Académique Documents

Professionnel Documents

Culture Documents

S I A (SIA) 6 A P: Tandard On Nternal Udit Nalytical Rocedures

Transféré par

Divine Epie Ngol'esuehDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

S I A (SIA) 6 A P: Tandard On Nternal Udit Nalytical Rocedures

Transféré par

Divine Epie Ngol'esuehDroits d'auteur :

Formats disponibles

STANDARD ON INTERNAL AUDIT (SIA) 6 ANALYTICAL PROCEDURES*

Contents

Paragraph(s) Introduction ............................................................................... 1-3 Nature and Purpose of Analytical Procedures........................... 4-9 Analytical Procedures as Risk Assessment Procedures and in Planning the Internal Audit ...................... 10-11 Analytical Procedures as Substantive Procedures ................ 12-14 Analytical Procedures in the Overall Review at the End of the Internal Audit .............................................................15 Extent of Reliance on Analytical Procedures......................... 16-18 Investigating Unusual Items or Trends ................................. 19-20 Effective Date .............................................................................21 The following is the text of the Standard on Internal Audit (SIA) 6, Analytical Procedures, issued by the Council of the Institute of Chartered Accountants of India. These Standards should be read in conjunction with the Preface to the Standards on Internal Audit, issued by the Institute. In terms of the decision of the Council of the Institute of Chartered Accountants of India taken at its 260 th meeting held in June 2006, the following Standard on Internal Audit shall be recommendatory in nature in the initial period. The Standards shall become mandatory from such date as notified by the Council.

Published in the October 2008 issue of The Chartered Accountant.

Standard on Internal Audit (SIA) 6

Introduction

1. The purpose of this Standard on Internal Audit (SIA) is to establish standards on the application of analytical procedures during an internal audit. The internal auditor should apply analytical procedures as the risk assessment procedures at the planning and overall review stages of the internal audit. Risk assessment procedures refer to the internal audit procedures performed to obtain an understanding of the entity and its environment, including the entitys internal control, to identify and assess the risks of material misstatement, whether due to fraud or error, in the information subjected to internal audit. Analytical procedures may also be applied at other stages. Analytical procedures means the analysis of significant ratios and trends, including the resulting investigation of fluctuations and relationships in both financial and non-financial data that are inconsistent with other relevant information or which deviate significantly from predicted amounts. Analytical procedures provide the internal auditor with an efficient and effective means of making an assessment of information collected in an audit. The assessment results from comparing such information with expectations identified or developed by the internal auditor. Analytical procedures include the consideration of comparisons of the entity's financial and non-financial information with, for example: Comparable information for prior periods. Anticipated results of the entity, such as budgets or forecasts or expectations of the internal auditor. Predictive estimates prepared by the internal auditor, such as an estimation of depreciation charge for the year. Similar industry information, such as a comparison of the entity's ratio of sales to trade debtors with industry averages, or with other entities of comparable size in the same industry. 2

2.

3.

Nature and Purpose of Analytical Procedures

4.

Analytical Procedures 5. Analytical procedures also include consideration of relationships: Among elements of financial information that would be expected to conform to a predictable pattern based on the entity's experience, such as gross margin percentages. Between financial information and relevant non-financial information, such as payroll costs to number of employees or total production costs to quantity produced.

6.

7.

Various methods may be used in performing the above procedures. These range from simple comparisons to complex analyses using advanced statistical techniques. Analytical procedures may be applied to consolidated financial statements, financial statements of components (such as subsidiaries, divisions or segments) and individual elements of financial information and relevant non-financial information. The internal auditor's choice of procedures, methods and level of application is a matter of professional judgement. Specific analytical procedures include, but are not limited to ratio, trend, and regression analysis, reasonableness tests, period-to-period comparisons, comparisons with budgets, forecasts, and external economic information. In determining the extent to which the analytical procedures should be used, the internal auditor should consider the following factors, including: The significance of the area being examined. The adequacy of the system of internal control. The availability and reliability of financial and non-financial information. The precision with which the results of analytical procedures can be predicted. The availability and comparability of information regarding the industry in which the organization operates. The extent to which other auditing procedures provide support for audit results. After evaluating the aforementioned factors, the internal auditor should consider and use additional auditing procedures, as necessary, to achieve the audit objective.

