Académique Documents

Professionnel Documents

Culture Documents

Des Tin

Transféré par

Sakshi SahaiDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Des Tin

Transféré par

Sakshi SahaiDroits d'auteur :

Formats disponibles

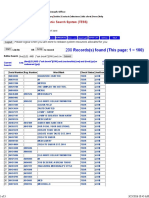

QUESTIONS Question1

Use the Overhead Cost Activity Analysis and other data on manufacturing costs to estimate product costs for valves, pumps, and flow controllers (Activity Based Costing).

The Company is producing 3 major products Valve, Pump and Flow Controller. Currently it is using traditional accounting system, Unit of product is charged for material cost, labor cost (standard time for labor times the labor pay rate $16 per hour) and overhead cost. OH cost assigned to production on basis of production run labor cost. A better way to do costing is to do Activity Based Costing with assigning costs to different transaction.

Activity Receiving Material Handling Maintenance Depreciation Packaging/shippi ng Engg Set up OH/Unit Direct Mat cost Direct Lab cost Cost/unit Actual Selling price Markup

Valve 600 6000 10500 94500 1800

Pump 3800 38000 17400 156600 13800

Flow contrioller 15600 156000 2100 18900 43800

20000 128 17.8 16 4 37.8 57.7 34.5

30000 640 20.8 20 8 48.8 81.2 39.9

50000 1290 71.9 22 6.4 100.3 97.7 -3.3

Previous markup

35

22

42

Based on this calculation, we can see that the markup of pumps is much higher than what was earlier calculated. Hence price of pumps can be reduced. However there is a need to increase the price of flow controllers

Question 2

Compare the estimated costs you calculate to existing standard unit costs and the revised unit costs. What causes the different product costing methods to produce such different results?

The subsequent table highlights only the most significant changes in overhead cost allocation. Material and labor cost were not affected by the costing method and have thus been neglected. Please refer the table given in answer 1, If we look at the ABC costing method stems mainly from allocating differently the engineering, packaging and shipping costs as well as the receiving and handling costs. This is due to the higher number of transactions necessary to produce the flow controllers. This aspect is ignored in the former method. For the R&D costs, the ABC method is also superior and closer to reality, meaning that the flow controllers are allocated a higher percentage of total costs.

Question 3

What are the strategic implications of your analysis? What actions would you recommend to the managers at Destin Brass Products Co?

Valves: There is little change in costs with ABC method. Profit margin is close to the target of 35%. Hence no need to revise prices

Pumps: Profit margin is recalculated as 40%. Hence prices can be lowered in to get to a margin of 35% to compete in the market

Flow controller: There is a loss for this product as per the new accounting method. Target price should be around $135 based on 35% margins.

Desin Brass should keep using ABC costing in future also to remain competitive in the market.

Question 4

How much higher or lower would the net income reported under the activitytransaction-based system be than the net income that will be reported under the present, more traditional system? Why?

valves ABC standard cost unit price profit margin(%) Targeted Profit Margin net income as per ABC earlier net income 37.7 57.78 34.64 35 15012 8.3 15165 0

pumps 48.8 81.26 39.86 35 40483 9.3 22675 0

flow controllers 100.3 97.07 -3.58 35 -13882.64 162280

Total Income($)

541085 540680

There is no major difference in the net income using standard cost and ABC method cost.

Vous aimerez peut-être aussi

- Nist - SP 800 153Document24 pagesNist - SP 800 153Sakshi SahaiPas encore d'évaluation

- Management of Risk - Principles and Concepts PDFDocument52 pagesManagement of Risk - Principles and Concepts PDFAli MohdPas encore d'évaluation

- Hiring Without FiringDocument1 pageHiring Without FiringSakshi SahaiPas encore d'évaluation

- An OvaDocument1 pageAn OvaSakshi SahaiPas encore d'évaluation

- 2009 Ibm AnnualDocument136 pages2009 Ibm AnnualVivek KashniaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- TBCH04Document14 pagesTBCH04Shayne LimPas encore d'évaluation

