Académique Documents

Professionnel Documents

Culture Documents

CGT Exemptions

Transféré par

dangle1Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CGT Exemptions

Transféré par

dangle1Droits d'auteur :

Formats disponibles

CGT Exemptions

Exempt Assets Car, motor cycle or similar vehicle. a car is a motor vehicle designed to carry a load of less than one tonne and less than 9 passengers (Case J63). Decorations for valour capital gain or loss from a decoration awarded for valour or brave conduct is ignored, unless it was purchased by the taxpayer. Collectables costing $500 or less gain or loss ignored if the first element of the cost base is $500 or less (excluding any input tax credit for the acquisition). If collectable is an interest in artwork, jewellery, an antique, a coin or medallion, a rare folio, manuscript or book, a postage stamp or first day cover - it is the market value of the asset that determine whether the exemption applies. Eg. If 20% interest is acquired for $400, the asset is worth $2,000 therefore exemption does not apply. (this rule does not apply to interest acquired before 16 Dec 1996)

Re

Se

Se

Se (2)

Certain personal use assets - capital gain from PUA or part of, is exempt if the first element is $10,000 or less (excluding any input tax credit on acquisition) - capital loss from disposal of shares in a company or an interest in trust does not result in capital loss to the extent that the loss relates to a decline in value of a personal use asset owned by the company or trust. Assets used to produce exempt income gain or loss from a CGT asset used to solely produce exempt income or non-assessable nonexempt income is ignored. Gain or loss resulting from disposal of shares in PDF is disregarded Compensation or damages received for any wrong or injury suffered in occupation Compensation or damages for any wrong, injury or illness suffered personally, eg. Slander, defamation and insurance money under personal accident policies gambling, game or competition with prizesetc Receipt of a right or entitlement to a tax offset, a deduction, or other similar benefit Leases not used for income-producing purposes

Se

Se

Se

Se

Se

Se

Se

Strata title conversion if owns land on which there is a building;

(a) the builiding is subdivided into stratum units and (b) each unit is transferred to the entity who had the right to occupy it just before the subdivision capital gain or loss from transfer of units disregarded Sale, transfer or assignment of rights to mine in area in Australia is disregarded if you have exempt income for the whole year from the sale, transfer or assignment. Foreign currency hedging contracts a capital gain/loss from a hedging contract is ignored for CGT purposes Gifts of property testamentary gift of property under: (a) the Cultural Bequests Program (b) testamentary gift deductible under s 30-15 if it had not been testamentary gift after 2005/06 do not have to value more than $5,000 to qualify for exemption). (c ) gift of property under Cultural Gifts Program Marriage or relationship breakdown settlements No CGT liabilities for: - marriage or relationship breakdown settlement or - with effect from the 2009/10 income year, settlements from the breakdown of relationship bw spouses (including same sex couples) For CGT evens happening after 12 Dec 2006, a capital loss or gain that resulting from CGT event C2 happening to a right is disregarded if: (a) that gain/loss is made in relation to a right that directly relates to the breakdown of a marriage (including de facto) or, (b) from the 2009/10 income year, relates to the breakdown of a relationship between spouses AND (c ) at the time of the trigger of the event, the spouses involved are separated and there is no reasonable likelihood of cohabilitation being resumed; AND (d) the trigger event happened because of reasons directly connected with marriage breakdown or, from 09/10 income year, the relationship breakdown Exempt taxpayers If assessable income is exempt during the income year, any capital gains are also exempt. A capital loss is ignored if it was an exempt entity at the time that it made the loss, despite not being an exempt entity during the whole year.

Se

Se

Se

Se

Se

Se

OTHER ANTI-OVERLAP PROVISIONS

Exempt Assets Carried interests

Re Se

Carried interests that is CGT event K9 received by venture capital manager is taxed as a capital gain. Depreciating assets a capital gain/loss may be disregarded if it arises from CGT event that happens to a depreciating asset, except: - CGT event J2 and K7. - CGT event is not equivalent to a balancing adjustment event; - various primary production assets deductible under Subdiv 40-F or G eg. Water facilities, horticultural plants & grapevines, landcare operations, electricity connections and telephone lies. Trading stock capital gain/loss is disregarded for CGT purpose Financial arrangements - a capital gain/loss is disregarded if at the time of CGT event, the asset is or is part of, a financial arrangement to which Subdiv 250-E applies - a capital gain/loss a taxpayer makes form a CGT asset, in creating a CGT asset or from the discharge of a liability will generally be disregarded if it was part of a Div 230 financial arrangement and ther is an assesable gain or deductible loss pursuant to Div 230

Se

Se

Se

Film copyright exemption a capital gain/loss from a CGT event relating to an interest in the copyright of a film is ignored if the amount is assessable under ITAA36 s 26AG because of the CGT event, or would be so assessable apart from ITAA36 s 23H. R&D exemption a capital gain/loss from a CGT event is ignored if an amount is assessable under specified R&D provisions because of that CGT event

Tax Law Amendment (Research and Development) Bill 2010)

Se

Se

CGT REDUCTION

Amount included in taxpayer's assessable income or exempt income A capital gain is reduced if, because of CGT event giving rise to it, a provision of the Act (other than CGT) includes the amount in: - assessable income or exempt income - if in a partnership, the amount is included in assessable or exempt income of the partnership. Discharge of debt Reduction also apply to discharge of debt arosing from provision of services and the income from those services was previously included in the taxpayer's assessable or exempt income.

