Académique Documents

Professionnel Documents

Culture Documents

Share Tips Expert Commodity Report 18042011

Transféré par

Hardeep YadavDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Share Tips Expert Commodity Report 18042011

Transféré par

Hardeep YadavDroits d'auteur :

Formats disponibles

’

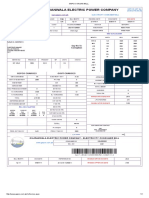

Daily Commodity Market Update as on Monday, April 18, 2011

PRECIOUS METALS COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX

GOLD 21491 21592 21438 21571 0.37 Bullion ended higher as euro zone sovereign debt

SILVER 61750 62840 61684 62390 1.42 concerns worries over inflation and expectations U.S.

SPOT $ monetary policy will stay accommodative all conspired to

GOLD 1485.25 1488.7 1483.8 1486.2 -0.04 lift the precious metal.

SILVER 43.07 43.37 43.06 43.26 0.63

PLATINUM 1787.49 1787.5 1782.5 1787.5 0.27

ENERGY COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX

CRUDE 4824 4878 4766 4852 0.97 Crude last week jumped as comments by Saudi Arabia

confirming a cut in crude production to counter an

N.GAS 188.3 188.7 186 187.5 -0.8

oversupplied market. Natural Gas slipped as forecasts

showed warmer-than-normal weather in the last week of

SPOT $ A il reducing

April, d i d

demandd ffor th

the h

heating

ti ffuel.

l

CRUDE 108.45 110.1 107.21 109.66 1.115722

BASEMETAL COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX

COPPER 422 5

422.5 423 416 417 -1 16

-1.16 Base metals ended mixed as mounting inflationary

ZINC 107.35 107.6 105.65 105.9 -1.09 pressure in China cast a shadow over the near-term

NICKEL 1165 1178 1154 1164.9 0.27 demand outlook.

LEAD 119.3 120.35 117.75 119.5 0.59

ALUMINIUM 117.55 118.8 117.05 118.15 0.85

LME LME STOCK

COPPER 9360 9448 9345.25 9425.5 0.46 COPPER -375 450425

ZINC 2391 2406 2384 2398 0.33 ZINC 525 764250

NICKEL 26200 2694 26200 26300 0.44 NICKEL -702 120480

LEAD 2640 2652 2626 2651.25 -0.04 LEAD 3225 287075

ALUMINIUM 2681 2652 2680 2691.5 0.41 ALUMINIUM -2750 4566375

GLOBAL MARKETS UPDATE

SENSEX NIFTY NASDAQ S&P NYSE DOW JON NIKKEI SHICOM KOREA HKFE $ INDEX

19551.11 5870.1 2307.58 1319.68 8400.31 12341.83 9570.86 3058.83 2135.36 24045.35 74.99

0.85 0.78 -0.16 0.39 0.31 0.46 -0.22 0.27 -0.24 0.16 0.14

Strictly for private circulation www.sharetipsexpert.com Page No. 1

OPEN

21491

HIGH

21592

FUTURE

LOW

21438

CLOSE

21571

% CNG

0.37

VOLUME

X GOLD F

29087

OI

10659

RE CNG

80

INTRADAY LEVELS

Gold ended positive as euro zone sovereign debt concerns worries over inflation and expectations

MCX

U.S. monetary policy will stay accommodative all conspired to lift the precious metal. While in the PP

P.P. 21534

short run gold is sensitive to any move lower in the euro, in the longer term these fears are set to

support the precious metal. The bullion market has found support one day from economic

SUP 1 RES 1

uncertainty and changes in risk sentiment, and on another day by high oil and food prices, and on 21475 21629

yet another by sovereign risk and fiscal concerns. Holdings in the SPDR Gold Trust, the world's SUP 2 RES 2

largest gold-backed exchange-traded fund, jumped 1.5 percent to 1,231.159 tonnes by April 15, 21380 21688

from 1,212.964 tonnes on April 13. Now support for the gold MCX is seen at 21475 and below could

SUP 3 RES 3

see a test of 21380. Resistance is now likely to be seen at 21629, a move above could see prices

testing 21688. 21321 21783

OPEN

61750

TURE

HIGH

62840

LOW

61684

LVER FUT

CLOSE

62390

% CNG

1.42

VOLUME

118260

OI

13682

MCX SIL

RE CNG

886

INTRADAY LEVELS

Silver rose to record high on concerns about rising inflation globally, and as a lingering Euro zone

sovereign debt crisis continued to boost safe-haven demand. Chinese inflation gauges rose strongly P.P. 62305

again and the overall U.S. producer and consumer inflation readings rose, but remained sub-1%. SUP 1 RES 1

