Académique Documents

Professionnel Documents

Culture Documents

Working Capital Management

Transféré par

Vikas KujurDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Working Capital Management

Transféré par

Vikas KujurDroits d'auteur :

Formats disponibles

Working Capital Management

Two Types of Capital in a firm

Fixed Capital or the Long Term Capital Working Capital or the Short Term Capital Working Capital Why do companies need them? The aim of the organizations is to Maximize the shareholders wealth The fixed capital is locked up for long term The day to day expenses need to be fulfilled and this is done by the working capital. Thus proper working capital management of the company is of utmost importance

Working Capital Management

Defining Working Capital Excess of Current Assets over Current Liabilities

What are Current Assets 1. Cash in hand and bank balance 2. Sundry Debtors

Amount that of fund locked with the sundry debtors is calculated on the basis of the credit Sales and the time lag in collecting that fund. Example: Credit sales of the year = Rs 1,20,000 Average credit period enjoyed by the debtors = 2 months Amount of working capital locked (and thus required) = 24,000

Working Capital Management

3. Advance Payment of Expenses 4. Inventory Inventory can be divided in to following parts

1. Stock of Raw Material ( Here only raw material cost is taken care) Total Raw material required by the firm is Rs 12000 annum Raw material remain in the warehouse( unused) for 3 months , so the working capital requirement = 3/12 X 12000 = RS 3000 Work in progress ( All costs associated with Manufacturing ) 1. Raw Material 2. Wages 3. Overhead and other costs Finished Goods

2.

3.

Working Capital Management

1. What are Current Liabilities

Sundry Creditors Lags in Payment

Raw Material Wages Rents Salaries etc. Taxation

Net Working Capital Requirement

Currents Assets Current Liabilities

Working Capital Management

Example: Calculate the average annual working capital requirement for the company. The following estimates are available about the company. Take 10% as contingency

1.

Average amount locked up in 1. Finished Goods = Rs 2500 2. Work in Progress = Rs 2500 3. Average amount locked up in Raw Material = Rs 8000 2. Sales Credit 1. Local Sales ( 2 weeks Credit) = Rs 78,000 2. Outside Sales( 4 weeks) = Rs 3,12,000 3. Time Available for payment 1. For Purchases (4 weeks) = Rs 96,000 2. For Payment of Wages (2 weeks) = Rs 2,60,000

Working Capital Management

Net Working Capital Req = Currents Assets Current Liabilities 1. Current Assets

Inventory

Stock of Finished Product = Rs 2500 Locked in WIP = Rs 2500 Locked in Stores, Raw Materials etc = Rs 8,000 Total = Rs 13,000

Account Receivable

Sales Credit Local Sales = 2/52 X 78,000 = Rs 3,000 Outside Sales = 6/52 X 3,12,000 = Rs 36000 Total Current Assets = Rs 13,000+ 39,000 = Rs 52,000

Working Capital Management

1. Current Liabilities

Account Payable

For Purchases = 4/52 X 96,000 = Rs7385 For Wages = 2/52 X 2,60,00 = Rs 10,000 Total = Rs 17385 Net Working Capital = Total Current Assets Total Current Liabilities = 52,000- 17385 = Rs 34,615 Add 10% of the contingency = Rs 3461.5 Total Working Capital Requirement = 34,615+3461.5 = Rs 38076

Working Capital Management

Example: Calculate the average annual working capital requirement for the company. The following estimates are available about the company. Add 10% as contingency Amount Locked in Stocks

1. 2. 3. Average amount locked up in Finished Goods = Rs 5000 Work in Progress = Rs 4000 Average amount locked up in Raw Material = Rs 4000 Inland Sales ( 6 weeks Credit) = Rs 3,12,000 Outside Sales( 1.5 week credit) = Rs 78,000

1.

2.

Average Credit given

1. 2.

3.

Lag for payment 1. Wages( 1.5 Weeks)

2. 3. 4. 5. 6.

= Rs 2,60,000

Stores, Materials etc. (1.5 months) = Rs 48,000 Rents,Roylaities (6 months) = Rs 10,000 Clerical Staff (0.5 months) = Rs 62,400 Manager (0.5 months) =Rs4800 Miscellaneous expenses (1.5 months) = Rs 48,000

Working Capital Management

4.

5.

