Académique Documents

Professionnel Documents

Culture Documents

Currency Printing Criteria

Transféré par

economistDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Currency Printing Criteria

Transféré par

economistDroits d'auteur :

Formats disponibles

In fact most of the educated population in any country, use the local currency without knowing the background

and validity of the same. I am happy that you have asked this question, which will impart a mandatory knowledge to many people all over the world. Because what is in India is applicable to all over the world. A) What and who decides the money (currency) in circulation in Indian money market? a) The Reserve Bank of India (RBI) manages currency in India. The Government, on the advice of the Reserve Bank, decides on the various denominations. The Reserve Bank also co-ordinates with the Government in the designing of bank notes, including the security features. The Reserve Bank estimates the quantity of notes that are likely to be needed denomination-wise, and places the indent with the various presses through the Government of India. The notes received from the presses are issued and a reserve stock maintained. Notes received from banks and currency chests are examined. Notes fit for circulation are reissued and the others (soiled and mutilated) are destroyed so as to maintain the quality of notes in circulation. The Reserve Bank derives its role in currency management on the basis of the Reserve Bank of India Act, 1934. b) To facilitate the distribution of notes and rupee coins, the Reserve Bank has authorised selected branches of banks to establish currency chests. These are actually storehouses where bank notes and rupee coins are stocked on behalf of the Reserve Bank. At present, there are over 4368 currency chests. The currency chest branches are expected to distribute notes and rupee coins to other bank branches in their area of operation. B) Can reserve bank of India or Indian government bodies decide to print additional currencies to meet public expenditure ? a) The Reserve Bank estimates the demand for bank notes on the basis of the growth rate of the economy, the replacement demand and reserve requirements by using statistical models. The Reserve Bank decides upon the volume and value of bank notes to be printed. The quantum of bank notes that needs to be printed broadly depends on the annual increase in bank notes required for circulation purposes, replacement of soiled notes and reserve requirements. b) The Government of India decides upon the quantity of coins to be minted. The responsibility for coinage vests with Government of India on the basis of the Coinage Act,

1906 as amended from time to time. The designing and minting of coins in various denominations is also attended to by the Government of India C) Do India need to Deposit some gold in IMF for additional currency printing for meeting the public expenditure? a) No. Absolutely there is no external foreign or IMF control on the estimation, printing or circulation of Indian rupee notes and coins. But the only external control on the value of Indian money in the international circulation is the Exchange rate, with reference to various other national currencies. Indian money is tied to a basket of European currencies (now jointly represented by Euro). The exchange rate parity of rupee fluctuates based on the Indian balance of payment to the world, exports/imports and the parity of Euro in the international market. b) The gold standard is a monetary system in which the standard economic unit of account is a fixed weight of gold and all currency issuance is to one degree or another regulated by the gold supply. To protect the public and guarantee the nation against any bankruptcy, the RBI keeps a certain percentage of gold in their own safe deposit vault, in proportion to the additional currency minted and directed into the circulation. The quantum percentage of gold kept in the deposit is not exposed in any documents or in the Websites of RBI or the Government of India.. c) In modern mainstream economic thought, a gold standard is considered undesirable because it is associated with the collapse of the world economy in the late 1920's. That aggregated the need for the supply and demand in a far better means of regulating interest rates, money supply and monetary basis. However, many other theories have been advanced for the turbulent economic conditions that existed at this time. While the gold standard is not currently in use, it has advocates for its resurrection and forms part of a basic theory of monetary policy as a standard for comparison for other monetary systems. Advocates of a variety of gold standards argue that gold is the only universal measure of value, that gold standards prevent inflation by preventing the creation of unlimited money supply in a fiat currency, and that it provides the soundest theoretical basis for a monetary system. d) In todays economics the fiat currency (a legally binding command or decision entered on the court or government record ) or fiat money is money that enjoys legal tender status

