Académique Documents

Professionnel Documents

Culture Documents

CommuniK 2004.V4.1 Fees

Transféré par

Alireza GoodarziDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CommuniK 2004.V4.1 Fees

Transféré par

Alireza GoodarziDroits d'auteur :

Formats disponibles

W i n t e r I s s u e | February 2004

Dispensing Fees

Educating employees can translate into big savings. And its simple.

One of the easiest and most effective ways to reduce benefit plan costs is to educate employees about dispensing fees.

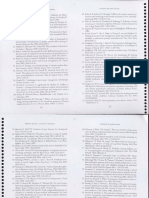

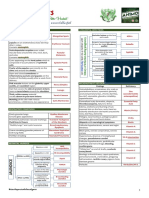

hese fees are the amounts pharmacies charge for providing professional services such as patient counselling, monitoring drug therapy, drug information to physicians and dispensing drug products. They also cover overhead costs such as the stocking of cial average. This will provide guidance and set expectamedication, maintaining patient medication records, tions. Depending on your culture and the extent of savgeneral operating costs such as taxes, employees ings that may be realized, you may consider a competisalaries, rent, insurance, etc. Typically, these are covered tion and have a portion of the savings put towards someby insurers up to a capped amount (usually $6), with the employee having to cover the difference. Communicating thing meaningful for employees such as a charity event, donation, etc. with employees about ways to minimize these costs and the significance of the savings to the individual, in terms Average Dispensing Fees Per Province of out-of-pocket expenses and premiums, can help January June, 2003 change employees behaviours for the better. There are two key messages to convey to employees Province Average Fee Average Cost when it comes to controlling the costs of fees. The first, Alberta $9.08 $43.17 and perhaps the most obvious, is to encourage phoning BC $8.07 $46.21 or visiting 4-5 local pharmacies for comparison. A recent Manitoba $7.87 $37.20 Canadian study shows that while nearly 75% of New Brunswick $7.81 $45.74 Canadians know that varying dispensing fees exist, only Newfoundland $8.02 $38.68 1 41% consider it when getting a prescription filled. Lets Ontario $9.31 $51.55 increase that number! PEI $7.65 $45.92 Stress the simplicity of this undertaking and the Quebec $6.21 $27.78 rewards to be realized. This simple exercise can take as Saskatchewan $6.89 $34.47 little as 15 minutes and the result may translate into as Total Averages $7.96 $41.69 much as 40% in savings. For example, a sample of pharmacies in Toronto in November 2003 revealed that Wal Source: Sun Life Assurance Company of Canada Marts dispensing fee, starting at $6.97, is 42% lower than those of The second message to communiIn This Issue Shoppers Drug Mart and Pharma cate to employees applies to those Plus, whose fees start at $11.99! Legally Speaking who have multi-month prescripYou may also wish to communiCompassionate Leave Benefits, tions for maintenance drugs. cate average provincial dispensing Privacy Legislation Under most Plans, they will be able fees to employees and encourage to obtain up to three months prethem to find a pharmacy whose Getting the Right Stuff from scription at a time. Although the cost does not exceed their provin-

your EAP

Do you want to email this document to someone? Logon to www.communik.ca

dispensing fee may increase per unit in some cases (typical for birth control pills), it will most likely not double or triple as each additional unit is dispensed. When all is said and done, it is imperative to stress to employees that they should never sacrifice quality for

cost. A pharmacists role always extends beyond dispensing medicine.

