Académique Documents

Professionnel Documents

Culture Documents

Comparative Advantage

Transféré par

Shahid RasheedDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Comparative Advantage

Transféré par

Shahid RasheedDroits d'auteur :

Formats disponibles

Comparative Advantage Part 1/2 1 The Freeman: Ideas on Liberty By Dwight R. Lee Dwight Lee (dlee@terry.uga.

edu) is Ramsey Professor at the Terry College of Business, University of Georgia, and an adjunct fellow at the Weidenbaum Center on the Economy, Government, and Public Policy at Washington University in St. Louis. One of the most powerful and straightforward economic concepts is comparative advantage. As important and simple as this concept is, however, it seldom seems to inform public discussions of international trade. Almost everyone knows that we cant compete with countries that have cheap laborif we have free trade with such countries either wages will be driven down or many workers will lose their jobs. As Will Rogers once observed, Its not what people dont know that is the problem, it is what they do know thats not true. Understanding comparative advantage has the same effect on concerns about free trade as water had on the Wicked Witch of the West. Free trade with other countries (regardless of how much or little their workers are paid) doesnt increase unemployment or lower wages. Indeed, one of the best ways of increasing the wages of U.S. workers is by allowing them to compete with workers (even very low paid workers) in other countries through free trade. Absolute Versus Comparative Advantage The most straightforward case for free trade is that countries have different absolute advantages in producing goods. For example, because of differences in soil and climate, the United States is better at producing wheat than Brazil, and Brazil is better at producing coffee than the United States. Obviously both countries are better off when Americans produce wheat and exchange a portion of it for some of the coffee that Brazilians produce. But does this mean that a country with an absolute advantage in the production of a good should always produce that good rather than import it? No, as the English economist David Ricardo first explained in the early 1800s. A country can have an absolute advantage in the production of a good without having a comparative advantage. Comparative advantage is what determines whether it pays to produce a good or import it. Assume that there are only two goods, cars and computers, and one productive resource which is some composite of land, labor, and capital. Assume also that producing 100 cars requires two units of the productive resource (PR) in the

1

Slightly modified for instructors and students using Common Sense Economics (CommonSenseEconomics.com)

United States and four units in Brazil, and producing 1,000 computers requires three units of PR in the United States and four in Brazil.

Thus: 100 cars 1,000 computers U.S. 2 3 Brazil 4 4

Americans have an absolute advantage in producing both cars and computers. It may seem that Americans can realize no gain by trading with Brazilians. Why not produce both cars and computers here? Because it costs more to produce computers in the United States than in Brazil. All costs are opportunity costs. The cost of producing computers is the cars that could have been produced. Using the three units of PR required to produce 1,000 computers in the United States requires sacrificing the production of 150 cars. Using the four units of PR required to produce 1,000 computers in Brazil requires sacrificing only 100 cars. So even though Americans have an absolute advantage in producing computers, Brazilians have a comparative advantage. Compared to what has to be sacrificed, Brazil produces computers for only two-thirds as much as it costs in the United States. The United States, of course, has a comparative advantage over Brazil in the production of cars. Producing 100 cars here costs 666 computers, while producing 100 cars in Brazil costs 1,000 computers. Clearly the United States benefits from specializing in cars, which it produces more cheaply than Brazil, and trading with Brazil for some of the computers it produces more cheaply. If, for example, the United States produced both cars and computers it might devote 70 units of PR to car production and 30 units to computer production, yielding 3,500 cars and 10,000 computers. If Brazil produced both products, it might devote 56 units of PR to car production and 24 to computer production, yielding 1,400 cars and 6,000 computers. On the other hand, by specializing in their comparative advantages, the United States can produce 5,000 cars and Brazil can produce 20,000 computers, or a total of 100 additional cars and 4,000 additional computers. The United States could trade 1,450 cars to Brazil for 12,500 computers and have 50 additional cars (3,550) and 2,500 more computers (12,500), while Brazil would have 50 more cars (1,450) and 1,500 more computers (7,500). Trade is productive since it generates more output of both products. Low Wages Dont Mean Low Cost Notice that in determining that it is less costly to produce cars in the United States and computers in Brazil, we never mentioned how much U.S. or Brazilian workers are paid. Workers in the United States will be paid more than those in

