Académique Documents

Professionnel Documents

Culture Documents

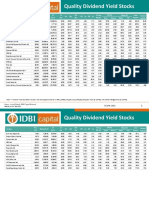

Dividend Yield Stocks 8 Mar

Transféré par

skynolimits0 évaluation0% ont trouvé ce document utile (0 vote)

34 vues2 pagesDividend yield is one of the main factors to consider when investing in dividend-paying stocks. In this list we have selected 45 stocks based on their financial performance.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDividend yield is one of the main factors to consider when investing in dividend-paying stocks. In this list we have selected 45 stocks based on their financial performance.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

34 vues2 pagesDividend Yield Stocks 8 Mar

Transféré par

skynolimitsDividend yield is one of the main factors to consider when investing in dividend-paying stocks. In this list we have selected 45 stocks based on their financial performance.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Error! Reference source not Error!

Reference source not

Dividend Yield Stocks March 07, 2011

found. found.

Dividend yield is one of the main factors to consider when investing in dividend-paying stocks. It is an indicator of the return

that the investors are earning on their shares. In this list we have selected 45 stocks based on their financial performance.

Investors interested in dividend income may consider the stocks in this list.

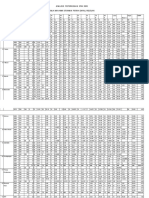

Mcap Equity CMP Book Div. Div.-% Div.-

(Rs In (Rs In Mar 04, FV Value EPS P/E Latest- [1 yr. %[2 yr Dividend

Company Name Industry Year End cr.) cr.) 2011 (Rs) (Rs) (Rs) (x) % before] before] Yield -%

HCL Infosystems Computers 201006 2262 43.63 103.7 2 87.31 11.62 8.96 375 325 400 7.23

Hero Honda Automobiles 201003 30643 39.94 1534.5 2 173.51 104.78 14.34 5500 1000 950 7.17

CPCL Refineries 201003 2868 148.94 192.55 10 232.44 9.15 21 120 0 170 6.23

Castrol India Lubricants 201012 9946 247.28 402.2 10 22.38 19.83 20.53 250 150 140 6.22

ON GC Oil Exploration 201003 229800 4277.7 268.6 5 102.02 23.27 11.55 330 320 320 6.14

ITC Cigarettes 201003 133199 772.17 172.5 1 18.15 6.13 28.2 1000 370 350 5.80

Kirl. Ferrous Steel - Pig Iron 201003 240 68.65 17.5 5 23.78 3.01 8.68 20 10 15 5.71

Cosmo Films Packaging 201003 184 19.44 94.9 10 150.05 22.92 5.99 50 50 50 5.27

SCI Shipping 201003 4486 423.45 105.95 10 149.65 10.76 13.49 50 65 85 4.72

MIRC Electronics Electronics 201003 290 14.2 20.45 1 18.01 1.54 13.52 95 40 100 4.65

Hawkins Cookers Domestic Appl. 201003 477 5.29 901.25 10 73.55 67.58 15.01 400 200 100 4.44

NRB Bearings Bearings 201003 438 19.38 45.2 2 19.36 4.34 12.1 100 80 120 4.42

JK Paper Paper 201003 371 78.15 47.45 10 60.16 13.52 4.3 20 17.5 15 4.21

IOCL Refineries 201003 76395 2428 314.65 10 208.21 37.47 8.33 130 75 55 4.13

Graphite India Electrodes 201003 1680 39.08 86 2 67.32 10.77 8.32 175 150 150 4.07

Electrost.Cast. Castings 201003 1011 32.68 30.95 1 48.46 4.71 7.93 125 125 125 4.04

Nava Bharat Vent Diversified 201003 1729 15.27 226.45 2 209.07 56.65 5.33 450 400 300 3.97

Clariant Chemica Chemicals 201012 1679 26.66 629.95 10 130.45 50.21 14.1 250 190 100 3.97

SJVN Power Generation 201003 8439 4136.6 20.4 10 16.14 2.22 10.18 7.95 7.79 5.94 3.90

Bajaj Holdings Finance 201003 8800 111.29 790.75 10 364.43 92.38 8.56 300 100 200 3.79

Orchid Chemicals Pharmaceuticals 201003 1907 70.44 270.75 10 139.07 59.27 4.78 100 10 30 3.69

