Académique Documents

Professionnel Documents

Culture Documents

14 317

Transféré par

iwantsheetmusic1Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

14 317

Transféré par

iwantsheetmusic1Droits d'auteur :

Formats disponibles

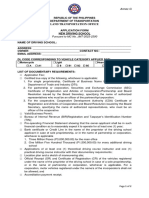

14-317 PRINT FORM CLEAR FIELDS

(Rev.10-10/3)

Affidavit of Motor Vehicle Gift Transfer

STATE OF TEXAS

COUNTY OF_______________________

Vehicle Information

Year Model Make Vehicle Identification Number (VIN)

Donor’s relationship to recipient (also includes in-law relationships) – Check one (must be one of the following as defined by Tax Code §152.025(a))

(Vehicle previously held as

Parent/Stepparent Child/Stepchild Spouse separate property; see TAC §3.80)

Grandchild Sibling Grandparent

Guardian Decedent’s estate Qualified nonprofit IRC §501(c)(3),

donor or recipient

Donor Certification

Name Phone (area code and number)

Mailing address

City State ZIP code

I hereby certify that all statements in this document are true and correct to the best of my knowledge and belief. This

motor vehicle is being transferred without consideration, including no assumption of debt.

sign sign

here here

SIGNATURE OF DONOR / EXECUTOR SIGNATURE OF DONOR / EXECUTOR

SWORN TO and SUBSCRIBED before me on this the _______ day of __________________ A.D. ________ .

sign

(SEAL) here

NOTARY PUBLIC FOR THE STATE OF ______________________________

authorized employee of the tax assessor-collector’s office

Recipient Certification

Name Phone (area code and number)

Mailing address

City State ZIP code

I hereby certify that all statements in this document are true and correct to the best of my knowledge and belief. This

motor vehicle is being transferred without consideration, including no assumption of debt.

sign sign

here here

SIGNATURE OF RECIPIENT SIGNATURE OF RECIPIENT

SWORN TO and SUBSCRIBED before me on this the _______ day of __________________ A.D. ________ .

sign

(SEAL) here

NOTARY PUBLIC FOR THE STATE OF ______________________________

authorized employee of the tax assessor-collector’s office

Faxed notary public authorizations are accepted.

Tax Code §152.101 provides a penalty to a person who signs a false statement. An offense under this section is a felony of the third degree.

Form 14-317 (Back)(Rev.10-10/3)

Instructions for Filing Form 14-317, Affidavit of Motor Vehicle Gift Transfer

Who May File –

The affidavit form should be filed by the title applicant to document a qualifying gift of a motor vehicle.

A motor vehicle received outside of Texas from an eligible donor may also qualify as a gift when brought

into Texas. Do not send the completed form to the Comptroller of Public Accounts.

Eligible Gift Transfers –

To qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties:

• spouse (separate property only – vehicles held as community property are not subject to the tax);

• parent or stepparent;

• father/mother-in-law or son/daughter-in-law;

• grandparent/grandparent-in-law or grandchild/grandchild-in-law;

• child or stepchild;

• sibling/brother-in-law/sister-in-law;

• guardian;

• decedent’s estate (inherited); or

• a nonprofit service organization qualifying under Section 501(c)(3), IRC (gift tax applies when

the entity is either the donor or recipient).

All other motor vehicle transfers made without payment of consideration are defined as sales and may be

subject to Standard Presumptive Value (SPV) procedures. See Tax Code Sec. 152.0412, Standard Presump-

tive Value; Use By Tax Assessor-Collector and Rule 3.79, Standard Presumptive Value.

Documenting Additional Eligible Donor Relationships –

The Parent/Stepparent check box applies also to a Father/Mother-in-Law gift; the Child/Stepchild check box

applies also to a Son/Daughter-in-Law gift; the Sibling check box applies also to a Brother/Sister-in-Law gift;

and the Grandparent check box applies also to a Grandparent-in-Law gift.

When and Where to File –

At time of title transfer with the County Tax Assessor-Collector.

Documents Required –

In addition to completing Application For Texas Certificate of Title, Form 130-U, both the donor and person

receiving the vehicle must complete Form 14-317, Affidavit of Motor Vehicle Gift Transfer, describing the

transaction and the relationship between the donor and recipient.The county TAC or staff member may

acknowledge the donor or recipient’s signature in lieu of formal notarization, provided that the person whose

signature is being acknowledged is present and signs the affidavit in front of the county TAC or staff member.

An individual with a Power of Attorney (POA) may complete the affidavit on behalf of the principal. A notary

from another state may notarize this document. A faxed copy is acceptable.

