Académique Documents

Professionnel Documents

Culture Documents

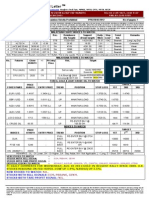

06-06-2011 10:27 AM A Converation Between A Sell-Side Rates Trader & Buy-Side Equities Trader

Transféré par

api-80847199Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

06-06-2011 10:27 AM A Converation Between A Sell-Side Rates Trader & Buy-Side Equities Trader

Transféré par

api-80847199Droits d'auteur :

Formats disponibles

06-06-2011 10:27 AM A Converation Between a Sell-side Rates Trader & Buy-side Equities Trader Interesting take, well defined

reasons for your trade. I'm with you in the turn around in July and resume in declines in the US$ by then. Your analysis provides support for the US$ carry trade and anticipation of higher interest rates outside the US. A side note, the possible unwinding of the US$ - Equities pairs trade (short equities, long US$) that I was considering, I don't think it will unwind anymore meaning I think the US$ won't move in step with a declining equity market as there is still near-term upside (good for longer term US$ shorts), which is why I recommend being flat US$ that technically is in a wide trading range, but shorting it here (73-74 handle) doesn't provide a good RTR, unless you think its risk on in the equities markets. That said, there are other sources of opportunities, like you mentioned: long AUD and GBP. I'd add the Singapore currecny as well. A few thoughts... >I would add that USD weakness seems to be also a rates story in addition to a >traditional safe haven theme.< I agree, it's all about a rate story this year, that why traders ideas are increasingly centered around what the central banks are doing, as you know when rates change so do people's risk approach. And since rates moves can be tied with currency moves, it's funny seeing equity traders trying to sound like currency analysts, with constant mention of appreciating currencies due to potential rate hikes. With the timing of tighter rates becoming increasingly difficult for central bank policy makers, the forces for keeping rates lower & rates higher are gaining equal strength for US & Euro-zone, those forces being slowing growth & inflation fears. The Fed & ECB have a more difficult task than China & Japan's central banks in regards to timing of monetary policy, as China, aside from interest rate and reserve requirement hikes, can appreciate the Yuan, and Japan has G7 coordination to help devalue the Yen as it approaches the 80 handle in the spot market, without having to loosen up in wake of economic recovery from unforeseen events. Asia has more near-term problems compared to the US & Euro-zone who are faced with challenges that aren't fixed with a linear rate policy because of an uneven growth environment admits inflation concerns, and now fiscal stability is becoming a growing crowd once again. FED Challenges: Structural Unemployment, Muted Housing Recovery, Lagging Large-cap Financial Sector (Regulatory Risks pressuring Loan Demand), Cyclical Slowdown, Commodity Inflation seeping into core (less food & energy) US$ Safe Haven Theme: Risk rotation out of equities into US$ (fundamental flight to safety) Risk rotation out of US$ into Gold, Treasuries, Yen, Swiss Franc on macroeconomic concerns (traditional) US$ Rates Story: Low Yields -> US$ Weakness [When money's cheaper you stretch it out sell it to buy into higher yielding currencies and bonds (carry trade)]