1 Sonya Felix, The 2003 Pulse on Plan Members, Benefits Canada Oct. 2003.

Legally Speaking

Effective January 1, 2004, the government amended the Employment Insurance Act to provide Canadians with compassionate leave benefits.

may require the employee to cover up to the full cost of the benefits while they are on compassionate leave. This enhancement to EI will help to ease concerns of the sandwich generation, who care for both children and elderly parents, by providing some financial assistance in stressful times. The federal government estimates approximately 270,000 workers will be eligible for compassionate leave benefits, while Canadian industry estimates the current cost of lost time due to terminal illness of family members at $2.4 billion. According to an IpsosReid 2003 survey, 32% of Canadian adults are responsible for the care of older adults. Quebec, Nova Scotia, New Brunswick, Nunavut and the Yukon have amended their employment standards to incorporate compassionate leave and the remaining provinces are expected to follow. Employers who are not federally regulated and in provinces without compassionate leave legislation are not required to provide compassionate leave for their employees. Forward thinking employers will recognize this is the way of the future and a benefit they can extend to employees in crisis at a very limited cost.

ompassionate leave will allow workers to take up to eight weeks off to provide care or support for a parent, spouse or child who is seriously ill with a significant risk of death within 26 weeks. In order to qualify, workers must provide a medical certificate from the family members doctor. A two-week waiting period applies to EI benefits and workers must have at least 600 insurable hours in their qualifying period. Compassionate leave EI benefits can be any six weeks taken over a 26week period, not necessarily consecutive weeks and multiple individuals may split the benefits for one terminally ill family member. Employers can top-up compassionate leave benefits to employees with no impact on the EI benefit. Employers must provide employees with the opportunity to continue coverage under a group benefit plan, but

Privacy Legislation

You might already be there

anuary 1, 2004 has come and gone, but what it brought us to stay is new legislation requiring companies to follow strict rules and guidelines when using personal information of employees and/or their clients. The PIPEDA (Personal Information Protection and Electronic Documents Act) has been described by the Canadian government as a business essential for the new economy. According to the Canadian Government the PIPEDA is a new law that protects personal information in the hands of organizations and provides guidelines for the collection, use and disclosure of that information in the course of commercial activity. The Privacy Commissioner of Canada and the Federal Court oversee the Act, based on ten privacy principles developed by the Canadian Standards Association. The PIPEDA established a set of ten principles with the Canadian Standards Association that organizations must follow when obtaining, using and storing personal information. The Principles are: Accountability Identifying Purposes Consent

Limit Collection Limiting Use, Disclosure, and Retention Accuracy Safeguard Openness Individual Access Challenging Compliance