If the gift transfer is the result of an inheritance, the executor should sign the gift affidavit as “donor.” If the

transfer is completed using an Affidavit of Heirship for a Motor Vehicle (TxDMV-VTR262), only one heir is

required to sign as donor. When there are multiple donors or recipients signing, additional copies of Form 14-317

should be used to document signatures and notary acknowledgements.

Questions –

If you have questions or need more information, contact the Comptroller’s office at (800) 252-1382 or e-mail

tax.help@cpa.state.tx.us. Rule 3.80, Motor Vehicles Transferred as a Gift or for No Consideration, explains

the law and its provisions and is available on the Comptroller’s website at www.window.state.tx.us.

Vous aimerez peut-être aussi

- Voluntary Surrender of VehicleDocument1 pageVoluntary Surrender of VehicleNadine AbenojaPas encore d'évaluation

- Obara BogbeDocument36 pagesObara BogbeOjubona Aremu Omotiayebi Ifamoriyo0% (1)

- Answer Key To World English 3 Workbook Reading and Crossword Puzzle ExercisesDocument3 pagesAnswer Key To World English 3 Workbook Reading and Crossword Puzzle Exercisesjuanma2014375% (12)

- DENR Request LetterDocument1 pageDENR Request LetterJomar Nobleza100% (2)

- Instructions: This Affidavit Should Be Executed by The PersonDocument1 pageInstructions: This Affidavit Should Be Executed by The PersonDeviant LemurPas encore d'évaluation

- Treasury Form 0385Document2 pagesTreasury Form 0385Nat Williams100% (5)

- Discrete Mathematics and Its Applications: Basic Structures: Sets, Functions, Sequences, and SumsDocument61 pagesDiscrete Mathematics and Its Applications: Basic Structures: Sets, Functions, Sequences, and SumsBijori khanPas encore d'évaluation

- Mark Magazine#65Document196 pagesMark Magazine#65AndrewKanischevPas encore d'évaluation

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasPas encore d'évaluation

- Affidavit of Motor Vehicle Gift TransferDocument1 pageAffidavit of Motor Vehicle Gift TransferChristopher BernsPas encore d'évaluation

- GEICO FL Total Loss PaperworkDocument3 pagesGEICO FL Total Loss PaperworkSandeep SuryavanshiPas encore d'évaluation

- Lien Form PDFDocument2 pagesLien Form PDFDaniellePas encore d'évaluation

- Form 29: 1. Vdesignhome - Se/telugu/puranalu - HTM - 11kDocument6 pagesForm 29: 1. Vdesignhome - Se/telugu/puranalu - HTM - 11kvenkubaiPas encore d'évaluation

- Rejecting Deck Collectors, Because of DisabilityDocument1 pageRejecting Deck Collectors, Because of DisabilityCarl CamachoPas encore d'évaluation

- POA (POWER OF ATTORNEY) LAX Amd4-BinexDocument1 pagePOA (POWER OF ATTORNEY) LAX Amd4-BinexzamoPas encore d'évaluation

- Occupational Limited License (Oll) Petition: (Type or Print Information)Document6 pagesOccupational Limited License (Oll) Petition: (Type or Print Information)Howard ShowersPas encore d'évaluation

- Notice of Failure To Present Certificate of Title - Vessel or WatercraftDocument1 pageNotice of Failure To Present Certificate of Title - Vessel or WatercraftJesse GibsonPas encore d'évaluation

- Instructions: This Affidavit Should Be Executed by The PersonDocument1 pageInstructions: This Affidavit Should Be Executed by The PersonspcbankingPas encore d'évaluation

- Form 30Document3 pagesForm 30JORDANPas encore d'évaluation

- SA Rental ApplicationDocument2 pagesSA Rental ApplicationGvz HndraPas encore d'évaluation

- 370 BfillDocument2 pages370 BfillJohnny LolPas encore d'évaluation

- Affidavit of Ownership PacketDocument8 pagesAffidavit of Ownership PacketJeremy WebbPas encore d'évaluation

- Vehicle Owner and Lienholder Notification: Print FormDocument1 pageVehicle Owner and Lienholder Notification: Print FormJesse GibsonPas encore d'évaluation

- Annex G - New Application Form DSDocument2 pagesAnnex G - New Application Form DSSSJ7Pas encore d'évaluation

- ABSLDocument3 pagesABSLARVINDPas encore d'évaluation

- MVR 1Document1 pageMVR 1Anonymous L3hKyrVEpPas encore d'évaluation

- Affidavit of Loss Release of Interest FormDocument2 pagesAffidavit of Loss Release of Interest FormtanPas encore d'évaluation

