Académique Documents

Professionnel Documents

Culture Documents

Tech Report 13 July

Transféré par

Vijay SinghDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tech Report 13 July

Transféré par

Vijay SinghDroits d'auteur :

Formats disponibles

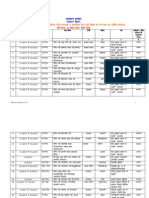

NB Daily Technicals Commodity, Precious Metals and Crude

Bullion Technical Outlook

Gold Silver

Commentary Gold prices have easily breached the resistance at 22650 levels and closed positive above the same. Thus the short term trend for gold looks bullish and buying is recommended between 22650-680, targeting 23300 in short term.

Commentary The silver prices achieved our target of 53000 and turned positive closing higher. Thus intraday buying can be done as long as prices sustain above 54000 levels targeting 54650-800. Below 54000 counter looks weak.

Levels for the day

Month S3 S2 S1 R1 R2 R3

Levels for the day

Month S3 S2 S1 R1 R2 R3

Gold

Aug

22450

22550

22650

22725

22850

22980

Silver

Sept

52650

53250

53650

54000

54500

55100

Wednesday, July 13, 2011

Page 1 of 4

NB Daily Technicals Commodity, Precious Metals and Crude

Base Metals Technical Outlook

Copper Nickel

Commentary The copper prices remained side-ways and closed near previous days high. Thus breaching 435, prices could move further upwards targeting 438-40. Thus buying is recommended above 435.

Commentary The counter almost achieved our target of 1018 and turned upwards closing higher. The indicators are however not looking very positive for the counter. Thus one should avoid buying as long as prices are below 1075.

Levels for the day

Month S3 S2 S1 R1 R2 R3

Levels for the day

Month S3 S2 S1 R1 R2 R3

Copper

Aug

425

429.50

432

438

441

444

Nickel

July

1018

1032

1051

1066

1075

1088

Wednesday, July 13, 2011

Page 2 of 4

NB Daily Technicals Commodity, Precious Metals and Crude

Base Metals Technical Outlook

Zinc Crude Oil

Energy Technical Outlook

Commentary The zinc prices formed a bullish engulfing candle, thus fresh buying is recommended above 105.25, targeting 106.50 and 107 for the day.

Commentary The crude prices continued to take support at 4190 and turned positive for the day. Thus fresh buying can be done above 4300 targeting 4350 and 4385 for the day. While selling pressure can emerge below 4300 levels.

Levels for the day

Month S3 S2 S1 R1 R2 R3

Levels for the day

Month S3 S2 S1 R1 R2 R3

Zinc Lead Alu

July July July

102.20 118.80 108.25

103.30 119.50 109.4

104.25 121 110.50

105.25 122.90 111.50

106.50 124 122.25

107.70 125.75 113.50

Crude Oil N Gas

July

4196

4250

4300

4350

4385

4435

July

182

185.5

189

195

198

201

Wednesday, July 13, 2011

Page 3 of 4

NB Daily Technicals Commodity, Precious Metals and Crude

Top Pre-Market Trading Strategy for the day

Commodity

Contract

Strategy

Rate

Target 1

Target 2

Target 3

Stop-Loss

Gold Silver Zinc

Aug Sept July

Buy Buy Buy

22650-700 Above 54000 Above 105

22775 54650 106.25

22850 54800 107

22600 53700 104.35

Kunal Shah Research Head Commodity Research E-mail address: kunal.shah@nirmalbang.com Devidas Rajadhikary Technical Analyst E-mail address: devidas.rajadhikary@nirmalbang.com Vikash Bairoliya Research Analyst Precious Metals & Currencies E-mail address: vikash.bairoliya@nirmalbang.com Harshal Mehta, Technical Analyst-E-mail address: harshal.mehta@nirmalbang.com Evelyn Rodrigues Technical Analyst E-mail address: evelyn.rodrigues@nirmalbang.com Sunit Mehta Research Associate Base Metals E-mail address: sunit.mehta@nirmalbang.com Disclaimer

This Document has been prepared by Nirmal Bang Research (A Division of Nirmal Bang Securities PVT LTD). The information, analysis and estimates contained herein are based on Nirmal Bang Research assessment and have been obtained from sources believed to be reliable. This document is meant for the use of the intended recipient only. This document, at best, represents Nirmal Bang Research opinion and is meant for general information only. Nirmal Bang Research, its directors, officers or employees shall not in anyway be responsible for the contents stated herein. Nirmal Bang Research expressly disclaims any and all liabilities that may arise from information, errors or omissions in this connection. This document is not to be considered as an offer to sell or a solicitation to buy any securities. Nirmal Bang Research, its affiliates and their employees may from time to time hold positions in securities referred to herein. Nirmal Bang Research or its affiliates may from time to time solicit from or perform investment banking or other services for any company mentioned in this document.