ECB Challenges: Peripheral Euro-zone Debt & Austerity Slowing Growth Central Euro-zone Inflation Euro Rates Story: Higher Yields -> Euro Strength [When money's more expensive you take advantage of those rates and buy into them] The ECB faces a polarity problem, while the FED faces a double edge sword in its own manner, with its controversial monetary polices (QE Installments). Tightening provides challenges that can choke off demand and prematurely stall the recovery by compressing & eventually peaking margins. Loosening provides challenges as banks benefit from a steeper yield curve not flat one, and continued flattening shows defensive risk-averse crowd formation and thus liquidity drying up. And with oil prices at this $100 level seeming to be problematic for sustainable growth with companies passing risks to the consumer potentially choking demand, as well as cutting payrolls to hedge energy costs, what's really going on amidst the noise is that the inflationary effects of federal stimulus in an already low interest rate environment is opening wounds central banks are trying to heal. Monetizing the national debt to sustain growth harnesses inflation, which eventually finds it way to risky assets such commodities and equities (ex. technology) and risk spilling over to other asset classes in core sectors. Evidence of this is shown in ticks up in CPI & core CPI, pressing even more significance to upcoming central banks meetings and inflation data points. Transitory inflation can be proven with a market correction that further reprices commodities with it, which I think is the likely case for a 'healthy correction' to prolong this bull market. With that scenario, the US$ will likely rise in the near-term, as a flight to safety mechanism as it has patterned in the past. Note when the US$ unwinds, it unwinds hard. So intermediate-term, I would stay flat US$ and let it trade in this wide trading range ever since it broke from it's recent lows on a weak Jobless claims numbers several weeks ago. History shows inflating an economy out of recession is only a temporary solution which is why I believe equities are in yet another primary bull market with a secular bear market until we get fundamental changes that allow for self-sustainable growth form a micro and macro perspective. 'Kick the can down the road' in forms of stimulus is what will keep asset prices up, and the evil "i" effects of inflation will eventually force developed economies to tighten. What if growth is not sustainable? That remains to be seen, but the bond market and Fed funds futures is pricing in that uncertainty to this day. I remember when the markets were fretting about emerging markets tightening while US & Europe remained loose, and all this speculation about interest rate hikes and timing became crowded trades. Just shows how market psychology continues to repeat itself. It's amazing how one man can have such power to move these markets that run deep. > 1) US yields showing longer lower trend as seen by 2,5,10 yr bonds (bull flattening since April) and Fed Fund futures are pricing in just a 38% chance of a 25 bps rate hike from the Fed for June 2012. That is down from 78% a week and a half ago. Just an interesting indication of how rapid yields are falling.<

With long-term and short term yields spreads narrowing, this rapid decrease in yields is not random. It's quite divergent from the view of eventually higher interest rate environment going forward. This is happening because the broad markets are pricing in a slower than expected economic recovery with rising energy prices from $100 oil. Evidence is showing up that the recovery at this time cannot support these oil prices, and let that not be overlooked, as this is the same issue during the start of the last bear market, pre-Lehman, pre-Bear Stearns. You mention you noticed the flattening of the long end of the yield curve started April, that's when the geo-political risk form MENA (Middle East North Africa) really unfolded, pausing the trend line strength seen in equities, and most notably, breaking out the price WTI crude passed $100. Why does that matter with yields? With low-rate environments making the US$ easier to borrow, it forms a fundamental support for commodities to get bid up, and with supply chain disruption fears (whether irrational or not) acting as catalyst for bullish oil, there are multiple forces in play that support long-term rising energy prices, not to mention emerging market demand. These recent events are creating an uncertain environment regarding the pace of the US economic recovery and thus global growth story, as market participants begin pricing in a more uneven economic recovery and potential need for more stimulus, basically tuning down their expectations for growth and increasing their expectations on inflation. You mention the Fed fund futures pushing back tightening estimates for June 2012 from a 78% chance just 1.5 weeks ago, that's because of the the weak us macro data (housing, productivity, and jobs data) putting doubt in global recovery which in turns drive speculation of continued low-rate environments with possibility of further stimulus such as assets purchased to remain on the FED's balance sheet longer then expected, and additional bond purchases. Inflation is a problematic for that theory as Ben Bernanke hinted in the last fed meeting, but cannot rule anything out and neither is the fixed income markets. The long end of the yield curve has been an excellent indicator these past few months of where equity prices are heading and what rate environment traders are pricing in, and it appears that evidence for pushing back tightening and correction in equity prices are what markets are ultimately headed towards. > So a lot of these next few months with USD, esp as US debt ceiling continues to get hit (tho obviously no default will ever occur) and lower yields USD continues to be sold for higher yielding ccys such as AUD (4.75% policy rate), EUR (1.25% target EONIA), GBP (50 basis point policy rate), and other high yielding such as EM space ccys.< Classic shift in carry trade away from the normal yen carry trade, so as long Fed keeps rates this low, I'm bullish on high yielders. > I like the timing of July to start really seeing the USD fall even more, or start rapidly accelerating. I think last two weeks and even now I guess are still good time to catch this longer trend move, given that bearish news have made it's rounds in the market. Why July? I expect Trichet this Friday to start showing ECB's cards that rate hike to 1.50% policy rate will be set for July ECB meeting. This will make USD weaker and make other countries such as GBP and AUD to start signaling rate hikes for Q3 or Q4 this year, adding to further USD weakness.<

