Académique Documents

Professionnel Documents

Culture Documents

ModeloNFe Entrada Importação

Transféré par

Renata Feliciano de AndradeTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ModeloNFe Entrada Importação

Transféré par

Renata Feliciano de AndradeDroits d'auteur :

Formats disponibles

Modelo.NFe.Imp.

(2)

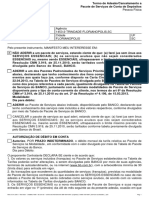

NOTA FISCAL DE ENTRADA

CFOP:

Natureza da Operao

Razo Social

Rem: RPS Spa

Viale Europa,7

Legnago (VR) 37045

3101

Compra para industrializao

CLCULO DO IMPOSTO

BASE CALCULO DO ICMS

288,157.99

Valor do Frete

0.00

Valor ICMS

51,828.35

Vlr. Seguro

0.00

BASE CALCULO DO ICMS-ST

Valor ICMS-ST

Outras Despesas Acessrias

21,043.71

Valor IPI

28,059.81

Valor Total dos Produtos

187,225.96

DESCRIO DE PRODUTO

IT

Frete p/conta

1

NCM

Especie

P. Bruto

703.000

Unidade

Peso Liquido

672.700

Unit.

Total

Valor Total da Nota

288,157.78

Marca

Impostos que no aparecem destacados nos itens -NF-e

s o Total em Dados Adicionais

BC ICMS

V.ICMS

V.IPI

Alquotas

ICMS IPI

DA

*Adio

II

PIS

COFINS

Sistema Ininterrupto de Energia (Nobreak) HPS HT40

1 40KVA 400/230v 60Hz 6HTA40KSPA

8504.40.40

1000

29.9295000

29,929.54

54,407.25

9,793.31

5,297.54

18%

15%

40.00

5,387.32

18%

706.27 1.65%

3,253.13 7.60%

Sistema de comunicao Netm 101Plus 6SOFT020B

2 220Vac 60Hz

8504.90.90

10500

12.2217000

128,327.90

233,082.37

41,954.83

22,714.04

18%

15%

10.00

23,099.03

18%

3,028.25 1.65%

13948.32 7.6%

Condensador de polipropileno 50UF 450Vca 50Hz

3 04F0041A

8532.25.90

33.9200000

305.32

488.80

58.66

35.43

12%

10%

4.00

48.86

16%

6.52 1.65%

30.02 7.6%

Condensador de polipropileno 8UF 450Vca 50Hz

4 04F0011A

8532.25.90

18.3800000

110.33

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

179.56

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

21.55

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

12.81

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

12%

10%

4.00

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

17.66

16%

2.36

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

10.85

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

158,673.09

288,157.99

51,828.35

28,059.81

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

Total

58.00

*

Dados Adicionais

FOB

II

IPI

DA

PIS

Cofins

R$

R$

R$

R$

R$

R$

18%

158,257.44

28,486.35

28,011.58

50.00

3,734.52

17,201.45

12%

Total

R$

Dividido: (1-18%) Celula F e (1-12%) Celula G

235,741.34

0.82

588.14

0.88

236,329.48

415.65

66.52

48.23

8.00

8.87

40.87

Total

158,673.09

28,552.87

28,059.81

58.00

3,743.40

17,242.31

Base ICMS

R$

287,489.44

668.34

288,157.78

Valor do ICMS

R$

51,748.10

80.20

51,828.30

28,552.87

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

1.65%

3,743.40

Adio DA = a cada grupo de itens c/mesmo NCM

exceto baterias que tm de ser consideradas adio a cada

tem diferente com voltagem e peso diferentes,mesmo que

tenham o mesmo NCM.

DI. 10/1819020-3 de 15/10/2010

Columbia - Porto de Santos - Ltda

Proc. CM10/453-455 - RPS V4/407757-407815

Pgina 1

R$0.02

R$1.65

0.02

TRANSPORTADOR/VOLUMES TRANSPORTADOS

Quantidade de Volumes

4

1.65

100.00

17,242.31

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

7.6%

Pis.Cofins (2)

Coordenao-Geral de Administrao Aduaneira (Coana)

Coordenao de Fiscalizao e Controle Aduaneiro (Cofia)

Diviso de Despacho Aduaneiro (Dides)

Ed. Anexo Ministrio da Fazenda sala 422

Braslia - DF

70048-901

Nmero da DI:

total

Nmero Adio

4

21,910.20

Valor Aduaneiro

II

IPI

IPI

Especfica

Quantidade

#REF!

20,182.60

#REF!

14.0%

0.00

15.0%

#REF!

1,311.95

#REF!

16.0%

0.00

10.0%

#REF!

305.32

#REF!

16.0%

0.00

10.0%

#REF!

110.33

#REF!

16.0%

0.00

10.0%

Pgina 2

Pis.Cofins (2)

tx siscomex apenas p/calc. ICMS

tx Siscomex apenas p/ calc.ICMS

58.00

Quantidade de Adies:

Alquotas%

Pis/Pasep

Cofins

Icms

COFINS

PIS/PASEP

Importao (R$) Importao (R$)

#REF!

#REF!

3,101.98

3,651.63

II

IPI

1.65%

7.60%

18.0%

#REF!

#REF!

2,825.56

3,451.22

1.65%

7.60%

18.0%

#REF!

#REF!

209.91

152.19

1.65%

7.60%

12.0%

#REF!

#REF!

