Académique Documents

Professionnel Documents

Culture Documents

Agreement of Limited Partnership

Transféré par

Wayne HowardDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Agreement of Limited Partnership

Transféré par

Wayne HowardDroits d'auteur :

Formats disponibles

AGREEMENT OF LIMITED PARTNERSHIP This Agreement of Limited Partnership is entered into and effective as of the __th day of __________,

199_ by and between _________________ the "General Partner" and __________ the "Limited Partner".

ARTICLE I FORMATION OF LIMITED PARTNERSHIP 1.01 PARTNERSHIP FORMATION AND PURPOSE. The parties hereto hereby form a limited partnership (the "Partnership") pursuant to the January 1, 2008, the California Uniform Limited Partnership Act of 2008 (the "Act"). 1.02 PURPOSE. The purpose of the Partnership is to enter into exclusive recording, publishing, and songwriter agreements with musical talent, to record, publish, manufacture, and distribute phonorecords to the public for profit . The Partnership anticipates the recording, release, and promotion of at least 2 (two) long playing albums per year. The Partnership anticipates the acquisition of the copyrights for at least 50 (fifty) musical compositions per year. The Partnership shall be the sole owner of the copyrights for all musical compositions acquired by the Partnership. In addition, the exclusive services of ___________(Artist/optional)________ shall be rendered unto the Partnership for the term of this Agreement. The Partnership shall hold sole possession of these musical copyrights unless assigned or sold to another publishing concern. The purpose of the Partnership is to acquire, produce, and market for profit, master recordings of the artists and talent acquired by the Partnership. 1.03 NAME. The name of the Partnership shall be __________. The Partnership shall do business under this and no other name. 1.04 ORGANIZATION CERTIFICATES. The parties shall cause to be executed and filed: (a) Certificate of Limited Partnership in connection with Section 3(a)(1) of the Act; (b) Certificates as required by the Assumed Name Act in each jurisdiction in which the Partnership has a place of business; and (c) All such other certificates, notices, statements, or other instruments required by law for the formation and operation of a limited partnership. 1.05 AFFILIATIONS. The Partnership or its publishing arm shall be an affiliate of both Broadcast Music Inc. (B.M.I.) and the American Society of Composers, Authors, and Publishers (A.S.C.A.P.) for the purpose of collecting royalty payments due it's artists and publishing concerns. 1.06 PRINCIPLE PLACE OF BUSINESS. The principle place of business of the Partnership shall be __(street)_________________,__(city,state)_______________, or such other place as the General Partner may, from time to time, designate by notice to the Limited Partner. The Partnership may maintain such other offices at such other places as the General Partner may determine to be in the best interest of the Partnership.

ARTICLE II DEFINITIONS

The following terms, when used herein, unless the context indicates otherwise, have the meanings assigned to them in this Article II: (a) ADMINISTRATIVE AND OVERHEAD EXPENSES": Those customary, routine, and necessary costs and expenses incurred or generated by the General Partner which are associated with or attributable to administration of the business of the Partnership. (b) "AGREEMENT": Shall mean this Agreement of Limited Partnership. (c) "CERTIFICATE": Shall mean the Certificate of Limited Partnership. (d) "COMMENCEMENT DATE": Shall mean the date of execution of this Agreement. (e) "CONTRIBUTION PERCENTAGE": Shall mean the percentage which each Partner's respective Capital Contribution bears to the total of all Capital Contributions. (f) "GENERAL PARTNER": Shall mean _______________________. (g) "LIMITED PARTNER": Shall mean _______________________. (h) "CAPITAL CONTRIBUTIONS": Shall mean the initial contributions of the Limited Partner which shall aggregate not less than $____________(dollars). (i) "PARTNER": Shall mean both the General Partner and the Limited Partner. (j) "PARTNERSHIP PROPERTY": Shall mean all property owned or acquired by the Partnership. (k) "PAYOUT": Shall mean the date as of which the Limited Partner has received cash distributions from the Partnership aggregating 100% (one hundred percent) of his Capital Contributions. (l) "SHARING PERCENTAGES": Shall mean the percentage in which each Partner shares in the costs, revenues, and items of income, gain, loss, deduction, and credit arising therefrom and cash and/or property distributions of the Partnership, as more particularly set out in Articles IV, VII, and VIII of this Agreement.

ARTICLE III TERM OF THE PARTNERSHIP 3.01 The Partnership shall be effective as to the General Partner and the Limited Partner from and after the date first above shown and shall continue in existence until December 31, 1999, at which time it shall terminate unless sooner terminated pursuant to any provisions of this Agreement.

