Académique Documents

Professionnel Documents

Culture Documents

Merger and Acquisition of Urban Co Operarive Banks

Transféré par

jahnavi2468Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Merger and Acquisition of Urban Co Operarive Banks

Transféré par

jahnavi2468Droits d'auteur :

Formats disponibles

MERGER AND ACQUISITION OF URBAN CO OPERARIVE BANKS Urban Co-operative Banks (UCBs) The UCBs probably pose the

most complex issues for a regulator since their governance is subject to the provisions of the Cooperative Societies Act, which is administered by the State governments while their banking operations are governed by the B R Act, administered by the RBI, leading to a duality of control. Hence, any move towards consolidation in this sector, required a very special and collaborative approach involving all the stakeholders. The constitution of the Taskforce for Cooperative Urban Banks (TAFCUB), for each State, at the initiative of the RBI, with representation from all the stakeholders was, therefore, a step in this direction and has proved effective in resolving the intractable issues of the UCBs

Conclusion Over the years, there has been considerable progress in consolidation in India in the private sector banks and the mergers have happened not only between the weak and the healthy banks but also, of late, between healthy and well-functioning banks as well. The RBI has been supportive of the initiatives for consolidation and there have been no cases so far where the approval for merger of banks was denied by the RBI, since the proposals conformed to the requirements and guidelines of the RBI. In the case of the urban cooperative banks, notable degree of consolidation has taken place over the years with a good number of weak UCBs getting weeded out from the system, through mergers and amalgamations. In the case of the RRBs, their number has reduced to less than half of their original number and the existing RRBs are in much better financial health. What is noteworthy is that the consolidation in the UCB and the RRB sector has been achieved through innovative ways devised, within the existing statutory framework and without waiting for any legislative amendments to come about. The DFIs have been largely phased out in an orderly manner with only a few refinancing institutions left now. The NBFCs sector too has witnessed a fair degree of consolidation with a sharp reduction in the number of

deposit-taking NBFCs, with their aggregate deposits amounting to not a significant proportion of the total deposits of the banking system, and hence, not a source of systemic risk. However, RNBCs will have to quickly gear up to a change in their business model. Though consolidation in the public sector banking segment, which accounts for about 75 per cent of the assets of the banking system, is still a work in progress, there are enabling legal provisions for the purpose in the respective statutes of the public sector banks. The RBI, as the regulator and supervisor of the banking system, would continue to play a supportive role in the task of banking consolidation based on commercial considerations, with a view to further strengthening the Indian financial sector and support growth while securing the stability of the system. Thank you

Vous aimerez peut-être aussi

- ConclusionDocument2 pagesConclusionezekiel50% (2)

- Omkar ConclusionDocument2 pagesOmkar ConclusionezekielPas encore d'évaluation

- Challenges in Privatization of Urban Cooperative BanksDocument4 pagesChallenges in Privatization of Urban Cooperative Banksakshayhemanth90_8620Pas encore d'évaluation

- Banking AssignmentDocument7 pagesBanking AssignmentAlikaPas encore d'évaluation

- Banking Regulation ActDocument18 pagesBanking Regulation ActHomiga BalasubramanianPas encore d'évaluation

- Role of Co-Operative Banks: My ResearchDocument4 pagesRole of Co-Operative Banks: My Researchsimran yadavPas encore d'évaluation

- Executive Summary 1. BackgroundDocument62 pagesExecutive Summary 1. BackgroundMehul AnandparaPas encore d'évaluation

- Regional Rural BanksDocument4 pagesRegional Rural BanksSiddhartha BindalPas encore d'évaluation

- Banking Regulation Structure in IndiaDocument11 pagesBanking Regulation Structure in IndiaPrateek JainPas encore d'évaluation

- Co-Operative Banks in IndiaDocument9 pagesCo-Operative Banks in Indiachaitali jadhavPas encore d'évaluation

- Cooperative Banks in IndiaDocument36 pagesCooperative Banks in IndiaRavi AgarwalPas encore d'évaluation

- M & A in IndiaDocument16 pagesM & A in IndiaMeher ShivaPas encore d'évaluation

- Role of Urban Cooperative Bank in Banking SectorDocument60 pagesRole of Urban Cooperative Bank in Banking SectorbluechelseanPas encore d'évaluation

- Ever NoteDocument22 pagesEver NoteAyush RaiPas encore d'évaluation

- Why Co-Operative Banks Fail in IndiaDocument22 pagesWhy Co-Operative Banks Fail in IndiaRohit YadavPas encore d'évaluation

- Difference Between Banks & NBFCDocument8 pagesDifference Between Banks & NBFCSajesh BelmanPas encore d'évaluation

- Reserve Bank of India - Function Wise MonetaryDocument1 pageReserve Bank of India - Function Wise MonetaryVishal KhannaPas encore d'évaluation

- The Non-Banking SectorDocument3 pagesThe Non-Banking SectorYogita KumariPas encore d'évaluation

