Académique Documents

Professionnel Documents

Culture Documents

India Infrastructure Jun10

Transféré par

Buddy BashDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

India Infrastructure Jun10

Transféré par

Buddy BashDroits d'auteur :

Formats disponibles

THINK TANK SERIES

In collaboration with Feedback Ventures

June 2010

India Transport Infrastructure Bigger opportunities, tougher qualifications

We are witnessing an increase in the average project size, tightening of prequalification norms and unfavorable geographical concentration of highway projects. Although the aggregate opportunity size remains about INR1.9t, cherry-picking the right project is gaining importance. IRB Infrastructure has won only 3% market share year to date, implying cautious bidding. IL&FS Transportation Networks has captured the highest share, at 9%. Our analysis of recent bids reveals that some smaller players were very aggressive bidders. Competition remains fragmented, implying a positive effect from the changes recommended by the B K Chaturvedi Committee. We expect this trend to reverse in the case of mega projects (tighter restrictions). The Dedicated Freight Corridor (DFC) is the next biggest opportunity in the railways segment (INR650b). The progress has been slow with only two partial stretches having been awarded so far. Partial financing has been tied up with multilateral agencies and a Japanese agency. Land acquisition remains the biggest challenge. L&T should be a major beneficiary in our sector coverage. Finally, metro projects are showing some progress. Hyderabad Metro (INR121b) will be re-bid in July 2010. Two other projects Jaipur (INR75b) and Pune (INR79b) are on the anvil. L&T and Reliance Infrastructure could be major beneficiaries of these opportunities.

This product has been prepared in collaboration with Feedback Ventures. Refer page 20 for details. BNP Paribas research is available on Thomson Reuters, Bloomberg, and on http://equities.bnpparibas.com. Please contact your salesperson for authorisation. Please see the important notice on the inside back cover.

Vishal Sharma, CFA

BNP Paribas Securities India Pvt Ltd (91 22) 6628 2441 vishal.sharma@asia.bnpparibas.com

Shashank Abhisheik

BNP Paribas Securities India Pvt Ltd (91 22) 6628 2446 shashank.abhisheik@asia.bnpparibas.com

PREPARED BY BNP PARIBAS SECURITIES ASIA

THIS MATERIAL HAS BEEN APPROVED FOR U.S DISTRIBUTION. IMPORTANT DISCLOSURES CAN BE FOUND IN THE DISCLOSURES APPENDIX.

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Contents 1) Changes in national highway business opportunity................................................................................................................ 3 Change in average project size of the balance NH pipeline ................................................................................................ 3 Change in pre-qualification norms....................................................................................................................................... 3 Change in geographical concentration ................................................................................................................................ 3 2) Project pipeline: Is it getting riskier? ........................................................................................................................................ 4 What are the naxal-affected areas? .................................................................................................................................... 4 Why is this issue a big deal? ............................................................................................................................................... 4 Who is affected? What to watch out for?............................................................................................................................. 4 How to tackle the issue? What are the steps taken by the government? ............................................................................ 4 3) Analysis of recent bids ............................................................................................................................................................... 5 Annuities versus Tolls ......................................................................................................................................................... 5 Fragmented competition...................................................................................................................................................... 5 Are the bids aggressive?..................................................................................................................................................... 6 4) Dedicated Freight Corridor......................................................................................................................................................... 8 Project administration.......................................................................................................................................................... 8 Dedicated freight lines......................................................................................................................................................... 8 Logistic parks ...................................................................................................................................................................... 8 Funding ............................................................................................................................................................................... 9 Technologically advanced ................................................................................................................................................... 9 Projects awarded ................................................................................................................................................................ 9 Major challenges ................................................................................................................................................................. 9 5) Metro projects............................................................................................................................................................................ 11 Hyderabad metro .............................................................................................................................................................. 11 Jaipur metro ...................................................................................................................................................................... 12 Pune metro........................................................................................................................................................................ 12 6) About Feedback Ventures ........................................................................................................................................................ 14

Looking for an alternative way to invest in the views and themes covered in this report? Explore BNP Paribass

Cover page pictures courtesy: Mumbai Metro I - Reliance Infrastructures Mumbai Monorail Larsen and Toubro Naini-Allahabad Bridge HCC with Hyundai E&C

Asia Pacific Sector Swap

Covering eight key markets and 13 sectors, Sector Swap gives investors all the tools to profit from macro events, including long and/or short Sector Swaps as well as options strategies.

Available on Bloomberg at BNSW [GO]

Winner Lee, Asia Equities Derivatives Strategist; +852 2108 5658; winner.lee@asia.bnpparibas.com

Please see India Research Team list on page 15.

2 BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Changes in national highway business opportunity

The national highway (NH) opportunity for developers is changing rapidly. The changes can be categorised along the following:

Change in average project size of the balance NH pipeline

An analysis of NHAI projects with bid dates in the months of May and June 2010 indicates that the average project size is increasing. The average project length is 150kms (compared with the 100kms for last year) and average project cost is above INR9b. In the current pipeline, there are at least five projects with project sizes of above INR20b. Very few Indian players are likely to qualify for projects of this size, allowing larger players a higher chance of winning such projects.

