Académique Documents

Professionnel Documents

Culture Documents

Project Term Loans: 1. Purpose

Transféré par

Ravi BajajDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Project Term Loans: 1. Purpose

Transféré par

Ravi BajajDroits d'auteur :

Formats disponibles

PROJECT TERM LOANS

A. RUPEE TERM LOAN

1. Purpose

To provide finance to all types of projects in state & private sector viz. generation,

transmission, distribution, renovation & modernization, uprating, environment

upgradation, metering, etc. The infrastructure projects having forward and

backward linkages with power projects are also covered.

2. Eligible entities

The entities engaged in generation, transmission, trading, distribution of power or

any combination of these activities including captive / co-gen power producers.

The entities engaged in the infrastructure projects with forward / backward

linkages to power projects.

3. Extent of assistance (restricted to actual requirement of funds)

Central / State sector entities - Upto 70% of the project cost

Reforming State sector entities - Upto 80% of the cost of project.

Private sector entities* - Upto 50% of the project cost.

The extent of funding may vary from project to project.

* In case of thermal generation projects and hydro projects, the financial assistance is generally

up to 20% and 25% of the project cost respectively. However, the enhanced limit can be

considered for loan size of Rs. 500 crs and above or where PFC is a lead institution. In case of

infrastructure projects with forward / backward linkages to power projects the financial

assistance is up to 20% of the project cost.

4. Interest rates & Other charges

Interest rates as notified by the Corporation from time to time.

Special interest rates are also available for loans exceeding Rs. 700

crs for generation projects in state sector and Rs. 500 crs in private

sector.

Interest rates prevailing on the date of disbursement(s) shall be

applicable.

Incentive / rebate available for timely payment of dues for state/

central sector utilities.

For all type of generation projects and infrastructure projects with

forward and backward linkages to power projects, reduction in

interest rate after commissioning of projects / COD as per

prevailing policy.

Penal interest payable on default-payments.

Commitment fees / upfront fees as may be applicable for

respective borrowers from time to time.

Processing fee, Lead fee & facility Agent fee for private sector

entities as applicable from time to time.

5. Interest rate reset option

Option to avail interest rate with reset after every 3 years or

with reset after 10 years.

Interest reset condition to apply from the standard due date

following the date of first disbursement after 3/10 years, as

the case may be.

6. Moratorium

Moratorium on principal is available upto 6 months from the date of project

commissioning / COD. There is no moratorium on interest payment.

7. Disbursement mechanism

Disbursement will be made, against bills, as per the ‘Disbursement Schedule’

submitted by the borrower. In case of small loans (below Rs. 20 crs.), simplified

disbursement procedure is applicable. In the case of private sector borrower,

disbursement is made through Trust and Retention Account mechanism.

8. Interest payment

Interest is to be paid quarterly, on standard due dates i.e. 15/4, 15/7, 15/10 and

15/1 every year.

9. Repayment

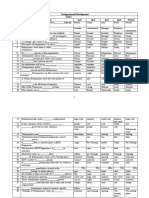

Repayment is to be made in maximum years of:

Type of Projects State / Central Sector Private Sector

3 Years 10 Years 3 Years/10 Years

Reset Clause* Reset Clause reset clause

Hydro Generation Project 20 15 12

Thermal Generation Project 15 15 12

Studies, Consultancy, 5 5 5

Training, R&D, S&I,

Computerisation, Meters

All other Projects 15 12 10

* All such loans shall also have put and call option after the end of 12 years

(thermal & other schemes) and 15 years for hydro schemes from the date of

commissioning of project.

The first repayment installment will become due on the standard due date

immediately following the end of moratorium period. Borrower may also opt for a

shorter repayment period.

10. Security requirements

State / Central government or bank guarantee or charge on assets,

for state and central sector entities, while charge on project assets

for others.

Letter of Credit or Tripartite Escrow Agreement amongst the

borrower, the bank and PFC for state and central sector entities

while Trust and Retention Account mechanism for others.

Corporate and / or personal guarantee of the promoters for private

sector, if the outcome of appraisal establishes a requirement for the

same.

Other securities, as may be necessary.

B. FOREIGN CURRENCY LOAN :

PFC sanction foreign currency loans based on the requirement of capital

expenditure of the project subject to its ability to provide foreign currency loans.

These loans are provided to power sector utilities for end use as permitted under

the External Commercial Borrowing Guidelines issued by RBI as amended from

time to time. The interest rates offered are based on six months US Dollar

LIBOR or LIBOR in any other currency. The margin over LIBOR is generally

reset at the end of every 5 years.