Payment in Advance

1. Sundry Expenses ( paid quarterly in advance) = Rs 8000

Undrawn Profits on the average throughout the year = Rs 11000

Working Capital Management

Solution

Current Assets

1. Amount Locked in Stocks Average amount locked up in Finished Goods = Rs 5000 Work in Progress = Rs 4000 Average amount locked up in Raw Material = Rs 4000 Total = Rs 13,000 2. Average Credit given

1. 2. 3. Inland Sales ( 6 weeks Credit) = Rs 36,000 Outside Sales( 1.5 week credit) = Rs 2250 Total = Rs 38250

3.

Advance Payment of Expenses = Rs 2000

Total Current Assets = Rs 13000+38250+2000 = Rs 53250

Working Capital Management

Current Liabilities

1. Lag for payment 1. Wages( 1.5 Weeks)

2. 3. 4. 5. 6. = Rs 7500 Stores, Materials etc. (1.5 months) = Rs 6000 Rents, Roylaities (6 months) = Rs 5000 Clerical Staff (0.5 months) = Rs 2600 Manager (0.5 months) = Rs 200 Miscellaneous expenses (1.5 months) = Rs 6,000

Total Liabilities = Rs 27300 Net Working Capital = 53250-27300= Rs 25950 Add10% contingency =Rs 2595 Total = RS 28545

Working Capital Management

Calculating the Working Capital Requirement by Operating cycle approach According to this approach, the requirement of the working capital depends upon the operating cycle of the business What is the operating cycle? The time period between the acquisition of the raw material to the collection of the receivables It is divided in to 4 stages

1. 2. 3. 4. a) b) Raw Material Storage Stage WIP Stage Finished Good Inventory Stage Receivable Collection Stage

In this approach we calculate the time period the money is locked up in stage Calculate the time period for which the money of creditors is locked in by the firm Calculate a-b

Working Capital Management

Symbolically

O = (R+W+F+D) C

O = Duration of the Operating cycle R = Raw material storage period W= WIP period F= Finished stocked storage period D= Debtors collection period C= Creditors payment period

Working Capital Management

How to calculate the different periods?

R= Average Stock of Raw Material Average Raw Material consumption per day Average WIP inventory Average cost of production per day Average finished stock Inventory Average cost of good sold per day

W=

F=

D=

Average book debts Average credit sales per day

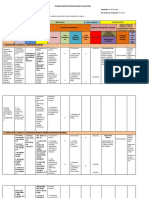

From the following information extracted from the books of the company xyz compute the operating cycle in days and the amount of working capital required

Period Covered Average Period for creditors allowed Average Total Debtors Outstanding 365 Days 16 days (Rs in 000) 480

Raw Material Consumption

Total Production cost Total cost of sales Sales for the year Value of the average stock maintained Raw Material Work in Progress Finished Goods

4400

10,000 10,500 16,000 (Rs in 000) 320 350 260

Working Capital Management

How to calculate the different periods?

R= Average Stock of Raw Material Average Raw Material consumption per day

Average Stock of Raw Material consumption per day = Total consumption/ No of days in operating cycle

= 4400000/365 = 12 000 per day R = 320,000/12000 = 26.6 = 27 days

Working Capital Management

How to calculate the different periods?

Average WIP inventory Average cost of production per day Average cost of production = Total COP/ No of days = 10,000,000/365 = RS 27397 per day W = 350,000/27397 = 12.77 days

W=

F = Average finished good in the Inventory/ Avg COG sold per day Avg Cost of good sold = Total cost of good sold/ Total no of days = 10,500,000/365 = RS 28767.12 per day F = 260,000/28767.12 = 9 days

Working Capital Management

D = Average total outstanding Debt Average Credit sales per day

Average Credit sales per day = Total Credit Sales/no of days = 16,000,000/365 =Rs 43835.6 /day D = 480,000/43835.6 = 10.95 days = 11 days

R+W+F+D = 27+13+9+11 =60 days Average period of credit allowed by creditors = 16 days Operating cycle period = 60-16 = 44 days No of operating cycles per year = 365/44 = 8.30 Working capital Required = Total Operating cost/ NO of Operating cycles 10,500,000/8.30 = Rs 1265,060

Working Capital Management

Factors affecting the working capital requirement

Production Policies

Labor Intensive vz Automated Small business need more working capital in comparison to the large organization where most of the transaction are in cash Manufacturing needs more WC than services