Holdings in the world's largest silver-backed exchange-traded fund, iShares Silver Trust, rose by

61769 62925

69.81 tonnes, or 0.64 percent, from the previous session to 11,044.07 tonnes by April 15. Now

technically market is in overbot as RSI for 18days is currently indicating 80.26,

80 26 where as 50DMA is SUP 2 RES 2

at 54359.78 and silver is trading above the same and getting support at 61769 and below could see 61149 63461

a test of 61149 level, And resistance is now likely to be seen at 62925, a move above could see SUP 3 RES 3

prices testing 63461.

60613 64081

Strictly for private circulation www.sharetipsexpert.com Page No. 2

OPEN

4824

HIGH

X CRUDE FUTURE

E

4878

LOW

4766

CLOSE

4852

% CNG

0.97

VOLUME

114992

OI

9884

RE CNG

47

INTRADAY LEVELS

Crude last week jumped as comments by Saudi Arabia confirming a cut in crude production to

MCX

counter an oversupplied market. Saudi Arabia

Arabia's

s oil minister said the kingdom had slashed output by PP

P.P. 4832

800,000 barrels per day in March due to oversupply; sending the strongest signal yet that OPEC will

not act to quell soaring prices. Consumers have urged the exporters' group to pump more crude to

SUP 1 RES 1

put a cap on London's Brent oil, which surged to more than $127 a barrel this month. UAE Oil 4786 4898

Minister Mohammed bin Dhaen al Hamli said on Sunday that current oil prices do not reflect market SUP 2 RES 2

fundamentals and that demand was being met with adequate supplies, according to the UAE official 4720 4944

news agency. OPEC should be flexible in the future with its supply policy, the managing director of

SUP 3 RES 3

the International Energy Agency said on Sunday, but he stopped short of calling on the group to

add supply to the market. Now market is getting support at 4786 and below could see a test of 4674 5010

OPEN

422.5

TURE

HIGH

423

LOW

416

PPER FUT

CLOSE

417

% CNG

-1.16

VOLUME

95072

OI

28590

MCX COP

RE CNG

-4.85

INTRADAY LEVELS

Copper yesterday traded with the negative node and settled -1.16% down at 417 posting its biggest

weekly loss since mid-March, as mounting inflationary pressure in China cast a shadow over the P.P. 418.7

near-term demand outlook. Copper again shunned rallies in the precious metals complex, with gold

and silver surging to record and 31-year highs, respectively, as investors bought both metals as a

SUP 1 RES 1

hedge against global inflation worries and rising oil prices. Chinese consumer price inflation sped to 414.3 421.3

5.4 p

percent in the yyear to March,, the fastest since Julyy 2008 and topping

pp g market forecasts of 5.2 SUP 2 RES 2

percent. Gross domestic product in China, the world's top copper buyer, eased a touch. China 411.7 425.7

accounts for about 40 percent of copper demand. In yesterday's trading session copper has touched

SUP 3 RES 3

the low of 416 after opening at 422.5, and finally settled at 417. For today's session market is

looking to take support at 414.3, a break below could see a test of 411.7 and where as resistance is 407.3 428.3

Strictly for private circulation www.sharetipsexpert.com Page No. 3

OPEN

107.35

HIGH

107.6

FUTURE

LOW

105.65

CLOSE

105.9

% CNG

-1.09

VOLUME

CX ZINC F

19962

OI

8618

RE CNG

-1.15

INTRADAY LEVELS

Zinc yesterday we have seen that market has moved -1.09% as investors were worrying

about that China will take additional tightening monetary policies because of high inflation,

inflation PP

P.P. 106

106.4

4

MC

which will cut consumer demand. Global refined zinc production will exceed demand by SUP 1 RES 1

almost 200,000 tonnes this year, the fifth year running of over-supply, the Lisbon-based

