Académique Documents

Professionnel Documents

Culture Documents

Indian Stock Market Final Report

Transféré par

Kranti ChandraDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Indian Stock Market Final Report

Transféré par

Kranti ChandraDroits d'auteur :

Formats disponibles

SUMMER PROJECT ON

PROJECT NAME

AMITY SCHOOL OF BUSINESS AMITY UNIVERSITY, NOIDA

Project Guide: Amity School of Business Amity University, Noida

Acknowledgement

There are certain quarters without whose guidance and support this project would not seen the light of the day. My sincere thanks are to due to all of them.

First of all, I am immensely grateful to, Amity School of Business, who has been a constant source of inspiration and motivation for me. She has always been the guiding force in holistic development of her students in all walks of life. While undergoing this project work, I have drawn immensely from her able guidance and leadership. She has always provided considerable flexibility and freedom to her students in successful and timely completion of their dissertation / research projects.

I am also thankful to my project nt for his unstinting guidance and support throughout the project.

My sincere thanks are also due to the Library staff of Amity School of Business for their constant support during my occasional visits to the departmental library for consulting related literature on the subject.

My special thanks are also to all other members of faculty, and staff of Amity School of Business, my friends and batchmates for extending their helping hand whenever I needed it the most.

KRANTI CHANDRA IMBA -22

Guide Certificate

Abstract

RESEARCH METHODOLOGY

A research is done whenever we try to analyse a particular trend, or to study the impact of a new policy on various socio-economic variables in the society. At times it is also undertaken to analyse the effects of some happenings in the past. The way in which such a research is done is called Research Methodology. A research work consists of an objective which tells us what we want to establish or co-relate with the help of our research.

Research objectives of this project

RESEARCH METHODOLOGY ADOPTED The research methodology being adopted in this project is to extract and analyse information and secondary data available in the public domain from credible sources such as, etc. Information has also been sought from the related literaure (books, business newspapers, and magazines) available in the departmental library. The information thus obtained has been edited and condensed accodingly keeping in mind the scope of the project. Time-series data has been analysed by plotting charts using MS-Excel software. Keeping in mind the nature of topic choosen, primary data / research has not been conducted or included in this research project.

CONCLUSIVE RESEARCH A conclusive research is meant to provide information that is useful in researching conclusion of decision making. It tends to be quantitative in nature which is to say in the form of numbers that can be quantified and summarized. It relies on both

secondary data, particularly existing database that are analyzed to shed light on different problems than the original one for which they were constituted and primary research or data specifically gathered for the current study

Data Collected : Secondary Data For analysis of data graphs have been used. Secondary Data Methodology: Secondary data was collected from the web, various repots published on the internet, books, newspapers (Economic Times, Business Standard, Financial Express) and business magazines.

Various websites those were visited and data / information collected from: www.wikipedia.com www.google.com

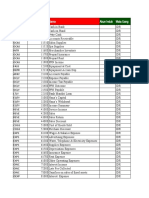

LIST OF CONTENTS

S.No.

Topic

Page No.

1. 2.

Introduction

9. 10. 11.

Conclusion Limitations Bibliography

CHAPTER 1

INTRODUCTION

1.1 Evolution

Indian Stock Markets are one of the oldest in Asia. Its history dates back to nearly 200 years ago. The earliest records of security dealings in India are meager and obscure. The East India Company was the dominant institution in those days and business in its loan securities used to be transacted towards the close of the eighteenth century. By 1830's business on corporate stocks and shares in Bank and Cotton presses took place in Bombay. Though the trading list was broader in 1839, there were only half a dozen brokers recognized by banks and merchants during 1840 and 1850. The 1850's witnessed a rapid development of commercial enterprise and brokerage business attracted many men into the field and by 1860 the number of brokers increased into 60. In 1860-61 the American Civil War broke out and cotton supply from United States of Europe was stopped; thus, the 'Share Mania' in India begun. The number of brokers increased to about 200 to 250. However, at the end of the American Civil War, in 1865, a disastrous slump began (for example, Bank of Bombay Share which had touched Rs 2850 could only be sold at Rs. 87). At the end of the American Civil War, the brokers who thrived out of Civil War in 1874, found a place in a street (now appropriately called as Dalal Street) where they would conveniently assemble and transact business. In 1887, they formally established in Bombay, the "Native Share and Stock Brokers' Association" (which is alternatively known as " The Stock Exchange "). In 1895, the Stock Exchange acquired a premise in the same street and it was inaugurated in 1899. Thus, the Stock Exchange at Bombay was consolidated.

