Académique Documents

Professionnel Documents

Culture Documents

Reading Material Scope of Cover

Transféré par

Abhisekh KumarDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reading Material Scope of Cover

Transféré par

Abhisekh KumarDroits d'auteur :

Formats disponibles

Reading material STANDARD FIRE AND SPECIAL PERILS POLICY SCOPE OF COVER 1. 1.1 1.

2 FIRE: The term fire, for insurance purposes, means actual ignition or burning, under accidental or fortuitous circumstances, so far as the insured is concerned. Once there is a fire within the meaning of the policy, the following types of losses are also payable: (a) Damage during or immediately following a fire caused by (i) (ii) (iii) (b) (i) (ii) (c) 1.3 Smoke; Scorching; Falling walls. damage caused by water damage caused by blowing up the property to prevent spreading of fire.

Damage caused by fire brigades in the discharge of their duties e.g.

Damage to property removed from a burning building caused by exposure to

weather, provided the removal was made in an endeavour to mitigate the loss. Excluding destruction or damage even if caused by fire resulting from (a) (b) (c) (i) (ii) its own fermentation, natural heating or spontaneous combustion its undergoing any heating or drying process

burning of property insured by order of any Public Authority caused by any of the excluded perils e.g., Earthquake/Terrorism/Forest Fire etc.

Note: For exclusions and add-on cover refer Annexure-1. 2. 3. 3.1 LIGHTNING: All damage caused by lightning, whether fire results or not, is covered. EXPLOSION/IMPLOSION: A simple definition of explosion is a sudden violent burst with a loud report and implosion means bursting inward or collapse due to external pressure. Apart from damage caused by fire resulting from explosion/implosion, damage caused by rupturing, shattering, cracking etc., of property (evidenced by broken machinery, shattered glass, splintered timbers and widely scattered debris) known as concussion damage is also covered. /2

:2: 3.2 Excludes destruction or damage caused to the boilers (other than domestic boilers), economizers, or other vessels in which stream is generated, machinery or apparatus subject to centrifugal force by is own explosion/implosion. Note: This exclusion refers to destruction or damage to boilers (other than domestic boilers), economizers, etc. which can be covered under an Engineering Policy for boilers and pressure vessels. 4. RIOT, STRIKE AND MALICIOUS DAMAGE: Direct visible physical loss, destruction or damage by external violent means caused to the property by riot, strike and malicious damage but excluding loss caused by: 4.1 4.2 total or partial cessation of work or the retarding or interruption or cessation of any process or operations or omissions of any kind. permanent or temporary dispossession resulting from confiscation, commandeering requisition or destruction by order of the government or any lawfully constituted authority. 4.3 permanent or temporary dispossession of any building or plant or unit or machinery resulting from the unlawful occupation by any person of such building or plant or unit or machinery or prevention of access to the same. 4.4 4.5 5. burglary, house breaking, theft, larceny or any attempt by any person taking part therein. Terrorism damage. STORM, CYCLONE, TYPHOON, TEMPEST, HURRICANE, TORNADO, FLOOD AND INUNDATION (STFI): These terms are not defined in the policy and have to be understood in their popularly accepted meanings. 5.1 Storm is defined as severe, if not violent, atmospheric disturbance such as unusually heavy rain, hail, wind, snow storms, or combination of these. Cyclone, typhoon, etc., are examples of storms with greater intensity. 5.2 6. Flood is usually defined as escape of a body of water from its normal confines, due to a rise in its level, or to the break down of the barriers restraining it. AIRCRAFT DAMAGE: Destruction or damage caused by (a) aircraft, (b) aerial or space devices and (c) articles dropped therefrom, excluding that caused by pressure waves. Notes: a) The term aerial or space devices includes balloons, rockets, artificial satellites etc. b) Pressure waves relates to damage, for example, of window panes caused by aircraft flying low or at supersonic speed. /3

:3: 7. SUBSIDENCE AND LANDSLIDE INCLUDING ROCKSLIDE: Destruction or damage caused by subsidence of part of the site on which the property stands or Landslide/Rockslide excluding: a) The normal cracking, settlement or bedding down of new structures b) The settlement or movement of made-up ground c) Coastal or river erosion d) Defective design or workmanship or use of defective materials e) Demolition, construction, structural alterations or repair of any property or ground works or excavations. 8. MISSILE TESTING OPERATIONS: Loss due to Missile Testing operations e.g., programmes conducted by Government of India or such public authorities. 9. BURSTING AND/OR OVERFLOWING OF WATER TANKS, APPARATUS AND PIPES. Loss/damage caused by overflowing of water pipes, overhead tanks etc. 10. IMPACT DAMAGE: Impact by direct contact by any rail/road vehicle not belonging to or owned by a) The Insured or any occupier of the premises or b) Their employees while acting in the course of their employment. 11. BUSH FIRE: Loss due to bush fire is covered, but not forest fire. Note: (a) Bush fire is limited and localized in nature (compared to forest fire) e.g., accidental burning of vegetation, grass etc., in and around the insured premises. (b) Forest fire is catastrophic in nature and can be covered as add-on cover on payment of extra premium. /4

