Académique Documents

Professionnel Documents

Culture Documents

IAS 19, Employee Benefits - Publications - Members - ACCA

Transféré par

Waqas Ahmad KhanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IAS 19, Employee Benefits - Publications - Members - ACCA

Transféré par

Waqas Ahmad KhanDroits d'auteur :

Formats disponibles

IAS 19, Employee Benefits | Publications | Members | ACCA Page 1

IAS 19, EMPLOYEE BENEFITS

By Graham Holt

INTRODUCTION

Welcome to ACCA's Accounting and Business CPD initiative which features articles on topical issues and allows you to test your

knowledge and understanding of the subject area by answering related questions.

We hope that this will add value to Accounting and Business and your membership of ACCA, and that this series will become an

additional means through which you may obtain verifiable CPD units. It is our aim to develop the technical and features section of the

magazine and Accounting and Business Direct to offer you a CPD resource in addition to those which are otherwise available.

How it works

To obtain three verifiable CPD units, read the article and answer five multiple-choice questions correctly online. Scroll down to the

multiple-choice questions, which are randomly selected from a bank of questions. Successful completion of five questions generates a

certificate on which you may record your points. You may also use it to update your CPD record.

We welcome your comments on this initiative, and your suggestions for other article topics, which we can use to offer CPD units to

members. Let us know what you think by contacting the editor.

THE ARTICLE

IAS 19 uses the principle that the cost of providing employee benefits should be recognised in the period in which the benefit is earned

by the employee, rather than when it is paid or payable.

The standard identifies several categories of employee benefit including:

short-term employee benefits, such as sick pay

post-employment benefits such as pensions

termination benefits, and

other long-term employee benefits including long service leave .

Classification of benefit plans

Defined contribution plans occur when a company pays a fixed contribution into a separate fund and has no legal or constructive

obligation to pay further contributions. Actuarial and investment risks of defined contribution plans are assumed either by the employee

or the third party. Plans not defined as contribution plans are classed as defined benefit plans.

If an employer is unable to show that all actuarial and investment risk has been transferred to another party and its obligations are

limited to contributions made during the period, a plan is defined benefit.

Under a defined benefits plan, the benefits payable to employees are not based solely on the amount of the contributions, but are

determined by the terms of the defined benefit plan. The benefits are typically based on such factors as age, length of service and

compensation. The employer retains the actuarial and investment risks of the plan.

For example, under the terms of a particular pension plan, a company contributes 6% of an employee’ s salary. The employee is

guaranteed a return of the contributions plus interest of 4 % a year. The plan would be classified as a defined benefit plan as the

employer has guaranteed a fixed rate of return and as a result carries the investment risk .

Accounting for defined contribution and defined benefit plans

The accounting for a defined contribution scheme is relatively straightforward, as the employer’s obligation for each period is

determined by the amount that has to be contributed to the scheme for that period. There are no actuarial assumptions required to

measure the obligation or expense and there are no actuarial expenses or losses.

Employers must use the projected unit credit method to determine the present value of a defined benefit obligation, the current service

cost and any past service cost. This method looks at each period of service, which gives rise to additional units of benefit and

measures each unit separately to build up the final obligation.

All of the post -employment benefit obligation is discounted. Actuarial assumptions are used, which are the best estimate of the

variables that determine the ultimate cost of providing post-employment benefits. These will include demographic assumptions such as

mortality, turnover and retirement age, and financial assumptions such as discount rates, salary and benefit levels .

The obligation will include both legal obligations and any constructive obligation arising from the employer's usual business practices

such as an established pattern of past practice. IAS 19 does not require an annual actuarial valuation of the defined benefit obligation,

but the employer is required to determine the present value of the defined benefit obligation and the fair value of the plan assets. This

http://www.accaglobal.com/members/publications/accounting_business/CPD/ias19 4/20/2011 12:23:16 AM

IAS 19, Employee Benefits | Publications | Members | ACCA Page 2

must be done with sufficient regularity so that the amounts recognised do not differ materially from the amounts that would be

determined at the balance sheet date. A volatile economic environment will require frequent valuations at least annually.

Plan assets are measured at fair value, which is normally market value. Fair value can be estimated by discounting expected future

cash flows. The rate used to discount estimated cash flows should be determined by reference to market yields at the balance sheet

date on high-quality corporate bonds. IAS 19 is not specific on what it considers to be a high-quality bond and therefore this can lead to

variation in the discount rates used.

Balance sheet recognition

The amount recognised in the balance sheet could be either an asset or a liability. The amount recognised will be the following:

the present value of the defined benefit obligation, plus

any actuarial gains less losses not yet recognised, minus

any past service cost not yet recognised, and minus

the fair value of the plan assets.

