Académique Documents

Professionnel Documents

Culture Documents

Sbi Case Study

Transféré par

Sankalp K. Chhetri0 évaluation0% ont trouvé ce document utile (0 vote)

330 vues3 pagesState Bank of India modernized its core processing systems in 2002. The bank converted 140 million accounts held at 14,600 domestic branches. The state bank is the second-largest bank in the world in number of branches.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentState Bank of India modernized its core processing systems in 2002. The bank converted 140 million accounts held at 14,600 domestic branches. The state bank is the second-largest bank in the world in number of branches.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

330 vues3 pagesSbi Case Study

Transféré par

Sankalp K. ChhetriState Bank of India modernized its core processing systems in 2002. The bank converted 140 million accounts held at 14,600 domestic branches. The state bank is the second-largest bank in the world in number of branches.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

Analyst Author: Robert Hunt

Senior Research Director, Retail Banking

Feb 2009

Reference # V58:06R

TowerGroup Take-Aways

Report Coverage

The implementation of the Tata Consultancy Services (TCS) BaNCS Core Banking at

the State

Bank of India (SBI) and its affiliate banks represents the largest centralized core

system

implementaion ever undertaken. The overall effort included the conversion of

approximately 140

million accounts held at 14,600 domestic branches of SBI and its affiliate banks. This

TowerGroup

Research Note is a case study that overviews the history of the State Bank of India

and details the

effort to modernize the bank's core processing systems. It also identifies the drivers

to

modernization, the critical success factors, and the conversion methodology. For a

broader

overview of the Indian core systems market, see TowerGroup Research Note

V47:13R, Looking for

State-of-the-Art Core Banking? Try India.

Background

The State Bank of India is the oldest and largest bank in India, with more than $250

billion (USD) in

assets. It is the second-largest bank in the world in number of branches; it opened its

10,000th

branch in 2008. The bank has 84 international branches located in 32 countries and

approximately

8,500 ATMs. Additionally, SBI has controlling or complete interest in a number of

affiliate banks,

resulting in the availability of banking services at more than 14,600 branches and

nearly 10,000

ATMs.

SBI traces its heritage to the 1806 formation of the Bank of Calcutta. The bank was

renamed the

Bank of Bengal in 1809 and operated as one of the three premier "presidency" banks

(the

presidency banks had the exclusive rights to manage and circulate currency and

were provided

capital to establish branch networks). In 1921, the government consolidated the

three presidency

banks into the Imperial Bank of India. The Imperial Bank of India continued until

1955, when India's

• The State Bank of India (SBI), the largest and oldest bank in India, had

computerized its

branches in the 1990s, but it was losing market share to private-sector banks that

had

implemented more modern centralized core processing systems.

• To remain competitive with its private-sector counterparts, in 2002, SBI began the

largest

implementation of a centralized core system ever undertaken in the banking

industry.

• The State Bank of India selected Tata Consultancy Services to customize the

software,

implement the new core system, and provide ongoing operational support for its

centralized

information technology.

• Although SBI initially planned to convert only 3,300 of its branches, it was so

successful that it

expanded the project to include all of the more than 14,600 SBI and affiliate bank

branches.

• The State Bank of India has achieved its goal of offering its full range of products

and services

to all its branches and customers, spreading economic growth to rural areas and

providing

financial inclusion for all of India's citizens.

OUR ANALYSTS

Robert Hunt

Senior Research Director, Retail Banking & Cards

l

Vous aimerez peut-être aussi

- Research Proposal On BankingDocument23 pagesResearch Proposal On Bankingrujuta88% (8)

- Regional Rural Banks of India: Evolution, Performance and ManagementD'EverandRegional Rural Banks of India: Evolution, Performance and ManagementPas encore d'évaluation

- Porifera and CnidariaDocument16 pagesPorifera and CnidariaMichaelPas encore d'évaluation

- Tcs Bancs On SbiDocument9 pagesTcs Bancs On SbiSushil GoyalPas encore d'évaluation

- Case Study: State Bank of India, World's Largest Centralized Core Processing ImplementationDocument11 pagesCase Study: State Bank of India, World's Largest Centralized Core Processing Implementationpadru007Pas encore d'évaluation

- Indian Banking: State of Banking in The Post-Liberalization PeriodDocument10 pagesIndian Banking: State of Banking in The Post-Liberalization Periodanilmourya5Pas encore d'évaluation

