Académique Documents

Professionnel Documents

Culture Documents

Crisil: Performance Highlights

Transféré par

Angel BrokingTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Crisil: Performance Highlights

Transféré par

Angel BrokingDroits d'auteur :

Formats disponibles

2QCY2011 Result Update | Credit Rating

July 21, 2011

CRISIL

Performance Highlights

Particulars (` cr) Net sales EBITDA EBITDA margin (%) Net profit 2QCY2011 2QCY2010 203.8 60.6 29.7 44.4 151.2 46.9 31.0 33.3 %chg (yoy) 1QCY2011 34.8 29.3 (127) 33.4 178.8 58.3 32.6 46.0 %chg (qoq) 14.0 3.9 (290) (3.3)

NEUTRAL

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Credit Rating 5,602 0.3 8,400 /5,391 1,033 10 18,436 5,542 CRSL.BO CRISIL@IN

`7,890 -

Source: Company, Angel Research

CRISIL registered strong top-line growth in 2QCY2011. The companys net sales grew by 34.8% yoy to `204cr. The company reported a 127bp yoy contraction in OPM to 29.7%. Net profit increased by 33.4% yoy to `44cr (`37cr). Top line posts strong growth, margin dips yoy: For 2QCY2011, CRISILs top line reported 34.8% yoy growth to `204cr (`151cr), led by strong growth in its research segment, which witnessed 54.4% growth because of addition of Pipals revenue for the full quarter and strong growth in Irevna and CRISIL Research. The rating business also picked up during the quarter, registering strong 19.2% yoy and 17.1 qoq growth. The advisory segment also witnessed an increase in its revenue, registering 20.2% yoy and 46.6% qoq growth. The companys EBITDA margin declined by 127bp yoy, largely due to higher employee cost, which increased to 45.6% of sales from 43.0% of sales. Net profit came in at `44cr, up 33.4% yoy. However, adjusting for other income, net profit increased by 31.7% as the company had sold property worth `3.32cr in 2QCY2011. Outlook and valuation: We expect CRISIL to post a 21% CAGR in revenue over CY201012 and continue to maintain its leadership position. CRISIL benefits from its asset-light business model, which is high on intellectual assets (employee costto-sales is around 40%). Further, the company is debt free and has 40% plus RoE. Additionally, CRISIL enjoys strong parentage (Standard and Poor's). Currently, the stock is available at 22.9x CY2012E earnings, which is at the higher end of its historical range of 16.429.9x one-year forward EPS. With the recent run-up in the stock price, we change our recommendation to Neutral.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 52.4 18.4 11.6 17.6

Abs. (%) Sensex CRISIL

3m (5.9) 20.3

1yr 2.6 34.7

3yr 33.1 137.0

Key financials (Consolidated)

Y/E December (` cr) Net sales % chg Net profit % chg FDEPS (`) EBITDA margin (%) P/E (x) RoE (%) RoCE (%) P/BV (x) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

CY2009 537 4.4 161 14.4 223 37.1 35.5 40.6 46.6 13.1 10.1 27.3

CY2010 631 17.5 160 (0.2) 290 34.5 27.3 49.6 47.4 14.2 8.6 25.0

CY2011E 766 21.3 201 25.0 283 34.8 27.9 46.4 55.3 11.9 7.0 20.2

CY2012E 926 20.9 244 21.7 344 35.0 22.9 47.8 58.1 10.2 5.7 16.3

Sharan Lillaney

022-3935 7800 Ext: 6811 sharanb.lillaney@angelbroking.com

Please refer to important disclosures at the end of this report

CRISIL | 2QCY2011 Result Update

Exhibit 1: 2QCY2011 Performance highlights

Particulars (` cr) Net Sales Total Expenditure EBITDA OPM (%) Depreciation EBIT Interest Other Income PBT Tax Minority Interest Net Profit NPM (%) Net Profit Adj. for other Income Diluted EPS (`)

Source: Company, Angel Research

2QCY2011 2QCY2010 203.8 143.2 60.6 29.7 7.4 53.2 5.6 58.8 14.4 44.4 21.8 38.8 62.6 151.2 104.3 46.9 31.0 5.0 41.8 3.9 45.7 8.7 3.6 33.3 22.0 29.5 46.1

