Académique Documents

Professionnel Documents

Culture Documents

Minimum Deductibles Applicable For Fire & Engg Policies: Annexure 1

Transféré par

m48bbsrDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Minimum Deductibles Applicable For Fire & Engg Policies: Annexure 1

Transféré par

m48bbsrDroits d'auteur :

Formats disponibles

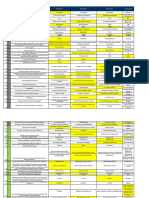

Annexure 1.

Minimum Deductibles Applicable for Fire & Engg Policies

With business incepting from 1st April 2011, in case of new business and renewals the minimum deductible under the policies in fire and engg portfolio would be as under:

Section 1

1. The following minimum deductibles are applicable

1.

Fire Insurance:

1.1 Standard Fire and Special Perils Policy (except dwellings with individual owners) 1.1.1 Policies having Sum Inured up to INR 10 cr per location 5% of claim amount subject to a minimum of Rs 10,000/1.1.2 Policies having Sum Insured above INR 10 cr per location up to INR 100 cr per location 5% of claim amount subject to a minimum of INR 25,000 1.1.3 Policies having Sum Insured above INR 100 cr and up to INR 1500 cr per location5% of claim amount subject to a minimum of INR 5 lakhs 1.1.4 Policies having Sum Insured above INR 1500 Cr and up to INR 2500 cr per location 5% of claim amount subject to a minimum of INR 25 lakhs 1.1.5 Policies having Sum Insured above INR 2500 Cr per location 5% of claim amount subject to a minimum of INR 50 lakhs

1.2 Business Interruption (FLOP)Other than Petro Chemical Risks 7 days of Gross Profit Petro chemical risks - 14 days of Gross Profit

1.3

Industrial All Risk Policy

1.3.1 Policies having Sum Insured upto INR 100 Cr per location for PD & BI Material Damage - 5% of claim amount subject to a minimum of 5 lakhs Business Interruption (FLOP)Other than Petro Chemical Risks - 7 days of Standard Gross Profit Petro chemical risks - 14 days of Standard Gross Profit Business Interruption (MLOP) - 14 days of Standard Gross Profit 1.3.2 Policies having Sum Insured above INR 100 Cr and up to INR 1500 cr per location for PD & BI . Material Damage - 5% of claim amount subject to a minimum of 10 lakhs Business Interruption (FLOP)Other than Petro Chemical Risks - 7 days of Standard Gross Profit Petro chemical risks - 14 days of Standard Gross Profit Business Interruption (MLOP) - 14 days of Standard Gross Profit 1.3.3 Policies having Sum Insured above INR 1500 Cr and up to INR 2500 cr per location for PD & BI. Material Damage - 5% of claim amount subject to a minimum of 25 lakhs Business Interruption (FLOP)Other than Petro Chemical Risks - 7 days of Standard Gross Profit Petro chemical risks - 14 days of Standard Gross Profit Business Interruption (MLOP) - 14 days of Standard Gross Profit 1.3.4 Policies having Sum Insured above INR 2500 cr per location for PD & BI. Material Damage - 5% of claim amount subject to a minimum of INR 50 lakh Business InterruptionFLOP - 14 Days of Standard Gross Profit MLOP 21 Days of Standard Gross Profit Note: The limit for sum insured is combined limit for MD + BI per location

1.4 Mega Risk Policies - Policies having Sum Insured above INR 2500 cr per location for PD & BI Material Damage - 5% of claim amount subject to a minimum of INR 50 lakh. Business InterruptionFLOP - 14 Days of Standard Gross Profit MLOP 21 Days of Standard Gross Profit Note: The limit for sum insured is combined limit for MD + BI per location

1.5 Cellular Network Policies Material Damage - 5% of claim amount subject to a minimum of INR 5 lakh Business Interruption- 3 Days of Gross Profit

Section 2 2. Engineering Insurance- Projects

2..0 Contractors All Risk Insurance/ Erection All Risk Insurance (other than combined cycle power plants/ gas based power plants)2.1.1. For Sum Insured up to INR 1500 cr. - All deductible amounts appearing in TAC Tariff would be increased to 5 times of the minimum amount. 2.1.2. For Sum Insured above INR 1500 cr. and up to INR 2500 cr - All deductible amounts appearing in TAC Tariff would be increased to 10 times of the minimum amount. . 2.1.3. For Sum Insured above INR 2500 cr. - All deductible amounts appearing in TAC Tariff would be increased to 15 times of the minimum amount.

