Académique Documents

Professionnel Documents

Culture Documents

FRC The Uk Approach To Corporate Governance Final

Transféré par

Ahmed Munir0 évaluation0% ont trouvé ce document utile (0 vote)

181 vues15 pagesThe key aspects of corporate governance in the UK A single board collectively responsible for the success of the company. Separate Chief Executive and Chairman. A balance of executive and independent non-executive directors. A Code of good practice based on extensive consultation with practitioners.

Description originale:

Titre original

FRC the Uk Approach to Corporate Governance Final

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

TXT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe key aspects of corporate governance in the UK A single board collectively responsible for the success of the company. Separate Chief Executive and Chairman. A balance of executive and independent non-executive directors. A Code of good practice based on extensive consultation with practitioners.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme TXT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

181 vues15 pagesFRC The Uk Approach To Corporate Governance Final

Transféré par

Ahmed MunirThe key aspects of corporate governance in the UK A single board collectively responsible for the success of the company. Separate Chief Executive and Chairman. A balance of executive and independent non-executive directors. A Code of good practice based on extensive consultation with practitioners.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme TXT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 15

FINANCIAL REPORTING COUNCIL

THE UK APPROACH TO CORPORATE GOVERNANCE

NOVEMBER 2006

The key aspects of corporate governance in the UK

A single board collectively responsible for the success of the company.

Checks and balances:

Separate Chief Executive and Chairman.

A balance of executive and independent non-executive directors.

Strong, independent audit and remuneration committees.

Annual evaluation by the board of its performance.

Emphasis on objectivity of directors in the interests of the company.

Transparency on appointments and remuneration.

Effective rights for shareholders.

A Code of good practice based on extensive consultation with

practitioners, and operating on the basis of the 'comply or explain'

principle.

Foreword

Good corporate governance is essential to the effective operation of a free

market, which enables wealth creation and freedom from poverty.

The City of London has a history of encouraging free trade and good

corporate governance, based on the application of simple principles to the

individual and distinct circumstances of each entity.

The more ingrained the system of corporate governance in a business

community, the less the need for detailed regulation to ensure effective

compliance with good standards of business behaviour.

The UK's system of business regulation, which is principles rather than

rules based, reduces the cost to global businesses of introducing

procedures to comply with detailed regulations, many of which

unnecessarily constrain business practice and innovation.

This publication has been produced by the Financial Reporting Council,

which is responsible for corporate governance in the UK, as part of the

"City of London - City of Learning" initiative.

Financial Reporting Council 1

We welcome this publication which describes the system of corporate

governance which we have found to be very advantageous.

John Stuttard, The Rt Hon The Lord Mayor of the City of London

JJoohhnnSSttuuttttaarrdd,,TThheeRRttHHoonnTThheeLLoorrddMMaayyoorroofftthheeCCii

ttyyooffLLoonnddoonn

Sir Paul Judge, Chairman, City of London -City of Learning

SSiirrPPaauullJJuuddggee,,CChhaaiirrmmaann,,CCiittyyooffLLoonnddoonn--CCiittyyoo

ffLLeeaarrnniinngg

Gordon Slaven, Deputy Director, Education Training Group, British Council

GGoorrddoonnSSllaavveenn,,DDeeppuuttyyDDiirreeccttoorr,,EEdduuccaattiioonnTTrraa

iinniinnggGGrroouupp,,BBrriittiisshhCCoouunncciill

Professor David Rhind, Vice Chancellor, The City University London

PPrrooffeessssoorrDDaavviiddRRhhiinndd,,VViicceeCChhaanncceelllloorr,,TThheeCCii

ttyyUUnniivveerrssiittyyLLoonnddoonn

Professor Sir Roderick Floud,

PPrrooffeessssoorrSSiirrRRooddeerriicckkFFlloouudd,,

Emeritus President, London Metropolitan University

EEmmeerriittuussPPrreessiiddeenntt,,LLoonnddoonnMMeettrrooppoolliittaannUUnniivv

eerrssiittyy

2 The UK Approach to Corporate Governance

The advantages of the UK approach

The UK approach combines high standards of corporate governance with

relatively low associated costs. Comparative studies consistently show that

the UK outperforms other countries in terms of governance standards,

while compliance costs are estimated to be lower than in other countries

with comparable standards.