- Case Study - SBI - Implementation of TCS BancsDocument11 pagesCase Study - SBI - Implementation of TCS BancsrahulgoelPas encore d'évaluation

- MIS of State Bank of IndiaDocument13 pagesMIS of State Bank of IndiaSpUnky RohitPas encore d'évaluation

- SBI SHRM Project - MihirDocument26 pagesSBI SHRM Project - MihirAmul KapoorPas encore d'évaluation

- Management Information System of State Bank of India and Its Associate BanksDocument13 pagesManagement Information System of State Bank of India and Its Associate BanksSushil Goyal75% (4)

- Project SBIDocument66 pagesProject SBIsourabh tyagiPas encore d'évaluation

- Performance Analysis of Top 5 Banks in India HDFC Sbi Icici Axis Idbi by SatishpgoyalDocument73 pagesPerformance Analysis of Top 5 Banks in India HDFC Sbi Icici Axis Idbi by SatishpgoyalNaveen Kumar GuptaPas encore d'évaluation

- ANUP College 1Document49 pagesANUP College 1NMA NMAPas encore d'évaluation

- Customer's Perception Towards The Loan Product of State Bank of IndiaDocument60 pagesCustomer's Perception Towards The Loan Product of State Bank of IndiaSubodh Sonawane33% (3)

- Final Central Bak of IndiaDocument40 pagesFinal Central Bak of IndiaNitinAgnihotriPas encore d'évaluation

- Report On Banking SectorDocument8 pagesReport On Banking SectorSaurabh Paharia100% (1)

- TQM & BPR ProjectDocument16 pagesTQM & BPR Projectrishi1987Pas encore d'évaluation

- BPR Project Report - Bank of IndiaDocument14 pagesBPR Project Report - Bank of IndiaPravah Shukla100% (4)

- Introduction To BanksDocument26 pagesIntroduction To BanksNirmal Mangalji SolankiPas encore d'évaluation

- SBI SoubikaDocument70 pagesSBI SoubikaSidharth Gupta0% (1)

- State Bank of India Company ProfileDocument21 pagesState Bank of India Company ProfileAbhishek MasihPas encore d'évaluation

- Ms Archana. Wali MBA II Semester Exam No. MBA0702009Document78 pagesMs Archana. Wali MBA II Semester Exam No. MBA0702009vijayakooliPas encore d'évaluation

- A Research Report ON Service Quality AND Customer Satisfaction of Kotak Mahindra BankDocument88 pagesA Research Report ON Service Quality AND Customer Satisfaction of Kotak Mahindra BankchaudharinitinPas encore d'évaluation

- Worlds Largest Centralized Core Processing Implementation SBI IT StrategyDocument17 pagesWorlds Largest Centralized Core Processing Implementation SBI IT Strategysachin_louisPas encore d'évaluation

- Adoption of Banking Technology: Indian RupeeDocument4 pagesAdoption of Banking Technology: Indian Rupeepuneetbansal14Pas encore d'évaluation

- Mis of State Bank of IndiaDocument13 pagesMis of State Bank of IndiaSushil Goyal100% (1)

- A Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Document70 pagesA Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Umang Vora0% (1)

- Karur VysyaDocument14 pagesKarur VysyaAnjana SubramanianPas encore d'évaluation

- Business Process Re-Engineering IN: Syndicate BankDocument14 pagesBusiness Process Re-Engineering IN: Syndicate BanksunnyPas encore d'évaluation

- BPR - Syndicate BankDocument14 pagesBPR - Syndicate BankPravah ShuklaPas encore d'évaluation

- Central Bank of IndiaDocument70 pagesCentral Bank of Indianandini_mba4870100% (6)

- A Synopsis ONDocument7 pagesA Synopsis ONSaloni GoyalPas encore d'évaluation

- Ashwini G Report On Axis BankDocument49 pagesAshwini G Report On Axis BankVishwas DeveeraPas encore d'évaluation

- Credit Risk Management in Uttara BankDocument62 pagesCredit Risk Management in Uttara Banksaif.letsdoPas encore d'évaluation

- Performance Analysis of Top 5 Banks in India HDFC Sbi Icici Axis Idbi by SatishpgoyalDocument72 pagesPerformance Analysis of Top 5 Banks in India HDFC Sbi Icici Axis Idbi by SatishpgoyaldeepakpinksuratPas encore d'évaluation