105.2 107.1

International Lead and Zinc Study Group (ILZSG) said. Market has opened at 107.35 & made

a low of 105.65 versus the day high of 107.6. The total volume for the day was at 19962 lots SUP 2 RES 2

and the open interest was at 8618.Now support for the zinc is seen at 105.2 and below could 104.4 108.3

see a test of 104.4. Resistance is now likely to be seen at 107.1, a move above could see SUP 3 RES 3

prices testing 108.3. 103.2 109.1

OPEN

1165

TURE

HIGH

1178

LOW

1154

CKEL FUT

CLOSE

1164.9

% CNG

0.27

VOLUME

43187

OI

9727

MCX NIC

RE CNG

3.2

INTRADAY LEVELS

Nickel prices moved below all day moving averages, with great resistance above. Weighed by P.P. 1166

China's further tightening measures, LME nickel prices are expected to continue struggling. The SUP 1 RES 1

International Nickel Study Group (INSG) said it expects the global nickel market to record a 60,000-

1153 1177

tonne surplus this year, compared with a deficit of 30,000 tonnes in 2010.Nickel has touched a low

of Rs 1154 a kg after opening at Rs.1165,

Rs 1165 and last traded at Rs 1164.9.For

1164 9 For today market is looking SUP 2 RES 2

for the support at 1153.3, a break below could see a test of 1141.6 and where as resistance is now 1142 1190

likely to be seen at 1177.3, a move above could see prices testing 1189.6. SUP 3 RES 3

1129 1201

Strictly for private circulation www.sharetipsexpert.com Page No. 4

URE

OPEN

117.55

HIGH

ALUMINIUM FUTU

118.8

LOW

117.05

CLOSE

118.15

% CNG

0.85

VOLUME

4931

OI

1935

RE CNG

1

INTRADAY LEVELS

MCX A

Aluminium

Al i i prices

i gained

i d supported d b

by hi

higher

h energy prices,

i with

i h prices

i returning

i to above

b 5

5-day

d PP

P.P. 118

118.0

0

and 10-day moving averages. Aluminium stocks held at three major Japanese ports came to SUP 1 RES 1

201,200 tonnes at the end of March, down 6,900 tonnes or 3.3 percent from a month earlier,

117.2 119.0

trading house Marubeni Corp said. Aluminium has touched a low of Rs 117.05 a kg after opening at

Rs 117.55, and last traded at Rs118.15.For today market is looking for the support at 117.2, a SUP 2 RES 2

break below could see a test of 116.3 and where as resistance is now likely to be seen at 119, a 116.3 119.8

move above could see prices testing 119.8. SUP 3 RES 3

115.5 120.7

OPEN

UTURE

188.3

HIGH

188.7

LOW

186

T.GAS FU

CLOSE

187.5

% CNG

-0.8

VOLUME

20683

OI

11091

RE CNG

MCX NAT

-1.5

INTRADAY LEVELS

Natural Gas yesterday we have seen that market has moved -0.8% as forecasts showed warmer-

than-normal weather in the last week of April, reducing demand for the heating fuel. About 52 P.P. 187.4

percent of U.S. households use natural gas for heating, according to the Energy Department. The

stockpile increase matched the five-year average gain for the week, leaving the storage surplus

SUP 1 RES 1

unchanged from the previous week at 0.6 percent. A deficit to year-earlier supplies widened to 7.9 186.1 188.8

M

percent from 5.2 p

p percent. The number of g

gas drilling

g rigs

g in the U.S. fell 4 to 885 this week. Market SUP 2 RES 2

has opened at 188.3 & made a low of 186 versus the day high of 188.7. The total volume for the 184.7 190.1

day was at 20683 lots and the open interest was at 11091.Now support for the Natural Gas is seen

SUP 3 RES 3

at 186.1 and below could see a test of 184.7. Resistance is now likely to be seen at 188.8, a move

above could see prices testing 190.1. 183.4 191.5

Strictly for private circulation www.sharetipsexpert.com Page No. 5

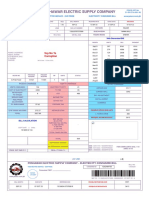

ACTIVE SPREAD UPDATE

DAILY SPREAD IN GOLD - MCX DAILY SPREAD IN SILVER - MCX

MONTH RATE JUNE AUG OCT MONTH RATE MAY JULY SEPT

JUNE 21571 292 627 MAY 62390 871 1848

AUG 21863 335 JULY 63261 977

OCT 22198 SEPT 64238

Spread between Gold JUN & AUG contracts yesterday Spread between Silver MAY & JUL contracts yesterday

ended at 292, we have seen yesterday that the gold ended at 871, we have seen yesterday that the silver

market had traded with a positive node and settled market had traded with a positive node and settled

0.37% up. Spread yesterday traded in the range of 288 - 1.42% up. Spread yesterday traded in the range of 821 -

327. 902.