ARTICLE IV SHARING PERCENTAGES OF PARTNER 4.01 TAX LOSSES PER FORM 1065:

(a) The Sharing Percentages of the Partners from commencement date until losses as per Form 1065 equal the amount of their respective capital contributions shall be: GENERAL PARTNER 20% LIMITED PARTNER 80% (b) The Sharing Percentages of the Partners from the date the losses as per Form 1065 equal the amount of their respective capital contributions until Payout shall be: GENERAL PARTNER 50% LIMITED PARTNER 50% (c) The Sharing Percentages of the Partners after Payout shall be: GENERAL PARTNER 50% LIMITED PARTNER 50% 4.02 TAXABLE INCOME PER FORM 1065 (a) Prior to Payout: GENERAL PARTNER 40% LIMITED PARTNER 60% (b) After Payout: GENERAL PARTNER 60% LIMITED PARTNER 40%

ARTICLE V CAPITAL CONTRIBUTIONS OF PARTNERS 5.01 CAPITAL CONTRIBUTIONS. The Capital Contributions of the Partners shall aggregate not less than $51,000 (fifty one thousand dollars) shall be made as follows: (a) GENERAL PARTNER $ __________ (b) LIMITED PARTNER $ _________ payable upon execution of this Agreement. 5.02 ASSESSMENTS AND ADDITIONAL CONTRIBUTIONS. No assessments of additional contributions shall be required of the Partners.

ARTICLE VI CAPITAL ACCOUNTS

6.01 CAPITAL ACCOUNTS. Capital accounts shall be established and maintained for each Partner and shall be adjusted as follows: (a) The capital account of each Partner shall be increased by: (1) The amount of his capital contribution to the Partnership; (2) The amount of net income from operations allocated to such Partner pursuant to Article VII. (b) The capital account of each Partner shall be decreased by: (1) The amount of losses from operations allocated to such Partner pursuant to Article VII; (2) All amounts of money and the fair market value of property paid or distributed to such Partner pursuant to the terms hereof (other than payments made with respect to loans made by such Partner to Partnership. 6.02 CALCULATION OF CAPITAL ACCOUNT. Except as may otherwise be provided herein, whenever it is necessary to determine the capital account of any partner, the capital account of such Partner shall be determined after giving effect to the allocation of the gains, income, loss, deductions, contributions and distributions as of the last day of the preceding calendar quarter. 6.03 WITHDRAWAL OF CAPITAL. A Partner shall not be entitled to withdraw any part of his capital account or to receive any distribution from the Partnership except as herein. 6.04 INTEREST ON CAPITAL ACCOUNTS. No interest shall be paid on any Capital Contribution to the Partnership.

ARTICLE VII INTEREST OF PARTNERS IN INCOME AND LOSS 7.01 DETERMINATION OF INCOME AND LOSS. At the end of each Partnership fiscal year, and at such other time as the General Partner shall deem necessary or appropriate, each item of Partnership income, expense, gain, loss and deduction shall be determined for the period then ending and shall be allocated among the Partners in accordance with the applicable Sharing Percentages as set forth in Article IV. 7.02 RECAPTURE. In the event that the Partnership recognizes income, gain or additions to tax by virtue of the recapture of any previously deducted or credited item, such recaptured income or gain or addition to tax shall be allocated to such Partner as were allocated such item at the time of its deduction.

ARTICLE VIII INTEREST OF PARTNERS IN CASH CONTRIBUTIONS 8.01 GROSS INCOME AND NET INCOME. "Net Income" shall mean the total gross income of the Partnership, less cash operating expenses, debt service, interest, and principle on loans made to the Partnership and all other cash expenditures of the Partnership. For purposes of determining Net Cash Flow, "Gross Income" shall mean proceeds from any source whatsoever, but excluding any Capital Contributions of the Partners.

8.02 DISTRIBUTION OF CASH. Subject to the terms of this Agreement, the General Partner shall make distributions of cash out of Partnership income, to the extent deemed available, in the following manner: (a) CASH FLOW FROM OPERATIONS. Except as provided in Article 6a. (b) AS PER ARTICLE IV. Cash distributions shall be distributed in accordance with the appropriate Sharing Percentages as set forth in Article IV hereof. (c) PROCEEDS AVAILABLE FROM DISSOLUTION. Upon dissolution and termination of the Partnership, the proceed from the sale of all or substantially all of the Partnership Property shall be distributed in the following order of priority: (1) There shall be distributed to the Partnership creditors (other than partners) funds to the extent available, sufficient to extinguish current Partnership liabilities and obligations, including costs and expenses of liquidation; (2) Any loans owed by the Partnership to the Partners shall be paid; and (3) The balance shall be distributed to the Partners in accordance with the proper Sharing Percentage as set forth in Article 4.02.