- Banking Industry in India Central Bank of India CCDocument57 pagesBanking Industry in India Central Bank of India CCAmit PasiPas encore d'évaluation

- "Role of SBI in The Indian Banking Sector" Presented By:-Karan Patel-201104100710010 Jignesh Mehta-201104100710048Document10 pages"Role of SBI in The Indian Banking Sector" Presented By:-Karan Patel-201104100710010 Jignesh Mehta-201104100710048Jignesh MehtaPas encore d'évaluation

- State Bank of India2Document15 pagesState Bank of India2sanjeet8Pas encore d'évaluation

- Banking Sector in IndiaDocument7 pagesBanking Sector in IndiaAnonymous k4oUWGF9bYPas encore d'évaluation

- Growth in Banking SectorDocument30 pagesGrowth in Banking SectorHarish Rawal Harish RawalPas encore d'évaluation

- Main DataDocument59 pagesMain Datachinmay parsekarPas encore d'évaluation

- State Bank of India: Department of Commerce & Management Government Degree College, GulbargaDocument33 pagesState Bank of India: Department of Commerce & Management Government Degree College, GulbargaManjunath@116Pas encore d'évaluation

- Term Paper: SUBMITTED TO: Prabhjot KaurDocument23 pagesTerm Paper: SUBMITTED TO: Prabhjot KauramritabarunPas encore d'évaluation

- A Project ReportDocument5 pagesA Project ReportHimanshu KumarPas encore d'évaluation

- Customer Satisfaction-ICICI BankDocument98 pagesCustomer Satisfaction-ICICI BankSabinYadav88% (16)

- YesbbnkDocument50 pagesYesbbnklatest updatePas encore d'évaluation

- BOB Summer Project RevisedDocument34 pagesBOB Summer Project RevisedSudeep DakuaPas encore d'évaluation

- State Bank of India (SBI) Is A Multinational Banking and Financial ServicesDocument5 pagesState Bank of India (SBI) Is A Multinational Banking and Financial ServicesTajMohammadFarooqui-AkPas encore d'évaluation

- Contemporary Issue Report ON: "A Critical Case Study of Icici Bank Before and After Merger of Bank of RajasthanDocument68 pagesContemporary Issue Report ON: "A Critical Case Study of Icici Bank Before and After Merger of Bank of RajasthanParesh DuaPas encore d'évaluation

- Final Ashish Npa Project 55Document75 pagesFinal Ashish Npa Project 55pritimehtaPas encore d'évaluation

- CRMDocument25 pagesCRMAlana PetersonPas encore d'évaluation

- About Banking IndustryDocument6 pagesAbout Banking IndustryKopal TandonPas encore d'évaluation

- State Bank of India Is An Indian Multinational,: Big Four BanksDocument6 pagesState Bank of India Is An Indian Multinational,: Big Four BanksSiddiq KhanPas encore d'évaluation

- HDFC BankDocument138 pagesHDFC BankKrishna KanthPas encore d'évaluation

- Banking India: Accepting Deposits for the Purpose of LendingD'EverandBanking India: Accepting Deposits for the Purpose of LendingPas encore d'évaluation

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)D'EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Pas encore d'évaluation

- Trial Balance: Private Sector Financing for Road Projects in IndiaD'EverandTrial Balance: Private Sector Financing for Road Projects in IndiaPas encore d'évaluation

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsD'EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsPas encore d'évaluation

- The role of banks in the regional economic development of Uzbekistan: lessons from the German experienceD'EverandThe role of banks in the regional economic development of Uzbekistan: lessons from the German experiencePas encore d'évaluation

- A Practical Approach to the Study of Indian Capital MarketsD'EverandA Practical Approach to the Study of Indian Capital MarketsPas encore d'évaluation

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexD'EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexPas encore d'évaluation

- Warranty FormDocument13 pagesWarranty FormEmpyrean Builders Corp.Pas encore d'évaluation

- Exploring Nurses' Knowledge of The Glasgow Coma Scale in Intensive Care and Emergency Departments at A Tertiary Hospital in Riyadh City, Saudi ArabiaDocument9 pagesExploring Nurses' Knowledge of The Glasgow Coma Scale in Intensive Care and Emergency Departments at A Tertiary Hospital in Riyadh City, Saudi Arabianishu thapaPas encore d'évaluation

