Académique Documents

Professionnel Documents

Culture Documents

Progress Report On Eu Govt Bond Instruments en

Transféré par

momentazoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Progress Report On Eu Govt Bond Instruments en

Transféré par

momentazoDroits d'auteur :

Formats disponibles

ECONOMIC AND FINANCIAL COMMITTEE

Brussels, 23 October 2000 EFC/ECFIN/666/00- En

Progress report on EU government Bond instruments

1- At its 17 May 2000 meeting, the ad-hoc group of the Economic and Financial Committee decided to prepare a report on government bond instruments and retail instruments. 2- Table 1 presents the share of national currency denominated bonds by type of instruments for each Member State. Table 2 describes the characteristics of the main instrument in each Member State. Table 3 gives some information on the retail instruments existing in some Member States. 3- The main findings of these tables are following :

- The characteristics (tables 1 and 2) of the bond issues in the EU Member States of the bond issues in the EU Member States register a great degree of similarity : * the fixed rate bond issues represent between 47 and 100% of total debt issuance, and more than 90% in 9 member States; * the floating rate issues are very limited, or do not exist anymore, except in 4 Member States, when it represents between 8 and 36% of the national currency denominated bonds ; * CPI-index issues exist in three Member States. - In all Member States, new issued bonds are plain vanilla security issued in fungible tranches. The maturity of bond issued is between 2 and 50 years, but the most important benchmarks are 5 and 10 years. -Retail instruments are issued in a majority of Member States, and are the most often specific instruments issued through specific placement channels, available to the large public (Table 3). They represent between 1 and 20% of total debt.

____________

Annex 1 : Characteristics of Government Bond instruments Current situation in EU Member States

Austria The main bond instrument uses in Austria is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 58% of the total debt. The main benchmarks on bonds markets are 5 and 10 years. Austria does not issue any specific retail instrument. Belgium The main bond instrument uses in Belgium is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 64% of the total debt. The main benchmarks on bonds markets are 5, 10 and 30 years. Belgium issues also specific retail instruments, whose placement is ensured by a consortium of financial institutions. Denmark The main bond instrument used in Denmark is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 98% of the total debt. The main benchmarks on bonds markets are 2, 5 and 10 years. In Denmark, there is no specific retail instrument. Finland The main bond instrument used in Finland is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 63% of the total debt. The main benchmarks on bond markets are 3,4,5,7,8 and 10 years. Belgium issues also specific retail instruments, sold be banks or directly by the State Treasury. France The main bond instrument used in France is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 95% of the total debt. The main benchmarks on Bond markets are 2, 5, 10 and 30 years. France does not issue any specific retail instrument, but sales a limited part of the OAT 10 Y and the OATi 10Y directly to the retail sector. Germany The main bond instrument used in Germany is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 77% of the total debt. The main benchmarks on bonds markets are 2, 5 and 10 years. Germany also issues specific retail instruments. Greece The main bond instrument used in Greece is a national currency plain vanilla fixed rate security auctioned in fungible tranches. It represents 61% of the total debt. The main benchmarks on Bond markets are 3, 5, 10 and 20 years. Greece issues also specific retail instruments, whose placement is ensured through public souscription. Ireland The only bond instrument used in Ireland is a national currency plain vanilla fixed rate security auctioned in fungible tranches.

The main benchmarks on Bond markets are 2, 5, 10 and 15 years. Ireland issues also specific retail instruments, sold through the Post Office. Italy The main bond instrument used in Italy is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 55 % of the total debt. The main benchmarks on Bond markets are 3, 5, 10 and 30 years. Italy issues also specific retail instruments, sold through the Post Office. Luxembourg The only bond instrument used in Luxembourg is a plain vanilla fixed rate security auctioned in fungible tranches, whose maturity is 10 years. Luxembourg does not issue any specific retail instruments.