If the result of the above is a positive amount then a liability has occurred and it is recorded in full in the balance sheet.

Any negative amount is an asset that is subject to a recoverability test. The asset recognised is the lesser of the negative amount

calculated above, or the net total of unrecognised actuarial losses and past service costs, and the present value of any benefits

available in the form of refunds or reductions in future employer contributions to the plan.

Plan assets and plan liabilities from the different plans are normally presented separately in the balance sheet.

Actuarial gains and losses

A company should recognise a portion of its actuarial gains and losses as income or expense if the net cumulative unrecognised

actuarial gains and losses at the end of the previous reporting period, (ie at the beginning of the current financial year) exceeds the

greater of 10% of the present value of the defined benefit obligation at the beginning of the year, and 10% of the fair value of the plan

assets at the same date.

These limits should be calculated and applied separately for each defined plan. The excess determined by the above method is then

divided by the expected average remaining lives of the employees in the plan. This method is called the corridor approach.

However, an entity can adopt any other method that results in faster recognition of actuarial gains and losses as long as it is applied

consistently. Additionally, there is the option of recognising actuarial gains and losses in full in the period in which they occur, outside

profit or loss, in a statement of recognised income and expense. Delays in the recognition of gains and losses can give rise to

misleading figures in the statement of financial position. Also, multiple options for recognising gains and losses can lead to poor

comparability.

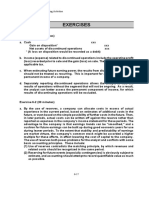

EXAMPLE A PLC

01/01/08 31/12/08

USDm USDm

Fair value plan assets 100 110

Present value -defined benefit

90 96

obligation

Unrecognised actuarial gain 16 26

Average working life of

10 years 10 years

employees

This entity has decided to use the corridor approach in recognising actuarial gains and losses.

It must recognise the portion of the net actuarial gain or loss in excess of 10% of the greater of defined benefit obligation or the fair

value of the plan assets at the beginning of the year.

Unrecognised actuarial gain at the beginning of the year was USD16m. The limit of the corridor is 10% of USD100m (value of plan

assets) ie USD10m, as this is greater than the present value of the obligation. The difference is USD6m, which divided by 10 years is

USD0.6m.

Expense recognition - defined benefit plans

The amount of the expense or income for a particular period is determined by a number of factors. The pension expense is the net of

the following items:

current service cost

interest cost

the expected return of any plan assets

actuarial gains and losses to the extent recognised

http://www.accaglobal.com/members/publications/accounting_business/CPD/ias19 4/20/2011 12:23:16 AM

IAS 19, Employee Benefits | Publications | Members | ACCA Page 3

past service cost to the extent that the standard requires the entity to recognise it, and

the effect of any curtailments or settlements.

The difference between the expected return and actual return on plan assets is an actuarial gain or loss. The expected return is based

on market expectations at the beginning of the period for returns over the entire life of the related obligation. This return is a very

subjective assumption and an increase in the return can create income at the expense of actuarial losses, which may not be

recognised when entities use the corridor approach.

Conclusion

Accounting for post-employment benefits is an important financial reporting issue. It has been suggested that many users of financial

statements do not fully understand the information that entities provide about post -employment benefits. Both users and preparers of

financial statements have criticised the accounting requirements for failing to provide high-quality, transparent information about post-

employment benefits.

Graham Holt is principal lecturer in accounting and finance at the Manchester Metropolitan University Business School, and an ACCA

examiner

View the multiple choice questions

http://www.accaglobal.com/members/publications/accounting_business/CPD/ias19 4/20/2011 12:23:16 AM

Vous aimerez peut-être aussi

- Intermediate Accounting Volume 2 Canadian 11th Edition Kieso Test BankDocument53 pagesIntermediate Accounting Volume 2 Canadian 11th Edition Kieso Test BankJenniferMartinezbisoa100% (19)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideD'EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuidePas encore d'évaluation

- HCI 2007 Prelim H2 P2 QN PaperDocument2 pagesHCI 2007 Prelim H2 P2 QN PaperFang Wen LimPas encore d'évaluation

- Ifrs Usgaap NotesDocument38 pagesIfrs Usgaap Notesaum_thai100% (1)

- Week 7 (Partnership)Document24 pagesWeek 7 (Partnership)Quevyn Kohl Surban100% (4)

- IAS 19: Employees Benefits: Classification of Benefit PlansDocument3 pagesIAS 19: Employees Benefits: Classification of Benefit PlansAsad TahirPas encore d'évaluation