Nature of business

Length of manufacturing process Credit Policy Seasonal Fluctuations

Vous aimerez peut-être aussi

- Working Capital Management Problems and SolutionsDocument15 pagesWorking Capital Management Problems and SolutionsAlma Lopez75% (4)

- CHAPTER 3 Social Responsibility and EthicsDocument54 pagesCHAPTER 3 Social Responsibility and EthicsSantiya Subramaniam100% (4)

- Chapter 14 Working Capital Current Asset Management 5 1Document77 pagesChapter 14 Working Capital Current Asset Management 5 1Ela Pelari100% (2)

- Missouri Courts Appellate PracticeDocument27 pagesMissouri Courts Appellate PracticeGenePas encore d'évaluation

- Expectation Vs Reality: Job Order and Contract of ServiceDocument10 pagesExpectation Vs Reality: Job Order and Contract of ServiceMikee Louise MirasolPas encore d'évaluation

- Working Capital Management PDFDocument46 pagesWorking Capital Management PDFNizar AhamedPas encore d'évaluation

- Working CapitalDocument61 pagesWorking CapitalSharmistha Banerjee100% (1)

- Working Capital ManagementDocument32 pagesWorking Capital ManagementAkash RanjanPas encore d'évaluation

- Working CapitalDocument4 pagesWorking CapitalArul Ambalavanan ThenappenPas encore d'évaluation

- WORKING CAPITAL ManagementDocument22 pagesWORKING CAPITAL ManagementPrajwal BhattPas encore d'évaluation

- Working Capital RequirementDocument20 pagesWorking Capital RequirementKrishnakant Mishra100% (1)

- Working Capital ManagementDocument32 pagesWorking Capital Managementnaveen penugondaPas encore d'évaluation

- Working Capital Management: Department of Finance and Accountancy Vavuniya Campus FIN2213 Financial ManagementDocument22 pagesWorking Capital Management: Department of Finance and Accountancy Vavuniya Campus FIN2213 Financial ManagementWathz NawarathnaPas encore d'évaluation

- Financial Management: Unit-V Liquidity DecisionDocument24 pagesFinancial Management: Unit-V Liquidity DecisionVinay VinnuPas encore d'évaluation

- Working Capital RequirementDocument20 pagesWorking Capital Requirementflashsd3000Pas encore d'évaluation

- Working Capital ManagementDocument15 pagesWorking Capital ManagementAli Mubin FitranandaPas encore d'évaluation

- 2.1 Working Capital ManagementDocument26 pages2.1 Working Capital ManagementMANAV ROYPas encore d'évaluation

- Working Capital ManagementDocument32 pagesWorking Capital ManagementrutikaPas encore d'évaluation

- Working CapitalDocument41 pagesWorking CapitalShivam GoelPas encore d'évaluation

- Working Capital Management: Col Vivek Mathur, RetdDocument10 pagesWorking Capital Management: Col Vivek Mathur, Retdsanjog kshetriPas encore d'évaluation

- Working Capital ManagementDocument17 pagesWorking Capital Managementlucky4anshPas encore d'évaluation

- Dibin K K Assistant ProfessorDocument69 pagesDibin K K Assistant ProfessorKartika Bhuvaneswaran NairPas encore d'évaluation

- Unit 7 Working Capital ManagementDocument36 pagesUnit 7 Working Capital ManagementNabin JoshiPas encore d'évaluation

- Ratios PresentationDocument13 pagesRatios PresentationAakash A. OzaPas encore d'évaluation

- Working Capital Practical QuestionsDocument8 pagesWorking Capital Practical Questionsfatimabiriq799Pas encore d'évaluation

- Small Scale IndustriesDocument15 pagesSmall Scale IndustriesSumit KumarPas encore d'évaluation

- Module 4 - Working Capital ManagementDocument23 pagesModule 4 - Working Capital Managementhats300972Pas encore d'évaluation

- The Working CapitalDocument68 pagesThe Working CapitalLalla fakhitaPas encore d'évaluation

- Cash Flow and Working Capital Management - Module 2 - Comprehensive Liquidity Index, Cash Conversion CycleDocument63 pagesCash Flow and Working Capital Management - Module 2 - Comprehensive Liquidity Index, Cash Conversion CyclecarlofgarciaPas encore d'évaluation