Netherlands The main bond instrument used in the Netherlands is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 93% of the total debt. The main benchmarks on Bond markets are 3, 10 and 30 years. The Netherlands do not issue any specific retail instrument. Portugal The main bond instrument used in Portugal is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 53% of the total debt. The main benchmarks on Bond markets are 5 and 10 years. Portugal issues also specific retail instruments, whose placement is ensured by the IGCP and the Post Office. Spain The main bond instrument used in Spain is a plain vanilla fixed rate security auctioned in fungible tranches. It represents 71% of the total debt. The main benchmarks on Bond markets are 3, 5, 10, 15 and 30 years. Spain does not issue specific retail instrument, but sells a limited part of its issuance to the retain sector, through a consortium of financial institutions or directly at the Treasury. It is currently preparing a placement through internet. Sweden The main bond instrument used in Sweden is a national currency plain vanilla fixed rate security auctioned in fungible tranches. It represents 47% of the total debt. In addition, Sweden issues inflation-linked bonds which represent 9% of the total debt, as well as specific retail instruments, sold by internet, phone, through mail order or using a consortium of financial institutions. United Kingdom The main bond instrument used in the UK is a national currency plain vanilla fixed rate security auctioned in fungible tranches. It represents 60% of the total debt. The main benchmarks on Bond markets are 5, 10, 15 and 30 years. Bonds indexed to the CPI represent a further 18% of total debt while non-marketable retail instruments, sold through National Savings, make up a further 17%.

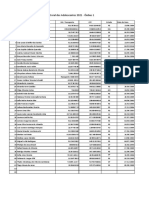

Table 1 : Share of national currency denominated bonds by type of instruments

AUSTRIA BELGIUM DENMARK FINLAND FRANCE GERMANY GREECE IRELAND ITALY LUXEMBURG NETHERLANDS PORTUGAL1 SPAIN SWEDEN UK

fixed 99 99 100 100 94.5 77,4 64 100 74 100 97.4 87.3 100 862 75

Floating 1 1

Index-linked (index)

other

4 8,5 36 26 2.6 12.7 03 1

1.5 (French CPI index) 0

14.1

14(CPI index) 23 (UK CPI index)

1 2

before swaps including retail isntruments of SEK 49 billion 3 Households products only

Table 2 : Main Bond instruments

AUSTRIA (Bearer global notes) BELGIUM (olo) DENMARK (Bullet loans) FINLAND FRANCE (OAT) GERMANY GREECE

% of Type total debt 58 Plain vanilla security auctioned in fungible tranches 64 97,9 63,4 94.5 77,4 61 Plain vanilla security auctioned in fungible tranches Plain vanilla security auctioned in fungible tranches Plain vanilla securities issued in fungible tranches Plain vanilla fixed rate security auctioned in fungible tranches Plain vanilla securities issued in fungible tranches National currency plain vanila securities auctioned in fungible tranches (reopenings) Plain vanilla type securities auctioned in fungible tranches Plain vanilla type securities auctioned in fungible tranches (BTP)

Maturity Not more than 50 years 2-30 years 2-10 years 2-10 years 2-30 years 2-30 years 2-20 years

Benchmarks Mainly 5 and 10 years 5,10, and 30 years 2,5 and 10 years 3, 4, 5, 7, 8 and 10 years 2,5,10,30 years

Coupon Fixed rate Fixed rate (15 lines)4 Floating rate (1 line)5 Fixed rate Fixed rate Fixed rate

2,5 and 10 Fixed rate years 3,5,10,20 years Fixed and floating rate 2,5,10,15 years Fixed rate 3, 5, 10, 30 years BTP 10 years 3,10,30 years Fixed rate

IRELAND ITALY6

100 54,7

2-15 years 3, 5, 10, 30 years

LUXEMBOURG NETHERLANDS

100 93

Plain vanilla fixed rate security issued by using the tap technique.

10 years 3-30 years

Fixed rate Fixed rate

4 5

Annual coupon, coupon date : March 28 or September 28 (for lines opened since 1996) quarterly coupon referenced on the 3 month Euribor 66 This percentage is referred to total of State securities, managed directly by the Treasury.