:4: Exclusions/Amounts not payable under Standard Fire Insurance Policy and add-on cover Sl No 1 (a) (b) Exclusions Deductible Access Rs.10,000 for each and every claim (other than due to Act of God Perils) 5% of claim subject to min. Rs.10,000 for Act of God Perils such as LIGHTNING/STFI/SUBSIDENCE LANDSLIDE AND ROCKSLIDE (and Earthquake risk if covered at extra premium) Loss due to war, invasion, civil war, mutiny and similar perils Loss due to radiation/contamination by radio active materials (nuclear perils) Loss due to pollution/contamination (unless it is caused by an insured peril) Loss by theft during or after the occurrence of fire Burning of insured property by order of any public authority Loss due to terrorism damage Loss due to Earth Quake, Fire and shock Architects fees in excess of 3% of claim amount Expenses for removal of debris, in excess of 1% of the claim amount Loss in excess of Rs.10,000/- in respect of bullion or unset precious stones, curios /works of art Loss in respect of currency notes, coins, books of accounts, computer syste m records, drawings etc. Forest Fire Loss due to its own fermentation, natural heating or spontaneous combustion (e.g. coal/haystack) (exclusion applies only for materials subject to risk of its own combustion. Spread of fire to other properties considered as accidental and hence covered). Loss/damage to stocks in cold storage premises caused by change of temperature (even by insured peril) Omission to Insure, additions, alterations/extension for fixed assets such as building, plant and machinery (not applicable for stocks) Temporary removal of stocks Loss of rent (for owners of buildings) Addl.rent for alternate accommodation (for tenants) Insured property removed to outside locations which is not covered under the policy Loss due to electrical risks (such as short-circuiting, over-running, arcing etc) Loss of earnings/loss of market and other forms of consequential loss :5: Terms for Add-on cover

Deductible access cannot be covered even on payment of extra premium Not available Not available Not available Not available Not available Available as Add-on cover at extra premium Addl. Amount (in excess of specified percentage to be specifically insured). Loss exceeding Rs.10,000 can be covered for specific amount. Can be covered subject to specific mention in the policy Available as Add-on cover

2 3 4 5 6 7 8 9 10 11 12 13 14

Available as Add-on cover at extra premium for such materials.

15 16 17 18 19 20 21 22

Can be covered for 5% of Sum Insured on building, plant & m/c. Can be covered for 10% of Sum Insured on stocks Can be covered for Sum Insured to be specified in the policy Limited cover available under Standard Policy for machinery taken out for repair (upto 60 days) Can be covered under MBD policy Can be covered (partly) under Consequential Loss Policy. /5

STANDARD TERMS AND CONDITIONS OF FIRE POLICY 1. VOIDABLE, IN CASE OF MISDESCRIPTION: This condition provides that the policy shall be voidable in the event of misrepresentation, mis-description or non-disclosure of any material particulars. This is a reiteration of the principle of utmost good faith, for the sake of emphasis and can be invoked at the option of the insurer. 2. FALL OR DISPLACEMENT: All insurances under the policy cease on the expiry of seven days from the date of fall or displacement of any building or part thereof. If notice is given not later than seven days of such fall, the company may agree to continue the insurance subject to revised terms and conditions and by endorsement of the policy. Note: This does not apply if such fall or displacement is caused by the insured perils 3. 3.1 MATERIAL ALTERATIONS: The insurance gets terminated under any of the following circumstances: a) Changes in trade or manufacture or nature of occupation or other circumstances which increase the risk of loss or damage by insured perils. b) Unoccupancy of the building for a period more than 30 days. c) Transfer of insurable interest unless by will or operation of law. When the insurable interest of the Insured ceases (e.g. on sale of property) the insurance automatically ceases. However, two exceptions are made. On the death of the insured the policy vests in the legal heirs named in the will. A trustee of liquidator in bankruptcy proceedings acquires insurable interest and becomes the insured. 3.2 4. The insurance may be continued if the insured obtains sanction of the company through endorsement before the occurrence of any loss or damage. MARINE POLICY: The insurance does not cover any loss or damage to property which, at the time of loss or damage, is insured by any marine policy. However the policy will cover the excess amount beyond the amount payable under the marine policy. Note: Marine cargo policies include cover in respect of fire and it is possible for fire and marine policies to overlap, as for example, for that period during storage of goods in port premises. 5. CANCELLATION: This insurance can be cancelled by the Insurer or the Insured at any time subject to the following: :6: /6

5.1

The Insured can cancel the policy at any time by giving a written notice in which case the Insurer will retain premium at short period scale for the period of cover and refund the balance premium to the Insured.

5.2 6. 6.1

The Insurer can cancel the policy, subject to giving a written notice of atleast 15 days and shall refund pro-rata premium for the un-expired period. CLAIM INTIMATION & PROCEDURAL REQUIREMENTS: The first part of the condition lays down the duties of the insured in the event of loss or damage and the procedure to be followed for processing claims. The requirements are: (i) (ii) Immediate notification of the loss to the company. Submission within 15 days of the loss or within such extension as may be granted by the company of a written statement of the claim giving full particulars of the loss or damage and of the property affected and details of other insurances, if any. (Usually, the insurers supply a claim form for the purpose). (iii) (iv) Submission at the cost of the Insured, all such documents which may be reasonably required for providing proof in respect of the claim. A declaration, on oath or in other legal form of the truth of the claim, if required. . Note: This condition expressly provides that compliance with its terms is condition precedent to insurers liability. Although an independent surveyor/loss assessor is appointed by the insurers to report on the cause and extent of loss, the provisions of this condition are still binding on the insured.