DAILY SPREAD IN CRUDE - MCX DAILY SPREAD IN COPPER - MCX

MONTH RATE APRIL MAY JUNE MONTH RATE APRIL JUNE

APRIL 4852 56 106 APRIL 417 7.15

MAY 4908 50 JUNE 424.15

JUNE 4958

Spread between crude MAR & APR contracts yesterday Spread between copper APR & JUN contracts yesterday

MARKET

ended at 56, we have seen yesterday that the crude ended at 7.15, we have seen yesterday that the copper

market had traded with a positive node and settled market had traded with a negative node and settled -

0.97% up. Spread yesterday traded in the range of 52 - 1.16% down. Spread yesterday traded in the range of

58. 6.6 - 7.15.

DAILY SPREAD IN ZINC - MCX DAILY SPREAD IN NICKEL - MCX

SPREAD M

MONTH RATE APRIL MAY MONTH RATE APRIL MAY

APRIL 105.9 1.4 APRIL 1164.9 9.8

MAY 107.3 MAY 1174.7

Spread between zinc APR & MAY contracts yesterday Spread between nickel APR & MAY contracts yesterday

ended at 1.4, we have seen yesterday that the zinc ended at 9.80, we have seen yesterday that the nickel

market had traded with a negative node and settled - market had traded with a positive node and settled

1.09% down. Spread yesterday traded in the range of 1 - 0.27% up. Spread yesterday traded in the range of 9.70 -

1.45. 11.

S

DAILY SPREAD IN NAT. GAS - MCX DAILY SPREAD IN MENTHOL - MCX

MONTH RATE APRIL MAY MONTH RATE APRIL MAY

APRIL 187.5 4.5 APRIL 1046.3 -46.2

MAY 192 MAY 1000.1

Spread between natural gas APR & MAY contracts Spread between menthol oil APR & MAY contracts

yesterday ended at 4.50, we have seen yesterday that yesterday ended at -46.20, we have seen yesterday that

the natural gas market had traded with a negative node the menthol oil market had traded with a positive node

and settled -0.8% down. Spread yesterday traded in the and settled 0.55% up. Spread yesterday traded in the

range of 4.3 - 4.5. range of -47 to -42.9.

Strictly for private circulation www.sharetipsexpert.com Page No. 6

DAY TIME CURRENCY DATA Forecast Previous

AL

7:30pm EUR Consumer Confidence -10 -11

ONOMICA

7:30pm USD NAHB Housing Market Index 17 17

8:00pm USD FOMC Member Fisher Speaks 0 0

DATA

10:00pm USD FOMC Member Fisher Speaks 0 0

0 0 0 0 0

0 0 0 0 0

Mon 0 0 0 0 0

0 0 0 0 0

0 0 0

ECO

0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0

0 0 0 0

International wheat companies Cargill, Louis Dreyfus, Olam India and Glencore (Agri Core) have started procuring

wheat from Gujarat and Rajasthan mandis. A bumper production and an increase in supplies have pushed prices

down by 10% in the past fortnight to 1,025 a quintal in the Rajkot mandi. Across Uttar Pradesh, Madhya Pradesh,

Punjab and Haryana supplies are yet to pick up pace.pace Kirit Parekh,

Parekh the owner of Rajkotbased trading company RK

Industries, said, "Prices have fallen from 235 for 20 kg to 205 for 20 kg in the past fortnight. Major players such as

Cargill, Louis Dreyfus and Olam are procuring thanks to a bumper crop this year compared to the previous year."

Although prices should drop due to selling pressure, he said that FCI procurement at 224 for 20 kg could arrest a

further decline. With production expected to touch 3.5 million tonne from 2.2 million tonne in the previous year,

major trading, food processing and milling houses are zeroing in on Gujarat which offers other incentives. ITC's agri

business division has been procuring the Lok 1 variety for 1,100 per quintal and the 4037 variety at 1,100 to 1,200 a

quintal, said Rakesh Khandelwal, a Kota-based trader. The ITC food division, however, has yet to start procurement

SE

for its Ashirwad atta brand and biscuits. Other major local processing companies such as Shakti Bhog , Parle and