The Canadian government has launched Critical Illness Update a PIPEDA E-kit for businesses to help them learn how to comply with the act. The kit, n May 2003 we released a special news bulletin to discuss the which can be found at www.privcom.gc.ca, recent rise in interest in Critical Illness Insurance. One of the includes such items as: issues we covered was the area of accessibility. Due to the fact The Personal Information Protection that most Critical Illness carriers require medical evidence of and Electronic Documents Act; and insurability assessment, this quickly eliminated a portion of the Your privacy responsibilities: A Guide employees. for Businesses and Organizations to the We have recently discovered a new Critical Illness insurer PIPEDA. product currently available on the market, which allows easier As we can see, the government has proaccessibility for employees. This product is a Guaranteed Issue vided a lot of resources with respect to product. This means that employees, when purchasing the compliance and implementation. insurance, require no medical information; only a 24-month preAs Human Resource professionals it is existing condition provision applies. The premiums for employyour duty to ensure that your company is in ees are still dependent upon gender, age and smoking status. compliance. But as Human Resources proWe would suggest that you review our May 2003 News fessionals you may soon realize that you Bulletin entitled Critical Illness Insurance available on our webhave already been in compliance because site at www.kriegerandassociates.com. If you wish to inquire your own internal policies have been reflecabout this new Guaranteed Issue Critical Illness Insurance, tive of the major components of the please do not hesitate to contact us and we will be happy to PIPEDA. provide you with more information. Human Resources has traditionally been the leader within organizations with respect In most organizations, Human Resources will become to privacy. It has ensured that employee information is a resource for other departments with respect to kept private and has deployed safeguards to ensure all compliance with the PIPEDA, similar to its current role employee information is protected previous to the PIPEof being a resource for Labour Standards and Human DA. Examples of protecting employee data include a Rights issues. secured area for employee files, confidentiality agreeAs Human Resource professionals, we recommend ments, separate areas for medical information, strict that you review the PIPEDA E-kit and ensure that you access for managers, etc. comply by comparing your current practices with the 10 Looking at the insurance industry, it has historically operated, and continues to operate today, with strict con- standards developed by the Canadian Standard Act. Make sure that your plan providers have undertaken fidentiality guidelines required solely due to the nature of an active process to change the affected wording on the subject matter it deals with. The same holds true for your forms and that all old forms are destroyed. You do any professional consulting or brokerage firm. What are not want to find yourself in a situation where a claimant the most impactful results from the PIPEDA on the indusdid not sign the right release. try? The language of waivers found on claim, enrolment Next, CHECK ALL YOUR PLAN COMMUNICATION and any other form used by the industry to manage a MATERIALS. While insurers seem to have paid attention benefit plan are. An unfortunate result is that some insurto forms, booklets and communication materials were ers are using the introduction of the new law to reduce overlooked in their messages. Your insurer or consultant service standards related to the release of information. can provide you with the necessary audits of language Here we often find an over-exaggeration of the requireand/or the proper language to insert. Destroy outdated ments of the law to reduce the quality of available informaterials now and ensure that you ask employees to mation needed to properly manage a plan. Be suspicious do the same. if an insurer starts using this as an excuse for not resolvLastly, dont live by the silence is golden rule when it ing problems. You still have the right to information needcomes to your employees. Make sure they understand ed to manage your plan. What you need to continue the changes to their plan and materials and your organidoing is to be highly respectful of the access and uses of zations commitment to compliance. If employees know that data just like you were before the law changed. to assist with the process of using the right documents, Taking a final look at the consulting industry, while we serious problems are less likely to occur. cant speak for everyone, we are very confident that If you have any questions with your compliance please most major firms already strictly controlled plan informagive us a call as we are always happy to help. tion of any kind, and K+A is certainly one of them. You must remember that this industry would not exist Legally Speaking was developed to provide you with in its current state today if confidentiality had not been a a quick summary of legislative updates as they relate to long-standing and serious concern. Without it, we lose the Human Resources and Group Benefits arena. It is not complete credibility and purpose. our intent that a reader of this column act or refrain from When you assess your compliance with the PIPEDA you will hopefully find that you are most of the way there acting without seeking the appropriate professional and the tools needed for compliance are already in place. advice.

K + a Viewpoint

Getting The Right Stuff from Your EAP

In our continuing focus on absence management, there is often a pertinent and overlooked assistance vehicle: your Employee Assistance Plan or EAP.

agement (discussed in our last Issue of CommuniK). The footprint employees leave on all coverages under a group benefit plan, including the EAP, tell HR a powerful story about the condition of their work forces and often the states of the organizations themselves. One commonly found weakness is a direct lack of a tangible connection between the patterns exhibited within each area of coverage or service and the implementation of a focused response. HR needs to be empowered in a professional manner with the knowledge derived from each area of health-related services, including the EAP. If HR is aware of a growing pattern of incidences in a particular area of treatment, work stress for example, and this finding is supported by trends shown in the disability and health areas of the benefit plan, there are significant business reasons and advantages to taking a proactive position in addressing, and putting into financial terms, the cost to the organization and the value of a remedy. Our goal of achieving excellence in absence management includes an important role for your EAP Plan and provider. Our hope is that this important area of work improves in that EAPs stop being the silent and invisible service and that what is learned from their use is relayed to HR professionals in a meaningful and helpful manner. Examining general trends does not violate anyones privacy and our EAP providers are the greatest source of expertise when interpreting patterns of use. Lets get EAPs fully integrated into our arsenal of absence management tools and open productive dialogue with HR that brings tangible value to an organization in addition to the important services provided to people in distress. A handy tip: Make sure to include information about your EAP plan in your disability communication to employees applying for coverage. During such times, this service can be an invaluable source of help for the disabled employee and his / her family.