About Nirmal Bang

Founded in 1986 by Shri Nirmal Bang, the Nirmal bang Group is recognized as one of the largest retail broking houses in India, providing an array of financial products and services. Our retail and institutional clients have access to products such as equities, derivatives, commodities, currency derivatives, mutual funds, IPOs, insurance, depository services and PMS. Throughout our history, we have fostered one overriding purpose to provide each client with personal service and quality of work. By adhering to this principle, we have grown to become a successful and well-respected firm of highly qualified professionals. The Group is headed by Mr. Dilip Bang and Mr. Kishore Bang who bring forward industry expertise, insight and most importantly, create an environment of unmatched commitment to clients. We are registered members of the Bombay Stock Exchange Limited (BSE), National Stock Exchange of India Limited (NSE), Multi Commodity Exchange of India Limited (MCX), National

Wednesday, July 13, 2011

Page 4 of 4

Vous aimerez peut-être aussi

- Granularity of GrowthDocument4 pagesGranularity of GrowthAlan TangPas encore d'évaluation

- Waste Tyre Reycling Project Report BriefDocument10 pagesWaste Tyre Reycling Project Report BriefVijay SinghPas encore d'évaluation

- Busi Environment MCQDocument15 pagesBusi Environment MCQAnonymous WtjVcZCg57% (7)

- Sarah Richards: - Professional SummaryDocument3 pagesSarah Richards: - Professional SummaryWendy StarkandPas encore d'évaluation

- Technical Report Metal Energy July 17Document5 pagesTechnical Report Metal Energy July 17Baljeet SinghPas encore d'évaluation

- Technical Report Metal Energy Jan 23Document5 pagesTechnical Report Metal Energy Jan 23jigu37Pas encore d'évaluation

- Technical Report Metal Energy Feb 07nirmalbangDocument5 pagesTechnical Report Metal Energy Feb 07nirmalbangGaurang GroverPas encore d'évaluation

- Indain Commodity Market TrendDocument9 pagesIndain Commodity Market TrendRahul SolankiPas encore d'évaluation

- Daily Commodity Technical: Trade StrategiesDocument6 pagesDaily Commodity Technical: Trade StrategiesaakashkagarwalPas encore d'évaluation

- Daily Commodity Report 19 Nov 2013 by EPIC RESEARCHDocument7 pagesDaily Commodity Report 19 Nov 2013 by EPIC RESEARCHNidhi JainPas encore d'évaluation

- Weekly-Commodity-Report by EPIC RESEACH 9 September 2013Document6 pagesWeekly-Commodity-Report by EPIC RESEACH 9 September 2013EpicresearchPas encore d'évaluation

- A Daily Technical Report On Commodities: Recommendations For MCX, Ncdex,, Nymex, Comex, Lme, Cbot, BMD & NmceDocument4 pagesA Daily Technical Report On Commodities: Recommendations For MCX, Ncdex,, Nymex, Comex, Lme, Cbot, BMD & NmceManish ChandakPas encore d'évaluation

- Daily Commodity Market Tips Via ExpertsDocument9 pagesDaily Commodity Market Tips Via ExpertsRahul SolankiPas encore d'évaluation

- Daily Commodity Market Report 26 - Feb - 2014 by Epic ResearchDocument13 pagesDaily Commodity Market Report 26 - Feb - 2014 by Epic ResearchNidhi JainPas encore d'évaluation

- Indian Commodity Market Trading TipsDocument9 pagesIndian Commodity Market Trading TipsRahul SolankiPas encore d'évaluation