Standard on Internal Audit (SIA) 6 8. Analytical procedures are used for the following purposes: to assist the internal auditor as risk assessment procedures to obtain initial understanding of the entity and its environment and thereafter in planning the nature, timing and extent of other internal audit procedures; as substantive procedures when their use can be more effective or efficient than tests of details in reducing detection risk for specific financial statement assertions; as an overall review of the systems and processes in the final review stage of the internal audit; and to evaluate the efficiency of various business/ management systems.

9.

Analytical procedures may identify, among other things, differences that are not expected or absence of differences when they are expected, which may have arisen on account of factors such as errors, frauds, unusual or non recurring transaction or events, etc.

Analytical Procedures as Risk Assessment Procedures and in Planning the Internal Audit

10. The internal auditor should apply analytical procedures as risk assessment procedures to obtain an understanding of the business, the entity and its environment and in identifying areas of potential risk. Application of analytical procedures may indicate aspects of the business of which the internal auditor was unaware and will assist in determining the nature, timing and extent of other internal audit procedures. Analytical procedures in planning the internal audit use both financial and non-financial information, for example, in retail business, the relationship between sales and square footage of selling space or volume of goods sold.

11.

Analytical Procedures as Substantive Procedures

12. The internal auditor's reliance on substantive procedures to reduce detection risk relating to specific financial statement assertions and assertions relating to process, systems and controls may be derived 4

Analytical Procedures from tests of details, from analytical procedures, or from a combination of both. The decision about which procedures to use to achieve a particular internal audit objective is based on the internal auditor's judgement about the expected effectiveness and efficiency of the available procedures in reducing detection risk for specific financial statement assertions or assertions relating to process, systems and controls. 13. The internal auditor will ordinarily inquire of management as to the availability and reliability of information needed to apply analytical procedures and the results of any such procedures performed by the entity. It may be efficient to use analytical data prepared by the entity, provided the internal auditor is satisfied that such data is properly prepared. When intending to perform analytical procedures as substantive procedures, the internal auditor will need to consider a number of factors such as the: Objectives of the analytical procedures and the extent to which their results can be relied upon. Nature of the business, entity and the degree to which information can be disaggregated. Availability of information, both financial, such as budgets or forecasts, and non-financial, such as the number of units produced or sold. Reliability of the information available, for example, whether budgets is prepared with sufficient professional care. Relevance of the information available, for example, whether budgets have been established as results to be expected rather than as goals to be achieved. Source of the information available, for example, sources independent of the entity are ordinarily more reliable than internal sources. Comparability of the information available, for example, broad industry data may need to be supplemented to be comparable to that of an entity that produces and sells specialised products. 5

14.

Standard on Internal Audit (SIA) 6 Knowledge gained during previous internal audits, together with the internal auditor's understanding of the effectiveness of the accounting and internal control systems and the types of problems that in prior periods have given rise to accounting adjustments. Controls over the preparation of the information, for example, controls over the preparation, review and maintenance of MIS reports, budgets, etc.

Analytical Procedures in the Overall Review at the End of the Internal Audit

15. The internal auditor should apply analytical procedures at or near the end of the internal audit when forming an overall conclusion as to whether the systems, processes and controls as a whole are robust, operating effectively and are consistent with the internal auditor's knowledge of the business. The conclusions drawn from the results of such procedures are intended to corroborate conclusions formed during the internal audit of individual components or elements of the financial statements, e.g., purchases, and assist in arriving at the overall conclusion. However, in some cases, as a result of application of analytical procedures, the internal auditor may identify areas where further procedures need to be applied before the internal auditor can form an overall conclusion about the systems, processes and associated controls.

Extent of Reliance on Analytical Procedures

16. The application of analytical procedures is based on the expectation that relationships among data exist and continue in the absence of known conditions to the contrary. The presence of these relationships provides the internal auditor evidence as to the completeness, efficiency and effectiveness of systems, processes and controls. However, reliance on the results of analytical procedures will depend on the internal auditor's assessment of the risk that the analytical procedures may identify relationships as expected when, in fact, a material misstatement exists.