T N Newsprint Paper 201003 848 69.21 122.5 10 116.22 23.97 5.48 45 45 45 3.67

NIIT Tech. Computers 201003 1128 59.02 191.05 10 80.52 19.38 9.78 70 65 65 3.66

HPCL Refineries 201003 11149 338.63 329.25 10 341.3 34.65 9.5 120 52.5 30 3.64

Andhra Bank Banks 201003 6800 485 140.2 10 90.93 24.63 5.69 50 45 40 3.57

JBF Inds. Textiles 201003 1209 71.37 169.35 10 119.15 17.72 10.2 60 50 15 3.54

Greaves Cotton Engines 201006 2092 48.84 85.65 2 17.9 5.34 18.01 150 40 60 3.50

Bank of Maha Banks 201003 2510 430.52 58.3 10 55.84 9.8 6.99 20 15 20 3.43

Century Enka Textiles 201003 394 21.85 180.4 10 264.46 31.63 6.62 60 50 50 3.33

Vijaya Bank Banks 201003 3353 434 77.35 10 61.44 13.85 5.58 25 10 20 3.23

Zee Enter. Entertainment 201003 12122 97.8 123.95 1 28.89 5.64 25.06 400 200 200 3.23

Orient Paper Diversified 201003 899 19.29 46.6 1 39.74 6.21 8.68 150 150 120 3.22

Jagran Prakash Media 201003 3664 63.25 115.85 2 85.37 6.33 17.9 175 100 100 3.09

Gateway Distr. Logistics 201003 1224 107.98 113.4 10 61.91 7.16 14.46 35 35 35 3.09

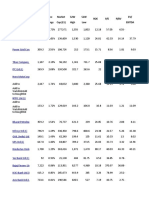

Corporation Bank Banks 201003 8010 143 558.4 10 403 96 6 165 125 105 2.95

Karur Vyasya Bank Bank 201003 4432 106.69 415.4 10 135.7 37.42 10.96 120 120 120 2.93

Indian Bank Banks 201003 9554 430 222.3 10 155 38 6 65 50 40 2.92

J & K Bank Banks 201003 3649 48.48 752.6 10 620.97 117.3 7.01 220 169 155 2.92

Bajaj Auto Automobiles 201003 39864 289 1377.7 10 101 86 16 400 220 200 2.90

Ashok Leyland Automobiles 201003 7164 133.03 53.85 1 17.56 4.18 12.68 150 100 150 2.83

Oil India Oil Exploration 201003 29884 240 1242.9 10 572.5 114.62 10.84 340 305 275 2.74

Tata Chemicals Fertilizers 201003 8422 255 330.6 10 182.38 15.8 20.93 90 90 90 2.72

Allahabad Bank Banks 201003 9128 447 204.65 10 131.73 31.12 6.57 55 25 35 2.69

REC Finance 201003 23743 987.46 240.45 10 39.61 24.62 9.91 65 45 30 2.66

Oriental Bank Banks 201003 8758 251 349.55 10 292.19 59.32 5.89 91 73 47 2.60

Ajay Kumar Srivastava Swati Saxena

1

Ajaykumar.s@religare.in swati.saxena@religare.in

Disclaimer

This document has been prepared by Religare Retail Research (Religare). is a part of Religare Securities Limited.

We are not soliciting any action based upon this material. This report is not to be construed as an offer to sell or a

solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It

is for the general information of recipients. It does not constitute a recommendation or take into account the

particular investment objectives, financial situations, or needs of individual recipients. Not all recipients may

receive this report at the same time. Religare will not treat recipients as customers/ clients by virtue of their

receiving this report. We have reviewed the report, and in so far as it includes current or historical information, it

is believed to be reliable. It should be noted that the information contained herein is from publicly available data

or other sources believed to be reliable. Neither Religare, nor any person connected with it, accepts any liability

arising from the use of this document.

This document is prepared for assistance only and is not intended to be and must not be taken as the basis for

any investment decision. The investment discussed or views expressed may not be suitable for all investors. The

user assumes the entire risk of any use made of this information. The recipients of this material should rely on

their own investigations and take their own professional advice. Each recipient of this document should make

such investigations as it deems necessary to arrive at an independent evaluation of an investment referred to in

this document (including the merits and risks involved), and should consult its own advisors to determine the

merits and risks of such an investment. Price and value of the investments referred to in this material may go up

or down. Past performance is not a guide for future performance. Certain transactions -including those involving

futures, options and other derivatives as well as securities - involve substantial risk and are not suitable for all

investors. Reports based on technical analysis centres on studying charts of price movement and trading volume,

as opposed to focusing on fundamentals and as such, may not match with a report based on fundamentals.

Opinions expressed are our current opinions as of the date appearing on this material only. We do not undertake

to advise you as to any change of our views expressed in this document. While we would endeavour to update

the information herein on a reasonable basis, Religare, its affiliates, subsidiaries and associated companies, their

directors and employees are under no obligation to update or keep the information current. Also there may be

regulatory, compliance, or other reasons that may prevent Religare and affiliates from doing so. Prospective

investors and others are cautioned that any forward-looking statements are not predictions and may be subject

to change without notice. This report is not directed or intended for distribution to, or use by, any person or

entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject Religare

and affiliates to any registration or licensing requirement within such jurisdiction. The investments described

herein may or may not be eligible for sale in all jurisdictions or to certain category of persons. Persons in whose

possession this document may come are required to ascertain themselves of and to observe such restriction.