- Weekly Commodity by Epic Research - 16 July 2012Document6 pagesWeekly Commodity by Epic Research - 16 July 2012Brian PacePas encore d'évaluation

- Daily Commodity Report 29-08-2013Document7 pagesDaily Commodity Report 29-08-2013Nidhi JainPas encore d'évaluation

- Commodity Market Trend With Market MovementDocument9 pagesCommodity Market Trend With Market MovementRahul SolankiPas encore d'évaluation

- Mid Week Technicals of Index, Currency and Commodities: NiftyDocument5 pagesMid Week Technicals of Index, Currency and Commodities: NiftyGauriGanPas encore d'évaluation

- Daily Commodity Report 26 Nov 2013 by EPIC RESEARCHDocument7 pagesDaily Commodity Report 26 Nov 2013 by EPIC RESEARCHNidhi JainPas encore d'évaluation

- African Barrick Flashnote 14 February 2013Document7 pagesAfrican Barrick Flashnote 14 February 2013TamilTower LiveMoviesPas encore d'évaluation

- Technical Report 5th December 2011Document5 pagesTechnical Report 5th December 2011Angel BrokingPas encore d'évaluation

- Daily Commodity Report 15-01-2014 by Epic ResearchDocument10 pagesDaily Commodity Report 15-01-2014 by Epic ResearchNidhi JainPas encore d'évaluation

- Technical Report 14th February 2012Document5 pagesTechnical Report 14th February 2012Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (16213) / NIFTY (4867)Document5 pagesDaily Technical Report: Sensex (16213) / NIFTY (4867)Angel BrokingPas encore d'évaluation

- Commodity MCX Gold and Silver Market TrendDocument9 pagesCommodity MCX Gold and Silver Market TrendRahul SolankiPas encore d'évaluation

- Weekly-Commodity-Report 15 - Oct - 2013 by EPIC RESEARCHDocument8 pagesWeekly-Commodity-Report 15 - Oct - 2013 by EPIC RESEARCHNidhi JainPas encore d'évaluation

- Our Presence: Epic Research India HNI & NRI Sales Contact Australia Toll Free NumberDocument8 pagesOur Presence: Epic Research India HNI & NRI Sales Contact Australia Toll Free NumberBhanuprakashReddyDandavoluPas encore d'évaluation

- Indian Commodity Market TrendDocument9 pagesIndian Commodity Market TrendRahul SolankiPas encore d'évaluation

- Daily Commodity Report 10 JANUARY 2013: WWW - Epicresearch.CoDocument6 pagesDaily Commodity Report 10 JANUARY 2013: WWW - Epicresearch.Coapi-196234891Pas encore d'évaluation

- Commodity Daily Report 20 Nov 2013 by EPIC RESEARCHDocument7 pagesCommodity Daily Report 20 Nov 2013 by EPIC RESEARCHNidhi JainPas encore d'évaluation

- Technical Report 2nd December 2011Document5 pagesTechnical Report 2nd December 2011Angel BrokingPas encore d'évaluation

- Technical Report 4th November 2011Document5 pagesTechnical Report 4th November 2011Angel BrokingPas encore d'évaluation

- Technical Report 25th January 2012Document5 pagesTechnical Report 25th January 2012Angel BrokingPas encore d'évaluation

- Technical Report 10th October 2011Document4 pagesTechnical Report 10th October 2011Angel BrokingPas encore d'évaluation

- Technical Report 30th January 2012Document5 pagesTechnical Report 30th January 2012Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (16372) / NIFTY (4906)Document5 pagesDaily Technical Report: Sensex (16372) / NIFTY (4906)Angel BrokingPas encore d'évaluation

- Technical Report 6th January 2012Document5 pagesTechnical Report 6th January 2012Angel BrokingPas encore d'évaluation

- Get Daily Nifty Market News - 08 Oct 2015Document8 pagesGet Daily Nifty Market News - 08 Oct 2015Pranjali UpadhyayPas encore d'évaluation

- Technical Report 13th February 2012Document5 pagesTechnical Report 13th February 2012Angel BrokingPas encore d'évaluation

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily DailyTheequicom AdvisoryPas encore d'évaluation

- Technical Report 12th March 2012Document5 pagesTechnical Report 12th March 2012Angel BrokingPas encore d'évaluation

