Académique Documents

Professionnel Documents

Culture Documents

Pyetesori 1

Transféré par

Rudina LipiDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Pyetesori 1

Transféré par

Rudina LipiDroits d'auteur :

Formats disponibles

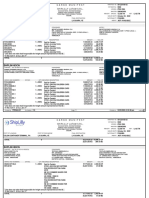

Financial Management Questionnaire

The following questions are intended to assess whether your company benets from strong nancial management practices. The questions also are intended to provoke thought and discussion. The Basics: 1) Are your historical nancial statements completed shortly after the end of the month, quarter or year? 2) Are the historical nancial statements accurate and in clear formats that impart a reasonable understanding of why the results occurred? 3) Do you have Revenue and Order forecasts at the beginning of each quarter and updated at least once during the quarter? 4) Does your company prepare prot and loss forecasts each quarter and review them with the management team? 5) Does your company have departmental expense and capital budgets? 6) Does your company have monthly or quarterly budget versus actual reports?

Yes/No Yes Yes Yes Yes Yes Yes No No No No No No

CONSU

COACH

Proactive Financial Management: (The importance of each of the following items will vary depending on the size, complexity and growth stage of your company) 7) Are the Revenue and Order forecasts in sucient detail to know what actions must be taken to achieve the forecast? 8) Do you have a clear, measured cost of each unit or deliverable for which your company receives revenue? Also known as cost of goods sold. 9) Are all costs that vary with revenues identied, and their relationship (the pattern in which they change relative to revenue) clearly understood? 10) Does your company forecast cost of goods sold, expenses and capital spending (and any other uses of cash) at least once per quarter? 11) Are the prot and loss forecasts prepared and reviewed far enough in advance that actions can be taken to substantially improve the results? 12) Is a Cash-ow forecast prepared showing all sources and uses of cash? 13) Are the revenue, P&L and cash ow forecasts linked in a way that variables such as changes in revenue assumptions or hiring can be modied and immediately ow through to P&L and Cash-ow forecasts? 14) Do you have key metrics for your specic business (such as inventory turnover, sta utilization rates, budget versus actual costs for specic projects) that are regularly reported and monitored?

CFO

Yes Yes Yes Yes Yes Yes

No No No No No No

STRATE

Yes

No

Yes

No

2550 SW Plum Court Portland, Oregon 97219 503.452.9429 503.490.6446 cell larry@willemansp.com

15) Do you have a clear understanding of what actions would need to be taken if your business orders/revenues increased or decreased 50% in a short period of time? (Substitute your best case and worst cases scenarios for the 50% assumption) 16) Have you identied the core competitive strengths of your business? 17) Does your team have the fortitude to take the necessary actions, if required, due to a severe drop in revenue while maintaining the core competitive strengths of your business? 18) Has your company dened its annual and three year nancial goals? 19) Have you projected the amount and timing of capital that will be needed for your company to reach its goals? 20) Have you identied what relationships will be necessary with external investors, bankers or other parties to reach your nancial goals? 21) If another party made you an oer you cant refuse to acquire, or merge with, your business, do you know what that oer would have to be in both nancial and non-nancial terms? 22) Do you have ways to gauge the non-nancial indicators of a companys health such as your teams responsiveness to customer issues, customer satisfaction, employee loyalty and moral?

Yes Yes Yes Yes Yes Yes

No No No No No No

Yes

No

Yes

No

2550 SW Plum Court Portland, Oregon 97219 503.452.9429 503.490.6446 cell larry@willemansp.com

Vous aimerez peut-être aussi

- Creating a Portfolio like Warren Buffett: A High Return Investment StrategyD'EverandCreating a Portfolio like Warren Buffett: A High Return Investment StrategyPas encore d'évaluation

- BUSINESS OVERVIEW - MO New ClientDocument3 pagesBUSINESS OVERVIEW - MO New ClientJide GdayPas encore d'évaluation

- Exam (Unfinished)Document4 pagesExam (Unfinished)Joy BerjuegaPas encore d'évaluation

- Olin Finance Club Interview Questions & AnswersDocument20 pagesOlin Finance Club Interview Questions & AnswersSriram ThwarPas encore d'évaluation

- General Finance Interview Tips: #1 Behavioral and Fit Questions Relate More ToDocument6 pagesGeneral Finance Interview Tips: #1 Behavioral and Fit Questions Relate More ToNneha BorkarPas encore d'évaluation

- To Copy 6 Component From Pg. 91 To 92 (Sales Forecast, Pro Forma Statement, ) With ExplanationDocument8 pagesTo Copy 6 Component From Pg. 91 To 92 (Sales Forecast, Pro Forma Statement, ) With Explanationkhin thuzar tinPas encore d'évaluation

