Académique Documents

Professionnel Documents

Culture Documents

Adams Rudolf 2010 08

Transféré par

Devolina DeshmukhDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Adams Rudolf 2010 08

Transféré par

Devolina DeshmukhDroits d'auteur :

Formats disponibles

A new approach to the valuation of banks

Michael Adams

and Markus Rudolf

First Version: November 2006

This version: August 2010

Abstract

We argue that the business model of the bank exhibits such pe-

culiarities that it deserves a special treatment in the approach to its

valuation as well. In particular, the exposure to interest rate risk is a

major characteristic of its business, not only in the process of maturity

transformation but also as a major determinant of price margin and

business volume. There exists no common framework to value a bank

which adequately accounts for these features. We propose a valuation

model for banks based on Mertons (1974) structural model of the

rm, which we adapt to the banking rm by the help of term struc-

ture models of the interest rates. In this setting, we interpret banks

as a particular portfolio of long and short positions in interest-rate

sensitive assets. In doing so, we are able to show another peculiarity

of bank valuation, i.e. that the exercise price of a call option on the

rm value, representing the banks equity, is not the face value of bank

liabilities but their economic value.

JEL classication: C22, G12, G13, G21.

Key Words: matched maturity marginal value of funds, MMMVF,

bank valuation, term structure, model

We are grateful to Stewart C. Myers, Matthias Muck, and participants of the 2005

Burgenland doctoral seminar for helpful comments and the WHU USA foundation for its

nancial support. Any remaining errors are our own.

Groe Gallusstrae 10-14, 60272 Frankfurt, Germany E-mail: michael.adams@db.com.

WHU - Otto Beisheim Graduate School of Management, Endowed Chair of Fi-

nance, Burgplatz 2, 56179 Vallendar, Germany, Tel.: +49-(0)261-6509-421, e-mail:

markus.rudolf@whu.edu.

1

1 Introduction

In corporate nance, it is not unusual to specify valuation models for partic-

ular types of rms. For example, to mention just one of them, Brennan and

Schwartz (1985) propose a real-options based valuation approach to natu-

ral resource companies, explicitly modeling the options to temporarily close,

reopen and shut-down the mine. For similar reasons, one can argue for a

special valuation approach for banks. Indeed, Copeland, Weston and Shastri

(2005) (p. 872) address bank valuation as one of the unresolved issues in

nancial research.

The characteristics of the banking business motivating a distinct valuation

approach can be subsumed in four categories. First, banking is a heavily

regulated industry.

1

Second, banks operate on both sides of their balance

sheets, actively seeking prots not only in lending but also in raising capital

2

.

This is the aspect this paper concentrates on. Third, banks are exposed to

credit default risk, but they also actively seek credit risk as part of their

business model. Last but not least, the prot and the value of the bank is

much more dependent on interest rate risk than other industries.

The impact of the interest rate risk on bank value is mainly driven by the

banks assets and liabilities mismatch. Though, there exist further eects.

Bank rates adjust asymmetrically to changes in market rates. This results in

a time-varying spread which is typically larger in a high interest-rate envi-

ronment; see e.g. by Hannan and Berger (1991), Ausubel (1991), or Neumark

and Sharpe (1992), and data in the monthly report of the Bundesbank (2006).

Moreover, the demand for deposits and loans does not only depend on the

market rate but also on the rate a bank charges or pays. Also, loan demand

1

See e.g. Carey and Stulz (2006).

2

see MacLeod (1875), p. I:275.

2

and deposit demand typically have a negative correlation. Consequently,

interest rate eects on bank value are signicant and nontrivial.

In contrast to existing discounted cash ow based frameworks like Samuel-

son (1945), Flannery and James (1984a), and (1984a, 1984b), we propose a

valuation model for banks based on Mertons (1974) structural model of the

rm, which we adapt to the banking rm by the help of interest rate term

structure models. In this setting, we interpret banks as a particular portfolio

of long and short positions in interest-rate sensitive assets and thus aim at

integrating the interest rate-sensitivity into the valuation approach.

The paper is structured as follows. The next section outlines the busi-

ness model of a bank. Section 3 derives a structural rm valuation model

and applies it to banks. Section 4 provides a valuation approach for the

deposit business, section 5 for the loan business, section for the ALM busi-

ness. Finally, the valuation model of the entire bank is presented in section

7. Section 8 concludes the paper.

2 The business model of a bank

To describe the bank in terms of our portfolio view, we make several sim-

plifying assumptions. First, we abstract from taxes, reserve requirements,

minimum capital requirements and other regulatory factors that could im-

pact the banks prot and portfolio value. Second, we assume that there is

no depreciation, amortization, or other non-cash item, which provides the

useful equality of free cash ow to equity (FCFE) and bank prots. Finally,

concerning the denition of our banks prots, we assume that there are only

variable cost for the beginning

3

. When accounting for all of this, our banks

3

Neglecting issues of xed cost is not as absurd as it may seem at rst sight and will

greatly simplify our analysis. We show how to introduce xed cost later without changing

3

prot,

bank

, can be stated in its simplest form as dierence between the

return on assets and the costs of liabilities,

bank

= r

c

L

L r

c

D

D, (1)

where L denotes the loan volume and D the deposit volume. r

c

L

and

r

c

D

, indicate the rates the bank actually earns after variable cost of service

and net of servicing fees charged to customers, while individuals receive the

deposit rate r

D

and pay r

L

on their loans.

In order to separately identify the sources of cash ows on both sides of

the balance sheet, we apply an instrument from internal bank controlling, the

transfer pricing based matched maturity marginal value of funds (MMMVF),

in the valuation process

4

. This requires to break up the prots of entire bank

into the parts of its constituent business units, i.e. a loan business (LB), a

deposit business (DB), and a treasury department which is in charge of the

asset-liability management of the bank (ALM). The LB is in charge of issuing

loans and measuring and managing credit risk. The DB issues transactions

and savings deposits, providing its customers with an access to the payment

system and the bank with an internal funding of the LB. The ALMs main

task in our simple model of the bank is to manage the interest rate risk or,

more precisely, term structure risk stemming from the diering maturities

of the assets and liabilities or the positive duration gap between loans and

deposits. Applying the MMMVF transfer pricing framework, the prot of

our major results here.

4

The MMMVF framework allows to achieve a separation of the banks prot into

two parts: One depending on general capital market conditions as captured in the term

structure of interest rates and the other one depending on the banks market power in

loan and deposit markets.

4

the bank can be restated as

bank

= (r

c

L

r

=2

) L + (r

=1

r

c

D

) D + (r

=2

L r

=1

D)

=

LB

+

DB

+

ALM

,

(2)

where r

=2

signies the default-risk-free capital market rate for a longer

maturity and r

=1

represents a comparable rate for a shorter maturity.

5

In

this representation, the banks prot is the sum of prots of LB, DB and

ALM,

LB

,

DB

, and

ALM

, respectively. An additional task of the ALM

would be the equalization of any imbalances arising temporarily between the

volume of assets and liabilities by use of external nancing, taking long or

short positions in the interbank market. Again for reasons of simplication,

we start developing our model with the additional assumption of L = D,

which simplies equation (2) to

6

bank

= (r

c

L

r

=2

) D + (r

=1

r

c

D

) D + (r

=2

r

=1

) D. (3)

From this restatement of prots, the economic value of the banks equity,

V

E

, can be obtained as the sum of discounted future cash ows (DCF),

originating from its three business units, which is

V

E

= NPV (

bank

) = NPV

LB

+ NPV

ALM

+ NPV

DB

, (4)

5

These can be thought of as average eective maturities of loans and deposits, where

deposits typically have a shorter maturity than loans.

6

We assume this for expository reasons and not to restrict the generality of our model.