- PAS 19 Practice GuideDocument4 pagesPAS 19 Practice GuideEllaine Montojo MirandaPas encore d'évaluation

- Ias 19Document9 pagesIas 19Hammad SarwarPas encore d'évaluation

- CPA Official IAS 19 02 AnsDocument4 pagesCPA Official IAS 19 02 AnsKambi OfficialPas encore d'évaluation

- T3 EmployeeDocument4 pagesT3 EmployeeLe YenPas encore d'évaluation

- Relevance:: ExampleDocument4 pagesRelevance:: ExampleNicoleMendozaPas encore d'évaluation

- Dmp3e Ch06 Solutions 01.26.10 FinalDocument39 pagesDmp3e Ch06 Solutions 01.26.10 Finalmichaelkwok1Pas encore d'évaluation

- Reporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionDocument34 pagesReporting and Analyzing Revenues and Receivables: Learning Objectives - Coverage by QuestionpoollookPas encore d'évaluation

- Indian Accounting Standards: Manish B TardejaDocument45 pagesIndian Accounting Standards: Manish B TardejaManish TardejaPas encore d'évaluation

- FM 15-17Document23 pagesFM 15-17HanaPas encore d'évaluation

- Q6-9. Explain How Management Can Shift Income From One Period Into Another by Its Estimation of Uncollectible AccountsDocument3 pagesQ6-9. Explain How Management Can Shift Income From One Period Into Another by Its Estimation of Uncollectible AccountsAkshay RaoPas encore d'évaluation

- Employee Benefits IAS 19Document4 pagesEmployee Benefits IAS 19munyerPas encore d'évaluation

- Solution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian EditionDocument38 pagesSolution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian Editionwarpingmustacqgmael100% (13)

- ADVANCE ASSIGNMENT FinalDocument17 pagesADVANCE ASSIGNMENT Finalaklilu shiferawPas encore d'évaluation

- Chapter 10Document33 pagesChapter 10Usman ShabbirPas encore d'évaluation

- Home Assignment 1Document3 pagesHome Assignment 1AUPas encore d'évaluation

- DCF Model Analysis Business ValuationDocument11 pagesDCF Model Analysis Business ValuationJack Jacinto100% (2)

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- IFRS - IAS19 - Employee BenefitsDocument16 pagesIFRS - IAS19 - Employee BenefitsPramita RoyPas encore d'évaluation

- IFRS - IAS19 - Employee BenefitsDocument16 pagesIFRS - IAS19 - Employee BenefitsFendy YamiPas encore d'évaluation

- Solutions - Chapter 6Document28 pagesSolutions - Chapter 6Dre ThathipPas encore d'évaluation

- Equity, Income and Expenses Definition of Equity-Owner's Equity Is A Residual Interest in The Assets of An Entity After Deducting Its LiabilitiesDocument21 pagesEquity, Income and Expenses Definition of Equity-Owner's Equity Is A Residual Interest in The Assets of An Entity After Deducting Its LiabilitiesFarah PatelPas encore d'évaluation

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariPas encore d'évaluation

- FSAV3eModules 5-8Document26 pagesFSAV3eModules 5-8bobdolePas encore d'évaluation

- Assignment: Prepared For: Md. Sajib Hossain, CFA Assistant Professor Department of Finance University of DhakaDocument9 pagesAssignment: Prepared For: Md. Sajib Hossain, CFA Assistant Professor Department of Finance University of DhakaMd Ohidur RahmanPas encore d'évaluation

- Financial Position and Performance in IFRS 17: Scandinavian Actuarial JournalDocument28 pagesFinancial Position and Performance in IFRS 17: Scandinavian Actuarial JournalUncle TeaPas encore d'évaluation

- BPP Revision Kit Sample Answers 1Document8 pagesBPP Revision Kit Sample Answers 1Kian TuckPas encore d'évaluation

- Dissertation On Revenue RecognitionDocument7 pagesDissertation On Revenue RecognitionCollegePaperGhostWriterSterlingHeights100% (1)

- Module 1 - Employee BenefitsDocument38 pagesModule 1 - Employee BenefitsMitchie Faustino100% (1)

- Don't Fall Foul of The New IFRS 9 and IFRS 15 Standards - ACCA GlobalDocument7 pagesDon't Fall Foul of The New IFRS 9 and IFRS 15 Standards - ACCA GlobalArun ThomasPas encore d'évaluation