PORTUGAL SPAIN SWEDEN (Treasury Bonds) UNITED KINGDOM

52.9 70.6 47 60

Plain vanilla fixed rate security auctioned in fungible tranches Plain vanilla fixed rate security auctioned in fungible tranches National currency plain vanilla security auctioned National currency fixed coupon bonds auctioned in fungible tranches

Not more that 30 years 3-30 years 2-14 years 5-30 years

5 and 10 years 3,5,10,15 and 30 years 2-14 years 5,10 and 30 years

Fixed rate Fixed rate Fixed coupon interest rate Fixed rate (semi-annual coupon)

Table 3: Retail instruments existence NO YES NO YES YES YES YES YES specific YES type Plain vanilla or restructured Maturity 3-8 years Fixed rate instruments, maturity 2-5 years Sale of a limited part of the OAT 10 Y and the OATi 10Y Federal savings bonds and Federal Treasury financing paper Saving certificates Saving bonds Maturity of 3 to 5.5 years Fixed rate Postal saving bonds (not marketable) issuance 4 times a year ; placement using a consortium of financial institutions Selling by banks and directly from the State Treasury Placement using a consortium of financial institutions % of total debt 2%

AUSTRIA BELGIUM DENMARK FINLAND FRANCE GERMANY GREECE IRELAND

YES NO YES7 YES* YES

2,9 % 2% 7,7%

Public subscription sold through the Post Office

2% 13.3

8

ITALY LUXEMBOURG NETHERLANDS PORTUGAL SPAIN

YES NO NO YES YES

YES

sold through the Post Office

8,7

YES NO

Saving certificates

SWEDEN

YES

YES

Mainly fixed rate issues Maturity 3-15 years 54 % floating rate, 31% fixed rate, 16% index-linked

UNITED KINGDOM

YES

YES

Sold at IGCP or at any post office Placement using a consortium of financial institutions or directly to the treasury (Internet under discussion) Selling by internet, telephone, through mail order, or using a consortium of financial institutions Non Marketable government liabilities issued by National Savings

19.8%

1%

17.5%

Five-year special bonds are also sold to the retail sector for a period of six months after which they are offered to the auction group. This percentage is referred to the total of State Sector debt, which includes not only Treasury marketable debts, but all liabilities of State Sector (corresponding, more or less, to Central Government), cleaned by liquid assets. Previous percentages

8

Vous aimerez peut-être aussi

- The Incomplete Currency: The Future of the Euro and Solutions for the EurozoneD'EverandThe Incomplete Currency: The Future of the Euro and Solutions for the EurozonePas encore d'évaluation

- The EU Stress Test and Sovereign Debt Exposures - by Blundell-Wignall and Slovik, Aug. 2010Document13 pagesThe EU Stress Test and Sovereign Debt Exposures - by Blundell-Wignall and Slovik, Aug. 2010FloridaHossPas encore d'évaluation

- 2010 June What You Get For 750bn JSDocument7 pages2010 June What You Get For 750bn JSmanmohan_9Pas encore d'évaluation

- The Economics of Target Balances: From Lehman to CoronaD'EverandThe Economics of Target Balances: From Lehman to CoronaPas encore d'évaluation

- Money Market Instruments-France: Kundan Jha-498 Viraj Gandhi-616Document37 pagesMoney Market Instruments-France: Kundan Jha-498 Viraj Gandhi-616Srikant SharmaPas encore d'évaluation

- 04 - Invesco European Bond FundDocument2 pages04 - Invesco European Bond FundRoberto PerezPas encore d'évaluation

- Bernard Connolly EuropeDocument12 pagesBernard Connolly EuropeZerohedgePas encore d'évaluation

- Euro Zone CrisisccDocument2 pagesEuro Zone CrisisccSami Ahmed ZiaPas encore d'évaluation

- Inflation Linked BondsDocument3 pagesInflation Linked BondsyukiyurikiPas encore d'évaluation