Britannia have entered or pplanningg to step

p into the market in the next one week when Uttar Pradesh begins

g supplies.

pp

U CAN US

ITC's agri business division has been procuring the Lok 1 variety for 1,100 per quintal and the 4037 variety at 1,100

to 1,200 a quintal, said Rakesh Khandelwal, a Kota-based trader. The ITC food division, however, has yet to start

Global experts meeting this week are likely to forecast a near-normal monsoon for India, providing international

commodities market the first hints of demand and supply in 2011-12 from one of the world’s top producers and

consumers of key farm goods. Failure of monsoons can force India into the international markets as a buyer,

pushing up global prices of basic foodstuffs, while favourable rainfall can boost its exports, helping governments

throughout Asia to battle food inflation. Agriculture accounts for a 14.6 per cent of India’s GDP and the outcome of

EWS YOU

the

h annuall JJune-September

S b southwest

h monsoons iimpacts the

h nation’s

i ’ economy, whichhi h iis struggling

li with

i h hi

high

h ffood

d

inflation and a massive subsidy bill for fuel, grains and fertilisers. A normal monsoon means the country receives

rainfall between 96-104 per cent of a 50-year average of 89 centimetres during the four-month rainy season,

according to the India’s weather office classification. Monsoon also impact demand for gold in India, the world’s top

consumer of the metal, as purchases get a boost when farming incomes rise amid high crop output. Rural areas

account for about 70 per cent of India’s annual gold consumption. India witnessed normal rains last year and the

April 13-15 meeting of weather officials in the southwestern city of Pune is likely to forecast a near-normal monsoon

this year based on various forecasting models, Indian officials said.

NE

Inflation in Eurozone accelerated more than previously estimated in March, driven by surging transport and housing

costs, latest figures from Eurostat showed Friday. It is the fourth month in a row that inflation has been above the

European Central Bank's target. Inflation was at 2.7 percent in March, higher than the 2.6 percent estimated in the

flash report and the fastest since October 2008. In February, the rate was 2.4 percent. ECB has an inflation target of

'below but close to 2 percent'. Economists believe that the latest spike in inflation levels may prompt the central

bank to hike its key policy rate further before long after lifting the rate by a quarter point to 1.25

1 25 percent in the April

meeting. That was the first rate hike since July 2008.

Strictly for private circulation www.sharetipsexpert.com Page No. 3

Contact us

CARROTINVESTMENT

Plot no 36, Sector 23, Gurgaon, Haryana (INDIA)

Work Tel#: Fax No:

Mobile Tel#:

E-Mail: carrotinvestment@gmail.com URL: http://www.sharetipsexpert.com

Disclaimer

The report and calls made herein are for general information purpose and report contains only the viewpoints. We make no

representation or warranty regarding the correctness, accuracy or completeness of any information, and are not responsible for

errors of any kind even though we have taken utmost care in obtaining the information from sources which are believed to be

reliable, which are publicly available. The information contained herein is strictly confidential and is meant for the intended

recipients. Any alteration, transmission, photocopied distribution in part or in whole or reproduction of any form of the

information without prior consent of SHARETIPSEXPERT GROUP is prohibited. The information and data are derived from the

source that are deemed & believed to be reliable and the calls are based on the theory of Technical Analysis. Neither the

company nor itsit employees

l are responsible

ibl ffor the

th ttrading

di P

Profit(es)

fit( ) & loss(es)

l ( ) arising

i i due

d tto th

the ttrader.

d Th

The commodities

diti andd

derivatives discussed and opinions expressed in this report may not be suitable for all investors falling under different categories

and jurisdictions. All futures trading entail significant risk, which should be fully understood prior to trading.

Strictly for private circulation www.sharetipsexpert.com Page No. 4

Vous aimerez peut-être aussi

- Semiconducting III–V Compounds: International Series of Monographs on SemiconductorsD'EverandSemiconducting III–V Compounds: International Series of Monographs on SemiconductorsPas encore d'évaluation

- Share Tips Expert Commodity Report 07042011Document8 pagesShare Tips Expert Commodity Report 07042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 06042011Document8 pagesShare Tips Expert Commodity Report 06042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 01042011Document8 pagesShare Tips Expert Commodity Report 01042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 11042011Document8 pagesShare Tips Expert Commodity Report 11042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Call Report 15042011Document8 pagesShare Tips Expert Commodity Call Report 15042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 08042011Document8 pagesShare Tips Expert Commodity Report 08042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 13042011Document8 pagesShare Tips Expert Commodity Report 13042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 21042011Document8 pagesShare Tips Expert Commodity Report 21042011Hardeep YadavPas encore d'évaluation