- Daily Commodity Report 21-01-2014 by Epic ResearchDocument13 pagesDaily Commodity Report 21-01-2014 by Epic ResearchNidhi JainPas encore d'évaluation

- Commodities Weekly Outlook 26.11.2012 To 01.12.2012Document6 pagesCommodities Weekly Outlook 26.11.2012 To 01.12.2012Angel BrokingPas encore d'évaluation

- Comex: 19 MARCH 2013Document8 pagesComex: 19 MARCH 2013api-210648926Pas encore d'évaluation

- Technical Report 14th October 2011Document5 pagesTechnical Report 14th October 2011Angel BrokingPas encore d'évaluation

- Comex: 3 JUNE 2013Document7 pagesComex: 3 JUNE 2013api-221305449Pas encore d'évaluation

- Free Commodity MCX Market Research ReportDocument9 pagesFree Commodity MCX Market Research ReportRahul SolankiPas encore d'évaluation

- EPIC Research ReportDocument9 pagesEPIC Research Reportapi-221305449Pas encore d'évaluation

- Daily Report: 29 OCTOBER. 2013Document7 pagesDaily Report: 29 OCTOBER. 2013api-212478941Pas encore d'évaluation

- Technical Report 9th November 2011Document5 pagesTechnical Report 9th November 2011Angel BrokingPas encore d'évaluation

- Technical Report 14th November 2011Document5 pagesTechnical Report 14th November 2011Angel BrokingPas encore d'évaluation

- Daily-Commodity-Report by Epic Research 11.02.13Document6 pagesDaily-Commodity-Report by Epic Research 11.02.13EpicresearchPas encore d'évaluation

- Comex: 11 MARCH 2013Document8 pagesComex: 11 MARCH 2013api-196234891Pas encore d'évaluation

- Technical Report 25th November 2011Document5 pagesTechnical Report 25th November 2011Angel BrokingPas encore d'évaluation

- Indian Commodity Future Market TrendDocument9 pagesIndian Commodity Future Market TrendRahul SolankiPas encore d'évaluation

- EPIC Research ReportDocument9 pagesEPIC Research Reportapi-221305449Pas encore d'évaluation

- Technical Report 31st January 2012Document5 pagesTechnical Report 31st January 2012Angel BrokingPas encore d'évaluation

- Daily Commodity Report 06-02-2014 by EPIC RESEARCHDocument13 pagesDaily Commodity Report 06-02-2014 by EPIC RESEARCHNidhi JainPas encore d'évaluation

- EPIC Research ReportDocument9 pagesEPIC Research Reportapi-221305449Pas encore d'évaluation

- Weekly View:: Nifty Likely To Trade in Range of 6600-6800Document14 pagesWeekly View:: Nifty Likely To Trade in Range of 6600-6800Raya DuraiPas encore d'évaluation

- Technical Report 12th January 2012Document5 pagesTechnical Report 12th January 2012Angel BrokingPas encore d'évaluation

- Bullion Weekly Technicals: Technical OutlookDocument16 pagesBullion Weekly Technicals: Technical OutlookMarcin LipiecPas encore d'évaluation

- Cash from Gold: Learn How to Invest Wisely In Gold and Earn an Income from ItD'EverandCash from Gold: Learn How to Invest Wisely In Gold and Earn an Income from ItPas encore d'évaluation

- Prithviiraj Chauhan - Chandrashekhar Pathak - Hindi - 192p9ULVu5Bk8kC PDFDocument477 pagesPrithviiraj Chauhan - Chandrashekhar Pathak - Hindi - 192p9ULVu5Bk8kC PDFVijay SinghPas encore d'évaluation

- Rajasthan Municipal Act 2009Document654 pagesRajasthan Municipal Act 2009Vijay SinghPas encore d'évaluation

- Izos'K Iwoz Ijh (KK & 2013 Fokku Hkou) Uohu Ifjlj) Eksguyky LQ (KKFM+ K Fo'Ofo - Ky ) MN Iqj & 313 039Document3 pagesIzos'K Iwoz Ijh (KK & 2013 Fokku Hkou) Uohu Ifjlj) Eksguyky LQ (KKFM+ K Fo'Ofo - Ky ) MN Iqj & 313 039Vijay SinghPas encore d'évaluation