1.2 Other Leading Cities in Stock Market Operations

Ahmedabad gained importance next to Bombay with respect to cotton textile industry. After 1880, many mills originated from Ahmedabad and rapidly forged ahead. As new mills were floated, the need for a Stock Exchange at Ahmedabad was realised and in 1894 the brokers formed "The Ahmedabad Share and Stock Brokers' Association". What the cotton textile industry was to Bombay and Ahmedabad, the jute industry was to Calcutta. Also tea and coal industries were the other major industrial groups in Calcutta. After the Share Mania in 1861-65, in the 1870's there was a sharp boom in jute shares, which was followed by a boom in tea shares in the 1880's and 1890's; and a coal boom between 1904 and 1908. On June 1908, some leading brokers formed "The Calcutta Stock Exchange Association". In the beginning of the twentieth century, the industrial revolution was on the way in India with the Swadeshi Movement; and with the inauguration of the Tata Iron and Steel Company Limited in 1907, an important stage in industrial advancement under Indian enterprise was reached. Indian cotton and jute textiles, steel, sugar, paper and flour mills and all companies generally enjoyed phenomenal prosperity, due to the First World War. In 1920, the then demure city of Madras had the maiden thrill of a stock exchange functioning in its midst, under the name and style of "The Madras Stock Exchange" with 100 members. However, when boom faded, the number of members stood reduced from 100 to 3, by 1923, and so it went out of existence. In 1935, the stock market activity improved, especially in South India where there was a rapid increase in the number of textile mills and many plantation companies were floated. In 1937, a stock exchange was once again organized in Madras - Madras Stock Exchange Association (Pvt) Limited. (In 1957 the name was changed to Madras Stock Exchange Limited). Lahore Stock Exchange was formed in 1934 and it had a brief life. It was merged with the Punjab Stock Exchange Limited, which was incorporated in 1936.

1.3 Indian Stock Exchanges - An Umbrella Growth

The Second World War broke out in 1939. It gave a sharp boom which was followed by a slump. But, in 1943, the situation changed radically, when India was fully mobilized as a supply base. On account of the restrictive controls on cotton, bullion, seeds and other commodities, those dealing in them found in the stock market as the only outlet for their activities. They were anxious to join the trade and their number was swelled by numerous others. Many new associations were constituted for the purpose and Stock Exchanges in all parts of the country were floated. The Uttar Pradesh Stock Exchange Limited (1940), Nagpur Stock Exchange Limited (1940) and Hyderabad Stock Exchange Limited (1944) were incorporated.

In Delhi two stock exchanges - Delhi Stock and Share Brokers' Association Limited and the Delhi Stocks and Shares Exchange Limited - were floated and later in June 1947, amalgamated into the Delhi Stock Exchnage Association Limited.

1.4 Trading Pattern of the Indian Stock Market

Trading in Indian stock exchanges are limited to listed securities of public limited companies. They are broadly divided into two categories, namely, specified securities (forward list) and nonspecified securities (cash list). Equity shares of dividend paying, growth-oriented companies with a paid-up capital of atleast Rs.50 million and a market capitalization of atleast Rs.100 million and having more than 20,000 shareholders are, normally, put in the specified group and the balance in non-specified group. Two types of transactions can be carried out on the Indian stock exchanges: (a) spot delivery transactions "for delivery and payment within the time or on the date stipulated when entering into the contract which shall not be more than 14 days following the date of the contract" : and (b) forward transactions "delivery and payment can be extended by further period of 14 days each so that the overall period does not exceed 90 days from the date of the contract". The latter is permitted only in the case of specified shares. The brokers who carry over the outstandings pay carry over charges (cantango or backwardation) which are usually determined by the rates of interest prevailing. A member broker in an Indian stock exchange can act as an agent, buy and sell securities for his clients on a commission basis and also can act as a trader or dealer as a principal, buy and sell securities on his own account and risk, in contrast with the practice prevailing on New York and London Stock Exchanges, where a member can act as a jobber or a broker only. The nature of trading on Indian Stock Exchanges are that of age old conventional style of face-toface trading with bids and offers being made by open outcry. However, there is a great amount of effort to modernize the Indian stock exchanges in the very recent times.

CHAPTER 2 2.1 National Stock Exchange (NSE)

With the liberalization of the Indian economy, it was found inevitable to lift the Indian stock market trading system on par with the international standards. On the basis of the recommendations of high powered Pherwani Committee, the National Stock Exchange was incorporated in 1992 by Industrial Development Bank of India, Industrial Credit and Investment Corporation of India, Industrial Finance Corporation of India, all Insurance Corporations, selected commercial banks and others. Trading at NSE can be classified under two broad categories: (a) Wholesale debt market and (b) Capital market. Wholesale debt market operations are similar to money market operations - institutions and corporate bodies enter into high value transactions in financial instruments such as government securities, treasury bills, public sector unit bonds, commercial paper, certificate of deposit, etc. There are two kinds of players in NSE: (a) trading members and (b) participants. Recognized members of NSE are called trading members who trade on behalf of themselves and their clients. Participants include trading members and large players like banks who take direct settlement responsibility. Trading at NSE takes place through a fully automated screen-based trading mechanism which adopts the principle of an order-driven market. Trading members can stay at their offices and execute the trading, since they are linked through a communication network. The prices at which the buyer and seller are willing to transact will appear on the screen. When the prices match the transaction will be completed and a confirmation slip will be printed at the office of the trading member. NSE has several advantages over the traditional trading exchanges. They are as follows:

NSE brings an integrated stock market trading network across the nation. Investors can trade at the same price from anywhere in the country since inter-market operations are streamlined coupled with the countrywide access to the securities. Delays in communication, late payments and the malpractices prevailing in the traditional trading mechanism can be done away with greater operational efficiency and informational transparency in the stock market operations, with the support of total computerized network.

Unless stock markets provide professionalised service, small investors and foreign investors will not be interested in capital market operations. And capital market being one of the major source of long-term finance for industrial projects, India cannot afford to damage the capital market path. In this regard NSE gains vital importance in the Indian capital market system.

