Académique Documents

Professionnel Documents

Culture Documents

ACE LTD April 2011 MLR Sec

Transféré par

chinmay_sDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ACE LTD April 2011 MLR Sec

Transféré par

chinmay_sDroits d'auteur :

Formats disponibles

Action Construction Equipment Ltd

13th April 2011

Action Construction Equipment Ltd (ACE) is into manufacturing

BUY of construction equipments. The company is the market leader

in mobile cranes and is increasing its presence in several other

Share Price (INR) 47 construction equipments also.

Target (INR) 57 The stock is currently trading at 11.3 and 8.4 x FY11e and FY12e

EPS of 4.2 and 5.7 respectively. We spoke to the management

Return (%) 21%

and we believe that the stock has the potential to surprise on

the upside on account of increase in sales volumes and recom-

Beta (Sensex) 1.14

mend a buy with a target price of 57 (10 x FY12e EPS).

Investment Rationale

Market Data 9mth FY11 Net Sales saw 63% jump yoy, likely to report 59%

yoy growth in Net Sales in FY11e and 25% yoy in FY12e

Total Shares (mn) 92.9

Low levels of mechanization and huge investment plans in

Mar Cap (INR mn) 4426.0 the construction industry augurs well for construction equip-

ment manufacturers like ACE

52 Wk High/Low (INR) 75/38

Large client base with presence in all major Infrastructure,

Avg Qtr Dly Vol (000's) 225.6

Construction, Heavy Engineering and Industrial Projects

across the country through a wide product range

EBITDA margins likely to show improvement as company

Shareholding

plans to start passing on the rise in raw material prices in the

Promoter 65.67

past few quarters

Established segments like pick & carry cranes, mobile tower

DII 9.34

cranes, fixed tower cranes, crawler cranes likely to grow at

FII 5.12 20%

Pick and carry cranes capacity to increase from 4800 units/

Other 19.87

annum to 9000 units/annum, Fixed tower cranes capacity to

increase from 150 units/annum to 300 units/annum in FY11

New production unit for tractors to come up in FY12, capac-

Stock Code

ity likely to double from present 4,000 units/annum to 8,000

NSE ACE units/annum

Market share likely to increase going ahead in products like

BSE 532762

back hoes, forklifts, etc. as new capacity comes up

Bloomberg ACCE IN

Key Risks

Reuters ACEL.BO

Sharp increase in steel prices, slowdown in construction ac-

Source : MLR, Company tivities, competition from other players.

1 MLR Investment Research

Action Construction Equipment Ltd

13th April 2011

Company Background

Action Construction Equipment Ltd (ACE) is into manufacturing

of construction equipments like pick & carry cranes, mobile

tower cranes, fixed tower cranes, crawler cranes, back hoes,

forklifts, etc. The company also added tractors to its product line

in the year 2009. ACE has production facilities in the state of

Haryana and Uttarakhand with dealership network spread all

over India.

Action Construction Equipment Ltd (ACE) was promoted by Mr.

Vijay Agarwal in the year 1995 and went public in the year 2005.

Mr. Vijay Agarwal possesses over 38 years of experience in ma-

terial handling and heavy engineering industry and has held es-

teemed positions in different reputed industrial organizations

for two decades. He has completed B.E. (Mechanical) and MBA

from FMS, Delhi.