48.85

35.42

1.65%

7.60%

12.0%

#REF!

#REF!

17.65

12.80

Pgina 3

Pis.Cofins (2)

tx siscomex apenas p/calc. ICMS

FCA x 0,18%

#REF!

#REF!

BC PIS/COFINS

#REF!

#REF!

SOMATORIO

#REF!

BASE ICMS

#REF!

ICMS

Armazenagem Columbia

#REF!

#REF!

#REF!

VALOR TOTAL

58.00

tx siscomex

#REF!

BASEICMS-IPI

rateio p/icms

#REF!

#REF!

#REF!

#REF!

40.00

#REF!

#REF!

#REF!

#REF!

#REF!

10.00

#REF!

#REF!

#REF!

#REF!

#REF!

4.00

#REF!

#REF!

#REF!

#REF!

#REF!

4.00

#REF!

Pgina 4

Vous aimerez peut-être aussi

- Payment InstructionsDocument1 pagePayment InstructionsPetrus NegreiroPas encore d'évaluation

- Orcamento 9 Condominio Praca Das AguasDocument1 pageOrcamento 9 Condominio Praca Das Aguasclaudiosorrigotti4Pas encore d'évaluation

- Questionário Alfabetização FinanceiraDocument8 pagesQuestionário Alfabetização FinanceiraCarlos AndradePas encore d'évaluation

- Pagamento de condomínio residencial EcovilleDocument2 pagesPagamento de condomínio residencial EcovilleCleber LimaPas encore d'évaluation

- Pagamento GRU Fundo Serviço MilitarDocument1 pagePagamento GRU Fundo Serviço MilitarThiago VigodPas encore d'évaluation

- Bancos comerciais: evolução histórica e futuroDocument18 pagesBancos comerciais: evolução histórica e futuroNatália CabidoPas encore d'évaluation

- Perícia contábil em ação de prestação de contasDocument14 pagesPerícia contábil em ação de prestação de contasAnderson OliveiraPas encore d'évaluation

- STR Participantes BrasilDocument3 pagesSTR Participantes BrasilMarcelo GuerraPas encore d'évaluation

- Lista de bancos brasileirosDocument3 pagesLista de bancos brasileirosVitor TrigueiroPas encore d'évaluation

- Caderno de Instrução de Eduacação Financeira - 1 Edição 2015Document61 pagesCaderno de Instrução de Eduacação Financeira - 1 Edição 2015Carlos EduardoPas encore d'évaluation

- 71269420Document4 pages71269420Robson OliveiraPas encore d'évaluation

- Simulado de Matemática - 19 questõesDocument3 pagesSimulado de Matemática - 19 questõesTarcisio MeloPas encore d'évaluation

- Glossario CartoesDocument3 pagesGlossario CartoesFrases & PoemasPas encore d'évaluation

- Extrato WiseDocument2 pagesExtrato WiseDiano Miguel100% (1)

- Prova ANCORD completa com gabaritos comentadosDocument32 pagesProva ANCORD completa com gabaritos comentados-roseira-100% (1)

- Fatura Detalhada Fatura Detalhada: Niptelecom Niptelecom Telecomunicações Ltda Telecomunicações LtdaDocument1 pageFatura Detalhada Fatura Detalhada: Niptelecom Niptelecom Telecomunicações Ltda Telecomunicações Ltdagabrielbrum6Pas encore d'évaluation

- Texto Guia 2do - Semestre 2017tyrone PDFDocument262 pagesTexto Guia 2do - Semestre 2017tyrone PDFEloisa PerezPas encore d'évaluation

- Mercado de DerivativosDocument43 pagesMercado de Derivativosbrunoorsiscribd100% (1)

- Cenario Open Finance 14. 04Document232 pagesCenario Open Finance 14. 04centroportoalegre01Pas encore d'évaluation

- Pacote de ServiçosDocument2 pagesPacote de ServiçosIsac MartinsPas encore d'évaluation

- Cpa 10Document179 pagesCpa 10Nadi MeloPas encore d'évaluation

- TampoDocument5 pagesTampoJair GonçalvesPas encore d'évaluation

- Boleto de parcelas de financiamentoDocument1 pageBoleto de parcelas de financiamentoAilson MedeirosPas encore d'évaluation

- Contabilidade Tributária: Aula 4 - ICMSDocument42 pagesContabilidade Tributária: Aula 4 - ICMSFrancisco AguiarPas encore d'évaluation

- Pagamento de parcela de consórcioDocument1 pagePagamento de parcela de consórcioEduardoPas encore d'évaluation

- Das Pgmei 14519899000168 Ac2024Document1 pageDas Pgmei 14519899000168 Ac2024Mega Infor e PapelariaPas encore d'évaluation

- Atividade 4º Ano MatemáticaDocument3 pagesAtividade 4º Ano MatemáticaEtevaldo LimaPas encore d'évaluation

- Ganhe com DólarDocument13 pagesGanhe com DólarRoberto DFPas encore d'évaluation

- Inflação e Os Planos Brasileiros de Combate À InflaçãoDocument17 pagesInflação e Os Planos Brasileiros de Combate À InflaçãoAlexandre Cuiabano Monteiro da SilvaPas encore d'évaluation

- Contrato Firmado Entre Empresa de Manutenção e Corpo de Bombeiros Militar Do DFDocument9 pagesContrato Firmado Entre Empresa de Manutenção e Corpo de Bombeiros Militar Do DFMetropolesPas encore d'évaluation