- European Debt Crisis 2009 - 2011: The PIIGS and The Rest From Maastricht To PapandreouDocument39 pagesEuropean Debt Crisis 2009 - 2011: The PIIGS and The Rest From Maastricht To PapandreouAnuj KantPas encore d'évaluation

- CEA - Executive Summary Life Insurance in 2009Document2 pagesCEA - Executive Summary Life Insurance in 2009Ilias SchneiderPas encore d'évaluation

- The European Sovereign Debt Crisis. A Correlation Study of Sovereign CDS Spreads - PublishDocument47 pagesThe European Sovereign Debt Crisis. A Correlation Study of Sovereign CDS Spreads - PublishNathan EvansPas encore d'évaluation

- UK Government Guide To GiltsDocument32 pagesUK Government Guide To GiltsFuzzy_Wood_PersonPas encore d'évaluation

- Intl Bond Mkts - Eun and ResnickDocument38 pagesIntl Bond Mkts - Eun and ResnickMukul BhatiaPas encore d'évaluation

- European Insurance in Figures 2011Document56 pagesEuropean Insurance in Figures 2011filipandPas encore d'évaluation

- European Equity Fund (EEA)Document40 pagesEuropean Equity Fund (EEA)ArvinLedesmaChiongPas encore d'évaluation

- International Financial ManagementDocument47 pagesInternational Financial ManagementAshish PriyadarshiPas encore d'évaluation

- Learning ObjectiveDocument13 pagesLearning Objectivevineet singhPas encore d'évaluation

- Bond Markets City UKDocument16 pagesBond Markets City UKmpp1982Pas encore d'évaluation

- The Future of The EuroAll SoulsDocument14 pagesThe Future of The EuroAll SoulsAliya AbdragimPas encore d'évaluation

- CNMVTrimestreI07 Een PDFDocument273 pagesCNMVTrimestreI07 Een PDFsolajeroPas encore d'évaluation

- Towards A Common European Monetary Union Risk Free Rate: Sergio Mayordomo Juan Ignacio Peña Eduardo S. SchwartzDocument56 pagesTowards A Common European Monetary Union Risk Free Rate: Sergio Mayordomo Juan Ignacio Peña Eduardo S. SchwartzsolajeroPas encore d'évaluation

- The Dutch Mortgage MarketDocument35 pagesThe Dutch Mortgage MarketIgor StojanovPas encore d'évaluation

- Research: Euro Area: "What To Watch" in The Coming MonthsDocument7 pagesResearch: Euro Area: "What To Watch" in The Coming MonthsvladvPas encore d'évaluation

- Euro-Zone and The European Debt Crises: A Study On Impact of European Debt Crisis On The European EconomyDocument45 pagesEuro-Zone and The European Debt Crises: A Study On Impact of European Debt Crisis On The European EconomyRavi ChavdaPas encore d'évaluation

- International: Financial ManagementDocument38 pagesInternational: Financial ManagementMansi VyasPas encore d'évaluation

- Iosif 329Document15 pagesIosif 329kalexyzPas encore d'évaluation

- Macro Economics Assignment 1Document13 pagesMacro Economics Assignment 1Naveen KumarPas encore d'évaluation

- Commonwealth Nations: MeaningDocument37 pagesCommonwealth Nations: MeaningPranav ViraPas encore d'évaluation

- International Financial MarketsDocument3 pagesInternational Financial MarketsDung Le ThuyPas encore d'évaluation

- Eurozone Debt Crisis 2009 FinalDocument51 pagesEurozone Debt Crisis 2009 FinalMohit KarwalPas encore d'évaluation

- NExitDocument164 pagesNExitdanuckyPas encore d'évaluation

- JPM Global Fixed Income 2012-03-17 810381Document72 pagesJPM Global Fixed Income 2012-03-17 810381deepdish7Pas encore d'évaluation