2.1.4 Advance Loss of Profits Time excess- 30 days for first year+ 1 day for each erection month in addition to 12 months not exceeding 60 days

2..2..1 Specialized risks ( The following risks would be termed as specialized risks - All works in water, dams, canals, hydro power projects, tunnels, irrigation systems, caverns.) All deductible amounts appearing in TAC Tariff would be increased to 15 times of the minimum amount.

2.2.2 Advance Loss of Profits Time excess- 45 days for first year+ 1 day for each erection month in addition to 12 months not exceeding 75 days

2.3.1 Combined cycle power plants/ gas based power plants50 MW to 200 MW- 5% of claim amount subject to a minimum of 60 lakhs for testing & 20 lakhs for normal excess 200 MW to 300 MW- 5% of claim amount subject to a minimum 100 lakhs for testing & 50 lakhs for normal excess 300 MW and above- 5% of claim amount subject to a minimum 125 lakhs for testing & 75 lakhs for normal excess

2.3.2 Advance Loss of Profits Time excess- 45 days for first year+ 1 day for each erection month in addition to 12 months not exceeding 75 days

2.4. Machinery Breakdown1% of sum insured for each machine subject to a minimum of Rs 2,500/Note: Sum Insured of the machine should be declared as a whole and should not be apportioned towards parts of machine. 2.5 Business Interruption (MLOP) - 14 days of Standard Gross Profit

2.6. Contractors Plant & Machinery- For all Machinery under Group I,II,III,IV, including cranes above 10 tonne capacity under Group III

EXCESSES Value of equipments Individual value upto Rs.1 lakh. For claims AOG perils arising out to of a For claims arising out of perils other than AOG 2 % of S.I. subject to minimum of Rs. 1,500/1.5 % of S.I. subject to minimum of Rs.2, 000/1.25 % of S.I. subject minimum of Rs. 7,500/1.00 % of S.I. subject minimum of Rs. 12, 500/to

10 % of S.I. Subject minimum of Rs. 5,000/5 % of S.I. Subject minimum of Rs.10, 000/-

Individual value over Rs. 1 lakh and upto Rs. 5 lakh. Individual value over Rs. 5 lakh and upto Rs.10 lakhs. Individual value over Rs. 10 lakhs upto Rs. 25 lakhs Individual value over Rs. 25 lakhs upto Rs. 50 lakhs Individual value over Rs. 50 lakhs

to

3 % of S.I. subject to a minimum of Rs. 25, 000/2 % of S.I. subject to a minimum of Rs. 30, 000/1 % of S.I. Subject to minimum of Rs. 50, 000/1 % of S.I. Subject to minimum of Rs. 50, 000/a

to

1 % of S.I. Subject to a minimum of Rs. 50, 000/-)

1 % of S.I. Subject to a minimum of Rs. 50, 000

Boom Section- 20 % of claim amount subject to minimum of Rs. 25, 000/For Machinery under Group V - Rs.2,500/- Flat. Excess. 2.7 Electronic Equipment Insurance- As per TAC tariff

2.8

Boiler Insurance- 5% of claim amount subject to a minimum of Rs 10,000/-

Vous aimerez peut-être aussi

- Personnel Manual OrientalDocument462 pagesPersonnel Manual Orientalballubalraj100% (4)

- University of Alberta's Economic ImpactDocument22 pagesUniversity of Alberta's Economic ImpactEmily MertzPas encore d'évaluation

- Fire & Eng.Document14 pagesFire & Eng.Anzu HondaPas encore d'évaluation

- MCQ Motor For PE Training 2018 VKA-1 PDFDocument7 pagesMCQ Motor For PE Training 2018 VKA-1 PDFJayalakshmi RajendranPas encore d'évaluation

