Académique Documents

Professionnel Documents

Culture Documents

Sec. 51.0001. DEFINITIONS. in This Chapter:: Qui Tam Suits Across The United States That Prove MERS

Transféré par

CaliforniagDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sec. 51.0001. DEFINITIONS. in This Chapter:: Qui Tam Suits Across The United States That Prove MERS

Transféré par

CaliforniagDroits d'auteur :

Formats disponibles

Foreclosure in Texas

Texas is a non-judicial foreclosure state. A foreclosure proceeding in Texas is like a Motion for

Summary Judgement.

And as Sergeant Major Basil Plumley stated: Gentlemen, prepare to defend yourselves!

Basically, the non-judicial process of foreclosure is used when a power of sale clause exists in a

mortgage or deed of trust. A "power of sale" clause is the clause in a deed of trust or mortgage, in which

the borrower pre-authorizes the sale of property to pay off the balance on a loan in the event of the

their default. In deeds of trust or mortgages where a power of sale exists, the power given to the lender to

sell the property may be executed by the lender or their representative, typically referred to as the trustee.

When is Section 51 of the Texas Property Code, an enforcement tool of the State Laws, if the secured

debt becomes bifurcated? The Deed of Trust, void?

When the Security Instrument, becomes a nullity, certain sections of the Texas Property Code, become

enforceable in a different way. These Codes all contain a specific reference, “deed of trust”. Without the

deed of trust, there is no legal enforcement of a foreclosure.

Sec. 51.0001. DEFINITIONS. In this chapter:

(1) "Book entry system" means a national book entry system for registering a beneficial interest in a

security instrument that acts as a nominee for the grantee, beneficiary, owner, or holder of the

security instrument and its successors and assigns.

“Book entry system”, according to most lenders, mortgage servicers, is Mortgage Electronic Registration

Systems, Inc, commonly known as MERS, the beneficiary/nominee. MERS never had this prestigious

status. It was only an illusion. There are many qui tam suits across the United States that prove MERS

has no authority to conduct business as a mortgagee. But, since MERS took up this “ability” to

assign/transfer mortgage loans by means of electronic process, MER bifurcated most all mortgages in

the United States. Maybe a thank you card is appropriate?

(2) "Debtor's last known address" means:

(A) for a debt secured by the debtor's residence, the debtor's residence address unless the

debtor provided the mortgage servicer a written change of address before the date the mortgage

servicer mailed a notice required by Section 51.002; or

Copyright© 2010 A.Campbell P.O. Box 291 Coupland, Texas 78615 1

(B) for a debt other than a debt described by Paragraph (A), the debtor's last known address as

shown by the records of the mortgage servicer of the security instrument unless the debtor

provided the current mortgage servicer a written change of address before the date the

mortgage servicer mailed a notice required by Section 51.002.

There is no debt secured by the debtor’s residence when bifurcation has occurred. There is no mortgage

servicer. There is only theft by third parties on victims of real property.

(3) "Mortgage servicer" means the last person to whom a mortgagor has been instructed by the

current mortgagee to send payments for the debt secured by a security instrument. A mortgagee

may be the mortgage servicer.

There is no debt secured by a security instrument when bifurcation has occurred. There is no mortgage

servicer once the secured debt was bifurcated.

(4) "Mortgagee" means:

(A) the grantee, beneficiary, owner, or holder of a security instrument;

(B) a book entry system; or

(C) if the security interest has been assigned of record, the last person to whom the security

interest has been assigned of record.

When bifurcation of the secured debt occurred, none of the above mentioned “Mortgagee” exist. There is

only the creditor of the unsecured debt.

(5) "Mortgagor" means the grantor of a security instrument.

When bifurcation of the secured debt occurred, the “Mortgagor” ceased to exist. Only the creditor

of the unsecured debt is left.

(6) "Security instrument" means a deed of trust, mortgage, or other contract lien on an interest in

real property.

Again, when bifurcation of the secured debt occurred, the “Security Instrument” ceased to exist.

It became a nullity taking up space in public records.

(7) "Substitute trustee" means a person appointed by the current mortgagee or mortgage servicer

under the terms of the security instrument to exercise the power of sale.

When bifurcation of the secured debt occurred, the “Substitute Trustee” ceased to exist. The

“Substitute Trustee”, became a third party committing theft upon the victims property.