derived from a declaratory fiat or an authoritative order of the government. It is often associated with paper money because, without government fiat, bank notes are not a legal tender in payment of debt, and only specie (metal money) has unlimited legal tender for money debts. (Note : This is not universally true, as some currencies, notably sterling issued by Scottish banks, is not legal tender but is accepted by longstanding confidence in the Scottish banking system). e) A Fiat currency or coin is guaranteed by the RBI and the Government of India that :A unit of paper or credit money (a rupee) can be presented to the issuing bank in exchange for a physical amount of gold, silver, or some other commodity. A rupee can be returned to the issuing bank in exchange for a rupee worth of the banks assets. To enable this guarantee, the RBI and the Government of India create adequate assets in the nation with assured value, equal or more than the additional notes and coins minted and sent in circulation. This is in addition to the percentage of gold kept in the safe deposit vault of the RBI (See C-b above). f) The term fiat currency is also used specifically to refer to a currency that is not pegged or fixed to a mass of precious metal, and similarly the term gold standard is used to refer to fiat currency with a gold bullion exchange system, or to a parallel gold coin/fiat currency with a law that requires that the fiat currency bank of issue to pay in gold coin. g) The fiat currency is explicitly circulated in the form of paper money. The inherent value of paper money is zero, except when it is measured against the value of consumables the bearer of such worthless paper can exchange for each unit of currency in his or her possession. Additionally; paper money has an intangible value that is directly related to the condition of need of its bearer. While a one hundred rupee currency may be inconsequential to a person with little material need the same may be the governing factor between homelessness, health, and even life for another with lesser means.. In other words, paper money is valued at the maximum amount of consumable for which it can be traded either directly or indirectly. D) If yes, is there any external power controlling the Indian money market or world

money market who decide how much & how India should make currency in circulation? The answer is NO. Please see answer ( C ) above. E) Additional reference and informative reading materials a) Reserve Bank of India : Frequently Asked Questions - Your Guide to Money Matters. http://www.rbi.org.in/scripts/BS_CurrencyFAQView.aspx?Id=39 http://www.rbi.org.in/scripts/AboutusDisplay.aspx b) Free Encyclopedia http://en.wikipedia.org/wiki/Gold_standard http://en.wikipedia.org/wiki/Fiat_currency

Vous aimerez peut-être aussi

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeD'EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadePas encore d'évaluation

- ATM Security: Presented By: Jefferson County Sheriff's OfficeDocument25 pagesATM Security: Presented By: Jefferson County Sheriff's OfficeDeepika ChopraPas encore d'évaluation

- Counterfiet 1Document12 pagesCounterfiet 1DrMayuri SahayPas encore d'évaluation

- As 2805.14.2-2009 Electronic Funds Transfer - Requirements For Interfaces Secure Cryptographic Devices (RetaiDocument8 pagesAs 2805.14.2-2009 Electronic Funds Transfer - Requirements For Interfaces Secure Cryptographic Devices (RetaiSAI Global - APACPas encore d'évaluation

- Fake Currency Detection Using Image Processing: AbstractDocument5 pagesFake Currency Detection Using Image Processing: AbstractthusharikaPas encore d'évaluation

- Police Response Times PresentationDocument11 pagesPolice Response Times PresentationMarchaund JonesPas encore d'évaluation

- Detecting Counterfeit BillsDocument12 pagesDetecting Counterfeit BillsmikePas encore d'évaluation

- AtmDocument2 pagesAtmJegan RichardPas encore d'évaluation

- A Path To The Next Generation of U.S. Banknotes Keeping Them RealDocument328 pagesA Path To The Next Generation of U.S. Banknotes Keeping Them RealMikhail BeloshevskiPas encore d'évaluation

- Trust Wallet Development - MobiloitteDocument1 pageTrust Wallet Development - MobiloitteMobiloitte TechnologiesPas encore d'évaluation

- A Cheque Is A DocumentDocument15 pagesA Cheque Is A Documentmi06bba030Pas encore d'évaluation

- Fake Note Detection PaperDocument14 pagesFake Note Detection PaperNikhil HosurPas encore d'évaluation

- Cash Larceny From The DepositDocument3 pagesCash Larceny From The DepositFajria OktavianiPas encore d'évaluation

- Exchange: Dealing Down UnderDocument32 pagesExchange: Dealing Down Underkblade_2000Pas encore d'évaluation

