Académique Documents

Professionnel Documents

Culture Documents

The India Cements LTD - Q4FY11 Result Update

Transféré par

Seema GusainTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The India Cements LTD - Q4FY11 Result Update

Transféré par

Seema GusainDroits d'auteur :

Formats disponibles

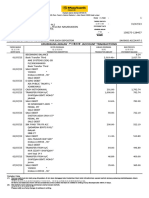

Company Report | Q4FY11 Result Update

LONG TERM INVESTMENT CALL

1 June 2011 Buy

Industry Cement Q4FY11 Result Highlights

CMP (INR) 86

Target (INR) 110 India Cement Ltd. (ICL) top-line came in line with Unicon’s estimates

Upside / Downside (%) 28 but positively surprised on margin front. Lower sales volume was off-

52 week High/Low (INR) 128 / 81 set by higher realisation. Net profit after tax was above our

Market Cap (INR Mn) 25,895 expectations.

3M Avg. Daily Vol. (‘000) 865.7

P/E (FY13e) 7.6 Income from operation at INR 10bn was flat on yearly basis (+2.7%

YoY) due to lower production, -14% YoY. The impact of lower volume

Shareholding Pattern (%) was off set by better price realisation. The operating profit grew by

33% YoY to INR 1,810Mn. Growth in operating profit was due to

Non Promoters

decline in power & fuel cost (-4% YoY), Staff cost (-16% YoY). The

Institutions 25% operating profit margin expanded by 414bps to 18.1% YoY.

30%

Institutions

Net profit after tax for the quarter under review was INR 660Mn,

45% (+152% YoY).

Other Update

During current month (May’11), ICL has redeemed its outstanding

Stock Performance Foreign Currency Convertible Bonds of USD 75Mn together with its

150 ICL NSE Nifty maturity premium.

Company’s new plant (capacity ~1.5mtpa) at Rajasthan is expected to

stabilise in 2HFY11. Additional volume from new plant would result

100

in higher cement production during 2HFY12.

Company is likely to begin its 70MW captive power plants during

50

Q3FY12 which would help in saving power cost.

Jul

Oct

May

Mar

Apr

Jun

Sep

Jan

Dec

Aug

Nov

Feb

Outlook & Valuation

Performance (%) We expect cement prices to correct over next 2-3 months owing to

poor off take by user and timely monsoon. Accordingly cement stocks

3

1 Month 1 Year would also remain under pressure. However, Coal consumption from

Months

captive mines, start of its captive power plants would be key triggers,

Company -7.5% -3.8% -20.5%

going forward, for ICL.

NIFTY -0.1% 4.8% 11.9%

* Source: Acequity

At the current market price, stock trades at 7.6x its FY13e. The core

business of the company is available at ~USD 75/tonne against

Particulars Actual Estimates replacement cost of USD 110-120 /tonne. Due to significant valuation

Total Income 10,001 10,114 gap, we maintain Buy for price target of INR 110/share (10x its FY13e).

EBIDTA 1,810 1,558

Reported PAT 660 384 Key risk to our rating would be lower than expected volume growth

* Source: AceEquity, Unicon Research and drop in cement prices.

Wealth Research, Unicon Financial Intermediaries. Pvt Ltd.

Email: wealthresearch@uniconindia.in

Financials (INR in mn)

Particulars Q4FY11 Q4FY10 YoY

Income from Operations 10,001 9,743 2.7

Operating Expenditure 8,192 8,383 (2.3)

RM Consumption 1,721 1,541 11.7

Operating & Mfg. Exp. 1,414 1,522 (7.1)

Power & Fuel Cost 2,507 2,610 (3.9)

Employee Cost 670 802 (16.4)

Selling & Distn. Exp. 1,879 1,908 (1.5)

EBITDA 1,810 1,360 33.1

EBITDA (%) 18.1 14.0 414 bps

Depreciation 615 616 (0.1)

EBIT 1,195 744 60.5

EBIT (%) 11.9 7.6 430 bps

Other Income 118 28 319.2

Interest 434 369 17.6

PBT 879 404 117.6

Tax 219 143 53.4

Tax (%) 25 35 (29.5)

PAT 660 261 152.7

PAT (%) 6.6 2.7 392 bps

Source: Company, Unicon Research

Wealth Research, Unicon Financial Intermediaries. Pvt Ltd.