- Free Commodity Trading Tips 27-12-2010Document8 pagesFree Commodity Trading Tips 27-12-2010Hardeep Yadav100% (1)

- Share Tips Expert Commodity Report 27042011Document8 pagesShare Tips Expert Commodity Report 27042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 04042011Document8 pagesShare Tips Expert Commodity Report 04042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 30032011Document8 pagesShare Tips Expert Commodity Report 30032011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 29032011Document8 pagesShare Tips Expert Commodity Report 29032011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 24032011Document8 pagesShare Tips Expert Commodity Report 24032011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 31032011Document8 pagesShare Tips Expert Commodity Report 31032011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 23032011Document8 pagesShare Tips Expert Commodity Report 23032011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 28032011Document8 pagesShare Tips Expert Commodity Report 28032011Hardeep YadavPas encore d'évaluation

- Commodity TipsDocument8 pagesCommodity TipsHardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 29042011Document8 pagesShare Tips Experts Commodity Report As On 29042011Hardeep YadavPas encore d'évaluation

- Submitted To: Dr. Abid Hussain Submitted By: Hamood Ahmad 17-ME-69 Section CDocument3 pagesSubmitted To: Dr. Abid Hussain Submitted By: Hamood Ahmad 17-ME-69 Section CArslan ShabbirPas encore d'évaluation

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupPas encore d'évaluation

- PF & Esi Challan ExcelDocument12 pagesPF & Esi Challan ExcelNitin KumarPas encore d'évaluation

- Fire Door Inspection Checklist - NeMark WearDocument2 pagesFire Door Inspection Checklist - NeMark WearNur E Alam NuruPas encore d'évaluation

- Metals - October 2 2018Document1 pageMetals - October 2 2018Tiso Blackstar GroupPas encore d'évaluation

- Metals - October 18 2017Document1 pageMetals - October 18 2017Tiso Blackstar GroupPas encore d'évaluation

- Multan Electric Power Company: Say No To CorruptionDocument1 pageMultan Electric Power Company: Say No To Corruptionhamza najamPas encore d'évaluation

- Metals - February 26 2018Document1 pageMetals - February 26 2018Tiso Blackstar GroupPas encore d'évaluation

- Metals - April 10 2018Document1 pageMetals - April 10 2018Tiso Blackstar GroupPas encore d'évaluation

- Metals - April 25 2017Document1 pageMetals - April 25 2017Tiso Blackstar GroupPas encore d'évaluation

- Metals - September 12 2018Document1 pageMetals - September 12 2018Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupPas encore d'évaluation

- Metals - February 27 2019Document1 pageMetals - February 27 2019Tiso Blackstar GroupPas encore d'évaluation

- Metals - June 26 2018Document1 pageMetals - June 26 2018Tiso Blackstar GroupPas encore d'évaluation

- Metals - January 22 2019Document1 pageMetals - January 22 2019Tiso Blackstar GroupPas encore d'évaluation

- Metals - February 28 2018Document1 pageMetals - February 28 2018Tiso Blackstar GroupPas encore d'évaluation

- GEPCODocument1 pageGEPCOAbu EssaPas encore d'évaluation

- Metals - February 14 2018Document1 pageMetals - February 14 2018Tiso Blackstar GroupPas encore d'évaluation

- Metals - March 4 2019Document1 pageMetals - March 4 2019Tiso Blackstar GroupPas encore d'évaluation

- Metals - January 15 2019Document1 pageMetals - January 15 2019Tiso Blackstar GroupPas encore d'évaluation

- Quality DailyDocument76 pagesQuality Dailydilip matalPas encore d'évaluation

- Metals - June 28 2018Document1 pageMetals - June 28 2018Tiso Blackstar GroupPas encore d'évaluation

- Metals - February 21 2019Document1 pageMetals - February 21 2019Tiso Blackstar GroupPas encore d'évaluation

- Metals - February 23 2018Document1 pageMetals - February 23 2018Tiso Blackstar GroupPas encore d'évaluation

- Metals - February 17 2019Document1 pageMetals - February 17 2019Anonymous 7A1d7fjj3Pas encore d'évaluation