- Bank Note Security PaperDocument3 pagesBank Note Security PaperGustavo MazaPas encore d'évaluation

- 4 Verifying FalsifyingDocument16 pages4 Verifying FalsifyingRazvan IulianPas encore d'évaluation

- PresentationDocument18 pagesPresentationSayali ZPas encore d'évaluation

- New Microsoft Word DocumentDocument23 pagesNew Microsoft Word DocumentHitesh BhatnagarPas encore d'évaluation

- Chimene Hamilton Onyeri IndictmentDocument27 pagesChimene Hamilton Onyeri IndictmentkxanwebteamPas encore d'évaluation

- Counterfeit MasterDocument2 pagesCounterfeit MasterEmilieAnn SumalloPas encore d'évaluation

- 0 F 62Document5 pages0 F 62Shivam TyagiPas encore d'évaluation

- "The Automated Teller Machine": Engineering College BikanerDocument12 pages"The Automated Teller Machine": Engineering College BikanerRajesh BishnoiPas encore d'évaluation

- Cryptocurrency Scams: January 2018Document11 pagesCryptocurrency Scams: January 2018Chi BīķěPas encore d'évaluation

- Printing and Minting of MoneyDocument3 pagesPrinting and Minting of Moneyrosalyn mauricioPas encore d'évaluation

- 7.fake Currency Detection Using Image Processing and OtherDocument4 pages7.fake Currency Detection Using Image Processing and Othervgmanjunatha0% (1)

- A Method To Possibly Break RSA Encryption Algorithm Is RevealedDocument6 pagesA Method To Possibly Break RSA Encryption Algorithm Is Revealedhansley cookPas encore d'évaluation

- Carding Vocabulary and Understanding Terms PDFDocument4 pagesCarding Vocabulary and Understanding Terms PDFcreative84Pas encore d'évaluation

- LAGARD Combogard Pro 39e Electronic Combination Lock Keypad Only Setup InstructionsDocument8 pagesLAGARD Combogard Pro 39e Electronic Combination Lock Keypad Only Setup InstructionsRon BerserkirPas encore d'évaluation

- MerchantAndBusiness PayPalUS Sept-21-2021 v1Document36 pagesMerchantAndBusiness PayPalUS Sept-21-2021 v1James SoracePas encore d'évaluation

- Uncashed Benefit Payment Check or Unclaimed Electronic Benefit Payment Claim FormDocument2 pagesUncashed Benefit Payment Check or Unclaimed Electronic Benefit Payment Claim Formemily ambrosinoPas encore d'évaluation

- Electronic Check ProcessingDocument1 pageElectronic Check Processingaaes2Pas encore d'évaluation

- What Is A Poop Scoop Service, and How Does It WorkDocument7 pagesWhat Is A Poop Scoop Service, and How Does It WorkBrandon HanesPas encore d'évaluation

- MicrDocument3 pagesMicrharyy1234567Pas encore d'évaluation

- Manufacturing Money, and Global Warming: Executive SummaryDocument35 pagesManufacturing Money, and Global Warming: Executive SummarynsloueyPas encore d'évaluation

- The 5-Minute Business Traveller Cyber Security: E-BookDocument20 pagesThe 5-Minute Business Traveller Cyber Security: E-BookAmalia L StefanPas encore d'évaluation

- Consumer Orientation Towards Counterfeit Fashion Products: A Qualitative AnalysisDocument5 pagesConsumer Orientation Towards Counterfeit Fashion Products: A Qualitative AnalysisGoan HospitalityPas encore d'évaluation

- Week 14.-Counterfeit IdentificationsDocument11 pagesWeek 14.-Counterfeit IdentificationsArriane Steph ZapataPas encore d'évaluation

- Counterfeit Currency Detection SystemDocument6 pagesCounterfeit Currency Detection SystemRahul SharmaPas encore d'évaluation

- Counterfeit BillsDocument2 pagesCounterfeit BillsHibbing Police DepartmentPas encore d'évaluation

- DU D Unit Question Bank 2018-19Document4 pagesDU D Unit Question Bank 2018-19Rajin Mahmud KhanPas encore d'évaluation