Quarterly Results | Standalone | INR mn

Quarterly Results Dec-10 Dec-09 Sep-10 Sep-09 Jun-10 Jun-09 Mar-10 Mar-09

Net Sales 1,816.6 1,062.5 1,537.2 970.8 1,291.8 804.9 1,433.1 769.8

Net Sales Growth (%) 71.0 - 58.4 - 60.5 - 86.2 -

Operating Expense 1,671.3 976.7 1,413.4 898.2 1,183.1 754.3 1,304.6 768.0

EBITDA 145.3 85.8 123.8 72.5 108.7 50.6 128.5 1.8

EBITDA Margin (%) 8.0 8.1 8.1 7.5 8.4 6.3 9.0 0.2

EBITDA Growth (%) 69.4 - 70.6 - 114.9 - 7,077.1 -

Other Item 36.1 13.2 24.3 19.2 17.5 14.5 21.8 42.2

Depreciation 19.6 13.1 15.1 12.3 13.2 12.0 15.2 18.2

Interest 11.3 6.7 9.8 7.5 5.0 7.8 3.8 12.1

Tax 44.2 19.6 32.7 17.6 28.4 11.2 34.8 4.0

Minority Interest - - - - - - - -

PAT 106.2 59.5 90.5 54.3 79.6 34.1 96.6 9.7

Non Recurring Item - - - - - - - -

Adjusted PAT 106.2 59.5 90.5 54.3 79.6 34.1 96.6 9.7

Adjusted PAT Margin (%) 5.8 5.6 5.9 5.6 6.2 4.2 6.7 1.3

Adjusted PAT Growth (%) 78.5 - 66.5 - 133.7 - 899.5 -

Share Capital 185.8 179.8 179.8 179.8 179.8 179.8 179.8 179.8

Face Value (INR) 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0

Adjusted EPS (INR) 1.1 0.7 1.0 0.6 0.9 0.4 1.1 0.1

Source : MLR, Company

2 MLR Investment Research

Action Construction Equipment Ltd

13th April 2011

Key Ratios & Cash Flow | Consolidated | INR mn

Key Ratios FY09 FY10 FY11e FY12e

Net Sales Growth (%) 5.3 (0.2) 59.0 25.0

EBITDA Margin (%) 6.3 9.1 8.3 9.0

EBITDA Growth (%) (37.6) 44.7 44.2 36.4

Adjusted PAT Margin (%) 4.6 5.5 5.8 6.2

Adjusted PAT Growth (%) (41.7) 18.4 66.4 34.5

Total Asset Turnover (x) 2.6 2.3 3.2 3.2

Debt Equity Ratio (x) 0.2 0.2 0.2 0.1

RoE (%) 14.6 15.6 21.4 23.1

EV/EBITDA (x) 17.0 11.8 8.2 6.0

BVPS (INR) 15.2 16.8 20.0 24.5

P/BV (x) 3.1 2.8 2.4 1.9

DPS (INR) 0.4 1.0 1.0 1.0

Dividend Yield (%) 0.8 2.1 2.1 2.1

Adjusted EPS (INR) 2.2 2.6 4.2 5.7

Adjusted P/E (x) 21.5 18.2 11.3 8.4

Cash Flow FY09 FY10 FY11e FY12e

PAT 198.9 235.6 392.1 527.2

Deferred Tax Liability (2.2) (0.3) - -

Interest(1-Tax%) 30.0 24.4 22.3 24.1

Minority Interest (12.3) (13.0) (13.8) (11.5)

Fixed Asset (52.5) (67.8) (188.6) (176.7)

Net Current Asset (387.1) 8.1 (358.2) (310.0)

FCFF (225.2) 187.1 (146.2) 53.1

Interest(1-Tax%) (30.0) (24.4) (22.3) (24.1)

Loan Fund 280.6 (89.6) - 50.0

Minority Interest 12.3 13.0 13.8 11.5

Minority Capital (0.5) (0.5) 0.6 0.6

FCFE 37.2 85.6 (154.1) 91.1

Source : MLR, Company

3 MLR Investment Research

Action Construction Equipment Ltd

13th April 2011

Income Statement & Balance Sheet | Consolidated | INR mn

Income Statement FY08 FY09 FY10 FY11e FY12e

Net Sales 4,064.3 4,281.4 4,274.6 6,795.2 8,494.0

Operating Expense 3,633.4 4,012.8 3,885.8 6,234.6 7,729.5

EBITDA 430.9 268.7 388.8 560.6 764.5

Other Item 55.5 95.3 6.9 52.5 51.6

Interest 20.0 44.9 36.6 33.4 36.2

Depreciation 32.5 58.0 53.1 61.4 73.3

Tax 93.9 74.3 83.4 139.9 190.8

Minority Interest (1.1) (12.3) (13.0) (13.8) (11.5)

