Académique Documents

Professionnel Documents

Culture Documents

US Internal Revenue Service: 11943601

Transféré par

IRSDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

US Internal Revenue Service: 11943601

Transféré par

IRSDroits d'auteur :

Formats disponibles

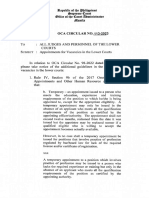

[4830-01-p]

DEPARTMENT OF THE TREASURY

Internal Revenue Service

26 CFR Part 1

[REG-119436-01]

RIN 1545-AY87

New Markets Tax Credit

AGENCY: Internal Revenue Service (IRS), Treasury.

ACTION: Notice of proposed rulemaking by cross-reference to temporary regulations

and notice of public hearing.

SUMMARY: In the Rules and Regulations section of this issue of the Federal

Register, the IRS is issuing temporary regulations relating to the new markets tax

credit. The text of those regulations also serves as the text of these proposed

regulations. This document also provides notice of a public hearing on these proposed

regulations.

DATES: Written and electronic comments must be received by February 25, 2002.

Outlines of topics to be discussed at the public hearing scheduled for March 14, 2002,

must be received by February 21, 2002.

ADDRESSES: Send submissions to: CC:ITA:RU (REG-119436-01), room 5226,

Internal Revenue Service, POB 7604, Ben Franklin Station, Washington, DC 20044.

Submissions may be hand delivered Monday through Friday between the hours of

8 a.m. and 5 p.m. to: CC:ITA:RU (REG-119436-01), Courier’s Desk, Internal Revenue

Service, 1111 Constitution Avenue NW., Washington, DC. Alternatively, taxpayers

-2-

may send submissions electronically via the Internet by selecting the “Tax Regs” option

on the IRS Home Page, or directly to the IRS Internet site at

The public hearing will be held in the IRS

Auditorium, Internal Revenue Building, 1111 Constitution Avenue, NW.,

Washington, DC.

FOR FURTHER INFORMATION CONTACT: Concerning the regulations, Paul

Handleman, (202) 622-3040; concerning submissions, the hearing, and/or to be placed

on the building access list to attend the hearing, Treena Garret, (202) 622-7180 (not

toll-free numbers).

SUPPLEMENTARY INFORMATION:

Paperwork Reduction Act

The collection of information contained in this notice of proposed rulemaking has

been submitted to the Office of Management and Budget for review in accordance with

the Paperwork Reduction Act of 1995 (44 U.S.C. 3507(d)). Comments on the

collection of information should be sent to the Office of Management and Budget,

Attn: Desk Officer for the Department of the Treasury, Office of Information and

Regulatory Affairs, Washington, DC 20503, with copies to the Internal Revenue

Service, Attn: IRS Reports Clearance Officer, W:CAR:MP:FP:S:O, Washington, DC

20224. Comments on the collection of information should be received by February 25,

2002.

Comments are specifically requested concerning:

-3-

Whether the proposed collection of information is necessary for the proper

performance of the functions of the IRS, including whether the information will have

practical utility;

The accuracy of the estimated burden associated with the proposed collection of

information (see below);

How the quality, utility, and clarity of the information to be collected may be enhanced;

How the burden of complying with the proposed collection of information may be

minimized, including through the application of automated collection techniques or

other forms of information technology; and

Estimates of capital or start-up costs and costs of operation, maintenance, and

purchase of services to provide information.

The requirement for the collection of information in this notice of proposed

rulemaking is in §1.45D-1(g)(2). The information is required so that a taxpayer may

claim a new markets tax credit on each credit allowance date during the 7-year credit

period and report compliance with the requirements of section 45D and the regulations

thereunder to the Secretary. The collection of information is mandatory. The likely

respondents are businesses or other for-profit institutions, nonprofit institutions, and

small businesses or organizations.

Estimated total annual reporting burden: 378 hours.

The estimated annual burden per respondent 2.5 hours.

Estimated number of respondents : 151.

Estimated annual frequency of responses: once.

-4-

An agency may not conduct or sponsor, and a person is not required to respond

to, a collection of information unless the collection of information displays a valid

control number assigned by the Office of Management and Budget.

Books or records relating to a collection of information must be retained as long

as their contents may become material in the administration of any internal revenue

law. Generally, tax returns and tax return information are confidential, as required by

26 U.S.C. 6103.

Background

Temporary regulations in the Rules and Regulations section of this issue of the

Federal Register amend the Income Tax Regulations (26 CFR part 1) relating to

section 45D. The temporary regulations provide guidance for taxpayers claiming the

new markets tax credit under section 45D. The text of those regulations also serves as

the text of these proposed regulations. The preamble to the temporary regulations

explains the amendments.