Email: wealthresearch@uniconindia.in

Unicon Investment Ranking Methodology

Rating Buy Accumulate Hold Reduce Sell

Return Range >= 20% 10% to 20% -10% to 10% -10% to -20% <= -20%

Disclaimer

This document has been issued by Unicon Financial Intermediaries Pvt. Ltd. (“UNICON”) for the information of its customers only. UNICON is governed by

the Securities and Exchange Board of India. This document is not for public distribution and has been furnished to you solely for your information and must

not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. The

information and opinions contained herein have been compiled or arrived at based upon information obtained in good faith from public sources believed to

be reliable. Such information has not been independently verified and no guarantee, representation or warranty, express or implied is made as to its accuracy,

completeness or correctness. All such information and opinions are subject to change without notice. This document has been produced independently of any

company or companies mentioned herein, and forward looking statements; opinions and expectations contained herein are subject to change without notice.

This document is for information purposes only and is provided on an “as is” basis. Descriptions of any company or companies or their securities mentioned

herein are not intended to be complete and this document is not, and should not be construed as an offer, or solicitation of an offer, to buy or sell or subscribe

to any securities or other financial instruments. We are not soliciting any action based on this document. UNICON, its associate and group companies its

directors or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action

taken on basis of this document, including but not restricted to, fluctuation in the prices of the shares and bonds, reduction in the dividend or income, etc. This

document is not directed to or intended for display, downloading, printing, reproducing or for distribution to or use by any person or entity who is a citizen

or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be

contrary to law or regulation or would subject UNICON or its associates or group companies to any registration or licensing requirement within such

jurisdiction. If this document is inadvertently sent or has reached any individual in such country, the same may be ignored and brought to the attention of the

sender. This document may not be reproduced, distributed or published for any purpose without prior written approval of UNICON. This document is for

the general information and does not take into account the particular investment objectives, financial situation or needs of any individual customer, and it

does not constitute a personalised recommendation of any particular security or investment strategy. Before acting on any advice or recommendation in this

document, a customer should consider whether it is suitable given the customer’s particular circumstances and, if necessary, seek professional advice. Certain

transactions, including those involving futures, options, and high yield securities, give rise to substantial risk and are not suitable for all investors. UNICON,

its associates or group companies do not represent or endorse the accuracy or reliability of any of the information or content of the document and reliance

upon it is at your own risk.

UNICON, its associates or group companies, expressly disclaims any and all warranties, express or implied, including without limitation warranties of

merchantability and fitness for a particular purpose with respect to the document and any information in it. UNICON, its associates or group companies, shall

not be liable for any direct, indirect, incidental, punitive or consequential damages of any kind with respect to the document. No part of this publication may

be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise,

without the prior written permission of Unicon Financial Intermediaries Pvt. Ltd.

Address:

Wealth Management

Unicon Financial Intermediaries. Pvt. Ltd.

VILCO Centre, A-Wing, 3rd Floor, Opp. Garware House, 8 Subhash Road,

Vile Parle (E), Mumbai – 400 057

Ph: 022-3390 1234

Email: wealthresearch@uniconindia.in

Visit us at www.uniconindia.in

Wealth Research, Unicon Financial Intermediaries. Pvt Ltd.

Email: wealthresearch@uniconindia.in

Vous aimerez peut-être aussi

- HDFC Bank Q2FY12 Result UpdateDocument3 pagesHDFC Bank Q2FY12 Result UpdateSeema GusainPas encore d'évaluation

- Biocon LTD Q2FY12 Result UpdateDocument4 pagesBiocon LTD Q2FY12 Result UpdateSeema GusainPas encore d'évaluation

- IDBI Bank Q2FY12 Result UpdateDocument3 pagesIDBI Bank Q2FY12 Result UpdateSeema GusainPas encore d'évaluation

- Persistent Systems LTD - Result Update Q2FY12Document3 pagesPersistent Systems LTD - Result Update Q2FY12Seema GusainPas encore d'évaluation

- Infosys Ltd-Q2 FY12Document4 pagesInfosys Ltd-Q2 FY12Seema GusainPas encore d'évaluation