Analytical Procedures 17. The extent of reliance that the internal auditor places on the results of analytical procedures depends on the following factors: materiality of the items involved, for example, when inventory balances are material, the internal auditor does not rely only on analytical procedures in forming conclusions. However, the internal auditor may rely solely on analytical procedures for certain income and expense items when they are not individually material; other internal audit procedures directed toward the same internal audit objectives, for example, other procedures performed by the internal auditor while reviewing the credit management process, in the collectibility of accounts receivable, such as the review of subsequent cash receipts, might confirm or dispel questions raised from the application of analytical procedures to an ageing schedule of customers' accounts; accuracy with which the expected results of analytical procedures can be predicted. For example, the internal auditor will ordinarily expect greater consistency in comparing gross profit margins from one period to another than in comparing discretionary expenses, such as research or advertising; and assessments of inherent and control risks, for example, if internal control over sales order processing is weak and, therefore, control risk is high, more reliance on tests of details of transactions and balances than on analytical procedures in drawing conclusions on receivables may be required.

18.

The internal auditor will need to consider testing the controls, if any, over the preparation of information used in applying analytical procedures. When such controls are effective, the internal auditor will have greater confidence in the reliability of the information and, therefore, in the results of analytical procedures. The controls over non-financial information can often be tested in conjunction with tests of accounting-related controls. For example, an entity in establishing controls over the processing of sales invoices may include controls over the recording of unit sales. In these circumstances, the internal auditor could tests the controls over the recording of unit sales in 7

Standard on Internal Audit (SIA) 6 conjunction with tests of the controls over the processing of sales invoices.

Investigating Unusual Items or Trends

19. When analytical procedures identify significant fluctuations or relationships that are inconsistent with other relevant information or that deviate from predicted amounts, the internal auditor should investigate and obtain adequate explanations and appropriate corroborative evidence. The examination and evaluation should include inquiries of management and the application of other auditing procedures until the internal auditor is satisfied that the results or relationships are sufficiently explained. Unexplained results or relationships may be indicative of a significant condition such as a potential error, irregularity, or illegal act. Results or relationships that are not sufficiently explained should be communicated to the appropriate levels of management. The internal auditor may recommend appropriate courses of action, depending on the circumstances. The investigation of unusual fluctuations and relationships ordinarily begins with inquiries of management, followed by: corroboration of management's responses, for example, by comparing them with the internal auditor's knowledge of the business and other evidence obtained during the course of the internal audit; and consideration of the need to apply other internal audit procedures based on the results of such inquiries, if management is unable to provide an explanation or if the explanation is not considered adequate.

20.

Effective Date

21. This Standard on Internal Audit is applicable to all internal audits commencing on or after ______. Earlier application of the SIA is encouraged.

Vous aimerez peut-être aussi

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18D'EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Pas encore d'évaluation

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19D'EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Pas encore d'évaluation

- Procedures", Issued by The Council of The Institute of Chartered Accountants of India. TheDocument4 pagesProcedures", Issued by The Council of The Institute of Chartered Accountants of India. TheRishabh GuptaPas encore d'évaluation

- Psa 520Document9 pagesPsa 520shambiruarPas encore d'évaluation

- SA 520 (AAS 14) : Nalytical RoceduresDocument10 pagesSA 520 (AAS 14) : Nalytical RoceduresSky509Pas encore d'évaluation

- 1.0 Review of Financial StatementsDocument25 pages1.0 Review of Financial Statementsmujuni brianmjuPas encore d'évaluation

- Analyiticalreviewproceduresandgoingconcern 101105102814 Phpapp01Document67 pagesAnalyiticalreviewproceduresandgoingconcern 101105102814 Phpapp01Mohamed NidhalPas encore d'évaluation

- Planning Key Activities: Objectives, Risk Assessment, Analytical ProceduresDocument3 pagesPlanning Key Activities: Objectives, Risk Assessment, Analytical ProceduresTasha MariePas encore d'évaluation

- Chapter 8 "RICK HAYES" "Analytical Procedures"Document15 pagesChapter 8 "RICK HAYES" "Analytical Procedures"Joan AnindaPas encore d'évaluation

- AU-00314 Auditing A Business Risk ApproachDocument43 pagesAU-00314 Auditing A Business Risk Approachredearth2929Pas encore d'évaluation