- Measuring TradeDocument4 pagesMeasuring Trademehdi484Pas encore d'évaluation

- I Securities Markets and Their Agents: Situation and OutlookDocument54 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroPas encore d'évaluation

- Profiting Without Producing: How Finance Exploits Us AllD'EverandProfiting Without Producing: How Finance Exploits Us AllÉvaluation : 4 sur 5 étoiles4/5 (2)

- L' Italia C'È: Noteworthy Data About A Worthy CountryDocument26 pagesL' Italia C'È: Noteworthy Data About A Worthy CountryManax85Pas encore d'évaluation

- Phone Than Sin Thwin Eco 2 The World Economy Assessment - 1Document11 pagesPhone Than Sin Thwin Eco 2 The World Economy Assessment - 1phone thansin thwinPas encore d'évaluation

- Rosen-A Comparison of European Housing Finance SystemsDocument20 pagesRosen-A Comparison of European Housing Finance SystemsLaercio Monteiro Jr.Pas encore d'évaluation

- CY QRT Bulletin Q3 - 2013Document2 pagesCY QRT Bulletin Q3 - 2013Vassos KoutsioundasPas encore d'évaluation

- ES - 2010chapter3Document22 pagesES - 2010chapter3Ben ChanPas encore d'évaluation

- December 2018Document12 pagesDecember 2018TraderPas encore d'évaluation

- Catlin 2011 Interim Financial ResultsDocument39 pagesCatlin 2011 Interim Financial Resultspatburchall6278Pas encore d'évaluation

- Eurozone Debt Crisis 2009 FinalDocument51 pagesEurozone Debt Crisis 2009 FinalMohit KarwalPas encore d'évaluation

- Switzerland Public Debt: APRIL 26, 2017 Gabriel Varva FBE, 3rd YearDocument11 pagesSwitzerland Public Debt: APRIL 26, 2017 Gabriel Varva FBE, 3rd YearGabi VarvaPas encore d'évaluation

- Tipping Point Nov 2011 FINALDocument51 pagesTipping Point Nov 2011 FINALAsad RaufPas encore d'évaluation

- Rato 2020Document131 pagesRato 2020Laura RodriguesPas encore d'évaluation

- Topic: Money Market Instruments of Sweden Subject: Security Analysis & Portfolio ManagementDocument7 pagesTopic: Money Market Instruments of Sweden Subject: Security Analysis & Portfolio ManagementAnonymous 9NnzPXKqPas encore d'évaluation

- I Securities Markets and Their Agents: Situation and OutlookDocument51 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroPas encore d'évaluation

- PIMCO GIS Euro Liquidity InstDocument2 pagesPIMCO GIS Euro Liquidity InstNeil WalshPas encore d'évaluation

- Euro Area Fact Book: Key FactsDocument13 pagesEuro Area Fact Book: Key FactsupatoPas encore d'évaluation

- European Sovereign-Debt Crisis: o o o o o o o oDocument34 pagesEuropean Sovereign-Debt Crisis: o o o o o o o oRakesh ShettyPas encore d'évaluation

- Euro Crisis's Impact On IndiaDocument49 pagesEuro Crisis's Impact On IndiaAncy ShajahanPas encore d'évaluation

- International Statistical Release 2015 Q2Document7 pagesInternational Statistical Release 2015 Q2Corcaci April-DianaPas encore d'évaluation

- Road To The EuroDocument31 pagesRoad To The EuronishithathiPas encore d'évaluation

- Tie w12 SinnDocument3 pagesTie w12 SinnTheodoros MaragakisPas encore d'évaluation

- Annual Report 2010Document60 pagesAnnual Report 2010ZahraPas encore d'évaluation

- The International Bond MarketDocument23 pagesThe International Bond Market2005raviPas encore d'évaluation

- 4 PDFDocument10 pages4 PDFMagofrostPas encore d'évaluation

- CPFContributionRatesTable 1jan2022Document5 pagesCPFContributionRatesTable 1jan2022ysam90Pas encore d'évaluation