ARTICLE IX OWNERSHIP OF PARTNERSHIP PROPERTY

9.01 OWNERSHIP OF COPYRIGHTS. The Partnership shall own for a period of fifty (50) years all musical compositions which were written by ________________________ or any other copyrights acquired by the Partnership under the term herein. 9.02 COPYRIGHT REVERSION. The ownership of copyrights exclusive of all musical compositions written by ________________________________, or other artist, and not commercially released on a phonorecord during the term of such Agreement shall, in some cases, automatically revert back to the Songwriter upon termination of the Songwriter Agreement and any extensions or renewals thereof. Ownership in and to any musical composition which is commercially released to the public by the Partnership shall remain Partnership property subject to the terms contained in this Agreement and the Songwriter Agreement. 9.03 MASTER RECORDINGS. The Partnership shall own all master tape recordings produced by the Partnership for promotion or resale.

ARTICLE X OPERATION OF PARTNERSHIP 10.01 ADMINISTRATIVE AND OVERHEAD EXPENSES. The Partnership shall reimburse the General Partner for Administrative and Overhead Expenses incurred by him on behalf of the Partnership.

10.02 INDEPENDENT SERVICES. All costs and charges of outside professional services, if any, which are related to the Partnership business, including legal fees and any independent accounting and auditing fees and fees incurred in connection with preparing Partnership federal income tax returns, shall be performed under the direction of the General Partner and shall be charged to the Partnership in accordance with generally accepted accounting procedures and practices.

ARTICLE XI ACCOUNTING

11.01 ELECTIONS. The Partnership shall elect as a fiscal year the calendar year and shall elect to be taxed on such method of accounting as the General Partner shall determine. The Partnership shall not elect to be taxed other than as a Partnership. 11.02 BOOKS. The Partnership shall be kept at the General Partners office in __(CITY/STATE)__. The Limited Partner shall, at all reasonable times during regular business hours, have access to such books for the purpose of inspecting and copying them. The accounts shall readily disclose all items which each Partner is required to take into account separately for income tax purposes. As to the matter of accounting not provided for in this Agreement, generally accepted accounting principles shall govern. 11.03 BANK ACCOUNTS. The Partnership shall maintain separate accounts in its name in one or more banks and the cash funds of the Partnership shall be kept in such accounts as determined by the General Partner.

ARTICLE XII RIGHTS AND OBLIGATIONS OF LIMITED PARTNERS 12.01 PARTICIPATION IN MANAGEMENT. The Limited Partner shall not have the right, power, or authority to participate in the ordinary and routine management of Partnership affairs or to bind the Partnership in any manner. 12.02 LIMITED LIABILITY. The Limited Partner shall not be liable for losses, debts, or obligations of the Partnership in excess of his Capital Contribution. 12.03 RIGHTS TO ENGAGE IN OTHER VENTURES. The Limited Partner (or any other officer, director, shareholder or other person holding a legal or beneficial interest in any Limited Partner) shall not be prohibited from or restricted in engaging in or possession of an interest in any other business venture of like or similar nature. 12.04 SPECIFIC RIGHTS. The Limited Partner shall have the same rights as the General Partner to: (a) have the Partnership books kept at the principal place of business of the Partnership and a formal accounting of Partnership affairs whenever circumstances render it justifiable and reasonable; (b) have on demand true and full information of all things affecting the Partnership and a formal

accounting of Partnership affairs whenever circumstances render it justifiable and reasonable. 12.05 LIMITS OF TRANSFERABILITY. The interest of the Limited Partner may not be transferred without the express written approval of the General Partner.

