Académique Documents

Professionnel Documents

Culture Documents

Altman Z Score

Transféré par

JJ UnDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Altman Z Score

Transféré par

JJ UnDroits d'auteur :

Formats disponibles

A environmental

--'Y'-dppsrtunities:

Altman ZScore Described

ZScore Analysis

The Z-Score is a measureof a company'sheaith and utilizes scveralkey ratios for its formulation.

The model was developedin the late 1960'sby Edward Altman, Professorof Financeat NewYork University School of

Busincss.The model incorporatesfive weighted financial ratios into the calculationsof the Z-Score. ProfessorAltman

continuesto update thc model's coefficientsto reflect changing ways ofconducting business.The coefficient values

used in this SDS, Inc. SupplierFinancialAnalysis Notebook were publishedin 1993 in ProfessorAltman's book entitled

" ' C o r p o r a t eF i n a n c i a lD i s t r c s sa n d B a n k r u p t c y " , Z n de d i t i o n C o p y r i g h t 1 9 9 3b y J o h n W i l c y & S o n s ,I n c . I S B N

041t-552534.

ProlcssorAltman has dcfined 5 variablesthat cornpriscthe Z-score for public and private conpanies:

l. Xl Conrponentof Z-Score is defined as (Xl = Working Capital/TotalAssets).The ratio of Working Capital to Total

Assets is the Z-Score componentwhich is consideredto be a rcasonablepredictor of dccpening trouble for a

company. A cornpanywhich experienccsrepeatedopcrating lossesgenerallywill suffer a rcduction in working

capital rclative to its total assets.

2. The X2 Componentof Z-Score is dc fined as (X2 : RetaincdEarnings/1'otalAsscts).The ratio o f Retained Earnings

to Total Assets is a Z-Score componentwhich provides information on the extent to which a company has been

ablc to reinvcst its earningsin itself. An oldercompany will have had more time to accumulateearnings so this

rncasurementtendsto creatc a positive bias towards older companies

3. X3 Componentof ZScore is defined as (X3 = [rarningst]elore Taxes * Interest/TotalAssets).This ratio adjustsa

company'searningslor varying income tax factors and makcsadjustmentsfor levcraging due to borrowings. Thcsc

adjustrnentsallow urore effective measurementsof the company'sutilization of its assets.

4. The X4 Componentof ZScorc is defined as (X4 : Market Valuc of Equity/TotalLiabilities).This ratio gives an

indication of how much a company'sassetscan dccline in value before debts rnay excccd asscts Equity consists

of the rnarketvalue of all outstandingcommon and preferrcd stock. For a private company the book valuc olequity

i s u s c d f o r t h i s r a t i o .T h i s d e p c n d so n t h e a s s u m p t i o nt h a t a p r i v a t e c o m p a n yr c c o r d si t s a s s e t sa t m a r k e t ' ua l u c .

5. The X5 Componentof Z-Score is definedas (X5 : Net Sales/'r'otal.\ssets).This ratio mcasllresthe ability of thc

cornpany'sassetsto generatcsales.This ratio is not included in cheZ-Scorc of a private company.

T h e Z - S c o r e m o d e l f o r P u b l i c i n d u sctor ima pl a n i e s i s : Z - l . 2 X l + 1 . 4 X 2 + 3 . 3 X 3 t 0 . 6 X 4 + l . 0 X 5 . A h e a l t h y p u r r l i c

c o m p a n y h a s a Z > 2 . 9 9 ; i t i s i n t h e g r e y z o n1e.i8f 1 < Z < 2 . 9 9 ; i t i s u n h e a l t h y i f i t h a s a Z < 1 . 8 1

The Z-Score model for Privateindustrialcompaniesis:7. = 6.56 Xl + 3.26 X2 + 6.72X3 + 1.05X4.A healthyprivate

c o n r p a n y h a s a Z > 2 . 6i 0t i;s i n t h e g r e y z o n e ilf. l < Z < 2 . 5 9 ; i t i s u n h e a l t h y i ift h a s a Z < 1 . 1 .

N o t e : T h i s n t o d e l v v a s d e v e l o p e d i n t h el 9 6 0 s a n d u p d a t e d i n t h e l 9 9 0 s , u s i n g d a t a f r o n n r i d - s i : e d p u b l i c u n d p r i v a t e

ntanu.factttringfrnts. Therefore, the speciJic entpirical result.smay or may not be directly applicable to present

financialexpectalioils,parlicularlyforalargetechnical serviceorganizalionsuchasaTSDF. Themodel'sresults

should be revievveclin lhat context and usedfot'screening purposes only.