I like the timing of July as well, as a point of acceleration of US$ weakening. From an equities perspective that is when I think broad markets will get a lift from clarity on global slowdown and Q2 margins, and possible stimulus as a catalyst for another leg in the bull market. That will go hand in hand with a weaker US$, inflating asset prices, etc. Keep in mind that with rates this low and continuing to decline, there's a huge spring of cash in bonds waiting to be deployed back in the equities market, and a bearish US$ will continue to act as a tailwind for higher oil prices which means potential return of commodity inflation, and global growth fears (another cycle). Since I believe evidence for a further commodity and equities correction is underway, near-term that is bullish for the US$ causing it to trade in an already established wide range, making range-bound strategies as well as short term momentum trades to the top of the range (76 handle) good hedges for subsequent additions for longer term short positions. One must not underestimate catalysts for US$ bounces, which makes those trying to short now for the long-term, susceptible of being stopped out in the near-term. As far as Trichet goes, he has shown he's not afraid of stimulus just as he was last summer with the Euro bail out package, and again this year with his hawkish tone in balancing the polarity problem that exists with central & peripheral euro-zone. That said, his actions speak for themselves, with ECB rates tightened to 1.25% to then remaining unchanged, forcing traders to wonder when the next tightening phase will be. And with the ECB meeting coming up Thursday, this event is being priced in with traders starting to bid up the Euro anticipating increases in ECB rates sooner than later, not to mention the recent details relieving the latest euro-zone stimulus package (and successful peripheral euro-zone bond auctions), as stimulus provides relief which is again bullish Euro in a market obsessed with inflation, growth, and debt scares. Since rates are going down this rapidly because the market is anticipating that growth is slowing down, to go along with fact of a continued loose monetary policy by the Fed, to the contrary, like you mentioned, anticipating ECB rate hikes is a tailwind for the Euro, and headwind for the US$. But, I expect further headline risk coming from Euro-zone, mainly with peripheral debt concerns, as these events take time to unfold with clarity acting as catalyst for more uncertainty in situations involving debt & stimulus, a lesson learned last summer. I suspect a reversal in the near-term uptrend in the Euro, thus a catalyst to again bounce the US$. I think this ECB meeting Thursday may provide the event for a setup to sell the rumor of a possible hike this July, as rates are likely to remain unchanged near-term due to contagion fears resurfacing in Euro-zone and a global slowdown with despite growing inflation that's becoming clearer with recent macro data. The rips in the Euro since the 1.40 handle this entire year have been related to ECB tightening. I stand by the idea with a market correction going hand in hand with a weaker Euro. I think it anybody's guess about Trichet and his hawkish comments or not, as he has the best poker face amongst central bankers while still inspiring confidence, though has been inconsistent with his comments. He has also been inconsistent with his rate policy this year and will keep interest rates unchanged again this upcoming meeting with most recent core CPI data giving him no reason to do so right now, until we see more upticks in forecast on inflation which is highly likely. So near-term I expect long Euro positions start to unwind, only to return back to the table around July when clarity on