Brazil because they are more productive in our example. So in terms of output, lower wages dont mean lower costs. Indeed, asking whether U.S. or Brazilian workers are less costly ignores the relevant question: less costly doing what? U.S. workers are less costly at producing cars, but Brazilian workers are less costly at producing computers. This is true no matter what U.S. and Brazilian workers are paid. Moreover, free trade does not cause unemployment in either the United States or Brazil. True, free trade eliminates U.S. jobs in the computer industry and Brazilian jobs in the car industry, but it increases U.S. jobs in the car industry and Brazilian jobs in the computer industry. Furthermore, the jobs that free trade eliminates are lower-paying jobs than the ones it creates. Without free trade, the United States and Brazil would each employ workers who produce both cars and computers. This means that many workers in each country would be doing jobs in which they do not have a comparative advantage, and therefore in which they are less productive than they could be. With free trade these workers would be directed into more jobs where they are more productive and receive higher pay, since the compensation workers receive ultimately depends on how productive they are. The concept of comparative advantage is deceptively simple. Tiger Woods surely has the potential of being one of the best caddies in the world. How many people could give you better advice on lining up a putt or selecting a club? He has an absolute advantage. But everyone knows that the opportunity cost to Tiger Woods of becoming a caddie is too high to make that a sensible option. He would be sacrificing the return from being a professional golfer, the activity in which he has a strong comparative advantage. Understanding why Tiger Woods doesnt become a caddie is enough to understand why high-paid U.S. workers benefit when free trade puts them in competition with lower-paid foreign workers.

Reference: Lee, Dwight R. "Comparative Advantage Continued" The Freeman: Ideas on Liberty - October 1999. Retrieved from the World Wide Web on 15 November 2006 at http://www.fee.org/publications/the-freeman/article.asp?aid=4962.

*Endnote Slightly modified for instructors and students using Common Sense Economics (CommonSenseEconomics.com)

Vous aimerez peut-être aussi

- 575 International Trade1 PDFDocument2 pages575 International Trade1 PDFdizhangPas encore d'évaluation

- Summary: Exporting America: Review and Analysis of Lou Dobbs's BookD'EverandSummary: Exporting America: Review and Analysis of Lou Dobbs's BookPas encore d'évaluation

- Message To DebatersDocument12 pagesMessage To Debaterskmd_2005Pas encore d'évaluation

- ГербовецDocument4 pagesГербовецAlena GerbovetsPas encore d'évaluation

- Summary: The World Is Flat: Review and Analysis of Thomas L. Friedman's BookD'EverandSummary: The World Is Flat: Review and Analysis of Thomas L. Friedman's BookPas encore d'évaluation

- International Economics (Mid-Term Part 2)Document19 pagesInternational Economics (Mid-Term Part 2)Ashish MahajanPas encore d'évaluation

- World Trade - Text ADocument6 pagesWorld Trade - Text AnatahesPas encore d'évaluation

- Obama Speech State of The UnionDocument15 pagesObama Speech State of The UnionEleonora MihailaPas encore d'évaluation

- 55 Reasons Why You Should Buy Products That Are Made in AmericaDocument24 pages55 Reasons Why You Should Buy Products That Are Made in AmericaGracia Thalia TPas encore d'évaluation

- Comparative AdvantageDocument7 pagesComparative AdvantageDhrs nnPas encore d'évaluation

- Summary: CAFTA and Free Trade: Review and Analysis of Greg Spotts's BookD'EverandSummary: CAFTA and Free Trade: Review and Analysis of Greg Spotts's BookPas encore d'évaluation

- 3 Traditional Trade TheoriesDocument6 pages3 Traditional Trade TheoriesOlga LiPas encore d'évaluation

- Open: The Progressive Case for Free Trade, Immigration, and Global CapitalD'EverandOpen: The Progressive Case for Free Trade, Immigration, and Global CapitalÉvaluation : 3.5 sur 5 étoiles3.5/5 (5)

- What Is Absolute Advantage?Document9 pagesWhat Is Absolute Advantage?Ken ChepkwonyPas encore d'évaluation