- Hksa 520Document7 pagesHksa 520Leungman LilyPas encore d'évaluation

- Analytical Review ProceduresDocument5 pagesAnalytical Review ProceduresnderitulinetPas encore d'évaluation

- Psa 540Document10 pagesPsa 540Rico Jon Hilario GarciaPas encore d'évaluation

- Audit Evidence and ProceduresDocument11 pagesAudit Evidence and ProceduresHolymaita TranPas encore d'évaluation

- AuditF8 SyDocument11 pagesAuditF8 SyZulu LovePas encore d'évaluation

- ISA 520 ANALYTICAL REVIEWDocument6 pagesISA 520 ANALYTICAL REVIEWRafik BelkahlaPas encore d'évaluation

- How to Prepare an Audit PlanDocument8 pagesHow to Prepare an Audit PlanJay Ann100% (1)

- Audit Planning ProcessDocument7 pagesAudit Planning ProcessJun Guerzon PaneloPas encore d'évaluation

- 5 Audit PlanningDocument31 pages5 Audit PlanningEliza BethPas encore d'évaluation

- Audit Procedure-5Document4 pagesAudit Procedure-5yashPas encore d'évaluation

- Essay On AuditingDocument7 pagesEssay On AuditingAndy Rdz0% (1)

- S I A (SIA) 15 K E E: Tandard On Nternal Udit Nowledge of The Ntity and Its NvironmentDocument13 pagesS I A (SIA) 15 K E E: Tandard On Nternal Udit Nowledge of The Ntity and Its NvironmentDivine Epie Ngol'esuehPas encore d'évaluation

- Audit Planning GuideDocument9 pagesAudit Planning GuidegumiPas encore d'évaluation

- Cpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Document5 pagesCpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Ma Yra YmataPas encore d'évaluation

- Auditing AssignmentDocument14 pagesAuditing AssignmentKeshav AggarwalPas encore d'évaluation

- Artical of F8Document103 pagesArtical of F8AhmadzaiPas encore d'évaluation

- Student Accountant Hub Page: Analytical ProceduresDocument4 pagesStudent Accountant Hub Page: Analytical ProceduresKevin KausiyoPas encore d'évaluation

- Understanding The Entity and Its Environment Including Its Internal Control and Assessing The Risks of Material MisstatementDocument35 pagesUnderstanding The Entity and Its Environment Including Its Internal Control and Assessing The Risks of Material MisstatementKathleenPas encore d'évaluation

- Auditing Practices" Issued by The Institute.: Audit of Accounting EstimatesDocument4 pagesAuditing Practices" Issued by The Institute.: Audit of Accounting EstimatesRishabh GuptaPas encore d'évaluation

- FACULTY OF ECONOMICS AND MANAGEMENT SCIENCES DEPARTMENT OF BUSINESS STUDIES PHD ASSIGNMENT AUDITING AND INVESTIGATIONSDocument12 pagesFACULTY OF ECONOMICS AND MANAGEMENT SCIENCES DEPARTMENT OF BUSINESS STUDIES PHD ASSIGNMENT AUDITING AND INVESTIGATIONSAlex SemusuPas encore d'évaluation

- Lesson 4Document37 pagesLesson 4Aldrin DagamiPas encore d'évaluation

- Audit and Assurance Part 2Document28 pagesAudit and Assurance Part 2ALEKSBANDAPas encore d'évaluation

- Af 316 - Audit TestingDocument5 pagesAf 316 - Audit Testinggregory georgePas encore d'évaluation

- Reviewer Sa AuditDocument6 pagesReviewer Sa Auditprincess manlangitPas encore d'évaluation

- Analytical ProceduresDocument3 pagesAnalytical ProceduresSukie TsePas encore d'évaluation

- IS Audit PlanningDocument19 pagesIS Audit PlanningMadhu khan100% (1)

- Account PayableDocument11 pagesAccount PayableShintia Ayu PermataPas encore d'évaluation

- Computer AuditingDocument3 pagesComputer AuditingTroy AJ GezyPas encore d'évaluation