6.2

The second part of the condition is known as limitation condition and provides as follows: (a) The liability of the insurer for any loss is extinguished after the expiry of 12 months from the date of the loss, unless the claim is the subject of pending action or arbitration. (b) If liability for any claim is disclaimed by the insurer and the insured has not filed a suit in a court of law, within 12 calendar months from the date of the disclaimer, then the claim is deemed to be abandoned and cannot be recovered thereafter. In other words, the claim becomes time barred. Note: This condition provides necessary protection to the insurer against inordinate delay on the part of the insured in substantiating the claims. It is not possible for the insurer to keep its accounts open for an indefinite period. In the absence of this condition, it would be possible for the insured to present his claim after a considerable lapse of time when the insurer may have lost all traces of the evidence which led to its original rejection. /7 :7:

7. 7.1

RIGHT OF ENTRY: This condition gives right to the company to enter the premises where loss has occurred, take possession of property and deal with it as may be necessary (e.g., salvaging) and sell such property for account of all concerned.

7.2

The condition further provides that: a) Exercise of these rights does not mean that liability for loss is admitted. b) Benefit under the policy is forfeited if the Insured does not co-operate. c) The Insured has no right to abandon the property to the Insurers whether taken possession of or not by them. Note: The right of abandonment arises under a Marine Policy where the Insured can abandon extensively damaged property to the Insurers and claim a total loss. This right is however denied under a fire policy.

7.3

This condition confers certain rights to the insurers which are necessary for: (a) (b) (c) ascertaining the cause and extent of loss or damage, minimizing the damage and protecting the salvage.

The condition enables the surveyor/loss assessors to enter the premises to establish the cause and extent of loss and specialized agencies like salvage corps to protect the salvage and minimize the damage that may be caused in the process of extinguishment. 7.4 The rights conferred by the condition are exercisable by the company at any time until 8. 8.1 Notice in writing is given by the insured that he makes no claim or Such claim is finally determined or withdrawn.

FRAUD: This condition deals with the consequences of fraud. All benefits under the policy shall be forfeited if: (i) (ii) (iii) (iv) The claim is fraudulent. The claim is supported by a false declaration. Fraudulent means are used by the insured or any one acting on his behalf. Loss or damage is caused by the willful act of the insured or with his connivance.

8.2

These provisions merely reiterate the position under common law. Utmost good faith is an implied condition in an insurance contract and places upon the insured the duty to deal honestly with the insurer when a claim arises. Fraud will automatically avoid the policy, so also willful fire caused by the insured or with his connivance. An express condition is incorporated in the policy for the sake of special emphasis. /8

:8:

9. 9.1

REINSTATEMENT: This is the reinstatement condition under which the insurer has the option to reinstate or replace damaged property, subject to: a) Reinstatement shall not be exact or complete but shall be in a reasonably sufficient manner. b) Expenditure is limited to the cost of reinstating the property to its pre-fire condition and subject to the sum insured. c) It is the duty of the insured to furnish, at his expense, the Insurer with all plans and such other particulars as may be required. d) Any act done by the insurer with a view to reinstatement is without prejudice to the final decision regarding reinstatement. e) If due to municipal or other regulations in respect of building construction etc., the insurer is unable to reinstate, then liability is limited to such sum as would be required to reinstate such property in the same condition as could be reinstated lawfully to its former condition.

9.2

The condition is rarely invoked in practice, in view of various constraints. The main object of inserting this condition is to have some protection against unreasonable or exaggerated claims. This can also be used by the Insurer for replacement of branded items available to the insurer at a discount.

9.3 10. 10.1

If the insured is not inclined to accept the offer of reinstatement, it may prove to be a factor in favour of the insurer in any subsequent litigation. PRORATA CONDITION: If the property hereby insured shall, at the breaking out of any fire, or at the commencement of damage by any other peril insured be collectively of greater value than the sum insured thereon, then the Insured shall be considered as being his own insurer for the difference and shall bear a ratable proportion of the loss accordingly. If the sum insured under the policy is less than the value of the property on the date of loss, the amount of loss payable will be proportionately reduced. The object of the condition is to penalize under insurance by reducing payment of claim on a proportionate basis. The application of the condition may be illustrated with an example: Sum Insured Value of property Loss Amount of claim payable Rs.5,00,000/Rs.6,00,000/Rs.90,000/Rs.75,000/- = (5,00,000 / 6,00,000 X 90,000) /9 :9:

10.2

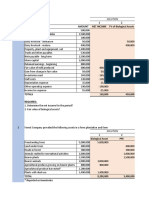

Every item of the policy, if more than one, shall be separately subject to this condition. This part of the condition provides that if the Fire Policy covers more than one item of property each item of property will be separately subject to average. This may be illustrated as follows: Sum Insured Building Machinery Stocks Total Rs Rs Rs Rs 1,00,000/3,00,000/5,00,000/9,00,000/Market Value 1,00,000/2,00,000/6,00,000/9,00,000/Adequacy Yes Over insured Under insured Yes Loss Amount payable 20,000/- 20,000/60,000/- 50,000/80,000/- 70,000/-