CHAPTER 3 3.1 BOMBAY STOCK EXCHANGE

Bombay Stock Exchange Mumba hear Bjr

Type Stock Exchange Location Mumbai, India Coordinates 18.929681N 72.833589E

Founded 1875 Owner Bombay Stock Exchange Limited Key people Madhu Kannan (CEO & MD) Currency INR No. of listings 4,900 MarketCap US$1.28 trillion (Feb, 2010) Volume US$980 billion (2006) Indexes BSE Sensex Website www.bseindia.com The Bombay Stock Exchange (BSE) Mumba hear Bjr (formerly, The Stock Exchange, Mumbai; popularly called Bombay Stock Exchange, or BSE) is the oldest stock exchange in Asia and has the third largest number of listed companies in the world, with 4900 listed as of Feb 2010. It is located at Dalal Street, Mumbai, India. On Feb, 2010, the equity market capitalization of the companies listed on the BSE was US$1.28 trillion, making it the largest stock exchange in South Asia and the 12th largest in the world.[2] With over 4900 Indian companies listed & over 7700 scrips on the stock exchange,] it has a significant trading volume. The BSE SENSEX (SENSitive indEX), also called the "BSE 30", is a widely used market index in India and Asia. Though many other exchanges exist, BSE and the National Stock Exchange of India account for most of the trading in shares in India.

3.2 Hours of operation

Session Timing

Beginning of the Day Session 8:00 9:00 Trading Session Position Transfer Session Closing Session Option Exercise Session

Margin Session

9:00 - 15:30 15:30 - 15:50 15:50 - 16:05 16:05 - 16:35

16:35 - 16:50

Query Session

16:50 - 17:35

End of Day Session

17:30

The hours of operation for the BSE quoted above are stated in terms of the local time (i.e. GMT +5:30) in Mumbai (Bombay), India. BSE's normal trading sessions are on all days of the week except Saturdays, Sundays and holidays declared by the Exchange in advance.

3.3 History

The Bombay Stock Exchange is known as the oldest exchange in Asia. It traces its history to the 1850s, when 4 Gujarati and 1 Parsi stockbroker would gather under banyan trees in front of

Mumbai's Town Hall. The location of these meetings changed many times, as the number of brokers constantly increased. The group eventually moved to Dalal Street in 1874 and in 1875 became an official organization known as 'The Native Share & Stock Brokers Association'. In 1956, the BSE became the first stock exchange to be recognized by the Indian Government under the Securities Contracts Regulation Act. The Bombay Stock Exchange developed the BSE Sensex in 1986, giving the BSE a means to measure overall performance of the exchange. In 2000 the BSE used this index to open its derivatives market, trading Sensex futures contracts. The development of Sensex options along with equity derivatives followed in 2001 and 2002, expanding the BSE's trading platform. Historically an open outcry floor trading exchange, the Bombay Stock Exchange switched to an electronic trading system in 1995. It took the exchange only fifty days to make this transition. This automated, screen-based trading platform called BSE On-line trading (BOLT) currently has a capacity of 80 lakh orders per day. The BSE has also introduced the world's first centralized exchange-based internet trading system, BSEWEBx.co.in to enable investors anywhere in the world to trade on the BSE platform.

CHAPTER 4

4.1 SEBI

Securities and Exchange Board of India

Securities and Exchange Board of India

SEBI Bhavan, Mumbai headquarters Agency overview Formed Jurisdiction Headquarters Employees 1992 India Mumbai, Maharashtra, India 525 [1]

Agency executive C B Bhave, Chairman Website http://www.sebi.gov.in

SEBI is the regulator for the securities market in India. It was formed officially by the Government of India in 1992 with SEBI Act 1992 being passed by the Indian Parliament. Chaired by C B Bhave, SEBI is headquartered in the popular business district of Bandra-Kurla complex inMumbai, and has Northern, Eastern, Southern and Western regional offices in New Delhi, Kolkata, Chennai and Ahmedabad.

Chandrasekhar Bhaskar Bhave is the sixth chairman of the Securities Market Regulator. Prior to taking charge as Chairman SEBI, he had been the chairman of NSDL (National Securities Depository Limited) ushering in paperless securities. Prior to his stint at NSDL, he had served SEBI as a Senior Executive Director. He is a former Indian Administrative Service officer of the 1975 batch. The Board comprises. Name Designation As per CHAIRMAN (S.4(1)(a) of the SEBI Act, 1992) Member (S.4(1)(b) of the SEBI Act, 1992) Member (S.4(1)(b) of the SEBI Act, 1992)

CB Bhave

Chairman SEBI

KP Krishnan Anurag Goel Dr G Mohan Gopal MS Sahoo

Joint Secretary, Ministry of Finance Secretary, Ministry of Corporate Affairs Director, National Judicial Academy, Bhopal Whole Time Member, SEBI

Member (S.4(1)(d) of the SEBI Act, 1992)

Member (S.4(1)(d) of the SEBI Act, 1992) Member (S.4(1)(d) of the SEBI Act, 1992) Member (S.4(1)(d) of the SEBI Act, 1992)

Dr KM Abraham Whole Time Member, SEBI Mohandas Pai Director, Infosys

Prashant Saran

Whole Time Member, SEBI

Member (S.4(1)(d) of the SEBI Act, 1992)

4.2Functions and responsibilities

SEBI has to be responsive to the needs of three groups, which constitute the market:

the issuers of securities the investors the market intermediaries.