For L = D, one might e.g. implicitly assume that the equity of the bank equals its non-loan

assets such as cash and property. Additional asset balances would have to be included in

the valuation of the entire bank, of course.

5

where

NPV

LB

=

T

t=1

LB,t

(1 + r

LB

)

t

=

T

t=1

(r

c

L,t

r

=2,t

) D

t

(1 + r

LB

)

t

, (5a)

NPV

ALM

=

T

t=1

ALM,t

(1 + r

ALM

)

t

=

T

t=1

(r

=2,t

r

=1,t

) D

t

(1 + r

ALM

)

t

, (5b)

NPV

DB

=

T

t=1

DB,t

(1 + r

DB

)

t

=

T

t=1

(r

=1,t

r

c

D,t

) D

t

(1 + r

DB

)

t

, (5c)

and where r

LB

, r

ALM

, and r

DB

signify the required rates of return of the

three respective business units. T is the valuation time horizon; typically,

T = .

In equations (5), the value attributable to the deposit business is a func-

tion of the outstanding balances and the relative cost savings originating from

the issuance of deposits, that is, the deposit spread. In the same fashion, the

value of the loan business depends on loan volume, which we set equal to

the deposit volume, and the average realized loan spread. The contribution

of the ALM also is a function of average business volume and additionally

of the spread between two market rates of diering maturities, depending on

the slope of yield curve. The net present value for each business unit can

then be calculated by discounting the annual cash ow prots at a discount

rate that provides an appropriate return on equity.

Consequently, the denition of the banks prot in the MMMVF frame-

work and the resulting net present value of the bank in equations (4) and (5)

allow us to identify ve types of parameters that aect it and which we will

have to account for in a valuation model:

1. The deposit volume, D, representing the business volume of the bank,

2. the loan rate, r

L

, respectively the loan rate net of cost, r

c

L

,

3. the deposit rate, r

D

, respectively the deposit rate net of cost, r

c

D

6

4. the required return on equity of all three business units, r

LB

, r

DB

, and

r

ALM

5. the market rate r

=1

for a short maturity and a long maturity (r

=2

).

Among these, the last applies to all banks in general and represents their

duration-dependent interest rate risk exposure. Opposed to this, the former

four are bank-specic, thereby determining the idiosyncratic component of

each banks rm value.

To assume a constant interest rate like in equation (5), would disregard

the factor that is at the heart of a banks business. Not only the discounting

factor but also all three sources of a banks cash ow (LB, ALM and DB)

are highly interest rate sensitive. Therefore, we propose a bank valuation

model which accounts for interest rate sensitivity in that it views the bank

as a portfolio of interest-rate contingent claims. In the following, we lay out

the ground for such a model, which is based on Mertons (1974) structural

model of the rm.

3 Structural, risk-neutral rm valuation ap-

proach to the bank

The book value of deposits equals the face value of this liability, i.e. 1

deposited is recorded at 1 in the banks books. As long as the deposit

rate deviates from its MMMVF or opportunity rate, though, the economic

value of this deposit will also deviate from its book value. The ability of the

bank to raise liabilities at rates below comparable market rates creates an

intangible asset (market power). The value NPV

DB

of this intangible asset

is positive and equals the net present value of prots derived from the ability

7

BANK

V

L

V

D

assets liabilities

NPV

LB

NPV

DB

E

BANK

L

D

assets liabilities

E

NPV

LB

NPV

DB

(a) book value of the bank

(b) economic value of the bank

V

E

Figure 1: Book value and economic value of bank assets and liabilities

Remarks: E stands for book equity and V

E

for its economic value.

to issue at below market rates as dened in equation (5). This provides the

link between the book value, D, and the economic value, V

D

, of deposits:

V

D

= D NPV

DB

. (6)

The relation between economic and the book value is depicted in Figure

1. The same argumentation applies vice versa for bank assets as well. In

the absence of credit risk (or after accounting for the expected loss), the

economic value of the loan portfolio, V

L

, results as the sum of its book value,

L, and the net present value of the prots NPV

LB

:

V

L

= L + NPV

LB

. (7)

Finally, the economic value of the ALM, V

ALM

, equals its net present

value

V

ALM

= NPV

ALM

, (8)

because it does not have a net book value. By assumption, the book or

face value of the ALMs long position is oset exactly by its short position.

8

Changes in the slope of the term structure aect only the ALMs economic

value, which is reected in NPV

ALM

.

7

According to Black and Scholes (1973) and given a planning horizon T,

the value of debt, V

B,T

, and equity, V

E,T

, at the end of the planning horizon

can be described by option-like payout prole,

V

B,T

= B

max[D V

A,T

; 0], (9a)

V

E,T

= max[V

A,T

D; 0], (9b)

where V

A,T

is the economic value of the banks assets at the planning horizon

T and B

represents a risk-free bond with a face value that equals the face

value of the banks liabilities, which in our case consist exclusively of deposits

D. The economic asset value of the bank, V

A

, can be dened as

V

A

= A+ NPV (

bank

), (10)

where NPV (

bank

) is the present value of the banks future prots as

dened in equation (4) and A is the asset book value. For the non-banking

rm, the economic asset value or market value of assets equals the rm value.

In the case of the bank, however, the rm value exceeds the market value of

the banks assets because the bank also generates value on the liability side.

Indicating the banks rm value as its asset value, V

A

, allows to simplify a

comparison between the structural model of the rm and the structural model

of the banking rm. Moreover, with this notation we want to highlight the

consequences of this important dierence between the bank and the non-

bank, which will become apparent shortly. From equations (10) and (4)

7

This value is positively correlated with the slope of the yield curve implying that banks

are usually more protable in an upward sloping yield curve environment.

9

follows

V

A

= A + NPV

LB

+ NPV

DB

+ NPV

ALM

, (11)

which we can state alternatively in terms of the units economic values

as previously dened in equations (6), (7), (8),

V

A

= V

L

+ NPV

DB

+ V

ALM

= L + NPV

LB

+ NPV

DB

+ V

ALM

, (12)

where, by assumption, A = L = D. This result can be seen as an

expression for the banks economic asset value in the MMMVF framework.

In order to obtain the boundary conditions for the banking rm, we combine

this term in (12) with the payout proles for the non-banking rm in (9).

This lets us obtain the equivalent expressions for the banking rm, when

equation (6) is substituted in,

V

bank

B,T

= B

max[V

D,T

V

L,T

V

ALM,T

; 0], (13a)

V

bank

E,T

= max[V

L,T

+ V

ALM,T

V

D,t

; 0]. (13b)

In this equation, we can see an interesting particularity of the banking

rm: For non-banking rms, the exercise price of the options is the face or

book value of debt. However, when applying the structural model to the

banking rm, the exercise price of the options in the structural model is

not the book value of liabilities, D, but their economic value, V

D

. This is a

consequence of the duality of the banks business model, which also seeks to

extract a prot from issuing its own liabilities. An alternative representation

highlights the dierence, which we obtain by substituting back equation (6)

into (13),

V

bank

B,T

= B

max[D

T

NPV

DB

V

L,T

V

ALM,T

; 0], (14a)

V

bank

E,T

= max[V

L,T

+ V

ALM,T

+ NPV

DB,T

D

T

; 0]. (14b)

10

In other words, should the banks asset value, V

A

, fall below the book

value of its debt, D, shareholders will not choose to default but will rather

be willing to uphold the banks business operations as long as the net present

value extracted from the deposit base, NPV

DB

, is large enough to cover a

potential decrease of the rest of the banks assets, V

L

and V

ALM

, below the

book value of debt (deposits), D. For creditors of the bank, the decrease

of the put options exercise price from D to V

D

also increases the value of

their debt for they hold a short position in that option. The additional value

gained in the liability business increases the distance to default of the bank,

thereby decreasing its probability of default and increasing the value of its

debt, V

bank

B,T

. The next step is to model the underlying economic value of a

banks assets and liabilities.