In the above example the total sum insured is adequate but the stocks are under insured. This item is therefore separately subject to average and the amount of loss is proportionately reduced for stocks. 10.3 Fire Insurance rates are determined on the assumption that properties are insured for their full value. If the amount insured is less than the full value, the insured makes a lesser contribution than what is due from him and is not eligible for full claim. This condition ensures that the sum insured is fixed adequately by the insured, so that contribution to the common is proportionate to the full value. 11. CONTRIBUTION: If more than one policy is taken for covering the same property, the company will be liable to pay only the ratable proportion of the loss in the event of loss. Rateable proportion of the policy may be defined as that proportion of the loss as the sum insured under the policy bears to the total sum insured under all the policies. 12. SUBROGATION: Under this condition, rights and remedies available to the Insured for obtaining relief or indemnity from other parties in respect of the loss/damage caused are subrogated to the Insurers who are entitled to exercise these rights even before they indemnify the loss. The condition also provides that the insured shall, at the expense of the company, render assistance to the company for enforcing these rights and remedies against the other parties responsible for the loss. 13. 13.1 ARBITRATION: The arbitration condition provides as follows: a) b) Any dispute or difference as to the quantum to be paid under this policy shall, independently of all other questions, be referred to arbitration. No dispute or difference shall be referable to arbitration, if the company has disputed (i.e., not accepted) liability under the policy. /10 : 10 :

c) d)

A sole arbitrator is to be appointed in writing by the parties, if they agree. If the parties cannot agree upon a single arbitrator within 30 days of any party invoking arbitration the same shall be referred to a panel of three arbitrators, one to be appointed by each of the parties and the third arbitrator to be appointed by the arbitrators nominated by the parties.

e) f) 13.2 14.

Arbitration shall be conducted under the provisions of the Arbitration and Conciliation Act, 1996. The award by arbitrator(s) shall be a condition precedent to any right of action or suit under the policy.

The object of this condition is to ensure that disputes regarding quantum of loss are settled quickly and at lesser cost, compared to litigation. NOTICE OR OTHER COMMUNICATION TO THE COMPANY: Every notice or other communication to the company required by the conditions must be written or printed.

15. 15.1

REINSTATEMENT OF SUM INSURED AFTER LOSS: The full sum insured has to be maintained throughout the currency of the Policy. Upon the settlement of loss, pro-rata premium on the amount of loss from the date of loss to the date of expiry shall be payable by the Insured. The condition provides that the extra premium shall be deducted from the net claim payable so that the continuous cover to the full extent will be available to the Insured irrespective of the fact whether the additional premium has been actually paid or not following a claim.

15.2

It is open to the insured to exercise his option not to reinstate the sum insured (immediately on occurrence of the loss), in which case the sum insured shall stand reduced by the amount of the loss. /11

:11:

COVER AGAINST TERRORISM DAMAGE UNDER FIRE POLICY A. 1. RECENT CHANGES WITH REGARD TO TERRORISM DAMAGE COVER: Damage due to terrorism was covered under the Fire Policy as part of Riot and Strike/Malicious Damage in the past, virtually at a marginal premium. However due to the recent developments involving major acts of terrorism, the Tariff Advisory Committee decided to exclude Terrorism Damage under Fire / Engineering / IAR Policies w.e.f.1.4.2002 and offer this cover as an Add-on Peril subject to certain conditions. 2. The following Terrorism Exclusion Damage Warranty was generally incorporated in all General Insurance Policies: 2.1 The policy excludes loss or damage due to an act of terrorism which means an act, including but not limited to the use of force or violence and/or the threat thereof, of any person or group(s) of persons whether acting alone or on behalf of or in connection with any organization(s) or government(s) committed for political, religious, ideological or similar purpose including the intention to influence any government and/or to put the public or any section of the public in fear. 2.2 The warranty includes the following additional conditions: a) Policy excludes loss, damage, cost or expenses of whatsoever nature directly or indirectly caused by, resulting from or in connection with any action taken in controlling, preventing, suppressing or in any way relating to action taken in respect of any act of terrorism. b) If the company alleges that by reason of this exclusion, any loss, damage, cost or expenses is not covered by this insurance the burden of proving the contrary shall be upon the insured. c) In the event any portion of this endorsement is found to be invalid or unenforceable, the remainder shall remain in full force and effect. B. 1. ENDORSEMENT FOR COVERING TERRORISM DAMAGE AT EXTRA PREMIUM: In consideration of payment of additional premium, the Terrorism Damage Exclusion Warranty incorporated in the policy stands deleted. The expression/s terrorism and/or act of terrorism shall have the same meaning/s as contained in Terrorism Damage Exclusion Warranty. /12