- Anual ReportDocument8 pagesAnual ReportjanuPas encore d'évaluation

- Thesis On Urban Cooperative BanksDocument6 pagesThesis On Urban Cooperative Bankssararousesyracuse100% (2)

- Case Study GroupDocument9 pagesCase Study GroupPrabhujot SinghPas encore d'évaluation

- PAPERDocument12 pagesPAPERTripti KejriwalPas encore d'évaluation

- BLP Module3 Paper 9 1Document634 pagesBLP Module3 Paper 9 1elliot fernandes100% (1)

- Non Performing AssetsDocument8 pagesNon Performing Assetsbhattcomputer3015Pas encore d'évaluation

- 4-Tier Structure For Urban Cooperative BanksDocument6 pages4-Tier Structure For Urban Cooperative BanksNavneet BhandariPas encore d'évaluation

- Cooperative BankDocument14 pagesCooperative Bank679shrishti Singh0% (1)

- BCSBI A ProfileDocument4 pagesBCSBI A Profileronnie07manuPas encore d'évaluation

- Current Affairs Primers: June - 2022Document9 pagesCurrent Affairs Primers: June - 2022Aniruddha SoniPas encore d'évaluation

- YV Reddy Financial Sector Reforms An UpdateDocument4 pagesYV Reddy Financial Sector Reforms An UpdateAnkit Kumar OjhaPas encore d'évaluation

- Co Operative Banking in IndiaDocument5 pagesCo Operative Banking in IndiaramuvindiaPas encore d'évaluation

- Consolidation in The Indian Financial Sector Shri V. LeeladharDocument17 pagesConsolidation in The Indian Financial Sector Shri V. LeeladharMahalaxmi KrishnanPas encore d'évaluation

- SomDocument2 pagesSomVinod KumarPas encore d'évaluation

- Commercial BankingDocument10 pagesCommercial BankingVikkuPas encore d'évaluation

- 065VMAR2005Document2 pages065VMAR2005xytisePas encore d'évaluation

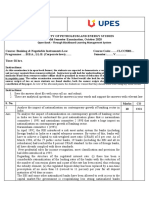

- Roll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemDocument4 pagesRoll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemAryan DevPas encore d'évaluation

- Banking On Non Bankinbanking-On-Non-Banking-Finance-CompaniesDocument32 pagesBanking On Non Bankinbanking-On-Non-Banking-Finance-CompaniesBharat LimayePas encore d'évaluation

- Vishakha Black Book ProjectDocument48 pagesVishakha Black Book ProjectrohitPas encore d'évaluation

- Banking Law and Practise 30112018 PDFDocument526 pagesBanking Law and Practise 30112018 PDFSuchith BPas encore d'évaluation

- NPA, SARFAESI Act and The Impact of ARCs in IndiaDocument89 pagesNPA, SARFAESI Act and The Impact of ARCs in IndiaShone Thattil75% (4)

- Universal Banking: An OverviewDocument5 pagesUniversal Banking: An Overviewjyotirout1987Pas encore d'évaluation

- Shri Vaishnav Institute of Management, Indore (M.P.)Document14 pagesShri Vaishnav Institute of Management, Indore (M.P.)Vikas_2coolPas encore d'évaluation

- Sip Report On SbiDocument46 pagesSip Report On SbiRashmi RanjanPas encore d'évaluation

- Blackbook Project On Indian Banking Sector 2Document119 pagesBlackbook Project On Indian Banking Sector 2anilmourya5Pas encore d'évaluation

- Encl. As Above I. Role of NbfcsDocument6 pagesEncl. As Above I. Role of NbfcsAnkur PandeyPas encore d'évaluation

- Urjit Patel SpeechDocument9 pagesUrjit Patel SpeechSuresh Kumar NayakPas encore d'évaluation

- Role of CRR and SLRDocument9 pagesRole of CRR and SLRVineeta Malan50% (2)

- Customer Centricicity 5Document4 pagesCustomer Centricicity 5ManviRajputPas encore d'évaluation

- Financial Sector Supervisory InitiativesDocument8 pagesFinancial Sector Supervisory InitiativesanmuliPas encore d'évaluation

- Y V Reddy: Public Sector Banks and The Governance Challenge - The Indian ExperienceDocument12 pagesY V Reddy: Public Sector Banks and The Governance Challenge - The Indian ExperiencePsubbu RajPas encore d'évaluation

- IIM Regulation V11Document19 pagesIIM Regulation V11Vikas NagarePas encore d'évaluation

- Merger of PsbsDocument3 pagesMerger of PsbsSanjay SolankiPas encore d'évaluation

- Bad BanksDocument3 pagesBad BanksKrish BhatiaPas encore d'évaluation

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)D'EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Pas encore d'évaluation

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaD'EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaPas encore d'évaluation

- Banking India: Accepting Deposits for the Purpose of LendingD'EverandBanking India: Accepting Deposits for the Purpose of LendingPas encore d'évaluation

- Regulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshD'EverandRegulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshPas encore d'évaluation

