Académique Documents

Professionnel Documents

Culture Documents

Mfibrief

Transféré par

Clifford OkwesiDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mfibrief

Transféré par

Clifford OkwesiDroits d'auteur :

Formats disponibles

Alitheia Goodwell Microfinance Fund Information for MFIs

An equity fund for the development of the microfinance

sector in Nigeria

Alitheia Capital, Goodwell Investments and JCS Investments are coming

together in a unique venture to support commercially-oriented microfinance

enterprises in West Africa. A fresh venture capital approach and in-depth

collaboration with investees marks the first region-focused microfinance

investment vehicle for West Africa. Well-regarded principals, experienced in

venture capital and microfinance, will ensure professionally managed and

mutually beneficial investments.

Creating Value

The Fund will invest equity in Start-up, Transforming (converting NGOs) and

Established MFIs in both Nigeria and Ghana.

• Target size: $60mn

• Take significant stakes in early funding rounds.

• Build value as active stakeholder with long-term perspective (5-7 years).

• Kick-start small MFIs by applying innovative networking approach.

• Support improvements to processes, technology and organizational structure

by disseminating best practice & connecting MFIs to worldwide network of

experts.

• Partner with public & private debt providers to ensure adequate funding of

MFIs.

Experienced Investors

• Alitheia Capital’s principals have over 35 years experience in investment

banking, private equity investing, technology and new business development,

project and asset management in Nigeria.

• Goodwell Investments has jointly managed a microfinance fund in India since

2005. Its principles have extensive experience in development finance, social

and private equity investments.

Target Companies

The Fund aims to build professional and mutually beneficial relationships with its

investees. As a result, trust, personal and strategic common ground are pre-

requisites for investment. On a strategic level, the Fund seeks MFIs that:

• Are committed to the provision of microfinance and its social & economic

impact

• Are led by professional and experienced management

• Are commercially oriented

• Have ambitious growth plans

The Alitheia Goodwell Microfinance Fund seeks to attract a variety of microfinance

organizations across three categories as listed above. As a result, the fund does

not employ strict criteria for age, size, location or the like. However, it is expected

that historical performance reflects the strategic priorities listed above.

Private & Confidential Page 1 of 2

Last updated: 27 May 2009

Alitheia Goodwell Microfinance Fund Information for MFIs

Investment Process

The investment process will include the following stages at a minimum:

1. Initial discussions

2. Business & Operational Plan and gap analysis

3. General due diligence

Once these stages are complete and your microfinance organizations and Alitheia

both wish to pursue investment negotiations, additional steps will follow.

Information Requirement

We would be delighted to hear from you, provided the following information

requirement can be met:

• Company Profile: Company History, Management Profile

• Business Plan: Detailed operational model, products, growth plans &

projections

• Financial: Please download and complete our financial framework. It can be

found at www.thealitheia.com/microfinance/datasheet.xls

• Detailed explanation of the use of any investment required

Please send any information by email only.

Contact Information

For more information, or to present the information about your microfinance

organization, please contact Mobola Onibonoje or Andre Wegner.

Andre Wegner

a.wegner@thealitheia.com

You can reach us by phone on +234 (1) 4627736/7, 2799383/4.

More information can be found under www.thealitheia.com/microfinance.html

Private & Confidential Page 2 of 2

Last updated: 27 May 2009

Vous aimerez peut-être aussi

- What Is Private Equity/ Venture Capital?Document27 pagesWhat Is Private Equity/ Venture Capital?sanjuPas encore d'évaluation

- Mastering the Art of Investing Using Other People's MoneyD'EverandMastering the Art of Investing Using Other People's MoneyPas encore d'évaluation

- Venture Capital, Microfinance and Credit RatingDocument60 pagesVenture Capital, Microfinance and Credit RatingManju B GowdaPas encore d'évaluation

- FIMIS Funds ManagementDocument50 pagesFIMIS Funds ManagementHitesh JawalePas encore d'évaluation

- ES19 Raising Capital March 25 27,2024Document26 pagesES19 Raising Capital March 25 27,2024joseph josePas encore d'évaluation

- Iaccelerator Business Plan Nov 5 2010Document48 pagesIaccelerator Business Plan Nov 5 2010Brigit Helms50% (2)

- SYIF RecommendationsDocument4 pagesSYIF RecommendationsSarah ThelwallPas encore d'évaluation

- Venture CapitalDocument19 pagesVenture Capitalrahuljiit0% (1)

- Curriculum Vitae: Professional ObjectiveDocument3 pagesCurriculum Vitae: Professional ObjectiveManuel De Luque MuntanerPas encore d'évaluation

