Académique Documents

Professionnel Documents

Culture Documents

Currency Analysis

Transféré par

Farhana HoqueDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Currency Analysis

Transféré par

Farhana HoqueDroits d'auteur :

Formats disponibles

Currency Analysis: USDCAD

AS

a Currency Analyst, working in an intelligence unit of a Banks

Treasury Department; Our currency investment strategy deals with

the overall, long-term guidelines that we set up and implement in an attempt to ensure success in meeting our financial goals. Most strategies used to invest in the Money market fall into three general categories: fundamental analysis, technical analysis, or buy and hold the market.

1. Fundamental Analysis: Fundamental analysis maintains that markets may misprice a currency in the short run but that the "correct" price will eventually be reached. Profits can be made by trading the mispriced currency and then waiting for the market to recognize its "mistake" and reprice the currency.

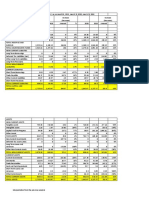

Factor consideration Interest rate Inflation Income level (GDP capita)

USD 0% - .25% 1.2% (Oct 2010) per $46,442 (2009)

CAD .75% 1.4% (2010 est.) $43,100 (2009)

a) Interest rate based on previous informations: US:

1|Page

Canada:

b) Inflation based on previous informations: US:

Canada:

c) Government influence: US government influence on USD:

Monetary policy regarding USD is made by the Federal Open Market Committee (FOMC), which consists of the members of the Board of Governors of the Federal Reserve System and five Reserve Bank presidents. The FOMC holds eight regularly scheduled meetings during the year, and other meetings as needed.

2|Page

Interest rates are influenced by the Federal Reserve which is an indirect intervention of US government. Management of demand through monetary policy dominates fiscal policy. Open market operations that mean purchases and sales of U.S. treasury and federal agency securities are the Federal Reserves primary tool for implementing monetary policy. The discount rate is the interest rate charged to commercial banks based on needs (Appreciate or to depreciate) Federal Reserve System take initiatives.

Canadian government influence on CAD:

Canada's flexible exchange rate permits citizens to pursue an independent monetary policy. The Bank carries out monetary policy by influencing short-term interest rates. It does this by raising and lowering the target for the overnight rate. (The overnight rate is the interest rate at which major financial institutions borrow and lend one-day (or "overnight") funds among themselves; the Bank sets a target level for that rate. This target for the overnight rate is often referred to as the Bank's key interest rate or key policy rate). Some important target for overnight rate: Date Target (%) Change (%) 7 December 2010 1.00 19 October 2010 1.00 8 September 1.00 + 0.25 2010 20 July 2010 0.75 + 0.25 The Bank of Canada adopted a system of eight pre-set dates per year and all the decisions regarding economic factors discussed in those dates. Their monitory policy consequences:

3|Page

d) Major/important factors/indicators US:

dates

related

with

the

economic

Published: 12/5/2010 10:17:16 PM By: TradingEconomics.com, US Bureau of Labor Statistics: The unemployment rate edged up to 9.8 percent in November, and nonfarm payroll employment was little changed (+39,000), the U.S. Bureau of Labor Statistics reported on December 3. Published: 11/23/2010 4:15:18 PM By: TradingEconomics.com, BloombergReal consumer spending increased at a 2.8% annualized clip, the fasted The U.S. economy grew at a 2.5 percent annual rate in the third quarter, more than previously calculated, as companies increased shipments abroad and Americans boosted their spending. Published: 11/17/2010 2:59:54 PM By: TradingEconomics.com, FT: Core US Inflation Falls to Record Low.

Canada:

Published: 12/7/2010 4:19:30 PM By: TradingEconomics.com, Bank of Canada: The Bank of Canada announced on December 12 that it is maintaining its target for the overnight rate at 1 per cent. The Bank

4|Page

Rate is correspondingly 1.25 percent and the deposit rate is 0.75 percent. Published: 12/5/2010 10:26:27 PM By: TradingEconomics.com, RTT News: Canada's Unemployment Rate Drops To 7.6%. Published: 12/2/2010 9:34:48 AM By: TradingEconomics.com, Statistics Canada: Canada's GDP grows 0.3% in Q3. Published: 11/23/2010 4:26:05 PM By: TradingEconomics.com: Canada's annual inflation rate unexpectedly jumped to a two-year high of 2.4 percent in October, but analysts differed on whether the data would prompt the Bank of Canada to raise interest rates sooner than expected.