Religare and its affiliates, officers, directors, and employees may: (a) from time to time, have long or short

positions in, and buy or sell the investments in / securities of company (ies) mentioned herein or (b) be engaged

in any other transaction involving such investments / securities and earn brokerage or other compensation or act

as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender /

borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation

and related information and opinions. Without limiting any of the foregoing, in no event shall Religare, any of its

affiliates or any third party involved in, or related to, computing or compiling the information have any liability for

any damages of any kind. Copyright in this document vests exclusively with Religare. This information should not

be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published,

copied, in whole or in part, for any purpose, without prior written permission from Religare. We do not guarantee

the integrity of any emails or attached files and are not responsible for any changes made to them by any other

person. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her

personal views about the subject company or companies and its or their securities, and no part of his or her

compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in

this report.

Vous aimerez peut-être aussi

- Dividend Yield Stocks 6 JanDocument2 pagesDividend Yield Stocks 6 JanIndrayani NimbalkarPas encore d'évaluation

- Div Yield 10Document2 pagesDiv Yield 10Hardik SompuraPas encore d'évaluation

- Dividend Yielding StocksDocument2 pagesDividend Yielding StocksleninbapujiPas encore d'évaluation

- DIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564Document5 pagesDIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564uma AgrawalPas encore d'évaluation

- Growth at Reasonable Price 12 Jun 2023 1218Document1 pageGrowth at Reasonable Price 12 Jun 2023 1218spahujPas encore d'évaluation

- Gitanjali Gems Shilpi CableDocument15 pagesGitanjali Gems Shilpi CablestrignentPas encore d'évaluation

- Dividend Yield StocksDocument2 pagesDividend Yield Stocksunu_uncPas encore d'évaluation

- ICICIdirect ExpectedHighDividendYieldStocksDocument2 pagesICICIdirect ExpectedHighDividendYieldStocksRamesh RajagopalanPas encore d'évaluation

- Stock DetailsDocument2 pagesStock DetailsNilesh DhandePas encore d'évaluation

- Dividend Yield Stocks 210922Document3 pagesDividend Yield Stocks 210922Aaron KaleesPas encore d'évaluation

- Industry WiseDocument21 pagesIndustry WiseRicha RaniPas encore d'évaluation

- Quality Dividend Yield Stocks Jan 22 03 January 2022 478756522Document4 pagesQuality Dividend Yield Stocks Jan 22 03 January 2022 478756522Jaikanth MuthukumaraswamyPas encore d'évaluation

- PhotoDocument8 pagesPhotoPrasad GopiPas encore d'évaluation

- Quality Dividend Yield Stocks - 301216Document5 pagesQuality Dividend Yield Stocks - 301216sumit guptaPas encore d'évaluation

- Dividend Yield StocksDocument3 pagesDividend Yield StocksSushilPas encore d'évaluation

- Dividend Yield Report June 2022 - Idbi CapDocument5 pagesDividend Yield Report June 2022 - Idbi CapcitisunPas encore d'évaluation

- NSE Nifty 50 Quarterly Financial Analysis With EPSDocument1 pageNSE Nifty 50 Quarterly Financial Analysis With EPSRajeev NaikPas encore d'évaluation

- Nifty 500Document4 pagesNifty 500vmichelle9Pas encore d'évaluation

- Dividend Yield Stocks: Retail ResearchDocument3 pagesDividend Yield Stocks: Retail ResearchAmeerHamsaPas encore d'évaluation

- Analyzing Indian companies using financial metricsDocument8 pagesAnalyzing Indian companies using financial metricsKrishna MoorthyPas encore d'évaluation

- Ipo Allotment Shares Returns (As On 05/01/2022)Document3 pagesIpo Allotment Shares Returns (As On 05/01/2022)Arpit jainPas encore d'évaluation

- Dividend Yield Stocks 300410Document1 pageDividend Yield Stocks 300410kunalprasherPas encore d'évaluation

- Dividend Yield StocksDocument3 pagesDividend Yield StocksDilip KumarPas encore d'évaluation

- Dalal Street - Top 1000 Companies Financial ReviewDocument19 pagesDalal Street - Top 1000 Companies Financial ReviewRoyden DSouzaPas encore d'évaluation

- Performance of Select Stocks Over Last 20 Years (2000-2020)Document12 pagesPerformance of Select Stocks Over Last 20 Years (2000-2020)GANESHPas encore d'évaluation

- Subject Class Date InstructorDocument15 pagesSubject Class Date Instructorlaila khanPas encore d'évaluation