- Okoliko NewDocument54 pagesOkoliko Newibrodan681Pas encore d'évaluation

- Venture Capital in India 2017 ProjectDocument80 pagesVenture Capital in India 2017 Projectakki_655150% (2)

- Microfinance Bank Proposal AjiboyeDocument12 pagesMicrofinance Bank Proposal AjiboyeYkeOluyomi Olojo81% (16)

- Fact Sheet Enterprises - BIODocument2 pagesFact Sheet Enterprises - BIOTelly V. OnuPas encore d'évaluation

- Chandu SvitDocument85 pagesChandu SvitkhayyumPas encore d'évaluation

- Caspian Impact Investment Adviser Associate or SR Associate Equity Investments May 2023Document2 pagesCaspian Impact Investment Adviser Associate or SR Associate Equity Investments May 2023Tanmay AgrawalPas encore d'évaluation

- Future Leaders Program BADocument9 pagesFuture Leaders Program BAwashPas encore d'évaluation

- Topic 8: Financing The New VentureDocument31 pagesTopic 8: Financing The New VentureAmrezaa IskandarPas encore d'évaluation

- Benefits and AwardsDocument15 pagesBenefits and AwardssereutyPas encore d'évaluation

- Expected Learning Outcomes: Module Six Financing of EnterprisesDocument8 pagesExpected Learning Outcomes: Module Six Financing of Enterprises255 nenoPas encore d'évaluation

- What Is Private Equity Private + EquityDocument18 pagesWhat Is Private Equity Private + EquityStar BrightPas encore d'évaluation

- Ch.6 FinanceDocument13 pagesCh.6 FinanceRitik MishraPas encore d'évaluation

- HNA Investment Fund Slide Deck Draft 1Document54 pagesHNA Investment Fund Slide Deck Draft 1WentPas encore d'évaluation

- Study On Venture CapitalDocument31 pagesStudy On Venture CapitalShaheen Books50% (2)

- Venture CapitalDocument95 pagesVenture CapitalAditi Rahurikar100% (1)

- FAB Group 8 On Private Equity FirmsDocument7 pagesFAB Group 8 On Private Equity Firmskartikay GulaniPas encore d'évaluation

- Topic 1 - Introduction To Venture Capital and Private EquityDocument79 pagesTopic 1 - Introduction To Venture Capital and Private EquityerilPas encore d'évaluation

- Global Mutual Fund and Global Market Versus Domestic MarketsDocument9 pagesGlobal Mutual Fund and Global Market Versus Domestic Marketsburrack19872Pas encore d'évaluation

- 4ip Group Showcase: Independent Impact Investing and Infrastructure PartnersDocument16 pages4ip Group Showcase: Independent Impact Investing and Infrastructure PartnerscalvocrisPas encore d'évaluation

- Iimc JD DeshawDocument3 pagesIimc JD DeshawVaishnaviRaviPas encore d'évaluation

- Corporate Finance & Project Finance AssignmentDocument10 pagesCorporate Finance & Project Finance AssignmentShweta TiwariPas encore d'évaluation

- VTK Profile 110922 - Andrew Mai and Nhat NguyenDocument12 pagesVTK Profile 110922 - Andrew Mai and Nhat NguyenTung_Le_Hoang_9263100% (1)

- About Edge Growth - Recruitment IntroDocument9 pagesAbout Edge Growth - Recruitment IntroMatthew SibandaPas encore d'évaluation

- Small Industries Development Bank of India (SIDBI)Document6 pagesSmall Industries Development Bank of India (SIDBI)AnshPas encore d'évaluation

- JD-for-Investment-Analyst - Impact Investing GhanaDocument3 pagesJD-for-Investment-Analyst - Impact Investing Ghanab.aggorPas encore d'évaluation

- Industrial Development Bank of India LimitedDocument29 pagesIndustrial Development Bank of India LimitedJason RoyPas encore d'évaluation

- The Start-Up Funding ProcessDocument24 pagesThe Start-Up Funding ProcessIan EddiePas encore d'évaluation

- GST 106 Conceptual Issues On Entrepreneurship and Entrepreneur 2Document6 pagesGST 106 Conceptual Issues On Entrepreneurship and Entrepreneur 2carenPas encore d'évaluation

- Study On Venture Capital &private Equity FundDocument18 pagesStudy On Venture Capital &private Equity FundRakesh kumarPas encore d'évaluation

- Cornett Finance 5e Chapter 01Document33 pagesCornett Finance 5e Chapter 01Lu LiPas encore d'évaluation

- TFG Asia-InvestmentsDocument33 pagesTFG Asia-InvestmentsYff DickPas encore d'évaluation

- A Live Project Report On Venture Capital : Problems and Challenges in India Compared To Global ScenarioDocument63 pagesA Live Project Report On Venture Capital : Problems and Challenges in India Compared To Global ScenarioRahul RavishPas encore d'évaluation