- Re-Made in the USA: How We Can Restore Jobs, Retool Manufacturing, and Compete With the WorldD'EverandRe-Made in the USA: How We Can Restore Jobs, Retool Manufacturing, and Compete With the WorldPas encore d'évaluation

- International Trade Activity Sheet 2Document2 pagesInternational Trade Activity Sheet 2Danielle JoenPas encore d'évaluation

- Absolute Advantage: Origin of The TheoryDocument5 pagesAbsolute Advantage: Origin of The TheoryactivenavaneethanPas encore d'évaluation

- Hubbard Solutions 3rd CH 8Document10 pagesHubbard Solutions 3rd CH 8donjuan6_9_47447927Pas encore d'évaluation

- Including The Middle Class Into America's Modern Trade PolicyDocument2 pagesIncluding The Middle Class Into America's Modern Trade PolicydennisPas encore d'évaluation

- WEB: CH. 1, Salvatore's Introduction To International Economics, 3 EdDocument3 pagesWEB: CH. 1, Salvatore's Introduction To International Economics, 3 EdRimeh BakirPas encore d'évaluation

- 20 Defenses of OffshoringDocument5 pages20 Defenses of OffshoringNinthCircleOfHellPas encore d'évaluation

- Mad About Trade: Why Main Street America Should Embrace GlobalizationD'EverandMad About Trade: Why Main Street America Should Embrace GlobalizationPas encore d'évaluation

- How International Trade WorksDocument4 pagesHow International Trade WorksfePas encore d'évaluation

- Chapter 3 (Interdependence and Gains From Trade)Document5 pagesChapter 3 (Interdependence and Gains From Trade)Md Fahim Islam Antur 1931900643Pas encore d'évaluation

- State of The Union Address 2012Document12 pagesState of The Union Address 2012The State NewspaperPas encore d'évaluation

- EconomicsDocument6 pagesEconomicsnorma johanna s. salamancaPas encore d'évaluation

- Economics Exam 2 Markets DecisionsDocument7 pagesEconomics Exam 2 Markets DecisionsMiguel MoraPas encore d'évaluation

- Yes Team: Debate Outline (Notes)Document12 pagesYes Team: Debate Outline (Notes)api-341212180Pas encore d'évaluation

- National College of Business Administration & Economics: Reading 1Document4 pagesNational College of Business Administration & Economics: Reading 1Hamza HusnainPas encore d'évaluation

- 3-2. Is International Trade Responsible For The Loss of American Manufacturing Jobs? How About Robots Instead?Document3 pages3-2. Is International Trade Responsible For The Loss of American Manufacturing Jobs? How About Robots Instead?Nguyen Thi Thuy NganPas encore d'évaluation

- Sotu 2012Document15 pagesSotu 2012Peggy W SatterfieldPas encore d'évaluation

- A. Scarcity: The Nature of Economic Systems: Unit OneDocument25 pagesA. Scarcity: The Nature of Economic Systems: Unit OneShoniqua JohnsonPas encore d'évaluation

- International Economics ReviewDocument8 pagesInternational Economics ReviewSmartKidDevelopmentPas encore d'évaluation

- World Economy FinishedDocument20 pagesWorld Economy FinishedAbdulla Gharib Abdulla RiyamiPas encore d'évaluation

- The Dwindling Power of A College DegreeDocument4 pagesThe Dwindling Power of A College Degreeskline3Pas encore d'évaluation

- Myths of Outsourcing McKinseyDocument6 pagesMyths of Outsourcing McKinseyapi-3832481Pas encore d'évaluation

- English 101 Final Exam - EssayDocument8 pagesEnglish 101 Final Exam - Essayapi-314425652Pas encore d'évaluation

- Free Trade EssayDocument5 pagesFree Trade Essayapi-605083273Pas encore d'évaluation

- The Theory of Comparative AdvantageDocument2 pagesThe Theory of Comparative AdvantageandrreaPas encore d'évaluation

- Theory and Practise of Free TradeDocument16 pagesTheory and Practise of Free TradeYash Raj Verma YmdPas encore d'évaluation