%chg (yoy) 1QCY2011 34.8 37.3 29.3 (126.8)bp 47.5 27.1 46.3 28.7 33.4 (22.1)bp 31.7 35.8 178.8 120.4 58.3 32.6 6.8 51.5 2.6 54.2 8.2 46.0 25.7 43.4 64.8

%chg (qoq) 14.0 18.9 3.9 (289.8)bp 9.5 3.1 114.8 8.6 (3.3) (391.2)bp (10.5) (3.3)

CY2010 631.1 413.3 217.7 34.5 21.3 196.5 67.7 264.1 58.7 205.5 32.6 137.8 277.0

CY2009 537.3 338.0 199.3 37.1 14.9 184.5 23.0 207.5 46.7 160.8 29.9 137.8 222.5

%chg (yoy) 17.5 22.3 9.2 (259.4)bp 43.1 6.5 194.2 27.3 27.8 263bp 0.0 24.5

Revenue up 34.8% yoy on the back of strong research growth

For 2QCY2011, CRISIL registered 34.8% yoy growth in revenue to `204cr on the back of strong 54.4% yoy growth in the research segment to `103cr (`67cr). Growth in the research segment was majorly because of consolidation of Pipals revenue and due to strong revenue growth of Irevna and CRISIL Research. 2QCY2011 witnessed an improvement in the rating segment, which registered strong 19.2% yoy and 17.1% qoq growth to `85cr. The advisory segments revenue reported a 20.2% yoy and 46.6% qoq growth to `16cr during the quarter.

Exhibit 2: Strong yoy growth in revenue continues

(` cr) 250 200 150 100 50 0 2QCY2010 3QCY2010 Net Sales (LHS) 4QCY2010 1QCY2011 2QCY2011 Growth (qoq) Growth (yoy) 159 177 179 (%) 40 35 204 151 30 25 20 15 10 5 0

Source: Company, Angel Research

July 21, 2011

CRISIL | 2QCY2011 Result Update

EBITDA improves, but margin dips

For 2QCY2011, EBITDA improved by 29.3% yoy to `61cr on the back of higher revenue. However, OPM dipped yoy to 29.7% (31.0%) due to higher employee cost, which increased to 45.6% of sales in 2QCY2011 compared to 43.0% of sales in 2QCY2010.

Exhibit 3: OPM declining qoq

(%) 45 39.1 35.3 35 31.0 30 32.6 29.7

40

25 2QCY2010 3QCY2010 4QCY2010 1QCY2011 2QCY2011

Source: Company, Angel Research

PAT witnesses strong 33.4% growth, but margin remains flat

For 2QCY2010, PAT increased by 33.4% yoy to `44cr on the back of higher revenue. Adjusted for other income, the company actually managed 31.7% yoy growth in PAT. Despite a dip in OPM, PAT margin dipped only by 22bp yoy to 21.8% (22.0%). PAT margin was aided by higher other income during the quarter, which increased by 46.3% yoy to `5.6cr. During the quarter, the company sold property worth `3.3cr.

Exhibit 4: PAT margin slightly down due to OPM contraction

(` cr) 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 33.3 2QCY2010 75.4 3QCY2010 50.6 4QCY2010 46.0 1QCY2011 NPM (RHS) 44.4 2QCY2011 22.0 28.5 47.4 (%) 50 45 40 35 30 25 20 15 10 5 0

25.7

21.8

Net Profit (LHS)

Source: Company, Angel Research

July 21, 2011

CRISIL | 2QCY2011 Result Update

Outlook and valuation

We expect CRISIL to post a 21% CAGR in revenue over CY201012 and continue to maintain its leadership position. CRISIL benefits from its asset-light business model, which is high on intellectual assets (employee cost-to-sales is around 40%). Further, the company is debt free and has 40% plus RoE. Additionally, CRISIL enjoys strong parentage (Standard and Poor's). Currently, the stock is available at 22.9x CY2012E earnings, which is at the higher end of its historical range of 16.429.9x one-year forward EPS. With the recent run-up in the stock price, we change our recommendation to Neutral.