Special Analyses

It has been determined that this notice of proposed rulemaking is not a

significant regulatory action as defined in Executive Order 12866. Therefore, a

regulatory assessment is not required. It is hereby certified that the collection of

information in these regulations will not have a significant economic impact on a

substantial number of small entities. This certification is based upon the fact that any

burden on taxpayers is minimal. Accordingly, a Regulatory Flexibility Analysis under

the Regulatory Flexibility Act (5 U.S.C. chapter 6) is not required. Pursuant to

-5-

section 7805(f) of the Internal Revenue Code, this notice of proposed rulemaking will

be submitted to the Chief Counsel for Advocacy of the Small Business Administration

for comment on its impact on small business.

Comments and Public Hearing

Before these proposed regulations are adopted as final regulations,

consideration will be given to any written comments (a signed original and eight (8)

copies) or electronic comments that are submitted timely to the IRS. The IRS and

Treasury Department specifically request comments on the clarity of the proposed rule

and how it may be made easier to understand. All comments will be available for public

inspection and copying.

A public hearing has been scheduled for March 14, 2002, at 10 a.m. in the IRS

Auditorium, Internal Revenue Building, 1111 Constitution Avenue, NW.,

Washington, DC. Due to building security procedures, visitors must use the main

building entrance on Constitution Avenue, NW. In addition, all visitors must present

photo identification to enter the building. Because of access restrictions, visitors will

not be admitted beyond the immediate entrance area more than 15 minutes before the

hearing starts. For information about having your name placed on the building access

list to attend the hearing, see the “FOR FURTHER INFORMATION CONTACT” section

of this preamble.

The rules of 26 CFR 601.601(a)(3) apply to the hearing.

-6-

Persons who wish to present oral comments at the hearing must submit an

outline of the topics to be discussed and the time to be devoted to each topic (signed

original and eight (8) copies) by February 21, 2002.

A period of 10 minutes will be allotted to each person for making comments.

An agenda showing the scheduling of the speakers will be prepared after the

deadline for receiving outlines has passed. Copies of the agenda will be available free

of charge at the hearing.

Drafting Information

The principal author of these regulations is Paul F. Handleman, Office of the

Associate Chief Counsel (Passthroughs and Special Industries), IRS. However, other

personnel from the IRS and Treasury Department participated in their development.

List of Subjects in 26 CFR Part 1

Income taxes, Reporting and recordkeeping requirements.

Proposed Amendments to the Regulations

Accordingly, 26 CFR part 1 is proposed to be amended as follows:

PART 1--INCOME TAXES

Paragraph 1. The authority citation for part 1 is amended by adding an entry in

numerical order to read as follows:

Authority: 26 U.S.C. 7805 * * *

Section 1.45D-1 also issued under 26 U.S.C. 45D(i); * * *

Par. 2. Section 1.45D-1 is added to read as follows:

-7-

§1.45D-1 New markets tax credit.

[The text of proposed §1.45D-1 is the same as the text of §1.45D-1T published

elsewhere in this issue of the Federal Register].

Robert E. Wenzel

Deputy Commissioner of Internal Revenue.

Vous aimerez peut-être aussi

- US Internal Revenue Service: 10274002Document7 pagesUS Internal Revenue Service: 10274002IRSPas encore d'évaluation

- US Internal Revenue Service: 10523799Document4 pagesUS Internal Revenue Service: 10523799IRSPas encore d'évaluation

- US Internal Revenue Service: 12256402Document6 pagesUS Internal Revenue Service: 12256402IRSPas encore d'évaluation

- US Internal Revenue Service: 15400004Document8 pagesUS Internal Revenue Service: 15400004IRSPas encore d'évaluation

- US Internal Revenue Service: 10951205Document8 pagesUS Internal Revenue Service: 10951205IRSPas encore d'évaluation

- Register, The IRS Is Issuing Temporary Regulations Relating To The RequirementsDocument8 pagesRegister, The IRS Is Issuing Temporary Regulations Relating To The RequirementsIRSPas encore d'évaluation

- US Internal Revenue Service: 15924303Document18 pagesUS Internal Revenue Service: 15924303IRSPas encore d'évaluation