- Top Indian companies by revenue in 2017Document22 pagesTop Indian companies by revenue in 2017Vaishnavi ReddyPas encore d'évaluation

- Market ResearchDocument22 pagesMarket ResearchBABU APas encore d'évaluation

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDocument12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliPas encore d'évaluation

- L Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CDocument5 pagesL Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CdineshPas encore d'évaluation

- CLSA Valuation Matrix 20131127Document3 pagesCLSA Valuation Matrix 20131127mkmanish1Pas encore d'évaluation

- Trending Value Portfolio Implementation-GoodDocument260 pagesTrending Value Portfolio Implementation-Gooddheeraj nautiyalPas encore d'évaluation

- Avg 22082020Document52 pagesAvg 22082020api-523630792Pas encore d'évaluation

- Stock MarketDocument11 pagesStock MarketMufaddal DaginawalaPas encore d'évaluation

- 6 YrsDocument7 pages6 YrszenPas encore d'évaluation

- Ten Years Activities of ICB at A Glance: 2007-08 To 2016-17 (Tk. in Crore)Document2 pagesTen Years Activities of ICB at A Glance: 2007-08 To 2016-17 (Tk. in Crore)Undefined OrghoPas encore d'évaluation

- StockTracker Rev2 OrigDocument149 pagesStockTracker Rev2 OrigPuneet100% (2)

- Screener DataDocument12 pagesScreener DataKartikay GoswamiPas encore d'évaluation

- BSE PSU Energy StocksDocument3 pagesBSE PSU Energy StocksYatrikPas encore d'évaluation

- High-Yield Dividend Stocks Under 40 CharactersDocument2 pagesHigh-Yield Dividend Stocks Under 40 CharactersPushkaraj SherkarPas encore d'évaluation

- S.No. Name P/E CMP Rs. Mar Cap Rs - CRDocument4 pagesS.No. Name P/E CMP Rs. Mar Cap Rs - CRCogniZancePas encore d'évaluation

- SMA Break Out StocksDocument12 pagesSMA Break Out StocksktanveersapPas encore d'évaluation

- MKT Shre Redymd AprlDocument1 pageMKT Shre Redymd AprlkbinayPas encore d'évaluation

- 07 Findings and ConclusionDocument7 pages07 Findings and ConclusionAmish SoniPas encore d'évaluation

- Agro Chemicals PerformanceDocument50 pagesAgro Chemicals PerformanceAmit SharmaPas encore d'évaluation

- Template Portfolio Analysis2Document145 pagesTemplate Portfolio Analysis2KalpeshPas encore d'évaluation

- ANTENATAL LaporanDocument16 pagesANTENATAL LaporanRany AnggrainyPas encore d'évaluation

- Rising Net Cash Flow and Cash From Operating Activity Aug 10Document3 pagesRising Net Cash Flow and Cash From Operating Activity Aug 10KabirPas encore d'évaluation

- Auto DataDocument41 pagesAuto DataViral MehtaPas encore d'évaluation

- Analisis Peperiksaan SPM 2009 SMJK Nan Hwa Sitiawan Perak Darul RidzuanDocument7 pagesAnalisis Peperiksaan SPM 2009 SMJK Nan Hwa Sitiawan Perak Darul Ridzuankamchoon2011Pas encore d'évaluation

- BSE Sensex Status: World IndicesDocument28 pagesBSE Sensex Status: World IndicesHirendra PatilPas encore d'évaluation

- Ratios Ispat Industries Limited JSW Steel Limited SharestatisticsDocument7 pagesRatios Ispat Industries Limited JSW Steel Limited SharestatisticsAbhishek DhanukaPas encore d'évaluation

- Market Statistics - Friday, October 30 2009: Japan - Nikkei 225Document7 pagesMarket Statistics - Friday, October 30 2009: Japan - Nikkei 225Andre SetiawanPas encore d'évaluation

- Asset Classsification 2005-10Document2 pagesAsset Classsification 2005-10Anoop MohantyPas encore d'évaluation

- Top Indian stocks 52-week performanceDocument8 pagesTop Indian stocks 52-week performanceSrikanth MarneniPas encore d'évaluation

- Alex ProcessingDocument11 pagesAlex Processingsaniyag_1Pas encore d'évaluation

- Name of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Document15 pagesName of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Adarsh JainPas encore d'évaluation

- CMP Price Market 52W 52W ROE P/E P/BV EV/ Change Cap (CR) High Low Ebitda Ompany Name (M.Cap)Document7 pagesCMP Price Market 52W 52W ROE P/E P/BV EV/ Change Cap (CR) High Low Ebitda Ompany Name (M.Cap)SandeepMalooPas encore d'évaluation

- Roa Roe 2012 2013 2014 2015 2016 2012Document76 pagesRoa Roe 2012 2013 2014 2015 2016 2012Aditya RahmanPas encore d'évaluation