Vous aimerez peut-être aussi

- Exception Report Document CodesDocument33 pagesException Report Document CodesForeclosure Fraud100% (1)

- Financing Structure SolarDocument21 pagesFinancing Structure SolarsandeepvempatiPas encore d'évaluation

- Module 2: Financing of ProjectsDocument24 pagesModule 2: Financing of Projectsmy VinayPas encore d'évaluation

- Short Term Financial Management 3rd Edition Maness Test BankDocument5 pagesShort Term Financial Management 3rd Edition Maness Test Bankjuanlucerofdqegwntai100% (16)

- Navarro Vs DomagtoyDocument3 pagesNavarro Vs Domagtoykvisca_martinoPas encore d'évaluation

- The Procurement Law No. 26 (2005) PDFDocument27 pagesThe Procurement Law No. 26 (2005) PDFAssouik NourddinPas encore d'évaluation

- Crusades-Worksheet 2014Document2 pagesCrusades-Worksheet 2014api-263356428Pas encore d'évaluation

- Procedimentos Técnicos PDFDocument29 pagesProcedimentos Técnicos PDFMárcio Henrique Vieira AmaroPas encore d'évaluation

- Road Infrastructure Financing Models (PPP) (BOT, BOOT, LOT, DBFO, Concession)Document29 pagesRoad Infrastructure Financing Models (PPP) (BOT, BOOT, LOT, DBFO, Concession)Devanjan ChakravartyPas encore d'évaluation

- Partial Credit Guarantee Facility and Project Completion Risk Guarantee FacilityDocument18 pagesPartial Credit Guarantee Facility and Project Completion Risk Guarantee FacilityAsian Development Bank - TransportPas encore d'évaluation

- (Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitDocument2 pages(Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitRonnie JimenezPas encore d'évaluation

- DILG Resources 2011216 85e96b8954Document402 pagesDILG Resources 2011216 85e96b8954jennifertong82Pas encore d'évaluation

- PT Paiton Energy CompiledDocument24 pagesPT Paiton Energy CompiledHummingbird11688Pas encore d'évaluation

- 4 - REAL ENERGY Lending ProgramDocument36 pages4 - REAL ENERGY Lending ProgramMarce MangaoangPas encore d'évaluation

- Amended RBPF PolicyDocument2 pagesAmended RBPF Policynfk roePas encore d'évaluation

- Proposal For Meeting Funds Requirement For Distributed Generation SchemesDocument20 pagesProposal For Meeting Funds Requirement For Distributed Generation SchemesMAX PAYNEPas encore d'évaluation

- SIDBI Ebrochure 4E Financing Word FileDocument1 pageSIDBI Ebrochure 4E Financing Word FileDhanraj PatilPas encore d'évaluation

- SBP Renewable Energy Circular July 2019Document9 pagesSBP Renewable Energy Circular July 2019Muzammil Hussain BrohiPas encore d'évaluation

- IREDA Solar PV Loan SchemeDocument31 pagesIREDA Solar PV Loan SchemeKamran100% (1)

- CHAPTER 1 Financing of Constructed FacilitiesDocument10 pagesCHAPTER 1 Financing of Constructed FacilitiesBrandy PacePas encore d'évaluation

- Policy For Buyers' Line of CreditDocument2 pagesPolicy For Buyers' Line of CreditAbhimaneu NairPas encore d'évaluation

- Works - Jan - 2011 - Final - Tender Document StandardDocument7 pagesWorks - Jan - 2011 - Final - Tender Document StandardLe Thi Anh TuyetPas encore d'évaluation

- REC Policy For Special Long-Term Transition Loan To DISCOMs For COVID 19 PDFDocument4 pagesREC Policy For Special Long-Term Transition Loan To DISCOMs For COVID 19 PDFsenthil031277Pas encore d'évaluation

- Section - 2: Financial Norms ofDocument12 pagesSection - 2: Financial Norms ofwqsdPas encore d'évaluation

- Reading Material On Term LoanDocument23 pagesReading Material On Term LoanNayana GoswamiPas encore d'évaluation

- Bridge Loan 31 - 10 - 2011Document2 pagesBridge Loan 31 - 10 - 2011Pawan Kumar RaiPas encore d'évaluation

- A9 - Financing PDFDocument5 pagesA9 - Financing PDFadnmaPas encore d'évaluation

- EDFC - Through PPP ModeDocument44 pagesEDFC - Through PPP ModeMd. Shiraz JinnathPas encore d'évaluation

- Loan SyndicationDocument30 pagesLoan SyndicationMegha BhatnagarPas encore d'évaluation

- I. Loan Scheme For Financing Rooftop Solar PV Grid Connected/ Interactive Power Projects (Industrial, Commercial and Institutional)Document29 pagesI. Loan Scheme For Financing Rooftop Solar PV Grid Connected/ Interactive Power Projects (Industrial, Commercial and Institutional)Yuvaperiyasamy MayilsamyPas encore d'évaluation