- Chapter 11 & 12 Sources of Finance For Small and Medium-Sized EnterprisesDocument33 pagesChapter 11 & 12 Sources of Finance For Small and Medium-Sized EnterprisesIvy CheekPas encore d'évaluation

- A Presentation ON Venture CapitalDocument14 pagesA Presentation ON Venture CapitalRashmi Ranjan PanigrahiPas encore d'évaluation

- January Capital ASEAN Technology Ecosystem 1709190944Document43 pagesJanuary Capital ASEAN Technology Ecosystem 1709190944Brandon TanPas encore d'évaluation

- Impact of Venture Capital On Indian EconomyDocument5 pagesImpact of Venture Capital On Indian EconomylenovoPas encore d'évaluation

- Chapter 8&9 Sources of Finance For SMEsDocument13 pagesChapter 8&9 Sources of Finance For SMEsWan HoonPas encore d'évaluation

- Financial AnalysisDocument18 pagesFinancial AnalysisanjuPas encore d'évaluation

- Job Advert CEO For IDC 29 August 2022 Print Media FinalDocument2 pagesJob Advert CEO For IDC 29 August 2022 Print Media FinalJosephine ChirwaPas encore d'évaluation

- Venture FinancingDocument57 pagesVenture FinancingZakir AliPas encore d'évaluation

- Presentation On Accounts: - Submitted To: Bhavik Sir - Prepared By: - Vipul Gohil (028) - Vishal PatelDocument21 pagesPresentation On Accounts: - Submitted To: Bhavik Sir - Prepared By: - Vipul Gohil (028) - Vishal Patelrucha4478Pas encore d'évaluation

- Private Equity in The Middle EastDocument13 pagesPrivate Equity in The Middle EastJaideep DhanoaPas encore d'évaluation

- Financial and Investment Planning in Reference To Mutual Funds IndustryDocument16 pagesFinancial and Investment Planning in Reference To Mutual Funds IndustryIshaan KumarPas encore d'évaluation

- Appropriate Capital For SME EnetrprisesDocument19 pagesAppropriate Capital For SME Enetrprisesrema subramanianPas encore d'évaluation

- Venture Capital Industry in IndiaDocument69 pagesVenture Capital Industry in IndiaDevyansh GuptaPas encore d'évaluation

- State of India Fintech Union 2022-1Document92 pagesState of India Fintech Union 2022-1RanjitPas encore d'évaluation

- Bank of The Philippine IslandDocument5 pagesBank of The Philippine IslandAdeline Mangulad MontebonPas encore d'évaluation

- 18552-18976 IndiaFPmarketslidesDocument49 pages18552-18976 IndiaFPmarketslidesEstiphanos GetPas encore d'évaluation

- About OCO GlobalDocument46 pagesAbout OCO Globalpotato6688wangPas encore d'évaluation

- Entrepreneur India 2011Document16 pagesEntrepreneur India 2011Amio KachariPas encore d'évaluation

- Chapter 7Document18 pagesChapter 7dheerajm88Pas encore d'évaluation

- Agriculture Subsidies and DevelopmentDocument2 pagesAgriculture Subsidies and Developmentbluerockwalla100% (2)

- Rufino Tan Vs Ramon Del RosarioDocument1 pageRufino Tan Vs Ramon Del RosarioJocelyn MagbanuaPas encore d'évaluation

- StartUp India - Case AnalysisDocument3 pagesStartUp India - Case AnalysisIrshad AzeezPas encore d'évaluation

- VisuSon - Business Stress TestingDocument7 pagesVisuSon - Business Stress TestingAmira Nur Afiqah Agus SalimPas encore d'évaluation

- Direct Mail Success SecretsDocument0 pageDirect Mail Success SecretsunpinkpantherPas encore d'évaluation

- MudraDocument19 pagesMudraManoj MawalePas encore d'évaluation

- Antwoordblad Instaptoets EngelsDocument4 pagesAntwoordblad Instaptoets EngelskadpoortPas encore d'évaluation

- Accounting For NotesDocument3 pagesAccounting For NotesRaffay MaqboolPas encore d'évaluation

- Capital StructureDocument44 pagesCapital Structure26155152Pas encore d'évaluation

- Indifference CurveDocument16 pagesIndifference Curveএস. এম. তানজিলুল ইসলামPas encore d'évaluation

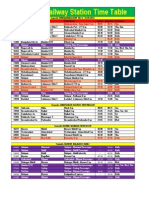

- Solapur Railway Station Time TableDocument2 pagesSolapur Railway Station Time TableAndrea Lopez33% (3)