SEBI has three functions rolled into one body quasi-legislative, quasi-judicial and quasiexecutive. It drafts regulations in its legislative capacity, it conducts investigation and enforcement action in its executive function and it passes rulings and orders in its judicial capacity. Though this makes it very powerful, there is an appeals process to create accountability. There is a Securities Appellate Tribunal which is a three-member tribunal and is presently headed by a former Chief Justice of a High court - Mr. Justice NK Sodhi. A second appeal lies directly to the Supreme Court. SEBI has enjoyed success as a regulator by pushing systemic reforms aggressively and successively (e.g. the quick movement towards making the markets electronic and paperless

rolling settlement on T+2 basis). SEBI has been active in setting up the regulations as required under law.

CHAPTER 5 5.1 Depository participant

In India, a Depository Participant (DP) is described as an agent of the depository. They are the intermediaries between the depository and the investors. The relationship between the DPs and the depository is governed by an agreement made between the two under the Depositories Act. In a strictly legal sense, a DP is an entity who is registered as such with SEBI under the provisions of the SEBI Act. As per the provisions of this Act, a DP can offer depository-related services only after obtaining a certificate of registration from SEBI. SEBI (D&P) Regulations, 1996 prescribe a minimum net worth of Rs. 50 lakh for stockbrokers, R&T agents and non-banking finance companies (NBFC), for granting them a certificate of registration to act as DPs. If a stockbroker seeks to act as a DP in more than one depository, he should comply with the specified net worth criterion separately for each such depository. No minimum net worth criterion has been prescribed for other categories of DPs; however, depositories can fix a higher net worth criterion for their DPs.

5.2 Basics of Depository

Depository is an institution or a kind of organization which holds securities with it, in which trading is done among shares, debentures, mutual funds, derivatives, F&O and commodities. The intermediatories perform its actions in various kinds of securities at Depository on the behalf of its clients. These intermediatories are called Dipositories Participants. There are basically two kinds of depositories in India. One is the National Securities Depository Limited(NSDL) and the other is the Central Depository Service Limited(CDSL). Every Depository Participant(DP) needs to be registered under this Depository before starting operation or trade in the market.

5.3 Benefits of Depository

Bad delivery eliminated Immediate transfer of shares No stamp duty on such transfers

Elimination of risks that are normally associated in dealing with Physical certificates loss / theft / mutilation due to careless handling / forgery / etc.

Reduced transaction cost.

5.4 How do Depository operate

Depository interacts with its clients / investors through its agents, called Depository Participants normally known as DPs. For any investor / client, to avail the services provided by the Depository, has to open Depository account, known as Demat A/c, with any of the DPs.

5.5 Demat Account Opening

A demat account is opened on the same lines as that of a Bank Account. Prescribed Account opening forms are available with the DP, needs to be filled in. Standard Agreements are to be signed by the Client and the DP, which details the rights and obligations of both parties. Along with the form the client requires to attach Photographs of Account holder, Attested copies of proof of residence and proof of identity needs to be submitted along with the account opening form. In case of Corporate clients, additional attachments required are - true copy of the resolution for Demat a/c opening along with signatories to operate the account and true copy of the Memorandum and Articles of Association is to be attached.

5.6 Services provided by Depositor

Dematerialisation (usually known as demat) is converting physical certificates to electronic form

Rematerialisation, known as remat, is reverse of demat, i.e. getting physical certificates from the electronic securities Transfer of securities, change of beneficial ownership Settlement of trades done on exchange connected to the Depository

5.7 No. of Depository in the country Currently there are two depositories operational in the country. 1. National Securities Depository Ltd. - NSDL - Having 95 Cr. Demat A/c as on 3103-2010 - 300 DPs in India

2. Central Depository Services Ltd. - CDSL - Having 65 laks Demat A/c as on 31-03-2010 - 500 DPs in India.

CHAPTER 6 6.1 DEMAT ACCOUNT

The term Demat, in India, refers to a dematerialised account. For individual Indian citizens to trade in listed stocks or debentures. The Securities Exchange Board of India (SEBI) requires the investor to maintain a Demat account. In a demat account shares and securities are held in

electronic form instead of taking actual possession of certificates. A Demat Account is opened by the investor while registering with an investment broker (or sub broker). The Demat account number which is quoted for all transactions to enable electronic settlements of trades to take place. Access to the demat account requires an internet password and a transaction password as well as initiating and confirming transfers or purchases of securities. Purchases and sales of securities on the Demat account are automatically made once transactions are executed and completed.

6.2 Advantages of Demat

The demat account reduces brokerage charges, makes pledging/hypothecation of shares easier, enables quick ownership of securities on settlement resulting in increased liquidity, avoids confusion in the ownership title of securities, and provides easy receipt of public issue allotments. It also helps you avoid bad deliveries caused by signature mismatch, postal delays and loss of certificates in transit. Further, it eliminates risks associated with forgery, counterfeiting and loss due to fire, theft or mutilation. Demat account holders can also avoid stamp duty (as against 0.5 per cent payable on physical shares), avoid filling up of transfer deeds, and obtain quick receipt of such benefits as stock splits and bonuses.