- YES Bank Q1FY12 Result UpdateDocument3 pagesYES Bank Q1FY12 Result UpdateSeema GusainPas encore d'évaluation

- Hexaware Technologies LTD - Q3FY11 Result UpdateDocument3 pagesHexaware Technologies LTD - Q3FY11 Result UpdateSeema GusainPas encore d'évaluation

- Tata Consultancy Services LTD - Q2FY12 Result UpdateDocument4 pagesTata Consultancy Services LTD - Q2FY12 Result UpdateSeema GusainPas encore d'évaluation

- Indusind Bank Q2FY12 Result UpdateDocument3 pagesIndusind Bank Q2FY12 Result UpdateSeema GusainPas encore d'évaluation

- Zee Entertainment Enterprises LTD - Q2FY12 Result UpdateDocument3 pagesZee Entertainment Enterprises LTD - Q2FY12 Result UpdateSeema GusainPas encore d'évaluation

- HCL Technologies LTD - Q1FY12 Result UpdateDocument3 pagesHCL Technologies LTD - Q1FY12 Result UpdateSeema GusainPas encore d'évaluation

- Weekly - 111015Document15 pagesWeekly - 111015Seema GusainPas encore d'évaluation

- Eadlines: Saturday, September 24, 2011Document16 pagesEadlines: Saturday, September 24, 2011Seema GusainPas encore d'évaluation

- WeeklyDocument17 pagesWeeklySeema GusainPas encore d'évaluation

- Development Credit Bank LTD Q2FY12 Result UpdateDocument3 pagesDevelopment Credit Bank LTD Q2FY12 Result UpdateSeema GusainPas encore d'évaluation

- WeeklyDocument16 pagesWeeklySeema GusainPas encore d'évaluation

- Index of Industrial Production October 12th 2011Document2 pagesIndex of Industrial Production October 12th 2011Seema GusainPas encore d'évaluation

- Unicon Quarterly Earnings Preview - Q2FY12Document38 pagesUnicon Quarterly Earnings Preview - Q2FY12Seema GusainPas encore d'évaluation

- Agrochemical Sector Outlook & Peer AnalysisDocument3 pagesAgrochemical Sector Outlook & Peer AnalysisSeema Gusain0% (1)

- Development Credit Bank LTD - Initiating CoverageDocument15 pagesDevelopment Credit Bank LTD - Initiating CoverageSeema GusainPas encore d'évaluation

- RBI Draft Report - New Banking LicensesDocument3 pagesRBI Draft Report - New Banking LicensesSeema GusainPas encore d'évaluation

- Eadlines: German Lawmakers Approved An Expansion of The Euro-Area Rescue Fund The Food Price Index Rose 9.13% WowDocument16 pagesEadlines: German Lawmakers Approved An Expansion of The Euro-Area Rescue Fund The Food Price Index Rose 9.13% WowSeema GusainPas encore d'évaluation

- Persistent Systems LTD - Initiating CoverageDocument24 pagesPersistent Systems LTD - Initiating CoverageSeema GusainPas encore d'évaluation

- Eadlines: Us GDP Q2 Growth Revised To 1% Food Inflation Rises To 9.8% (Wow)Document16 pagesEadlines: Us GDP Q2 Growth Revised To 1% Food Inflation Rises To 9.8% (Wow)Seema GusainPas encore d'évaluation

- TATA Steel LTD - Q1FY12 Result UpdateDocument4 pagesTATA Steel LTD - Q1FY12 Result UpdateSeema GusainPas encore d'évaluation

- Tribue-29 August 2011Document1 pageTribue-29 August 2011Seema GusainPas encore d'évaluation

- TD Power Systems LTD - IPO NoteDocument6 pagesTD Power Systems LTD - IPO NoteSeema GusainPas encore d'évaluation

- Opto Circuits Q1FY12 Result UpdateDocument4 pagesOpto Circuits Q1FY12 Result UpdateSeema GusainPas encore d'évaluation

- RBI Monetary Policy Sep 2011Document2 pagesRBI Monetary Policy Sep 2011Seema GusainPas encore d'évaluation