- Woolf Prompt WritingDocument1 pageWoolf Prompt Writingapi-2089824930% (1)

- Best Practices in Hotel Financial ManagementDocument3 pagesBest Practices in Hotel Financial ManagementDhruv BansalPas encore d'évaluation

- Supervisory Development Final ProjectDocument12 pagesSupervisory Development Final ProjectCarolinaPas encore d'évaluation

- Avro RJ General Data Brochure PDFDocument66 pagesAvro RJ General Data Brochure PDFMonica Enin100% (2)

- Bradford Snell The Street Car ConspiracyDocument4 pagesBradford Snell The Street Car ConspiracyDaniel DavarPas encore d'évaluation

- PinoyDocument5 pagesPinoyLarete PaoloPas encore d'évaluation

- EnglishtoMath##1Document8 pagesEnglishtoMath##1zubairPas encore d'évaluation

- Tennis Ball Activity - Diminishing Returns - Notes - 3Document1 pageTennis Ball Activity - Diminishing Returns - Notes - 3Raghvi AryaPas encore d'évaluation

- ElectiveDocument5 pagesElectiveMarkPas encore d'évaluation

- FM 8th Edition Chapter 12 - Risk and ReturnDocument20 pagesFM 8th Edition Chapter 12 - Risk and ReturnKa Io ChaoPas encore d'évaluation

- Business Level StrategyDocument28 pagesBusiness Level StrategyMohammad Raihanul HasanPas encore d'évaluation

- Spisak Parfema NEWDocument1 pageSpisak Parfema NEWDouglas CoxPas encore d'évaluation

- Super Injunction BookDocument3 pagesSuper Injunction BookReckless Kobold0% (1)

- Ticket PDFDocument1 pageTicket PDFVenkatesh VakamulluPas encore d'évaluation

- Diebold Case StudyDocument2 pagesDiebold Case StudySagnik Debnath67% (3)

- Case Study-1 SHEENADocument2 pagesCase Study-1 SHEENARushikesh Dandagwhal100% (1)

- Walt Disney Company PDFDocument20 pagesWalt Disney Company PDFGabriella VenturinaPas encore d'évaluation

- Tourism PolicyDocument6 pagesTourism Policylanoox0% (1)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeD'EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeÉvaluation : 4.5 sur 5 étoiles4.5/5 (91)

- Having It All: Achieving Your Life's Goals and DreamsD'EverandHaving It All: Achieving Your Life's Goals and DreamsÉvaluation : 4.5 sur 5 étoiles4.5/5 (65)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryD'EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryÉvaluation : 4 sur 5 étoiles4/5 (26)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureD'EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (100)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurD'Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderD'EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderÉvaluation : 4.5 sur 5 étoiles4.5/5 (61)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizD'EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizÉvaluation : 4.5 sur 5 étoiles4.5/5 (112)

- Every Tool's a Hammer: Life Is What You Make ItD'EverandEvery Tool's a Hammer: Life Is What You Make ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (249)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4 sur 5 étoiles4/5 (1)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsD'EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsÉvaluation : 5 sur 5 étoiles5/5 (48)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveD'EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveÉvaluation : 4.5 sur 5 étoiles4.5/5 (89)

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachD'EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachÉvaluation : 3.5 sur 5 étoiles3.5/5 (6)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyD'EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyÉvaluation : 4 sur 5 étoiles4/5 (51)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeD'EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeÉvaluation : 5 sur 5 étoiles5/5 (25)

- Generative AI: The Insights You Need from Harvard Business ReviewD'EverandGenerative AI: The Insights You Need from Harvard Business ReviewÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldD'EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldÉvaluation : 4.5 sur 5 étoiles4.5/5 (55)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedD'EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedÉvaluation : 4.5 sur 5 étoiles4.5/5 (38)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyD'EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyPas encore d'évaluation

- System Error: Where Big Tech Went Wrong and How We Can RebootD'EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootPas encore d'évaluation

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyD'EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyÉvaluation : 5 sur 5 étoiles5/5 (22)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesD'EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesÉvaluation : 4.5 sur 5 étoiles4.5/5 (99)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceD'EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceÉvaluation : 5 sur 5 étoiles5/5 (364)

- Summary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoD'EverandSummary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoÉvaluation : 4 sur 5 étoiles4/5 (1)

- WEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouD'EverandWEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouÉvaluation : 4.5 sur 5 étoiles4.5/5 (87)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorD'EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- AI Superpowers: China, Silicon Valley, and the New World OrderD'EverandAI Superpowers: China, Silicon Valley, and the New World OrderÉvaluation : 4.5 sur 5 étoiles4.5/5 (399)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberD'EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberÉvaluation : 5 sur 5 étoiles5/5 (39)