Change in pre-qualification norms

Recent changes in the pre-bid qualification criteria of the NHAIs concessions have altered the scenario for Indian players considerably. In line with expectations of more stringent technical and financial requirements, the method of calculating the technical and financial scores of consortiums has been changed. The new method requires taking a weighted average of scores (technical and financial) in proportion to the equity share for each member in a consortium. This means that the size of the players and their credentials need to be substantially bigger to fit the bill. The magnitude of the change can be understood from the fact that, for a INR50b project, in the past two players with a combined technical score of 5,000 would have sufficed; now in the most favourable scenario, the combined technical score would have to be 5,000, multiplied by the number of members in the consortium. This means that the requirement for financial and technical scores for a consortium has gone up by a factor equal to (or greater than) the number of members in it. We estimate only 10-15 Indian players have more than 2,500 technical points on their own to qualify for projects of INR25b. This means that rest of the players would need to form consortiums with larger players to bid for large projects and competition in these projects would be limited.

Change in geographical concentration

The remaining opportunities in the highways development program are getting concentrated with filtered projects. Some of these opportunities did not attract bids in the initial rounds, due to the non-viability of the projects or they were located in the disturbed areas, where it becomes difficult to execute projects. We discuss this in detail in the next section of this report.

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Project pipeline: Is it getting riskier?

Incidents such as the Dantewada (Chattisgarh) Maoist attacks raise questions about the implementation of the infrastructure development program in India. We analyze this with respect to transport infrastructure specifically. Naxal activities (terrorist activities) affect development in two ways: 1) they create challenges in acquiring land (one of the biggest impediments in infrastructure development); and 2) make the work environment dangerous for workers, repelling private contractors from these regions.

What are the naxal-affected areas?

Naxal-affected areas in India are notified by the Central Government under the Terrorist Affected Areas (Special Courts) Act 1984. Accordingly, the Central Government has identified 131 districts that are at least marginally naxal-affected, of which 51 are severely affected and 18 moderately affected. The government notifies an area as naxal affected based on the gravity of the (terrorist) offence. The states that are particularly affected are Andhra Pradesh, Chattisgarh, Jharkhand, Jammu & Kashmir, North-eastern states, parts of West Bengal, Orissa, Bihar, Karnataka, Madhya Pradesh, Maharashtra and Tamil Nadu.

Why is this issue a big deal?

As long as there were projects available in attractive, higher-growth regions of India, projects in naxal-affected areas did not get sufficient bidder interest. Consequently, a significant portion of the projects that are going to be awarded now, especially in highways sector, are in these areas. For instance, 2,800kms (23% or INR280b) of NHAIs Work Plan I and 6,000kms (50% or INR600b) of Work Plan II are in the naxalaffected areas. Separately, two of the UMPPs that have yet to be bid out are in the states of Orissa and Chattisgarh (one each). Additionally, in the railway sector, parts of the Dedicated Freight Corridors (Eastern) pass through these areas, which will likely to create impediments in land acquisition.

Who is affected? What to watch out for?

Private developers that take up projects in these areas face issues in executing them. On the positive side, profitability in these projects is typically higher than average. Investors should judge historical success of execution of such projects before choosing to invest in a specific developer. Hindustan Construction (HCC IN, CP: INR117, REDUCE) is one of the developers that has expertise in executing projects in these areas.

How to tackle the issue? What are the steps taken by the government?

In almost all infrastructure projects, the onus of land acquisition is on the government. Private developers typically start work after the possession of land has been given. However, in certain cases, we believe effective execution of the project is ensured if the private developer works with the government in educating the benefits of development and inclusive growth. For instance, in highways, the NHAI has the option to award the projects on BOT-Toll or BOT-Annuity or EPC basis. In naxal-affected areas, the choice is typically annuity (eliminates traffic risk) or EPC (eliminates ownership risk) contracts. Therefore, by reducing or eliminating certain risks from the projects, NHAI can still award these projects and ensure development in the naxal-affected areas.

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Analysis of recent bids

Annuities versus Tolls

We analyze 3,611kms of highway project awards worth INR417b (43 projects) since November 2009. The average cost per kilometer for these projects is INR99m and the average cost per lane kilometer is INR23m. Annuities comprised 28% of the highway universe by length and 34% by value, implying that the average cost of annuity projects was higher than the toll awards. Exhibit 1: Share By Length During Nov 2009-Jun 2010 Exhibit 2: Share By Value, During Nov 2009-Jun 2010

Annuity 28%

Annuity 34%

Toll 72%

Toll 66%

Sources: NHAI; BNP Paribas

Sources: NHAI; BNP Paribas

Fragmented competition

Competition in the market remains fragmented. The highest market share was garnered by IL&FS Transportation Network (ILFT IN, CP: INR289; Not rated) with a 9% share of the total awards in the universe. Nagarjuna Construction (NJCC IN, CP: INR188, BUY), Reliance Infrastructure (RELI IN, CP: INR1,188, BUY), Hindustan Construction, Soma (in consortium; not listed), Transtroy (in consortium; not listed), Navyuga (in consortium; not listed), and IVRCL (IVRC IN, CP: INR185, BUY) were other major gainers (5% or more market share). IRB Infrastructure (IRB IN, CP: INR276, BUY) bagged one project that translates into 3% market share. Exhibit 3: Fragmented Competition

IL&FS 10%

Others (15) 27%

NCC 8% RELI 8%

IRB 3% Shapoorji 4% SEL 4% IVRCL 5%

HCC 7% SomaIsolux 7% Transstroy 6%

OrientalLeighton 5%

Navyuga 6%

Sources: NHAI; BNP Paribas

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Are the bids aggressive?