Copyright© 2010 A.Campbell P.O. Box 291 Coupland, Texas 78615 2

(8) "Trustee" means a person or persons authorized to exercise the power of sale under the terms

of a security instrument in accordance with Section 51.0074.

When bifurcation of the secured debt occurred, the “Substitute Trustee” was converted to a third

party attempting to use an invalid deed of trust to take control of the property by theft and sell it

for a profit.

Sec. 51.002. SALE OF REAL PROPERTY UNDER CONTRACT LIEN.

(a) A sale of real property under a power of sale conferred by a deed of trust or other contract lien

must be a public sale at auction held between 10 a.m. and 4 p.m. of the first Tuesday of a month.

(d) Notwithstanding any agreement to the contrary, the mortgage servicer of the debt shall serve a

debtor in default under a deed of trust or other contract lien on real property used as the debtor's

residence with written notice by certified mail stating that the debtor is in default under the deed of

trust or other contract lien and giving the debtor at least 20 days to cure the default before notice of sale

can be given under Subsection (b).

Subsection (a), clearly states “A sale of real property under a power of sale conferred by a deed

of trust” . When the Security Instrument, or Deed of Trust, is not perfected in public records, the

Deed of Trust becomes void. Therefore, this subsection is no longer enforceable.

Subsection (d), also clearly states “Notwithstanding any agreement to the contrary, the

mortgage servicer of the debt shall serve a debtor in default under a deed of trust” and “debtor

is in default under the deed of trust ”. There is no default under the deed of trust. The Mortgage

Servicer has no standing under this subsection. The Deed of Trust is a nullity. This subsection is

not enforceable, due to the bifurcation.

Due to the destruction of the Secured debt, Sec. 51.002. SALE OF REAL PROPERTY UNDER

CONTRACT LIEN, is no longer a valid enforcement tool by the mortgage servicer, trustee, substitute

trustee, or any other entity who attempts to use the deed of trust, power of sale clause, to foreclose and

trustee sale the homeowners property. The secured debt was destroyed by bifurcation. Only the unsecured

“Note” exists?

Sec. 51.0025. ADMINISTRATION OF FORECLOSURE BY MORTGAGE SERVICER. A

mortgage servicer may administer the foreclosure of property under Section 51.002 on behalf of a

mortgagee if:

Copyright© 2010 A.Campbell P.O. Box 291 Coupland, Texas 78615 3

(1) the mortgage servicer and the mortgagee have entered into an agreement

granting the current mortgage servicer authority to service the mortgage; and

(2) the notices required under Section 51.002(b) disclose that the mortgage servicer is

representing the mortgagee under a servicing agreement with the mortgagee and the name of the

mortgagee and:

(A) the address of the mortgagee; or

(B) the address of the mortgage servicer, if there is an agreement granting a

mortgage servicer the authority to service the mortgage.

This is the favorite Section of the Property Code of the alleged Mortgage Servicer. This section

went out the window when the secured debt was bifurcated.. There is no secured debt. There is no

Mortgage Servicer. There is no Mortgagee. Only an unsecured debt owned by the Creditor.

Sec. 51.003. DEFICIENCY JUDGMENT.

(a) If the price at which real property is sold at a foreclosure sale under Section 51.002 is

less than the unpaid balance of the indebtedness secured by the real property, resulting in a

deficiency, any action brought to recover the deficiency must be brought within two years of

the foreclosure sale and is governed by this section.

(b) Any person against whom such a recovery is sought by motion may request that the

court in which the action is pending determine the fair market value of the real property as

of the date of the foreclosure sale. The fair market value shall be determined by the finder of

fact after the introduction by the parties of competent evidence of the value. Competent evidence

of value may include, but is not limited to, the following: (Blah, Blah, Blah)

(a) Once the secured debt was bifurcated, the third party continues to commit theft by deception by

recovering addition profits from the victim.

(b) Third party commits fraud upon the courts by making such fraudulent motion in the court of the

real property jurisdiction to obtain additional profit from the theft they committed.

Sec. 51.004. JUDICIAL FORECLOSURE--DEFICIENCY.

(a) This section applies if:

(1) real property subject to a deed of trust or other contract lien is sold at a foreclosure sale under a

court judgment foreclosing the lien and ordering the sale; and

Copyright© 2010 A.Campbell P.O. Box 291 Coupland, Texas 78615 4

This subsection would not be a valid enforcement tool, if proof of bifurcation is proved, that the

secured debt was destroyed, due to the wording “real property subject to a deed of trust”?