- Action1 Test U7 1Document4 pagesAction1 Test U7 1Ñlkj Ñlkj100% (1)

- 118 Homework QuestionsDocument3 pages118 Homework QuestionscarlacauntayPas encore d'évaluation

- ArtisteDocument15 pagesArtisteRojin Georjee KoshyPas encore d'évaluation

- Chester Properties GroupDocument55 pagesChester Properties GroupkflimPas encore d'évaluation

- Portfolio AnalysisDocument36 pagesPortfolio Analysissalman200867100% (2)

- Global Marketing Strategy of Coca-ColaDocument2 pagesGlobal Marketing Strategy of Coca-ColaRimsha shakirPas encore d'évaluation

- Industrial Visit Report of Surya NepalDocument24 pagesIndustrial Visit Report of Surya NepalSuman Poudel0% (1)

- Pmo Framework and Pmo Models For Project Business ManagementDocument22 pagesPmo Framework and Pmo Models For Project Business Managementupendras100% (1)

- Standard Costing Practice QuestionsDocument3 pagesStandard Costing Practice Questionsmohammad AliPas encore d'évaluation

- C 7 A 7 D 97 Fe 120 e 81 F 0170Document14 pagesC 7 A 7 D 97 Fe 120 e 81 F 0170api-406646129Pas encore d'évaluation

- C1 Entrepreneurship ModuleDocument19 pagesC1 Entrepreneurship ModuleLENA ELINNA OLIN BINTI AMBROSEPas encore d'évaluation

- List of Cost CenterDocument1 pageList of Cost Centersivasivasap100% (1)

- Cash Flow StatementDocument46 pagesCash Flow StatementSiraj Siddiqui100% (1)

- Investments, Chapter 4: Answers To Selected ProblemsDocument5 pagesInvestments, Chapter 4: Answers To Selected ProblemsRadwan MagicienPas encore d'évaluation

- Tarea de InglesDocument3 pagesTarea de Inglesmariapaniagua83Pas encore d'évaluation

- Shams Dubai Consultants and Contractor ListDocument2 pagesShams Dubai Consultants and Contractor ListIshfaq AhmedPas encore d'évaluation

- UNITED - Flight World MapDocument1 pageUNITED - Flight World MaparquitrolPas encore d'évaluation

- Entrepreneurial Finance ResourcesDocument6 pagesEntrepreneurial Finance Resourcesfernando trinidadPas encore d'évaluation

- Examination No. 1Document4 pagesExamination No. 1Cristel ObraPas encore d'évaluation

- McDonalds' Trademark RegistrationsDocument10 pagesMcDonalds' Trademark RegistrationsDaniel BallardPas encore d'évaluation

- Business Proposal FormatDocument4 pagesBusiness Proposal FormatAgnes Bianca MendozaPas encore d'évaluation

- Olympics, A Zim AppraisalDocument3 pagesOlympics, A Zim Appraisalbheki213Pas encore d'évaluation

- Images Janatics Brief ProfileDocument18 pagesImages Janatics Brief ProfileHarsha KolarPas encore d'évaluation

- GRE Data InterpretationDocument19 pagesGRE Data InterpretationVikram JohariPas encore d'évaluation

- 2 SJ 117Document3 pages2 SJ 117Nacho ConsolaniPas encore d'évaluation

- Sushant SrivastavaDocument90 pagesSushant SrivastavaKamal KiranPas encore d'évaluation

- WNS PresentationDocument24 pagesWNS PresentationRohit Prasad100% (1)

- Freemark Abbey WineryDocument14 pagesFreemark Abbey WineryKunal Kaushal100% (1)

- Sworn Statement of Assets, Liabilities and Net WorthDocument4 pagesSworn Statement of Assets, Liabilities and Net WorthLance Aldrin AdionPas encore d'évaluation