growth, inflation, and stimulus concerns have settled in this market, and traders prepare for an actual rate hike which will provide further weakness to the US$. That said, with all these central bank uncertainties it just makes gold a more attractive to buy as markets are realizing that an economy built on leverage may struggle to return to its full capacity, which long-term also makes emerging markets a prime source of opportunity for equity bulls. Final thoughts, regarding the S&P 500, I continue to watch for liquidation in defensive sectors in a declining tape (de-risking environment), which suggests risk rotation into other asset classes instead of classic sector rotation. It is difficult timing a bounce to fade when risk just rotates from speculative sectors to defensive sectors, where a decline from liquidation in one sector creates a false top, with risk then transferring to another sector within the market, thus resuming the trend. But when defensive sectors start leading an overall decline in the broad market, that suggests the mass crowd is raising cash (leaving room more for wider spreads and more volatility from quants) or, just rotating into other defensive asset classes like bonds, and also currencies. Though interest rates in the US continue to remain low which like we mentioned pressures the US$, in the intermediate-term, in order for this decline in equities to be a 'healthy' correction, US$ needs to trade higher to pressure commodities & relieve inflation, before this stress cycle eventually returns. These are very complex relationships, which is what makes markets difficult to forecast and trade, but hope this provides clarity on why I think the the FED & ECB have backed themselves in a corner thus broad markets will have to reprice equities back to fair value. There are many analytics for fair value, I like looking at the investors average (200-day EMA), and we're still clearly above that so the trade is to remain short S&P 500 heading into the summer.

Vous aimerez peut-être aussi

- Economics 101Document19 pagesEconomics 101tawhid anamPas encore d'évaluation

- Gold Yield Reports Investors IntelligenceDocument100 pagesGold Yield Reports Investors IntelligenceAmit NadekarPas encore d'évaluation

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999Pas encore d'évaluation

- Netflix Streaming Growth StoryDocument26 pagesNetflix Streaming Growth Storymskrier67% (3)

- Cpa Review School - Prac 1Document12 pagesCpa Review School - Prac 1jikee1150% (2)

- Corporate Finance Ross 10th Edition Test BankDocument15 pagesCorporate Finance Ross 10th Edition Test Bankotoscopyforklesslx8v100% (29)

- The Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyD'EverandThe Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyÉvaluation : 5 sur 5 étoiles5/5 (1)

- Daily Breakfast Spread highlights risks to growth and inflationDocument6 pagesDaily Breakfast Spread highlights risks to growth and inflationShou Yee WongPas encore d'évaluation

- Barclays UPDATE Global Rates Weekly Withdrawal SymptomsDocument74 pagesBarclays UPDATE Global Rates Weekly Withdrawal SymptomsVitaly Shatkovsky100% (1)

- CS - FX Compass Looking For Cracks 20230131Document10 pagesCS - FX Compass Looking For Cracks 20230131G.Trading.FxPas encore d'évaluation

- Gitman Chapter 7 Stock ValuationDocument71 pagesGitman Chapter 7 Stock ValuationMa Angeli GomezPas encore d'évaluation

- The Consequences Are ProfoundDocument3 pagesThe Consequences Are ProfoundshamikbhosePas encore d'évaluation

- Us Interest RatesDocument3 pagesUs Interest Ratesapi-301070912Pas encore d'évaluation

- Rupee vs Dollar analysisDocument7 pagesRupee vs Dollar analysisManinder Vadhrah VirkPas encore d'évaluation

- The Feds March MadnessDocument1 pageThe Feds March Madnessrichardck61Pas encore d'évaluation

- Olivers Insights - Share CorrectionDocument2 pagesOlivers Insights - Share CorrectionAnthony WrightPas encore d'évaluation

- DailyFX - US Dollar Index October 14 - 2014Document3 pagesDailyFX - US Dollar Index October 14 - 2014Helen BrownPas encore d'évaluation

- Weekly Economic Commentary 3-12-12Document8 pagesWeekly Economic Commentary 3-12-12monarchadvisorygroupPas encore d'évaluation

- Leveling The Playing Field September 8, 2015: TH THDocument6 pagesLeveling The Playing Field September 8, 2015: TH THPensford FinancialPas encore d'évaluation

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightPas encore d'évaluation

- The World Overall 05:10 - Week in ReviewDocument4 pagesThe World Overall 05:10 - Week in ReviewAndrei Alexander WogenPas encore d'évaluation

- Will interest rates continue to riseDocument2 pagesWill interest rates continue to riseNEHA HOTAPas encore d'évaluation

- Calm Before The Storm: Thursday, 23 May 2013Document11 pagesCalm Before The Storm: Thursday, 23 May 2013Marius MuresanPas encore d'évaluation