Sec. 51.005. JUDICIAL OR NONJUDICIAL FORECLOSURE AFTER JUDGMENT AGAINST

GUARANTOR--DEFICIENCY.

(a) This section applies if:

(1) the holder of a debt obtains a court judgment against a guarantor of the debt;

This subsection clearly states “the holder of a debt”. The “Note” was an agreement between the

original parties, the Borrower and the Lender. Unless the Mortgage Servicer, Trustee or any other

party, provides legal proof, they are the holder of the debt, they are no legally entitled to

foreclose.

(2) real property subject to a deed of trust or other contract lien securing the guaranteed debt is sold

at a foreclosure sale under Section 51.002 or under a court judgment foreclosing the lien and ordering

the sale;

This subsection clearly states “real property subject to a deed of trust” and “securing the

guaranteed debt is sold at a foreclosure sale under Section 51.002”, meaning, unless there is a

valid Deed of Trust, Section 51.005. JUDICIAL OR NONJUDICIAL FORECLOSURE AFTER

JUDGMENT AGAINST GUARANTOR—DEFICIENCY, is no longer a valid enforcement tool.

Only a third party committing theft by deception.

Sec. 51.005. JUDICIAL OR NONJUDICIAL FORECLOSURE AFTER JUDGMENT AGAINST

GUARANTOR--DEFICIENCY. (a) This section applies if:

(1) the holder of a debt obtains a court judgment against a guarantor of the debt;

(2) real property subject to a deed of trust or other contract lien securing the guaranteed

debt is sold at a foreclosure sale under Section 51.002 or under a court judgment foreclosing

the lien and ordering the sale;

(3) the price at which the real property is sold is less than the unpaid balance of the indebtedness

secured by the real property, resulting in a deficiency; and

(4) a motion or suit to determine the fair market value of the real property as of the date of the

foreclosure sale has not been filed under Section 51.003 or 51.004.

(b) The guarantor may bring an action in the district court in the county in which

the real property is located for a determination of the fair market value of the real

property as of the date of the foreclosure sale. The suit must be brought not later than

the 90th day after the date of the foreclosure sale or the date the guarantor receives actual

notice of the foreclosure sale, whichever is later. The fair market value shall be

determined by the finder of fact after the introduction by the parties of competent

evidence of the value. Competent evidence of value may include:

Copyright© 2010 A.Campbell P.O. Box 291 Coupland, Texas 78615 5

(1) The holder of a debt obtains a court judgment? There is no holder when the secured debt is

bifurcated. Only an unsecured debt held by the Creditor. These third party thieves have audacity

to commit fraud upon the court?

(2) There is no real property subject to a deed of trust when the secured debt is bifurcated.

(4) a motion or suit to determine the fair market value of the real property as of the date of the

foreclosure sale has not been filed under Section 51.003 or 51.004.

(b) When the secured debt is bifurcated, there is no guarantor to bring forth an action in court. If

an imposter brings an action in the district court, they are committing fraud upon the court.

Sec. 51.006. DEED-OF-TRUST FORECLOSURE AFTER DEED IN LIEU OF FORECLOSURE.

(a) This section applies to a holder of a debt under a deed of trust who accepts from the debtor a

deed conveying real property subject to the deed of trust in satisfaction of the debt.

When the bifurcation of the Secured debt takes place, there is no “debt under the deed of trust”.

The Deed of Trust is no longer a useful tool to foreclose on the home, or to bargain for another

negotiable instrument, legally. The third party commits theft of real property by deception, taking

possession of real property that does not legally belong to them, and sells it for a profit.

The secured debt was destroyed, now only the “note”, as an unsecured debt, is left as evidence.

They cannot be put back together.

Sec. 51.007. TRUSTEE UNDER DEED OF TRUST, CONTRACT LIEN OR SECURITY

INSTRUMENT.

(a) The trustee named in a suit or proceeding may plead in the answer that the trustee is not a necessary

party by a verified denial stating the basis for the trustee's reasonable belief that the trustee was named as

a party solely in the capacity as a trustee under a deed of trust, contract lien, or security instrument.