urveys tell us that the vast majority of mid to large Canadian Benefit Plans offer some form of EAP. To recap, an EAP is a program of services that provides an employee (and often his / her immediate family members) access to professional counseling. The types of conditions covered by each Plan can vary by design and/or provider, as well as the Plans specific purpose. For example, there are EAPs with highly specialized purposes and needs, such as crisis and trauma management to address violent acts in the work place. The most common Plan, however, is one offering employees and their family members professional help with the unfortunate rigors of everyday life, such as work stress, family crisis, and illness. The mere nature of these benefits, especially in a world of increasingly strict controls over personal information, requires that individual confidentiality be fiercely guarded. There is no question of this necessity as once a plan of this nature becomes the subject of employee suspicion its value and use immediately plummet. It is for this reason that many HR professionals rarely address the coverage, its value to the company and employees, and most importantly its role as a valuable partner in the maintenance of a healthy work force with manageable absenteeism and a profitable company. There exists fear of violating privacy and an absence of knowledge of how to safely employ the knowledge and skills of their EAP provider. Some of the blame for this hesitancy is the EAP provider itself. Rarely are the tools and processes of an EAP accompanied by a tangible role for HR, other than as a management tool for assisted referrals. Another reason is the prevalence of segregated thinking about absence man-

Krieger + associates, Suite 300, 43 Front Street East, Toronto, Ontario Canada M5E 1B3 T. 416.363.1221 F. 416.363.0677 E. communik@kriegerandassociates.com Web.

www.communik.ca

CommuniK is written, designed and produced by Team Krieger. We want to know what you think! Please email us your benefits, pensions and communications questions or suggestions. The content of this newsletter is provided to you for your information only. Though Krieger + Associates has made every effort to ensure the accuracy of CommuniK, it is accepted by the reader on the condition that any error or omission shall not be made the basis for any claim, demand or cause for action. No reader of this newsletter should act or refrain from acting without seeking the appropriate professional advice.

Vous aimerez peut-être aussi

- Rapidcare Medical Billing ManualDocument93 pagesRapidcare Medical Billing Manualapi-19789919100% (3)

- Affordable Care Act Literature ReviewDocument4 pagesAffordable Care Act Literature Reviewdkrnkirif100% (1)

- Affordable Care Act Term PaperDocument8 pagesAffordable Care Act Term Paperd1jim0pynan2100% (1)

- If You Are Well: Health and Wellness Tips for the Empowered Health Care ConsumerD'EverandIf You Are Well: Health and Wellness Tips for the Empowered Health Care ConsumerPas encore d'évaluation

- A Guide for Medical Case Managers: Stop Loss Insurance for Medical ProfessionalsD'EverandA Guide for Medical Case Managers: Stop Loss Insurance for Medical ProfessionalsPas encore d'évaluation

- Maximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsD'EverandMaximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Research Paper On Employee BenefitsDocument7 pagesResearch Paper On Employee Benefitskrqovxbnd100% (1)

- Literature Review PensionDocument8 pagesLiterature Review Pensionc5mr3mxf100% (1)

- Code from Home: Launch Your Home-Based Medical Billing ServiceD'EverandCode from Home: Launch Your Home-Based Medical Billing ServiceÉvaluation : 5 sur 5 étoiles5/5 (1)

- Real World Medicine: What Your Attending Didn't Tell You and Your Professor Didn't KnowD'EverandReal World Medicine: What Your Attending Didn't Tell You and Your Professor Didn't KnowPas encore d'évaluation

- International HRMDocument2 pagesInternational HRMLovely Audrey IgotPas encore d'évaluation

- Sebelius Medicare BrochureDocument4 pagesSebelius Medicare BrochureErick BrockwayPas encore d'évaluation