- Audit & Assurance Individual Assignment: A Report by by Mr. G.L.S Anuradha Sab/Bsc/2020A/We-044Document9 pagesAudit & Assurance Individual Assignment: A Report by by Mr. G.L.S Anuradha Sab/Bsc/2020A/We-044Shehan AnuradaPas encore d'évaluation

- Checklist For Standards On Internal Audit ( Sia')Document12 pagesChecklist For Standards On Internal Audit ( Sia')VaspeoPas encore d'évaluation

- Chapter 8 Summary TaskDocument5 pagesChapter 8 Summary TaskRinchi MatsuokaPas encore d'évaluation

- SA 540 (AAS 18) : Udit of Ccounting StimatesDocument7 pagesSA 540 (AAS 18) : Udit of Ccounting StimatesDeepika PantPas encore d'évaluation

- Allama Iqbal Open University: MBA Banking & FinanceDocument22 pagesAllama Iqbal Open University: MBA Banking & FinanceawaisleoPas encore d'évaluation

- Audit Evid Analyt ProcedDocument9 pagesAudit Evid Analyt ProcedMunyaradzi Onismas ChinyukwiPas encore d'évaluation

- Audit Sampling Techniques and ProceduresDocument31 pagesAudit Sampling Techniques and ProceduresKananelo MOSENAPas encore d'évaluation

- Performing Effective (And Efficient) Audits - The Importance of Planning and MaterialityDocument13 pagesPerforming Effective (And Efficient) Audits - The Importance of Planning and MaterialityClaudine Carie SalomsonPas encore d'évaluation

- IntroductionDocument5 pagesIntroductionJasmine Roberts MatorresPas encore d'évaluation

- Chapter 3 SolutionsDocument13 pagesChapter 3 SolutionsjessicaPas encore d'évaluation

- Audit PlanningDocument12 pagesAudit PlanningDeryl GalvePas encore d'évaluation

- Chapter 8 Analytical ProceduresDocument19 pagesChapter 8 Analytical ProceduresVishal Kumar 5504Pas encore d'évaluation

- Audting Chapter4Document12 pagesAudting Chapter4Getachew JoriyePas encore d'évaluation

- Slaus 08Document8 pagesSlaus 08PrasangaPas encore d'évaluation

- Learn key analytical proceduresDocument14 pagesLearn key analytical proceduresNouran MuhammedPas encore d'évaluation

- Chapter 5 - AUDIT PLANNINGDocument8 pagesChapter 5 - AUDIT PLANNINGAljean Castro DuranPas encore d'évaluation

- Sa - 300-499 Risk Assessment & Response To Assessed Risks PDFDocument11 pagesSa - 300-499 Risk Assessment & Response To Assessed Risks PDFsarvjeet_kaushal100% (1)

- Arens Auditing16e SM 12Document40 pagesArens Auditing16e SM 12김현중Pas encore d'évaluation

- Assess control risk matrixDocument10 pagesAssess control risk matrixkasim_arkin2707100% (1)

- Understanding Risk Assessment Procedures for Entity's EnvironmentDocument14 pagesUnderstanding Risk Assessment Procedures for Entity's EnvironmentPhia TeoPas encore d'évaluation

- TufDocument14 pagesTufHoàng VũPas encore d'évaluation

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19D'EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Pas encore d'évaluation

- ProjdocDocument4 pagesProjdocDivine Epie Ngol'esuehPas encore d'évaluation

- Summary of Ifrs 7Document5 pagesSummary of Ifrs 7Divine Epie Ngol'esueh100% (1)

- Summary of Ifrs 1Document9 pagesSummary of Ifrs 1Divine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 15 K E E: Tandard On Nternal Udit Nowledge of The Ntity and Its NvironmentDocument13 pagesS I A (SIA) 15 K E E: Tandard On Nternal Udit Nowledge of The Ntity and Its NvironmentDivine Epie Ngol'esuehPas encore d'évaluation

- Summary of Ifrs 5Document4 pagesSummary of Ifrs 5Divine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 14 I A I T E: Tandard On Nternal Udit Nternal Udit in An Nformation Echnology NvironmentDocument12 pagesS I A (SIA) 14 I A I T E: Tandard On Nternal Udit Nternal Udit in An Nformation Echnology NvironmentDivine Epie Ngol'esuehPas encore d'évaluation