When the secured debt is bifurcated, there is no TRUSTEE. There is only a third party

committing theft by deception, illegally gaining control of real property for a profit.

Sec. 51.0074. DUTIES OF TRUSTEE.

(a) One or more persons may be authorized to exercise the power of sale under a security instrument.

There is no person authorized to exercise the power of sale when the secured debt was bifurcated. Only

theft and deception by the third party.

(b) A trustee may not be:

Copyright© 2010 A.Campbell P.O. Box 291 Coupland, Texas 78615 6

(1) assigned a duty under a security instrument other than to exercise the power of sale in

accordance with the terms of the security instrument; or

(2) held to the obligations of a fiduciary of the mortgagor or mortgagee.

Because of the bifurcation of the secured debt, “Sec. 51.0074. DUTIES OF TRUSTEE”, is not

enforceable, by a trustee, or any other person. The Deed of Trust is null and void. There is no

power of sale clause. There is a third party committing theft of real property.

Sec. 51.0075. AUTHORITY OF TRUSTEE OR SUBSTITUTE TRUSTEE.

(a) A trustee or substitute trustee may set reasonable conditions for conducting the public

sale if the conditions are announced before bidding is opened for the first sale of the day

held by the trustee or substitute trustee.

Again, when the secured debt was bifurcated, there is no trustee. Only a third party committing theft by

deception to gain control of real property and sell for a profit.

(b) A trustee or substitute trustee is not a debt collector.

This could be correct. The trustee is a third party committing theft by force selling real property of a

victim for a profit.

Sec. 51.009. FORECLOSED PROPERTY SOLD "AS IS".

A purchaser at a sale of real property under Section 51.002:

(1) acquires the foreclosed property "as is" without any expressed or implied warranties, except as to

warranties of title, and at the purchaser's own risk; and

(2) is not a consumer.

Purchaser’s of foreclosure property, failure to research the property, could find out later,

that they may stand the chance of losing their investment. But I suppose this is all a

gamble?

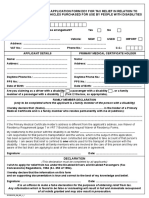

Sec. 51.015. SALE OF CERTAIN PROPERTY OWNED BY MEMBER OF THE MILITARY.

(a) In this section:

(1) "Active duty military service" means:

(A) service as a member of the armed forces of the United States; and

Copyright© 2010 A.Campbell P.O. Box 291 Coupland, Texas 78615 7

(B) with respect to a member of the Texas National Guard or the National

Guard of another state or a member of a reserve component of the armed forces of the United States,

active duty under an order of the president of the United States.

(b) This section applies only to an obligation:

(1) that is secured by a mortgage, deed of trust, or other contract lien on real

property or personal property that is a dwelling owned by a military servicemember;

(2) that originates before the date on which the servicemember's active duty

military service commences; and

(3) for which the servicemember is still obligated.

When bifurcation of a Secured debt has occurred, there is no deed of trust. These thieves still commit

fraud upon the very people who serve this great country, here and abroad. Goes to show, they do not care

who you are.

That just about covers the Texas Property Code, Chapter 51. Defend yourself!

Copyright© 2010 A.Campbell P.O. Box 291 Coupland, Texas 78615 8

Vous aimerez peut-être aussi

- Foreclosure in TexasDocument10 pagesForeclosure in TexasA. Campbell100% (2)

- Assignment of Rent ActDocument8 pagesAssignment of Rent ActstarhoneyPas encore d'évaluation

- Law On BailmentsDocument48 pagesLaw On BailmentsDenmar Daryl GecobePas encore d'évaluation

- Assignment What Is The Contract of Pledge? What Are The Requisites of A Contract of Pledge?Document9 pagesAssignment What Is The Contract of Pledge? What Are The Requisites of A Contract of Pledge?Arvin RobertPas encore d'évaluation

- Gould Real Estate Finance Winter 2010 Final OutlineDocument82 pagesGould Real Estate Finance Winter 2010 Final OutlinesznitzelPas encore d'évaluation

- Art. 2085. The Following Requisites Are Essential To: Chapter 8. Chattel Mortgage A. General ConceptsDocument5 pagesArt. 2085. The Following Requisites Are Essential To: Chapter 8. Chattel Mortgage A. General ConceptsKenneth Peter MolavePas encore d'évaluation