- US Internal Revenue Service: 16281304 CheckedDocument6 pagesUS Internal Revenue Service: 16281304 CheckedIRSPas encore d'évaluation

- US Internal Revenue Service: 14489804Document13 pagesUS Internal Revenue Service: 14489804IRSPas encore d'évaluation

- US Internal Revenue Service: 116704Document5 pagesUS Internal Revenue Service: 116704IRSPas encore d'évaluation

- US Internal Revenue Service: 25248796Document5 pagesUS Internal Revenue Service: 25248796IRSPas encore d'évaluation

- US Internal Revenue Service: 13888202Document6 pagesUS Internal Revenue Service: 13888202IRSPas encore d'évaluation

- US Internal Revenue Service: 10534401Document9 pagesUS Internal Revenue Service: 10534401IRSPas encore d'évaluation

- IRS Proposed Rule On Penalities For Preparers Under 6695 Comments Due by Nov 10 2011Document4 pagesIRS Proposed Rule On Penalities For Preparers Under 6695 Comments Due by Nov 10 2011Dean CarsonPas encore d'évaluation

- US Internal Revenue Service: 10869702Document4 pagesUS Internal Revenue Service: 10869702IRSPas encore d'évaluation

- Awards For Information Relating To Detecting Underpayments of Tax or Violations of The Internal Revenue Laws.Document17 pagesAwards For Information Relating To Detecting Underpayments of Tax or Violations of The Internal Revenue Laws.john7451Pas encore d'évaluation

- Technologicali N Nature Federal Register - Credit For Increasing Research ActivitiesDocument40 pagesTechnologicali N Nature Federal Register - Credit For Increasing Research ActivitiesResearch and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910Pas encore d'évaluation

- US Internal Revenue Service: 15623203Document13 pagesUS Internal Revenue Service: 15623203IRSPas encore d'évaluation

- US Internal Revenue Service: 12237902Document24 pagesUS Internal Revenue Service: 12237902IRSPas encore d'évaluation

- 2023-10000 InfoDocument3 pages2023-10000 Info7ddcchfhv6Pas encore d'évaluation

- US Internal Revenue Service: 11547203Document6 pagesUS Internal Revenue Service: 11547203IRSPas encore d'évaluation

- US Internal Revenue Service: td8845Document29 pagesUS Internal Revenue Service: td8845IRSPas encore d'évaluation

- US Internal Revenue Service: 12970903Document6 pagesUS Internal Revenue Service: 12970903IRSPas encore d'évaluation

- US Internal Revenue Service: 12927404Document1 pageUS Internal Revenue Service: 12927404IRSPas encore d'évaluation

- Washington: New York 1101 New York Avenue, NW 8th Floor Washington, DC 20005-4269 P: 202.962.7300 F: 202.962.7305Document10 pagesWashington: New York 1101 New York Avenue, NW 8th Floor Washington, DC 20005-4269 P: 202.962.7300 F: 202.962.7305ABC DEFPas encore d'évaluation

- US Internal Revenue Service: n-00-65Document4 pagesUS Internal Revenue Service: n-00-65IRSPas encore d'évaluation

- US Internal Revenue Service: 14719504Document5 pagesUS Internal Revenue Service: 14719504IRSPas encore d'évaluation

- Federal Register / Vol. 76, No. 244 / Tuesday, December 20, 2011 / Rules and RegulationsDocument40 pagesFederal Register / Vol. 76, No. 244 / Tuesday, December 20, 2011 / Rules and RegulationsDinSFLAPas encore d'évaluation

- Thesis On Internal Revenue AllotmentDocument5 pagesThesis On Internal Revenue Allotmentafkojbvmz100% (2)

- US Internal Revenue Service: n-02-20Document6 pagesUS Internal Revenue Service: n-02-20IRSPas encore d'évaluation

- Proposed Rules: WWW - Regulations.gov, Including AnyDocument4 pagesProposed Rules: WWW - Regulations.gov, Including Anyzkhavarian1Pas encore d'évaluation

- US Internal Revenue Service: 15317203Document5 pagesUS Internal Revenue Service: 15317203IRS100% (1)

- PTA Regs 2011-30933Document4 pagesPTA Regs 2011-30933flipper345Pas encore d'évaluation

- Revenue Bulletin No. 1-2003 No Ruling AreasDocument3 pagesRevenue Bulletin No. 1-2003 No Ruling AreasArianne CyrilPas encore d'évaluation