e) Candlestick chart of the currency: USDCAD Start date: 7th June 2010 to 9th December 2010 RSI: 30 (Green) MVI: From 30(Blue) to 70 (Red)

Fig 1: Candlestick chart of USDCAD

5|Page

f) Variability (Focus on Nov 9th to Dec 9th)

Countr y US US Canad a US

Day/Month/date Monday, November 15th Wednesday, November 17th Tuesday, November 23rd Tuesday, November 23rd

Variables that affect USDCAD U.S. Retail Sales Jump 1.2 Percent in October, Empire Manufacturing Enters Negative Territory USD Consumer Price Index variables The Bank of Canada has a target inflation band of 1 - 3 % and uses CPI and Core CPI as its principle gauges. USD Gross Domestic Product (Annualized), Focus: Economic expansion in US also raises concerns about inflationary pressures which may lead to monetary policy tightening. CAD Gross Domestic Product, Focus: Actual GDP figures usually confirm expectations. CAD Net Change in Employment, Focus: Increases in employment are generally accompanied by higher consumption and expenditure levels. A surge in new Non-farm Payrolls suggests rising employment and potential inflation pressures, which the Fed often counters with rate increases. On the other hand, a consistent decline in Non-farm Employment suggests a slowing economy, which makes a decline in rates more likely. CAD Bank of Canada Rate Decision (1.00%)

Canad a Canad a

Tuesday, November 30th Friday, December 1st

UD

Friday, December 3rd

Canad a

Tuesday, December 7th

g) Government views, Inter-Bank forward rates, Market / traders

view:

6|Page

USD CAD @ 13th December 2010 GMT+6, 20:46PM

USD CAD @ 13th December 2010 GMT+6, 20:46PM

USDCAD

Price 1.0046

Chg. -0.0047

Chg. % -0.466%

2. Technical Analysis: Technical analysis maintains that all information is reflected already in the currency price. Trends 'are your friend' and sentiment changes predate and predict trend changes. Investors' emotional responses to price movements lead to recognizable price chart patterns. Technical analysis does not care what the 'value' of a currency is. Their price predictions are only extrapolations from historical price patterns. Here we represent the RSI (Relative Strength Index) and Moving Average to conduct a Technical analysis.

RSI (Relative Strength Index):

7|Page

RSI determine overbought and oversold conditions of an asset. In the above graph shows the RSI ranges from 0 to 100. An asset is considered to be overbought once the RSI approaches the level 70, meaning that it may be getting overvalued and is a good to sell the currency. Likewise, if the RSI approaches level 30, it is an indication that the asset may be getting oversold and therefore likely buys the currency.

Fig 2: Relative Strength Index

Here we define

line indicate level 70 and another one is

line indicate

level 30. So that whenever curve line cross the line level 70 then it indicate investor has to sell the currency. And another thing is, whenever curve line cross the line level 30 then it indicate investor have to buy the currency.

8|Page

In this graph in the month of 6th May, and then 21th May to 22nd May the line of RSI cross over the level 70 so that investor has to sell currency, on the other hand probably at the 17th March to 22nd March the line of RSI cross the level 30 so that investor has to buy currency.

Moving Average: Moving averages are used to indicate the direction of a trend and to settle the price and volume fluctuation that helps to take decision making. Usually, upward moves is confirmed when a short-term average (e.g.10-day) crosses above a longer-term average (e.g. 25-day). Downward momentum is confirmed when a short-term average crosses below a long-term average.

B b b b u y

S b b b u y

B b b b u y

S b b b u y

B b b b u y

S b b b u y

B b b b u y

S b b b u y

B b b b u y

S b b b u y

Fig 3: Moving Average

9|Page

Short run moving average (10): Long run moving average (25): B Buy point indicator: Sell point indicator:

b b S b b u b y b u y

curve curve

At the start month of May MV (25) crosses down through MV (10) or MV (10) cross up through MV (25) so investor has to buy currency. In the middle month of June MV (10) cross down through MV (25) or MV (25) cross up through MV (10) so investor has to sell currency.