We have classified the bids into three categories: 1 Annuity-based projects: In these projects, the concessionaire receives a fixed amount (the bid amount) from the NHAI every six months (semi-annual payout) for the duration of the concession. There is no traffic risk in these projects for the concessionaire. We have compared the difference of the net present value of the winning bid and the next best bid as a proportion to the total project cost (TPC) to decide if the project was aggressively bid for.

Exhibit 4: Annuity-Based Bid

NPV of bid (INR m) 37,820 51,467 1,029 1,450 7,598 9,280 3,088 4,988 2,972 5,379 9,483 12,745 29,274 34,073 46,035 52,198 19,661 21,735 1,670 2,017 10,512 10,715 19,545 20,009 Variation in NPV of L1 and L2 (INR m) 13,646 420 1,682 1,899 2,407 3,262 4,799 6,162 2,073 347 203 464 Variation in NPV as % of TPC (%) 68.68 57.21 53.91 50.79 48.04 47.21 26.46 24.46 21.35 16.60 9.35 4.21

TPC Quazigund-Banihal Forbesganj - Jogbani Muzaffarpur - Sonbarsa Trichy-Karaikudi including Trichy bypass Dindigul-Theni- and Theni-Kumli Sect Chhapra - Hazipur Jammu to Udhampur Chennai Nashri Udhampur Ramban Bhopal-Sanchi Jorbat-Shillong (SARDP) Srinagar Banihal

Sources: NHAI; BNP Paribas

Bidder Navyuga KPCL Coastal SREI GPT Infraprojects/RDS Projects (annuity) JKM Infra Projects Pvt Ltd. BSC-C&C Madhucon Transstroy (I) Pvt Ltd GVR Infra Transstroy - OJSC consor GVR Galfar Madhucon BSC & C&C Shapoorji Gammon ILFS Gammon SREI Gulfar BSC & C&C Pratibha JMC IL&FS Oriental Ramky BSC & C&C

L1 L2 L1 735 L2 L1 3,120 L2 L1 3,740 L2 L1 5,010 L2 L1 6,910 L2 L1 18,140 L2 L1 25,190 L2 L1 9,710 L2 L1 2,090 L2 L1 2,170 L2 L1 11,010 L2 19,870

Bid (INR m) 2,450 3,334 71 100 524 640 213 344 205 371 654 879 2,019 2,350 3,175 3,600 1,356 1,499 130 157 725 739 1,348 1,380

Toll-based projects bid on a grant to be received from NHAI: In these projects, the concessionaire would receive a grant from the NHAI during the construction period. This grant is to augment toll revenues, which were insufficient to provide an adequate return on the construction and other O&M costs. Here, the aggressive bid is the one where the difference between the winning bid and the next best bid as a proportion of the total project cost is higher than the average.

Exhibit 5: Toll-Based Bids (Grant)

NPV of bid (INR m) 1,120 3,490 550 1,080 5,640 7,140 2,736 2,799 3,409 3,476 1,240 1,330 612 620 1,392 Variation in NPV of L1 and L2 (INR m) 2370 530 1,500 63 67 90 8 Variation in NPV as % of TPC (%) 19.19 9.30 5.27 0.84 0.71 0.44 0.12

TPC Kar/Ker Border to Kannur Tirupathi-Tirutani-Chennai Varanasi - Aurangabad Bijapur-Hungund section of NH 13 Hungund-Hospet section of NH13 Dankuni-Baleshwar Hyderabad - Bangalore of NH 7 Barhi-Hazaribagh

Sources: NHAI; BNP Paribas

Bidder Transstroy - OJSC Patel KNR Transstroy IRB Soma-Isolux Gammon-Macquarie SEL GMR-Oriental GMR-Oreintal (51:49) SEL NCC Soma Navayuga SEL Abhijeet

L1 L2 L1 5,700 L2 L1 28,480 L2 L1 7,480 L2 L1 9,460 L2 L1 20,340 L2 L1 6,800 L2 L1 3,980 L2 12,350

Bid (INR m) 1120 3490 550 1080 5640 7140 2736 2799 3409 3476 1240 1330 612 620 1392

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Toll-based projects bid on a premium: In these projects, the toll revenues are adequate to compensate for the costs incurred on the project. Hence, the concessionaire agrees to share a fixed amount of money with NHAI in the first year of operations, which increases by 5% per annum throughout the concession period. In this case, the difference between the net present values of the winning bid and the second best bid as a proportion to the total project cost would indicate whether a bid has been aggressive.