- AlopDocument39 pagesAlopabhishekmantri100% (1)

- Fixing of Sum Insured Under Fire Insurance PoliciesDocument17 pagesFixing of Sum Insured Under Fire Insurance PoliciesShayak Kumar GhoshPas encore d'évaluation

- Tata Aig Marine BrochureDocument8 pagesTata Aig Marine Brochurechaitanyabarge100% (2)

- Sla - PrudentDocument9 pagesSla - Prudentloveleen_samuelPas encore d'évaluation

- QNG01185A21 - Quote Slip (For AUL)Document23 pagesQNG01185A21 - Quote Slip (For AUL)Ashutosh Sharma100% (1)

- Fire & Engg W.E.F. 01-11-2018Document6 pagesFire & Engg W.E.F. 01-11-2018Utsav J BhattPas encore d'évaluation

- All India Tariff CARDocument62 pagesAll India Tariff CARManish Kumar GuptaPas encore d'évaluation

- Motor Tariff Gist - Study MaterialDocument9 pagesMotor Tariff Gist - Study MaterialSadasivuni007Pas encore d'évaluation

- What Is Engineering InsuranceDocument4 pagesWhat Is Engineering InsuranceParth Shastri100% (1)

- Final PPT Motor TP Insurance & ClaimsDocument57 pagesFinal PPT Motor TP Insurance & ClaimsPRAKASH100% (1)

- MOTOR Insurance-3Document46 pagesMOTOR Insurance-3m_dattaias100% (1)

- Fire ClausesDocument62 pagesFire ClauseschriscalarionPas encore d'évaluation

- Griha Suvidha PolicyDocument6 pagesGriha Suvidha PolicypkkothariPas encore d'évaluation

- Claim Procedure and Terms & Conditions For Personal Accident InsuranceDocument11 pagesClaim Procedure and Terms & Conditions For Personal Accident InsuranceMayur AbhinavPas encore d'évaluation

- Motor Insurance Study Material FinalDocument67 pagesMotor Insurance Study Material FinalsekkilarjiPas encore d'évaluation

- Machine Breakdown Insuranc Etariff RateDocument60 pagesMachine Breakdown Insuranc Etariff Rateben8_cheenathPas encore d'évaluation

- All India Fire TariffDocument92 pagesAll India Fire Tariffkrmchandru0% (1)

- REINSURANCEDocument22 pagesREINSURANCENURUL AIN NAJIHAH TUKIRANPas encore d'évaluation

- Guide For Marketing & Public Relations: Key For Fellowship ExaminationDocument14 pagesGuide For Marketing & Public Relations: Key For Fellowship ExaminationRakesh KumarPas encore d'évaluation

- Ic s01 Miscellaneous InsuranceDocument60 pagesIc s01 Miscellaneous InsuranceRanjith0% (1)

- About IMT 47 in Motor - Analysis in DetailDocument5 pagesAbout IMT 47 in Motor - Analysis in DetailNaishadh J Desai AnD'sPas encore d'évaluation

- Proportional Treaty SlipDocument3 pagesProportional Treaty SlipAman Divya100% (1)

- 2.0 Fire InsuranceDocument18 pages2.0 Fire InsuranceSneha SinhaPas encore d'évaluation

- Table No 133Document2 pagesTable No 133ssfinservPas encore d'évaluation

- III AssociateDocument2 pagesIII Associateagupta_118177Pas encore d'évaluation

- Frudulent ClaimsDocument23 pagesFrudulent ClaimsNaishadh J Desai AnD'sPas encore d'évaluation

- Fire Study Material - NWDocument29 pagesFire Study Material - NWDILEEP KAULPas encore d'évaluation

- Fire & Consequential Loss Insurance 57Document15 pagesFire & Consequential Loss Insurance 57surjith rPas encore d'évaluation

