Part I). In the case of a stock Specific Instructions

form will vary depending on individual company described in section 809(h)(3), make

Address.—Include the suite, room, or other

circumstances. The estimated average time appropriate adjustments on an eliminations

unit number after the street address. If the

is: schedule.

Post Office does not deliver mail to the street

When and Where To File.—Form 8390 must address and the corporation has a P.O. box,

Recordkeeping 57 hr., 24 min.

be filed no later than September 30, 1994. show the box number instead of the street

Learning about the File Form 8390 with the Internal Revenue address.

law or the form 3 hr., 28 min. Service, P.O. Box 3100, Church St. Station,

Item E.—Stock subsidiaries of mutual life

Preparing and sending Attention: Group 1162, 13th floor, New York,

insurance companies should check “Mutual.”

the form to the IRS 4 hr., 34 min. NY 10008.

If you have comments concerning the Period Covered.—File the 1993 Form 8390

accuracy of these time estimates or for calendar year 1993. Part I—Earnings Rate

suggestions for making this form more Method of Reporting.—Report all amounts Line 1.—Enter the amount from the Capital

simple, we would be happy to hear from you. on Form 8390 and the accompanying and Surplus Account of the Annual

You can write to both the Internal Revenue schedules in U.S. dollars. Attach a detailed Statement. Do not include surplus notes.

Service, Attention: Reports Clearance Officer, explanation if converting from a foreign Line 2.—Nonadmitted financial assets are

PC:FP, Washington, DC 20224; and the currency. financial assets that are not permitted to be

Office of Management and Budget, All items must reflect both the general and included as part of the corporation’s financial

Paperwork Reduction Project (1545-0927), separate accounts. condition for state regulatory purposes.

Washington, DC 20503. DO NOT send the

Amounts included in equity under section In general, this includes the sum of lines 1

tax form to either of these offices. Instead,

809 generally refer to amounts shown on the through 10, column 3, Exhibit 13, from the

see When and Where To File below.

NAIC Annual Statement (the Annual Annual Statement. This also includes, at their

Statement). However, an item should not be fair market value, financial assets shown on

General Instructions classified or characterized on the Annual

Statement in an attempt to avoid the

Schedule X of the Annual Statement. Attach a

schedule of all nonadmitted assets (both

Unless otherwise noted, all section references requirements of section 809. financial and nonfinancial) other than due and

are to the Internal Revenue Code. accrued investment income, investments in

Penalties.—Any life insurance company

Purpose of Form.—Form 8390 is used to failing to file on time or provide all information office furnishings or fixtures, or agents’

gather information regarding the earnings requested may be subject to penalties under balances owed to the corporation.

rates of the 50 largest domestic stock life section 7203 and other penalties. Line 3.—Enter the total (as reported on the

insurance companies (stock companies), as Signature.—The return must be signed and Annual Statement) of the following items:

determined by the Secretary, and all mutual dated by the president, vice president, (1) Life insurance reserves as defined in

life insurance companies (mutual companies). treasurer, assistant treasurer, chief section 816(b); (2) Unearned premiums and

This information is used to compute the accounting officer, or any other officer (such unpaid losses included in total reserves under

“differential earnings rate,” as defined in as tax officer) authorized to sign. A receiver, section 816(c)(2); (3) Amounts (discounted at

section 809(c), which affects the tax liability trustee, or assignee must sign and date any the appropriate rate of interest) necessary to

of all mutual life insurance companies. return required to be filed on behalf of a satisfy the obligations under insurance and

Affiliated Groups.—All life insurance corporation. annuity contracts that do not involve life,

members of an affiliated group must accident, or health contingencies (section

When an affiliated group files Form 8390,

cooperate in filing a single Form 8390. One 807(c)(3)); (4) Dividend accumulations and

only the “lead company” must sign the return.

member should be designated as the “lead other amounts held at interest in connection

company” to compute a single earnings rate If a corporate officer completes Form 8390, with insurance and annuity contracts;

for all members. Attach to Form 8390: the Paid Preparer’s space should remain (5) Premiums received in advance and

blank. Anyone who prepares Form 8390 but liabilities for premium deposit funds; and

● A separate Part I for each life insurance does not charge the corporation should not (6) Reasonable special contingency reserves

member; sign the return. under contracts of group term life insurance

● A schedule explaining all adjustments made Generally, anyone who is paid to prepare or group accident and health insurance that

to eliminate double counting of items, e.g., the return must sign it and fill in the Paid are established and maintained for the

intercorporate dividends or the value of the Preparer’s Use Only area. provision of insurance on either retired lives

stock of a life insurance subsidiary; and or for premium stabilization, or both.