- Fair Festivals 2013-14Document5 pagesFair Festivals 2013-14Vijay SinghPas encore d'évaluation

- Cantorme Vs Ducasin 57 Phil 23Document3 pagesCantorme Vs Ducasin 57 Phil 23Christine CaddauanPas encore d'évaluation

- I See Your GarbageDocument20 pagesI See Your GarbageelisaPas encore d'évaluation

- Achieving Rapid Internationalization of Sub Saharan Africa - 2020 - Journal of BDocument11 pagesAchieving Rapid Internationalization of Sub Saharan Africa - 2020 - Journal of BErnaPas encore d'évaluation

- Future Trends in Mechanical Engineering-ArticleDocument2 pagesFuture Trends in Mechanical Engineering-ArticleanmollovelyPas encore d'évaluation

- Martin, BrianDocument3 pagesMartin, Brianapi-3727889Pas encore d'évaluation

- CV2022095403 5222023 Minute EntryDocument6 pagesCV2022095403 5222023 Minute EntryJordan Conradson100% (2)

- Mysteel IO Daily - 2Document6 pagesMysteel IO Daily - 2ArvandMadan CoPas encore d'évaluation

- Problem Solving and Decision MakingDocument14 pagesProblem Solving and Decision Makingabhiscribd5103Pas encore d'évaluation

- About Debenhams Company - Google SearchDocument1 pageAbout Debenhams Company - Google SearchPratyush AnuragPas encore d'évaluation

- Ocampo - v. - Arcaya-ChuaDocument42 pagesOcampo - v. - Arcaya-ChuaChristie Joy BuctonPas encore d'évaluation

- Retail Strategy: MarketingDocument14 pagesRetail Strategy: MarketingANVESHI SHARMAPas encore d'évaluation

- CTC VoucherDocument56 pagesCTC VoucherJames Hydoe ElanPas encore d'évaluation

- Small Hydro Power Plants ALSTOMDocument20 pagesSmall Hydro Power Plants ALSTOMuzairmughalPas encore d'évaluation

- 4th Exam Report - Cabales V CADocument4 pages4th Exam Report - Cabales V CAGennard Michael Angelo AngelesPas encore d'évaluation

- Text and Meaning in Stanley FishDocument5 pagesText and Meaning in Stanley FishparthPas encore d'évaluation

- Iso 14001 Sample ProceduresDocument19 pagesIso 14001 Sample ProceduresMichelle Baxter McCullochPas encore d'évaluation

- Vayutel Case StudyDocument10 pagesVayutel Case StudyRenault RoorkeePas encore d'évaluation

- I'M NOT A SKET - I Just Grew Up With Them (Chapter 4 & 5)Document13 pagesI'M NOT A SKET - I Just Grew Up With Them (Chapter 4 & 5)Chantel100% (3)

- UNIDO EIP Achievements Publication FinalDocument52 pagesUNIDO EIP Achievements Publication FinalPercy JacksonPas encore d'évaluation

- Compsis at A CrossroadsDocument4 pagesCompsis at A CrossroadsAbhi HarpalPas encore d'évaluation

- La Bugal BLaan Tribal Association Inc. vs. RamosDocument62 pagesLa Bugal BLaan Tribal Association Inc. vs. RamosAKnownKneeMouseePas encore d'évaluation

- A#2 8612 SehrishDocument16 pagesA#2 8612 SehrishMehvish raniPas encore d'évaluation

- Cartographie Startups Françaises - RHDocument2 pagesCartographie Startups Françaises - RHSandraPas encore d'évaluation

- Henry IV Part 1 Study GuideDocument21 pagesHenry IV Part 1 Study GuideawtshfhdPas encore d'évaluation

- The Holy Rosary 2Document14 pagesThe Holy Rosary 2Carmilita Mi AmorePas encore d'évaluation

- Literature Component SPM'13 Form 4 FullDocument12 pagesLiterature Component SPM'13 Form 4 FullNur Izzati Abd ShukorPas encore d'évaluation

- Allama Iqbal Open University, Islamabad: WarningDocument3 pagesAllama Iqbal Open University, Islamabad: Warningمحمد کاشفPas encore d'évaluation