- Interest Rates - KSFCDocument4 pagesInterest Rates - KSFCSanjay GowdaPas encore d'évaluation

- Mrunalini's Task 3Document4 pagesMrunalini's Task 3Pampana Bala Sai Saroj RamPas encore d'évaluation

- Interest RateDocument21 pagesInterest RateSagara AbeykoonPas encore d'évaluation

- VN Projects - S.Resources - QuestionnairesDocument3 pagesVN Projects - S.Resources - QuestionnairesAZHAR HASANPas encore d'évaluation

- PNB Bank LoanDocument3 pagesPNB Bank Loanapi-3838281Pas encore d'évaluation

- Pagibig DDLPDocument5 pagesPagibig DDLPraymondPas encore d'évaluation

- BCA-Circular On One-Off Advance Payment For Public Sector Construction Contracts Affected by The Extended Circuit BreakerDocument2 pagesBCA-Circular On One-Off Advance Payment For Public Sector Construction Contracts Affected by The Extended Circuit BreakerKahSeng ChaiPas encore d'évaluation

- 6 File General Term Loan Scheme Oct 2017 2Document1 page6 File General Term Loan Scheme Oct 2017 2Ashwet GaonkarPas encore d'évaluation

- IREDA Financing Norms and SchemesDocument18 pagesIREDA Financing Norms and SchemesAvishek GuptaPas encore d'évaluation

- Guidelines - For - Solar - PV - Private - Sector - Power - Generation - ProjectsDocument1 pageGuidelines - For - Solar - PV - Private - Sector - Power - Generation - ProjectsPawan Kumar RaiPas encore d'évaluation

- Assignment 1Document5 pagesAssignment 1ankur sikriPas encore d'évaluation

- Bay Area TOAH Fund Project Loan Term Sheet Construction To Mini Perm May 2011Document2 pagesBay Area TOAH Fund Project Loan Term Sheet Construction To Mini Perm May 2011edbassonPas encore d'évaluation

- Luxury Hotels in JaipurDocument5 pagesLuxury Hotels in JaipurmayoonlyPas encore d'évaluation

- Build Operate TransferDocument4 pagesBuild Operate TransferpaviPas encore d'évaluation

- Uttarakahnd - (More Than 100 MW)Document5 pagesUttarakahnd - (More Than 100 MW)subhankarprusty5259Pas encore d'évaluation

- Crb5100512an PDFDocument11 pagesCrb5100512an PDFanand sahuPas encore d'évaluation

- Scheme For Financing of Industrial LandDocument3 pagesScheme For Financing of Industrial LandkamshaarmaPas encore d'évaluation

- Unit 4Document19 pagesUnit 4Dawit NegashPas encore d'évaluation

- Implementation of Off-Grid Solar PV Project Under JNNSMDocument4 pagesImplementation of Off-Grid Solar PV Project Under JNNSMravis1985Pas encore d'évaluation

- Mohan's Task-3Document5 pagesMohan's Task-3Pampana Bala Sai Saroj RamPas encore d'évaluation

- Lesson 5Document6 pagesLesson 5shadowlord468Pas encore d'évaluation

- LESSON5Document5 pagesLESSON5Ira Charisse BurlaosPas encore d'évaluation

- Policy For Underwriting of DebtDocument2 pagesPolicy For Underwriting of DebtPawan Kumar RaiPas encore d'évaluation

- Name Smart Task No. Project TopicDocument3 pagesName Smart Task No. Project Topichemanth kumarPas encore d'évaluation

- Chapter 7Document10 pagesChapter 7mamta230100Pas encore d'évaluation

- Citizen CharterDocument9 pagesCitizen Chartertnpsc2busarPas encore d'évaluation

- Procurement Guide: CHP Financing: 1. OverviewDocument9 pagesProcurement Guide: CHP Financing: 1. OverviewCarlos LinaresPas encore d'évaluation

- Project Financing Program - VN QuestionnairesDocument3 pagesProject Financing Program - VN QuestionnairesAZHAR HASANPas encore d'évaluation

- Housing and Mortgage Financing in The Emerging Markets.Document6 pagesHousing and Mortgage Financing in The Emerging Markets.Rashid Ahmad SheikhPas encore d'évaluation

- Circular 257Document5 pagesCircular 257Carlos VelascoPas encore d'évaluation

- Chapter 5 CPFDocument15 pagesChapter 5 CPFSara NegashPas encore d'évaluation

- Financial TerminologiesDocument11 pagesFinancial TerminologiesAnand Prabhat SharmaPas encore d'évaluation