4 Valuation approach to the deposit business

The analysis of deposits as interest rate sensitive claims includes Hutchison

and Pennacchi (1996), Selvaggio (1996), Jarrow and van Deventer (1998),

OBrien (2000), Kalkbrener and Willing (2004), and Dewachter, Lyrio and

Maes (2006). Although we will draw on elements and insights from all of

those, the model of Jarrow and van Deventer (1998) seems to be the most

useful for our problems.

8

Hutchison and Pennacchi (1996)s equilibrium ap-

proach would require the design of an analogous equilibrium in the loan

market before we could extend the model to the entire bank; besides, equi-

librium models often exhibit a poorer t in empirical implementations when

compared with arbitrage-free models because the former impose more struc-

8

A valuation based on this model yields at the same time an estimate for the deposit

balances eective duration, which is needed for selecting the appropriate MMMVF trans-

fer rate.

11

ture on the data.

9

The model of OBrien (2000) is similar to that of Jarrow

and van Deventer (1998) but additionally incorporates the asymmetric ad-

justment feature of the deposit rate, this comes at the price of sacricing

a closed-form solution to the valuation problem, though. In the trade-o

between allowing for an additional trait of empirical data and obtaining a

closed-form solution, we chose the latter.

4.1 The steps to take in the model

Following these approaches, we dene a pattern of deposit cash ows and

then apply a valuation model to them. As can be seen from table 1, the

NPV of the banks deposit business actually has two sources; one is the

spread earned in each period, D

t

(r

c

D,t

r

t

), and the other is the growth of

the deposit base from period to period D

(t+1)

D

t

. We will account for this

growth eect later in the derivation of our valuation formula.

t = 0 t = 1 . . . t = T 1 t = T

New deposits +D

0

+D

1

. . . +D

(T1)

Deposits withdrawn D

0

. . . D

(T2)

D

(T1)

Interest paid D

0

r

c

D,0

. . . D

(T2)

r

c

D,(T2)

D

T1

r

c

D,(T1)

Interest earned +D

0

r

0

. . . +D

(T2)

r

T2

+D

(T1)

r

(T1)

Table 1: Cash ow streams of the deposit business

Hence based on this, the valuation process of the deposit business is:

9

Duee (2002) for example nds that martingales possess a higher predictive power

than ane models and Dai and Singleton (2002) have similar concerns related to the

matching of the observed term structure. In other words, the dierence between the

yields predicted by an ane model at the estimated parameter values and the actual yield

data can be substantial.(Piazzesi (2003), p. 48).

12

1. Choose a term structure model to account for the dynamics of the short

rate, r

t

. Typical choices include single-factor strictly ane models,

such as Cox, Ingersoll and Ross (1985), multi-factor essentially ane

models, as proposed by Dai and Singleton (2000), and no arbitrage

models, e.g. Heath, Jarrow and Morton (1992) or Miltersen, Sandmann

and Sondermann (1997).

2. Specify a process for the deposit rate, r

D,t

, and the deposit base, D

t

.

3. In the deposit valuation equation, which we will derive within this

section in equations (16) and (17), substitute D

t

, r

D,t

, and r

t

with the

solutions to the (stochastic) processes of the deposit rate, the deposit

base, and the short rate. If possible, solve for an analytical solution.

4. Calibrate the process specications under the empirical probability

measure on a suitable data sample.

5. Should a closed-form solution be available, plugging in the estimates of

the parameters yields the deposit value; otherwise, use the estimates

for a Monte Carlo simulation to obtain a distribution of the deposit

value.

4.2 A multi-factor model for deposit valuation

Jarrow and van Deventer (1998) introduce a market segmentation hypothesis

to set up their deposit valuation model: There are two types of agents in

the market, banks and individuals. Both have specic trading limitations.

On one side, banks can issue a limited and exogenously given volume of

deposits, i.e. they are free to issue less but cannot issue deposits beyond this

limit. On the other side, individuals can hold deposits but cannot issue them.

13

Finally, both banks and individuals can buy and sell risk-free bonds without

limitation and do behave rationally in line with the usual assumptions.

10

Subsequently, these assumptions allow Jarrow and van Deventer (1998) to

value bank deposits using an arbitrage argument while at the same time

preserving a positive spread for the bank. In the case that deposits pay

less than the market rate, i.e. r

D

< r, individuals cannot arbitrage this

discrepancy away since they cannot issue bank deposits. As long as r

c

D

< r,

banks can issue deposits and invest the proceeds in the risk-free security,

thereby earning a positive spread, r r

c

D

> 0. As stated in the assumptions,

however, this does not represent an unlimited arbitrage opportunity since

banks are restricted in this type of transaction by the exogenously given

maximum amount of deposit volume in the market.

As a result, the absence of exploitable arbitrage opportunities in this

segmented deposit market implies that

r

D,t

r

t

for all t, (15a)

r

c

D,t

r

t

for all t, and (15b)

r

c

D,t

< r

t

for some t. (15c)

Based on the market segmentation, the deposit valuation formula can

be derived as a hedging portfolio which osets the cash ow pattern of the

deposit business as shown in table 1 in a risk-neutral valuation procedure,

i.e. as expectation, E

P

0

, under the risk-neutral probability measure, P

. This

yields

V

D

= D

0

+ E

P

T2

t=0

D

(t+1)

D

t

g(t + 1)

T1

t=0

D

t

r

c

D,t

g(t + 1)

D

(T1)

g(T)

, (16)

10

For a denition of rational behavior in nancial theory, see e.g. Ingersoll (1987). The

issue of credit risk when shorting the risk-free bond is discussed later.

14

where g(t) represents the money market account with g(0) = 1. Besides

the market rate, the cash ows of the deposit business depend on the deposit

base and the deposit rate, for both of which we suggested the specication

of a vector autoregressive (VAR) process. Hence, any exogenous explanatory

variable we include in these processes may add an additional state variable

to our deposit derivative.

11

Jarrow and van Deventer (1998) oer an intuitive interpretation for the

value of the deposit business V

D

in equation (16): The value of the deposit

liability is the sum of the book value of the initial deposit base, D

0

, plus

the present value of any changes in the deposit base over time, minus the

present value of total costs, and minus the present value of deposit volume

at maturity or the valuation horizon. In other words, the DBs economic

value is that of a series of T 1 single-period, risk-free bonds paying below

risk-free interest rates. Consequently, all of these bonds will have a price

below par and shorting them can derive positive value, since the proceeds

can be invested in the risk-free asset.

In analogy to the prot of the deposit business in equation (5c), an equiv-

alent but simpler valuation formula is given by

V

D

= E

P

T1

t=0

D

t

r

=1,t

r

c

D,t

g(t + 1)

, (17)

which in continuous time can be represented by (r

t

: Shortrate)

V

D

= E

P

T

0

D

t

(r

t

r

c

D,t

)

g(t)

dt

. (18)

The economic value of the deposit liability in equation (17) or equa-

tion (18) can be linked to the value of an interest rate swap, lasting for T

11

We rely on single-factor (ane) term structure models in their specication of deposit

dynamics. A three-factor model based on the term structure model of Heath, Jarrow and

Morton (1992) has been suggested by Kalkbrener and Willing (2004).

15

periods, receiving oating at r

t

and paying xed at r

c

D

, and with an alter-

nating principal of D

t

.

When specifying a multi-factor model of the term structure of interest

rates, we have the basic choice between exogenous and endogenous models.

Which one to choose is driven by the research focus, that is, economic in-

tuition vs. close t on the observed term structure. For example, we know

of only two existing papers proposing multi-factor frameworks for the valu-

ation of deposits, where one Dewachter, Lyrio and Maes (2006) relies on an

endogenous multi-factor ane term structure model (ATSM), and the other

(Kalkbrener and Willing 2004) implements its deposit valuation model based

on an exogenous HJM type of model and motivates this with better cali-

bration results with the non-parametric models. For our problem at hand,

though, we feel that endogenous models represent a more suitable choice.