- California Real Property Journal explores secured guaranties and third party deeds of trustDocument13 pagesCalifornia Real Property Journal explores secured guaranties and third party deeds of trustmtandrewPas encore d'évaluation

- 2sr Nego ReyesDocument4 pages2sr Nego ReyesRikka ReyesPas encore d'évaluation

- BLANKET MORTGAGE CLAUSES VALIDDocument6 pagesBLANKET MORTGAGE CLAUSES VALIDRonnel DeinlaPas encore d'évaluation

- Sonny Lo vs. KJS Eco-Formwork System Phil, Inc, GR No. 149420 (2003)Document2 pagesSonny Lo vs. KJS Eco-Formwork System Phil, Inc, GR No. 149420 (2003)Je S BePas encore d'évaluation

- Credit Transactions Case Doctrines: Chattel Mortgage & Real Estate MortgageDocument20 pagesCredit Transactions Case Doctrines: Chattel Mortgage & Real Estate MortgageMerGonzagaPas encore d'évaluation

- Once A Mortgage Always A MortgageDocument6 pagesOnce A Mortgage Always A MortgageSudarshani SumanasenaPas encore d'évaluation

- NEGO Case DigestDocument13 pagesNEGO Case DigestptbattungPas encore d'évaluation

- Real Estate Mortgage Law EssentialsDocument15 pagesReal Estate Mortgage Law EssentialsAlexis dimagiba100% (1)

- Guarantee and Undue InfluenceDocument10 pagesGuarantee and Undue InfluenceKELVIN A JOHNPas encore d'évaluation

- Defense For Collection Sum of MoneyDocument11 pagesDefense For Collection Sum of MoneyJero TakeshiPas encore d'évaluation

- Credit Transactions THEORYDocument5 pagesCredit Transactions THEORYnikolePas encore d'évaluation

- Part II Trust Receipt and Warehouse Receipt LawsDocument12 pagesPart II Trust Receipt and Warehouse Receipt LawsSimmonette Lim100% (1)

- Group 3-Dacion&Cession Comprehensive ReviewerDocument5 pagesGroup 3-Dacion&Cession Comprehensive ReviewerMaureen SanchezPas encore d'évaluation

- 2020new Ruling On Fiduciary Security Enforcement 002AHH TIA APR-compressedDocument3 pages2020new Ruling On Fiduciary Security Enforcement 002AHH TIA APR-compressedEmily BatubaraPas encore d'évaluation

- Contracts and Installment Sales ProtectionsDocument5 pagesContracts and Installment Sales ProtectionsDawn BitangcorPas encore d'évaluation

- Understanding Mortgages: Types, Rights, and LiabilitiesDocument22 pagesUnderstanding Mortgages: Types, Rights, and LiabilitiesNaina JageshaPas encore d'évaluation

- Trusts Law OverviewDocument25 pagesTrusts Law OverviewTharindu MalindaPas encore d'évaluation

- Real Estate Mortgage CasesDocument14 pagesReal Estate Mortgage CasesMatthew WittPas encore d'évaluation

- Pactum Commissorium - Complete NotesDocument11 pagesPactum Commissorium - Complete Noteseppieseverino583% (6)

- Real Mortgage Report FinalDocument17 pagesReal Mortgage Report FinalMaritesCatayongPas encore d'évaluation

- Secured Transactions OutlineDocument31 pagesSecured Transactions Outlinekurt100% (1)

- CREDITS Reviewer FinalsDocument9 pagesCREDITS Reviewer Finalsdorothy annPas encore d'évaluation

- Expert Witness Affidavit by Attorney SampleDocument24 pagesExpert Witness Affidavit by Attorney SampleCFLA, Inc100% (1)

- Disclaimer and Disclaimer TrustsDocument15 pagesDisclaimer and Disclaimer Trustsrobertkolasa50% (2)

- Provisions Common To Pledge and Mortgage Group 1Document23 pagesProvisions Common To Pledge and Mortgage Group 1Lisa PorjeoPas encore d'évaluation

- CREDIT CASE RULINGS | Evayne’s notes | exam prepDocument15 pagesCREDIT CASE RULINGS | Evayne’s notes | exam prepTrishPas encore d'évaluation

- Mercantile Law Bar Exam Q&ADocument26 pagesMercantile Law Bar Exam Q&AVerdeth Marie Wagan100% (1)