: 12 : 2. This endorsement does not cover loss of or damage caused by : a) total or partial cessation of work or the retardation or interruption or cessation of any process or operations or omissions of any kind. b) Permanent or temporary dispossession resulting from confiscation,

commandeering, requisition or destruction by order of the Government or any lawfully constituted Authority. c) Permanent or temporary dispossession of any building or plant or unit of machinery resulting from the unlawful occupation by any person of such building or plant or unit or machinery or prevention of access to the same. d) Loss or damage, cost or expenses of whatsoever nature directly or indirectly caused by, resulting from or in connection with any action taken in controlling, preventing, suppressing or in any way relating to action taken in respect of any act of terrorism. C. 1. SPECIAL FEATURES OF TERRORISM COVER: The Terrorism Damage Cover under Fire, Engineering and Industrial All Risks Policies of insurance is administered under a Pooling arrangement through General Insurance Corporation of India (GIC) on behalf of all general insurance companies in India. The Terrorism Pool consists of all general insurance companies operating in India and they share the risk on a pre-determined basis. 2. The total liability of all insurers is subject to certain limits under Material Damage plus Loss of Profit (LOP) cover for all assets in a particular location within one compound. 3. Premium is charged at Tariff rates which are notified by GIC (with approval from IRDA) on a periodical basis. These are net rates without any commission/brokerage/discount etc. Refer enclosure for details. 4. The coverage under this endorsement is subject to an excess of 0.5% of the total sum insured subject to a minimum of Rs. One lakh for each and every claim in respect of both material damage and loss of profits combined. /13

: 13 : D. 1. MID-TERM COVER FOR TERRORISM As per the previous regulations terrorism cover has to be taken at the commencement of policy and could not be included at a later date during the currency of the policy. 2. As per recent amendment, effective from 1.4.2009, Mid-term cover can be taken for Terrorism damage subject to the following conditions: a) b) Premium will be charged on the basis of short period scale applicable. No claims will be payable for loss or damage to property caused by an act of terrorism, occurring during the first 15 days from the date of granting such cover. E. CURRENT LIMITS OF LIABILITY AND PREMIUM (Effective from 1.4.2009):

Total Sum Premium on Total Sum Insured Overall Liability (MD Insured (TSI) + LOP) per (MD + LOP) location/compound TSI upto Rs.750 Full rate of Re.0.30 per mille (for Industrial TSI crores Risks) or Re.0.20 per mille (for NonIndustrial Risks) or Re.0.10 per mille (for Residential Risks) TSI exceeding a) Full Rate of Re.0.30 per mille (for Rs.750 crores Rs.750 crores Industrial Risks) or Rs.0.20 per mille (for but not Non-Industrial Risks) on the first Rs.750 exceeding crores and Rs.2000 crores b) Re.0.25 per mille (for Industrial Risks) or Re.0.15 per mille (for Non-Industrial Risks) on the balance TSI. TSI exceeding a) Full Rate of Re.0.30 per mille (for Rs. 750 crores Rs.2000 crores Industrial Risks) or Re.0.20 per mille (for Non-Industrial Risks) on the first Rs.750 crores and b) Re.0.25 per mille (for Industrial Risks) or Re.0.15 per mille (for Non-Industrial Risks) on the next Rs.1250 crores and c) Re.0.20 per mille (for Industrial Risks) or Re.0.12 per mille (for Non-Industrial Risks) on the balance TSI in excess of Rs.2000 crores. /14

: 14 : REINSTATEMENT VALUE POLICIES 1. 2. This policy is issued only in respect of fixed assets viz., building, plant, machinery, furniture, fixture and fittings and not for stocks. The basic distinction between the Standard Policy and Reinstatement Value (RIV) Policy is that depreciation in the value of assets is taken into account under the standard policy whereas depreciation is ignored under RIV policy (both for fixing the Sum Insured and for settlement of claims). 3. This type of insurance represents a certain degree of deviation from the principle of indemnity since the Insured will be able to acquire a new asset, in place of old and used asset, in case of loss or damage due to fire and other perils. This form of policy was initially introduced in UK after the First World War since it was found that there was high inflation in the value of assets and it was not possible for the factory owners to replace the assets in case of fire damage with the help of the claim paid by the insurance company. Other sources such as depreciation fund were also not adequate in view of high escalation in cost. Considering the macro economic issues regarding the need for replacement of damaged assets and growth of economy, this form of policy was introduced. However the principle of indemnity is maintained (in a slightly modified extent) by imposing certain conditions explained in 5 to 7 below:. 4. 4.1 The operative clause used for this cover is reproduced below, since it is necessary to study and understand this policy thoroughly: It is hereby declared and agreed that in the event of the property insured under (item Nos..) of the within policy being destroyed or damaged, the basis upon which the amount payable under (each of the said items of) the policy is to be calculated, shall be the cost of replacing or reinstating on the same site or any other site with property of the same kind or type but not superior to or more extensive than the insured property when new as on date of the loss, subject to the following Special Provisions and subject also to the terms and conditions of the policy except in so far as the same may be varied hereby. 4.2 Replacement should be Property of the same kind or type which implies that the new assets are not materially different from the damaged assets. For example: (a) If a drilling machine is damaged by fire, it cannot be replaced with a plastic moulding machine. (b) Machinery in an Engineering Industry cannot be replaced with chemical machinery and line of manufacture altered. /15