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupPas encore d'évaluation

- Metals - March 8 2017Document1 pageMetals - March 8 2017Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupPas encore d'évaluation

- Metals - February 26 2019Document1 pageMetals - February 26 2019Tiso Blackstar GroupPas encore d'évaluation

- CAT 330 B 9 HN Parts Catalog PDF - Part11Document1 pageCAT 330 B 9 HN Parts Catalog PDF - Part11riansiregarPas encore d'évaluation

- Metals - September 26 2018Document1 pageMetals - September 26 2018Tiso Blackstar GroupPas encore d'évaluation

- Metals - January 31 2018Document1 pageMetals - January 31 2018Tiso Blackstar GroupPas encore d'évaluation

- PESCODocument2 pagesPESCOMuhammad AamirPas encore d'évaluation

- Markets and Commodity Figures: MetalsDocument1 pageMarkets and Commodity Figures: MetalsTiso Blackstar GroupPas encore d'évaluation

- Metals - November 6 2017Document1 pageMetals - November 6 2017Tiso Blackstar GroupPas encore d'évaluation

- Quetta Electric Supply Company: Say No To CorruptionDocument2 pagesQuetta Electric Supply Company: Say No To CorruptionM Saeed KhosaPas encore d'évaluation

- Metals - January 28 2019Document1 pageMetals - January 28 2019Tiso Blackstar GroupPas encore d'évaluation

- Metals - August 31 2017Document1 pageMetals - August 31 2017Tiso Blackstar GroupPas encore d'évaluation

- Metals - July 24 2018Document1 pageMetals - July 24 2018Tiso Blackstar GroupPas encore d'évaluation

- MCX TipsDocument3 pagesMCX TipsHardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 11052011Document8 pagesShare Tips Experts Commodity Report As On 11052011Hardeep YadavPas encore d'évaluation

- www.sharetipsexpert.comDocument8 pageswww.sharetipsexpert.comHardeep YadavPas encore d'évaluation

- Commodity TipsDocument8 pagesCommodity TipsHardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 13052011Document8 pagesShare Tips Experts Commodity Report As On 13052011Hardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 16052011Document8 pagesShare Tips Experts Commodity Report As On 16052011Hardeep YadavPas encore d'évaluation

- MCX Tips Free TrialDocument8 pagesMCX Tips Free TrialHardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 10052011Document8 pagesShare Tips Experts Commodity Report As On 10052011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Calls Report 06052011Document3 pagesShare Tips Expert Calls Report 06052011Hardeep YadavPas encore d'évaluation

- Sharetips Weekly Economical Data For 9-13 MayDocument6 pagesSharetips Weekly Economical Data For 9-13 MayHardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 09052011Document8 pagesShare Tips Experts Commodity Report As On 09052011Hardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Calls Report As On 10052011Document3 pagesShare Tips Experts Commodity Calls Report As On 10052011Hardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 05052011Document8 pagesShare Tips Experts Commodity Report As On 05052011Hardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 06052011Document8 pagesShare Tips Experts Commodity Report As On 06052011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Calls Report 02052011Document3 pagesShare Tips Expert Calls Report 02052011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Calls Report 29042011Document3 pagesShare Tips Expert Calls Report 29042011Hardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 03052011Document8 pagesShare Tips Experts Commodity Report As On 03052011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Calls Report 04052011Document3 pagesShare Tips Expert Calls Report 04052011Hardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 04052011Document8 pagesShare Tips Experts Commodity Report As On 04052011Hardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 02052011Document8 pagesShare Tips Experts Commodity Report As On 02052011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 26042011Document8 pagesShare Tips Expert Commodity Report 26042011Hardeep YadavPas encore d'évaluation

- Share Tips Experts Commodity Report As On 29042011Document8 pagesShare Tips Experts Commodity Report As On 29042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 27042011Document8 pagesShare Tips Expert Commodity Report 27042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 12042011Document8 pagesShare Tips Expert Commodity Report 12042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 21042011Document8 pagesShare Tips Expert Commodity Report 21042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 13042011Document8 pagesShare Tips Expert Commodity Report 13042011Hardeep YadavPas encore d'évaluation

- Share Tips Expert Commodity Report 08042011Document8 pagesShare Tips Expert Commodity Report 08042011Hardeep YadavPas encore d'évaluation

- HeavyOil WorksheetDocument320 pagesHeavyOil Worksheetrodrigo100% (1)