The paid preparer must complete the

● A reconciliation for all items if the total of required preparer information and: Line 4b.—Include reserves for due and

those items for the group as a whole differs unpaid premiums, as well as reserves for

● Sign the return, by hand, in the space

from the sum of the totals of the individual deferred and uncollected premiums, if the

members. provided for the preparer’s signature.

(Signature stamps or labels are not establishment of the reserve is not permitted

For Form 8390, an affiliated group is acceptable.) under section 811(c).

defined under section 1504(a) without regard

to section 1504(b)(2). In general, affiliation ● Give a copy of the return to the taxpayer.

Cat. No. 13861V

Line 4c.—Enter the amount of reserves Line 17e.—Enter the amount of the separately reported on Exhibits 8 and 9 of the

related to items entered on lines 14a through amortization of the interest maintenance Annual Statement. If the reserves under a

14c. Also, include any other adjustments to reserve (IMR) from line 4a, column 1, of the group of policies clearly fit in a major product

line 3 and attach a schedule showing those Summary of Operations section of the Annual category but not in a product subcategory

adjustments. Statement. under that category, report the reserves in the

Lines 5 and 6.—See the instructions below Line 18.—Include in columns (a) and (b) all most appropriate subcategory. When

for Schedule A—Reserves. statutory reserves (including deficiency determining the most appropriate category,

reserves) taken into account in determining choose a subcategory that has similar

Line 10.—Attach a schedule showing the valuation characteristics. If the valuation

nature and amount of: (1) each voluntary gain or (loss) from operations on the Annual

Statement. Do not include reserves for due characteristics are unknown, use a

reserve; and (2) any Annual Statement reasonable allocation method to allocate

reserve that is: (a) not an item listed in and unpaid premiums or for deferred and

uncollected premiums if the establishment of among the appropriate product

section 807(c); (b) not part of the policyholder subcategories. Attach a description of the

dividend reserve; (c) not a deficiency reserve the reserves is not permitted under section

811(c). policies allocated with an explanation of why

included on line 4a; and (d) not included on the allocation is appropriate.

line 10. Line 21.—Include realized capital gains and

(losses) (generally as determined for Annual Calculation of Reserves.—The tax reserves

For a stock company, any reserve treated reported in the subcategories under

as a voluntary reserve for the base period Statement purposes) only to the extent not

included in annual statement gain or (loss) categories A through I (Schedule A, Form

must be treated as a voluntary reserve for 8390), must be calculated as accurately as

subsequent years unless there is a from operations in the current year or in

previous years. those on Form 1120-L, U.S. Life Insurance

demonstrated change in circumstances. Company Income Tax Return.

Line 11.—Include 50% of the total Annual Line 22a.—Enter the amount shown on line

21 minus the portion of total net realized Product Categories.—Uniform assumptions

Statement provision for policyholder concerning paid-to dates and mode of

dividends to be paid in the following year, capital gains and (losses) subject to the IMR

(before reduction for capital gains tax). premium payment may be made for all

whether accrued or unaccrued for tax product types included in the same category.

purposes at the end of the tax year. Line 23.—Other adjustments include any Reserves ceded under yearly renewable term

Policyholder dividends include excess separate account net operating gains or reinsurance need only be stated in total in

interest, premium adjustments, and (losses) and any other amounts for any item each category.

experience-rated refunds. Any Annual that is charged directly to the Capital and

Statement provision for policyholder Surplus Account of the Annual Statement, but Category A—Individual Life Insurance

dividends payable after the close of the which could be taken as a deduction in Policies.—The reserves stated under the

following tax year is treated as a voluntary computing LICTI. Attach a schedule showing subcategories of term, permanent, or flexible

reserve. all computations. premium policies must not include

supplemental benefit reserves described in

Line 12.—Attach a schedule showing the section 807(e)(3)(D).

computation, where applicable, with Schedule A—Reserves

appropriate line references to the Annual The reserves under the subcategories of

Statement. Schedule A is used to report additional permanent or flexible premium policies (lines

information concerning statutory reserves 2 and 3) must be separately stated for

Line 14b.—Enter an amount on this line only policies issued in the year to which this return

(Part I, line 5) and tax reserves (Part I, line 6)

if an election has been made under section relates, the immediately preceding year, the

for the current year.

814 (or section 819A of prior law). 2nd through 9th preceding years, and years

In determining the amount of tax reserves

Line 16.—Do not complete the rest of the before the 9th preceding year. On lines 2a

of a subsidiary of a mutual life insurance

form if the corporation is a stock company through 2d and lines 3a through 3d, state the

company for contracts issued before January

and the amount shown on line 16 is zero or a corresponding amount of insurance in force.