At the start month of July MV (25) crosses down through MV (10) or MV (10) cross up through MV (25) so investor has to buy currency.

In the middle month of July MV (10) cross down through MV (25) or MV (25) cross up through MV (10) so investor has to sell currency.

At the end part of August MV (25) crosses down through MV (10) or MV (10) cross up through MV (25) so investor has to buy currency.

In the middle month of September MV (10) cross down through MV (25) or MV (25) cross up through MV (10) so investor has to sell currency

At the end of October MV (25) crosses down through MV (10) or MV (10) cross up through MV (25) so investor has to buy currency.

At the start month of November MV (25) crosses down through MV (10) or MV (10) cross up through MV (25) so investor has to sell currency.

10 | P a g e

At the end part of November MV (10) crosses down through MV (25) or MV (25) cross up through MV (10) so investor has to buy currency.

At the start month of December MV (25) crosses down through MV (10) or MV (10) cross up through MV (25) so investor has to sell currency.

Forecast for the upcoming week:

USD/CAD: A recent weekly break and close back above 1.0100 confirms bullish outlook, and should now open the door for a fresh upside extension to test next key resistance by 1.0375 over the coming sessions. For now, look

11 | P a g e

for any intraday pullbacks to be well supported above 1.0000. A close back above 1.0300 accelerates.

Recommendations: Based on our survey and the experts suggestions we can give away some suggestions to the clients. Here they are:

USDCAD

Price 1.0046

Chg. -0.0047

Chg. % -0.466%

USD CAD @ 13th December 2010 GMT+6, 20:46PM

Last nights scenario clearly shows that the CAD is depreciated by . 466% against USD and the candlestick chart shows reflects same story.

So far friendly trend shows CAD is depreciating respective to USD so directly one can say stick with the USD. From the technical analysis its visible that the trend is downward and the probability of CAD will go down is high. To make an overnight profit buying USD will be more profitable.

12 | P a g e

One thing should be considered cautiously this is the month of December and the historical data shows at January the price of the CAD will go up. So for long term plan holding CAD will be more profitable.

The investor should hold the USD against CAD for short term.

13 | P a g e

Bibliography

The additional helping sources in doing this report are:

o http://www.dailyfx.com/ o http://www.bankofcanada.ca/en/index.html o http://www.federalreserve.gov/ o http://www.tradingeconomics.com/Economics/Currency.aspx? symbol=CAD o http://www.bankofcanada.ca/en/monetary_mod/mechanism/index.html

o

http://www.forexpros.com/currencies/usd-cad-forward-rates

o http://www.tradingeconomics.com/united-states/indicators/ o http://www.tradingeconomics.com/World-Economy/Calendar.aspx o http://www.forex-tribe.com/forum/viewtopic.php?id=2950 o http://www.fxstreet.com/technical/currencies-glance/pair.aspx? id=usd/cad

14 | P a g e

Vous aimerez peut-être aussi

- Lords of Finance - Liaquat Ahamed PDFDocument12 pagesLords of Finance - Liaquat Ahamed PDFasaid100% (2)

- Fundamental Analysis of Forex Markets ExplainedDocument13 pagesFundamental Analysis of Forex Markets ExplainedAar Rageedi0% (1)

- International Financial Management 9th Edition Jeff Madura Solutions Manual 1Document15 pagesInternational Financial Management 9th Edition Jeff Madura Solutions Manual 1eleanor100% (39)

- 2011 HSBC EM Asia GuideEmergingMarketCurrencies2011Document132 pages2011 HSBC EM Asia GuideEmergingMarketCurrencies2011David SongPas encore d'évaluation

- FX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HigherDocument25 pagesFX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HighertekesburPas encore d'évaluation

- Welcome To Financial Trend ForecasterDocument48 pagesWelcome To Financial Trend ForecasterPrincess BinsonPas encore d'évaluation

- Istilah NFPDocument6 pagesIstilah NFPHenry AndersonPas encore d'évaluation

- Int Econ Final ExamDocument9 pagesInt Econ Final ExamWilson LiPas encore d'évaluation

- Signs of Risk Aversion ReturnsDocument5 pagesSigns of Risk Aversion ReturnsValuEngine.comPas encore d'évaluation