- Chemistry Final Study Guide: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument22 pagesChemistry Final Study Guide: Identify The Choice That Best Completes The Statement or Answers The Questionsrahimi@verizon.netPas encore d'évaluation

- Wellhead Housing Otc15396Document12 pagesWellhead Housing Otc15396jovyan1982Pas encore d'évaluation

- Injection Pump Test SpecificationsDocument2 pagesInjection Pump Test SpecificationsEdinson Ariel Chavarro QuinteroPas encore d'évaluation

- Undertaking Letter For Purchase Fuel Tank From WoqodDocument1 pageUndertaking Letter For Purchase Fuel Tank From Woqodemad0% (1)

- Air Handlers Service InstructionsDocument93 pagesAir Handlers Service InstructionsAnonymous uGPcnH0XppPas encore d'évaluation

- Bulletin 96 AFQR Oct 2016 PDFDocument9 pagesBulletin 96 AFQR Oct 2016 PDFpersadanusantaraPas encore d'évaluation

- Proses Konstruksi, Proteksi Turbin Dan CommisioningDocument11 pagesProses Konstruksi, Proteksi Turbin Dan CommisioningAji PrastiaPas encore d'évaluation

- Siemens Technical Paper Gas Turbine ModernizationDocument14 pagesSiemens Technical Paper Gas Turbine ModernizationAldiarso UtomoPas encore d'évaluation

- Saonon Datasheet-S80H PDFDocument4 pagesSaonon Datasheet-S80H PDFAhmed ElbihyPas encore d'évaluation

- 9103 9112 Burley Wood Burner Installation Instructions AUGUST 2016Document20 pages9103 9112 Burley Wood Burner Installation Instructions AUGUST 2016g4okk8809Pas encore d'évaluation

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word Document1balamanianPas encore d'évaluation

- Air Fuel Ratio ControlDocument3 pagesAir Fuel Ratio Controlwagner_guimarães_1100% (1)

- M.M.University, Mullana: B.Tech (Seventh Semester) Mechanical Engineering ME 401 Automobile EngineeringDocument7 pagesM.M.University, Mullana: B.Tech (Seventh Semester) Mechanical Engineering ME 401 Automobile EngineeringsnehanituguptaPas encore d'évaluation

- 08 HydroprocessingDocument38 pages08 HydroprocessingrciographyPas encore d'évaluation

- Notas de Listas de Despieces Bombas EPIC HSDIDocument2 pagesNotas de Listas de Despieces Bombas EPIC HSDIUliAlejandroRodriguezCoriangaPas encore d'évaluation

- PS TXT Packer Technical DatasheetDocument3 pagesPS TXT Packer Technical DatasheetEvolution Oil ToolsPas encore d'évaluation

- Fluid Power Question & AnswerDocument3 pagesFluid Power Question & AnswerSriram Sastry100% (2)

- EnviroGear PDFDocument4 pagesEnviroGear PDFrasottoPas encore d'évaluation

- NP2 InstallationDocument31 pagesNP2 InstallationRianPas encore d'évaluation

- Engines Classification and Its ComponentsDocument43 pagesEngines Classification and Its ComponentsKLUniveristyPas encore d'évaluation

- Slides 3 Ir Wong See FoongDocument32 pagesSlides 3 Ir Wong See FoongMc ChPas encore d'évaluation

- Euroblast Scope of SupplyDocument5 pagesEuroblast Scope of SupplyUmair AwanPas encore d'évaluation

- Interview QuestionsDocument9 pagesInterview QuestionsSuresh SuryaPas encore d'évaluation

- Hydrogen VechileDocument22 pagesHydrogen VechilePrittam Kumar JenaPas encore d'évaluation

- The Fluctuating Price of Oil Has A Big Impact OnDocument1 pageThe Fluctuating Price of Oil Has A Big Impact OnAmit PandeyPas encore d'évaluation

- Nuclear-Reactor - Working and ConstructionDocument15 pagesNuclear-Reactor - Working and Constructionprince arora80% (5)

- GE Frame 5 Gas Turbine MaintenanceDocument4 pagesGE Frame 5 Gas Turbine MaintenanceMohamed Nawar100% (2)

- Hydroxy BoostersDocument265 pagesHydroxy Boostersmars1976100% (3)

- D1146 D1146T P086TI Manuals PDFDocument179 pagesD1146 D1146T P086TI Manuals PDFnpachecorecabarren73% (11)