: 15 : 4.3 The expression that the property should not be superior to or more extensive than the insured property when new implies that the new asset should not only be of same type but should also be more or less of similar specifications and capacity to the damaged asset. 4.4 5. The work of replacement can be carried out at the same site or alternate location subject to the liability of the insurance company not being increased due to the change. Settlement of claims for loss or damage to buildings or other assets which can be repaired (including replacement of parts) is relatively simple under this clause. Claims will be settled in full for the actual cost of repairs, without making any deduction for depreciation. 6. Settlement of claims for total loss requiring complete replacement of damaged assets presents difficulties, since it is difficult to acquire new assets of the same type and capacity as damaged assets due to technological advancement and other reasons. This difficulty may arise particularly in respect of machinery due to continuous improvement in technology and phasing out of lower capacity machinery. A practical solution is therefore allowed by the Insurers by which the Insured is permitted to go in for a more advanced machinery of higher capacity subject to the condition that the Insured should contribute an agreed portion of the cost of new asset, based on technology improvement and higher capacity. 7. 7.1 The other terms and conditions applicable for RIV cover are given below: The work of reinstatement should be carried out within a maximum period of 12 months from the date of damage unless extension of time is agreed upon in writing by the insurance company. If the work is not carried out within 12 months or agreed extension, settlement of claim will be on market value basis. 7.2 Settlement on RIV basis will be done only after the work of replacement is carried out by the insured. However on account payment can be made by the Insurer based on market value to facilitate the replacement works. 7.3 7.4 Pro-rata condition of average will apply if the amount insured is not adequate to cover the replacement value of the new asset, on the date of replacement. RIV clause will not be valid or effective if : a) b) 8 the insured does not intimate the insurance company about intention to reinstate within a period of 6 months from the date of loss (unless extension is agreed). the insured is unable or unwilling to replace or reinstate the damaged property at the same or alternate location. The Reinstatement Value Policy is different from reinstatement condition of the Standard Fire Policy, as explained below. /16

: 16 : 8.1 Reinstatement condition under Standard Fire Policy provides an option to the Insurer to carry out repair or replacement whereas the Reinstatement Value Policy is an option to the Insured to replace the damaged assets. 8.2 Settlement under reinstatement condition is done on market value basis, i.e., after deducting depreciation whereas settlement under Reinstatement Value Policy provides new for old i.e., without deducting depreciation into account.

: 17 : INSURANCE OF STOCKS DECLARATION & FLOATER A. DECLARATION POLICIES

1.

NEED FOR DECLARATION POLICY:

1.1

Stocks which are subject to frequent fluctuations in value present the following issues for insurance purpose:

(a)

Sum Insured under the fire policy will have to be increased or decreased by endorsement frequently which requires constant monitoring by the Insured and additional administrative work both for the Insurer and the Insured.

(b)

1.2

If the Sum is fixed at the expected peak level for the year to avoid under insurance, premium paid is higher, without corresponding benefit.

The issues can be resolved by opting for a declaration policy under which the Insured is encouraged to fix provisional Sum Insured based on the highest value of stocks expected at any point of time during the policy period. The premium paid on this sum insured is treated as provisional and a refund of premium is allowed on the expiry of the policy, so that the premium paid is consistent with the value of stocks. DECLARATION CONDITIONS:

2.1

The Insured should declare in writing the value of his stocks (other than retail stocks and after adjustment of any amount insured by Policies other than declaration policies), on the following basis namely : a] average of the values at risk on each day of the month or b] the highest value at risk during the month.

2.2

The Insured shall make such declaration(s) before the end of the succeeding month. If the declaration is not made for any month or the declaration is delayed beyond the time allowed, the Insured shall be deemed to have declared the Sum Insured for that month.

2.3

If there are other policies on declaration basis covering the same stocks, the declarations shall be made so as to apportion to each policy a share of the value of the stocks insured under all such policies, on pro-rata basis.

2.4 2.5

The maximum liability of the Company shall not exceed the Sum Insured under the policy and premium shall not be charged on any value declared in excess thereof. The Sum Insured may be increased by prior agreement with the Company in which event the new Sum Insured and the date from which it is effective will be recorded on the policy by endorsement. Premium for such increase is charged on pro-rata basis.

2.6 2.7

No reduction in Sum Insured shall be allowed during the currency of the policy. The basis of value for declarations shall be the market value. /18

: 18 : 2.8 On the expiry of each period of insurance the actual premium shall be calculated on the average Sum Insured namely, the total of the values declared or deemed to have been declared divided by the number of declarations deemed to have been made. If the resultant premium is less than the provisional premium charged under the policy and endorsements if any for increase in Sum Insured, the excess amount shall be refunded, subject to such repayment not exceeding 50% of the provisional premium charged. 2.9 If at the time of any loss, there be any subsisting insurance or insurances on other than on declaration basis, whether effected by the Insured or by any other person or persons, covering the stocks hereby insured, this policy shall apply only to the excess of the value of such stocks at the time of the loss. 2.10 If after the occurrence of a loss it is found that the amount of the last declaration previous to the loss is less than the amount that ought to have been declared, then the amount of claim payable shall be reduced in such proportion as the amount of the said last declaration bears to the amount that ought to have been declared. 2.11 3. 3.1 3.2 It is warranted that every other policy covering the stocks on declaration basis shall be on identical terms. OTHR REGULATIONS FOR ISSUE OF DECLARATION POLICY The minimum sum insured shall be Rs.1 crore. It is not permissible to issue Declaration policy in respect of: (a) (b) (c) (d) 4. 4.1 Insurance required for a short period Stocks undergoing process Retail stocks Stocks at Railway sidings.