Our primary concern is not to exactly price an interest rate derivative based

on the presently given shape of the term structure, but rather the valuation

of an deposit-type of interest rate derivative which depends on the long-run

dynamics of the term structure. With this rationale, we follow Dewachter,

Lyrio and Maes (2006).

Choosing a term structure model Among endogenous models, a com-

mon choice of multi-factor models is the class of essentially ane models,

which can include up to N state factors in their general specication. Set-

ting N = 3 is the usual choice in the literature to closely track the empirically

observed yield curve dynamics.

12

Now, we add a fourth risk factor to the spec-

ication of the ATSM which is supposed to capture the time-varying deposit

12

Recall the study of Litterman and Scheinkman (1991) and also see Knez, Litterman

and Scheinkmann (1994).

16

spread, r

t

r

D,t

.

13

This implies that the state factor process X

D

t

R

N+1

under the empirical probability measure can be stated as

dX

D

t

= K

D

(

X

D

X

D

t

)dt +

D

S

D

(X

D

t

) dW

D

t

, (19)

where

X

D

R

N+1

,

D

, K

D

R

(N+1)(N+1)

, dW

D

t

is a (N+1)-dimensional

independent standard Brownian motion under P, and S

D

(X

D

t

) R

(N+1)(N+1)

is a diagonal matrix of the form

S

D

(X

D

t

) =

S

D

1

0

0

.

.

. 0

0 0 S

D

N+1

, (20)

where diagonal elements are again given by

S

D

i

=

D

i

+

D

i

X

D

t

for i = 1, . . . , N + 1, (21)

with

D

i

R and

D

i

R

N+1

.

14

We modify the matrix of mean reversion

speed, K

D

, to have o-diagonal elements dierent from zero in row N + 1,

K

D

=

D

(1,1)

0 . . . 0

0

.

.

. 0 0

0 0

D

(N,N)

0

(N+1,1)

. . .

(N+1,N)

D

(N+1,N+1)

. (22)

If equation (22) had only diagonal elements,

(i,i)

, this would mean that the

mean-reversion speeds of state variables were independent. In the present

13

The idea to include the deposit spread as an additional state variable in the term

structure model was rst proposed by Dewachter, Lyrio and Maes (2006).

14

For the following derivations, we remark that in contrast to our heteroskedastic spec-

ication, Dewachter, Lyrio and Maes (2006) assume constant volatility; thus, some of our

results will deviate from theirs, such as e.g. the Riccati equations of the bond pricing

formula (36). For a specication similar to ours, see e.g. Duee (2002) or Duarte (2003).

17

case, however, where

(N+1,i)

= 0, this intuitively means that we relax the

assumption of independence between the state variable N +1 of the deposit

spread and the rest of the factors driving the term structure of the interest

rate, i.e. the deposit rate may be a function of the market rate.

Adding a state variable in such a fashion is an elegant way to install a

functional dependence of the deposit rate on the market rate. An unpleasant

and serious side eect of this procedure is the loss of a unique martingale

probability measure.

15

The addition of a state variable to an otherwise com-

plete market leads to market incompleteness. According to the Fundamental

Theorem of Finance, if a market is incomplete, the pricing kernel will be inde-

terminate, and according to the Martingale Representation Theorem, an in-

determinate pricing kernel is equivalent to an indeterminate martingale prob-

ability measure, or innitely many martingale probability measures.

16

This

also implies that arbitrage cannot be precluded. To overcome this problem,

Kalkbrener and Willing (2004) apply a variance-minimizing martingale

probability measure, as presented e.g. in Schweizer (1995) or Delbaen and

Schachermayer (1996).

17

According to the latter, the variance-minimizing

martingale measure is dened as the measure

P

which comes closest to the

given martingale measure P

, where the t is determined by the time-varying

market price of risk, (X

t

) R

N+1

. For this, recall from the denition of

the Radon-Nikodym derivative,

t

, that the density of P

with respect to

P is given by

= exp

t

0

D

(X

D

s

)dW

D

s

1

2

t

0

D

(X

D

s

)

2

ds

, (23)

15

This loss is not a weakness of this approach only. Kalkbrener and Willing (2004) face

the same problem.

16

Ross (2004) (chapter 1) provides an intuitive derivation of these relationships.

17

An alternative valuation approach would be good deal bounds. See Cochrane and

Saa-Requejo (2001) for this.

18

where

D

(X

t

) is the time-varying market price of risk and has the form

D

(X

D

t

) =

D

1

(x

D

1,t

) . . .

D

N

(x

D

N,t

) 0

, (24)

which according to Duee (2002) can be dened as

D

(X

D

t

) = S

D

t

+S

D

t

(1)

X

t

, (25)

where

1

. . .

N

0

, (26)

and R

(N+1)(N+1)

is a matrix in which the elements specify the depen-

dence of the market price of risk,

D

, on the vector of state variables with

the exception of row and column N + 1, which contain zeros. In the den-

sity of the Girsanov transformation in (23), P can be seen as the empirical

equivalent of an indeterminate martingale measure. More meaningful is the

variance-minimizing martingale measure,

P

, that can be obtained from its

density with respect to the observable empirical measure,

P,

= exp

t

0

D

(X

D

s

)dW

D

s

1

2

t

0

D

(X

D

s

)

2

ds

. (27)

Finally, obtaining dW

D

t

is straightforwardly possible by

d

W

D

t

= d

W

D

t

D

(X

t

)dt. (28)

For the calibration of the model, this basic relationship allows us to mod-

ify the drift and the stochastic term in (19) such that we obtain an empir-

ical state factor process from its risk-neutral equivalent under the variance-

minimizing martingale measure,

P

,

dX

D

t

=

K

D

(

X

D

X

D

t

)dt +

D

S

D

(X

D

t

) d

W

D

t

, with (29)

K

D

=K

D

+, (30a)

X

D

=(K

D

+)

1

(K

D

X

D

S

). (30b)

19

Specifying processes of the deposit rate and deposit base After

we have spent much eort on deriving the term structure model with the

additional state factor deposit spread, we can now conveniently formulate

the dynamics of the deposit rate as linear function of the state variables

vector X

t

,

r

D,t

=

D

0

+

D

1

X

D

t

+ u

D

t

, (31)

where

D

0

is a constant,

D

1

R

N+1

is a vector of coecients with

D

1

1 . . . 1

1,(N+1)

, (32)

and u

D

t

is the error term.

18

Concerning the deposit base, Dewachter, Lyrio and Maes (2006) do not

account for volume growth and concentrate on the decay rate only. They

justify this by limitations of data availability. Their simple assumption is

that deposits increase at the deposit rate, i.e. depositors do not collect the

interest earned, and decrease at the estimated decay rate, r

w

,

dD(t) = (r

D

(t) r

w

)D(t)dt. (33)

This specication is too simplistic for our purposes. In contrast to this,

while Kalkbrener and Willing (2004) did not spend much time on specifying

an innovative deposit rate process, they propose a more sophisticated evo-

lution of the deposit base, which seems suitable for our problem. In their

model, the deposit base D(t) is the sum of two terms, a deterministic trend

growth function, G(t), and a mean-reverting Ornstein-Uhlenbeck process of

the detrended deposit base,

D(t),

D(t) = G(t) +

D(t) with (34)

18

See Dewachter, Lyrio and Maes (2006) for a slightly dierent approach to obtain a

deposit rate process. Kalkbrener and Willing (2004) dene the deposit rate simply as a

linear function of the short rate r.

20

G(t) =

D

0

+

D

1

t, (35a)

d

D(t) =

D

D(t)dt +

D

d w

t

, (35b)

with constant

D

and the Wiener process d w

t

under the empirical probability

measure

P in an incomplete state space.