- Chattel Mortgage General Concepts: New Civil Code Act No. 1508 ("Chattel Mortgage Law"), 1 August 1906Document6 pagesChattel Mortgage General Concepts: New Civil Code Act No. 1508 ("Chattel Mortgage Law"), 1 August 1906Judy Ann ShengPas encore d'évaluation

- REMIC AND UCC EXPLAINED BY Plus NotesDocument66 pagesREMIC AND UCC EXPLAINED BY Plus Notesfgtrulin100% (9)

- CONTRACT OF PLEDGEDocument11 pagesCONTRACT OF PLEDGEColee StiflerPas encore d'évaluation

- Lowry Federal Credit Union, Creditor-Appellant v. James Dale West and Sharon Kay West, Debtors-Appellees, 882 F.2d 1543, 10th Cir. (1989)Document6 pagesLowry Federal Credit Union, Creditor-Appellant v. James Dale West and Sharon Kay West, Debtors-Appellees, 882 F.2d 1543, 10th Cir. (1989)Scribd Government DocsPas encore d'évaluation

- In The United States Bankruptcy Court For The District of DelawareDocument29 pagesIn The United States Bankruptcy Court For The District of DelawarePaula RushPas encore d'évaluation

- Credit Transactions - NotesDocument74 pagesCredit Transactions - Notesstubborn_dawg100% (9)

- Chapter 11 - 15Document113 pagesChapter 11 - 15Imran ShaikhPas encore d'évaluation

- Notes 4Document12 pagesNotes 4Kurukshetra Milk PlantPas encore d'évaluation

- ObliCon FinalDocument18 pagesObliCon Finalemdi19Pas encore d'évaluation

- Assignment TopicDocument8 pagesAssignment Topicumaima aliPas encore d'évaluation

- Mortgage NotesDocument6 pagesMortgage NotesJohn AguirrePas encore d'évaluation

- The Chattel Mortgage Law GuideDocument6 pagesThe Chattel Mortgage Law GuideArriane Hapon100% (1)

- Rights and Liabilities of MortgagorDocument21 pagesRights and Liabilities of MortgagorYash ToshniwalPas encore d'évaluation

- Lecture Notes On Credit Transactions Copy 3Document131 pagesLecture Notes On Credit Transactions Copy 3Irish Gracielle Dela CruzPas encore d'évaluation

- Lecture Notes On Credit Transactions Copy 2Document59 pagesLecture Notes On Credit Transactions Copy 2Irish Gracielle Dela CruzPas encore d'évaluation

- Lecture Notes On Credit TransactionsDocument82 pagesLecture Notes On Credit TransactionsIrish Gracielle Dela CruzPas encore d'évaluation

- REAL ESTATE MORTGAGE GuideDocument6 pagesREAL ESTATE MORTGAGE GuideGlennReyAninoPas encore d'évaluation

- Villaruz, John Roel S. 21 MAY 2020 Civil Law Review 2 New Era University College of LawDocument2 pagesVillaruz, John Roel S. 21 MAY 2020 Civil Law Review 2 New Era University College of Lawjayar medicoPas encore d'évaluation

- Lecture Notes On Credit Transactions 2Document47 pagesLecture Notes On Credit Transactions 2Cristine Mae CastroPas encore d'évaluation

- G.R. No. 74886.december 8, 1992. Prudential Bank, Petitioner, vs. Intermediate Appellate Court, Philippine Rayon Mills Inc. and ANACLETO R. CHI, RespondentsDocument26 pagesG.R. No. 74886.december 8, 1992. Prudential Bank, Petitioner, vs. Intermediate Appellate Court, Philippine Rayon Mills Inc. and ANACLETO R. CHI, RespondentsYrra LimchocPas encore d'évaluation

- Essential requisites of pledge and mortgageDocument35 pagesEssential requisites of pledge and mortgageLilibeth Dee GabuteroPas encore d'évaluation

- Mortgages Certain Legal IssuesDocument7 pagesMortgages Certain Legal IssuesZubair MirzaPas encore d'évaluation

- Convention on International Interests in Mobile Equipment - Cape Town TreatyD'EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyPas encore d'évaluation

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsD'EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (1)

- California Supreme Court Petition: S173448 – Denied Without OpinionD'EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionÉvaluation : 4 sur 5 étoiles4/5 (1)