- VoterListweb2016-2017 81Document1 pageVoterListweb2016-2017 81ShahzadPas encore d'évaluation

- ACR Format Assisstant and ClerkDocument3 pagesACR Format Assisstant and ClerkJalil badnasebPas encore d'évaluation

- Calendar of ActivitiesDocument2 pagesCalendar of ActivitiesAJB Art and Perception100% (3)

- Nurlilis (Tgs. Bhs - Inggris. Chapter 4)Document5 pagesNurlilis (Tgs. Bhs - Inggris. Chapter 4)Latifa Hanafi100% (1)

- Work Place CommitmentDocument24 pagesWork Place CommitmentAnzar MohamedPas encore d'évaluation

- Dua AdzkarDocument5 pagesDua AdzkarIrHam 45roriPas encore d'évaluation

- Gillette vs. EnergizerDocument5 pagesGillette vs. EnergizerAshish Singh RainuPas encore d'évaluation

- MOP Annual Report Eng 2021-22Document240 pagesMOP Annual Report Eng 2021-22Vishal RastogiPas encore d'évaluation

- Numerical Problems Ni AccountingDocument7 pagesNumerical Problems Ni AccountingKenil ShahPas encore d'évaluation

- WFP Specialized Nutritious Foods Sheet: Treating Moderate Acute Malnutrition (MAM)Document2 pagesWFP Specialized Nutritious Foods Sheet: Treating Moderate Acute Malnutrition (MAM)elias semagnPas encore d'évaluation

- Reading Job Advertisements 4Document2 pagesReading Job Advertisements 456. Trần Thị Thanh Tuyền100% (1)

- Development of Modern International Law and India R.P.anandDocument77 pagesDevelopment of Modern International Law and India R.P.anandVeeramani ManiPas encore d'évaluation

- Superstore PROJECT 1Document3 pagesSuperstore PROJECT 1Tosin GeorgePas encore d'évaluation

- Ikea ReportDocument48 pagesIkea ReportPulkit Puri100% (3)

- Show Catalogue: India's Leading Trade Fair For Organic ProductsDocument58 pagesShow Catalogue: India's Leading Trade Fair For Organic Productsudiptya_papai2007Pas encore d'évaluation

- Tan Vs PeopleDocument1 pageTan Vs PeopleGian Tristan MadridPas encore d'évaluation

- Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationDocument15 pagesProblem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationLovely Anne Dela CruzPas encore d'évaluation

- 2010 Final Graduation ScriptDocument8 pages2010 Final Graduation ScriptUmmu Assihdi100% (1)

- EVNDocument180 pagesEVNMíša SteklPas encore d'évaluation

- Corporate Social Responsibility and Economic GR - 2023 - The Extractive IndustriDocument11 pagesCorporate Social Responsibility and Economic GR - 2023 - The Extractive IndustriPeace NkhomaPas encore d'évaluation

- Types of Quiz-2-QDocument9 pagesTypes of Quiz-2-QAhmed Tamzid 2013028630Pas encore d'évaluation

- Priyanshu Mts Answer KeyDocument34 pagesPriyanshu Mts Answer KeyAnima BalPas encore d'évaluation

- The Renaissance PeriodDocument8 pagesThe Renaissance PeriodAmik Ramirez TagsPas encore d'évaluation

- Construction Companies in MauritiusDocument4 pagesConstruction Companies in MauritiusJowaheer Besh100% (1)

- ARTA Art of Emerging Europe2Document2 pagesARTA Art of Emerging Europe2DanSanity TVPas encore d'évaluation

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascDocument1 pageCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaPas encore d'évaluation

- TS4F01-1 Unit 3 - Master DataDocument59 pagesTS4F01-1 Unit 3 - Master DataLuki1233332100% (1)

- Verka Project ReportDocument69 pagesVerka Project Reportkaushal244250% (2)

- Types of Love in Othello by ShakespeareDocument2 pagesTypes of Love in Othello by ShakespeareMahdi EnglishPas encore d'évaluation