ARTICLE XIII POWERS, DUTIES AND LIMITATIONS OF GENERAL PARTNER 13.01 MANAGEMENT OF THE PARTNERSHIP. The General Partner shall have full, exclusive and complete discretion in the management and control of the Partnership. The General Partner agrees to manage and control the affairs of the Partnership to the best of his ability and to conduct the operations contemplated under this Agreement in a careful and prudent manner and in accordance with good industry practice. The General Partner shall only be required to devote such part of his time as is reasonably needed to manage the business of the Partnership, it being understood that the General Partner shall not be required to devote his time exclusively to the Partnership. 13.02 COMPENSATION TO THE GENERAL PARTNER. The General Partner shall receive up to _____(Amount/Optional)_____ dollars per month as an advance against his share in cash disbursements of the partnership. Any portion of such cash advances to the General Partner from the Partnership shall be deducted from the General Partner's share in cash disbursements. 13.03 ADMISSION OF LIMITED PARTNERS. No additional Limited Partners shall be admitted to the Partnership without the consent of the Limited Partner. 13.04 SPECIFIC LIMITATIONS. The General Partner shall not, except as herein provided, without written consent of the Limited Partner: (a) Do any act in contravention of this Agreement; (b) Do any act which would make it impossible to carry on the ordinary business of the Partnership; (c) Confess a judgement against the Partnership; (d) Possess Partnership property, or assign its specific rights in specific Partnership property, for other than a Partnership purpose; (e) Admit a person as a General or Limited Partner. 13.05 SPECIFIC POWERS. The General Partner shall have the following power and duties: (a) With the approval of the Limited Partner, to cause the dissolution and winding up of the Partnership; (b) To collect all monies due the Partnership; (c) To establish, maintain, and supervise the deposits and withdrawals of funds into bank accounts of the Partnership; (d) To employ accountants or prepare required tax returns. The fee for preparation of such tax returns shall be an expenses of the Partnership.

(e) To employ attorneys for Partnership purposes. Any such attorney's fees and expenses incident thereto shall be an expense of the Partnership. 13.06 AMENDMENTS. Amendments to this Agreement may be proposed by the General Partner or by the Limited Partner. 13.07 LIMITATION ON DUTY. Notwithstanding anything to the contrary contained in this Article or elsewhere in this Agreement, the General Partner shall have no duty to take affirmative action with respect to management of the Partnership business or property which might require the expenditure of monies by the Partnership or the General Partner unless the Partnership is then possessed of such monies available for the proposed expenditure. Under no circumstances shall the General Partner be required to expend personal funds in connection with the Partnership business. 13.08 PRESUMPTION OF POWER. The execution by the General Partner of the contracts or agreements relating to Partnership business shall be sufficient to bind the Partnership. No person dealing with the General Partner shall be required to determine his authority to make or execute any undertaking on behalf of the Partnership, nor determine any fact or circumstances bearing upon the existence of his authority nor to see the application or distribution of revenue or proceeds derived therefrom, unless and until such persons have received written noticed to the contrary. 13.09 OBLIGATIONS NOT EXCLUSIVE. The General Partner shall devote such time as is reasonably necessary to manage the Partnership's business, it being understood that the General Partner may engage in other employment and other transactions for his own account and for the account of others. General Partner shall not engage in any employment or transactions that would be in direct conflict of interest to the Partnership. 13.10 INDEMNIFICATION OF GENERAL PARTNER. The General Partner shall be indemnified and held harmless by the Partnership from and against any and all claims of any nature, whatsoever, arising out of or incidental to the General Partner's management of Partnership affairs; provided, however, that the General Partner shall not be entitled to indemnification hereunder for liability arising out of gross negligence or willful misconduct of the General Partner or the breach by the General Partner of any provisions of this Agreement. 13.11 LIMITATION OF TRANSFERABILITY. The interest of the General Partner may not be transferred without written approval from the Limited Partner.

ARTICLE XIV DISSOLUTION, TERMINATION AND LIQUIDATION 14.01 DISSOLUTION. Unless provisions of Section 14.01 are elected, the Partnership shall be dissolved and it's business shall be wound up on the earliest to occur: (a) December 31, 2010 (b) The death, resignation, insolvency, bankruptcy or other legal incapacity of the General Partner or any other event which would legally disqualify the General Partner from acting hereunder; or (c) The occurrence of any other event which, by law, would require the Partnership to be dissolved. 14.02 CONTINUATION OF COPYRIGHT OWNERSHIP. The dissolution of the Partnership shall