- National Stock Exchange: Financial Market Regulations Project OnDocument11 pagesNational Stock Exchange: Financial Market Regulations Project OnNehmat SethiPas encore d'évaluation

- Manual Accounting Practice SetDocument8 pagesManual Accounting Practice SetVincent RuanPas encore d'évaluation

- Your Bill For Mobile ServicesDocument18 pagesYour Bill For Mobile ServicesKristy WilcoxPas encore d'évaluation

- CNH Tracker Aug 12 2011Document2 pagesCNH Tracker Aug 12 2011Kevin PlumbergPas encore d'évaluation

- Compliance Officers (Brokers) Module Curriculum 1.Document2 pagesCompliance Officers (Brokers) Module Curriculum 1.ambreenkhanamPas encore d'évaluation

- Financial Leasing in Tanzania: BriefingDocument3 pagesFinancial Leasing in Tanzania: BriefingArden Muhumuza KitomariPas encore d'évaluation

- Aviva Easy Life PlusDocument14 pagesAviva Easy Life PlusManju LovePas encore d'évaluation

- The United Republic of Tanzania: Annual Report For The Year Ended 30 JUNE 2018Document130 pagesThe United Republic of Tanzania: Annual Report For The Year Ended 30 JUNE 2018Hussein BoffuPas encore d'évaluation

- Iimt Placement Brochure 2010Document113 pagesIimt Placement Brochure 2010Imtiyajali KadiwalaPas encore d'évaluation

- Tabla DinamicaDocument76 pagesTabla Dinamicalaboral.lescanoPas encore d'évaluation

- Project Plan & Charter - MotlatsiDocument5 pagesProject Plan & Charter - MotlatsiMotlatsi MokoenaPas encore d'évaluation

- Rti Annexure 2Document9 pagesRti Annexure 2talk2hemi2598Pas encore d'évaluation

- LOI Letter 464635Document2 pagesLOI Letter 464635Ajay GangavarapuPas encore d'évaluation

- Statement of account transactionsDocument1 pageStatement of account transactionsSagar GuptaPas encore d'évaluation

- Transit of Planets On Thy Birth ChartDocument2 pagesTransit of Planets On Thy Birth Chartanshi0% (1)

- NCB Undersdtanding ZOG 1Document52 pagesNCB Undersdtanding ZOG 1Pip ArgotPas encore d'évaluation

- Investor Account - Zakat Declaration FormDocument2 pagesInvestor Account - Zakat Declaration FormMuhammad WasimPas encore d'évaluation

- An Insider's Guide To SFTR For The Buy-SideDocument12 pagesAn Insider's Guide To SFTR For The Buy-SideMalika DwarkaPas encore d'évaluation

- Central Bank v. CitytrustDocument2 pagesCentral Bank v. CitytrustAnjPas encore d'évaluation

- Canara StatememtDocument31 pagesCanara StatememtUŕs RohithPas encore d'évaluation

- Research MethodologyDocument45 pagesResearch MethodologyutuutkarshPas encore d'évaluation

- Aspiration Bank 2020Document6 pagesAspiration Bank 2020SAM0% (1)

- Mr. Wan Mohd Nazri Wan Osman, Central Bank of MalaysiaDocument6 pagesMr. Wan Mohd Nazri Wan Osman, Central Bank of Malaysiabrendan lanzaPas encore d'évaluation

- FinCEN Ripple Labs Facts and ViolationsDocument6 pagesFinCEN Ripple Labs Facts and ViolationscryptosweepPas encore d'évaluation

- dd1 PDFDocument3 pagesdd1 PDFChazMichaelmichaelsPas encore d'évaluation

- Renew your Health Insurance PolicyDocument2 pagesRenew your Health Insurance PolicyNishant PandeyPas encore d'évaluation

- Functions of RBIDocument8 pagesFunctions of RBIdchauhan21Pas encore d'évaluation

- Poverty Alleviation Through Micro Finance in India: Empirical EvidencesDocument8 pagesPoverty Alleviation Through Micro Finance in India: Empirical EvidencesRia MakkarPas encore d'évaluation

- Intermediate Course Study Material: TaxationDocument27 pagesIntermediate Course Study Material: TaxationBharath WajPas encore d'évaluation

- Bses PDFDocument1 pageBses PDFShivam VishvakarmaPas encore d'évaluation