- Summary of IFRS 3Document5 pagesSummary of IFRS 3St Dalfour CebuPas encore d'évaluation

- Summary of Ifrs 6Document1 pageSummary of Ifrs 6Divine Epie Ngol'esueh100% (1)

- Summary of Ifrs 4Document4 pagesSummary of Ifrs 4Divine Epie Ngol'esuehPas encore d'évaluation

- Special Edition of Our IAS Plus Newsletter: IAS Plus Guide To IFRS 2 Share-Based Payment 2007Document9 pagesSpecial Edition of Our IAS Plus Newsletter: IAS Plus Guide To IFRS 2 Share-Based Payment 2007Divine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 16 U W E: Tandard On Nternal Udit Sing The Ork of An XpertDocument5 pagesS I A (SIA) 16 U W E: Tandard On Nternal Udit Sing The Ork of An XpertDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 12 I C E: Tandard On Nternal Udit Nternal Ontrol ValuationDocument14 pagesS I A (SIA) 12 I C E: Tandard On Nternal Udit Nternal Ontrol ValuationDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 13 E R M: Tandard On Nternal Udit Nterprise ISK AnagementDocument6 pagesS I A (SIA) 13 E R M: Tandard On Nternal Udit Nterprise ISK AnagementDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 9 C M: Tandard On Nternal Udit Ommunication With AnagementDocument8 pagesS I A (SIA) 9 C M: Tandard On Nternal Udit Ommunication With AnagementDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 10 I A E: Tandard On Nternal Udit Nternal Udit VidenceDocument5 pagesS I A (SIA) 10 I A E: Tandard On Nternal Udit Nternal Udit VidenceDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 8 T I A E: Tandard On Nternal Udit Erms of Nternal Udit NgagementDocument6 pagesS I A (SIA) 8 T I A E: Tandard On Nternal Udit Erms of Nternal Udit NgagementDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 7 Q A I A: Tandard On Nternal Udit Uality Ssurance in Nternal UditDocument8 pagesS I A (SIA) 7 Q A I A: Tandard On Nternal Udit Uality Ssurance in Nternal UditDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 5 S: Tandard On Nternal Udit AmplingDocument17 pagesS I A (SIA) 5 S: Tandard On Nternal Udit AmplingBarney AguilarPas encore d'évaluation

- S I A (SIA) 2 B P G I A: Tandard On Nternal Udit Asic Rinciples Overning Nternal UditDocument6 pagesS I A (SIA) 2 B P G I A: Tandard On Nternal Udit Asic Rinciples Overning Nternal UditDivine Epie Ngol'esuehPas encore d'évaluation

- STD On Internal Audit17Document16 pagesSTD On Internal Audit17jayeshouPas encore d'évaluation

- 10 Top Tips For Grant ManagementDocument36 pages10 Top Tips For Grant ManagementDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 4 R: Tandard On Nternal Udit EportingDocument8 pagesS I A (SIA) 4 R: Tandard On Nternal Udit EportingDivine Epie Ngol'esuehPas encore d'évaluation

- 1 Planning An Internal AuditDocument12 pages1 Planning An Internal AuditvmmalviyaPas encore d'évaluation

- (R) Going PublicDocument31 pages(R) Going PublicDivine Epie Ngol'esuehPas encore d'évaluation

- S I A (SIA) 3 D: Tandard On Nternal Udit OcumentationDocument8 pagesS I A (SIA) 3 D: Tandard On Nternal Udit OcumentationDivine Epie Ngol'esuehPas encore d'évaluation

- Audit ManualDocument211 pagesAudit ManualSaif Khan100% (9)

- Mergers and Acquisitions Notes MBADocument24 pagesMergers and Acquisitions Notes MBAMandip Luitel100% (1)

- UT Dallas Syllabus For Ee3311.002.07f Taught by Gil Lee (Gslee)Document3 pagesUT Dallas Syllabus For Ee3311.002.07f Taught by Gil Lee (Gslee)UT Dallas Provost's Technology GroupPas encore d'évaluation

- BMXNRPDocument60 pagesBMXNRPSivaprasad KcPas encore d'évaluation

- WA Beretta M92FS Parts ListDocument2 pagesWA Beretta M92FS Parts ListDenis Deki NehezPas encore d'évaluation

