Académique Documents

Professionnel Documents

Culture Documents

Discussion Question

Transféré par

playdreamsaroundDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Discussion Question

Transféré par

playdreamsaroundDroits d'auteur :

Formats disponibles

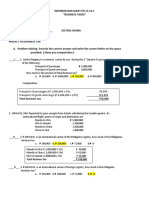

Beast Sdn Bhd, a resident company involved in manufacturing of furniture, prepared its profit and loss account for

the year ended 31 December 2010 as follows: Notes RM'000 RM'000 Sales 40,900 Less: Cost of sales 1 (15,000) 25,900 Add: Other incomes 2 200 26,100 Less: Remuneration 3 10,000 Repair and maintenance 4 5,000 Marketing 100 Fright charges 5 300 Entertainment 6 6,000 Financial charges 7 50 Motor vehicle expenses 8 10 Provision for bad debts 9 6 Donation 10 5 Training and consultancy 4 Foreign exchange 11 300 Deprecation 500 Insurance 12 300 (22,575) Net profit before taxation 3,525 Notes: (1) Cost of sales includes a sum of RM 10,000 written off in respect of a consignment of furniture damaged in an accident in the course of its transportation from the supplier. (2) Other incomes comprise: Tax exempt dividend from a pioneer company Dividend from co-operative society Rental Income from Singapore (3) Remuneration comprise: RM 000 Employees Provident Fund (EPF) contributions in 3,500 entertainment allowance paid to managing director and marketing executives Remuneration paid to three disable employees 500 Embezzlement by a director of the company 4,000 Entertainment allowance paid to managing director and 2,000 marketing executive 10,000 RM000 20 80 100 200

(4) Repair and maintenance include: RM 000 Cost of maintaining a holiday bungalow in Johor used by 500 marketing executives of the company Cost of maintaining a holiday bungalow in Port Dickson 1,000 used exclusively by the companys clients (5) Freight charges: The freight charges are for shipping the furniture manufactured by the company from Sabah to Port Klang (6) Entertainment include: RM000 Overseas leave passages for the managing director and 2,500 two other senior executives Corporate memberships to golf clubs made up of entrance 1,000 fees ( purpose is to promote the business of the company) Corporate memberships to golf club monthly 500 subscriptions (purpose is to promote the business of the company Company annual dinner 2,000 6,000 (7) Financial charges includes: A sum of RM 30,000 being the mortgage loan interest incurred on the property in Hong Kong and a loss of RM 10,000 on foreign exchange on the mortgage loan interest (8) Motor vehicle expenses include: RM 000 Gain on the sale of a lorry 5 Fine on traffic offences committed by the lorry driver on 1 delivery of goods (9) Provision for bad debts comprise: Bad debts written off Net increase in specific provision Net increase in general provision Bad debts recovered (10) RM 000 6 3 2 (5) 6

Donation comprise: A cash donation of RM 5,000 was made to a healthcare centre approved by the Ministry of Health.

(11) (12)

Foreign exchange gain of RM 300,000 is in respect of furniture exported to Thailand (realized). Insurance includes a sum of RM 20,000 recovered from an insurance company in respect of loss of profits after a fire broke out in one of the restaurants. On 1st April 2010, the company purchased new equipment for RM 100,000. The Ministry of Energy, Communications and Multimedia certified that the equipment is used by the company exclusively for conserving energy. Brought forward capital allowance are RM 200,000. The capital allowances for the year of assessment 2010 amount to RM 180,000 excluding the asset acquired during the financial year An adjusted loss of RM 50,000 is brought forward from year of assessment 2009. The companys paid up capital at the beginning of the financial year was RM 2 million.