July 21, 2011

CRISIL | 2QCY2011 Result Update

Profit and loss statement (Consolidated)

Y/E December (` cr) Net Sales % chg Total Expenditure Establishment Expenses Other Expenses Personnel Other EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Adj. Other Income (% of PBT) Share in profit of Associates Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Add: Share of earnings of associate Less: Minority interest (MI) % chg Prior period items PAT after MI (reported) Extraordinary Income post tax ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg CY2008 CY2009 CY2010 CY2011E CY2012E 515 27.3 335 52 93 191 179 52.8 34.8 14 165 63.0 32.1 22 11.6 187 69.1 187 46 24.8 141 68.0 141 141 68.0 27.3 194.6 194.6 68.0 537 4.4 338 55 75 208 199 11.3 37.1 15 184 11.5 34.3 23 11.1 207 10.9 207 47 22.5 161 14.4 161 161 14.4 29.9 222.5 222.5 14.4 631 17.5 413 71 84 258 218 9.2 34.5 21 196 6.5 31.1 68 25.6 264 27.3 264 59 22.2 205 27.8 205 45 160 (0.2) 25.4 289.5 289.5 30.1 766 21.3 499 86 103 310 266 22.4 34.8 27 239 21.8 31.3 20 7.5 259 (2.0) 259 58 22.5 201 (2.4) 201 201 25.0 26.2 282.7 282.7 (2.4) 926 20.9 602 101 127 374 324 21.6 35.0 28 296 23.8 32.0 27 8.4 323 24.9 323 79 24.5 244 21.7 244 244 21.7 26.4 343.9 343.9 21.7

July 21, 2011

CRISIL | 2QCY2011 Result Update

Balance sheet (Consolidated)

Y/E December (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Investments Current Assets Cash Loans & Advances Other Current Assets Debtors Other Current liabilities Net Current Assets DEFERRED TAX ASSETS (Net) Total Assets 190 64 126 4 118 261 129 53 2 77 160 101 8 358 184 64 120 64 118 323 158 62 11 92 200 122 10 434 310 85 225 0 26 343 161 51 22 109 214 129 14 394 320 112 208 20 449 229 56 23 141 220 229 14 471 326 140 186 20 589 332 62 24 170 260 329 14 550 7.2 350 358 358 7.2 427 434 434 7.1 387 394 394 7.1 464 471 471 7.1 542 550 550 CY2008 FY2009 CY2010 CY2011E CY2012E

July 21, 2011

CRISIL | 2QCY2011 Result Update

Cash flow statement (Consolidated)

Y/E December (` cr) Profit before tax Depreciation Change in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations Inc./ (Dec.) in Fixed Assets Inc./ (Dec.) in Investments Inc./ (Dec.) in loans and advances Other income Cash Flow from Investing Issue/(Buy Back) of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances CY2008 FY2009 CY2010 CY2011E CY2012E 187 14 36 22 46 169 0 (21) (12) 22 (11) (59) (12) (71) 87 42 129 207 15 16 23 47 169 (54) 1 (9) 23 (40) (85) (16) (101) 28 129 158 267 21 (14) 70 59 145 (62) 91 11 70 111 (79) (168) (3) (250) 6 158 163 259 27 (27) 20 58 182 (10) 6 (5) 20 11 (124) (124) 68 161 229 323 28 9 27 79 254 (6) (6) 27 15 (166) (166) 103 229 332

July 21, 2011

CRISIL | 2QCY2011 Result Update

Key ratios

Y/E December Valuation Ratio (x) P/E (on FDEPS) P/E (on basic, reported EPS) P/CEPS P/BV Dividend yield (%) Market cap. / Sales EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis (%) EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Asset Turnover (Net Block) Asset Turnover (Total Assets) Operating Income / Invested Capital Inventory / Sales (days) Receivables (days) Payables (days) Working capital cycle (ex-cash) (days) Solvency ratios (x) Gross debt to equity Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Interest) 2.7 4.0 1.6 4.2 59 104 (11) 2.9 4.4 1.4 4.0 58 122 (21) 2.6 3.7 1.5 3.5 58 120 (19) 2.4 3.5 1.8 3.6 59 103 (8) 2.9 4.7 1.8 4.4 61 95 (1) 52.2 141.2 44.3 46.6 183.6 40.6 47.4 130.2 49.6 55.3 111.7 46.4 58.1 141.5 47.8 32.1 75.2 4.2 100.9 100.9 34.3 77.5 4.0 106.4 106.4 31.1 77.8 3.5 83.6 83.6 31.3 77.5 3.6 86.6 86.6 32.0 75.5 4.4 106.8 106.8 194.6 194.6 213.4 70.0 494.8 222.5 222.5 243.1 100.0 600.4 289.5 289.5 319.5 199.6 555.8 282.7 282.7 320.9 150.0 663.6 343.9 343.9 383.1 200.0 774.3 40.5 40.5 37.0 15.9 0.9 10.9 10.6 30.5 15.3 35.5 35.5 32.5 13.1 1.3 10.4 10.1 27.3 12.5 27.3 27.3 24.7 14.2 2.5 8.9 8.6 25.0 13.8 27.9 27.9 24.6 11.9 1.9 7.3 7.0 20.2 11.4 22.9 22.9 20.6 10.2 2.5 6.0 5.7 16.3 9.6 CY2008 FY2009 CY2010 CY2011E CY2012E