- Practical Guide To IFRS: IAS 19 (Revised) Significantly Affects The Reporting of Employee BenefitsDocument13 pagesPractical Guide To IFRS: IAS 19 (Revised) Significantly Affects The Reporting of Employee BenefitsSanath FernandoPas encore d'évaluation

- Accrual: AccountancyDocument8 pagesAccrual: Accountancymhrscribd014Pas encore d'évaluation

- 1FU491 Employee BenefitsDocument14 pages1FU491 Employee BenefitsEmil DavtyanPas encore d'évaluation

- ACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsDocument5 pagesACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsNatalie Laurent SiaPas encore d'évaluation

- Corporate Reporting Homework (Day 6)Document4 pagesCorporate Reporting Homework (Day 6)Sara MirchevskaPas encore d'évaluation

- Capital BudgetingDocument45 pagesCapital BudgetingLumumba KuyelaPas encore d'évaluation

- p7hkg 2008 Dec ADocument19 pagesp7hkg 2008 Dec Abillyboy221Pas encore d'évaluation

- Chapter 6 Multiple Choice T F Test QuestionsDocument6 pagesChapter 6 Multiple Choice T F Test QuestionsAnh LýPas encore d'évaluation

- GTHW 2010 Chapter 7 MaterialityDocument9 pagesGTHW 2010 Chapter 7 MaterialityasaPas encore d'évaluation

- Equity Methods - ECIB - Tax Settlement ForecastingDocument13 pagesEquity Methods - ECIB - Tax Settlement ForecastingmzurzdcoPas encore d'évaluation

- S C6Document7 pagesS C6Duy LêPas encore d'évaluation

- Pension DisclosureDocument1 pagePension Disclosureapi-3713979Pas encore d'évaluation

- Employee BenefitDocument32 pagesEmployee BenefitnatiPas encore d'évaluation

- Accounting Concept and Principles - 20160822Document32 pagesAccounting Concept and Principles - 20160822jnyamandePas encore d'évaluation

- Ias 19Document43 pagesIas 19Reever RiverPas encore d'évaluation

- Pastor Chapters23 24Document47 pagesPastor Chapters23 24Rodken VallentePas encore d'évaluation

- Intermediate Accounting IIIDocument12 pagesIntermediate Accounting IIIAlma FigueroaPas encore d'évaluation

- Group Statements of Cashflows PDFDocument19 pagesGroup Statements of Cashflows PDFObey SitholePas encore d'évaluation

- Residual Income ValuationDocument6 pagesResidual Income ValuationKumar AbhishekPas encore d'évaluation

- Financial Statement Analysis: 7.1.A. Accounting Income and Assets: The Accrual ConceptDocument6 pagesFinancial Statement Analysis: 7.1.A. Accounting Income and Assets: The Accrual ConceptKrishna PrasadPas encore d'évaluation

- CH 03Document44 pagesCH 03min xuan limPas encore d'évaluation

- Ias 37Document6 pagesIas 37Tope JohnPas encore d'évaluation

- Chapter 1 Accounting ConceptsDocument6 pagesChapter 1 Accounting ConceptsJamEs Luna MaTudioPas encore d'évaluation

- SBR - Chapter 5Document6 pagesSBR - Chapter 5Jason KumarPas encore d'évaluation

- Assignment: On Financial Statement Analysis and ValuationDocument4 pagesAssignment: On Financial Statement Analysis and ValuationMd Ohidur RahmanPas encore d'évaluation

- QA Before Week 11 Tute PDFDocument17 pagesQA Before Week 11 Tute PDFShek Kwun HeiPas encore d'évaluation

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingD'EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingPas encore d'évaluation

- Audit, Assurance and Related Services: RiskDocument9 pagesAudit, Assurance and Related Services: RiskWaqas Ahmad KhanPas encore d'évaluation

- Aaud Cfap 6Document8 pagesAaud Cfap 6Muhammad AhmedPas encore d'évaluation

- Bookkeeping Brochure 2Document22 pagesBookkeeping Brochure 2Waqas Ahmad KhanPas encore d'évaluation

- AFF's Document On The Listed Companies (Code of Corporate Governance) Regulations, 2019Document25 pagesAFF's Document On The Listed Companies (Code of Corporate Governance) Regulations, 2019Ali ZaheerPas encore d'évaluation

- Assistant Manager Taxation RequiredDocument1 pageAssistant Manager Taxation RequiredWaqas Ahmad KhanPas encore d'évaluation

- Business ManagementDocument36 pagesBusiness Managementalishayan123Pas encore d'évaluation

- Scenario BuildingDocument1 pageScenario BuildingWaqas Ahmad KhanPas encore d'évaluation