- Project Insurance by Er. Amrit Lal Meena, SBM National Insurance Company LTDDocument52 pagesProject Insurance by Er. Amrit Lal Meena, SBM National Insurance Company LTDDr S Rajesh KumarPas encore d'évaluation

- Reinsurance 3Document19 pagesReinsurance 3Muhammad IrfanPas encore d'évaluation

- Miscellaneous Manual 1Document507 pagesMiscellaneous Manual 1shrey12467% (3)

- IC-24 - Legal Aspects of Life AssuranceDocument1 pageIC-24 - Legal Aspects of Life Assuranceaman vermaPas encore d'évaluation

- Additional Advanced Questions IC 72 Motor ChaptwewiseDocument20 pagesAdditional Advanced Questions IC 72 Motor ChaptwewiseSandeep NehraPas encore d'évaluation

- IC 11 PractisesDocument287 pagesIC 11 PractisesaashishPas encore d'évaluation

- Legal Framework in InsuranceDocument36 pagesLegal Framework in InsuranceHarshit Srivastava 18MBA0050Pas encore d'évaluation

- Machinery Breakdown PolicyDocument7 pagesMachinery Breakdown PolicyDikshit KapilaPas encore d'évaluation

- INSURANCEDocument116 pagesINSURANCE시석인한Pas encore d'évaluation

- It's English That Kills YouDocument63 pagesIt's English That Kills YouSujeet DongarjalPas encore d'évaluation

- New Syllabus PDFDocument77 pagesNew Syllabus PDFPrashantPas encore d'évaluation

- Principles of Cargo Marine InsuranceDocument13 pagesPrinciples of Cargo Marine InsuranceKatiaPas encore d'évaluation

- Ic33 Print Out 660 English PDFDocument54 pagesIc33 Print Out 660 English PDFumesh100% (1)

- Marine Insurance and Fire InsuranceDocument33 pagesMarine Insurance and Fire InsuranceSuzanne Pagaduan CruzPas encore d'évaluation

- United India Insurance Co. LTD.: Fire & Engineering DepartmentDocument4 pagesUnited India Insurance Co. LTD.: Fire & Engineering DepartmentRamanPas encore d'évaluation

- Introduction On Motor Insurance: TH STDocument32 pagesIntroduction On Motor Insurance: TH STRahil Khan100% (1)

- Insurance SectorDocument45 pagesInsurance Sectorverma786786100% (1)

- Flop (Fire Loss of Profit)Document41 pagesFlop (Fire Loss of Profit)john0% (1)

- CLAIM NOTES pdf-1 PDFDocument9 pagesCLAIM NOTES pdf-1 PDFJackson Mkwasa100% (1)

- Aviation Fuelling Liability PdsDocument3 pagesAviation Fuelling Liability PdsNoraini Mohd Shariff100% (1)

- ENGG - Study - Material Fast RevisionDocument13 pagesENGG - Study - Material Fast RevisionDr S Rajesh KumarPas encore d'évaluation

- Ic 2Document30 pagesIc 2Radhie NoahPas encore d'évaluation

- Free Irda Ic 38 Insurance Agents GeneralDocument12 pagesFree Irda Ic 38 Insurance Agents GeneralShabaz AliPas encore d'évaluation

- Fire Protection TACDocument72 pagesFire Protection TACNandkishore Paramal MandothanPas encore d'évaluation

- Comm BrokersDocument12 pagesComm BrokersVaibhav JoshiPas encore d'évaluation

- Survey Fee 2013Document6 pagesSurvey Fee 2013abcPas encore d'évaluation

- Presentation On Householder Insurance PolicyDocument63 pagesPresentation On Householder Insurance Policychhavigupta1689Pas encore d'évaluation

- EAR TAriffDocument72 pagesEAR TAriffbenasfs100% (2)

- CISV Travel Insurance Claim Form 2019Document4 pagesCISV Travel Insurance Claim Form 2019sara ulloaPas encore d'évaluation

- Whole Turnover PolicyDocument4 pagesWhole Turnover PolicyHippoo NguyễnPas encore d'évaluation

- Contracts Outline - Abuse of The Bargaining ProcessDocument64 pagesContracts Outline - Abuse of The Bargaining ProcessJason HenryPas encore d'évaluation