July 21, 2011

CRISIL | 2QCY2011 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

CRISIL No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

July 21, 2011

Vous aimerez peut-être aussi

- Crisil: Performance HighlightsDocument9 pagesCrisil: Performance HighlightsAngel BrokingPas encore d'évaluation

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- DB Corp: Performance HighlightsDocument11 pagesDB Corp: Performance HighlightsAngel BrokingPas encore d'évaluation

- Infosys Result UpdatedDocument15 pagesInfosys Result UpdatedAngel BrokingPas encore d'évaluation

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingPas encore d'évaluation

- Infosys Result UpdatedDocument14 pagesInfosys Result UpdatedAngel BrokingPas encore d'évaluation

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingPas encore d'évaluation

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAngel BrokingPas encore d'évaluation

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAtul ShahiPas encore d'évaluation

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- GSK ConsumerDocument10 pagesGSK ConsumerAngel BrokingPas encore d'évaluation

- Dena Bank Result UpdatedDocument10 pagesDena Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of India Result UpdatedDocument12 pagesBank of India Result UpdatedAngel BrokingPas encore d'évaluation

- DB Corp: Performance HighlightsDocument11 pagesDB Corp: Performance HighlightsAngel BrokingPas encore d'évaluation

- Corporation Bank Result UpdatedDocument11 pagesCorporation Bank Result UpdatedAngel BrokingPas encore d'évaluation

- JP Associates Result UpdatedDocument12 pagesJP Associates Result UpdatedAngel BrokingPas encore d'évaluation

- Icici Bank: Performance HighlightsDocument15 pagesIcici Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Persistent, 29th January 2013Document12 pagesPersistent, 29th January 2013Angel BrokingPas encore d'évaluation

- Yes Bank: Performance HighlightsDocument12 pagesYes Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Moil 2qfy2013Document10 pagesMoil 2qfy2013Angel BrokingPas encore d'évaluation

- Persistent Systems Result UpdatedDocument11 pagesPersistent Systems Result UpdatedAngel BrokingPas encore d'évaluation

- DB Corp.: Performance HighlightsDocument11 pagesDB Corp.: Performance HighlightsAngel BrokingPas encore d'évaluation

- ICICI Bank Result UpdatedDocument16 pagesICICI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- HCLTech 3Q FY13Document16 pagesHCLTech 3Q FY13Angel BrokingPas encore d'évaluation

- Bosch 3qcy2012ruDocument12 pagesBosch 3qcy2012ruAngel BrokingPas encore d'évaluation

- Hex AwareDocument14 pagesHex AwareAngel BrokingPas encore d'évaluation

- Tata Consultancy Services Result UpdatedDocument14 pagesTata Consultancy Services Result UpdatedAngel BrokingPas encore d'évaluation

- Glaxosmithkline Pharma: Performance HighlightsDocument11 pagesGlaxosmithkline Pharma: Performance HighlightsAngel BrokingPas encore d'évaluation

- HCL Technologies: Performance HighlightsDocument15 pagesHCL Technologies: Performance HighlightsAngel BrokingPas encore d'évaluation

- Ashoka Buildcon: Performance HighlightsDocument14 pagesAshoka Buildcon: Performance HighlightsAngel BrokingPas encore d'évaluation

- Jagran Prakashan: Performance HighlightsDocument10 pagesJagran Prakashan: Performance HighlightsAngel BrokingPas encore d'évaluation

- Reliance Communication: Performance HighlightsDocument11 pagesReliance Communication: Performance HighlightsAngel BrokingPas encore d'évaluation