- Financial Modeling By: CA Tapan Kumar DasDocument16 pagesFinancial Modeling By: CA Tapan Kumar DasLAMOUCHI RIMPas encore d'évaluation

- Topic 5 Financial Forecasting For Strategic GrowthDocument20 pagesTopic 5 Financial Forecasting For Strategic GrowthIrene KimPas encore d'évaluation

- Interview Base - Knowledge & PracticalDocument39 pagesInterview Base - Knowledge & Practicalsonu malikPas encore d'évaluation

- Effectively Create A Marketing Strategy That Will Ensure Knowledge and Consumption of The Product or Service To The End Consumer". Please ExplainDocument4 pagesEffectively Create A Marketing Strategy That Will Ensure Knowledge and Consumption of The Product or Service To The End Consumer". Please ExplaingekmasradharaniPas encore d'évaluation

- FP&A Interview Questions and AnswersDocument7 pagesFP&A Interview Questions and Answershrithikoswal1603Pas encore d'évaluation

- Finance and Research Analyst Interview Question 1568208407Document7 pagesFinance and Research Analyst Interview Question 1568208407Hitesh PunjabiPas encore d'évaluation

- Interview Questions - Finance DirectorDocument2 pagesInterview Questions - Finance DirectorExtreme TourismPas encore d'évaluation

- 20BSP1623 - PRACHI DAS - Financial Statement Analysis AssignmentDocument2 pages20BSP1623 - PRACHI DAS - Financial Statement Analysis AssignmentASHUTOSH KUMAR SINGHPas encore d'évaluation

- Chapter 8 COMM 320Document10 pagesChapter 8 COMM 320Erick GellisPas encore d'évaluation

- FM - Assignment 1 (Part 2)Document4 pagesFM - Assignment 1 (Part 2)Layla AfidatiPas encore d'évaluation

- SGX Investor's Guide To Reading Annual ReportsDocument12 pagesSGX Investor's Guide To Reading Annual Reportsjilbo604Pas encore d'évaluation

- Assessing The FirmDocument7 pagesAssessing The FirmJohnYadavPas encore d'évaluation

- Financial Management Module 10 Activity PK1Document1 pageFinancial Management Module 10 Activity PK1Ali NasarPas encore d'évaluation

- Lesson 2 Organization PDFDocument20 pagesLesson 2 Organization PDFAngelita Dela cruzPas encore d'évaluation

- Mission Statement, Corporate SocialDocument12 pagesMission Statement, Corporate SocialBasnet BidurPas encore d'évaluation

- Philip Fisher's 15-Point Investment ChecklistDocument2 pagesPhilip Fisher's 15-Point Investment Checklisttejasi100% (1)

- Financial Statement Analysis: Financial Policy and PlanningDocument27 pagesFinancial Statement Analysis: Financial Policy and PlanningGurjeit SinghPas encore d'évaluation

- Finance Interview QuestionsDocument17 pagesFinance Interview Questionsfilmy.photographyPas encore d'évaluation

- Internation BusinessDocument36 pagesInternation BusinessneeleshPas encore d'évaluation

- Steps in Achieving A Successful M&A OutcomeDocument5 pagesSteps in Achieving A Successful M&A OutcomeZuraidah KassimPas encore d'évaluation

- ACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgDocument2 pagesACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgGauri SinghPas encore d'évaluation

- REPORT Engg ManagementDocument5 pagesREPORT Engg Managementjc casordPas encore d'évaluation

- Business Plan: Company Analysis: Industry AnalysisDocument3 pagesBusiness Plan: Company Analysis: Industry AnalysisVictor Diaz RoldanPas encore d'évaluation

- Due Deligence Check List and Quetionnaire Complete UBA RESPONSE-APX-HO-PC-WS-03Document19 pagesDue Deligence Check List and Quetionnaire Complete UBA RESPONSE-APX-HO-PC-WS-03EnochPas encore d'évaluation

- ITF AssignmentDocument6 pagesITF AssignmentSDF45215Pas encore d'évaluation

- Philip Fisher Investment ChecklistDocument1 pagePhilip Fisher Investment ChecklistNIVE SPas encore d'évaluation

- Chapter 1Document35 pagesChapter 1CharleneKronstedtPas encore d'évaluation

- A Suggested Format For The Company Analysis ReportDocument4 pagesA Suggested Format For The Company Analysis ReportPrasanth VngPas encore d'évaluation

- BSBMGT617 Task 5Document3 pagesBSBMGT617 Task 5jot jotPas encore d'évaluation

- Accountancy Project TopicDocument14 pagesAccountancy Project TopicIsha BhattacharjeePas encore d'évaluation

- Develop and Implement A Business PlanDocument5 pagesDevelop and Implement A Business PlanHamza MunirPas encore d'évaluation