not effect the rights in and to the copyrights owned by the Partnership. 14.03 OBLIGATIONS ON DISSOLUTION. The dissolution of the Partnership shall not release any of the parties hereto from their contractual obligations under this Agreement. 14.04 LIQUIDATION PROCEDURE. A reasonable time shall be allowed for the orderly liquidation of the assets of the Partnership and the discharge of liabilities to creditors so as to enable the Partnership to minimize the losses normally attendant to a liquidation. (a) Upon dissolution of the Partnership for any reason, the Partners shall continue to receive cash distribution, and provided in Article XIII, subject to the other provisions of this Agreement and to the provisions of subsection (b) hereof and shall share income and losses for all tax and other purposes during the period of liquidation. (b) The General Partner, as liquidator, shall proceed to liquidate the Partnership Properties to the extent that it has not already been reduced to cash unless the General Partner elects to make distributions in kind to the extent and in the manner herein provided and such case, in any, and property in kind, shall be applied and distributed in accordance with Section 8.02 (b). 14.05 DEATH OR INSANITY OF THE LIMITED PARTNER. The death or insanity of a Limited Partner shall have no effect on the life of the Partnership and the Partnership shall not be dissolved thereby.

ARTICLE XV MISCELLANEOUS 15.01 NOTICES. Notices or instruments of any kind which may be or are required to be given hereunder by any Partner to another shall be in writing and deposited in the United States Mail, certified or registered, postage prepaid, addressed to the respective Partner at the address appearing in the records of the Partnership. The Partners may change their address by giving notice in writing, stating their new address, to the other Partner. 15.02 LOAN TO THE PARTNERSHIP. If the Limited Partner shall, in addition to his Capital Contribution to the Partnership, lend any monies to the Partnership, the amount of any such loan shall not increase his capital account nor shall it entitle him to any increases in his share of the distribution of the Partnership, but the amount of any such loan shall be an obligation on the part of the Partnership to such Partner and shall be repaid to him on the terms and at the interest rate evidenced by a promissory note executed by the General Partner, except that the General Partner shall not be personally obligated to repay the loan, which shall be payable and collectable only out of the assets of the Partnership. 15.03 POWER OF ATTORNEY. By the execution of this Agreement, the Limited Partner does irrevocably constitute and appoint the General Partner his true and lawful attorney-in-fact and agent to effectuate and to act in his name, place, and stead, in effectuating the purposes of the Partnership including the execution, verification, acknowledgement, delivery, filing and recording of this Agreement as well as all authorized amendments thereto, all assumed name certificates, documents, bills of sale, and all other documents which may be required to effect the continuation of the Partnership and which the General Partner deems necessary or reasonably appropriate. The power of attorney granted herein shall be deemed to be coupled with an interest, shall be irrevocable and survive the death, incompetence, or legal disability of a Limited Partner.

15.04 ___(STATE)____ LAWS GOVERN. This Agreement shall be construed in accordance with the laws of the State of ________ . 15.05 COUNTERPARTS. This Agreement may be executed in multiple counterparts, each of which shall be an original but all of which shall constitute an instrument. 15.06 BINDING EFFECT. This Agreement shall be binding upon and shall inure to the benefit of the Partners and their spouses, as well as their respective heirs, legal representatives, successors and assigns. 15.07 PARAGRAPH TITLES. Paragraph titles are for descriptive purposes only and shall not control or alter the meaning of this Agreement as set forth in the text.

EXECUTED as of the date herein first above stated.

________________________________ LIMITED PARTNER ________________________________ GENERAL PARTNER

#2 SAMPLE PARTNERSHIP AGREEMENT PARTNERSHIP AGREEMENT THIS PARTNERSHIP AGREEMENT ("Agreement") made and effective this [date], by and between the following individuals, referred to in this Agreement as the "Partners": [list names of partners]. The Partners wish to set forth, in a written agreement, the terms and conditions by which they will associate themselves in the Partnership. NOW, THEREFORE, in consideration of the promises contained in this Agreement, the Partners affirm in writing their association as a partnership in accordance with the following provisions: 1. Name and Place of Business. The name of the partnership shall be called [name of partnership] (the "Partnership"). Its principal place of business shall be [city and state of principal place of business], until changed by agreement of the Partners, but the Partnership may own property and transact business in any and all other places as may from time to time be agreed upon by the Partners. 2. Purpose. The purpose of the Partnership shall be to [describe business purpose]. The Partnership may also engage in any and every other kind or type of business, whether or not pertaining to the foregoing, upon which the Partners may at any time or from time to time agree. 3. Term.