- Competition Act 2010Document34 pagesCompetition Act 2010Waqas Ahmad KhanPas encore d'évaluation

- HR Audit ChecklistDocument5 pagesHR Audit Checklistdavidvilla90090% (1)

- GSTR1 37aaffo8985r1zz 102023Document4 pagesGSTR1 37aaffo8985r1zz 102023ORANGE FIBERNETPas encore d'évaluation

- Segregation of DutiesDocument1 pageSegregation of DutiesjadfarranPas encore d'évaluation

- Olympiads Reg. Form - Excel Version 2020-21Document26 pagesOlympiads Reg. Form - Excel Version 2020-21Itismita PriyadarshiPas encore d'évaluation

- My Internship Report (2) Hina MasoodDocument255 pagesMy Internship Report (2) Hina Masoodulovet67% (3)

- (B) Increase DecreaseDocument5 pages(B) Increase Decreaseyiming peiPas encore d'évaluation

- Accounting Cycle Requirement 1: Journal Entries T-AccountsDocument5 pagesAccounting Cycle Requirement 1: Journal Entries T-Accountsnerissa belloPas encore d'évaluation

- Balance Sheet of Eicher Motors For MonicaDocument4 pagesBalance Sheet of Eicher Motors For MonicaBBA SFPas encore d'évaluation

- Bank StatementDocument2 pagesBank StatementZakaria EL MAMOUNPas encore d'évaluation

- Extra 3Document2 pagesExtra 3Ahmed GemyPas encore d'évaluation

- Fabm1 Completing The Accounting CycleDocument16 pagesFabm1 Completing The Accounting CycleVenicePas encore d'évaluation

- Tax Invoice: Dtwelve Spaces Pvt. LTDDocument3 pagesTax Invoice: Dtwelve Spaces Pvt. LTDChanchal MadankarPas encore d'évaluation

- GIRO Instalment Plan For Income Tax: Month Month Amount ($) Amount ($)Document2 pagesGIRO Instalment Plan For Income Tax: Month Month Amount ($) Amount ($)Nelly HPas encore d'évaluation

- Marriott Corporation Cost of Capital Case AnalysisDocument11 pagesMarriott Corporation Cost of Capital Case Analysisjen1861269% (13)

- 2014 12 Mercer Risk Premia Investing From The Traditional To Alternatives PDFDocument20 pages2014 12 Mercer Risk Premia Investing From The Traditional To Alternatives PDFArnaud AmatoPas encore d'évaluation

- Solutions To Chapter 8 (20ebooks - Com)Document18 pagesSolutions To Chapter 8 (20ebooks - Com)T. MuhammadPas encore d'évaluation

- A4A COVID Impact Updates 58Document26 pagesA4A COVID Impact Updates 58ajayprakash1000Pas encore d'évaluation

- BOI-business Guide 2017-20170222 - 44021Document146 pagesBOI-business Guide 2017-20170222 - 44021Kamon Eak AungkhasirikunPas encore d'évaluation

- DW Data 2014 q4Document15 pagesDW Data 2014 q4helpdotunPas encore d'évaluation

- 12Document16 pages12JDPas encore d'évaluation

- Cash QuizDocument6 pagesCash QuizGwen Cabarse PansoyPas encore d'évaluation

- Account Balance Statement As On 30-JUN-2020 For (03525-103672)Document1 pageAccount Balance Statement As On 30-JUN-2020 For (03525-103672)IkramPas encore d'évaluation

- The Corporate Director's Guide ESG OversightDocument19 pagesThe Corporate Director's Guide ESG OversightJenny Ling Lee Mei A16A0237Pas encore d'évaluation

- PFM3063 - Advanced Financial Management Quiz 2 and 3 (Dec 2023)Document5 pagesPFM3063 - Advanced Financial Management Quiz 2 and 3 (Dec 2023)Putri YaniPas encore d'évaluation

- Debt Collector Disclosure StatementDocument8 pagesDebt Collector Disclosure StatementGreg WilderPas encore d'évaluation

- Terms of Reference of All Positions of NRLMRC.Document42 pagesTerms of Reference of All Positions of NRLMRC.udi969Pas encore d'évaluation

- Netflix Inc.: Content Ramp Adding Torque To The FlywheelDocument30 pagesNetflix Inc.: Content Ramp Adding Torque To The FlywheelManvinder SinghPas encore d'évaluation

- Issue of Debentures Redemption of Debentures UnderwrtingDocument47 pagesIssue of Debentures Redemption of Debentures UnderwrtingKeshav PantPas encore d'évaluation