Exhibit 6: Toll Based Bids (Premium)

NPV of bid (INR m) (2,333) (494) (4,619) (2,566) (14,023) (12,694) (6,475) (5,826) Variation in NPV of L1 and L2 (INR m) 1,839 2,053 1,328 648 Variation in NPV as % of TPC (%) 56.58 34.60 11.07 6.97

TPC L1 L2 L1 5,934 L2 L1 12,000 L2 L1 9,300 L2 3,250

Bidder DLF-Gayatri Ashoka Buildcon GVK IRB IRB BSCPL RELI Ashoka Buildcon

Bid (INR m) (241) (51) (486) (270) (1404) (1271) (669) (602)

Indore-Dewas Deoli - Kota Tumkur-Chitradurga Hosur Krishnagiri

Sources: NHAI; BNP Paribas

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Dedicated Freight Corridor

Project administration

A special purpose vehicle (SPV), Dedicated Freight Corridor Corp of India Ltd (DFCCIL), was set up in October 2006 to implement the Dedicated Freight Corridor project. While the design, construction and development will be done by DFCCIL, the operations will be handled by Indian Railways. The implementation will be in a combination of EPC and PPP models. Consultants have been appointed to finalize the framework for implementation.

Dedicated freight lines

The project envisages construction of 2,800kms of rail corridor spanning seven states. The maximum length will be in Uttar Pradesh (UP) (37%). Total land required is 12,500 hectares. The DFC is divided into two Eastern Corridor and Western Corridor. The Eastern Corridor will connect Ludhiana (Punjab) and Son Nagar (Bihar) (1,279kms) and the Western Corridor will connect Dadri (UP) to Jawaharlal Nehru Port Trust, Mumbai (Maharashtra) (1,483kms). Beneficiaries are civil contractors, Larsen & Toubro (LT IN, CP: INR1,836, BUY) for civil, mechanical and electrical works), Kalindee Rail Nirman (KRNE IN; CP: INR133; Not rated), Texmaco (TXM IN, CP: INR133; Not rated), Stone India (STON IN; CP: INR54; Not rated), BEML (BEML IN, CP: INR1,036; Not rated), Titagarh Wagons (TWM IN, CP: INR379; Not rated), Kernex Microsystems (KMSI IN, CP: INR95; Not rated) and MIC Electronics (MICE IN, CP: INR41; Not rated).

Logistic parks

The DFC envisages setting up a complete supply chain that includes logistic parks located along railways. Multimodal Logistic Parks (MMLPs) are envisaged at selected locations along the DFCs. The locations for the logistic parks are Navi Mumbai, Vapi, Ahmedabad, Gandhidham, Jaipur, and Rewari on the Western Corridor and Ludhiana and Kanpur on the Eastern Corridor. This initiative will be through the Public Private Partnership (PPP) route. The total opportunity is worth INR200b. Beneficiaries are logistics companies such as Sical Logistics (SICL IN, CP: INR74; Not rated), World Windows Infrastructure (not listed), Container Corp of India (CCRI IN, CP: INR1,297; Not rated), DHL Logistics (not listed), Mahindra Logistics (not listed), Transport Corporation of India (TRPC IN, CP: INR117; Not rated), GATI (GTIC IN, CP: INR62; Not rated) and Adani Logistics (not listed). Exhibit 7: Implementation Phases Of The DFC

Corridor Stretch Distance Expected completion Western Phase I Phase II Phase III Eastern Phase IA Phase IB Phase II Sonenagar-Mughalsarai Mughalsarai-Khurja Khurja-Ludhiana na 710 kms 413 kms 2009-16 2010-16 2011-17 World Bank INR125b (USD2.5b) 5.50% Rewari-Vadodara Vadodara-JNPT Rewari-Dadri 920 kms 430 kms 140 kms 2009-16 2010-17 2010-17 JICA INR180b 0.20% Institution Financing amount Cost

Note: JICA: Japan International Cooperation Agency; ADB: Asian Development Bank; na: Not available Sources: DFCCIL; BNP Paribas

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Funding

DFCCILs most recent estimate of DFC is INR650b. This expenditure is likely to be funded in 2:1 debt-to-equity ratio. The sources of funds are the Ministry of Railways (MoR) internal generation, budgetary support, multilateral/bilateral agencies, PPP and debt. The World Bank has in principle approved USD2.5b for construction of the Mughalsarai-Khurja stretch on the Western Corridor. The Asian Development Bank (ADB) has proposed to provide technical assistance of USD1.5b for feasibility study of the 430km of Ludhiana-Khurja stretch on the Western Corridor. Both loans are at an annual interest of 5.5%. JICA has committed to INR180b at 0.2% for funding 920kms stretch between Rewari and Vadodara on the condition that at least 30% of the total equipment is sourced from Japan.

Technologically advanced

The DFC will employ technology that is more advanced than that used now. The corridor will be made of double lines with an upgraded design and dimensions of containers. The project aims to run double stack containers to carry goods such as passenger cars. The speed of the carriages will be enhanced to an average of 100kmph from the existing 50kmph. Increase in axle load from 23-25 tonnes to 32.5 tonnes and train load from 4,000 tonnes to 15,000 tonnes. Train dimensions will increase (length to double to 1,500 meters, height increase from 4.26 meters to 7.1 meters, width from 3.2 meters to 3.66 meters).