- The Pensford Letter - 4.21.14Document3 pagesThe Pensford Letter - 4.21.14Pensford FinancialPas encore d'évaluation

- 59 - Fundamental Breakdown 05.02.23Document13 pages59 - Fundamental Breakdown 05.02.23Yar Zar AungPas encore d'évaluation

- FX Daily The Dollar Comeback Hinges On Powell Again 20230207Document5 pagesFX Daily The Dollar Comeback Hinges On Powell Again 20230207Brandon Zevallos PoncePas encore d'évaluation

- Market Commentary 4/25/2012Document1 pageMarket Commentary 4/25/2012CJ MendesPas encore d'évaluation

- The World Overall 06:21 - Week in ReviewDocument5 pagesThe World Overall 06:21 - Week in ReviewAndrei Alexander WogenPas encore d'évaluation

- The Bark Is Worse Than The BiteDocument6 pagesThe Bark Is Worse Than The BitedpbasicPas encore d'évaluation

- 11/6/14 Global-Macro Trading SimulationDocument18 pages11/6/14 Global-Macro Trading SimulationPaul KimPas encore d'évaluation

- The World Overall 04:12 - Week in ReviewDocument6 pagesThe World Overall 04:12 - Week in ReviewAndrei Alexander WogenPas encore d'évaluation

- Investment Directions en UsDocument12 pagesInvestment Directions en UsothergregPas encore d'évaluation

- The Pensford Letter - 8.19.13Document6 pagesThe Pensford Letter - 8.19.13Pensford FinancialPas encore d'évaluation

- Bii 2016 Outlook Us VersionDocument20 pagesBii 2016 Outlook Us VersionEmil Biobelemoye Hirai-GarubaPas encore d'évaluation

- Out of The Shadows For Now.: LPL Compliance Tracking #1 LPL Compliance Tracking #1-456099Document8 pagesOut of The Shadows For Now.: LPL Compliance Tracking #1 LPL Compliance Tracking #1-456099Clay Ulman, CFP®Pas encore d'évaluation

- Weekly Market Commentary 6/3/2013Document4 pagesWeekly Market Commentary 6/3/2013monarchadvisorygroupPas encore d'évaluation

- Slow Growth Lingers Despite StimulusDocument4 pagesSlow Growth Lingers Despite Stimuluspathanfor786Pas encore d'évaluation

- The World Overall 03:22 - Week in ReviewDocument4 pagesThe World Overall 03:22 - Week in ReviewAndrei Alexander WogenPas encore d'évaluation

- FX 20140417Document2 pagesFX 20140417eliforuPas encore d'évaluation

- Is The Market About To CrashDocument21 pagesIs The Market About To CrashSoren K. GroupPas encore d'évaluation

- US Equity Strategy Q2 11Document8 pagesUS Equity Strategy Q2 11dpbasicPas encore d'évaluation

- The Pensford Letter - 9.14.15Document6 pagesThe Pensford Letter - 9.14.15Pensford FinancialPas encore d'évaluation

- 11/4/14 Global-Macro Trading SimulationDocument20 pages11/4/14 Global-Macro Trading SimulationPaul KimPas encore d'évaluation

- The Weekly Peak - December 10, 2010Document7 pagesThe Weekly Peak - December 10, 2010derailedcapitalism.comPas encore d'évaluation

- Fed Doves No Longer Rule The Roost: Economic and Financial AnalysisDocument5 pagesFed Doves No Longer Rule The Roost: Economic and Financial AnalysisOwm Close CorporationPas encore d'évaluation

- Today's Highlights - 06-29-11Document9 pagesToday's Highlights - 06-29-11timurrsPas encore d'évaluation

- From Low Volatility To High GrowthDocument4 pagesFrom Low Volatility To High GrowthdpbasicPas encore d'évaluation

- Degussa Marktreport Engl 22-07-2016Document11 pagesDegussa Marktreport Engl 22-07-2016richardck61Pas encore d'évaluation

- Weekly Trends March 20, 2015Document4 pagesWeekly Trends March 20, 2015dpbasicPas encore d'évaluation