PAT 341.0 198.9 235.6 392.1 527.2

Non Recurring Item - - - - -

Adjusted PAT 341.0 198.9 235.6 392.1 527.2

Dividend 71.9 36.0 89.9 92.9 92.9

Balance Sheet FY08 FY09 FY10 FY11e FY12e

Share Capital 179.8 179.8 179.8 185.8 185.8

Reserve 1,120.8 1,249.5 1,409.6 1,884.0 2,302.9

Total Equity 1,300.6 1,429.3 1,589.4 2,069.7 2,488.7

Loan Fund 110.8 391.4 301.8 301.8 351.8

Minority Capital 3.9 3.4 2.9 3.6 4.2

Deferred Tax Liability 10.0 7.8 7.5 7.5 7.5

Total Capital 1,425.3 1,831.9 1,901.6 2,382.6 2,852.2

Fixed Asset 703.5 756.0 823.7 1,012.3 1,189.0

Investment 4.1 0.1 0.1 0.1 0.1

Cash 214.7 185.8 195.9 130.0 112.8

Inventory 369.0 546.0 596.6 807.1 1,008.8

Other Current Asset 1,122.2 1,279.7 1,550.3 2,063.5 2,579.4

Total Current Liabilitiy 988.3 935.7 1,265.0 1,630.4 2,038.0

Net Current Asset 717.7 1,075.9 1,077.8 1,370.2 1,663.1

Total Asset 1,425.3 1,831.9 1,901.6 2,382.6 2,852.2

Source : MLR, Company

4 MLR Investment Research

Action Construction Equipment Ltd

13th April 2011

Research Analyst

Saurabh Singh +91 22 40023026 saurabh.singh@mlrsecurities.com

Head of Research

Aditya Damani +91 22 22630125 aditya.damani@mlrsecurities.com

Head Office

4th Floor, Surya Mahal

5, Burjorji Bharucha Marg

Fort

Mumbai-400001

Disclaimer : This document has been prepared by MLR Securities Pvt. Ltd. This document does not constitute an offer or solicitation for the pur-

chase or sale of any financial instrument. The information contained herein is from publicly available data or other sources believed to be reliable,

but we do not represent that it is accurate or complete and it should not be relied on as such. MLR Securities Pvt. Ltd. or any of its affiliates/ group

companies shall not be in any way responsible for any loss or damage that may arise to any person from any information contained in this report.

The user assumes the entire risk of any use made of this information. We and our affiliates, group companies, officers, directors, and employees

may have potential conflict of interest with respect to any recommendation and related information and opinions. This information is strictly

confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on

directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or in-

tended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdic-

tion, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MLR Securities Pvt. Ltd.

and affiliates/ group companies to any registration or licensing requirements within such jurisdiction.

5 MLR Investment Research

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- ISO 13485-2016 - DR - Pack - Control of Non Conforming ProductsDocument4 pagesISO 13485-2016 - DR - Pack - Control of Non Conforming ProductskmasanPas encore d'évaluation

- CS709 HandoutsDocument117 pagesCS709 HandoutsalexPas encore d'évaluation

- Financial Analysis of Wipro LTDDocument101 pagesFinancial Analysis of Wipro LTDashwinchaudhary89% (18)

- Actal Market AnalysisDocument167 pagesActal Market AnalysisNaviedmalik100% (3)

- MGMT Meet Update - IDirectDocument5 pagesMGMT Meet Update - IDirectchinmay_sPas encore d'évaluation

- Metal 171109 PDFDocument19 pagesMetal 171109 PDFGediya RockyPas encore d'évaluation

- There Is There Are Exercise 1Document3 pagesThere Is There Are Exercise 1Chindy AriestaPas encore d'évaluation

- White Box Testing Techniques: Ratna SanyalDocument23 pagesWhite Box Testing Techniques: Ratna SanyalYogesh MundhraPas encore d'évaluation