It is proportionate and capable of dealing with a wide variety of

circumstances. There is a relative lack of prescription as to how the

company's board organises itself and exercises its responsibilities. The

Combined Code on Corporate Governance identifies good governance

practices, but companies can choose to adopt a different approach if that is

more appropriate to their circumstances.

The key relationship is between the company and its shareholders, not

between the company and the regulator. Boards and shareholders are

encouraged to engage in dialogue on corporate governance matters.

Shareholders have voting rights and rights to information, set out in

company law and the Listing Rules, which enable them to hold the board

to account.

The development of corporate governance in the UK

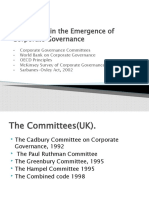

The development of corporate governance in the UK has its roots in a

series of corporate collapses and scandals in the late 1980s and early 1990s,

including the collapse of the BCCI bank and the Robert Maxwell pension

funds scandal, both in 1991.

Financial Reporting Council 3

The UK business community recognised the need to put its house in

order. This led to the setting up in 1991 of the Committee on the Financial

Aspects of Corporate Governance, chaired by Sir Adrian Cadbury, which

issued a series of recommendations - known as the Cadbury Report - in

1992. The Cadbury Report addressed issues such as the relationship

between the chairman and chief executive, the role of non-executive

directors and reporting on internal control and on the company's position.

A requirement was added to the Listing Rules of the London Stock

Exchange that companies should report whether they had followed the

recommendations or, if not, explain why they had not done so (this is

known as 'comply or explain').

The recommendations in the Cadbury Report have been added to at

regular intervals since 1992. In 1995 the Greenbury Report set out

recommendations on the remuneration of directors. In 1998 the Cadbury

and Greenbury reports were brought together and updated in the

Combined Code, and in 1999 the Turnbull guidance was issued to provide

directors with guidance on how to develop a sound system of internal

control.

Following the Enron and WorldCom scandals in the US, the Combined

Code was updated in 2003 to incorporate recommendations from reports

on the role of non-executive directors (the Higgs Report) and the role of

the audit committee (the Smith Report). At this time the UK Government

confirmed that the Financial Reporting Council (FRC) was to have the

responsibility for publishing and maintaining the Code. The FRC made

further, limited, changes to the Code in 2006. Throughout all of these

changes, the 'comply or explain' approach first set out in the Cadbury

Report has been retained.

4 The UK Approach to Corporate Governance

The rationale behind the UK approach

The UK approach starts from the position that good governance is a tool

that can improve the board's ability to manage the company effectively as

well as provide accountability to shareholders. To quote from the Cadbury

Report:

"The effectiveness with which boards discharge their responsibilities

determines Britain's competitive position. They must be free to drive their

companies forward, but exercise that freedom within a framework of

effective accountability. This is the essence of any system of good

corporate governance."

A regulatory framework that aims to improve standards of corporate

governance is more likely to succeed, and be accepted by those that it

regulates, if it recognises that governance should support, not constrain,

the entrepreneurial leadership of the company, while ensuring risk is

properly managed. Governance must also work to the benefit of the

shareholders by improving the long-term value of the company.

This requires a degree of flexibility in the way companies adopt and adapt

governance practices. To be effective good governance needs to be

implemented in a way that fits the culture and organisation of the

individual company. This can vary enormously from company to company

depending on factors such as size, ownership structure and the complexity

of the business model.

The assessment of whether the company's governance practices are

effective should be made by the intended beneficiaries - i.e. the

shareholders.

Financial Reporting Council 5

Investors can take a pragmatic approach about how to apply best practice

in a way that is in the best interests of the company. This is in contrast to

regulators, who find it more difficult to allow exceptions as they must be

seen to be applying the rules consistently.

The UK regulatory framework

The UK has developed a market-based approach that enables the board to

retain flexibility in the way in which it organises itself and exercises its

responsibilities, while ensuring that it is properly accountable to its

shareholders.

This is done primarily through the Combined Code on Corporate

Governance which operates on the basis of 'comply or explain'. The

Combined Code identifies good governance practices relating to, for

example, the role and composition of the board and its committees and

the development of a sound system of internal control, but companies can

choose to adopt a different approach if that is more appropriate to their

circumstances. Where they do so, however, they are required to explain

the reason to their shareholders who must decide whether they are

content with the approach that has been taken.