- Medicare Term PaperDocument4 pagesMedicare Term Paperafdtzvbex100% (1)

- The Finance of Health Care: Wellness and Innovative Approaches to Employee Medical InsuranceD'EverandThe Finance of Health Care: Wellness and Innovative Approaches to Employee Medical InsurancePas encore d'évaluation

- Thesis Workers CompensationDocument5 pagesThesis Workers Compensationhollyvegacorpuschristi100% (2)

- Supplemental BenefitsDocument7 pagesSupplemental Benefitsshubhankar paulPas encore d'évaluation

- The Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansD'EverandThe Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansPas encore d'évaluation

- President & CEO: Message From TheDocument7 pagesPresident & CEO: Message From Theneyj_8Pas encore d'évaluation

- Medicare ThesisDocument5 pagesMedicare Thesisnicolekatholoverlandpark100% (2)

- Affordable Healthcare Act Research PaperDocument4 pagesAffordable Healthcare Act Research Papergz98szx1100% (1)

- The New Health Insurance Solution: How to Get Cheaper, Better Coverage Without a Traditional Employer PlanD'EverandThe New Health Insurance Solution: How to Get Cheaper, Better Coverage Without a Traditional Employer PlanÉvaluation : 4 sur 5 étoiles4/5 (1)

- Thesis Statement About Canadian Health CareDocument8 pagesThesis Statement About Canadian Health Careaprildavislittlerock100% (2)

- Pharmacy Daily For Mon 03 Sep 2012 - Corum Profit Soars, Pharmacy Scoopon, MD Injunction, Stopping Script Shopping and Much More...Document3 pagesPharmacy Daily For Mon 03 Sep 2012 - Corum Profit Soars, Pharmacy Scoopon, MD Injunction, Stopping Script Shopping and Much More...pharmacydailyPas encore d'évaluation

- Financial Strategies for the Successful Physician: Helping Successful People Continue Toward Their Life's GoalsD'EverandFinancial Strategies for the Successful Physician: Helping Successful People Continue Toward Their Life's GoalsPas encore d'évaluation

- Social Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceD'EverandSocial Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlacePas encore d'évaluation

- Thesis Statement Against The Affordable Care ActDocument6 pagesThesis Statement Against The Affordable Care Actjanetrobinsonjackson100% (2)

- Best Practice News Alert No 176 - New Laws and New PenaltiesDocument5 pagesBest Practice News Alert No 176 - New Laws and New PenaltiesDavidDahmPas encore d'évaluation

- US Healthcare System Analysis v2-0Document31 pagesUS Healthcare System Analysis v2-0Achintya KumarPas encore d'évaluation

- Research Paper On MedicaidDocument7 pagesResearch Paper On Medicaidafnkhujzxbfnls100% (1)

- Medicaid Term PaperDocument8 pagesMedicaid Term Paperc5qz47sm100% (1)

- Thesis Health InsuranceDocument5 pagesThesis Health Insuranceamandadetwilerpeoria100% (2)

- Risky Business: Sharing Health Data While Protecting PrivacyD'EverandRisky Business: Sharing Health Data While Protecting PrivacyPas encore d'évaluation

- Beating Obamacare 2014: Avoid the Landmines and Protect Your Health, Income, and FreedomD'EverandBeating Obamacare 2014: Avoid the Landmines and Protect Your Health, Income, and FreedomPas encore d'évaluation

- Final Project For HINT 220Document16 pagesFinal Project For HINT 220Maxine WhitePas encore d'évaluation

- A Message From Our Captain: Helping To Navigate The Troubled Waters of Workers CompensationDocument6 pagesA Message From Our Captain: Helping To Navigate The Troubled Waters of Workers Compensationjcarey13Pas encore d'évaluation

- Medicare Research Paper TopicsDocument4 pagesMedicare Research Paper Topicsm1dyhuh1jud2100% (1)

- Thesis On Health InsuranceDocument8 pagesThesis On Health Insurancekimberlyjonesnaperville100% (2)

