Académique Documents

Professionnel Documents

Culture Documents

Assignment 2

Transféré par

surajit_dgDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assignment 2

Transféré par

surajit_dgDroits d'auteur :

Formats disponibles

Derivative Securities, Courant Institute, Fall 2008 http://www.math.nyu.edu/faculty/goodman/teaching/DerivSec08/index.

html Always check the class bboard on the blackboard site from home.nyu.edu (click on academics, then on Derivative Securities) before doing any work on the assignment.

Assignment 2, due September 17

Corrections: (September 12) put call in question 1. return cash ow in question 2i. 1. Show that the price of a vanilla European call or put is a convex function of the strike price. Discussion: A function f (K) is a convex function of K (in the interval [K0 , K3 ]) if f (K1 + (1 )K2 ) f (K1 ) + (1 )f (K2 ) , (1)

whenever 0 1 (and K0 K1 K2 K3 ). If f (K) is twice dierentiable as a function of K, this is the same as f (K) 0. We can check (1), say, for = 1/2, by comparing the payout diagram for the portfolio: 1 1 call at K1 + call at K2 2 2 1 to the payout of the single call struck at 2 (K1 + K2 ) (draw the diagram). The argument for other values of and for puts is similar. Some options dealers post a curve of options prices at which they are willing to buy and sell as functions of strike and maturity. If the curve is not convex for any reason (e.g. non-convex interpolation) this represents an arbitrage opportunity for the client. 2. In a one period model, suppose a risky asset has a present spot price S0 = 1. The unknown spot price after one period is S1 . There is a pu = 90% chance that S1 = su = 3 and a pd = 10% chance S1 = sd = 1. A risk free dollar invested today yields two dollars after one period (technically, B(0, 1) = 1 ). Let C be the payout of a vanilla European call option, 2 with strike price K = 1.5 that may be exercised after one period. It is common to refer to probabilities in the real world as the P measure and probabilities in the risk neutral world as the Q measure. (a) What is the expected discounted payout of the call option: EP [B(0, 1) C]? (b) What are the risk neutral probabilities qu and qd , of S1 = 3 and S1 = 1 respectively? Is pu > qu ? (c) What is the expected discounted value of C with respect to the risk neutral probabilities, EQ [B(0, 1)C]? This is the arbitrage price of C. (d) Is the arbitrage price larger or smaller than the expected discounted payout from part (b)? Why? 1

(e) Let be the portfolio at the present time that exactly hedges C. How much risk free asset and how much risky asset are in ? (f) If you buy the option at its risk neutral price, what are the mean and standard deviation of your expected return? How does this compare to the mean and variance of the return on the stock? Make sure to make the return a percentage money gained (or lost) divided by money invested. (g) If we x the value of sd , what value of su results in the P probabilities being equal to the Q probabilities? Call this s . u (h) Suppose it were possible to buy or sell the call option today at the price equal to its real world expected value from part (a). Describe the arbitrage portfolio that prots from this possibility, being short or long one unit of C. Call this portfolio A (i) Suppose that S1 is a Gaussian random variable that matches the real 2 2 world mean and variance: EG [S1 ] = EP [S1 ] and EG S1 = EP S1 . (Here, EG [ ] refers to expected value if S1 is Gaussian.) What are the expected discounted cash ow and variance: EG [B(0, 1)A ] and varG [B(0, 1)A ]? 3. Consider a one period market in which the forward price is described by a trinomial tree/ The forward price today is F0 = 10. The possible forward prices at time T are Fd = 8, Fm = 11, and Fu = 12. Take the risk free rate to be so that erT = 2. Consider an option whose payout is Vd = 0, Vm = 10, and Vu = 15. The price of the option today is V0 . (a) Show that it is not possible to replicate VT (one of the three numbers Vd , Vm , Vu ) exactly with the forward and cash. Conclude that there is more than one value of V0 that does not permit arbitrage with cash and the forward. (b) Is there a value of Vm so that V0 is uniquely determined by the no arbitrage condition? If so, nd it. (c) Clearly 0 V0 7.5. Use the arbitrage construction to get tighter bounds.