- S. Kumars Nationwide: Performance HighlightsDocument19 pagesS. Kumars Nationwide: Performance HighlightsmarathiPas encore d'évaluation

- Jyoti Structures: Performance HighlightsDocument12 pagesJyoti Structures: Performance HighlightsAngel BrokingPas encore d'évaluation

- HDFC Result UpdatedDocument12 pagesHDFC Result UpdatedAngel BrokingPas encore d'évaluation

- Mphasis Result UpdatedDocument12 pagesMphasis Result UpdatedAngel BrokingPas encore d'évaluation

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Hexaware Result UpdatedDocument14 pagesHexaware Result UpdatedAngel BrokingPas encore d'évaluation

- Motherson Sumi Systems Result UpdatedDocument14 pagesMotherson Sumi Systems Result UpdatedAngel BrokingPas encore d'évaluation

- Indraprasth Gas Result UpdatedDocument10 pagesIndraprasth Gas Result UpdatedAngel BrokingPas encore d'évaluation

- Rallis India Result UpdatedDocument10 pagesRallis India Result UpdatedAngel BrokingPas encore d'évaluation

- Subros Result UpdatedDocument10 pagesSubros Result UpdatedAngel BrokingPas encore d'évaluation

- Finolex Cables: Performance HighlightsDocument10 pagesFinolex Cables: Performance HighlightsAngel BrokingPas encore d'évaluation

- Performance Highlights: NeutralDocument10 pagesPerformance Highlights: NeutralAngel BrokingPas encore d'évaluation

- Infosys Result UpdatedDocument14 pagesInfosys Result UpdatedAngel BrokingPas encore d'évaluation

- HCL Technologies 3QFY2011 Result Update | Strong Growth Momentum ContinuesDocument16 pagesHCL Technologies 3QFY2011 Result Update | Strong Growth Momentum Continueskrishnakumarsasc1Pas encore d'évaluation

- DB Corp 4Q FY 2013Document11 pagesDB Corp 4Q FY 2013Angel BrokingPas encore d'évaluation

- IRB Infrastructure: Performance HighlightsDocument13 pagesIRB Infrastructure: Performance HighlightsAndy FlowerPas encore d'évaluation

- Axis Bank Result UpdatedDocument13 pagesAxis Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Bajaj Electricals: Performance HighlightsDocument10 pagesBajaj Electricals: Performance HighlightsAngel BrokingPas encore d'évaluation

- Ll& FS Transportation NetworksDocument14 pagesLl& FS Transportation NetworksAngel BrokingPas encore d'évaluation

- Hexaware Result UpdatedDocument13 pagesHexaware Result UpdatedAngel BrokingPas encore d'évaluation

- Dena BankDocument11 pagesDena BankAngel BrokingPas encore d'évaluation

- Crompton Greaves: Performance HighlightsDocument12 pagesCrompton Greaves: Performance HighlightsAngel BrokingPas encore d'évaluation

- Union Bank of India Result UpdatedDocument11 pagesUnion Bank of India Result UpdatedAngel BrokingPas encore d'évaluation

- Allcargo Global Logistics LTD.: CompanyDocument5 pagesAllcargo Global Logistics LTD.: CompanyjoycoolPas encore d'évaluation

- Aventis Pharma Result UpdatedDocument10 pagesAventis Pharma Result UpdatedAngel BrokingPas encore d'évaluation

- KEC International Result UpdatedDocument11 pagesKEC International Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of BarodaDocument12 pagesBank of BarodaAngel BrokingPas encore d'évaluation

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsD'EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsPas encore d'évaluation

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingPas encore d'évaluation

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingPas encore d'évaluation

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingPas encore d'évaluation

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingPas encore d'évaluation

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingPas encore d'évaluation

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingPas encore d'évaluation

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingPas encore d'évaluation

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingPas encore d'évaluation

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingPas encore d'évaluation

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingPas encore d'évaluation

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingPas encore d'évaluation

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingPas encore d'évaluation

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingPas encore d'évaluation

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingPas encore d'évaluation

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingPas encore d'évaluation

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingPas encore d'évaluation

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingPas encore d'évaluation

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingPas encore d'évaluation

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingPas encore d'évaluation

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingPas encore d'évaluation

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingPas encore d'évaluation

- Final Accounts Without AdjustmentsDocument22 pagesFinal Accounts Without AdjustmentsFaizan MisbahuddinPas encore d'évaluation