- 78 - Fundamental Breakdown 18.06.23Document11 pages78 - Fundamental Breakdown 18.06.23Ahmed AbedPas encore d'évaluation

- What Happens When The Fed Raises RatesDocument3 pagesWhat Happens When The Fed Raises RatesBobit la MadridPas encore d'évaluation

- Alpha Fractal ReportDocument7 pagesAlpha Fractal Reportapi-213311303Pas encore d'évaluation

- Weekly Investment Commentary en UsDocument4 pagesWeekly Investment Commentary en UsbjkqlfqPas encore d'évaluation

- 11/3/14 Global-Macro Trading SimulationDocument20 pages11/3/14 Global-Macro Trading SimulationPaul KimPas encore d'évaluation

- Weekly Economic Commentary 06-27-2011Document3 pagesWeekly Economic Commentary 06-27-2011Jeremy A. MillerPas encore d'évaluation

- Hadrian BriefDocument11 pagesHadrian Briefspace238Pas encore d'évaluation

- Leveling The Playing Field October 12, 2015Document5 pagesLeveling The Playing Field October 12, 2015Pensford FinancialPas encore d'évaluation

- The Pensford Letter - 6.24.13Document3 pagesThe Pensford Letter - 6.24.13Pensford FinancialPas encore d'évaluation

- The World Overall 03:01 - Week in ReviewDocument4 pagesThe World Overall 03:01 - Week in ReviewAndrei Alexander WogenPas encore d'évaluation

- Trump Policy Challenges and Global Growth OutlookDocument11 pagesTrump Policy Challenges and Global Growth OutlookAnonymous TApDKFPas encore d'évaluation

- 29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEDocument18 pages29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEtimurrsPas encore d'évaluation

- Lane Asset Management Stock Market Commentary April 2012Document7 pagesLane Asset Management Stock Market Commentary April 2012Edward C LanePas encore d'évaluation

- The List Market Outlook en UsDocument12 pagesThe List Market Outlook en UsothergregPas encore d'évaluation

- Macro Update (07/01/15) : Euro-ZoneDocument5 pagesMacro Update (07/01/15) : Euro-Zoneapi-80847199Pas encore d'évaluation

- 11/16/12 Market MemoDocument1 page11/16/12 Market Memoapi-80847199Pas encore d'évaluation

- Micro / Macro Analysis: Greece yDocument5 pagesMicro / Macro Analysis: Greece yapi-80847199Pas encore d'évaluation

- Macro Update (07/01/15) : Euro ZoneDocument6 pagesMacro Update (07/01/15) : Euro Zoneapi-80847199Pas encore d'évaluation

- A Continuing Series of Broadening Formations (Updated Video List) (11/07/12)Document1 pageA Continuing Series of Broadening Formations (Updated Video List) (11/07/12)api-80847199Pas encore d'évaluation

- A Continuing Series of Broadening Formations (Updated Video List) (11/16/12)Document1 pageA Continuing Series of Broadening Formations (Updated Video List) (11/16/12)api-80847199Pas encore d'évaluation

- A Continuing Series of Broadening Formations (Updated Video List) (11/16/12)Document1 pageA Continuing Series of Broadening Formations (Updated Video List) (11/16/12)api-80847199Pas encore d'évaluation

- UntitledDocument4 pagesUntitledapi-80847199Pas encore d'évaluation

- A Continuing Series of Broadening Formations (Updated Video List) (11/14/12)Document1 pageA Continuing Series of Broadening Formations (Updated Video List) (11/14/12)api-80847199Pas encore d'évaluation

- Monday's Links & Index Quotes (06/25/12)Document5 pagesMonday's Links & Index Quotes (06/25/12)api-80847199Pas encore d'évaluation

- A Continuing Series of Broadening Formations (Updated Video List) (11/07/12)Document1 pageA Continuing Series of Broadening Formations (Updated Video List) (11/07/12)api-80847199Pas encore d'évaluation

- Earnings Update 07-19-11Document2 pagesEarnings Update 07-19-11api-80847199Pas encore d'évaluation