19

For simplicity, we assume that the

Wiener process of the deposit base is uncorrelated with those of the state

variable processes.

20

Deriving a deposit pricing formula For the derivation of a value of the

deposit business, V

D

, recall from (36) that in N-factor ATSMs, the value of

a risk-free zero bond at time t with time to maturity can be obtained by

B

(t, ) = exp

A

D

() B

D

()

X

D

t

. (36)

where A

D

() and B

D

() are ODEs given by the following Riccati equations

21

:

A()

=

X

B()+

i=

[

B()]

(37a)

B()

= K

B()

i=

[

B()]

i

x

. (37b)

These ordinary dierential equations (ODEs) can be solved by integration

under the initial boundary conditions A(0) = 0 and B(0) =0

N1

, which result

19

Kalkbrener and Willing (2004) note that, theoretically, the deposit base in this model

can become negative. To their defense, they propose to oor D(t) at 0 and mention that

this theoretical possibility did not play any role in their empirical study.

20

Kalkbrener and Willing (2004) allow for correlation but, in turn, limit the number of

state factor to N = 2.

21

A derivation of this solution to the Riccati problem for the multivariate case can be

found in Cochrane (2001), pp. 374377.

21

from (36) since we know that the initial zerobond price in time 0 is B

(t, 0) =

1 for a standardized unit of a risk-free zero coupon-bond. Solutions to these

ODEs are nite given some technical regularity conditions on K

and .

The Riccati equations can be solved by integration under the initial

boundary conditions A

D

(0) = 0 and B

D

(0) = 0

N1

. Analytical solutions

for these are not available in our setting. Instead, the numerical proce-

dure will be more cumbersome in the present case, as we allowed here for

a correlation among the state variables in the ODEs. For the calibration

of this model on historical deposit data, a discretization of the time steps

0 = t

0

, t

1

, . . . , t

s1

, t

s

= T with step size

t

= t

i

t

i1

is necessary.

Implementing a model describing the deposit behavior of a bank requires

to calibrate the following three processes:

dX

D

t

=K

D

(

X

D

X

D

t

)dt +

D

S

D

(X

D

t

) dW

D

t

, (38a)

r

D,t

=

D

0

+

D

1

X

D

t

+ u

D

t

, (38b)

D(t) =

D

0

+

D

1

t +

D

D(t)dt +

D

d w

t

. (38c)

5 Valuation of the loan business

For ease of modeling and exposition, we assume that the only credit product

a bank oers is a non-maturing overdraft facility, although, in principle, our

approach can be applied to all kinds of credit products when allowing for their

respective special characteristics and features. Regarding a formal valuation

setup for the loan business, a comparable market segmentation argument can

be made for the loan market.

22

When abstracting from credit default risk,

obtaining a valuation formula for the loan business is based on table 2 and

22

Jarrow and van Deventer (1998) propose this in their paper already; see p. 255.

22

equation (39) which are mirror images of the ones for the DB.

23

t = 0 t = 1 . . . t = T 1 t = T

New loans L

0

L

1

. . . L

(T1)

Loans paid o +L

0

. . . +L

(T2)

+L

(T1)

Interest received +L

0

r

c

L,0

. . . +L

(T2)

r

c

L,(T2)

+L

T1

r

c

L,(T1)

Interest paid L

0

r

=2,0

. . . L

(T2)

r

=2,(T2)

L

(T1)

r

=2,(T1)

Table 2: Cash ow streams of the loan business

For simplicity of modeling, we have chosen the same time intervals as for

deposits. This is a sensible and unproblematic assumption for it only aects

the frequency of estimation points in the models estimating the loan base

and the loan rate. The resulting decay rate and eective maturity of assets

should remain unaected of this assumption. Thus, the relevant rate would

still typically be one of longer eective maturity, = 2. Bank customers

pay r

L

on their loans and banks receive this rate less cost, r

c

L

. Assuming a

loan business with only such loans, a planning horizon T, and a exogenously

given loan volume of the bank, L

t

, the economic value of the banks assets is

analogously given by

V

L

= E

P

T

0

L

t

(r

c

L,t

r

=2,t

)

g(t)

dt

. (39)

5.1 Valuation procedure

The valuation procedure of the LB follows the same ve steps list in the

beginning of section 4, where one should resort to the same choice of term

structure model for reasons of consistency. Moreover, the term structure

23

When abstracting from credit risk we assume that credit risk can eciently be hedged

in the market so that its value impact can be neglected.

23

model should have multiple factors in order to avoid perfect correlations of

yields across maturities. Ideally, the dynamics of the loan rate are integrated

in the estimation of the essentially ane term structure dynamics as done

with the deposit rate already in the multi-factor model specication of the de-

posit business. We propose to add another state variable for the loan spread,

r

c

L,t

r

=2,t

, to the multi-factor framework presented above in section 4.2.

The implementation of our model with both spreads, the deposit spread and

the loan spread, increases the dimension of our original state vector X

t

by

2, from N = 3 to N + 2 = 5, which we can denote in the following with the

superscript LD, X

LD

t

R

N+2

. The process of the state variables under the

empirical probability measure becomes then

dX

LD

t

= K

LD

(

X

LD

X

LD

t

)dt +

LD

S

LD

(X

LD

t

) dW

LD

t

, (40)

where

X

LD

R

N+2

,

LD

, K

LD

R

(N+2)(N+2)

, dW

LD

t

is a (N + 2)-

dimensional independent standard Brownian motion under P, i.e. we do not

assume a correlation of the processes other than given by the joint dependence

on the short rate. S

LD

(X

LD

t

) R

(N+2)(N+2)

is again a diagonal matrix

of a form which follows in analogy from equation (20) and equation (21).

We stop here with further derivations to avoid a repetition of trivial results.

By help of the variance-minimizing martingale measure, we can once again

obtain a pricing equations although the market is incomplete. The price of

a risk-free zero coupon bond is given by the similar but extended formula

B

(t, ) = exp

A

LD

() B

LD

()

X

LD

t

, (41)

for which a closed-form solution cannot be derived. Hence, we suggest Monte

Carlo simulations of the stochastic processes describing the evolution of the

loan volume and the loan rate with parameters calibrated on historical loan

data. In this context, the far inferior amount of empirical studies on loans

24

as when compared to deposits is suspectingdata availability is certainly an

issue. Ausubel (1991) resorts to credit card loan data of interbank transac-

tions of loan portfolios and also discusses the issue of credit risk. Another

but related point is the higher opacity of the loan business. The appropriate

MMMVF transfer rate can be easily obtained as soon as an estimate of the

eective maturity of loans is available. Then, the empirically given can be

used as argument in the following denition of the yield y(t, ) at time t of

a riskless zero coupon bond maturing in ATSMs.

y

(t, ) =

ln B

(t, )

=

A() +B()

X

t

. (42)

When leaving these questions aside, we have to estimate two equations.

Of course, the estimation of the SDE in (40), including N +2 state variables,

serves as basis for the estimation of both r

D,t

and r

L,t

and therefore replaces

the estimation of (38a). When comparing the studies on deposit valuation

with Ausubel (1991) and Chatterjea, Jarrow, Neal and Yildirim (2003) on

credit card loan valuation, one nds that the loan rate exhibit traits similar

to those of the deposit rate, respectively. Consequently, a natural choice for

this is a process specication in analogy to the deposit rate:

r

L,t

=

L

0

+

L

1

X

LD

t

+ u

L

t

(43)

Finally, the assumption L = D alleviates us from estimating a third process.

6 Asset/Liability Management Valuation

The prot of the ALM is dened as

ALM

= D

t

(r

=2

r

=1

) . (44)

25

As such, this unit isolates and internalizes the interest rate risk stemming

from changes in the slope and the curvature of the term structure, represent-

ing a particular type of yield curve swap with time-varying notional principal.