1, 1985, under a plan of life insurance in

negative amount. However, be sure to sign Category I—Miscellaneous.—List only those

existence on July 1, 1983, the provision of

the form. reserves that do not fall in categories A

section 811(d) regarding guaranteed interest

Line 17a.—Enter the amount from the payments in excess of the prevailing state through H. Attach a description of the

Summary of Operations section of the Annual assumed rate beyond the current tax year will reserves placed in this category, along with

Statement page 4, line 27. not apply. an explanation of why the categorization is

Line 17b.—Include all section 808 Do not subdivide the uniform product appropriate.

policyholder dividends (without regard to categories and subcategories in this schedule

section 808(c)(2)) paid or accrued during the by the different valuation characteristics

tax year. Do not include any amounts taken

into account in determining the amount from

the Annual Statement entered on line 17a.

Page 2

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSPas encore d'évaluation

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Bag InvoiceDocument1 pageBag InvoiceRounak GhoshPas encore d'évaluation

- Case Doctrines Tax 2Document22 pagesCase Doctrines Tax 2NingClaudioPas encore d'évaluation

- Heathify PremiumDocument1 pageHeathify PremiumdishandshahPas encore d'évaluation

- Krishn Vilas (Plot) Price List 08.01.2021 X CatagoryDocument1 pageKrishn Vilas (Plot) Price List 08.01.2021 X CatagoryZama KazmiPas encore d'évaluation

- Bir 0605Document11 pagesBir 0605Sheelah Sawi0% (1)

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument42 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORKen ChiaPas encore d'évaluation

- Answer Guidance For c6Document13 pagesAnswer Guidance For c6thicknhinmaykhoc100% (1)

- Calibration Invoice June 20-SignedDocument1 pageCalibration Invoice June 20-SignedDeepak Das0% (1)

- Solved A Tornado Extensively Damaged The Community in Which Bodine Comp PDFDocument1 pageSolved A Tornado Extensively Damaged The Community in Which Bodine Comp PDFAnbu jaromiaPas encore d'évaluation

- Supply Earth Filling Cement Bag in Pit at Paprera Bhatawali RoadDocument6 pagesSupply Earth Filling Cement Bag in Pit at Paprera Bhatawali RoadRoopesh ChaudharyPas encore d'évaluation

- Bruce Byrd 2013 Tax Return - T13 - For - Records PDFDocument69 pagesBruce Byrd 2013 Tax Return - T13 - For - Records PDFjessica50% (2)

- Form GST Rfd11Document63 pagesForm GST Rfd11forbooksPas encore d'évaluation

- Hafiz Muhammad Abdullah Appointment Letter 1Document1 pageHafiz Muhammad Abdullah Appointment Letter 1wilayatPas encore d'évaluation

- MNGRL AccDocument21 pagesMNGRL AcceiPas encore d'évaluation

- FED (Federal Excise Duty)Document4 pagesFED (Federal Excise Duty)Imran UmarPas encore d'évaluation

- Multiple Choice Questions 1 Which If Any of The Following StatementsDocument2 pagesMultiple Choice Questions 1 Which If Any of The Following StatementsTaimour HassanPas encore d'évaluation

- 2014 AllslipsDocument3 pages2014 Allslipsapi-652848320Pas encore d'évaluation

- Taxation Law Case Doctrines (4DF1920)Document45 pagesTaxation Law Case Doctrines (4DF1920)roigtcPas encore d'évaluation

- Form WW ExcelDocument97 pagesForm WW Excelchandhiran100% (1)

- Form 4490 (Proof of Claim)Document6 pagesForm 4490 (Proof of Claim)Benne James100% (5)

- Tally ERP 9 With GST Notes: Mr. Rahul K PathakDocument12 pagesTally ERP 9 With GST Notes: Mr. Rahul K PathakAkash RoyPas encore d'évaluation

- SAP CIN Configuration GuideDocument46 pagesSAP CIN Configuration GuideDebangshu D Ekalavya33% (3)

- Lesco - Web BillDocument2 pagesLesco - Web BillRashidsarfrazPas encore d'évaluation

- Estate Tax Return: Part I - Taxpayer InformationDocument3 pagesEstate Tax Return: Part I - Taxpayer InformationHartel BuyuccanPas encore d'évaluation

- Chapter 2 - Residential Status and Scope of Total Income PDFDocument9 pagesChapter 2 - Residential Status and Scope of Total Income PDFchoudharyPas encore d'évaluation

- Introduction To Business TaxesDocument3 pagesIntroduction To Business Taxesyatot carbonelPas encore d'évaluation

- SW04Document8 pagesSW04Nadi Hood0% (1)

- BillDocument1 pageBillSowmya DPas encore d'évaluation

- Administrative RemediesDocument16 pagesAdministrative RemediesNoemae CerroPas encore d'évaluation

- FAR Vol 2 Chapter 16 18Document14 pagesFAR Vol 2 Chapter 16 18Allen Fey De Jesus100% (1)