- Application For Certificate of Title For A VehicleDocument1 pageApplication For Certificate of Title For A VehiclePrajalahari PrajalahariPas encore d'évaluation

- Gift Declaration Sample Au463pdfDocument1 pageGift Declaration Sample Au463pdfSan ChristianoPas encore d'évaluation

- 2021-11 Annex A APPLICATION FORM - Res - 0Document2 pages2021-11 Annex A APPLICATION FORM - Res - 0NASSER DUGASANPas encore d'évaluation

- Issue of Duplicate Share Certificate 15092022Document8 pagesIssue of Duplicate Share Certificate 15092022shahrukhtakiya9Pas encore d'évaluation

- Form ISR 5Document3 pagesForm ISR 5Jaspreet Singh KhalsaPas encore d'évaluation

- Promissory Note ContractDocument2 pagesPromissory Note Contractlane.moreau29Pas encore d'évaluation

- Annex G New Application Form DS VDMDocument2 pagesAnnex G New Application Form DS VDMMhavhic SadiaPas encore d'évaluation

- AcctauthDocument2 pagesAcctauthalcapaynePas encore d'évaluation

- Sav 0385Document2 pagesSav 0385datlavarma25Pas encore d'évaluation

- Nonresidence and Military Service Exemption From Specific Ownership Tax AffidavitDocument2 pagesNonresidence and Military Service Exemption From Specific Ownership Tax AffidavitWerewolfman 186Pas encore d'évaluation

- A. Personal Information: Stuart MussonDocument4 pagesA. Personal Information: Stuart MussonDhruvaPas encore d'évaluation

- Acc TauthDocument2 pagesAcc TauthOSCAR SPENCER RAMIREZ100% (2)

- Performance Bond Agreement TemplateDocument3 pagesPerformance Bond Agreement TemplateSyarifah Mohd NordinPas encore d'évaluation

- Edeclaration of Source Funds FormDocument2 pagesEdeclaration of Source Funds FormRaymond WilliamsPas encore d'évaluation

- Application For Duplicate Certificate of Title by Owner: Applicant and Vehicle Information ADocument2 pagesApplication For Duplicate Certificate of Title by Owner: Applicant and Vehicle Information AroyayscuePas encore d'évaluation

- Abandoned Property Bill of Sale: Sections 304.155 To 304.158Document2 pagesAbandoned Property Bill of Sale: Sections 304.155 To 304.158Jesse GibsonPas encore d'évaluation

- Sav 5188Document3 pagesSav 5188sopor,es painPas encore d'évaluation

- T3 Transmission Request Form For Nominee & Legal HeirDocument2 pagesT3 Transmission Request Form For Nominee & Legal HeirSaurabh JainPas encore d'évaluation

- Adobe Scan Aug 23, 2023Document1 pageAdobe Scan Aug 23, 2023gomsha200Pas encore d'évaluation

- DMV Form VP 147Document2 pagesDMV Form VP 147lovegoa3Pas encore d'évaluation

- Non-Commercial Driver'S License Application For RenewalDocument2 pagesNon-Commercial Driver'S License Application For RenewalHansel Gabriel Pop MendezPas encore d'évaluation

- Sworn Declaration of No Improvement On Real Property: (Date of Sale/donation/death of Decedent)Document1 pageSworn Declaration of No Improvement On Real Property: (Date of Sale/donation/death of Decedent)Kat KatPas encore d'évaluation

- Declaration of No ImprovementDocument1 pageDeclaration of No ImprovementKat Kat100% (1)

- 5 PDFDocument1 page5 PDFNic NalpenPas encore d'évaluation

- Odometer Disclosure StatementDocument1 pageOdometer Disclosure StatementPhilip VargasPas encore d'évaluation

- AcctauthDocument2 pagesAcctauthIva JacksonPas encore d'évaluation

- Mechanic's Lien Foreclosure: Vehicle InformationDocument2 pagesMechanic's Lien Foreclosure: Vehicle InformationToshiba userPas encore d'évaluation

- DR2395Document2 pagesDR2395Heryanto ChandrawarmanPas encore d'évaluation

- Disposal Instruction For Handling Foreign Inward RemittancesDocument3 pagesDisposal Instruction For Handling Foreign Inward Remittancessishir chandraPas encore d'évaluation

- TN - Enrollment Document For SCWI0 - Created 6 12 2023 - 37734108Document4 pagesTN - Enrollment Document For SCWI0 - Created 6 12 2023 - 37734108kalinalveyPas encore d'évaluation

- FS Form 5188Document3 pagesFS Form 51882Plus100% (4)