6.3 Indian Market Scenario

Indian capital market has seen unprecedented boom in its activity in the last 15 years in terms of number of stock exchanges, listed companies, trade volumes, market intermediaries, investor population, etc. However, this surge in activity has brought with it numerous problems that threaten the very survival of the capital markets in the long run, most of which are due to the large volume of paper work involved and paper based trading, clearing and settlement. Until the late eighties, the common man kept away from capital market and thus the quantum of funds Benefit to the Investor The depository system reduces risks involved in holding physical certificated, e.g., loss, theft, mutilation, forgery, etc.It ensures transfer settlements and reduces delay in registration of shares. It ensures faster communication to investors. It helps avoid bad delivery problem due to signature differences, etc.It ensures faster payment on sale of shares. No stamp duty is paid on transfer of shares. It provides more acceptability and liquidity of securities.

Benefit to Brokers The depository system reduces risk of delayed settlement. It ensures greater profit due to increase in volume of trading. It eliminates chances of forgery bad delivery. It increases overall of trading and profitability.It increases confidence in investors.

6.4 Demat conversion

Converting physical holding into electronic holding (dematerialising securities) In order to dematerialise physical securities one has to fill in a DRF (Demat Request Form) which is available with the DP and submit the same along with physical certificates one wishes to dematerialise. Separate DRF has to be filled for each ISIN Number. The complete process of dematerialisation is outlined below: Surrender certificates for dematerialisation to your depository participant. Depository participant intimates Depository of the request through the system. Depository participant submits the certificates to the registrar of the Issuer Company. Registrar confirms the dematerialisation request from depository. After dematerialising the certificates, Registrar updates accounts and informs depository of the completion of dematerialisation. Depository updates its accounts and informs the depository participant. Depository participant updates the demat account of the investor.

6.5 Demat Options

Banks score over others Around 200 depository participants (DPs) offer the demat account facility. A comparison of the fees charged by different DPs is detailed below. But there are three distinct advantages of having a demat account with a bank quick processing, accessibility and online transaction. Generally, banks credit your demat account with shares in case of purchase, or credit your savings accounts with the proceeds of a sale on the third day. Banks are also advantageous because of the number of branches they have. Some banks give the option of opening a demat account in any branch, while others restrict themselves to a select set of branches. Some private banks also provide online access to the demat account. So, you can check on your holdings, transactions and status of requests through the net banking facility. A broker who acts as a DP may not be able to provide these services.

6.6 Fees Involved

There are four major charges usually levied on a demat account: Account opening fee, annual maintenance fee, custodian fee and transaction fee. All the charges vary from DP to DP.

6.7 Account-opening fee

Depending on the DP, there may or may not be an opening account fee. Private banks, such as ICICI Bank, HDFC Bank and UTI Bank, do not have one. However, players such as Globe Capital, Karvy Consultants and the State Bank of India do so. But most players levy this when you re-open a demat account, though the Stock Holding Corporation offers a lifetime account opening fee, which allows you to hold on to your demat account over a long period. This fee is refundable.

6.8 Annual maintenance fee

This is also known as folio maintenance charges, and is generally levied in advance.

6.9 Custodian fee

This fee is charged monthly and depends on the number of securities (international securities identification numbers ISIN) held in the account. It generally ranges between Rs 0.5 to Rs 1 per ISIN per month. DPs will not charge custody fee for ISIN on which the companies have paid one-time custody charges to the depository. 6.10 Transaction fee The transaction fee is charged for crediting/debiting securities to and from the account on a monthly basis. While some DPs, such as SBI, charge a flat fee per transaction, HDFC Bank and ICICI Bank peg the fee to the transaction value, subject to a minimum amount. The fee also differs based on the kind of transaction (buying or selling). Some DPs charge only for debiting the securities while others charge for both. The DPs also charge if your instruction to buy/sell fails or is rejected. In addition, service tax is also charged by the DPs. In addition to the other fees, the DP also charges a fee for converting the shares from the physical to the electronic form or vice-versa. This fee varies for both demat and remat requests. For demat, some DPs charge a flat fee per request in addition to the variable fee per certificate, while others charge only the variable fee. For instance, Stock Holding Corporation charges Rs 25 as the request fee and Rs 3 per certificate as the variable fee. However, SBI charges only the variable fee, which is Rs 3 per certificate. Remat requests also have charges akin to that of demat. However, variable charges for remat are generally higher than demat. Some of the additional features (usually offered by banks) are as follows.Some DPs offer a frequent trader account, where they charge frequent traders at lower rates than the standard charges.Demat account holders are generally required to pay the DP an advance fee for each account which will be adjusted against the various service charges. The account holder needs to raise the balance when it falls below a certain amount prescribed by the DP. However, if you also hold a savings account with the DP you can provide a debit

authorisation to the DP for paying this charge.Finally, once you choose your DP, it will be prudent to keep all your accounts with that DP, so that tracking your capital gains liability is easier. This is because, for calculating capital gains tax, the period of holding will be determined by the DP and different DPs follow different methods. For instance, ICICI Bank uses the first in first out (FIFO) method to compute the period of holding. The proof of the cost of acquisition will be the contract note. The computation of capital gains is done account-wise.