- BloomerbergDocument13 pagesBloomerbergRobin SharmaPas encore d'évaluation

- Fight Back Against InflationDocument14 pagesFight Back Against InflationZeeshan AliPas encore d'évaluation

- Forex Sector Presentation: by Stefan Mihailescu and Hu Yi 23 of November 2010Document14 pagesForex Sector Presentation: by Stefan Mihailescu and Hu Yi 23 of November 2010eydmann69Pas encore d'évaluation

- Articulo. The Economist - Why Zero Interest Rates Might Lead To Currency VolatilityDocument2 pagesArticulo. The Economist - Why Zero Interest Rates Might Lead To Currency VolatilityAndres OrlandoPas encore d'évaluation

- Determinants of Exchange RateDocument5 pagesDeterminants of Exchange RatedayaksdPas encore d'évaluation

- Barclays UPDATE Global Rates Weekly Withdrawal SymptomsDocument74 pagesBarclays UPDATE Global Rates Weekly Withdrawal SymptomsVitaly Shatkovsky100% (1)

- Cycles BusinessDocument6 pagesCycles BusinessdeepakpaharyaPas encore d'évaluation

- Across - The - Curve - in - Rates - and - Structured - Products - and - Across - The - Grade - in - Credit - Products - December 19, 2006 - (Bear, - Stearns - & - Co. - Inc.) PDFDocument60 pagesAcross - The - Curve - in - Rates - and - Structured - Products - and - Across - The - Grade - in - Credit - Products - December 19, 2006 - (Bear, - Stearns - & - Co. - Inc.) PDFQuantDev-MPas encore d'évaluation

- 1 - Trade StrategyDocument9 pages1 - Trade StrategyMarvinPas encore d'évaluation

- Degussa Marktreport Engl 22-07-2016Document11 pagesDegussa Marktreport Engl 22-07-2016richardck61Pas encore d'évaluation

- The Financial Sector of The Economy: Money and BankingDocument12 pagesThe Financial Sector of The Economy: Money and BankingNefta BaptistePas encore d'évaluation

- Commodity Money 3iat Money Jank MoneyDocument11 pagesCommodity Money 3iat Money Jank MoneyRabia RabiPas encore d'évaluation

- The Feds Invisible Moving TargetDocument12 pagesThe Feds Invisible Moving TargetJose Fernando PereiraPas encore d'évaluation

- 0927 UsfiwDocument42 pages0927 Usfiwbbj1039Pas encore d'évaluation

- Currency DepreciationDocument18 pagesCurrency DepreciationRamesh GoudPas encore d'évaluation

- Ec103 Week 09 and 10 s14Document44 pagesEc103 Week 09 and 10 s14юрий локтионовPas encore d'évaluation

- Guide Emerging Market Currencies 2010Document128 pagesGuide Emerging Market Currencies 2010ferrarilover2000Pas encore d'évaluation

- Government Intervention in The Exchange RateDocument4 pagesGovernment Intervention in The Exchange RateThankachan CJPas encore d'évaluation

- US Fed Tapering and Its ImpactDocument2 pagesUS Fed Tapering and Its ImpactGoutham BabuPas encore d'évaluation

- 0320 US Fixed Income Markets WeeklyDocument96 pages0320 US Fixed Income Markets WeeklycwuuuuPas encore d'évaluation

- 2.5 Monetary Policy (SL&HL)Document30 pages2.5 Monetary Policy (SL&HL)Shuchun YangPas encore d'évaluation

- Global Macro Commentary Jan 5Document2 pagesGlobal Macro Commentary Jan 5dpbasicPas encore d'évaluation

- Yield CurveDocument10 pagesYield Curvekhurram_ahmedPas encore d'évaluation

- International Financial Management 9th Edition Jeff Madura Solutions Manual 1Document36 pagesInternational Financial Management 9th Edition Jeff Madura Solutions Manual 1paulagomezcjsqfeaoyi100% (24)

- Economics 101Document19 pagesEconomics 101tawhid anamPas encore d'évaluation

- Exchange RatesDocument32 pagesExchange RatesStuti BansalPas encore d'évaluation

- Predicting Trends Intermkt AnalysisDocument81 pagesPredicting Trends Intermkt AnalysisMike Brandt100% (3)