- Investment Requirement Assessment - TowhidDocument26 pagesInvestment Requirement Assessment - TowhidMohammad Shahnewaz HossainPas encore d'évaluation

- Working Capital ManagementDocument16 pagesWorking Capital ManagementdhruvPas encore d'évaluation

- Income StatementDocument42 pagesIncome StatementS100% (1)

- Abbott A R 2017 FinalDocument18 pagesAbbott A R 2017 FinalSimul MondalPas encore d'évaluation

- Module IV - Working Capital ManagementDocument50 pagesModule IV - Working Capital ManagementAshwin DholePas encore d'évaluation

- Working CapitalDocument38 pagesWorking CapitalMonicaPas encore d'évaluation

- UNIT 3 Tutorial Q & ADocument14 pagesUNIT 3 Tutorial Q & AAlicia AbsolamPas encore d'évaluation

- 2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxDocument7 pages2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxBryent GawPas encore d'évaluation

- UNIT-4 Working Capital ManagementDocument13 pagesUNIT-4 Working Capital ManagementChandanN81Pas encore d'évaluation

- Session 15-21-Assessment of Credit - Working Capital & Term LendingDocument60 pagesSession 15-21-Assessment of Credit - Working Capital & Term LendingHaardik GandhiPas encore d'évaluation

- Financial Management-Financial Statements-Chapter 2Document37 pagesFinancial Management-Financial Statements-Chapter 2Bir kişi100% (1)

- Profit Planning: Chapter NineDocument80 pagesProfit Planning: Chapter NineAliya UmairPas encore d'évaluation

- Working Capital Management - 131218Document39 pagesWorking Capital Management - 131218bhumika manwaniPas encore d'évaluation

- Working Capital ManagementDocument52 pagesWorking Capital ManagementSuraj KumarPas encore d'évaluation

- Working Capital Manageme NTDocument66 pagesWorking Capital Manageme NTcmsundaram82Pas encore d'évaluation

- Working CapitalDocument17 pagesWorking CapitalSnehal ShahPas encore d'évaluation

- Working Capital ProblemsDocument3 pagesWorking Capital ProblemsSayonarababayPas encore d'évaluation

- Working Capital Management 2Document78 pagesWorking Capital Management 2Roopan DoluiPas encore d'évaluation

- Analysis of Accounts.: Grade 11Document16 pagesAnalysis of Accounts.: Grade 11Mary TanuiPas encore d'évaluation

- A29260146 - 15831 - 28 - 2019 - Ratios For UploadingDocument85 pagesA29260146 - 15831 - 28 - 2019 - Ratios For UploadingMehak SinghPas encore d'évaluation

- Working Capital NewDocument9 pagesWorking Capital NewSubodh SinghPas encore d'évaluation

- MB20202 CF Unit V Working Capital Management Application QuestionsDocument4 pagesMB20202 CF Unit V Working Capital Management Application QuestionsSarath kumar CPas encore d'évaluation

- Working Capital ManagementDocument62 pagesWorking Capital ManagementANISH KUMARPas encore d'évaluation

- Financial ManagementDocument53 pagesFinancial ManagementOmPas encore d'évaluation

- Working Capital PDFDocument20 pagesWorking Capital PDFPooja KhimaniPas encore d'évaluation

- Liquidity and Its TestDocument41 pagesLiquidity and Its TestSiddharth AroraPas encore d'évaluation

- Financial Management - Notes NumericalsDocument6 pagesFinancial Management - Notes NumericalsSandeep SahadeokarPas encore d'évaluation

- 06 CBM Fin Working Capital 22 May'18Document52 pages06 CBM Fin Working Capital 22 May'18AM FMPas encore d'évaluation

- Profit & Loss AccountDocument38 pagesProfit & Loss AccountAbhirup Sengupta100% (1)

- Corporate FinanceDocument4 pagesCorporate FinancePrashant AhujaPas encore d'évaluation

- Week 1 - Introduction and Balance Sheet PDFDocument84 pagesWeek 1 - Introduction and Balance Sheet PDFHisham ShihabPas encore d'évaluation

- Working Capital ManagementDocument98 pagesWorking Capital ManagementGanesh PatashalaPas encore d'évaluation

- Financial Accounting and Reporting Study Guide NotesD'EverandFinancial Accounting and Reporting Study Guide NotesÉvaluation : 1 sur 5 étoiles1/5 (1)