ADVANTAGES The provision for adjustment of premium enables the insured to effect cover for the maximum amount that may be anticipated during the next 12 months and eliminates the need for monitoring the fluctuations in the stock value.

4.2

The premium payable on the expiry of the policy is limited to the average amount at risk and not the initial sum insured. Therefore there is no loss of premium due to unutilized amount of insurance

4.3

The policy provides for increasing the amount Insured on a prospective basis, to take care of increasing trend in stock value which could not be anticipated initially. This helps the Insured to fix the initial amount on a realistic basis and take action based on trend. /19

: 19 : B. 1. FLOATING POLICY Floating Policies (also known as Floater Policies) are granted to cover stocks at different locations under a single Sum Insured to take care of fluctuation between different locations. 2. 3. 4. The stocks may be stored in different godowns at different locations in the same town, city, state or other states as well. The premium charged is at the highest rate applicable to insureds property at any of the locations plus 10% loading. In consideration of Floater Extra charged over and above the policy rate the aggregate Sum Insured under the policy is available for any one or more, or all locations as specified in the policy. 5 6. Pro-rata condition of average will apply if the aggregate values at risk in all locations exceeds the total Sum Insured under the policy. The insured should have a good internal audit and accounting procedure under which the total amount at risk and the locations can be established at any particular time if required. 7 Any changes in the address of locations declared at inception should be communicated, as and when such changes occur. Otherwise, stocks at the new locations are not covered. /20

: 20 : OPTIONAL CLAUSES WITHOUT INVOLVING ADDITIONAL PREMIUM 1. DESIGNATION OF PROPERTY CLAUSE For the purpose of determining, where necessary, the item under which any property is insured, the insurers agree to accept the designation under which the property has been entered in the insureds books. 2. CONTRACT PRICE INSURANCE CLAUSE (for imported goods only) In the case of insurance of imported goods only (and not for goods of local manufacture) which are sold under a contract which is cancelled either wholly or to the extent of loss or damage, it is permissible to issue a policy on the basis of Contract Price and the following clause shall be inserted in the Policy. It is hereby agreed and declared that in respect only of goods sold but not delivered for which the insured is responsible and with regard to which under the conditions of sale, the sale contract is by reason of the perils covered under the Policy, cancelled either wholly or to the extent of the loss or damage, the liability of the company shall be based on the contract price and for the purpose of average the value of all goods to which the clause would in the event of loss or damage be applicable shall be ascertained on the same basis. 3 LOCAL AUTHORITIES CLAUSE (for RIV policy) Reinstatement Value Policy may be extended to cover additional cost of reinstatement solely by reason of the necessity to comply with the regulations of local authority by incorporating the following clause in the policy: The insurance by this policy extends to include such additional cost of reinstatement of the destroyed or damaged property hereby insured as may be incurred solely by reason of the necessity to comply with the Building or other Regulations under or framed in pursuance of any act of Parliament or with Bye-laws of any Municipal or Local authority provided that: 1) The amount recoverable under this extension shall not include: a) The cost incurred in complying with any of the aforesaid Regulations or Bye-laws i) In respect of destruction or damage occurring prior to the granting of this extension ii) In respect of destruction or damage not insured by the policy the destruction or damage iv) In respect of undamaged property or undamaged portions of property other than foundations (unless foundations are specifically excluded from the insurance by this policy) of that portion of the property destroyed or damaged. /21 iii) Under which notice has been served upon the insured prior to the happening of

: 21 : b) The additional cost that would have been required to make good the property damaged or destroyed to a condition equal to its condition when new, had the necessity to comply with any of the aforesaid Regulations or Bye-laws not arisen 2) The work of reinstatement must be commenced and carried out with reasonable dispatch and in any case must be completed within twelve months after the destruction or damage or within such further time as the insurers may (during the said twelve months) in writing allow and may be carried out wholly or partially upon another site (if the aforesaid Regulations or Bye-laws to necessitate) subject to the liability of the insurer under the extension not being thereby increased. 3) If the liability of the insurer under (any item of) the policy apart from the extension shall be reduced by the application of any of the terms and conditions of the policy then the liability of the insurers under this extension (in respect of any such item) shall be reduced in like proportion. 4) 5) The total amount recoverable under any item of the policy shall not exceed the sum insured thereby. All the conditions of the policy except in so far as they may be hereby expressly varied shall apply as if they had been incorporated herein ________________________

Vous aimerez peut-être aussi

- Porter Generic Strategy ManagementDocument10 pagesPorter Generic Strategy ManagementAbhisekh KumarPas encore d'évaluation

- Project On General InsuranceDocument71 pagesProject On General Insurancerohan_punjabi784% (64)

- SuggestionsDocument3 pagesSuggestionsAbhisekh KumarPas encore d'évaluation

- Krupanidhi Institute of Management EducationDocument5 pagesKrupanidhi Institute of Management EducationAbhisekh KumarPas encore d'évaluation

- Project On General InsuranceDocument71 pagesProject On General Insurancerohan_punjabi784% (64)

- Project On General InsuranceDocument71 pagesProject On General Insurancerohan_punjabi784% (64)