- UntitledDocument3 pagesUntitledapi-80847199Pas encore d'évaluation

- Gravity International Group LLC Pre-Market Trading Desk Comments 7-21-11Document1 pageGravity International Group LLC Pre-Market Trading Desk Comments 7-21-11api-80847199Pas encore d'évaluation

- Practice QuestionsDocument4 pagesPractice QuestionsDimple PandeyPas encore d'évaluation

- Mergers and AcquisitionsDocument20 pagesMergers and Acquisitionsfirman prabowoPas encore d'évaluation

- Portfolio Management - Chapter 13Document39 pagesPortfolio Management - Chapter 13Dr Rushen SinghPas encore d'évaluation

- Quizesfm 2Document2 pagesQuizesfm 2Prince MalabaPas encore d'évaluation

- Motilal Oswal ProjectDocument54 pagesMotilal Oswal Projectmathibettu100% (2)

- Important Features of IAS 1 PDFDocument6 pagesImportant Features of IAS 1 PDFJayedPas encore d'évaluation

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongPas encore d'évaluation

- ACC 309 Final Project Student WorkbookDocument46 pagesACC 309 Final Project Student Workbooknick george100% (1)

- FAR.3030 Share-Based PaymentDocument8 pagesFAR.3030 Share-Based PaymentTatianaPas encore d'évaluation

- PLEASE READ OUR FAQ FIRST - Http://bit - Ly/btcguidefaq: Best Trading Course PricelistDocument1 pagePLEASE READ OUR FAQ FIRST - Http://bit - Ly/btcguidefaq: Best Trading Course PricelistBillionairekaPas encore d'évaluation

- Investment in Equity SecuritiesDocument3 pagesInvestment in Equity SecuritiesNicole Galnayon100% (1)

- Instructions For Using Texas Instruments BA II Plus CalculatorDocument3 pagesInstructions For Using Texas Instruments BA II Plus Calculatorsir bookkeeperPas encore d'évaluation

- Fundamentals of Futures and Options Markets Hull 8th Edition Test BankDocument5 pagesFundamentals of Futures and Options Markets Hull 8th Edition Test Bankroxanabinhlhe100% (23)

- Graham & Harvey 2001 The Theory and Practice of Corporate Finance Evidence From The FieldDocument53 pagesGraham & Harvey 2001 The Theory and Practice of Corporate Finance Evidence From The Fielder4sall100% (1)

- PresentationDocument29 pagesPresentationpermafrostXx0% (1)

- 2,3,4 Ir Uzd PDFDocument31 pages2,3,4 Ir Uzd PDFLeonid LeoPas encore d'évaluation

- Corporate Governance & Corporate FinanceDocument780 pagesCorporate Governance & Corporate FinancenabiilahhsaPas encore d'évaluation

- Scope of DerivativesDocument14 pagesScope of DerivativesAbhinav Roy0% (1)

- Primary and Secondary MarketsDocument73 pagesPrimary and Secondary MarketsNadia RosmanPas encore d'évaluation

- Bca 302 Special Accounts Dec 1Document6 pagesBca 302 Special Accounts Dec 1omondifoe23Pas encore d'évaluation

- Investment Opportunities in Equity Markets - Primary, Secondary Markets ExplainedDocument38 pagesInvestment Opportunities in Equity Markets - Primary, Secondary Markets ExplainedRanjeet SinghPas encore d'évaluation

- Tax Principles Broad Basing Simplicity EfficiencyDocument8 pagesTax Principles Broad Basing Simplicity EfficiencyPrithvi PrasadPas encore d'évaluation

- Financial Management - Grinblatt and TitmanDocument68 pagesFinancial Management - Grinblatt and TitmanLuis Daniel Malavé RojasPas encore d'évaluation

- Antiquee ReportDocument51 pagesAntiquee ReportanushkakiranPas encore d'évaluation

- Financial Accounting-I Sem-1 (GU-DEC-2014)Document12 pagesFinancial Accounting-I Sem-1 (GU-DEC-2014)Ekta RanaPas encore d'évaluation

- Kitov China DealDocument1 pageKitov China DealAnonymous ipErpL6Pas encore d'évaluation