This makes it similar to the DB and the LB but, in contrast to them, the

spread of the ALM is based on market rates and not bank rates. In turn,

that dierence slightly facilitates the valuation of the ALM, for which it can

be shown that its value in continuous time is given by the expectation under

the risk-neutral probability measure, E

P

0

,

V

ALM

= E

P

T

0

(r

=2,t

r

=1,t

) D

t

g(t)

dt

. (45)

Such structures are traded in the market as spreads of constant maturity

swaps, or yield curve steepeners: As opposed to a plain vanilla interest rate

swap, here both legs are oating but of diering maturities. Both market

rates can be obtained from the short rate process according to the result in

equation (42) as yields y(t, ) at time t of a riskless zero coupon bond matur-

ing from now. The stochastic process of D

t

is proposed in equation (38).

Once again, the distribution of V

ALM

has to be determined by simulation.

7 Valuation of the entire bank

Substituting (6) and (7) into equation (11) and adding precise time subscripts

and taking into consideration that A = L yields the equivalent expression

V

A,t

= V

L,t

+ D

t

V

D,t

+ V

ALM,t

. (46)

Unfortunately, there is no closed-form solution available for any of the

economic values in (46). Simulating the three components

24

of the bank

24

Loan, Deposit, ALM business.

26

value is a tedious task, whereas valuing options on the portfolio of all three

is even more complicated, even before taking into account that the strike

prices of both options are time-varying as can be observed in equations (47).

In the specication of V

L

, V

D

, and V

ALM

, we assumed independence of the

generating processes. Hence, these three values are correlated insofar only

as each of them is also a function of the short rate. From the boundary

conditions for bank debt, V

bank

B,T

, and bank equity, V

bank

E,T

, as derived in (13),

the value of our banks debt and equity can formally be dened as

V

bank

B,0

= E

P

0

[(B

max[V

D,T

V

L,T

V

ALM,T

; 0])] B

(0, T), (47a)

V

bank

E,0

= E

P

0

[max[V

L,T

+ V

ALM,T

V

D,T

; 0]] B

(0, T), (47b)

where an evaluation of the expectation involves the valuation of interest rate

options with time-varying strike prices, which can be achieved numerically.

25

The value components in equations (46) and (47) have to be calculated ac-

cording to the preceding paragraphs:

The multi-factor economic value of the deposit business value V

D,t

is

based on equation (36).

The economic value of the loan business value V

L,t

is implied by the

numerical solution to equation (41).

The economic value of the asset and liability management business

value V

ALM,t

is implied by the numerical solution to equation (45).

After having characterized the valuation model in a very stylized way in

section 3, the sections 4 to 6 have provided the formulas needed to ll into

(47).

25

While Rebonato (1998) gives a general overview of interest rate contingent claims val-

uation under dierent term structure models, the valuation of option with time-dependent

strike prices is put forward e.g. in Xia and Zhou (1997).

27

8 Conclusions

We argue that the problem of valuing a bank as a rm which is particularly

exposed to interest rate risk has not been adequately solved in the literature

so far. We propose a bank equity valuation model based on the contingent

claims theory and derive the banking rm value as constituting of the value

of three stylized business units, the asset business, liability business, and the

asset-liability management. The value of each of these units can be derived

in a risk-neutral valuation framework as equivalent to the costs of a hedging

strategy that osets the risk exposure but still allows for arbitrage prots.

There exist several models for the valuation of banking products and we have

exemplied our model drawing on the deposit valuation model of Jarrow and

van Deventer (1998) and extending it to the entire bank.

28

References

Ausubel, L. M. (1991), The failure of competition in the credit card market,

American Economic Review 81(1), 5081.

Black, F. and Scholes, M. (1973), The pricing of options and corporate

liabilities, Journal of Political Economy 81, 673654.

Brennan, M. J. and Schwartz, E. S. (1985), Evaluating natural resource

investments, Journal of Business 58(2), 135157.

Bundesbank (2006), Monatsbericht September 2006. Monatsberichte der

Deutschen Bundesbank, 58. Jg., Nr. 9.

Carey, M. and Stulz, R. M., eds (2006), The Risks of Financial Institutions,

National Bureau of Economic Research Conference Report, The Univer-

sity of Chicago Press, Chicago, Il, USA.

Chatterjea, A., Jarrow, R. A., Neal, R. and Yildirim, Y. (2003), How valu-

able is credit card lending?, Journal of Derivatives 11(Winter), 3952.

Cochrane, J. C. and Saa-Requejo, J. (2001), Beyond arbitrage: Good-deal

asset price bounds in incomplete markets, Journal of Political Economy

108(108), 79119.

Cochrane, J. H. (2001), Asset Pricing, Princeton University Press, Princeton,

NJ, USA.

Copeland, T. E., Weston, J. F. and Shastri, K. (2005), Financial Theory and

Corporate Policy, 4th edn, Pearson Addison Wesley,.

Cox, J. C., Ingersoll, J. E. and Ross, S. A. (1985), A theory of the term

structure of interest rates, Econometrica 53, 385407.

29

Dai, Q. and Singleton, K. J. (2000), Specication analysis of ane term

structure models, Journal of Finance 55, 19431978.

Dai, Q. and Singleton, K. J. (2002), Expectation puzzles, time-varying risk

premia, and dynamic models of the term structure, Journal of Financial

Economics 63, 415441.

Delbaen, F. and Schachermayer, W. (1996), The variance-optimal martin-

gale measure for continuous processes, Bernoulli 2, 85105.

Dewachter, H., Lyrio, M. and Maes, K. (2006), A multi-factor model for the

valuation and risk management of demand deposits. National Bank of

Belgium working paper No. 83.

Duarte, J. (2003), Evaluating an alternative risk preference in ane term

structure models, Review of Financial Studies 17(2), 379404.

Duee, G. R. (2002), Term premia and interest rate forecasts in ane mod-

els, Journal of Finance 57, 405443.

Flannery, M. J. and James, C. M. (1984a), The eect of interest rate changes

on the common stock returns of nancial institutions, Journal of Fi-

nance 39(4), 11411153.

Flannery, M. J. and James, C. M. (1984b), Market evidence on the eective

maturity of bank assets and liabilities, Journal of Money, Credit and

Banking 16, 435445.

Hannan, T. H. and Berger, A. N. (1991), The rigidity of prices: Evidence

from the banking industry, American Economic Review 81, 938945.

30

Heath, D., Jarrow, R. and Morton, A. (1992), Bond pricing and the term

structure of interest rates: A new methodology for contingent claims

valuation, Econometrica 60, 77105.

Hutchison, D. E. and Pennacchi, G. G. (1996), Measuring rents and interest

rate risk in imperfect nancial markets: The case of retail bank de-

posits, Journal of Financial and Quantitative Analysis 31(3), 399417.

Ingersoll, J. E. (1987), Theory of nancial decision making, Rowman & Lit-

tleeld, Lanham, Maryland, USA.

Jarrow, R. A. and van Deventer, D. R. (1998), The arbitrage-free valua-

tion and hedging of demand deposits and credit card loans, Journal of

Banking and Finance 22, 249272.

Kalkbrener, M. and Willing, J. (2004), Risk management of non-maturing

liabilities, Journal of Banking and Finance 28, 15471568.

Knez, P., Litterman, R. and Scheinkmann, J. (1994), Explorations into fac-

tors explaining money market returns, Journal of Finance 49, 1861

1882.

Litterman, R. and Scheinkman, J. A. (1991), Common factors aecting bond

returns, Journal of Fixed Income 1, 4953.

MacLeod, H. D. (1875), Theory and Practice of Banking, 3rd edn, Longman,

Brown, Green and Longmans, London, UK.