This 'comply or explain' approach enables judgements about, for example,

the independence of non-executive directors, to be made on a case by case

basis. It is supported by companies, investors and regulators in the UK,

and has increasingly been adopted as a model in other financial markets.

For the system to work effectively shareholders need to have appropriate

and relevant information to enable them to make a judgement on the

governance practices of the companies in which they invest. They also

6 The UK Approach to Corporate Governance

need the rights to enable them to influence the behaviour of the board

when they are not content. 'Comply or explain' therefore needs to be

underpinned by an appropriate regulatory framework.

Under UK company law, shareholders have comparatively extensive

voting rights, including the rights to appoint and dismiss individual

directors and, in certain circumstances, to call an Extraordinary General

Meeting of the company. Certain requirements relating to the AGM,

including the provision of information to shareholders and arrangements

for voting on resolutions, are also set out in company law, as are some

requirements for information to be disclosed in the annual report and

accounts. These include requirements for a Business Review (in which the

board sets out, inter alia, a description of the principal risks and

uncertainties facing the company) and a report on directors'

remuneration, on which shareholders have an advisory vote.

This framework is reinforced by the Listing Rules that must be followed by

companies listed on the Main Market of the London Stock Exchange. The

Listing Rules provide further rights to shareholders (for example, by

requiring that major transactions are put to a vote), and require certain

information to be disclosed to the market. This includes the requirement

to provide a 'comply or explain' statement in the annual report explaining

how the company has applied the Combined Code (or, in the case of

companies incorporated outside the UK, to describe how the companies'

governance practices differ from those set out in the Code).

Copies of the Combined Code can be obtained from

http://www.frc.org.uk/corporate/combinedcode.cfm

Financial Reporting Council 7

The benefits of the UK approach

The UK approach combines high standards of corporate governance with

relatively low associated costs.

Studies consistently show that the UK outperforms other countries in

terms of governance standards, and that standards within the UK continue

to rise. Reports published in 2005 by the FTSE ISS Corporate Governance

Index and Governance Metrics International both put the UK at the top of

the list of countries by average corporate governance score. A survey

carried out by the National Association of Pension Funds in the same year

found that 94% of large UK pension funds believed that corporate

governance standards in UK companies had improved.

Compliance costs in the UK are considered to be lower than in other

countries with comparable standards. A study published in June 2006 by

Oxera on behalf of the London Stock Exchange found that the corporate

governance requirements were seen by some companies as one of the

main factors influencing the choice between a UK and US listing (to the

advantage of the UK).

8 The UK Approach to Corporate Governance

The essential features of UK corporate governance

The role and composition of the board

TThheerroolleeaannddccoommppoossiittiioonnoofftthheebbooaarrdd

A single board with members collectively responsible for leading

the company and setting its values and standards.

A clear division of responsibilities for running the board and

running the company with a separate chairman and chief

executive.

A balance of executive and independent non-executive directors for

larger companies at least 50% of the board members should be

independent non-executive directors; smaller companies should

have at least two independent directors.

Formal and transparent procedures for appointing directors, with

all appointments and re-appointments to be ratified by

shareholders.

Regular evaluation of the effectiveness of the board and its

committees.

Remuneration

RReemmuunneerraattiioonn

Formal and transparent procedures for setting executive

remuneration, including a remuneration committee made up of

independent directors and an advisory vote for shareholders.

A significant proportion of remuneration to be linked to performance.

Financial Reporting Council 9

Accountability and Audit

AAccccoouunnttaabbiilliittyyaannddAAuuddiitt

The board is responsible for presenting a balanced assessment of

the company's position (including through the accounts), and

maintaining a sound system of internal control.

Formal and transparent procedures for carrying out these

responsibilities, including an audit committee made up of

independent directors and with the necessary experience.

Relations with shareholders

RReellaattiioonnsswwiitthhsshhaarreehhoollddeerrss

The board must maintain contact with shareholders to understand

their opinions and concerns.

Separate resolutions on all substantial issues at general meetings.