Projects awarded

Two major projects have been awarded on the Eastern Corridor: Soma Enterprises has been awarded an INR6.05b contract in February 2009. A consortium of B. Seenaiah and Co (not listed) and C&C Constructions (CCON IN; CP: INR243; Not rated) has been awarded a contract for INR7.81b.

Major challenges

Land acquisition is a major impediment. Examples, such as Kolkata Metro extension, Ajmer-Pushkar rail line and Munger Rail Bridge, are indicative of the challenges involved as these projects were delayed due to incomplete land acquisition. Additionally, land acquisition is much more difficult in crowded urban areas due to encroachments. The Indian Railways has special powers to acquire land for major infrastructure projects; a notification u/s 20E has been issued for acquisition of 6,000 hectares of land. Indian firms ability and capacity to execute large packages of specialized works in mechanized track-laying, electrification, and signalling work is limited.

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Exhibit 8: Current Status Of DFC

Corridor Western Phase I Rewari-Vadodara 920kms 2009-16 JICA funding available; land acquisition by mid-2011; civil contractor selection by end-2011; testing & commission by 2016 Loan agreement signed in March 2010 for 25% of commitment, tenders to be finalized by mid-2010 30% of the project cost to be spent on Japanese equipment. Phase II Phase III Eastern Phase IA Phase IB Sonenagar-Mughalsarai Mughalsarai-Khurja na 710kms 2009-16 2010-16 World Bank funding available, land acquisition to be completed by end-2010, Testing & Commission in 2016 Loan agreement to be signed in September 2010 Parsons Brinckerhoff India, Halcrow Group (UK), Wilbur Smith and Lee Associates appointed as consultants for system design, bid document, and construction supervision for KhurjaKanpur ADB funding proposed, land acquisition to be completed by end-2010, Testing & Commission in 2017 ADB appointed consultant submitted feasibility report in November 2009

Sources: DFFCIL; BNP Paribas

Stretch

Distance

Expected Completion

Current status

Vadodara-JNPT Rewari-Dadri

430kms 140kms

2010-17 2010-17

Land acquisition by mid-2011; civil contractor by end-2012; testing & commissioning by 2017 Land acquisition by mid-2011; civil contractor by end-2012; testing & commissioning by 2017

Phase II

Khurja-Ludhiana

413 kms

2011-17

10

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Metro projects

The previous editions of this newsletter have discussed contract awards in Kolkata, Bengaluru and Chennai metros which are being implemented on an EPC basis. This newsletter edition discusses two metro projects coming up on a PPP basis in Pune and Jaipur. We also provide an update on the Hyderabad metro, where financial bids are due in July 2010. Since the metro rail projects are not financially viable on their own, they need either viability gap funds (the Government typically allows a maximum grant of 40% of the project cost 20% from the Centre and 20% from the state) or bundling with real estate to enhance viability. Hyderabad and Jaipur are being planned as bundled metro rail and real-estate projects. Pune is likely to be awarded as a pure metro rail project, supported by grants from the Government and municipality.

Hyderabad metro

This project was earlier awarded to a consortium of Maytas Infra (MAY IN, CP: INR205; Not rated), Navabharat Ventures (NBVL IN; CP: INR428; Not rated), Ital Thai of Thailand (ITD TB, CP: THB3; Not rated) and IL&FS (not listed) in July 2008. However, since the consortium failed to achieve financial closure in the stipulated period, the contract was scrapped in July 2009, and is now being re-bid. Project length and features: Metro rail line of 71.16kms (fully elevated) and real estate development rights over 269 acres of land. Project cost: INR121.32b (metro rail component only). Short-listed bidders: The following bidders have submitted applications for prequalification for the project in response to the Global RFQ floated by Hyderabad Metro Rail. All eight bidders have pre-qualified for the RFP Phase of the project. Exhibit 9: Hyderabad Metro Short-listed Bidders

Larsen & Toubro Ltd Lanco Infratech-OHL Concesiones SL consortium Reliance Infrastructure-Reliance Infocomm consortium Essar-Leighton-Gayatri-VNR consortium GVK-Samsung C&T Corporation consortium GMR Infrastructure Ltd Transstroy-OJSC Transstroy-CR 18G-BEML consortium Soma-Strabag AG (Austria) consortium.

Source: Feedback Ventures

Timelines (for bidding, construction and concession period): The bid for the project is due on 14 July 2010. The concession period is for 35 years, which includes five years for construction of the metro. The concession period is extendable by another 25 years. Alignment: Hyderabad Metro Rail Project consists of three corridors joining important locations in the Hyderabad Metropolitan Region: Corridor-I : Miyapur to L B Nagar: 29.87kms; Corridor-II : Jubilee Bus Station to Falaknuma: 14.78kms; Corridor-III : Nagole to Shilparamam: 26.51kms. Key risks: Political uncertainty regarding the fate of Hyderabad in the wake of the Telangana issue has increased the political risk associated with the project.

11

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

The high real estate component of the project, especially when Hyderabad real estate is in over-supply mode: The project envisages development of 269 acres of land to make it financially viable for investments. What the project would mean for the winning entity/consortium: Hyderabad Metro would be a prestigious project for the winning consortium. While the viability of the project largely rests on real estate development, the project would prove lucrative for developers who are able to tap the potential of the real estate component.