Merton, R. C. (1974), On the pricing of corporate debt: The risk structure

of interest rates, Journal of Finance 29, 449470.

31

Miltersen, K. R., Sandmann, K. and Sondermann, D. (1997), Closed form

solutions for term structure derivatives with log-normal interest rates,

Journal of Finance 52(1), 409430.

Neumark, D. and Sharpe, S. A. (1992), Market structure and the nature of

price rigidity: Evidence from the market for consumer deposits, Quar-

terly Journal of Economics 107, 657680.

OBrien, J. M. (2000), Estimating the value and interest rate risk of interest-

bearing transactions deposits. Working Paper, Division of Research and

Statistics, Board of Governors of the Federal Reserve System.

Piazzesi, M. (2003), Ane term structure models. Working Paper, University

of California at Los Angeles.

Rebonato, R. (1998), Interest-rate option models, 2nd edn, John Wiley &

Sons; New York, USA.

Ross, S. A. (2004), Neoclassical nance, Princeton University Press, Prince-

ton, NJ, USA.

Samuelson, P. A. (1945), The eect of interest rate increases on the banking

system, American Economic Review 35(1), 1627.

Schweizer, M. (1995), Variance-optimal hedging in discrete-time, Mathe-

matics of Operations Research 20, 132.

Selvaggio, R. D. (1996), The Handbook of asset/liability management, Irwin,

Chicago, IL, USA, chapter Using the OAS methodology to value and

hedge commercial bank retail demand deposit premiums, pp. 363373.

Xia, J. and Zhou, X. Y. (1997), Stock loans, Mathematical Finance

17(2), 307317.

32

Vous aimerez peut-être aussi

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskD'EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskÉvaluation : 3.5 sur 5 étoiles3.5/5 (1)

- III.B.6 Credit Risk Capital CalculationDocument28 pagesIII.B.6 Credit Risk Capital CalculationvladimirpopovicPas encore d'évaluation

- A Hybrid Bankruptcy Prediction Model With Dynamic Loadings On Acct-Ratio-Based and Market-Based InfoDocument16 pagesA Hybrid Bankruptcy Prediction Model With Dynamic Loadings On Acct-Ratio-Based and Market-Based InfoTitoHeidyYantoPas encore d'évaluation

- Impact of Government Policy and Regulations in BankingDocument65 pagesImpact of Government Policy and Regulations in BankingNiraj ThapaPas encore d'évaluation

- Model Management Guidance PDFDocument70 pagesModel Management Guidance PDFChen CharlesPas encore d'évaluation

- Caiib Material For Studying and Refreshing Asset Liability Management ofDocument62 pagesCaiib Material For Studying and Refreshing Asset Liability Management ofsupercoolvimiPas encore d'évaluation

- Financial Risk Management Assignment: Submitted By: Name: Tanveer Ahmad Registered No: 0920228Document13 pagesFinancial Risk Management Assignment: Submitted By: Name: Tanveer Ahmad Registered No: 0920228Tanveer AhmadPas encore d'évaluation

- Macroeconomic Analysis 2003: Monetary Policy: Transmission MechanismDocument26 pagesMacroeconomic Analysis 2003: Monetary Policy: Transmission MechanismYasir IrfanPas encore d'évaluation

- CDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsDocument26 pagesCDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsSimran AroraPas encore d'évaluation

- Risk Management Solution Chapters Seven-EightDocument9 pagesRisk Management Solution Chapters Seven-EightBombitaPas encore d'évaluation

- Given Data: P TK 1075 Coupon Rate 9% Coupon Interest 9% / 2 1000 TK 45 Time To Maturity, N 10Document4 pagesGiven Data: P TK 1075 Coupon Rate 9% Coupon Interest 9% / 2 1000 TK 45 Time To Maturity, N 10mahin rayhanPas encore d'évaluation

- Mathematics in Financial Risk ManagementDocument10 pagesMathematics in Financial Risk ManagementJamel GriffinPas encore d'évaluation

- Interest Rate Modeling & Bond Markets: Andres Sørensen SusrudDocument26 pagesInterest Rate Modeling & Bond Markets: Andres Sørensen Susrudserdna82Pas encore d'évaluation

- CP v1993 n6 2Document6 pagesCP v1993 n6 2leelaPas encore d'évaluation

- RSKMGT Module II Credit Risk CH 4 - Prediction of Exposure at DefaultDocument8 pagesRSKMGT Module II Credit Risk CH 4 - Prediction of Exposure at DefaultAstha PandeyPas encore d'évaluation

- Forecasting Default With The KMV-Merton ModelDocument35 pagesForecasting Default With The KMV-Merton ModelEdgardo Garcia MartinezPas encore d'évaluation

- Transfer Pricing - Pitfalls in Using Multiple Benchmark Yield CurvesDocument6 pagesTransfer Pricing - Pitfalls in Using Multiple Benchmark Yield CurvesPoonsiri WongwiseskijPas encore d'évaluation

- Forecasting Long Term Interest RateDocument19 pagesForecasting Long Term Interest RateLê Thái SơnPas encore d'évaluation

- 3 - 1-Asset Liability Management PDFDocument26 pages3 - 1-Asset Liability Management PDFjayaPas encore d'évaluation

- Credit Derivatives: An Overview: David MengleDocument24 pagesCredit Derivatives: An Overview: David MengleMonica HoffmanPas encore d'évaluation

- Forecasting Volatility of Stock Indices With ARCH ModelDocument18 pagesForecasting Volatility of Stock Indices With ARCH Modelravi_nysePas encore d'évaluation

- Hillier Model 3Document19 pagesHillier Model 3kavyaambekarPas encore d'évaluation

- Alternatives in Todays Capital MarketsDocument16 pagesAlternatives in Todays Capital MarketsjoanPas encore d'évaluation

- Done-BU7305 Midterm Exam S2 2020-2021 201700889 Amina AltimimiDocument15 pagesDone-BU7305 Midterm Exam S2 2020-2021 201700889 Amina AltimimiMoony TamimiPas encore d'évaluation

- Asset Quality Management in BankDocument13 pagesAsset Quality Management in Bankswendadsilva100% (4)

- Chap 012Document29 pagesChap 012azmiikptPas encore d'évaluation

- Fixed Income Assignment 4Document4 pagesFixed Income Assignment 4Rattan Preet SinghPas encore d'évaluation

- 04.04.2016 F3 Exam Techniques WebinarDocument11 pages04.04.2016 F3 Exam Techniques WebinarHusnina FakhiraPas encore d'évaluation

- Bekaert 2e SM Ch20Document13 pagesBekaert 2e SM Ch20Unswlegend100% (1)

- Statistical Cost AccountingDocument20 pagesStatistical Cost AccountingBirat Sharma100% (1)

- KMV ModelDocument5 pagesKMV ModelVijay BehraPas encore d'évaluation

- Bekaert 2e SM Ch10Document11 pagesBekaert 2e SM Ch10Xinyi Kimmy LiangPas encore d'évaluation

- Methodology For Rating General Trading and Investment CompaniesDocument23 pagesMethodology For Rating General Trading and Investment CompaniesAhmad So MadPas encore d'évaluation

- CT5, Actuarial KnowledgeDocument15 pagesCT5, Actuarial KnowledgePriyaPas encore d'évaluation

- 5.0 RiskFoundation Install GuideDocument132 pages5.0 RiskFoundation Install GuideARIZKIPas encore d'évaluation

- Relationship Between Bonds Prices and Interest RatesDocument1 pageRelationship Between Bonds Prices and Interest RatesNikhil JoshiPas encore d'évaluation

- Taylor & Francis, Ltd. Financial Analysts JournalDocument16 pagesTaylor & Francis, Ltd. Financial Analysts JournalJean Pierre BetancourthPas encore d'évaluation