The Partnership shall commence as of the date of this Agreement and shall continue until terminated as provided herein. 4. Capital Accounts. A. The Partners shall make an initial investment of capital, contemporaneously with the execution of this Agreement, as follows: Partners and Capital [list partners' names and amounts invested] In addition to each Partner's share of the profits and losses of the Partnership, as set forth in Section 5, each Partner is entitled to an interest in the assets of the Partnership. B. The amount credited to the capital account of the Partners at any time shall be such amount as set forth in this Section 4 above, plus the Partner's share of the net profits of the Partnership and any additional capital contributions made by the Partner and minus the Partner's share of the losses of the Partnership and any distributions to or withdrawals made by the Partner. For all purposes of this Agreement, the Partnership net profits and each Partner's capital account shall be computed in accordance with generally accepted accounting principles, consistently applied, and each Partner's capital account, as reflected on the Partnership federal income tax return as of the end of any year, shall be deemed conclusively correct for all purposes, unless an objection in writing is made by any Partner and delivered to the accountant or accounting firm preparing the income tax return within one (1) year after the same has been filed with the Internal Revenue Service. If an objection is so filed, the validity of the objection shall be conclusively determined by an independent certified public accountant or accounting firm mutually acceptable to the Partners. 5. Profits and Losses. Until modified by mutual consent of all the Partners, the profits and losses of the Partnership and all items of income, gain, loss, deduction, or credit shall be shared by the Partners in the following proportions: Partner and Shares [list partners' names and percent of profits or losses] 6. Books and Records of Account. The Partnership books and records shall be maintained at the principal office of the Partnership and each Partner shall have access to the books and records at all reasonable times. 7. Future Projects. The Partners recognize that future projects for the Partnership depend upon many factors beyond present control, but the Partners wish to set forth in writing and to mutually acknowledge their joint understanding, intentions, and expectations that the relationship among the Partners will continue to flourish in future projects on similar terms and conditions as set forth in this Agreement, but there shall be no legal obligations among the Partners to so continue such relationship in connection with future projects. 8. Time and Salary. Until and unless otherwise decided by unanimous agreement of the Partners, [list time commitments]. Each Partner shall nonetheless be expected to devote such time and attention to Partnership affairs as shall from time to time be determined by agreement of the Partners. No Partner shall be entitled to any salary or to any compensation for services rendered to the Partnership or to another Partner. 9. Transfer of Partnership Interests. A. Restrictions on Transfer. None of the Partners shall sell, assign, transfer, mortgage, encumber,

or otherwise dispose of the whole or part of that Partner's interest in the Partnership, and no purchaser or other transferee shall have any rights in the Partnership as an assignee or otherwise with respect to all or any part of that Partnership interest attempted to be sold, assigned, transferred, mortgaged, encumbered, or otherwise disposed of, unless and to the extent that the remaining Partner(s) have given consent to such sale, assignment, transfer, mortgage, or encumbrance, but only if the transferee forthwith assumes and agrees to be bound by the provisions of this Agreement and to become a Partner for all purposes hereof, in which event, such transferee shall become a substituted partner under this Agreement. B. Transfer Does Not Dissolve Partnership. No transfer of any interest in the Partnership, whether or not permitted under this Agreement, shall dissolve the Partnership. No transfer, except as permitted under Subsection 9.A. above, shall entitle the transferee, during the continuance of the Partnership, to participate in the management of the business or affairs of the Partnership, to require any information or account of Partnership transactions, or to inspect the books of account of the Partnership; but it shall merely entitle the transferee to receive the profits to which the assigning Partner would otherwise be entitled and, in case of dissolution of the Partnership, to receive the interest of the assigning Partner and to require an account from the date only of the last account agreed to by the Partners. 10. Death, Incompetency, Withdrawal, or Bankruptcy. Neither death, incompetency, withdrawal, nor bankruptcy of any of the Partners or of any successor in interest to any Partner shall operate to dissolve this Partnership, but this Partnership shall continue as set forth in Section 3, subject, however, to the following terms and conditions: A. Death or Incompetency. In the event any Partner dies or is declared incompetent by a court of competent jurisdiction, the successors in interest of that Partner shall succeed to the partnership interest of that Partner and shall have the rights, duties, privileges, disabilities, and obligations with respect to this Partnership, the same as if the successors in interest were parties to this Agreement, including, but not limited to, the right of the successors to share in the profits or the burden to share in the losses of this Partnership, in the same manner and to the same extent as the deceased or incompetent Partner; the right of the successors in interest to continue in this Partnership and all such further rights and duties as are set forth in this Agreement with respect to the Partners, the same as if the words "or his or her successors in interest" followed each reference to a Partner; provided, however, that no successor in interest shall be obligated to devote any service to this Partnership and, provided further, that such successors in interest shall be treated as holding a passive, rather than active, ownership investment. B. Payments Upon Retirement or Withdrawal of Partner. (1) Amount of Payments. Upon the retirement or withdrawal of a Partner, that Partner or, in the case of death or incompetency, that Partner's legal representative shall be entitled to receive the amount of the Partner's capital account (as of the end of the fiscal year of the Partnership next preceding the day on which the retirement or withdrawal occurs) adjusted for the following: (a) Any additional capital contributions made by the Partner and any distributions to or withdrawals made by the Partner during the period from the end of the preceding fiscal year to the day on which the retirement or withdrawal occurs; (b) The Partner's share of profits and losses of the Partnership from the end of the preceding fiscal year of the Partnership to the day on which the retirement or withdrawal occurs, determined in accordance with generally accepted accounting principles, consistently applied; and (c) The difference between the Partner's share of the book value of all of the Partnership assets and the fair market value of all Partnership assets, as determined by a fair market value appraisal of all assets. Unless the retiring or withdrawing Partner and the Partnership can agree on one appraiser, three (3) appraisers shall be appointed--one by the Partnership, one by the retiring or