- What Is The Enterprise Overall Goals For This Year? - To Survive - To Firm Up Our Foundations (Systems, Procedures, Product Improvement)Document11 pagesWhat Is The Enterprise Overall Goals For This Year? - To Survive - To Firm Up Our Foundations (Systems, Procedures, Product Improvement)Catherine D. AdrayanPas encore d'évaluation

- Genpact Finance Interview QDocument5 pagesGenpact Finance Interview QJakir Hussain DargaPas encore d'évaluation

- R2RDocument3 pagesR2RPeeyush Singh100% (1)

- FINMAN Mod01 - 3e - 030512 2Document46 pagesFINMAN Mod01 - 3e - 030512 2Anonymous XCpe2nPas encore d'évaluation

- Writing A Business Plan: How To Win Backing To Start Up or Grow Your Business (Bahasa Indonesia)Document79 pagesWriting A Business Plan: How To Win Backing To Start Up or Grow Your Business (Bahasa Indonesia)MiraPas encore d'évaluation

- Study MaterialDocument9 pagesStudy MaterialJAYPas encore d'évaluation

- Cover LetterDocument1 pageCover LetterAli AyubPas encore d'évaluation

- Cash Flow AnalysisDocument19 pagesCash Flow Analysisanwar_pblPas encore d'évaluation

- SFM - Sem 3Document219 pagesSFM - Sem 3Yogesh AnaghanPas encore d'évaluation

- 6 Types Of: Business PlansDocument2 pages6 Types Of: Business PlansRainier TalitePas encore d'évaluation

- Finance Interview QuesDocument4 pagesFinance Interview QuesloyolaitePas encore d'évaluation

- Tutorial Set 1 AnsweredDocument3 pagesTutorial Set 1 AnsweredGerald SmithPas encore d'évaluation

- Financial TrainingDocument15 pagesFinancial TrainingGismon PereiraPas encore d'évaluation

- Financial Analyst Interview QuestionsDocument3 pagesFinancial Analyst Interview QuestionsCharish Jane Antonio CarreonPas encore d'évaluation

- Corporate Analysis Project BA 505: Financial AccountingDocument6 pagesCorporate Analysis Project BA 505: Financial AccountingfredmanntraPas encore d'évaluation

- FP&ADocument7 pagesFP&AomkarPas encore d'évaluation

- Main Components of A Business PlanDocument8 pagesMain Components of A Business PlanReynhard DalePas encore d'évaluation

- Business Plan: International Philippine School in Jeddah Senior High School DepartmentDocument29 pagesBusiness Plan: International Philippine School in Jeddah Senior High School DepartmentDanikkaGayleBonoanPas encore d'évaluation

- 3is Learning Partner - Lesson 4Document12 pages3is Learning Partner - Lesson 4wild lunaPas encore d'évaluation

- Financial Reporting Thesis PDFDocument6 pagesFinancial Reporting Thesis PDFUK100% (2)

- Fsa 1Document26 pagesFsa 1Nabanita GhoshPas encore d'évaluation

- Phil Fisher Investing ChecklistDocument3 pagesPhil Fisher Investing ChecklistAlexander LuePas encore d'évaluation

- Lecture 3: Business Intelligence: OLAP, Data Warehouse, and Column StoreDocument119 pagesLecture 3: Business Intelligence: OLAP, Data Warehouse, and Column StoreRudina LipiPas encore d'évaluation

- Chap 001Document26 pagesChap 001Lokesh MundraPas encore d'évaluation

- Chap 003Document23 pagesChap 003Rudina LipiPas encore d'évaluation

- Lecture 1Document47 pagesLecture 1meetsatyajeePas encore d'évaluation

- Chap 004Document20 pagesChap 004Rudina LipiPas encore d'évaluation

- Chap 002Document37 pagesChap 002Rudina LipiPas encore d'évaluation

- Chap 005Document28 pagesChap 005Rudina LipiPas encore d'évaluation

- Totali 443,000 402,670 443,000 60,401Document2 pagesTotali 443,000 402,670 443,000 60,401Rudina LipiPas encore d'évaluation

- Chapter 3 Organisation Structure CultureDocument10 pagesChapter 3 Organisation Structure Culturevivy100% (3)

- Chapter 1Document13 pagesChapter 1Rudina LipiPas encore d'évaluation

- Capital Budgeting - IMPORTANT PDFDocument8 pagesCapital Budgeting - IMPORTANT PDFsalehin1969Pas encore d'évaluation

- Role of Science, Uncertainty & Risk Perception in Making Informed Decisions - An Industry PerspectiveDocument47 pagesRole of Science, Uncertainty & Risk Perception in Making Informed Decisions - An Industry PerspectiveRudina LipiPas encore d'évaluation

- Ethics in Business ResearchDocument23 pagesEthics in Business Researchprabakar070Pas encore d'évaluation