(13)

(14)

(15) (16)

Required: Starting with the net profit before taxation, compute the income tax payable of Beast Sdn Bhd for year of assessment 2010. Every item mentioned in the notes to the accounts must be listed in your computation irrespective of whether an adjustment is necessary. Where no adjustment is required, indicate NIL in the appropriate column.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Enron ReflectionDocument2 pagesEnron ReflectionRanie MonteclaroPas encore d'évaluation

- Chapter 2 - External Environment AnalysisDocument23 pagesChapter 2 - External Environment Analysismuhammad naufalPas encore d'évaluation

- You Exec - Business Strategies and Frameworks Part 1 FreeDocument7 pagesYou Exec - Business Strategies and Frameworks Part 1 FreeMurugesh BalaguruPas encore d'évaluation

- Managing Small Projects PDFDocument4 pagesManaging Small Projects PDFJ. ZhouPas encore d'évaluation

- Course Outline: International FinanceDocument6 pagesCourse Outline: International FinanceShammo AhzPas encore d'évaluation

- Project in Business TaxDocument5 pagesProject in Business TaxJemalyn PiliPas encore d'évaluation

- IFID BrochureDocument6 pagesIFID BrochurePrabhakar SharmaPas encore d'évaluation

- Market Research WorksheetDocument7 pagesMarket Research WorksheetNabila Nailatus SakinaPas encore d'évaluation

- Financial Statement Analysis and Security Valuation 5th Edition by Penman ISBN Test BankDocument16 pagesFinancial Statement Analysis and Security Valuation 5th Edition by Penman ISBN Test Bankcindy100% (24)

- AnnualReport2017 2018 PDFDocument236 pagesAnnualReport2017 2018 PDFsuryateja kudapaPas encore d'évaluation

- The Relationship of Innovation With Organizational PerformanceDocument16 pagesThe Relationship of Innovation With Organizational PerformanceGuiquan CPas encore d'évaluation

- ERP Post Implementation Challenges 3Document11 pagesERP Post Implementation Challenges 3Neelesh KumarPas encore d'évaluation

- The History of The Philippine Currency: Republic Central CollegesDocument8 pagesThe History of The Philippine Currency: Republic Central CollegesDaishin Kingsley SesePas encore d'évaluation

- Royal Decree 50 of 2023 Promulgating The System of The Social Protection FundDocument4 pagesRoyal Decree 50 of 2023 Promulgating The System of The Social Protection FundmsadiqcsPas encore d'évaluation

- AML - An Overview: What Is Money Laundering (ML)Document13 pagesAML - An Overview: What Is Money Laundering (ML)Chiranjib ParialPas encore d'évaluation

- A Study On Customer Preference Towards Brand FactoryDocument21 pagesA Study On Customer Preference Towards Brand FactoryH.Arokiaraj100% (2)

- Discuss The Nexus Between Corporate Governance and Prevention of Corporate FraudDocument14 pagesDiscuss The Nexus Between Corporate Governance and Prevention of Corporate FraudLindiwe Makoni100% (4)

- Trade Finance Presentation - 24-01-2024Document22 pagesTrade Finance Presentation - 24-01-2024Anup KhanalPas encore d'évaluation

- Business Plan of Agricultural MechanizationDocument32 pagesBusiness Plan of Agricultural MechanizationTarik Kefale86% (90)

- Click Below and Continue Your Application From Where You LeftDocument2 pagesClick Below and Continue Your Application From Where You LeftRAHUL KUMARPas encore d'évaluation

- Defence Against Hostile TakeoversDocument2 pagesDefence Against Hostile TakeoversAhmad AfghanPas encore d'évaluation

- Solved Question Rhodes CorporationDocument4 pagesSolved Question Rhodes CorporationBilalTariqPas encore d'évaluation

- Far 250Document18 pagesFar 250Aisyah SaaraniPas encore d'évaluation

- Excerpt From "Newcomers: Gentrification and Its Discontents" by Matthew Schuerman.Document13 pagesExcerpt From "Newcomers: Gentrification and Its Discontents" by Matthew Schuerman.OnPointRadioPas encore d'évaluation

- 2023 Budget Ordinance First ReadingDocument3 pages2023 Budget Ordinance First ReadinginforumdocsPas encore d'évaluation

- Complete Topic 1 - Cost - Cost ClassificationDocument12 pagesComplete Topic 1 - Cost - Cost ClassificationchaiigasperPas encore d'évaluation

- Rights of An Unpaid Seller Under The Sale of Goods ActDocument6 pagesRights of An Unpaid Seller Under The Sale of Goods ActSreepathi ShettyPas encore d'évaluation

- Death of Big LawDocument55 pagesDeath of Big Lawmaxxwe11Pas encore d'évaluation

- NCR NegoSale Batch 15134 090522Document35 pagesNCR NegoSale Batch 15134 090522April Jay BederioPas encore d'évaluation