withdrawing Partner, and one by the two appraisers thus appointed. All appraisers shall be appointed within fifteen (15) days of the date of retirement or withdrawal. The average of the three appraisals shall be binding on all Partners. (2) Time of Payments. Subject to a different agreement among the Partners or successors thereto, the amount specified above shall be paid in cash, in full, but without interest, no later than twelve (12) months following the date of the retirement or withdrawal. (3) Alternate Procedure. In lieu of purchasing the interest of the retiring or withdrawing Partner as provided in subparagraph (1) and (2) above, the remaining Partners may elect to dissolve, liquidate and terminate the Partnership. Such election shall be made, if at all, within thirty (30) days following receipt of the appraisal referred to above. 11. Procedure on Dissolution of Partnership. Except as provided in Section 10.B.(3) above, this Partnership may be dissolved only by a unanimous agreement of the Partners. Upon dissolution, the Partners shall proceed with reasonable promptness to liquidate the Partnership business and assets and wind-up its business by selling all of the Partnership assets, paying all Partnership liabilities, and by distributing the balance, if any, to the Partners in accordance with their capital accounts, as computed after reflecting all losses or gains from such liquidation in accordance with each Partner's share of the net profits and losses as determined under Section 5. 12. Title to Partnership Property. If for purposes of confidentiality, title to Partnership property is taken in the name of a nominee or of any individual Partner, the assets shall be considered to be owned by the Partnership and all beneficial interests shall accrue to the Partners in the percentages set forth in this Agreement. 13. Leases. All leases of Partnership assets shall be in writing and on forms approved by all the Partners. 14. Controlling Law. This Agreement and the rights of the Partners under this Agreement shall be governed by the laws of the State of [state of governing law]. 15. Notices. Any written notice required by this Agreement shall be sufficient if sent to the Partner or other party to be served by registered or certified mail, return receipt requested, addressed to the Partner or other party at the last known home or office address, in which event the date of the notice shall be the date of deposit in the United States mails, postage prepaid. 16. General. This Agreement contains the entire agreement of the Partners with respect to the Partnership and may be amended only by the written agreement executed and delivered by all of the Partners. 17. Binding Upon Heirs. This Agreement shall bind each of the Partners and shall inure to the benefit of (subject to the Sections 9 and 10) and be binding upon their respective heirs, executors, administrators, devisees, legatees, successors and assigns. IN WITNESS WHEREOF, the Partners have executed this Agreement the date first above written.

__________________________________________

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Remedial Law Review I: Civil Procedure OverviewDocument27 pagesRemedial Law Review I: Civil Procedure Overviewmelaniem_1100% (1)

- 02 Civil Litigation NLS PDFDocument442 pages02 Civil Litigation NLS PDFAmadi OgbondaPas encore d'évaluation

- Attorneys' Fees Provisions in Contracts Arbitration Provisions in ContractsDocument9 pagesAttorneys' Fees Provisions in Contracts Arbitration Provisions in ContractsamberspanktowerPas encore d'évaluation

- Strict LiabilityDocument11 pagesStrict LiabilityMWAKISIKI MWAKISIKI EDWARDSPas encore d'évaluation

- Caridad Ongsiako, Et. Al Vs Emilia Ongsiako, Et. Al (GR. No. 7510, 30 March 1957, 101 Phil 1196-1197)Document1 pageCaridad Ongsiako, Et. Al Vs Emilia Ongsiako, Et. Al (GR. No. 7510, 30 March 1957, 101 Phil 1196-1197)Archibald Jose Tiago ManansalaPas encore d'évaluation