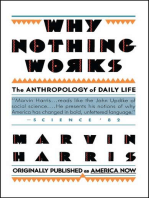

- Why Nothing Works: The Anthropology of Daily LifeD'EverandWhy Nothing Works: The Anthropology of Daily LifeÉvaluation : 4 sur 5 étoiles4/5 (30)

- Absolute and Comparative AdvantageDocument2 pagesAbsolute and Comparative AdvantageCarla Mae F. DaduralPas encore d'évaluation

- Praktice 3.abs - Com.advDocument20 pagesPraktice 3.abs - Com.advСофи БреславецPas encore d'évaluation

- The Negative Effects of Trade Barriers On The United States EconomyDocument7 pagesThe Negative Effects of Trade Barriers On The United States EconomyKunal ShahPas encore d'évaluation

- Chapter 17. Commerce and Trade: A. The General Division of Labor ProblemDocument17 pagesChapter 17. Commerce and Trade: A. The General Division of Labor ProblemBaby DollPas encore d'évaluation

- Essay ILO 2Document2 pagesEssay ILO 2Kezia Rev LimPas encore d'évaluation

- Remarks by The President in State of The Union AddressDocument12 pagesRemarks by The President in State of The Union AddressNguyên MinhPas encore d'évaluation

- Theory of Absolute AdvantageDocument19 pagesTheory of Absolute AdvantageSaimuna YeasminPas encore d'évaluation

- Create $50/Hour Jobs in Your Town or City: and Help Solve the "Too Big to Fail" ProblemD'EverandCreate $50/Hour Jobs in Your Town or City: and Help Solve the "Too Big to Fail" ProblemPas encore d'évaluation

- Transcription Doc Foreign Trade: Speaker: Chris OatesDocument9 pagesTranscription Doc Foreign Trade: Speaker: Chris OatesAnirban BhattacharyaPas encore d'évaluation

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Chapter 3Document5 pagesChapter 3LiloPas encore d'évaluation

- How to Stop the World: How Over-Regulation, Over-Taxation and Crony Capitalism are Preventing the Growth of the American EconomyD'EverandHow to Stop the World: How Over-Regulation, Over-Taxation and Crony Capitalism are Preventing the Growth of the American EconomyPas encore d'évaluation

- 10 Principles of EconsDocument50 pages10 Principles of EconsAnh PhạmPas encore d'évaluation

- Comparative Advantage: What Happens When A Country Has An Absolute Advantage in All GoodsDocument4 pagesComparative Advantage: What Happens When A Country Has An Absolute Advantage in All Goodsparamita tuladharPas encore d'évaluation

- International Trade and Enterprise 1707385Document31 pagesInternational Trade and Enterprise 1707385Ravi KumawatPas encore d'évaluation

- Theories Explaining Patterns of National TradeDocument3 pagesTheories Explaining Patterns of National Trademirasolbanlaygas715Pas encore d'évaluation

- Full Download Test Bank For Economics Global Edition 13th Edition Michael Parkin Isbn 10 1292255463 Isbn 13 9781292255460 PDF Full ChapterDocument36 pagesFull Download Test Bank For Economics Global Edition 13th Edition Michael Parkin Isbn 10 1292255463 Isbn 13 9781292255460 PDF Full Chapterapodanhymar.wk2c2y100% (15)

- Dave Anu Jayantilal Mba 2017Document93 pagesDave Anu Jayantilal Mba 2017Shahid RasheedPas encore d'évaluation

- Researh Problem Definition: Research MethodologyDocument10 pagesResearh Problem Definition: Research MethodologyShahid RasheedPas encore d'évaluation

- Sec Guide To Proxy BrochuresDocument4 pagesSec Guide To Proxy BrochuresShahid RasheedPas encore d'évaluation

- Glaxo Smith KlinewordDocument1 pageGlaxo Smith KlinewordShahid RasheedPas encore d'évaluation

- Operational Systems ExampleDocument3 pagesOperational Systems ExampleShahid RasheedPas encore d'évaluation

- LTA Form A PDFDocument3 pagesLTA Form A PDFGopal Chandra DasPas encore d'évaluation