- Comparison of Modeling Methods For Loss Given DefaultDocument14 pagesComparison of Modeling Methods For Loss Given DefaultAnnPas encore d'évaluation

- Risk Management in BankingDocument2 pagesRisk Management in Bankinghoney1994Pas encore d'évaluation

- Tutorial 2 QuestionsDocument4 pagesTutorial 2 QuestionswarishaaPas encore d'évaluation

- Volcker Rule Facts On MetricsDocument15 pagesVolcker Rule Facts On Metricschandkhand2Pas encore d'évaluation

- Capital Budgeting AnswerDocument18 pagesCapital Budgeting AnswerPiyush ChughPas encore d'évaluation

- FAPDocument12 pagesFAPAnokye AdamPas encore d'évaluation

- 4315 Written Project 4 Report Monte Carlo SimulationDocument9 pages4315 Written Project 4 Report Monte Carlo SimulationVictor Marcos Hyslop100% (1)

- Mtps 06Document1 pageMtps 06fredPas encore d'évaluation

- Bond MathematicsDocument68 pagesBond MathematicsDeepali JhunjhunwalaPas encore d'évaluation

- Common Factors Affecting Bond Returns PDFDocument2 pagesCommon Factors Affecting Bond Returns PDFRebecca50% (2)

- Consumer Credit Risk Machine LearningDocument56 pagesConsumer Credit Risk Machine LearningmnbvqwertyPas encore d'évaluation

- 02 How To Forecast Sales More Accurately 1Document1 page02 How To Forecast Sales More Accurately 1eduson2013Pas encore d'évaluation

- PS9Document1 pagePS9Elaine Vincent100% (1)

- Investments & RiskDocument20 pagesInvestments & RiskravaladityaPas encore d'évaluation

- 6 & 7Document13 pages6 & 7Awais ChPas encore d'évaluation

- Solutions - Chapter 2Document29 pagesSolutions - Chapter 2Dre ThathipPas encore d'évaluation

- Economic Capital in Banking v03Document10 pagesEconomic Capital in Banking v03AndreKochPas encore d'évaluation

- A Study of Corporate Bond Returns - Using Sharpe-Lintner CAPM and Fama & FrenchDocument56 pagesA Study of Corporate Bond Returns - Using Sharpe-Lintner CAPM and Fama & FrenchTalin MachinPas encore d'évaluation

- Eri WP Predicting Decomposing Risk Data Driven Portfolios 0 PDFDocument46 pagesEri WP Predicting Decomposing Risk Data Driven Portfolios 0 PDFdemetraPas encore d'évaluation

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideD'EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuidePas encore d'évaluation

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsD'EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsPas encore d'évaluation

- 10 Things You Should Know On GraduationDocument3 pages10 Things You Should Know On GraduationDevolina DeshmukhPas encore d'évaluation

- Equity Research - Course ContentDocument3 pagesEquity Research - Course ContentDevolina DeshmukhPas encore d'évaluation

- Indian Retail IndustryDocument12 pagesIndian Retail IndustryDevolina DeshmukhPas encore d'évaluation

- The Sale of Goods ActDocument22 pagesThe Sale of Goods ActDipesh MandalPas encore d'évaluation

- Training Plan TemplateDocument2 pagesTraining Plan Templateus_hazizi100% (3)

- Electronic Chips Connected To Gps. Strategic Business Units. Travel Insurance For BaggagesDocument1 pageElectronic Chips Connected To Gps. Strategic Business Units. Travel Insurance For BaggagesDevolina DeshmukhPas encore d'évaluation

- Presentation 1Document8 pagesPresentation 1Devolina DeshmukhPas encore d'évaluation

- Special Lecture Handouts in TaxationDocument24 pagesSpecial Lecture Handouts in TaxationTep DomingoPas encore d'évaluation

- Republic Act No. 7279Document25 pagesRepublic Act No. 7279Sharmen Dizon GalleneroPas encore d'évaluation

- Mcq-Income TaxesDocument7 pagesMcq-Income TaxesRandy Manzano100% (1)

- Citi Card Pay PDFDocument1 pageCiti Card Pay PDFShamim KhanPas encore d'évaluation

- Presentation On IOCL - PPT On SUMMER INTERNSHIP PROJECTDocument15 pagesPresentation On IOCL - PPT On SUMMER INTERNSHIP PROJECTMAHENDRA SHIVAJI DHENAK33% (3)

- Strategy With MACD and ADX 21 5 2017Document3 pagesStrategy With MACD and ADX 21 5 2017Anant MalaviyaPas encore d'évaluation

- Module 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGDocument12 pagesModule 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGMae Gamit LaglivaPas encore d'évaluation

- FY23 Maximus Investor Presentation - AugDocument15 pagesFY23 Maximus Investor Presentation - AugMarisa DemarcoPas encore d'évaluation

- SDH 231Document3 pagesSDH 231darff45Pas encore d'évaluation

- Mid (Zara)Document4 pagesMid (Zara)hbuzdarPas encore d'évaluation

- Merchandising Reviewer 2Document5 pagesMerchandising Reviewer 2Sandro Marie N. ObraPas encore d'évaluation

- Accounting Words IDocument1 pageAccounting Words IArnold SilvaPas encore d'évaluation

- CA51024 - Quiz 2 (Solutions)Document6 pagesCA51024 - Quiz 2 (Solutions)The Brain Dump PHPas encore d'évaluation

- Day CareDocument21 pagesDay CareSarfraz AliPas encore d'évaluation

- Ala in Finacct 3Document4 pagesAla in Finacct 3VIRGIL KIT AUGUSTIN ABANILLAPas encore d'évaluation

- Summary - Rule 68 71Document32 pagesSummary - Rule 68 71Allana NacinoPas encore d'évaluation

- ARTI Annual Report 2019 PDFDocument139 pagesARTI Annual Report 2019 PDFS Gevanry SagalaPas encore d'évaluation

- Investment Wisdom From The Super AnalystsDocument6 pagesInvestment Wisdom From The Super Analystsautostrada.scmhrdPas encore d'évaluation

- Finance InstrumentsDocument28 pagesFinance InstrumentsThanh Hằng NgôPas encore d'évaluation

- Direst Selling Agent Policy-Retail & Consumer LendingDocument13 pagesDirest Selling Agent Policy-Retail & Consumer LendingVijay DubeyPas encore d'évaluation

- Solution: Econ 2123, Fall 2018, Problem Set 1Document6 pagesSolution: Econ 2123, Fall 2018, Problem Set 1Pak Ho100% (1)

- Assignment 01-Fin421Document11 pagesAssignment 01-Fin421i CrYPas encore d'évaluation

- IFM11 Solution To Ch05 P20 Build A ModelDocument6 pagesIFM11 Solution To Ch05 P20 Build A ModelDiana SorianoPas encore d'évaluation

- BSE SME Exchange - BusinessDocument53 pagesBSE SME Exchange - BusinessDeepak GajarePas encore d'évaluation

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesManjulaPas encore d'évaluation

- Annexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeDocument1 pageAnnexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeenamsribdPas encore d'évaluation

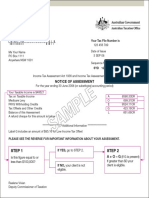

- Step 1 Step 2: Notice of AssessmentDocument1 pageStep 1 Step 2: Notice of Assessmentabinash manandharPas encore d'évaluation

- Daily Report MonitoringDocument9 pagesDaily Report MonitoringMaasin BranchPas encore d'évaluation

- Government Finance Statistics (GFSX) : Valuation of TransactionsDocument2 pagesGovernment Finance Statistics (GFSX) : Valuation of TransactionsKhenneth BalcetaPas encore d'évaluation

- SECTION 4.1 Payment or PerformanceDocument6 pagesSECTION 4.1 Payment or PerformanceMars TubalinalPas encore d'évaluation