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersD'EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersÉvaluation : 2 sur 5 étoiles2/5 (4)

- Lab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabDocument7 pagesLab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabHayat AnsariPas encore d'évaluation

- COOKERY10 Q2W4 10p LATOJA SPTVEDocument10 pagesCOOKERY10 Q2W4 10p LATOJA SPTVECritt GogolinPas encore d'évaluation

- Forecasting of Nonlinear Time Series Using Artificial Neural NetworkDocument9 pagesForecasting of Nonlinear Time Series Using Artificial Neural NetworkranaPas encore d'évaluation

- Expense Tracking - How Do I Spend My MoneyDocument2 pagesExpense Tracking - How Do I Spend My MoneyRenata SánchezPas encore d'évaluation

- Difference Between Mountain Bike and BMXDocument3 pagesDifference Between Mountain Bike and BMXShakirPas encore d'évaluation

- Amare Yalew: Work Authorization: Green Card HolderDocument3 pagesAmare Yalew: Work Authorization: Green Card HolderrecruiterkkPas encore d'évaluation

- PeopleSoft Application Engine Program PDFDocument17 pagesPeopleSoft Application Engine Program PDFSaurabh MehtaPas encore d'évaluation

- Proceedings of SpieDocument7 pagesProceedings of SpieNintoku82Pas encore d'évaluation

- Engine Diesel PerfomanceDocument32 pagesEngine Diesel PerfomancerizalPas encore d'évaluation

- Delta AFC1212D-SP19Document9 pagesDelta AFC1212D-SP19Brent SmithPas encore d'évaluation

- HandloomDocument4 pagesHandloomRahulPas encore d'évaluation

- G.R. No. 185449, November 12, 2014 Del Castillo Digest By: DOLARDocument2 pagesG.R. No. 185449, November 12, 2014 Del Castillo Digest By: DOLARTheodore DolarPas encore d'évaluation

- 2016 066 RC - LuelcoDocument11 pages2016 066 RC - LuelcoJoshua GatumbatoPas encore d'évaluation

- Cdi 2 Traffic Management and Accident InvestigationDocument22 pagesCdi 2 Traffic Management and Accident InvestigationCasanaan Romer BrylePas encore d'évaluation

- Algorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésDocument298 pagesAlgorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésSerges KeouPas encore d'évaluation

- CV Ovais MushtaqDocument4 pagesCV Ovais MushtaqiftiniaziPas encore d'évaluation

- BCG - Your Capabilities Need A Strategy - Mar 2019Document9 pagesBCG - Your Capabilities Need A Strategy - Mar 2019Arthur CahuantziPas encore d'évaluation

- Fidp ResearchDocument3 pagesFidp ResearchIn SanityPas encore d'évaluation

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocument2 pagesSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloPas encore d'évaluation

- Privacy: Based On Slides Prepared by Cyndi Chie, Sarah Frye and Sharon Gray. Fifth Edition Updated by Timothy HenryDocument50 pagesPrivacy: Based On Slides Prepared by Cyndi Chie, Sarah Frye and Sharon Gray. Fifth Edition Updated by Timothy HenryAbid KhanPas encore d'évaluation

- Epidemiologi DialipidemiaDocument5 pagesEpidemiologi DialipidemianurfitrizuhurhurPas encore d'évaluation

- Sweet Biscuits Snack Bars and Fruit Snacks in MexicoDocument17 pagesSweet Biscuits Snack Bars and Fruit Snacks in MexicoSantiagoPas encore d'évaluation

- Food and Beverage Department Job DescriptionDocument21 pagesFood and Beverage Department Job DescriptionShergie Rivera71% (7)

- Supergrowth PDFDocument9 pagesSupergrowth PDFXavier Alexen AseronPas encore d'évaluation

- P 1 0000 06 (2000) - EngDocument34 pagesP 1 0000 06 (2000) - EngTomas CruzPas encore d'évaluation

- X-17 Manual Jofra PDFDocument124 pagesX-17 Manual Jofra PDFBlanca Y. Ramirez CruzPas encore d'évaluation

- Lactobacillus Acidophilus - Wikipedia, The Free EncyclopediaDocument5 pagesLactobacillus Acidophilus - Wikipedia, The Free Encyclopediahlkjhlkjhlhkj100% (1)