- Health Economics PHD Thesis TopicsDocument5 pagesHealth Economics PHD Thesis TopicsBuySchoolPapersSingapore100% (1)

- Research Paper Employee BenefitsDocument7 pagesResearch Paper Employee Benefitspdtgpuplg100% (1)

- Benefit Newsletter201112Document8 pagesBenefit Newsletter201112Latisha WalkerPas encore d'évaluation

- Cite HR 2Document13 pagesCite HR 2juhi_me_30Pas encore d'évaluation

- Sample Research Paper On Health Care ReformDocument7 pagesSample Research Paper On Health Care Reformnoywcfvhf100% (1)

- Sharon Hollander ThesisDocument5 pagesSharon Hollander ThesisOrderPapersOnlineWorcester100% (2)

- Insurance Research Paper TopicsDocument6 pagesInsurance Research Paper Topicsrtggklrif100% (1)

- Many Turning To Personalized Healthcare For Financial Relief Under "Obamacare"!Document21 pagesMany Turning To Personalized Healthcare For Financial Relief Under "Obamacare"!Timothy Christian TePas encore d'évaluation

- Working 4 YouDocument8 pagesWorking 4 Youapi-310517163Pas encore d'évaluation

- Midwest Edition: Vouchers Could Spike PremiumsDocument5 pagesMidwest Edition: Vouchers Could Spike PremiumsPayersandProvidersPas encore d'évaluation

- Health Insurance ThesisDocument5 pagesHealth Insurance Thesisginabuckboston100% (2)

- Health Insurance Dissertation TopicsDocument6 pagesHealth Insurance Dissertation TopicsPapersWritingServiceCanada100% (1)

- Estevan Padilla Annotated Bibliography Final DraftDocument6 pagesEstevan Padilla Annotated Bibliography Final Draftapi-302323953Pas encore d'évaluation

- Affordable Care Act ThesisDocument5 pagesAffordable Care Act Thesisgbtrjrap100% (1)

- Documentation for Skilled Nursing & Long-Term Care: A Guide for Occupational TherapistsD'EverandDocumentation for Skilled Nursing & Long-Term Care: A Guide for Occupational TherapistsPas encore d'évaluation

- Newsletter FinalDocument10 pagesNewsletter FinalPuneet SharmaPas encore d'évaluation

- Pension Dissertation TopicsDocument5 pagesPension Dissertation TopicsSomeoneWriteMyPaperSingapore100% (1)

- Literature Review On Pension SchemeDocument8 pagesLiterature Review On Pension Schemes1bivapilyn2100% (1)

- Summer Internship Project ReportDocument48 pagesSummer Internship Project ReportShalvi Vartak100% (2)

- Outline For Medicaid Research PaperDocument6 pagesOutline For Medicaid Research Paperafnhiheaebysya100% (1)

- EU Manual Version 4 2008Document406 pagesEU Manual Version 4 2008Dobu KolobingoPas encore d'évaluation

- Tube ThoracostomyDocument17 pagesTube ThoracostomyheiyuPas encore d'évaluation

- Aneurysms & Aortic DissectionDocument36 pagesAneurysms & Aortic Dissectionr100% (1)

- Antibody Structure and Function: Parham - Chapter 2Document66 pagesAntibody Structure and Function: Parham - Chapter 2Vishnu Reddy Vardhan PulimiPas encore d'évaluation

- Swen Malte John, Jeanne Duus Johansen, Thomas Rustemeyer, Peter PDFDocument2 597 pagesSwen Malte John, Jeanne Duus Johansen, Thomas Rustemeyer, Peter PDFHardiyanti banduPas encore d'évaluation

- IDL - Final Tir 1400Document630 pagesIDL - Final Tir 1400Atlasgen TradePas encore d'évaluation

- Doming The Diaphragm in A Patient With Multiple SclerosisDocument2 pagesDoming The Diaphragm in A Patient With Multiple SclerosisFabrizio PaglierucciPas encore d'évaluation