6.11 Opening an account

Steps involved in opening a demat account First an investor has to approach a DP and fill up an account opening form. The account opening form must be supported by copies of any one of the approved documents to serve as proof of identity (POI) and proof of address (POA) as specified by SEBI. Besides, production of PAN card in original at the time of opening of account has been made mandatory effective from April 1, 2006. All applicants should carry original documents for verification by an authorized official of the depository participant, under his signature. Further, the investor has to sign an agreement with DP in a depository prescribed standard format, which details rights and duties of investor and DP. DP should provide the investor with a copy of the agreement and schedule of charges for their future reference. The DP will open the account in the system and give an account number, which is also called BO ID (Beneficiary Owner Identification number). The DP may revise the charges by giving 30 days notice in advance. SEBI has rationalised the cost structure for dematerialisation by removing account opening charges, transaction charges for credit of securities, and custody charges vide circular dated January 28, 2005. Further, SEBI has vide circular dated November 9, 2005 advised that with effect from January 9, 2006, no charges shall be levied by a depository on DP and consequently, by a DP on a Beneficiary Owner (BO) when a BO transfers all the securities lying in his account to another branch of the same DP or to another DP of the same depository or another depository, provided the BO Account/s at transferee DP and at transferor DP are one and the same, i.e. identical in all respects. In case the BO Account at transferor DP is a joint account, the BO Account at transferee DP should also be a joint account in the same sequence of ownership.

Disadvantages of Demat

The disadvantages of dematerialization of securities can be summarised as follows: Trading in securities may become uncontrolled in case of dematerialized securities. It is incumbent upon the capital market regulator to keep a close watch on the trading in dematerialized securities and see to it that trading does not act as a detriment to investors. The role of key market players in case of dematerialized securities, such as stock-brokers, needs to be supervised as they have the capability of manipulating the market. Multiple regulatory frameworks have to be confirmed to, including the Depositories Act, Regulations and the various By-Laws of various depositories. Additionally, agreements are entered at various levels in the process of dematerialization. These may cause anxiety to the investor desirous of simplicity in terms of transactions in dematerialized securities. However, the advantages of dematerialization outweigh its disadvantages and the changes ushered in by SEBI and the Central Government in terms of compulsory dematerialization of securities is important for developing the securities market to a degree of advancement. Freely traded securities are an essential component of such an advanced market and dematerialization addresses such issues and is a step towards the advancement of the market.

Vous aimerez peut-être aussi

- Lyft CaseDocument5 pagesLyft CaseMyDude IsHungryPas encore d'évaluation

- Estmt - 2016 07 08Document10 pagesEstmt - 2016 07 08Dennis Chen100% (1)

- Impact of Fii and Fdi On Indian Stock MarketDocument69 pagesImpact of Fii and Fdi On Indian Stock MarketRamgarhia SandhuPas encore d'évaluation

- Project On Indian Stock Market..........Document10 pagesProject On Indian Stock Market..........Kirti ....0% (1)

- Summer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDDocument71 pagesSummer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDSatyendraSinghPas encore d'évaluation

- Project On Demat Account FinalDocument70 pagesProject On Demat Account FinalBHARAT0% (1)

- MBA Project Report On Online Trading Derivatives - 126193635Document95 pagesMBA Project Report On Online Trading Derivatives - 126193635PriyaPas encore d'évaluation

- Comparative Analysis of Sharekhan and Other Stock Broker HouseDocument78 pagesComparative Analysis of Sharekhan and Other Stock Broker Housekunal khairePas encore d'évaluation

- Capital MarketDocument87 pagesCapital MarketYogesh9918100% (1)

- Security Analysis and Portfolio Management Project by TanveerDocument77 pagesSecurity Analysis and Portfolio Management Project by TanveeradeenPas encore d'évaluation

- Project Report On Indian Stock Market - DBFSDocument100 pagesProject Report On Indian Stock Market - DBFSkartikPas encore d'évaluation

- Ipo Sharekhan ProjectDocument73 pagesIpo Sharekhan ProjectSaadullah Khan100% (1)

- Perception of Investors Towards Online Trading: IntrodutionDocument64 pagesPerception of Investors Towards Online Trading: IntrodutionArjun S A100% (1)

- Performance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDDocument74 pagesPerformance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDPrashanth PBPas encore d'évaluation

- Comparative Study On Online & Offline Trading at Karvey Priyanka MauryaDocument80 pagesComparative Study On Online & Offline Trading at Karvey Priyanka MauryaTahir HussainPas encore d'évaluation

- Ram Online Trading Project1Document95 pagesRam Online Trading Project1Dilipkumar DornaPas encore d'évaluation

- Investors Perception Towards Stock MarketDocument64 pagesInvestors Perception Towards Stock MarketsonuPas encore d'évaluation

- Financial Services Provided by Anand RathiDocument65 pagesFinancial Services Provided by Anand RathimiksharmaPas encore d'évaluation

- PROJECT Final 9 (SIP)Document70 pagesPROJECT Final 9 (SIP)Shefali ShuklaPas encore d'évaluation

- Fundamental Analysis of FMCG SectorDocument78 pagesFundamental Analysis of FMCG Sectormd_akhter_8Pas encore d'évaluation

- Analysis of Investment in Mutual FundsDocument96 pagesAnalysis of Investment in Mutual FundsAnonymous lNwEvIgWqPas encore d'évaluation

- Project On Risk & Return Analysis of Reliance Mutual FundDocument74 pagesProject On Risk & Return Analysis of Reliance Mutual FundPiya Bhatnagar0% (1)

- "Fundamental Analysis of Script Under Pharmaceutical Sector"Document82 pages"Fundamental Analysis of Script Under Pharmaceutical Sector"sg31Pas encore d'évaluation

- Derivatives (Futures & Options) Sharekhan Stockbroking Co. LTDDocument84 pagesDerivatives (Futures & Options) Sharekhan Stockbroking Co. LTDManoj ReddyPas encore d'évaluation