- Deluxe RentAcar's Fraud King and Special Interest's Poster Child For AbuseDocument129 pagesDeluxe RentAcar's Fraud King and Special Interest's Poster Child For Abusetheplatinumlife100% (1)

- Identity Fraud PresentationDocument6 pagesIdentity Fraud Presentationputi rizna nabilaPas encore d'évaluation

- CounterfeitingDocument4 pagesCounterfeitingPEDRO ANTONIO LORZAPas encore d'évaluation

- Diebold Nixdorf CS 5500Document2 pagesDiebold Nixdorf CS 5500Dario SantanaPas encore d'évaluation

- The Magic PassportDocument7 pagesThe Magic Passportmarcelo cobiasPas encore d'évaluation

- Glory RZ 100 Currency RecyclerDocument2 pagesGlory RZ 100 Currency RecyclerAgustin Alonso LasenPas encore d'évaluation

- A Presentation On: Credit CardsDocument26 pagesA Presentation On: Credit Cardsshweta.gdp100% (2)

- 8 Credit Card System OOADDocument29 pages8 Credit Card System OOADMahesh WaraPas encore d'évaluation

- Identity Document Challenges and SolutionsDocument4 pagesIdentity Document Challenges and SolutionsCHANDER SHEKHAR JEENAPas encore d'évaluation

- Titan 2006 - 2007 S&G Lock InstructionsDocument5 pagesTitan 2006 - 2007 S&G Lock InstructionsEd SkidmorePas encore d'évaluation

- Part One: State Capitalist Intervention in The MarketDocument6 pagesPart One: State Capitalist Intervention in The Marketfree.market.anticapitalist7523Pas encore d'évaluation

- Cash Deposit Machines-2Document9 pagesCash Deposit Machines-2study journalsPas encore d'évaluation

- Oil-Less Decal Transfer: Copyfun WhiteDocument1 pageOil-Less Decal Transfer: Copyfun WhiteIgor Cece GigoPas encore d'évaluation

- Forensic 4: How To Detect Counterfeit Money?Document4 pagesForensic 4: How To Detect Counterfeit Money?Kate Serrano ManlutacPas encore d'évaluation

- Parts of A ChequeDocument7 pagesParts of A ChequeRohan UppalPas encore d'évaluation

- Collis Card SpyDocument4 pagesCollis Card SpySali LalaPas encore d'évaluation

- Online Fraud Detection A Complete Guide - 2019 EditionD'EverandOnline Fraud Detection A Complete Guide - 2019 EditionPas encore d'évaluation

- Internet Download Manager A Complete Guide - 2019 EditionD'EverandInternet Download Manager A Complete Guide - 2019 EditionPas encore d'évaluation

- Enforcement of Foreign Judgement and Foreign Arbitral Awards in IndiaDocument4 pagesEnforcement of Foreign Judgement and Foreign Arbitral Awards in Indiaeconomist100% (2)

- Understanding Foreign ExchangeDocument3 pagesUnderstanding Foreign ExchangeeconomistPas encore d'évaluation

- The Law of Arbitration and ConciliationDocument4 pagesThe Law of Arbitration and ConciliationeconomistPas encore d'évaluation

- Tax HavensDocument2 pagesTax HavenseconomistPas encore d'évaluation

- Management Control SystemsDocument5 pagesManagement Control SystemsDhaha RoohullaPas encore d'évaluation

- Foreign Trade Policy 2009-2014Document112 pagesForeign Trade Policy 2009-2014shruti_siPas encore d'évaluation

- Legal Issues Identified by The CourtDocument5 pagesLegal Issues Identified by The CourtKrishna NathPas encore d'évaluation

- Corod DWR Regular Strength 29feb12Document3 pagesCorod DWR Regular Strength 29feb12Ronald LlerenaPas encore d'évaluation

- National Police Commission: Interior and Local Government Act of 1990" As Amended by Republic Act No. 8551Document44 pagesNational Police Commission: Interior and Local Government Act of 1990" As Amended by Republic Act No. 8551April Elenor Juco100% (1)

- Britmindogroupcompanyprofile PDFDocument20 pagesBritmindogroupcompanyprofile PDFSatia Aji PamungkasPas encore d'évaluation