- Rallis India LTD - Result Update Q1 FY12Document3 pagesRallis India LTD - Result Update Q1 FY12Seema GusainPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 72825cajournal Feb2023 22Document4 pages72825cajournal Feb2023 22S M SHEKARPas encore d'évaluation

- Employee Stock Options: A Concise GuideDocument26 pagesEmployee Stock Options: A Concise GuideMurtaza VadiwalaPas encore d'évaluation

- Inventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialDocument5 pagesInventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialMimiPas encore d'évaluation

- QUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestDocument3 pagesQUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestLalaine Jhen Dela CruzPas encore d'évaluation

- Commercial Arithmetic PDFDocument8 pagesCommercial Arithmetic PDFagnelwaghelaPas encore d'évaluation

- Allied Bank ReportDocument70 pagesAllied Bank ReportRaja YasirPas encore d'évaluation

- Rent Agreement SummaryDocument2 pagesRent Agreement SummaryJohn FernendicePas encore d'évaluation

- 101 Bir FormDocument3 pages101 Bir Formmijareschabelita2Pas encore d'évaluation

- M2U SA 128457 Jul 2023Document5 pagesM2U SA 128457 Jul 2023syafiqah.mohdali38Pas encore d'évaluation

- Garman 9e PPT Basic Ch07Document28 pagesGarman 9e PPT Basic Ch07bonifacio gianga jrPas encore d'évaluation

- 03 Denny Ermawan OkDocument62 pages03 Denny Ermawan OkAbdul ManafPas encore d'évaluation

- Form 16 Part BDocument4 pagesForm 16 Part BDharmendraPas encore d'évaluation

- IAS 36 - Impairment of Assets - 2020Document17 pagesIAS 36 - Impairment of Assets - 2020ayman el-saidPas encore d'évaluation

- Multiple Choice Questions on Accounting FundamentalsDocument10 pagesMultiple Choice Questions on Accounting FundamentalsChinmay Sirasiya (che3kuu)Pas encore d'évaluation

- 2 Financial Reporting Theory UpdatedDocument52 pages2 Financial Reporting Theory UpdatedSiham OsmanPas encore d'évaluation

- 2 Acknowledgement, Abstract, ContentDocument5 pages2 Acknowledgement, Abstract, ContentHema MaliniPas encore d'évaluation

- Latest Jurisprudence and Landmark Doctrines On DepreciationDocument2 pagesLatest Jurisprudence and Landmark Doctrines On DepreciationCarlota Nicolas VillaromanPas encore d'évaluation

- Prog AngDocument6 pagesProg AngZakaria ImoussatPas encore d'évaluation

- International Money TransferDocument2 pagesInternational Money TransferMainSq100% (1)

- Case Study - Track SoftwareDocument6 pagesCase Study - Track SoftwareRey-Anne Paynter100% (14)

- 4 Kpi For All ManagerDocument8 pages4 Kpi For All ManagernumlumairPas encore d'évaluation

- Trading Options: The Ultimate Guide ToDocument25 pagesTrading Options: The Ultimate Guide ToHikmah Republika100% (1)

- Genealogy ReportDocument2 pagesGenealogy Reportzhaodonghk3Pas encore d'évaluation

- Super Secret Tax DocumentDocument4 pagesSuper Secret Tax Documentk11235883% (6)

- Financial Reporting and Analysis: - Session 4-Professor Raluca Ratiu, PHDDocument54 pagesFinancial Reporting and Analysis: - Session 4-Professor Raluca Ratiu, PHDDaniel YebraPas encore d'évaluation

- Praktek Akuntansi PD UD Buana (Kevin Jonathan)Document67 pagesPraktek Akuntansi PD UD Buana (Kevin Jonathan)kevin jonathanPas encore d'évaluation

- GPNR 2019-20 Notice and Directors ReportDocument9 pagesGPNR 2019-20 Notice and Directors ReportChethanPas encore d'évaluation

- Lecture 5 PDFDocument28 pagesLecture 5 PDFJanicePas encore d'évaluation

- Testbirds GmbH Credit Note for Rahul Rohera WorkDocument1 pageTestbirds GmbH Credit Note for Rahul Rohera WorkRahul RoheraPas encore d'évaluation

- PMGT WhitepaperDocument56 pagesPMGT WhitepapermbidPas encore d'évaluation