- Indian Institute OF Management, BangaloreDocument20 pagesIndian Institute OF Management, BangaloreGagandeep SinghPas encore d'évaluation

- ChE 135 Peer Evaluation PagulongDocument3 pagesChE 135 Peer Evaluation PagulongJoshua Emmanuel PagulongPas encore d'évaluation

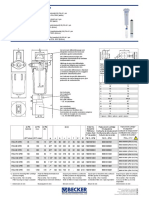

- Medical filter performance specificationsDocument1 pageMedical filter performance specificationsPT.Intidaya Dinamika SejatiPas encore d'évaluation

- STERNOL Specification ToolDocument15 pagesSTERNOL Specification ToolMahdyZargarPas encore d'évaluation

- Rescue Triangle PDFDocument18 pagesRescue Triangle PDFrabas_Pas encore d'évaluation

- Motivations for Leaving Public Accounting FirmsDocument33 pagesMotivations for Leaving Public Accounting Firmsran0786Pas encore d'évaluation

- Desarme Del ConvertidorpdfDocument7 pagesDesarme Del ConvertidorpdfDiego Orlando Santos BuitragoPas encore d'évaluation

- Aircraft ChecksDocument10 pagesAircraft ChecksAshirbad RathaPas encore d'évaluation

- Brochure - Truemax Concrete Pump Truck Mounted TP25M4Document16 pagesBrochure - Truemax Concrete Pump Truck Mounted TP25M4RizkiRamadhanPas encore d'évaluation

- Long Run Average Cost (LRAC) : Economies of ScaleDocument3 pagesLong Run Average Cost (LRAC) : Economies of ScaleA PPas encore d'évaluation

- Fisher FIELDVUE DVC2000 Digital Valve Controller: Instruction ManualDocument108 pagesFisher FIELDVUE DVC2000 Digital Valve Controller: Instruction ManualsrinuvoodiPas encore d'évaluation

- Write 10 Lines On My Favourite Subject EnglishDocument1 pageWrite 10 Lines On My Favourite Subject EnglishIrene ThebestPas encore d'évaluation

- JR Hydraulic Eng. Waterways Bed Protection Incomat BelfastDocument2 pagesJR Hydraulic Eng. Waterways Bed Protection Incomat Belfastpablopadawan1Pas encore d'évaluation

- Flexible AC Transmission SystemsDocument51 pagesFlexible AC Transmission SystemsPriyanka VedulaPas encore d'évaluation

- Legal Research MethodsDocument10 pagesLegal Research MethodsCol Amit KumarPas encore d'évaluation

- Tugas B InggrisDocument6 pagesTugas B Inggrisiqbal balePas encore d'évaluation

- 67c Series Bulletin 08 04 PDFDocument12 pages67c Series Bulletin 08 04 PDFnight wolfPas encore d'évaluation

- Ne 01 20 09 2018Document436 pagesNe 01 20 09 2018VaradrajPas encore d'évaluation

- Genre Worksheet 03 PDFDocument2 pagesGenre Worksheet 03 PDFmelissaPas encore d'évaluation

- AJK Newslet-1Document28 pagesAJK Newslet-1Syed Raza Ali RazaPas encore d'évaluation

- PM - Network Analysis CasesDocument20 pagesPM - Network Analysis CasesImransk401Pas encore d'évaluation

- Startups Helping - India Go GreenDocument13 pagesStartups Helping - India Go Greensimran kPas encore d'évaluation

- Obsolescence 2. Book Value 3. Depreciation 4. Depletion EtcDocument9 pagesObsolescence 2. Book Value 3. Depreciation 4. Depletion EtcKHAN AQSAPas encore d'évaluation

- Learn Square Roots & Plot on Number LineDocument11 pagesLearn Square Roots & Plot on Number LineADAM CRISOLOGOPas encore d'évaluation

- COT EnglishDocument4 pagesCOT EnglishTypie ZapPas encore d'évaluation

- MVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDocument4 pagesMVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDe Gala ShailynPas encore d'évaluation

- Analysis of VariancesDocument40 pagesAnalysis of VariancesSameer MalhotraPas encore d'évaluation