- Municipal Council of Iloilo v. EvangelistaDocument2 pagesMunicipal Council of Iloilo v. EvangelistaWinterBunBunPas encore d'évaluation

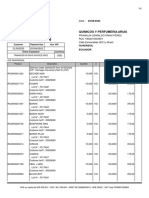

- Factura ComercialDocument6 pagesFactura ComercialKaren MezaPas encore d'évaluation

- Cuozzo Speed Technologies, LLC v. Lee, No. 15-446 (June 26, 2016)Document3 pagesCuozzo Speed Technologies, LLC v. Lee, No. 15-446 (June 26, 2016)Mitali PatelPas encore d'évaluation

- Local Government Legislature 2Document8 pagesLocal Government Legislature 2Rasheed M IsholaPas encore d'évaluation

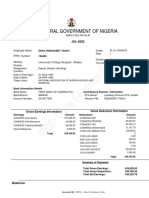

- Federal Pay Slip for Margaret Taiwo GiwaDocument1 pageFederal Pay Slip for Margaret Taiwo GiwaHalleluyah HalleluyahPas encore d'évaluation

- Implementation of EU-Georgia Association Agenda 2017-2020 Assessment by Civil SocietyDocument52 pagesImplementation of EU-Georgia Association Agenda 2017-2020 Assessment by Civil SocietyOSGF100% (4)

- American International University - Bangladesh (AIUB)Document94 pagesAmerican International University - Bangladesh (AIUB)dinar aimcPas encore d'évaluation

- 21 CFR 174 Indirect Food Additives GeneralDocument3 pages21 CFR 174 Indirect Food Additives GeneralJose Jesus Vazquez CarranzaPas encore d'évaluation

- GR 158896 Siayngco Vs Siayngco PIDocument1 pageGR 158896 Siayngco Vs Siayngco PIMichael JonesPas encore d'évaluation

- New customer letterDocument4 pagesNew customer letterBusiness OnlyPas encore d'évaluation

- Updated Bandolera Constitution Appendix A-General InfoDocument3 pagesUpdated Bandolera Constitution Appendix A-General Infoapi-327108361Pas encore d'évaluation

- CHAPTER ONE: Statutes in General Enactment of Statutes: Jural and Generic Jural and ConcreteDocument84 pagesCHAPTER ONE: Statutes in General Enactment of Statutes: Jural and Generic Jural and Concretenigel alinsugPas encore d'évaluation

- Contract Formation Issues in Betty and Albert's Car Sale NegotiationsDocument2 pagesContract Formation Issues in Betty and Albert's Car Sale NegotiationsRajesh NagarajanPas encore d'évaluation

- Red Tape Report: Behind The Scenes of The Section 8 Housing ProgramDocument7 pagesRed Tape Report: Behind The Scenes of The Section 8 Housing ProgramBill de BlasioPas encore d'évaluation

- Leg Res - and Justice For AllDocument4 pagesLeg Res - and Justice For AllbubuchokoyPas encore d'évaluation

- KeelerDocument4 pagesKeelerChris BuckPas encore d'évaluation

- List of Taxpayers For Deletion in The List of Top Withholding Agents (Twas)Document217 pagesList of Taxpayers For Deletion in The List of Top Withholding Agents (Twas)Hanabishi RekkaPas encore d'évaluation

- Guarin v. Limpin A.C. No. 10576Document5 pagesGuarin v. Limpin A.C. No. 10576fg0% (1)

- JOSE C. SABERON v. ATTY. FERNANDO T. LARONGDocument4 pagesJOSE C. SABERON v. ATTY. FERNANDO T. LARONGshienna baccayPas encore d'évaluation

- Javellana Vs TayoDocument1 pageJavellana Vs TayoEman EsmerPas encore d'évaluation

- APR - Form 3Document2 pagesAPR - Form 3Michelle Muhrie TablizoPas encore d'évaluation

- CLAVERIA ActDocument6 pagesCLAVERIA ActCharles Aloba DalogdogPas encore d'évaluation

- Summary judgment on pleadingsDocument3 pagesSummary judgment on pleadingsVloudy Mia Serrano PangilinanPas encore d'évaluation

- Sean Noonan ReportDocument10 pagesSean Noonan ReportDavid GiulianiPas encore d'évaluation

- Letter 2Document2 pagesLetter 2Scott AsherPas encore d'évaluation