ID

Se

Receipt of retail premium Capital gain made by non-participating shareholder from receipt of a retail premium is reduced to the extent that the amount is included in the taxpayer's assessable or nonassessable non-exempt income

Dr

For other reductions see Master Tax Guide page 566

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Deed of Absolute Sale of Heavy Equipment - Red Jingang, DICADocument2 pagesDeed of Absolute Sale of Heavy Equipment - Red Jingang, DICABibo Gunther50% (6)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Top 100 Non-Financial TNCs From Developing and Transition Economies, Ranked by Foreign AssetsDocument3 pagesThe Top 100 Non-Financial TNCs From Developing and Transition Economies, Ranked by Foreign Assetsth_razorPas encore d'évaluation

- Significant Controllers Register SCR HKDocument2 pagesSignificant Controllers Register SCR HKFairuz IbrahimPas encore d'évaluation

- Cir V ManningDocument12 pagesCir V Manningnia_artemis3414Pas encore d'évaluation

- Rekor PrestasiDocument2 pagesRekor PrestasiAhmad Syah Guntur AdityaPas encore d'évaluation

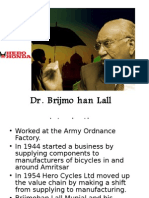

- HERO GROUP and DR Brij Mohal Lall MunjalDocument14 pagesHERO GROUP and DR Brij Mohal Lall MunjalAzhar k.pPas encore d'évaluation

- National TaxesDocument17 pagesNational TaxesAlex OndevillaPas encore d'évaluation

- The K.D.A. (Disposal of Land) Rules, 1971 PDFDocument25 pagesThe K.D.A. (Disposal of Land) Rules, 1971 PDFAbid BashirPas encore d'évaluation

- Jharna Singh CVDocument2 pagesJharna Singh CVnitinbhaskarPas encore d'évaluation

- Crossing of ChequesDocument14 pagesCrossing of ChequesNikitha C P100% (1)

- CvRevII-Syl-2019 07 17Document3 pagesCvRevII-Syl-2019 07 17Carla VirtucioPas encore d'évaluation

- 081.AINIO, Carole (p.10) & Augustus (p.8,9), As Company Directors & Secretaries.Document43 pages081.AINIO, Carole (p.10) & Augustus (p.8,9), As Company Directors & Secretaries.Flinders TrusteesPas encore d'évaluation

- Grant Thornton Dealtracker Q1 2016Document59 pagesGrant Thornton Dealtracker Q1 2016sherwinmitraPas encore d'évaluation

- Indian Toy Industry Hit Hard by ImportsDocument2 pagesIndian Toy Industry Hit Hard by ImportsNikunj PatelPas encore d'évaluation

- Delhi Tourism ListDocument2 pagesDelhi Tourism Listkritu90Pas encore d'évaluation

- Tax Cases - Atty CatagueDocument264 pagesTax Cases - Atty CatagueJo-Al GealonPas encore d'évaluation

- GSIS Family Bank Vs BPI Family Savings BankDocument2 pagesGSIS Family Bank Vs BPI Family Savings Banklordj zaragoza67% (3)

- Pob SbaDocument17 pagesPob SbaTae TaePas encore d'évaluation

- SGX SICOM RSS 3 Rubber Approved Packer ListDocument2 pagesSGX SICOM RSS 3 Rubber Approved Packer ListJulian AngPas encore d'évaluation

- Copyreading and Headline WritingDocument4 pagesCopyreading and Headline Writingcarlo hermocillaPas encore d'évaluation

- Testbank Ch01-02 REV Acc STDDocument7 pagesTestbank Ch01-02 REV Acc STDmimiemirandaPas encore d'évaluation

- Introduction and DefinitionsDocument7 pagesIntroduction and DefinitionsmandeepPas encore d'évaluation

- ABS-CBN Broadcasting Corp. vs. CADocument2 pagesABS-CBN Broadcasting Corp. vs. CAAaliyahPas encore d'évaluation

- BELA Company OverviewDocument6 pagesBELA Company OverviewAIPas encore d'évaluation

- Painting The Future Bright - The Daily StarDocument5 pagesPainting The Future Bright - The Daily StarAkash79Pas encore d'évaluation

- Live Case Study - Lssues For AnalysisDocument4 pagesLive Case Study - Lssues For AnalysisNhan PhPas encore d'évaluation

- Project Report On Working Capital Management in HCLDocument95 pagesProject Report On Working Capital Management in HCLRockyLagishetty100% (2)

- Methods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Document21 pagesMethods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Precious MamigoPas encore d'évaluation

- The Changing Role of Managerial Accounting in A Global Business EnvironmentDocument14 pagesThe Changing Role of Managerial Accounting in A Global Business EnvironmentNastia Putri PertiwiPas encore d'évaluation

- Tax Review DoctrinesDocument18 pagesTax Review DoctrinesGrace Robes HicbanPas encore d'évaluation