- Online Trading and Clearing Settlements at Arihant Capital Market LTD Mba ProjectDocument88 pagesOnline Trading and Clearing Settlements at Arihant Capital Market LTD Mba Projectprakash_rish120Pas encore d'évaluation

- 2.1 Industry Profile: Mutual FundDocument16 pages2.1 Industry Profile: Mutual FundAbdulRahman ElhamPas encore d'évaluation

- Investors' Attitude Towards Stock MarketDocument24 pagesInvestors' Attitude Towards Stock MarketBoopathi Kalai100% (1)

- PROJECT REPORT OF Angel BrokingDocument57 pagesPROJECT REPORT OF Angel BrokingChandrakant80% (5)

- A Project Report On Derivative Market (Abhay Bhatt) FINALDocument54 pagesA Project Report On Derivative Market (Abhay Bhatt) FINALharryPas encore d'évaluation

- A Study On Financial Performance Analysis of Bharti Airtel LimitedDocument6 pagesA Study On Financial Performance Analysis of Bharti Airtel LimitedInternational Journal of Business Marketing and ManagementPas encore d'évaluation

- A STUDY ON INDIAN STOCK MARKET - IiflDocument10 pagesA STUDY ON INDIAN STOCK MARKET - IiflkiziePas encore d'évaluation

- Karvy Report On Mutual FundsDocument96 pagesKarvy Report On Mutual FundsNeetu shrivastavaPas encore d'évaluation

- Investors Attitude Towards Primary Market - BrijenderDocument56 pagesInvestors Attitude Towards Primary Market - BrijenderGaurav GuptaPas encore d'évaluation

- A Study of Investment in Financial Instruments by Working People in MumbaiDocument72 pagesA Study of Investment in Financial Instruments by Working People in MumbaiAJAY RAJBHARPas encore d'évaluation

- Mba Project Report On Online Trading DerivativesDocument94 pagesMba Project Report On Online Trading DerivativesChakradhar Palagiri0% (1)

- Sbi Project ReportDocument54 pagesSbi Project ReportVikas Choudhary100% (1)

- Instability in Indian Stock Market DraftDocument53 pagesInstability in Indian Stock Market Draftrushabh1819Pas encore d'évaluation

- India Bulls ProjectDocument108 pagesIndia Bulls ProjectSk Khasim50% (2)

- Comparative Study of Financial Statement Reports of Canara Bank and Comparative BankDocument41 pagesComparative Study of Financial Statement Reports of Canara Bank and Comparative Bankparamjeet kourPas encore d'évaluation

- A ComparativeStudy of BSE and NSE-1Document27 pagesA ComparativeStudy of BSE and NSE-1Vaishnavi MewatiPas encore d'évaluation

- Project On Mutual FundsDocument39 pagesProject On Mutual FundsprasadradhakrishnanPas encore d'évaluation

- A Study of Currency Derivatives in IndiaDocument5 pagesA Study of Currency Derivatives in IndiaNikunj Bafna100% (1)

- Analysis of Uti Mutual Fund With Reliance Mutual FundDocument64 pagesAnalysis of Uti Mutual Fund With Reliance Mutual FundSanjayPas encore d'évaluation

- Startup India-Boosting Indian EconomyDocument7 pagesStartup India-Boosting Indian EconomyAfad KhanPas encore d'évaluation

- Summer Training Report by Deepak DhingraDocument94 pagesSummer Training Report by Deepak Dhingraashurpt1288% (8)

- Project On Mutual FundsDocument81 pagesProject On Mutual FundsDev BosePas encore d'évaluation

- Project On Mutual FundsDocument75 pagesProject On Mutual FundsParag MorePas encore d'évaluation

- Final Project On FDI and FIIDocument39 pagesFinal Project On FDI and FIIReetika BhatiaPas encore d'évaluation

- IIFL Project 2010Document112 pagesIIFL Project 2010695269100% (3)

- Icici Prudential ReportDocument70 pagesIcici Prudential Reportrahulsogani123Pas encore d'évaluation

- Mutual Fund Investment InternshipDocument69 pagesMutual Fund Investment InternshipSv KhanPas encore d'évaluation

- Final Project On Fdi in IndiaDocument66 pagesFinal Project On Fdi in Indiasantosh_boyePas encore d'évaluation

- Project On Online TradingDocument133 pagesProject On Online Tradingshivamcim33% (3)

- Cash Management.... Icici Bank1Document75 pagesCash Management.... Icici Bank1Shadan Institute of Management StudiesPas encore d'évaluation

- Significance, Role or Functions of Capital MarketDocument13 pagesSignificance, Role or Functions of Capital Marketjaswinder731Pas encore d'évaluation

- Venu 42 ReportDocument64 pagesVenu 42 ReportSubbaRaoPas encore d'évaluation

- Factor Influencing The Investment Decision Making of InvestorsDocument100 pagesFactor Influencing The Investment Decision Making of InvestorsajjuPas encore d'évaluation

- Introduction To Capital MarketDocument39 pagesIntroduction To Capital MarketR Rabi ReddyPas encore d'évaluation

- Project NewDocument52 pagesProject Newbalki123Pas encore d'évaluation

- Technical AnalysisDocument138 pagesTechnical AnalysisHina GajeraPas encore d'évaluation

- Factor Influencing The Investment Decision Making of InvestorsDocument101 pagesFactor Influencing The Investment Decision Making of InvestorsmarishakevatPas encore d'évaluation