- US Internal Revenue Service: A-06-22Document51 pagesUS Internal Revenue Service: A-06-22IRSPas encore d'évaluation

- Securities and Exchange Commission (SEC) - FormadvDocument1 pageSecurities and Exchange Commission (SEC) - FormadvhighfinancePas encore d'évaluation

- Cta 2D CV 06681 D 2006aug31 Ref PDFDocument17 pagesCta 2D CV 06681 D 2006aug31 Ref PDFKevin Ken Sison GancheroPas encore d'évaluation

- US Internal Revenue Service: A-02-96Document4 pagesUS Internal Revenue Service: A-02-96IRSPas encore d'évaluation

- Complaint Form - OSC-11 - Complaint of Possible Prohibited Personnel PracticeDocument5 pagesComplaint Form - OSC-11 - Complaint of Possible Prohibited Personnel Practiceiamnumber8Pas encore d'évaluation

- US Internal Revenue Service: Irb04-43Document27 pagesUS Internal Revenue Service: Irb04-43IRSPas encore d'évaluation

- US Internal Revenue Service: 064602fDocument6 pagesUS Internal Revenue Service: 064602fIRSPas encore d'évaluation

- Department of The Treasury: Vol. 77 Thursday, No. 169 August 30, 2012Document96 pagesDepartment of The Treasury: Vol. 77 Thursday, No. 169 August 30, 2012MarketsWikiPas encore d'évaluation

- Federal Register / Vol. 77, No. 76 / Thursday, April 19, 2012 / Rules and RegulationsDocument5 pagesFederal Register / Vol. 77, No. 76 / Thursday, April 19, 2012 / Rules and Regulationsshurst2Pas encore d'évaluation

- DBE Proposed Program ChangesDocument160 pagesDBE Proposed Program Changessarr rossPas encore d'évaluation

- Or by Email To in The Subject Line of The Message.: Federalregister - Gov/d/2023-09273, and On Govinfo - GovDocument3 pagesOr by Email To in The Subject Line of The Message.: Federalregister - Gov/d/2023-09273, and On Govinfo - Govscribd.recent479Pas encore d'évaluation

- US Internal Revenue Service: td8734Document314 pagesUS Internal Revenue Service: td8734IRSPas encore d'évaluation

- Revenue Bulletin No. 01-03Document4 pagesRevenue Bulletin No. 01-03MMPas encore d'évaluation

- Federal Register / Vol. 75, No. 229 / Tuesday, November 30, 2010 / NoticesDocument3 pagesFederal Register / Vol. 75, No. 229 / Tuesday, November 30, 2010 / NoticesMarketsWikiPas encore d'évaluation

- US Internal Revenue Service: rp-05-46Document7 pagesUS Internal Revenue Service: rp-05-46IRSPas encore d'évaluation

- IRS InfoDocument15 pagesIRS InfoSnowdenKonanPas encore d'évaluation

- ADV UpdateDocument104 pagesADV UpdateMarketsWikiPas encore d'évaluation

- US Internal Revenue Service: 11033298Document6 pagesUS Internal Revenue Service: 11033298IRSPas encore d'évaluation

- Federal Register / Vol. 76, No. 243 / Monday, December 19, 2011 / Proposed RulesDocument32 pagesFederal Register / Vol. 76, No. 243 / Monday, December 19, 2011 / Proposed RulesGovtfraudlawyerPas encore d'évaluation

- Small Entity Compliance Guide FY2020 Final Rule1Document20 pagesSmall Entity Compliance Guide FY2020 Final Rule1tidwellmafiaonePas encore d'évaluation

- 9 LipinDocument34 pages9 LipinLuiPas encore d'évaluation

- FormadvDocument1 pageFormadvMANOJPas encore d'évaluation

- PWC Tax Insight Mexico Sept-Oct 2015Document3 pagesPWC Tax Insight Mexico Sept-Oct 2015AhmedPas encore d'évaluation

- VAT CasesDocument57 pagesVAT CasesGerald RoxasPas encore d'évaluation

- Article On Coca ColaDocument145 pagesArticle On Coca ColaJhe LoPas encore d'évaluation

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsD'EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSPas encore d'évaluation

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Fariñas and Al Nacino Vs Barba, 256 SCRA 396, G.R. No. 116763, April 19, 1996Document2 pagesFariñas and Al Nacino Vs Barba, 256 SCRA 396, G.R. No. 116763, April 19, 1996Gi NoPas encore d'évaluation