Jaipur metro

Jaipur Metro Rail project was planned as a Government-funded project until recently, when it was decided to use the PPP model. The project has been in the limelight recently due to the political will shown by Chief Minister Ashok Gehlot to ensure that the project is expedited. A Comprehensive Mobility Plan (CMP) survey outcome indicates that the population of the Jaipur region would be 6.7m by the year 2031, with the peak hour vehicular trip increasing 2.8 times from the current level. Project length and features: 28.5kms in Phase I (6.5kms underground, while 22kms is elevated). Project cost: INR75.03b (metro rail component only). Likely bidders: The project has generated high interest among many developers, many being first-time entrants in the metro rail arena. Timelines: All surveys and DPR completed for project to be undertaken on EPC basis. Government decided to implement the project on PPP basis in April 2010; the Planning Commission has indicated a viability gap funding of 20% from the Centre if executed through the PPP route. Government is in the process of appointing a consultant for preparing the bid documents and managing the award transaction. The bid process is likely to commence in about six months. Key risks: With the recent shift to the PPP model of operation for the metro, the project may get delayed by at least a year as fresh proposals are to be submitted for the Central Government nod. Lack of agreement over the applicability of PPP model of operation for the Jaipur metro. Planning Commission had raised concerns about the expected traffic for the metro; only 19% of Jaipurs population depends on public transport for commuting, so shifting them to the metro would take a long time and there would be a smaller traffic load for the proposed rail service. What the project would mean for the winning entity/consortium: The project is likely to have very high dependence on real estate revenues higher than other metro rail projects due to lower fare box revenues. Hence, the project viability remains a question mark until more details about project structuring are announced.

Pune metro

The Pune Metro project, conceptualized in 2006, has seen significant delays and local protests. With the current resolve of the Municipal Body to expedite the implementation process, the project is now likely to move faster. Pune Metro is currently being planned as a PPP project the proposed funding mix as given below.

12

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

Exhibit 10: Pune Metro SPV Planned Holding Structure

Pune Municipal Corp 10% State Govt 20%

Private Parties 50%

Central Govt 20%

Source: Ministry of Urban Development

Project length and features: 42.5kms in Phase I; total envisaged length is 75.5kms (only 5kms underground, with the balance being elevated). Project cost: INR78.97b for the first component of 31.5kms (metro rail component only). Likely bidders: Likely to witness very high interest levels, as this is likely to be a pure metro rail project (no bundling with real estate) supported by viability grant funds from the Government. Pune is also considered very attractive due to its rapid growth and the Pune-Mumbai development corridor. Timelines: The timelines are yet uncertain for the Pune Metro due to the various unresolved issues related to the project. The DPR is ready (and approved by the Maharashtra Government) for the corridor falling with the limits of the Pune Municipal Corporation (PMC). Pimpri-Chinchwad Municipal Corporation (PCMC) PCMC asked DMRC to prepare a DPR for the metro route falling within PCMC limits in March 2010. (Pimpri and Chinchwad are suburbs of Pune city, with much of the industrial activity concentrated here). Key issues and reasons for delay: Lack of agreement on cost sharing between PMC and PCMC. Public dissent regarding past proposals to award high FSI in regions surrounding the metro rail alignment. Public dissent on choice of technology: Proposed standard gauge to be imported at high cost as against broad gauge, which is already available in India. Lower capacity of standard gauge trains means longer trains and, hence, longer platforms, stations and yards, resulting in higher cost. Assessed traffic not sufficient for Metro in the short term. Linear metro design for a city radial in shape. High number of intersections of tracks at various levels. What the project would mean for the winning entity/consortium: While we await the project contours to take final shape, Pune is a fast growing city and development of metro rail in the city would be an attractive project for the winning consortium.

13

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

About Feedback Ventures

Feedback Ventures is Indias leading integrated infrastructure services company, with a mission of Making Infrastructure Happen. Totally focused on infrastructure development, Feedback Ventures offers an integrated suite of services across the core and social sectors of infrastructure. Feedback is known for its innovative work and for operationalizing challenging projects in difficult locations. Some 17 of Indias 50 biggest listed companies are Feedbacks clients. So are the governments 22 of the 28 Indian states and 4 of Indias 7 Union Territories. Feedback Ventures is presently working on more than 35,000 MW of new power generation capacity; 20,000 km of National and State Highways; 100,000 acres of real estate development and a building area of more than 22 million square feet. Feedback is enabled by a large pool of multidisciplinary experts; cutting-edge functional and domain knowledge; an all-India network of offices; and a strong shareholding L&T, IDFC, and HDFC. Feedback Venture Product Offerings Feedback offers:

An INTEGRATED SUITE OF SERVICES covering all the steps From Concept to Commissioning

FEEDBACK WORKS ACROSS ALL CORE AND SOCIAL SECTORS OF INFRASTRUCTURE

Transportation & Logistics Highways Railways MRTS Ports Airports Logistics

Energy Power Generation Power Transmission Power Distribution Power Trading Power Regulation Coal Oil and Gas

Realty & Townships Water & Sanitation SEZs Hospitals Urban Planning & Development IT Parks, Offices, Buildings Hotels, Clubs, Convention Centres

Feedback today has Indias largest independent group of multi-disciplinary infrastructure professionals. The team comprising planners, architects, engineers, social and environmental scientists, and MBAs is considered the best in the industry. Having the right mix of experience and expertise with a commitment to stay ahead of the competition has made Feedback the most admired infrastructure services company.