- CASE Digests For Tax Review Starting From INCOME TaxDocument69 pagesCASE Digests For Tax Review Starting From INCOME TaxAna LogosandprintsPas encore d'évaluation

- 1980 OWRBAnnualReportDocument48 pages1980 OWRBAnnualReportrianselve3Pas encore d'évaluation

- Should Your Medical Insurance Provider Be Paying More? Your Explanation of Benefits Explained.Document1 pageShould Your Medical Insurance Provider Be Paying More? Your Explanation of Benefits Explained.nlprofitsPas encore d'évaluation

- Cost Cutting Ideas PDFDocument4 pagesCost Cutting Ideas PDFmuthuswamy77100% (1)

- 85-Medical Insurance Scheme For The Serving Officers & Employees Along With Option For Super Top Up FacilityDocument36 pages85-Medical Insurance Scheme For The Serving Officers & Employees Along With Option For Super Top Up FacilityParthasarathi LakshmanPas encore d'évaluation

- Micro Insurance in India ..Document58 pagesMicro Insurance in India ..Amit WaghelaPas encore d'évaluation

- 100 Largest LossesDocument68 pages100 Largest Lossesnaqvi44100% (1)

- Newsletter 2023 10Document2 pagesNewsletter 2023 10mbalenhleangel200Pas encore d'évaluation

- Many Languages PDFDocument6 pagesMany Languages PDFMalambo IncPas encore d'évaluation

- AGCS Safety Shipping Review 2019Document52 pagesAGCS Safety Shipping Review 2019Akash MishraPas encore d'évaluation

- Tongko Atok DigestDocument5 pagesTongko Atok DigestJeromy VillarbaPas encore d'évaluation

- 31 - Arrieta vs. NARIC, 10 SCRA 79 - 6pgDocument6 pages31 - Arrieta vs. NARIC, 10 SCRA 79 - 6pgMela CorderoPas encore d'évaluation

- Chapter 22 Share CapitalDocument25 pagesChapter 22 Share CapitalHammad AhmadPas encore d'évaluation

- RHYS MURILLO - Insurance Reviewer - Ateneo Law SchoolDocument102 pagesRHYS MURILLO - Insurance Reviewer - Ateneo Law Schoollex libertadore94% (31)

- HRM AssignmentDocument39 pagesHRM AssignmentAbhinav NarulaPas encore d'évaluation

- What Is A Memorandum of Agreement?Document3 pagesWhat Is A Memorandum of Agreement?Tobal FrnandzPas encore d'évaluation

- DIGEST - The Insular Life Assurance Company, Ltd. vs. KhuDocument2 pagesDIGEST - The Insular Life Assurance Company, Ltd. vs. KhuJass Elardo100% (1)

- Blue Card Condition Survey Report 2010.1Document11 pagesBlue Card Condition Survey Report 2010.1HelloshusPas encore d'évaluation

- Introduction To ULIPDocument24 pagesIntroduction To ULIPPriyanka KumariPas encore d'évaluation

- Day 1Document39 pagesDay 1Abubakar MohammedPas encore d'évaluation

- Encyclopedia of Medical Decision MakingDocument1 266 pagesEncyclopedia of Medical Decision MakingAgam Reddy M100% (3)

- Tanggung Jawab PT Jasaraharja Putera PekDocument12 pagesTanggung Jawab PT Jasaraharja Putera PekAlvo herlambangPas encore d'évaluation

- Aia Pro Achiever IIDocument12 pagesAia Pro Achiever IIKok Heong TanPas encore d'évaluation

- Your Personal Details: Name: Gender: Male / Female Current Age: Occupation: Salaried / Self Employeed / OthersDocument2 pagesYour Personal Details: Name: Gender: Male / Female Current Age: Occupation: Salaried / Self Employeed / OthersHarsh VardhanPas encore d'évaluation

- Start Up Expenses WorksheetDocument16 pagesStart Up Expenses WorksheetArthur GreensteinPas encore d'évaluation