- Cia Review: Part 1 Study Unit 3: Control Frameworks and FraudDocument14 pagesCia Review: Part 1 Study Unit 3: Control Frameworks and FraudjorgePas encore d'évaluation

- Examen Final - Ingles Iv - TerminadoDocument3 pagesExamen Final - Ingles Iv - TerminadoDavid CarbajalPas encore d'évaluation

- Shell Pakistan LTD: Presented By: Umer Saleem Adina Javed Obaid Ghori Pirah Ahsan Paras Batool Shahzad ShahidDocument18 pagesShell Pakistan LTD: Presented By: Umer Saleem Adina Javed Obaid Ghori Pirah Ahsan Paras Batool Shahzad ShahidHasan KaziPas encore d'évaluation

- Customer Journey MapsDocument9 pagesCustomer Journey MapsadinamdarPas encore d'évaluation

- Lecture 11 - Standards On Auditing (SA 540 and 550)Document7 pagesLecture 11 - Standards On Auditing (SA 540 and 550)Harshit JainPas encore d'évaluation

- Cost-Volume-Profit: Learning ObjectivesDocument66 pagesCost-Volume-Profit: Learning Objectiveskashif aliPas encore d'évaluation

- Orgma Ni WawonDocument3 pagesOrgma Ni WawonMay Ann MagbanuaPas encore d'évaluation

- MAS 1 - Standard Cost and Variance AnalysisDocument2 pagesMAS 1 - Standard Cost and Variance AnalysisKris FernandezPas encore d'évaluation

- AFAR04-12 Process CostingDocument2 pagesAFAR04-12 Process CostingArcii BarbaPas encore d'évaluation

- Retail Marketing Questions PaperDocument51 pagesRetail Marketing Questions PaperAli ShaikhPas encore d'évaluation

- National Highways Authority of India Request For ProposalDocument2 pagesNational Highways Authority of India Request For ProposalPraveen KumarPas encore d'évaluation

- Enterpreneurship Lec 10Document10 pagesEnterpreneurship Lec 10SaMee KHanPas encore d'évaluation

- Resume NORHIDAYAHBINTIMUSTAFADocument4 pagesResume NORHIDAYAHBINTIMUSTAFAnur nadiahPas encore d'évaluation

- Chapter 11: Flexible Budgeting and The Management of Overhead and Support Activity CostsDocument37 pagesChapter 11: Flexible Budgeting and The Management of Overhead and Support Activity CostsSteph GonzagaPas encore d'évaluation

- CBRE VN - ILS Quarterly Market Update (June 20)Document52 pagesCBRE VN - ILS Quarterly Market Update (June 20)Galih AnggoroPas encore d'évaluation

- General Purpose Financial StatementsDocument19 pagesGeneral Purpose Financial StatementsJames LopezPas encore d'évaluation

- Milestone 1Document12 pagesMilestone 1Elizabeth OmotayoPas encore d'évaluation

- Inception Cheat SheetDocument1 pageInception Cheat SheetAntonny JaramilloPas encore d'évaluation

- HIS ModulesDocument28 pagesHIS Modulespriya sainiPas encore d'évaluation

- Idea To Business Model Koe060Document1 pageIdea To Business Model Koe060viku9267Pas encore d'évaluation

- Common KPIs Cascading GuidlineDocument13 pagesCommon KPIs Cascading GuidlineJemal YayaPas encore d'évaluation

- Iso 19600 TemplateDocument2 pagesIso 19600 TemplateAmirPas encore d'évaluation

- Muhammad Shoaib CSCP CLTD 21..2Document4 pagesMuhammad Shoaib CSCP CLTD 21..2MudasserAliKhanPas encore d'évaluation

- Unit 3 Study GuideDocument3 pagesUnit 3 Study Guide高瑞韩Pas encore d'évaluation

- Safety Requirements For ScaffoldsDocument17 pagesSafety Requirements For ScaffoldsRackie Enriquez83% (6)

- Manifiesto de Carga Import La Guaira MN Ipek Oba V-006e (Final)Document43 pagesManifiesto de Carga Import La Guaira MN Ipek Oba V-006e (Final)Daisy, Roda,JhonPas encore d'évaluation

- Aging 6.17.2021Document81 pagesAging 6.17.2021Ricardo DelacruzPas encore d'évaluation

- Partnership FundamentalsDocument3 pagesPartnership FundamentalsDeepanshu kaushikPas encore d'évaluation

- Ramco Cement Limited: Insight Into Their Marketing AnalyticsDocument15 pagesRamco Cement Limited: Insight Into Their Marketing Analyticsnishant1984Pas encore d'évaluation

- Gantt Chart Technician DutiesDocument7 pagesGantt Chart Technician DutiesCoolaboo22Pas encore d'évaluation