- Introduction To Interest Rate Trading: Andrew WilkinsonDocument44 pagesIntroduction To Interest Rate Trading: Andrew WilkinsonLee Jia QingPas encore d'évaluation

- Central Bank and Market Share RoutDocument34 pagesCentral Bank and Market Share Routcharlie simoPas encore d'évaluation

- China's Evolving Managed Float: An Exploration of The Roles of The Fix and Broad Dollar Movements in Explaining Daily Exchange Rate ChangesDocument12 pagesChina's Evolving Managed Float: An Exploration of The Roles of The Fix and Broad Dollar Movements in Explaining Daily Exchange Rate ChangesTawanda MagomboPas encore d'évaluation

- InflationDocument6 pagesInflationasmiPas encore d'évaluation

- The Foreign Exchange Markets: Case: 1. The Collapse of Thai BahtDocument21 pagesThe Foreign Exchange Markets: Case: 1. The Collapse of Thai BahtsoheltushPas encore d'évaluation

- Literature Review On Exchange Rate FluctuationsDocument4 pagesLiterature Review On Exchange Rate Fluctuationsea7j5ys3100% (1)

- Exchange Rate ForecastingDocument7 pagesExchange Rate ForecastingNikita BangeraPas encore d'évaluation

- Factors Affecting Exchange RatesDocument9 pagesFactors Affecting Exchange RatesAnoopa NarayanPas encore d'évaluation

- Thesis On Currency DevaluationDocument5 pagesThesis On Currency Devaluationchristinavaladeznewyork100% (2)

- Determination of Exchange RateDocument14 pagesDetermination of Exchange RateAshish Tagade100% (2)

- Contentment: Neutral Stance Maintained: Economic InsightsDocument2 pagesContentment: Neutral Stance Maintained: Economic InsightsAnonymous hPUlIF6Pas encore d'évaluation

- The Pensford Letter - 10.24.11Document7 pagesThe Pensford Letter - 10.24.11Pensford FinancialPas encore d'évaluation

- Winter 2009 Market OutlookDocument13 pagesWinter 2009 Market OutlookcollegeanalystsPas encore d'évaluation

- GLOBALISATION FORCES. (Forces Influencing International Business)Document5 pagesGLOBALISATION FORCES. (Forces Influencing International Business)Nguyễn Thùy LinhPas encore d'évaluation

- The Monarch Report 10/28/2013Document4 pagesThe Monarch Report 10/28/2013monarchadvisorygroupPas encore d'évaluation

- Global Macro Commentary Nov 12Document2 pagesGlobal Macro Commentary Nov 12dpbasicPas encore d'évaluation

- What Are Exchange RatesDocument3 pagesWhat Are Exchange RatesZubaria BashirPas encore d'évaluation

- What Causes Currency To Increase/decrease On A Daily Basis?Document5 pagesWhat Causes Currency To Increase/decrease On A Daily Basis?Deepak Nagathihalli ChandruPas encore d'évaluation

- LTI Newsletter - Sep 2011Document19 pagesLTI Newsletter - Sep 2011LongTermInvestingPas encore d'évaluation

- AccOrg ReportDocument4 pagesAccOrg ReportJohn Miguel GordovePas encore d'évaluation

- Monetary Policy: Dr.V.Raman NairDocument45 pagesMonetary Policy: Dr.V.Raman Nairkisna1209Pas encore d'évaluation

- International Bond Market ParticipantsDocument6 pagesInternational Bond Market ParticipantsNandini JaganPas encore d'évaluation

- Stock Volatility PerspectiveDocument6 pagesStock Volatility PerspectiveMrStan BWPas encore d'évaluation

- Day Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)D'EverandDay Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)Pas encore d'évaluation

- ZTBL Annual ReportDocument64 pagesZTBL Annual ReportHaris NaseemPas encore d'évaluation

- SBLC Offer For A Leased BG-SBLC, Procedure and MemorandumDocument2 pagesSBLC Offer For A Leased BG-SBLC, Procedure and MemorandumSharonPas encore d'évaluation

- Family Trust Q A For Download PDFDocument9 pagesFamily Trust Q A For Download PDFphil8984Pas encore d'évaluation