- Updates On Revised Kisan Credit Card (KCC) SchemeDocument10 pagesUpdates On Revised Kisan Credit Card (KCC) SchemeSelvaraj VillyPas encore d'évaluation

- Ias 23Document18 pagesIas 23Shah KamalPas encore d'évaluation

- Capital Project FundDocument7 pagesCapital Project FundmeselePas encore d'évaluation

- Citizen’s Guide to P3 Projects: A Legal Primer for Public-Private PartnershipsD'EverandCitizen’s Guide to P3 Projects: A Legal Primer for Public-Private PartnershipsPas encore d'évaluation

- Global Best Practices in Risk and Treasury Management: Indian Banks' Association (IBA)Document38 pagesGlobal Best Practices in Risk and Treasury Management: Indian Banks' Association (IBA)Ravi BajajPas encore d'évaluation

- Fundamental Analysis of Bharti AirtelDocument25 pagesFundamental Analysis of Bharti Airtelrubyrudra83% (6)

- Course Curriculum ForexDocument12 pagesCourse Curriculum ForexbharatPas encore d'évaluation

- Caiibfinancialmanagement 3Document13 pagesCaiibfinancialmanagement 3Sushant SurPas encore d'évaluation

- Windows 10 100% Disk Usage in Task Manager (SOLVED) - Driver EasyDocument46 pagesWindows 10 100% Disk Usage in Task Manager (SOLVED) - Driver EasyMrinal K MahatoPas encore d'évaluation

- Unit - I - MCQDocument3 pagesUnit - I - MCQDrSankar CPas encore d'évaluation

- Iherb Online ShopDocument16 pagesIherb Online ShopВалерия ТеслюкPas encore d'évaluation

- Double Shot Arcade Basketball System: Assembly InstructionsDocument28 pagesDouble Shot Arcade Basketball System: Assembly Instructionsمحمد ٦Pas encore d'évaluation

- Stress and StrainDocument2 pagesStress and StrainbabePas encore d'évaluation

- AMCTender DocumentDocument135 pagesAMCTender DocumentsdattaPas encore d'évaluation

- Jamii Cover: Type of PlansDocument2 pagesJamii Cover: Type of PlansERICK ODIPOPas encore d'évaluation

- Nobels Ab1 SwitcherDocument1 pageNobels Ab1 SwitcherJosé FranciscoPas encore d'évaluation

- Soon Singh Bikar v. Perkim Kedah & AnorDocument18 pagesSoon Singh Bikar v. Perkim Kedah & AnorIeyza AzmiPas encore d'évaluation

- Loss or CRDocument4 pagesLoss or CRJRMSU Finance OfficePas encore d'évaluation

- EssayDocument3 pagesEssayapi-358785865100% (3)

- G.O.Ms - No.1140 Dated 02.12Document1 pageG.O.Ms - No.1140 Dated 02.12bksridhar1968100% (1)

- Audit of A Multi-Site Organization 1. PurposeDocument4 pagesAudit of A Multi-Site Organization 1. PurposeMonica SinghPas encore d'évaluation

- Pre-Commencement Meeting and Start-Up ArrangementsDocument1 pagePre-Commencement Meeting and Start-Up ArrangementsGie SiegePas encore d'évaluation

- Full Download Introduction To Brain and Behavior 5th Edition Kolb Test Bank PDF Full ChapterDocument36 pagesFull Download Introduction To Brain and Behavior 5th Edition Kolb Test Bank PDF Full Chapternaturismcarexyn5yo100% (16)

- Hall 14 FOC Indemnity FormDocument4 pagesHall 14 FOC Indemnity FormXIVfocPas encore d'évaluation

- Buhay, Guinaban, and Simbajon - Thesis Chapters 1, 2 and 3Document78 pagesBuhay, Guinaban, and Simbajon - Thesis Chapters 1, 2 and 3pdawgg07Pas encore d'évaluation

- (NAME) (NAME) : Day A.M P.M Undertime Day A.M P.M UndertimeDocument2 pages(NAME) (NAME) : Day A.M P.M Undertime Day A.M P.M UndertimeAngelica Joy Toronon SeradaPas encore d'évaluation

- Hydrostatic Testing of Control ValvesDocument34 pagesHydrostatic Testing of Control ValvesMuhammad NaeemPas encore d'évaluation

- ParlPro PDFDocument24 pagesParlPro PDFMark Joseph SantiagoPas encore d'évaluation

- A Community For All: Looking at Our Common Caribbean Information HeritageDocument3 pagesA Community For All: Looking at Our Common Caribbean Information HeritageEmerson O. St. G. BryanPas encore d'évaluation

- Document 5Document6 pagesDocument 5Collins MainaPas encore d'évaluation