- PEER PRESSURE - The Other "Made" Do ItDocument2 pagesPEER PRESSURE - The Other "Made" Do ItMyrrh PasquinPas encore d'évaluation

- Confidentiality Statement 02Document1 pageConfidentiality Statement 02Herbert KaplanPas encore d'évaluation

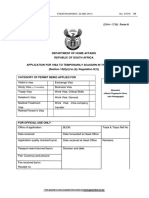

- (DHA-1738) Form 8: Department of Home Affairs Republic of South AfricaDocument20 pages(DHA-1738) Form 8: Department of Home Affairs Republic of South AfricaI QPas encore d'évaluation

- ADR PresentationDocument9 pagesADR PresentationAshraf AliPas encore d'évaluation

- 86A141FH16-iCare InstallationDocument26 pages86A141FH16-iCare Installationaccel2008Pas encore d'évaluation

- POLITICAL SYSTEM of USADocument23 pagesPOLITICAL SYSTEM of USAMahtab HusaainPas encore d'évaluation

- Parts of A DecisionDocument3 pagesParts of A DecisionChristine-Thine Malaga CuliliPas encore d'évaluation

- 55 Salas, Jr. vs. Aguila, G.R. 202370, September 23, 2013Document3 pages55 Salas, Jr. vs. Aguila, G.R. 202370, September 23, 2013Lara Yulo100% (1)

- Employment in IndiaDocument51 pagesEmployment in IndiaKartik KhandelwalPas encore d'évaluation

- Mobile Services: Your Account Summary This Month'S ChargesDocument4 pagesMobile Services: Your Account Summary This Month'S Chargeskumar JPas encore d'évaluation

- Price Adaptation Strategies in MarketingDocument17 pagesPrice Adaptation Strategies in MarketingAlj Kapilongan50% (2)

- Al Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Document199 pagesAl Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Islamic Reserch Center (IRC)Pas encore d'évaluation

- PCARD AssignmentDocument7 pagesPCARD AssignmentMellaniPas encore d'évaluation

- Recio Garcia V Recio (Digest)Document3 pagesRecio Garcia V Recio (Digest)Aljenneth MicallerPas encore d'évaluation

- Imm5786 2-V1V20ZRDocument1 pageImm5786 2-V1V20ZRmichel foguePas encore d'évaluation

- 64 Zulueta Vs PAN-AMDocument3 pages64 Zulueta Vs PAN-AMShaira Mae CuevillasPas encore d'évaluation

- Judaism: Pre-Test Directions: Fill in The Blank With The Correct AnswerDocument9 pagesJudaism: Pre-Test Directions: Fill in The Blank With The Correct AnswerShineeljay TumipadPas encore d'évaluation

- MCQ ISC 2023 Retirement and DeathDocument15 pagesMCQ ISC 2023 Retirement and DeathArnab NaskarPas encore d'évaluation

- Research ProposalDocument2 pagesResearch ProposalNina MateiPas encore d'évaluation

- Bpats Enhancement Training ProgramDocument1 pageBpats Enhancement Training Programspms lugaitPas encore d'évaluation

- International Business Review: Farok J. Contractor, Ramesh Dangol, N. Nuruzzaman, S. RaghunathDocument13 pagesInternational Business Review: Farok J. Contractor, Ramesh Dangol, N. Nuruzzaman, S. RaghunathQuang NguyễnPas encore d'évaluation

- The Birds of Pulicat Lake Vs Dugarajapatnam PortDocument3 pagesThe Birds of Pulicat Lake Vs Dugarajapatnam PortVaishnavi JayakumarPas encore d'évaluation

- GR No. 186417 People vs. Felipe MirandillaDocument1 pageGR No. 186417 People vs. Felipe MirandillaNadine GabaoPas encore d'évaluation

- UCO Amended ComplaintDocument56 pagesUCO Amended ComplaintKFOR100% (1)

- BS-300 Service Manual (v1.3)Document115 pagesBS-300 Service Manual (v1.3)Phan QuanPas encore d'évaluation

- APSA2011 ProgramDocument191 pagesAPSA2011 Programsillwood2012Pas encore d'évaluation