- FM Chapter 9Document8 pagesFM Chapter 9Bebean AninangPas encore d'évaluation

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsKuladeep Naidu PatibandlaPas encore d'évaluation

- Angelo Chua 庄向志 PETA 1 Financial StatementsDocument4 pagesAngelo Chua 庄向志 PETA 1 Financial Statements채문길Pas encore d'évaluation

- 014 - Acceptance For Value A4vDocument2 pages014 - Acceptance For Value A4vDavid E Robinson95% (43)

- FFM 9 Im 13Document15 pagesFFM 9 Im 13Ernest NyangiPas encore d'évaluation

- Capital Structure - Bharati CementDocument14 pagesCapital Structure - Bharati CementMohmmedKhayyumPas encore d'évaluation

- Commercial Paper: (Industrial Paper, Finance Paper, Corporate Paper)Document27 pagesCommercial Paper: (Industrial Paper, Finance Paper, Corporate Paper)shivakumar N100% (1)

- PFRS 9Document1 pagePFRS 9Ella MaePas encore d'évaluation

- Pakistan Stock Exchange Limited: Internet Trading Subscribers ListDocument3 pagesPakistan Stock Exchange Limited: Internet Trading Subscribers ListMuhammad AhmedPas encore d'évaluation

- Revenue Code 2023Document113 pagesRevenue Code 2023Mark Andrei GubacPas encore d'évaluation

- Money ManagementDocument12 pagesMoney ManagementRachelle Gunderson SmithPas encore d'évaluation

- TVM and No-Arbitrage Principle: Practice Questions and ProblemsDocument2 pagesTVM and No-Arbitrage Principle: Practice Questions and ProblemsMavisPas encore d'évaluation

- 57b2e7d35a4d40b8b460abe4914d711a.docxDocument6 pages57b2e7d35a4d40b8b460abe4914d711a.docxZohaib HajizubairPas encore d'évaluation

- Statement - 271185814 - Juan Camilo Cardenas AguirreDocument12 pagesStatement - 271185814 - Juan Camilo Cardenas AguirrePedro Ant. Núñez UlloaPas encore d'évaluation

- Problem 1 1245Document3 pagesProblem 1 1245Rhanda BernardoPas encore d'évaluation

- LOAN REQUIREMENTS OF BANKS AND NONBANKSDocument84 pagesLOAN REQUIREMENTS OF BANKS AND NONBANKSPhill SamontePas encore d'évaluation

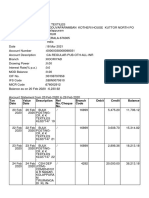

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument4 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceJaseem MonuPas encore d'évaluation

- Background of The StudyDocument2 pagesBackground of The StudyAdonis GaoiranPas encore d'évaluation

- Project Proposal On The EstablishmentDocument35 pagesProject Proposal On The Establishmentwendemu100% (1)

- Tax Free ExchangeDocument4 pagesTax Free ExchangeLara YuloPas encore d'évaluation

- JPM Annual ReportDocument50 pagesJPM Annual ReportSummaiya BarkatPas encore d'évaluation

- CF (MBF131) Exam QDocument13 pagesCF (MBF131) Exam QSai Set NaingPas encore d'évaluation

- S. Strange InternationalDocument28 pagesS. Strange InternationalMircea Muresan100% (1)

- Terms and Conditions of The Loan AgreementsDocument2 pagesTerms and Conditions of The Loan AgreementsCLATOUS CHAMAPas encore d'évaluation

- Investment BankingDocument4 pagesInvestment BankingNirajGBhaduwalaPas encore d'évaluation

- Working Capital ManagementDocument39 pagesWorking Capital ManagementRebelliousRascalPas encore d'évaluation

- Sample Problems Solutions Sections 2.3 & 2.4.: R P P M A R MDocument5 pagesSample Problems Solutions Sections 2.3 & 2.4.: R P P M A R MTerry Clarice DecatoriaPas encore d'évaluation

- JPMorgan Chase Bank statement summaryDocument6 pagesJPMorgan Chase Bank statement summaryytprem agu100% (2)

- Agricultural Business ManagementDocument5 pagesAgricultural Business ManagementAreicra NutPas encore d'évaluation