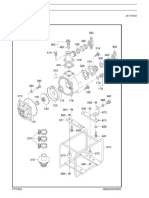

- Fuel SystemDocument24 pagesFuel SystemHammad Uddin JamilyPas encore d'évaluation

- Operator Training ManualDocument195 pagesOperator Training ManualIgnacio MuñozPas encore d'évaluation

- Laminar Premixed Flames 6Document78 pagesLaminar Premixed Flames 6rcarpiooPas encore d'évaluation

- Def - Pemf Chronic Low Back PainDocument17 pagesDef - Pemf Chronic Low Back PainFisaudePas encore d'évaluation

- Important Instructions For Winter-2020 MCQ Based Online ExaminationDocument1 pageImportant Instructions For Winter-2020 MCQ Based Online Examinationdenoh32751Pas encore d'évaluation

- Zanussi Parts & Accessories - Search Results3 - 91189203300Document4 pagesZanussi Parts & Accessories - Search Results3 - 91189203300Melissa WilliamsPas encore d'évaluation

- IJREAMV06I0969019Document5 pagesIJREAMV06I0969019UNITED CADDPas encore d'évaluation

- Course 3 Mathematics Common Core Workbook AnswersDocument4 pagesCourse 3 Mathematics Common Core Workbook Answerspqdgddifg100% (1)

- ARRANGING For Marchong or Concert BandDocument13 pagesARRANGING For Marchong or Concert BandCheGus AtilanoPas encore d'évaluation

- ActivityDocument2 pagesActivityShaira May SalvadorPas encore d'évaluation

- Vialyn Group ResearchDocument17 pagesVialyn Group ResearchVial LynPas encore d'évaluation

- Tugas Bahasa Inggris: ButterflyDocument4 pagesTugas Bahasa Inggris: ButterflyRiyadi TeguhPas encore d'évaluation

- PTD30600301 4202 PDFDocument3 pagesPTD30600301 4202 PDFwoulkanPas encore d'évaluation

- Decolonization DBQDocument3 pagesDecolonization DBQapi-493862773Pas encore d'évaluation

- Bethelhem Alemayehu LTE Data ServiceDocument104 pagesBethelhem Alemayehu LTE Data Servicemola argawPas encore d'évaluation

- Hydrotest Test FormatDocument27 pagesHydrotest Test FormatRähûl Prätäp SïnghPas encore d'évaluation

- Assignment OSDocument11 pagesAssignment OSJunaidArshadPas encore d'évaluation

- Practice Paper Pre Board Xii Biology 2023-24-1Document6 pagesPractice Paper Pre Board Xii Biology 2023-24-1salamnaseema14Pas encore d'évaluation

- GDCR - Second RevisedDocument290 pagesGDCR - Second RevisedbhaveshbhoiPas encore d'évaluation

- E WiLES 2021 - BroucherDocument1 pageE WiLES 2021 - BroucherAshish HingnekarPas encore d'évaluation

- Maharashtra State Board of Technical Education. Academic Monitoring Department ProfileDocument14 pagesMaharashtra State Board of Technical Education. Academic Monitoring Department Profilevspd2010Pas encore d'évaluation

- Dokumen - Tips - Dominick Salvatore Microeconomics Wwwpdfsdocuments2comd38dominick SalvatorepdfDocument2 pagesDokumen - Tips - Dominick Salvatore Microeconomics Wwwpdfsdocuments2comd38dominick SalvatorepdfIshan SharmaPas encore d'évaluation

- Is.2750.1964 SCAFFOLDING PDFDocument32 pagesIs.2750.1964 SCAFFOLDING PDFHiren JoshiPas encore d'évaluation

- Section ADocument7 pagesSection AZeeshan HaiderPas encore d'évaluation

- Fisker Karma - Battery 12V Jump StartDocument2 pagesFisker Karma - Battery 12V Jump StartRedacTHORPas encore d'évaluation

- Attitude of Tribal and Non Tribal Students Towards ModernizationDocument9 pagesAttitude of Tribal and Non Tribal Students Towards ModernizationAnonymous CwJeBCAXpPas encore d'évaluation

- A Review On PRT in IndiaDocument21 pagesA Review On PRT in IndiaChalavadi VasavadattaPas encore d'évaluation