From Sourcing Decisiott Support, Inc.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

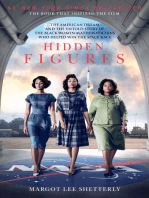

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Buku Manajemen Keuangan Internasional PDFDocument116 pagesBuku Manajemen Keuangan Internasional PDFWen'z Dina100% (2)

- CH09Document26 pagesCH09devinaPas encore d'évaluation

- Group 5 Part 1 Restructuring StrategyDocument21 pagesGroup 5 Part 1 Restructuring Strategylharlyn ambantaPas encore d'évaluation

- Case StudyDocument4 pagesCase StudyAnju PuthanamkuzhiPas encore d'évaluation

- Whistle BlowingDocument17 pagesWhistle BlowingJieYee Tay100% (1)

- English ProductionDocument16 pagesEnglish ProductionDarwin E PurbaPas encore d'évaluation

- COT Index IndicatorDocument9 pagesCOT Index IndicatorDiLungBan75% (4)

- CIR v. BOAC (1987, 149 SCRA 395)Document20 pagesCIR v. BOAC (1987, 149 SCRA 395)KTPas encore d'évaluation

- Cost Accounting Foundations and EvolutionsDocument49 pagesCost Accounting Foundations and EvolutionsTina LlorcaPas encore d'évaluation

- Relational Database Management SystemDocument3 pagesRelational Database Management SystemUtkarsh KaharPas encore d'évaluation

- Book of RecordsDocument396 pagesBook of RecordsareyoubeefinPas encore d'évaluation

- Prakas 068 On Full Implementation of Ifrs MefDocument3 pagesPrakas 068 On Full Implementation of Ifrs MefLona Chee100% (2)

- Directors Duties Cases UkDocument13 pagesDirectors Duties Cases UkRodney Gabriel Vaz67% (3)

- 11 - Palay, Inc. v. ClaveDocument2 pages11 - Palay, Inc. v. ClaveRea Jane B. Malcampo100% (1)

- Case Study - Pegasus AirDocument23 pagesCase Study - Pegasus AirSheila Serrano100% (2)

- Extras de Cont - 20221028 - 110021Document2 pagesExtras de Cont - 20221028 - 110021Cosma ElenaPas encore d'évaluation

- BSP and Dof Floor Plan GFDocument1 pageBSP and Dof Floor Plan GFKarl Anton ClementePas encore d'évaluation

- PPT-Judicial Pronouncement IBC CASE LAWSDocument37 pagesPPT-Judicial Pronouncement IBC CASE LAWSAkhil GoyalPas encore d'évaluation

- 2017 Agm MinutesDocument6 pages2017 Agm Minutesapi-248973401Pas encore d'évaluation

- 1FRbm0KszMg zH40DV8vvoGr5Vy9mf8SDocument6 pages1FRbm0KszMg zH40DV8vvoGr5Vy9mf8SRisca Punya MimpiPas encore d'évaluation

- IBC May 19 Arpita MamDocument58 pagesIBC May 19 Arpita Mamvishnuverma100% (8)

- China-Biotics' 2009 Revenue Is 70 Million Dollars OffDocument19 pagesChina-Biotics' 2009 Revenue Is 70 Million Dollars OffmatberryPas encore d'évaluation

- When Was The AOB Set Up?: What Is It Supposed To Do?Document4 pagesWhen Was The AOB Set Up?: What Is It Supposed To Do?liliniek321Pas encore d'évaluation

- Place of Effective Manangement (PoEM)Document14 pagesPlace of Effective Manangement (PoEM)LEKHA DHILIP KUMARPas encore d'évaluation

- TATA CommunicationsDocument9 pagesTATA CommunicationsHiral PatelPas encore d'évaluation

- PDI Renewal 2019 - Q1Document27 pagesPDI Renewal 2019 - Q1Kuldip JaniPas encore d'évaluation

- MRP Projects For AutomobileDocument25 pagesMRP Projects For AutomobileSagar Vijayvargiya0% (1)

- Creating An Ethical OrganizationDocument17 pagesCreating An Ethical OrganizationAnkit KumarPas encore d'évaluation

- Sahara InidaDocument5 pagesSahara InidaRicha UmraoPas encore d'évaluation