- Stroboscopy For Benign Laryngeal Pathology in Evidence Based Health CareDocument5 pagesStroboscopy For Benign Laryngeal Pathology in Evidence Based Health CareDoina RusuPas encore d'évaluation

- Public Private HEM Status AsOn2May2019 4 09pmDocument24 pagesPublic Private HEM Status AsOn2May2019 4 09pmVaibhav MahobiyaPas encore d'évaluation

- List of Reactive Chemicals - Guardian Environmental TechnologiesDocument69 pagesList of Reactive Chemicals - Guardian Environmental TechnologiesGuardian Environmental TechnologiesPas encore d'évaluation

- Problem Set SolutionsDocument16 pagesProblem Set SolutionsKunal SharmaPas encore d'évaluation

- How To Text A Girl - A Girls Chase Guide (Girls Chase Guides) (PDFDrive) - 31-61Document31 pagesHow To Text A Girl - A Girls Chase Guide (Girls Chase Guides) (PDFDrive) - 31-61Myster HighPas encore d'évaluation

- BenchmarkDocument4 pagesBenchmarkKiran KumarPas encore d'évaluation

- !!!Логос - конференц10.12.21 копіяDocument141 pages!!!Логос - конференц10.12.21 копіяНаталія БондарPas encore d'évaluation

- Analyze and Design Sewer and Stormwater Systems with SewerGEMSDocument18 pagesAnalyze and Design Sewer and Stormwater Systems with SewerGEMSBoni ClydePas encore d'évaluation

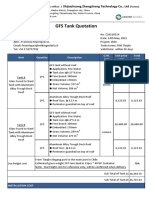

- GFS Tank Quotation C20210514Document4 pagesGFS Tank Quotation C20210514Francisco ManriquezPas encore d'évaluation

- DBMS Architecture FeaturesDocument30 pagesDBMS Architecture FeaturesFred BloggsPas encore d'évaluation

- Pemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchDocument16 pagesPemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchAri HendriawanPas encore d'évaluation

- Simba s7d Long Hole Drill RigDocument2 pagesSimba s7d Long Hole Drill RigJaime Asis LopezPas encore d'évaluation

- Hi-Line Sportsmen Banquet Is February 23rd: A Chip Off The Ol' Puck!Document8 pagesHi-Line Sportsmen Banquet Is February 23rd: A Chip Off The Ol' Puck!BS Central, Inc. "The Buzz"Pas encore d'évaluation

- Efaverenz p1Document4 pagesEfaverenz p1Pragat KumarPas encore d'évaluation

- Paradigms of ManagementDocument2 pagesParadigms of ManagementLaura TicoiuPas encore d'évaluation

- Nokia CaseDocument28 pagesNokia CaseErykah Faith PerezPas encore d'évaluation

- Techniques in Selecting and Organizing InformationDocument3 pagesTechniques in Selecting and Organizing InformationMylen Noel Elgincolin ManlapazPas encore d'évaluation

- Corporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Document18 pagesCorporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Lia asnamPas encore d'évaluation

- Cableado de TermocuplasDocument3 pagesCableado de TermocuplasRUBEN DARIO BUCHELLYPas encore d'évaluation

- A Reconfigurable Wing For Biomimetic AircraftDocument12 pagesA Reconfigurable Wing For Biomimetic AircraftMoses DevaprasannaPas encore d'évaluation

- Open Far CasesDocument8 pagesOpen Far CasesGDoony8553Pas encore d'évaluation

- CTR Ball JointDocument19 pagesCTR Ball JointTan JaiPas encore d'évaluation

- NLP Business Practitioner Certification Course OutlineDocument11 pagesNLP Business Practitioner Certification Course OutlineabobeedoPas encore d'évaluation

- Chromate Free CoatingsDocument16 pagesChromate Free CoatingsbaanaadiPas encore d'évaluation

- Grading System The Inconvenient Use of The Computing Grades in PortalDocument5 pagesGrading System The Inconvenient Use of The Computing Grades in PortalJm WhoooPas encore d'évaluation