- 2 Muskrat Vs United StatesDocument1 page2 Muskrat Vs United StatesVanityHughPas encore d'évaluation

- Right To Information Act 2005Document42 pagesRight To Information Act 2005GomathiRachakondaPas encore d'évaluation

- IMO Publications Catalogue 2005 - 2006Document94 pagesIMO Publications Catalogue 2005 - 2006Sven VillacortePas encore d'évaluation

- Personal Data SheetDocument4 pagesPersonal Data SheetStefany ApaitanPas encore d'évaluation

- Transparency Law: Unit: 1 Citizen CharterDocument51 pagesTransparency Law: Unit: 1 Citizen CharterRajatPas encore d'évaluation

- Famanila vs. Court of AppealsDocument11 pagesFamanila vs. Court of AppealsAngel Amar100% (1)

- Statutes in EnglishDocument84 pagesStatutes in EnglishzulhakimPas encore d'évaluation

- Dela Cruz vs. Sosing, 94 Phil. 260Document1 pageDela Cruz vs. Sosing, 94 Phil. 260RussellPas encore d'évaluation

- Sem3 SocioDocument15 pagesSem3 SocioTannya BrahmePas encore d'évaluation

- Agent Orange CaseDocument165 pagesAgent Orange CaseזנוביהחרבPas encore d'évaluation

- EssayDocument10 pagesEssayalessia_riposiPas encore d'évaluation

- Susi vs. RazonDocument2 pagesSusi vs. RazonCaitlin Kintanar100% (1)

- Lecture 5 Political History of PakistanDocument33 pagesLecture 5 Political History of PakistanAFZAL MUGHALPas encore d'évaluation

- Tourist Visa Document Checklist: More Details Can Be Found at UDI's WebpagesDocument3 pagesTourist Visa Document Checklist: More Details Can Be Found at UDI's WebpagesibmrPas encore d'évaluation

- Valmores v. AchacosoDocument16 pagesValmores v. AchacosoRah-rah Tabotabo ÜPas encore d'évaluation

- Ras PDFDocument3 pagesRas PDFPadgro Consultants Pvt Ltd - EngineeringPas encore d'évaluation

- (Civilisations Vol. 18 Iss. 2) Opeyemi Ola - Confederal Systems - A Comparative Analysis (1968) (10.2307 - 41231119) - Libgen - LiDocument16 pages(Civilisations Vol. 18 Iss. 2) Opeyemi Ola - Confederal Systems - A Comparative Analysis (1968) (10.2307 - 41231119) - Libgen - LiChukwudi EzeukwuPas encore d'évaluation

- Cornell Notes 5Document5 pagesCornell Notes 5api-525394194Pas encore d'évaluation

- Leadership Style of Raul RocoDocument25 pagesLeadership Style of Raul RocoRadee King CorpuzPas encore d'évaluation

- cs14 2013Document3 pagescs14 2013stephin k jPas encore d'évaluation

- Rhema International Livelihood Foundation, Inc., Et Al., v. Hibix, Inc. G.R. Nos. 225353-54, August 28, 2019Document2 pagesRhema International Livelihood Foundation, Inc., Et Al., v. Hibix, Inc. G.R. Nos. 225353-54, August 28, 2019Kristel Alyssa MarananPas encore d'évaluation

- 05 ConceptsonQRRPADocument20 pages05 ConceptsonQRRPARochelle Balincongan LapuzPas encore d'évaluation

- Republic Flour Mills Inc vs. Comm. of Cutoms (39 SCRA 509) Case DigestDocument3 pagesRepublic Flour Mills Inc vs. Comm. of Cutoms (39 SCRA 509) Case DigestCamelle EscaroPas encore d'évaluation

- Minutes of The Meeting: Issues and ConcernsDocument5 pagesMinutes of The Meeting: Issues and ConcernsBplo CaloocanPas encore d'évaluation

- OCA Circular No. 113-2023Document9 pagesOCA Circular No. 113-2023Allahlea CarreonPas encore d'évaluation

- 2Document8 pages2Bret MonsantoPas encore d'évaluation

- Maritime LiensDocument3 pagesMaritime LiensJohn Ox100% (1)

- Noli Me TangereDocument18 pagesNoli Me TangereDeseryl Hermenegildo100% (2)

- Indo Pak History Papers 2006 - CSS Forums PDFDocument7 pagesIndo Pak History Papers 2006 - CSS Forums PDFMansoor Ali KhanPas encore d'évaluation