- Regional Rural Banks of India: Evolution, Performance and ManagementD'EverandRegional Rural Banks of India: Evolution, Performance and ManagementPas encore d'évaluation

- The Bankable SOE: Commercial Financing for State-Owned EnterprisesD'EverandThe Bankable SOE: Commercial Financing for State-Owned EnterprisesPas encore d'évaluation

- Guidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsD'EverandGuidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsPas encore d'évaluation

- Strengthening Partnerships: Accountability Mechanism Annual Report 2014D'EverandStrengthening Partnerships: Accountability Mechanism Annual Report 2014Pas encore d'évaluation

- Stainless Steel 1.4404 316lDocument3 pagesStainless Steel 1.4404 316lDilipSinghPas encore d'évaluation

- Government of India Act 1858Document3 pagesGovernment of India Act 1858AlexitoPas encore d'évaluation

- Crivit IAN 89192 FlashlightDocument2 pagesCrivit IAN 89192 FlashlightmPas encore d'évaluation

- BS en 118-2013-11Document22 pagesBS en 118-2013-11Abey VettoorPas encore d'évaluation

- Fast Binary Counters and Compressors Generated by Sorting NetworkDocument11 pagesFast Binary Counters and Compressors Generated by Sorting Networkpsathishkumar1232544Pas encore d'évaluation

- OOPS Notes For 3rd Sem ALL ChaptersDocument62 pagesOOPS Notes For 3rd Sem ALL Chaptersabhishek singh83% (6)

- Yamaha F200 Maintenance ScheduleDocument2 pagesYamaha F200 Maintenance ScheduleGrady SandersPas encore d'évaluation

- M70-700 4th or 5th Axis Install ProcedureDocument5 pagesM70-700 4th or 5th Axis Install ProcedureNickPas encore d'évaluation

- Cencon Atm Security Lock Installation InstructionsDocument24 pagesCencon Atm Security Lock Installation InstructionsbiggusxPas encore d'évaluation

- BS As On 23-09-2023Document28 pagesBS As On 23-09-2023Farooq MaqboolPas encore d'évaluation

- Dreamfoil Creations & Nemeth DesignsDocument22 pagesDreamfoil Creations & Nemeth DesignsManoel ValentimPas encore d'évaluation

- Spa ClaimsDocument1 pageSpa ClaimsJosephine Berces100% (1)

- 990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Document25 pages990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Marvin NerioPas encore d'évaluation

- Qualifi Level 6 Diploma in Occupational Health and Safety Management Specification October 2019Document23 pagesQualifi Level 6 Diploma in Occupational Health and Safety Management Specification October 2019Saqlain Siddiquie100% (1)

- CC Anbcc FD 002 Enr0Document5 pagesCC Anbcc FD 002 Enr0ssierroPas encore d'évaluation

- Cara Membuat Motivation LetterDocument5 pagesCara Membuat Motivation LetterBayu Ade Krisna0% (1)

- Starrett 3812Document18 pagesStarrett 3812cdokepPas encore d'évaluation

- Giuliani Letter To Sen. GrahamDocument4 pagesGiuliani Letter To Sen. GrahamFox News83% (12)

- Ahakuelo IndictmentDocument24 pagesAhakuelo IndictmentHNNPas encore d'évaluation

- Fin 3 - Exam1Document12 pagesFin 3 - Exam1DONNA MAE FUENTESPas encore d'évaluation

- HW4 Fa17Document4 pagesHW4 Fa17mikeiscool133Pas encore d'évaluation

- 01 Eh307 Crimpro Case Digests Part 1Document214 pages01 Eh307 Crimpro Case Digests Part 1Kimberly PerezPas encore d'évaluation

- EMI-EMC - SHORT Q and ADocument5 pagesEMI-EMC - SHORT Q and AVENKAT PATILPas encore d'évaluation

- Software Hackathon Problem StatementsDocument2 pagesSoftware Hackathon Problem StatementsLinusNelson100% (2)

- Business Plan GROUP 10Document35 pagesBusiness Plan GROUP 10Sofia GarciaPas encore d'évaluation

- Computer System Sevicing NC Ii: SectorDocument44 pagesComputer System Sevicing NC Ii: SectorJess QuizzaganPas encore d'évaluation

- 19-2 Clericis LaicosDocument3 pages19-2 Clericis LaicosC C Bờm BờmPas encore d'évaluation

- Types of Electrical Protection Relays or Protective RelaysDocument7 pagesTypes of Electrical Protection Relays or Protective RelaysTushar SinghPas encore d'évaluation

- Civil NatureDocument3 pagesCivil NatureZ_Jahangeer100% (4)

- Brother Fax 100, 570, 615, 625, 635, 675, 575m, 715m, 725m, 590dt, 590mc, 825mc, 875mc Service ManualDocument123 pagesBrother Fax 100, 570, 615, 625, 635, 675, 575m, 715m, 725m, 590dt, 590mc, 825mc, 875mc Service ManualDuplessisPas encore d'évaluation