- Cellular and Molecular Immunology Module1: IntroductionDocument32 pagesCellular and Molecular Immunology Module1: IntroductionAygul RamankulovaPas encore d'évaluation

- Career 1Document2 pagesCareer 1api-387334532Pas encore d'évaluation

- Slim SpurlingDocument217 pagesSlim SpurlingEli king100% (1)

- Synaptic TransmissionDocument11 pagesSynaptic TransmissionSharmaine TolentinoPas encore d'évaluation

- Genuine Works of HippocratesDocument494 pagesGenuine Works of HippocratesThrice_Greatest100% (1)

- Skin Whitening Cosmetics Feedback and Challenges I PDFDocument24 pagesSkin Whitening Cosmetics Feedback and Challenges I PDFSandeep RautPas encore d'évaluation

- EL TENDON Valoracion y Tratamiento en Fi-121-180Document60 pagesEL TENDON Valoracion y Tratamiento en Fi-121-180doradoPas encore d'évaluation

- Case - Pediatric Community Acquired Pneumonia PCAPDocument6 pagesCase - Pediatric Community Acquired Pneumonia PCAPMedical Clerk100% (1)

- Positive Affirmations: 101 Life-Changing Thoughts To Practice DailyDocument10 pagesPositive Affirmations: 101 Life-Changing Thoughts To Practice DailyWindi Dawn Salleva100% (2)

- Laserdoctor-LGM Operation ManualDocument48 pagesLaserdoctor-LGM Operation ManualJames ScurryPas encore d'évaluation

- 7 Myths About BreastfeedingDocument3 pages7 Myths About BreastfeedingRuan MarchessaPas encore d'évaluation

- Anti-Obesity MedicationsDocument33 pagesAnti-Obesity MedicationsJorge Luis Alva AlonsoPas encore d'évaluation

- Herbs and Spice List PDFDocument7 pagesHerbs and Spice List PDFapi-230727138Pas encore d'évaluation

- Understanding The Self in Individuals With Autism Spectrum Disorders (ASD) : A Review of LiteratureDocument8 pagesUnderstanding The Self in Individuals With Autism Spectrum Disorders (ASD) : A Review of LiteraturenegriRDPas encore d'évaluation

- Mouth Tongue and Salivary GlandsDocument52 pagesMouth Tongue and Salivary GlandsIrfan FalahPas encore d'évaluation

- Maria Deleanu Carte de BucateDocument68 pagesMaria Deleanu Carte de BucateAnonymous 52KH7Ki95Pas encore d'évaluation

- Pediatrics: Compilation of Tables From Topnotch Pedia HandoutDocument6 pagesPediatrics: Compilation of Tables From Topnotch Pedia HandoutCielo Lomibao0% (1)

- Notice: Environmental Statements Availability, Etc.: Agency Statements— Interregional Research Project (No. 4)Document5 pagesNotice: Environmental Statements Availability, Etc.: Agency Statements— Interregional Research Project (No. 4)Justia.comPas encore d'évaluation

- Gastrointestinal and Esophageal Foreign Bodies in The Dog and CatDocument5 pagesGastrointestinal and Esophageal Foreign Bodies in The Dog and CatMuh Iqbal DjamilPas encore d'évaluation

- 90 TOP THORACIC SURGERY Multiple Choice Questions and Answers PDF 2018Document28 pages90 TOP THORACIC SURGERY Multiple Choice Questions and Answers PDF 2018Ahmed Kassem0% (1)

- Effects of Drug Abuse and Addiction ON SocietyDocument9 pagesEffects of Drug Abuse and Addiction ON SocietyAditya guptaPas encore d'évaluation

- Videsh PrintingDocument22 pagesVidesh PrintingAbroadnayak KumarPas encore d'évaluation

- De 6Document5 pagesDe 6Thao Nguyen100% (2)