14

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

India Research Team

MANISHI RAYCHAUDHURI

Head of India Research BNP Paribas Securities India Pvt Ltd +91 22 6628 2403 manishi.raychaudhuri@asia.bnpparibas.com

GAUTAM MEHTA

Associate BNP Paribas Securities India Pvt Ltd +91 22 6628 2413 gautam.mehta@asia.bnpparibas.com

KARAN GUPTA

Metals & Mining BNP Paribas Securities India Pvt Ltd +91 22 6628 2427 karan.gupta@asia.bnpparibas.com

VISHAL SHARMA, CFA

Infrastructure - E&C BNP Paribas Securities India Pvt Ltd +91 22 6628 2441 vishal.sharma@asia.bnpparibas.com

SHASHANK ABHISHEIK

Infrastructure - E&C (Associate) BNP Paribas Securities India Pvt Ltd +91 22 6628 2446 shashank.abhisheik@asia.bnpparibas.com

AVNEESH SUKHIJA

Real Estate (Associate) BNP Paribas Securities India Pvt Ltd +91 22 6628 2432 avneesh.sukhija@asia.bnpparibas.com

LAKSHMINARAYANA GANTI

Capital Goods/Cement BNP Paribas Securities India Pvt Ltd +91 22 6628 2438 lakshminarayana.ganti@asia.bnpparibas.com

CHARANJIT SINGH

Capital Goods/Cement (Associate) BNP Paribas Securities India Pvt Ltd +91 22 6628 2448 charanjit.singh@asia.bnpparibas.com

GIRISH NAIR

Utilities BNP Paribas Securities India Pvt Ltd +91 22 6628 2449 girish.nair@asia.bnpparibas.com

AMIT SHAH

Oil & Gas BNP Paribas Securities India Pvt Ltd +91 22 6628 2428 amit.shah@asia.bnpparibas.com

SRIRAM RAMESH

Oil & Gas (Associate) BNP Paribas Securities India Pvt Ltd +91 22 6628 2429 sriram.ramesh@asia.bnpparibas.com

ABHIRAM ELESWARAPU

Tech - IT BNP Paribas Securities India Pvt Ltd +91 22 6628 2406 abhiram.eleswarapu@asia.bnpparibas.com

AVINASH SINGH

Tech - IT (Associate) BNP Paribas Securities India Pvt Ltd +91 22 6628 2407 avinash.singh@asia.bnpparibas.com

SAMEER NARINGREKAR

Tech - Telecom BNP Paribas Securities India Pvt Ltd +91 22 6628 2454 sameer.naringrekar@asia.bnpparibas.com

KUNAL VORA, CFA

Tech - Telecom (Associate) BNP Paribas Securities India Pvt Ltd +91 22 6628 2453 kunal.d.vora@asia.bnpparibas.com

VIJAY SARATHI, CFA

Financial Services BNP Paribas Securities India Pvt Ltd +91 22 6628 2412 vijay.sarathi@asia.bnpparibas.com

ABHISHEK BHATTACHARYA

Financial Services (Associate) BNP Paribas Securities India Pvt Ltd +91 22 6628 2411 abhishek.bhattacharya@asia.bnpparibas.com

JOSEPH GEORGE

Consumer BNP Paribas Securities India Pvt Ltd +91 22 6628 2452 joseph.george@asia.bnpparibas.com

MANISH A GUPTA

Consumer (Associate) BNP Paribas Securities India Pvt Ltd +91 22 6628 2451 manish.a.gupta@asia.bnpparibas.com

ANMOL GANJOO

Healthcare BNP Paribas Securities India Pvt Ltd +91 22 6628 2421 anmol.ganjoo@asia.bnpparibas.com