10 The UK Approach to Corporate Governance

© The Financial Reporting Council 2006

FINANCIAL REPORTING COUNCIL

5TH FLOOR

ALDWYCH HOUSE

71-91 ALDWYCH

LONDON WC2B 4HN

Tel: +44 (0)20 7492 2300

fax: +44 (0)20 7492 2301

WEBSITE: www.frc.org.uk

Vous aimerez peut-être aussi

- Corporate Governance: A practical guide for accountantsD'EverandCorporate Governance: A practical guide for accountantsÉvaluation : 5 sur 5 étoiles5/5 (1)

- UK Corporate Governance Code 2014Document36 pagesUK Corporate Governance Code 2014Simon YossefPas encore d'évaluation

- All MCQ QuestionsDocument35 pagesAll MCQ Questionsprathmesh survePas encore d'évaluation

- Chapter I:-: Corporate Governance:-An Introduction IntroductionDocument76 pagesChapter I:-: Corporate Governance:-An Introduction IntroductionrampunjaniPas encore d'évaluation

- Cadbury and Turnbull ReportDocument10 pagesCadbury and Turnbull ReportlulughoshPas encore d'évaluation

- UK Corporate Governance MilestonesDocument5 pagesUK Corporate Governance MilestonesCristina Cimpoes DoroftePas encore d'évaluation

- Defence ICT StrategyDocument64 pagesDefence ICT StrategykapsicumPas encore d'évaluation

- Cadbury CommiteeDocument5 pagesCadbury CommiteeAnkit Raj100% (2)

- The New Public Leadership Challenge 2010Document434 pagesThe New Public Leadership Challenge 2010waqas724Pas encore d'évaluation

- UK Approach To Corporate Governance Oct 20101Document16 pagesUK Approach To Corporate Governance Oct 20101Alice PhamPas encore d'évaluation

- The Cadbury Committee Report On Corporate GovernanceDocument15 pagesThe Cadbury Committee Report On Corporate GovernanceDiksha VashishthPas encore d'évaluation

- Balu CG RPDocument26 pagesBalu CG RPPriyanka GrandhiPas encore d'évaluation

- Corporate GovernanceDocument5 pagesCorporate GovernanceBell VilsonPas encore d'évaluation

- ACC 401 Lecture1 Corporate GovernanceDocument8 pagesACC 401 Lecture1 Corporate GovernanceWihemina PhoebePas encore d'évaluation

- UK Corporate Governance CodeDocument6 pagesUK Corporate Governance CodeNabil Ahmed KhanPas encore d'évaluation

- UK Corporate Governance Code 2014Document36 pagesUK Corporate Governance Code 2014Herbert NgwaraiPas encore d'évaluation

- MCCG 2000 Finance CommDocument59 pagesMCCG 2000 Finance CommJiong Xun ChuahPas encore d'évaluation

- Corporate Governance in Financial InstitutionsDocument36 pagesCorporate Governance in Financial InstitutionsGolam KibriaPas encore d'évaluation

- 25 Landmarks in Corporate GovernanceDocument25 pages25 Landmarks in Corporate Governancem_dattaias100% (5)

- Sob 2022 Assignment 1-1Document8 pagesSob 2022 Assignment 1-1mwenifumbocheluPas encore d'évaluation

- Audit Firm Governance Code: Revised 2016Document23 pagesAudit Firm Governance Code: Revised 2016Arsalan AliPas encore d'évaluation

- Landmarks in Emergence of CGDocument93 pagesLandmarks in Emergence of CGhitarthsarvaiyaPas encore d'évaluation

- Corporate Governance - UK N USDocument15 pagesCorporate Governance - UK N USvarunPas encore d'évaluation

- CGBEDocument36 pagesCGBEPapunPas encore d'évaluation

- Corporate Governance Committees UKDocument18 pagesCorporate Governance Committees UKDhruv Aghi100% (1)

- Cadbury and Greenbury CommitteeDocument9 pagesCadbury and Greenbury Committeeofficial emailPas encore d'évaluation

- Corporate GovernanceDocument2 pagesCorporate GovernanceMehedi Hasan ShaikotPas encore d'évaluation

- Corporate Governance RegulationDocument33 pagesCorporate Governance RegulationSaeed Agha Ahmadzai100% (1)

- A Regulatory EnvironmentDocument28 pagesA Regulatory EnvironmenttsololeseoPas encore d'évaluation

- Module 9 - Corporate GovernanceDocument13 pagesModule 9 - Corporate GovernanceSuraj AgarwalPas encore d'évaluation

- Research Proposal On The UK Regulatory Framework For Corporate GovernanceDocument14 pagesResearch Proposal On The UK Regulatory Framework For Corporate GovernanceADAMS UVEIDAPas encore d'évaluation