- History of Stock ExchangeDocument7 pagesHistory of Stock ExchangeTelika RamuPas encore d'évaluation

- Bizpre06 PDFDocument13 pagesBizpre06 PDFSyakina NurPas encore d'évaluation

- Recruitment To Clerical Cadre in Associate Banks of State Bank of IndiaDocument4 pagesRecruitment To Clerical Cadre in Associate Banks of State Bank of IndiaKranti ChandraPas encore d'évaluation

- 6ef23mod 1Document22 pages6ef23mod 1Kranti ChandraPas encore d'évaluation

- Amity School of Business: Bba Semester V Bs V (GDTB) Bba+Mba Module-1 Parul GoelDocument40 pagesAmity School of Business: Bba Semester V Bs V (GDTB) Bba+Mba Module-1 Parul GoelKranti ChandraPas encore d'évaluation

- Report On Working Capital MGT of JSPLDocument43 pagesReport On Working Capital MGT of JSPLharshal_gupta100% (3)

- All I KnowDocument305 pagesAll I Knowhitesh_21Pas encore d'évaluation

- Seminar - PPT - FinalDocument26 pagesSeminar - PPT - FinalMythili MuthappaPas encore d'évaluation

- Signed FS Inocycle Technology Group TBK 2018 PDFDocument74 pagesSigned FS Inocycle Technology Group TBK 2018 PDFmichele hazelPas encore d'évaluation

- Role of RBI in Indian EconomyDocument17 pagesRole of RBI in Indian Economychaudhary9259% (22)

- Advacc 3 Question Set A 150 CopiesDocument6 pagesAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasPas encore d'évaluation

- Accounting and The Business Environment Accounting and The Business EnvironmentDocument73 pagesAccounting and The Business Environment Accounting and The Business EnvironmentFederico LannesPas encore d'évaluation

- AT.2900b - Auditing (AUD) SyllabusDocument2 pagesAT.2900b - Auditing (AUD) SyllabusBryan Christian MaragragPas encore d'évaluation

- Mock Bar - Commercial Law PDFDocument8 pagesMock Bar - Commercial Law PDFPatricia Anne GarciaPas encore d'évaluation

- Attendee List As of 4-22-19.Document7 pagesAttendee List As of 4-22-19.karthik83.v209Pas encore d'évaluation

- ApplicationForm - WB 001 108617 00286102Document4 pagesApplicationForm - WB 001 108617 00286102anishmistri8333Pas encore d'évaluation

- Professional Ethics - , Accountancy For Lawyers and Bench-BarDocument27 pagesProfessional Ethics - , Accountancy For Lawyers and Bench-BarArpan Kamal100% (6)

- Minimum Variance PortfolioDocument13 pagesMinimum Variance PortfolioSohag KhanPas encore d'évaluation

- Models and Theories of Corporate Governance PDFDocument30 pagesModels and Theories of Corporate Governance PDFSai Venkatesh RamanujamPas encore d'évaluation

- Insync Partnership DeedDocument5 pagesInsync Partnership DeedAbhishek SinghPas encore d'évaluation

- Internship Report MTMDocument45 pagesInternship Report MTMusmanaltafPas encore d'évaluation

- Mmi 07 Bma 14 Corporate FinancingDocument20 pagesMmi 07 Bma 14 Corporate FinancingchooisinPas encore d'évaluation

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludPas encore d'évaluation

- Accounting For Corporate Combinations and Associations Australian 8th Edition Arthur Solutions ManualDocument12 pagesAccounting For Corporate Combinations and Associations Australian 8th Edition Arthur Solutions Manualmaryturnerezirskctmy100% (27)

- M. Com. I Advanced Accountancy Paper-I AllDocument134 pagesM. Com. I Advanced Accountancy Paper-I Allसदानंद देशपांडेPas encore d'évaluation

- CEO COO General Counsel in Bermuda Resume William FawcettDocument3 pagesCEO COO General Counsel in Bermuda Resume William FawcettWilliamFawcett100% (1)

- Singur and Nandigram and The Untold Story OF Capitalised MarxismDocument145 pagesSingur and Nandigram and The Untold Story OF Capitalised MarxismChandan BasuPas encore d'évaluation

- Daftar Akun Rumah Cantik HanaDocument4 pagesDaftar Akun Rumah Cantik HanaLSP SMKN 1 BanjarmasinPas encore d'évaluation

- Suzlon Annual Report 2015 16Document184 pagesSuzlon Annual Report 2015 16ramasamyPas encore d'évaluation

- Swayam Siddhi College of Management and Research: Summer Internship Project Topic For Finance:-Provident FundDocument10 pagesSwayam Siddhi College of Management and Research: Summer Internship Project Topic For Finance:-Provident Fundpranjali shindePas encore d'évaluation

- PAS 7 Summary NotesDocument2 pagesPAS 7 Summary NotesdaraPas encore d'évaluation

- CryptocurrencyDocument5 pagesCryptocurrency165Y105 CHAITHRA SATHYANPas encore d'évaluation

- FNB SG Retail 2017-03Document23 pagesFNB SG Retail 2017-03Arravind UdayakumarPas encore d'évaluation

- Chapter: Company Final Accounts (Set-1) : Corporate AccountingDocument6 pagesChapter: Company Final Accounts (Set-1) : Corporate AccountingVashu KatiyarPas encore d'évaluation