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Market Technician No42Document16 pagesMarket Technician No42ppfahdPas encore d'évaluation

- Solutions OptionsDocument215 pagesSolutions OptionsManton Yeung50% (2)

- Martin Forde - The Real P&LDocument13 pagesMartin Forde - The Real P&LfrancescomaterdonaPas encore d'évaluation

- PRM Self Study Guide - Exam IIDocument16 pagesPRM Self Study Guide - Exam IIHasan Tariqul IslamPas encore d'évaluation

- TheCycleCode PDFDocument88 pagesTheCycleCode PDFfsolomonPas encore d'évaluation

- Option GreeksDocument135 pagesOption GreeksYugen NamiPas encore d'évaluation

- CRM Pine Street CapitalDocument12 pagesCRM Pine Street CapitalMuhammad Daniala Syuhada50% (2)

- Financial Markets Advanced Module PDFDocument134 pagesFinancial Markets Advanced Module PDFAditya Vikram SinghPas encore d'évaluation

- Currency Futures, Options and Swaps PDFDocument22 pagesCurrency Futures, Options and Swaps PDFHemanth Kumar86% (7)

- Fundamentals of Futures and Options Markets, 6Document30 pagesFundamentals of Futures and Options Markets, 6kaylakshmi8314Pas encore d'évaluation

- Initial Information Report (IIR) : Summer Internship ProgramDocument2 pagesInitial Information Report (IIR) : Summer Internship ProgramSupriya TholetePas encore d'évaluation

- Week07 - Ch09 - Interest Rate Risk - The Duration Model (Part II)Document22 pagesWeek07 - Ch09 - Interest Rate Risk - The Duration Model (Part II)Kaison LauPas encore d'évaluation

- Minka Dirichlet PDFDocument14 pagesMinka Dirichlet PDFFarhan KhawarPas encore d'évaluation

- ICSE 2014 Pupil Analysis MathematicsDocument26 pagesICSE 2014 Pupil Analysis MathematicsRohit AgarwalPas encore d'évaluation

- Finance Interview QuestionsDocument7 pagesFinance Interview QuestionsKenneth DomingoPas encore d'évaluation

- Entry Level Financial Analyst in New York City Resume Jibran ShahDocument1 pageEntry Level Financial Analyst in New York City Resume Jibran ShahJibranShahPas encore d'évaluation

- Horizontal and Vertical Dis AllowanceDocument12 pagesHorizontal and Vertical Dis Allowancesuhaspujari93Pas encore d'évaluation

- Water Always Finds Its Way - Identifying New Forms of Money LaunderingDocument18 pagesWater Always Finds Its Way - Identifying New Forms of Money LaunderingPaulo FelixPas encore d'évaluation

- Method of Variation of ParametersDocument6 pagesMethod of Variation of ParametersRashmi RaiPas encore d'évaluation

- What Is Financial Mathematics?Document52 pagesWhat Is Financial Mathematics?BoladePas encore d'évaluation

- Unavista EMIR Faq v2.3Document59 pagesUnavista EMIR Faq v2.3Ant ArtPas encore d'évaluation

- Advanced Fixed Income Analytics Fixed Income Models: Assessment and New DirectionsDocument13 pagesAdvanced Fixed Income Analytics Fixed Income Models: Assessment and New DirectionsRaman IyerPas encore d'évaluation

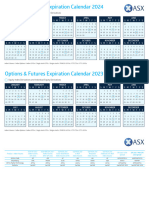

- Options Expiry Calendar 2023 24Document3 pagesOptions Expiry Calendar 2023 24srinu.jnpr124Pas encore d'évaluation

- UGBS 202 Study GuideDocument17 pagesUGBS 202 Study Guidejeff bansPas encore d'évaluation

- Math & Eng Eco General Evaluation Exam Problems and Elements (With Answers and Solutions)Document53 pagesMath & Eng Eco General Evaluation Exam Problems and Elements (With Answers and Solutions)Columbo ArcenaPas encore d'évaluation

- Chapter 12 The Black-Scholes FormulaDocument5 pagesChapter 12 The Black-Scholes FormulaMuhammad Luthfi Al AkbarPas encore d'évaluation

- Is-LM Model With Rational ExpectationsDocument17 pagesIs-LM Model With Rational Expectationssmart__petea9423Pas encore d'évaluation

- Types of Derivative MarketDocument2 pagesTypes of Derivative MarketTin RobisoPas encore d'évaluation

- AIR Basic Calculus Q3 W4 - Module 4Document17 pagesAIR Basic Calculus Q3 W4 - Module 4Love EpiphanyPas encore d'évaluation

- Algbra Trigo Wkly Exm WITH NO SolutionDocument7 pagesAlgbra Trigo Wkly Exm WITH NO SolutionChristopher Inoval ParilPas encore d'évaluation