- Loan Form and PN 2021Document2 pagesLoan Form and PN 2021tom10carandangPas encore d'évaluation

- Odometer Disclosure Statement: Year Make Model Body Vehicle Identification NoDocument0 pageOdometer Disclosure Statement: Year Make Model Body Vehicle Identification NoNooruddin SheikPas encore d'évaluation

- LTC, TA, GPF, Medical Forms For Central Govt EmployeesDocument27 pagesLTC, TA, GPF, Medical Forms For Central Govt Employeesprinceej100% (5)

- Vehicle/Vessel Refund Request: Dol - Wa.Gov Customercare@Dol - Wa.GovDocument1 pageVehicle/Vessel Refund Request: Dol - Wa.Gov Customercare@Dol - Wa.GovRonald SandersPas encore d'évaluation

- Everthing You Need To Know To Start An Auto DealershipD'EverandEverthing You Need To Know To Start An Auto DealershipÉvaluation : 5 sur 5 étoiles5/5 (1)

- Brochure International ConferenceDocument6 pagesBrochure International ConferenceAnubhav Sharma sf 12Pas encore d'évaluation

- Bài Tập Từ Loại Ta10Document52 pagesBài Tập Từ Loại Ta10Trinh TrầnPas encore d'évaluation

- Bachelors - Harvest Moon Animal ParadeDocument12 pagesBachelors - Harvest Moon Animal ParaderikaPas encore d'évaluation

- ICD10WHO2007 TnI4Document1 656 pagesICD10WHO2007 TnI4Kanok SongprapaiPas encore d'évaluation

- How To Present A Paper at An Academic Conference: Steve WallaceDocument122 pagesHow To Present A Paper at An Academic Conference: Steve WallaceJessicaAF2009gmtPas encore d'évaluation

- BS en Iso 06509-1995 (2000)Document10 pagesBS en Iso 06509-1995 (2000)vewigop197Pas encore d'évaluation

- Planning EngineerDocument1 pagePlanning EngineerChijioke ObiPas encore d'évaluation

- Formal Letter LPDocument2 pagesFormal Letter LPLow Eng Han100% (1)

- Jurnal Ekologi TerestrialDocument6 pagesJurnal Ekologi TerestrialFARIS VERLIANSYAHPas encore d'évaluation

- Le Chatelier's Principle Virtual LabDocument8 pagesLe Chatelier's Principle Virtual Lab2018dgscmtPas encore d'évaluation

- Technion - Computer Science Department - Technical Report CS0055 - 1975Document25 pagesTechnion - Computer Science Department - Technical Report CS0055 - 1975MoltKeePas encore d'évaluation

- Onset Hobo Trade T Cdi 5200 5400 User ManualDocument3 pagesOnset Hobo Trade T Cdi 5200 5400 User Manualpaull20020% (1)

- 2a Unani Medicine in India - An OverviewDocument123 pages2a Unani Medicine in India - An OverviewGautam NatrajanPas encore d'évaluation

- Bluestar Annual Report 2021-22Document302 pagesBluestar Annual Report 2021-22Kunal PohaniPas encore d'évaluation

- Adverbs of Manner and DegreeDocument1 pageAdverbs of Manner and Degreeslavica_volkan100% (1)

- Feds Subpoena W-B Area Info: He Imes EaderDocument42 pagesFeds Subpoena W-B Area Info: He Imes EaderThe Times LeaderPas encore d'évaluation

- NHM Thane Recruitment 2022 For 280 PostsDocument9 pagesNHM Thane Recruitment 2022 For 280 PostsDr.kailas Gaikwad , MO UPHC Turbhe NMMCPas encore d'évaluation

- Advent Wreath Lesson PlanDocument2 pagesAdvent Wreath Lesson Planapi-359764398100% (1)

- Business CombinationsDocument18 pagesBusiness Combinationszubair afzalPas encore d'évaluation

- IPM GuidelinesDocument6 pagesIPM GuidelinesHittesh SolankiPas encore d'évaluation

- ThaneDocument2 pagesThaneAkansha KhaitanPas encore d'évaluation

- IFR CalculationDocument15 pagesIFR CalculationSachin5586Pas encore d'évaluation

- Ed Post Lab Heat of Formation of NaClDocument4 pagesEd Post Lab Heat of Formation of NaClEdimar ManlangitPas encore d'évaluation

- Dialog InggrisDocument4 pagesDialog Inggrisبايو سيتياوانPas encore d'évaluation

- IG Deck Seal PumpDocument3 pagesIG Deck Seal PumpSergei KurpishPas encore d'évaluation