- Maksājuma Uzdevums NR.: (Valūtas Maksājumiem)Document1 pageMaksājuma Uzdevums NR.: (Valūtas Maksājumiem)Sergejs UrbanovičsPas encore d'évaluation

- FICA Configuration Step by Step - SAP Expertise Consulting PDFDocument35 pagesFICA Configuration Step by Step - SAP Expertise Consulting PDFsrinivaspanchakarla50% (6)

- Public Trust Registration Office: Trust Accounts Submission Verification FormDocument1 pagePublic Trust Registration Office: Trust Accounts Submission Verification FormHashtag ComputersPas encore d'évaluation

- Atlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003Document4 pagesAtlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003babe447Pas encore d'évaluation

- New Zealand 2009 Financial Knowledge SurveyDocument11 pagesNew Zealand 2009 Financial Knowledge SurveywmhuthnancePas encore d'évaluation

- HTTPS:WWW - Studocu.com:row:document:the University of The South Pacific:auditing:solutions Test Bank:40332482:download:solutions Test BankDocument66 pagesHTTPS:WWW - Studocu.com:row:document:the University of The South Pacific:auditing:solutions Test Bank:40332482:download:solutions Test BankXuân NhiPas encore d'évaluation

- Steps in Accounting CycleDocument34 pagesSteps in Accounting Cycleahmad100% (4)

- Central Bank: The Guardian of CurrencyDocument6 pagesCentral Bank: The Guardian of CurrencyBe YourselfPas encore d'évaluation

- Risk Assessment Worksheet BlankDocument5 pagesRisk Assessment Worksheet BlankisolongPas encore d'évaluation

- Chapter Four Discounting and Alternative Investment CriteriaDocument22 pagesChapter Four Discounting and Alternative Investment CriteriaYusuf HusseinPas encore d'évaluation

- Definition of InflationDocument28 pagesDefinition of InflationRanjeet RanjanPas encore d'évaluation

- Starbuck PPT by Pershing SquareDocument44 pagesStarbuck PPT by Pershing SquareJainam VoraPas encore d'évaluation

- Mba 410: Commercial Banking Credit Units: 03 Course ObjectivesDocument6 pagesMba 410: Commercial Banking Credit Units: 03 Course ObjectivesakmohideenPas encore d'évaluation

- Exercises 1Document2 pagesExercises 1ilayda demirPas encore d'évaluation

- Important Banking Awareness Handy NotesDocument33 pagesImportant Banking Awareness Handy NotesSimran MishraPas encore d'évaluation

- Contemporary Economic Issues Facing The Filipino EntrepreneurDocument16 pagesContemporary Economic Issues Facing The Filipino EntrepreneurNicole EnriquezPas encore d'évaluation

- ILAEAnnual Report2015Document80 pagesILAEAnnual Report2015LunaFiaPas encore d'évaluation

- Deposit Mobilization of Commercial Bank in Nepal Case Study of Nabil Bank LTDDocument9 pagesDeposit Mobilization of Commercial Bank in Nepal Case Study of Nabil Bank LTDKrishanKhadkaPas encore d'évaluation

- Hire Purchase For Bcom and Nepal CADocument14 pagesHire Purchase For Bcom and Nepal CANandani BurnwalPas encore d'évaluation

- IFM M.Com NotesDocument36 pagesIFM M.Com NotesViraja GuruPas encore d'évaluation

- Fundamentals of Financial Management - Preetha ChandranDocument7 pagesFundamentals of Financial Management - Preetha ChandranAditya KumarPas encore d'évaluation

- Vinati OrganicsDocument6 pagesVinati OrganicsNeha NehaPas encore d'évaluation

- CSEC POA June 2012 P1 PDFDocument12 pagesCSEC POA June 2012 P1 PDFjunior subhanPas encore d'évaluation

- Financial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDocument87 pagesFinancial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDaniel YebraPas encore d'évaluation

- Book4time 25.06.2020 PDFDocument1 pageBook4time 25.06.2020 PDFCira ShotadzePas encore d'évaluation

- Cryptocurrencies and Blockchain Technology - The Future of FinanceDocument14 pagesCryptocurrencies and Blockchain Technology - The Future of FinanceBenjo HodzicPas encore d'évaluation