- Chapter 2 - Corporate Governance CodeDocument19 pagesChapter 2 - Corporate Governance Codekemalatha88Pas encore d'évaluation

- Corporate Governance of Unilever and MicDocument22 pagesCorporate Governance of Unilever and MicAnushk ShuklaPas encore d'évaluation

- Cadbury CommitteeDocument65 pagesCadbury CommitteeGaganPas encore d'évaluation

- CH 3 Corporate GovernanceDocument29 pagesCH 3 Corporate GovernanceMazhar IqbalPas encore d'évaluation

- Audit AssignmentDocument3 pagesAudit AssignmentHiya BhandariBD21070Pas encore d'évaluation

- Regulatory Framework of Corporate GovernanceDocument47 pagesRegulatory Framework of Corporate GovernanceIshan UpretyPas encore d'évaluation

- Corporate GovernanceDocument3 pagesCorporate GovernanceUsman KhanPas encore d'évaluation

- DeliveryDocument6 pagesDeliveryVenkata Sai Varun KanuparthiPas encore d'évaluation

- UK Stewardship CodeDocument4 pagesUK Stewardship CodeCharity ChikwandaPas encore d'évaluation

- 2018 UK Corporate Governance CodeDocument20 pages2018 UK Corporate Governance Codeprince.inkproPas encore d'évaluation

- Bica Panel Notes (Final)Document6 pagesBica Panel Notes (Final)lucky mishraaPas encore d'évaluation

- Chapter 3Document94 pagesChapter 3Sanjay KumarPas encore d'évaluation

- Assignment On Cadbury Code: Submitted To Submitted byDocument15 pagesAssignment On Cadbury Code: Submitted To Submitted bytoaha0% (1)

- Cadbury CodeDocument15 pagesCadbury CodetoahaPas encore d'évaluation

- Corporate Governance Best Practices in The Developing World - A Unified PerspectiveDocument11 pagesCorporate Governance Best Practices in The Developing World - A Unified PerspectiveClay JensenPas encore d'évaluation

- A Review of Corporate Governance in Uk Banks and Other Financial Industry EntitiesDocument40 pagesA Review of Corporate Governance in Uk Banks and Other Financial Industry EntitiesImi MaximPas encore d'évaluation

- CG & AccountabilityDocument60 pagesCG & AccountabilitysushilkhannaPas encore d'évaluation

- UK Corporate Governance: Comply or Explain PrincipleDocument14 pagesUK Corporate Governance: Comply or Explain PrincipleIrena RiabchychPas encore d'évaluation

- Corporate Governance ProjectDocument13 pagesCorporate Governance ProjectHarshSuryavanshiPas encore d'évaluation

- Corporate Ethics From Global PerspectiveDocument18 pagesCorporate Ethics From Global PerspectiveDooms 001Pas encore d'évaluation

- Corporate Governance FinalDocument63 pagesCorporate Governance Finalrampunjani100% (1)

- Corporate Governance From A Global PerspectiveDocument18 pagesCorporate Governance From A Global PerspectiveAsham SharmaPas encore d'évaluation

- Corporate Governance From A Global Perspective: SSRN Electronic Journal April 2011Document18 pagesCorporate Governance From A Global Perspective: SSRN Electronic Journal April 2011Tehsemut AntPas encore d'évaluation

- UK Corporate Governance Code 2024 kRCm5ssDocument19 pagesUK Corporate Governance Code 2024 kRCm5ssPaulina SagardiaPas encore d'évaluation

- Models of Corporate GovernanceDocument2 pagesModels of Corporate GovernanceneilonlinedealsPas encore d'évaluation

- United Kingdom - Corporate GovernanceDocument13 pagesUnited Kingdom - Corporate GovernanceVân Thảo PhạmPas encore d'évaluation

- CorfinalrptDocument18 pagesCorfinalrptapi-3817560Pas encore d'évaluation

- 1 History and Intro To Corporate GovernanceDocument29 pages1 History and Intro To Corporate Governancearun achariPas encore d'évaluation

- International AccountingDocument4 pagesInternational AccountingJoey WongPas encore d'évaluation

- Skans School of Accountancy: What Is Corporate Governance?Document9 pagesSkans School of Accountancy: What Is Corporate Governance?shahabPas encore d'évaluation