- Porter Generic Strategy ManagementDocument10 pagesPorter Generic Strategy ManagementAbhisekh KumarPas encore d'évaluation

- Porter Generic Strategy ManagementDocument10 pagesPorter Generic Strategy ManagementAbhisekh KumarPas encore d'évaluation

- Porter Generic Strategy ManagementDocument10 pagesPorter Generic Strategy ManagementAbhisekh KumarPas encore d'évaluation

- IntroductionDocument3 pagesIntroductionAbhisekh KumarPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PAS 1: Requirements for Financial Statement PresentationDocument1 pagePAS 1: Requirements for Financial Statement PresentationElisha EPas encore d'évaluation

- Example Accounting Problems - SolutionsDocument7 pagesExample Accounting Problems - Solutionscarol indangan100% (1)

- Basic Overview of Financial Statements: Income Statement Balance Sheet Cash Flow StatementDocument10 pagesBasic Overview of Financial Statements: Income Statement Balance Sheet Cash Flow StatementRutuja KunkulolPas encore d'évaluation

- International Accounting Standard 36 (IAS 36), Impairment of AssetsDocument10 pagesInternational Accounting Standard 36 (IAS 36), Impairment of AssetsMadina SabayevaPas encore d'évaluation

- ACCT1101 - Solution - Chapter 07Document7 pagesACCT1101 - Solution - Chapter 07hayleyPas encore d'évaluation

- (A) Alpha Bit Design Worksheet For The Month Ended October 31, 2020Document5 pages(A) Alpha Bit Design Worksheet For The Month Ended October 31, 2020Sergio NicolasPas encore d'évaluation

- Poultry Layer Farm Business PlanDocument18 pagesPoultry Layer Farm Business PlanGlyde Vince Isidore DuriaPas encore d'évaluation

- ACCT 1201 Syllabus - Spring 2013 ZulloDocument13 pagesACCT 1201 Syllabus - Spring 2013 ZullodriffusPas encore d'évaluation

- 1 Installment SalesDocument26 pages1 Installment SalesSameer Hussain100% (2)

- 2 Aa2e Hal Errata 012015Document37 pages2 Aa2e Hal Errata 012015JohnPas encore d'évaluation

- Cma Format For Bank-3Document40 pagesCma Format For Bank-3technocrat_vspPas encore d'évaluation

- GoldmanSachs HyundaiMobis (012330KS) ElectrificationasmajorgrowthdriverbutmarginrecoverymaytaketimeInitiDocument22 pagesGoldmanSachs HyundaiMobis (012330KS) ElectrificationasmajorgrowthdriverbutmarginrecoverymaytaketimeInitiKhurshid AbduraimovPas encore d'évaluation

- Corporate Tax Planning Unit 3Document17 pagesCorporate Tax Planning Unit 3Abinash PrustyPas encore d'évaluation

- Polytechnic University of The PhilippinesDocument12 pagesPolytechnic University of The PhilippinesKyla Dane P. Prado0% (1)

- Unit 3 and 4Document21 pagesUnit 3 and 4Angry BirdPas encore d'évaluation

- Maximizing Profits and Shareholder ValueDocument49 pagesMaximizing Profits and Shareholder ValueEDPSENPAIPas encore d'évaluation

- Net Income ReviewDocument3 pagesNet Income ReviewJustine HusainPas encore d'évaluation

- Assignment 1Document21 pagesAssignment 1siddhant jainPas encore d'évaluation

- Case 11 Financial ForecastingDocument9 pagesCase 11 Financial ForecastingFD ReynosoPas encore d'évaluation

- Discussion QuestionsDocument4 pagesDiscussion QuestionsPatrick John RifilPas encore d'évaluation

- Resumen: Capitulo 2 Ross Financial Statements and Flow of CashDocument2 pagesResumen: Capitulo 2 Ross Financial Statements and Flow of CashEric CarreraPas encore d'évaluation

- Kermit D. Larson, Heidi Dieckmann, John Harris - Fundamental Accounting Principles (2022) - Libgen - LiDocument2 188 pagesKermit D. Larson, Heidi Dieckmann, John Harris - Fundamental Accounting Principles (2022) - Libgen - Lilinhptk23413ePas encore d'évaluation

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaPas encore d'évaluation

- CHAPTER 3 (Notes 3)Document17 pagesCHAPTER 3 (Notes 3)Nor Farhanah NanaPas encore d'évaluation

- Accounting For Electricity Company (IPCC)Document10 pagesAccounting For Electricity Company (IPCC)Rahul Prasad67% (3)

- Sybba ProjectsDocument72 pagesSybba Projectsproject guide100% (1)

- Company Analysis SAPMDocument19 pagesCompany Analysis SAPMtincu_01Pas encore d'évaluation

- Intermediate Accounting 8th Edition Spiceland Solutions Manual DownloadDocument94 pagesIntermediate Accounting 8th Edition Spiceland Solutions Manual DownloadKenneth Travis100% (28)

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaPas encore d'évaluation

- IAS 41 - Determine Net Income and Fair Value of Biological AssetsDocument2 pagesIAS 41 - Determine Net Income and Fair Value of Biological Assetslet me live in peacePas encore d'évaluation