- Service Rules 1995Document45 pagesService Rules 1995Urvashi urvashiPas encore d'évaluation

- IntegrityQuestionnaire PDFDocument5 pagesIntegrityQuestionnaire PDFCharlie100% (3)

- Starting A Roofing Business - Free GuideDocument20 pagesStarting A Roofing Business - Free Guidesteve1848375100% (1)

- 7 Top Recruitment Agencies in Germany For English Speakers - FasthireDocument8 pages7 Top Recruitment Agencies in Germany For English Speakers - FasthireShijo PodiyanPas encore d'évaluation

- Writing: Know Your AudienceDocument11 pagesWriting: Know Your AudienceshubhamPas encore d'évaluation

- Gccatalog 2011Document266 pagesGccatalog 2011tiernaousleyPas encore d'évaluation

- Training and DevelopmentDocument20 pagesTraining and DevelopmentashairwaysPas encore d'évaluation

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)COMMON SERVICE CENTERPas encore d'évaluation

- IPS Brief Profile PresentationDocument22 pagesIPS Brief Profile PresentationJohn DolanPas encore d'évaluation

- RRL DiversityDocument20 pagesRRL DiversityIvy mariel Amita100% (1)

- Employability SkillsDocument62 pagesEmployability Skillsbharathimanian75% (4)

- Ra 207 m6 Case StudyDocument2 pagesRa 207 m6 Case Studyapi-2589346110% (1)

- What Is An Elevator PitchDocument5 pagesWhat Is An Elevator Pitchrheza oropaPas encore d'évaluation

- Director Sales Operations in Atlanta GA Resume Preston RobinsonDocument2 pagesDirector Sales Operations in Atlanta GA Resume Preston RobinsonPrestonRobinsonPas encore d'évaluation

- Research Paper Final Draft 2Document5 pagesResearch Paper Final Draft 2api-549572618Pas encore d'évaluation

- CS Form No. 34-B Plantilla of Casual Appointment - AccreditedDocument3 pagesCS Form No. 34-B Plantilla of Casual Appointment - AccreditedAngelic RecioPas encore d'évaluation

- Endorsement Letter For Referral: (Full Name/Rank/Fleet)Document2 pagesEndorsement Letter For Referral: (Full Name/Rank/Fleet)Batistel ClerPas encore d'évaluation

- Main Part 1 TranningDocument23 pagesMain Part 1 TranningRaju100% (2)

- Impact of OB On PerformanceDocument6 pagesImpact of OB On PerformanceLalith MandalaPas encore d'évaluation

- InfosysDocument2 pagesInfosysManzoor Elahi LaskarPas encore d'évaluation

- OPNAVINST Chapter 13 Fall ProtectionDocument12 pagesOPNAVINST Chapter 13 Fall ProtectionCameron W-MPas encore d'évaluation

- MGB15-4 TemplateDocument3 pagesMGB15-4 TemplateVincent Salarda BaldomeroPas encore d'évaluation

- CV - Ingles Simiao Fenias - 2018Document5 pagesCV - Ingles Simiao Fenias - 2018Simiao FeniasPas encore d'évaluation

- Work Rules!: Insights From Inside Google That Will Transform How You Live and Lead Chapter 3 Culture Eats Strategy For BreakfastDocument1 pageWork Rules!: Insights From Inside Google That Will Transform How You Live and Lead Chapter 3 Culture Eats Strategy For BreakfastOctarinaPas encore d'évaluation

- Employee Training Tracking Log 2Document6 pagesEmployee Training Tracking Log 2Carlos MorenoPas encore d'évaluation

- 6 Owner-Builder+Handbook+NSWDocument115 pages6 Owner-Builder+Handbook+NSWzirconianPas encore d'évaluation

- 5 Simple Tips To Beat Age Bias Webinar WORKSHEETDocument6 pages5 Simple Tips To Beat Age Bias Webinar WORKSHEETIcq joyPas encore d'évaluation

- Income Elasticity of DemandDocument4 pagesIncome Elasticity of DemandUsama GilaniPas encore d'évaluation

- Percentage WorksheetDocument5 pagesPercentage WorksheetLeong SamPas encore d'évaluation