- Corporate GovernanceDocument10 pagesCorporate GovernancepriitiikuumariiPas encore d'évaluation

- The Role of Principles and Practices of Financial Management in the Governance of With-Profits UK Life InsurersD'EverandThe Role of Principles and Practices of Financial Management in the Governance of With-Profits UK Life InsurersPas encore d'évaluation

- Doctrine of Separation of PowersDocument41 pagesDoctrine of Separation of Powersaayush lathiPas encore d'évaluation

- The Adoption of Digital Technology in The ArtsDocument34 pagesThe Adoption of Digital Technology in The ArtsHelga ThiesPas encore d'évaluation

- Dominos 2021 Annual ReportDocument204 pagesDominos 2021 Annual ReportAtif NaumanPas encore d'évaluation

- Res2022-255 - SK GemsDocument12 pagesRes2022-255 - SK GemsSangguniang Bayan TulunanPas encore d'évaluation

- FSSCC ACAT v2 1Document61 pagesFSSCC ACAT v2 1César R d kPas encore d'évaluation

- Narrative ReportDocument79 pagesNarrative ReportJerald Kim VasquezPas encore d'évaluation

- Bicol RDP 2023 2028Document317 pagesBicol RDP 2023 2028Shaira LuzonPas encore d'évaluation

- Group 2 Evolution of Philippine ConstitutionDocument23 pagesGroup 2 Evolution of Philippine ConstitutionZion WilliamsonPas encore d'évaluation

- Data Mesh PaperDocument35 pagesData Mesh PaperSekhar SahuPas encore d'évaluation

- Integrated Thinking PrinciplesDocument24 pagesIntegrated Thinking Principlesmusahlungwane456Pas encore d'évaluation

- ETGRMDocument38 pagesETGRMThe Bearded Guy (TheBeardedGuy)Pas encore d'évaluation

- China's Political Party System: Cooperation and ConsultationDocument25 pagesChina's Political Party System: Cooperation and ConsultationGabriel QuintanilhaPas encore d'évaluation

- Effective Corporate Governance - A Reassessment by Dr. V.R. Narasimhan 7Document5 pagesEffective Corporate Governance - A Reassessment by Dr. V.R. Narasimhan 7routraykhushbooPas encore d'évaluation

- Governance & EthicsDocument403 pagesGovernance & EthicsJanani ParameswaranPas encore d'évaluation

- The Constitution 2022Document11 pagesThe Constitution 2022Abiba JumaPas encore d'évaluation

- Corporate Governance in BangladeshDocument9 pagesCorporate Governance in BangladeshAmaan Al WaasiPas encore d'évaluation

- Chapter 12 CSR and Corporate GovernanceDocument24 pagesChapter 12 CSR and Corporate GovernanceJoeriel L. MontebonPas encore d'évaluation

- The General Counsel and The Board 1Document28 pagesThe General Counsel and The Board 1Guneit DhillonPas encore d'évaluation

- Constitutional Power of TaxationDocument42 pagesConstitutional Power of Taxationdhwani shahPas encore d'évaluation

- RMZ Sustainability PolicyDocument2 pagesRMZ Sustainability Policysanjeev kumar vsPas encore d'évaluation

- A Accounting Ethics in The Digital AgeDocument5 pagesA Accounting Ethics in The Digital AgeBrook KongPas encore d'évaluation

- HCR 3031Document3 pagesHCR 3031Rob PortPas encore d'évaluation

- CSOs-NGOs in Ethiopia - Partners in DevelopmentDocument104 pagesCSOs-NGOs in Ethiopia - Partners in DevelopmentMathieu Boulanger100% (1)

- Public Administration Theory Primer ExamplesDocument6 pagesPublic Administration Theory Primer ExamplesrinalPas encore d'évaluation

- Electoral Politics Module-2, Hand Out 2, Class 9, Civics, Lesson-3, Electoral PoliticsDocument4 pagesElectoral Politics Module-2, Hand Out 2, Class 9, Civics, Lesson-3, Electoral PoliticsSaiPas encore d'évaluation

- Marc - International Corporate Governance (2012, Pearson)Document337 pagesMarc - International Corporate Governance (2012, Pearson)Irsa AritaniaPas encore d'évaluation

- 2022 Utah Election AuditDocument134 pages2022 Utah Election AuditKUTV 2NewsPas encore d'évaluation