15

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

NOTES

16

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

NOTES

17

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

NOTES

18

BNP PARIBAS

VISHAL SHARMA, CFA

INDIA TRANSPORT INFRASTRUCTURE

22 JUNE 2010

DISCLAIMERS

&

DISCLOSURES

ANALYST(S) Vishal Sharma, CFA, BNP Paribas Securities India Pvt Ltd, +91 22 6628 2441, vishal.sharma@asia.bnpparibas.com. Shashank Abhisheik, BNP Paribas Securities India Pvt Ltd, +91 22 6628 2446, shashank.abhisheik@asia.bnpparibas.com. 1 This report was produced by a member company of the BNP Paribas Group (Group) . This report is for the use of intended recipients only and may not be reproduced (in whole or in part) or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein. The information contained in this report has been obtained from public sources believed to be reliable and the opinions contained herein are expressions of belief based on such information. No representation or warranty, express or implied, is made that such information or opinions is accurate, complete or verified and it should not be relied upon as such. This report does not constitute a prospectus or other offering document or an offer or solicitation to buy or sell any securities or other investments. Information and opinions contained in this report are published for reference of the recipients and are not to be relied upon as authoritative or without the recipients own independent verification or taken in substitution for the exercise of judgement by the recipient. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. No member company of the Group accepts any liability whatsoever for any direct or consequential loss arising from any use of the materials contained in this report. The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed herein. This report is prepared for professional investors and is being distributed in Hong Kong by BNP Paribas Securities (Asia) Limited to persons whose business involves the acquisition, disposal or holding of securities, whether as principal or agent. BNP Paribas Securities (Asia) Limited, a subsidiary of BNP Paribas, is regulated by the Securities and Futures Commission for the conduct of dealing in securities, advising on securities and providing automated trading services. This report is being distributed in the United Kingdom by BNP Paribas London Branch to persons who are not private customers as defined under U.K. securities regulations. BNP Paribas London Branch, a branch of BNP Paribas, is regulated by the Financial Services Authority for the conduct of its designated investment business in the U.K. This report may be distributed in the United States by BNP PARIBAS SECURITIES ASIA or by BNP Paribas Securities Corp. Where this report has been distributed by BNP PARIBAS SECURITIES ASIA it is intended for distribution in the United States only to major institutional investors (as such term is defined in Rule 15a-6 under the Securities Exchange Act of 1934, as amended) and is not intended for the use of any person or entity that is not a major institutional investor. Where this report has been distributed by BNP Paribas Securities Corp, a U.S. broker dealer, it will have been reviewed by a FINRA S16 qualified registered supervisory analyst or a S24 qualified and authorized person, in accordance with FINRA requirements concerning third party affiliated research. All U.S. institutional investors receiving this report should effect transactions in securities discussed in the report through BNP Paribas Securities Corp. BNP Paribas Securities Corp. is a member of the New York Stock Exchange, the Financial Industry Regulatory Authority and the Securities Investor Protection Corporation. Reproduction, distribution or publication of this report in any other places or to persons to whom such distribution or publication is not permitted under the applicable laws or regulations of such places is strictly prohibited. Information on Taiwan listed stocks is distributed in Taiwan by BNP Paribas Securities (Taiwan) Co., Ltd. Distribution or publication of this report in any other places to persons which are not permitted under the applicable laws or regulations of such places is strictly prohibited. 1 No portion of this report was prepared by BNP Paribas Securities Corp personnel. Disclosure and Analyst Certification BNP Paribas represents that: Within the next three months, BNPP or its affiliates may receive or seek compensation in connection with an investment banking relationship with one or more of the companies referenced herein. The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal view of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report; (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, relate to the specific recommendation or views expressed herein; and (iii) BNPP is not aware of any other actual or material conflicts of interest concerning any of the subject securities and companies referenced herein as of the time of publication of the research report. Recommendation structure All share prices are as at market close on 21 June 2010 unless otherwise stated. Stock recommendations are based on absolute upside (downside), which we define as (target price* - current price) / current price. If the upside is 10% or more, the recommendation is BUY. If the downside is 10% or more, the recommendation is REDUCE. For stocks where the upside or downside is less than 10%, the recommendation is HOLD. In addition, we have key buy and key sell lists in each market, which are our most commercial and/or actionable BUY and REDUCE calls and are limited to at most five key buys and five key sells in each market at any point in time. Unless otherwise specified, these recommendations are set with a 12-month horizon. Thus, it is possible that future price volatility may cause a temporary mismatch between upside/downside for a stock based on market price and the formal recommendation. *In most cases, the target price will equal the analyst's assessment of the current fair value of the stock. However, if the analyst doesn't think the market will reassess the stock over the specified time horizon due to a lack of events or catalysts, then the target price may differ from fair value. In most cases, therefore, our recommendation is an assessment of the mismatch between current market price and our assessment of current fair value. Rating distribution (as at 18 June 2010) Out of 540 rated stocks in the BNP Paribas coverage universe, 353 have BUY ratings, 108 are rated HOLD and 79 are rated REDUCE. Within these rating categories, 1.85% of the BUY-rated companies either currently are or have been BNP Paribas clients in the past 12 months, 4.82% of the HOLD-rated companies are or have been clients in the past 12 months, and 6.33% of the REDUCE-rated companies are or have been clients in the past 12 months. Should you require additional information please contact the relevant BNP Paribas research team or the author(s) of this report. 2010 BNP Paribas Group

19

BNP PARIBAS

HONG KONG

BNP Paribas Securities (Asia) Ltd 63/F, Two International Finance Centre 8 Finance Street, Central Hong Kong SAR China Tel (852) 2825 1888 Fax (852) 2845 9411

BNP Paribas Equities (Asia) Ltd Beijing Representative Office Unit 1618, South Tower Beijing Kerry Centre 1 Guang Hua Road, Chao Yang District Beijing 100020, China Tel (86 10) 6561 1118 Fax (86 10) 6561 2228

BEIJING

SHANGHAI

BNP Paribas Equities (Asia) Ltd Shanghai Representative Office Room 2630, 26/F Shanghai World Financial Center 100 Century Avenue Shanghai 200120, China Tel (86 21) 6096 9000 Fax (86 21) 6096 9018

BANGKOK

(In cooperation with BNP Paribas) Thanachart Securities Public Co Ltd 28/F, Unit A1 Siam Tower Building 989 Rama 1 Road, Patumwan Bangkok 10330 Thailand Tel (66 2) 617 4900 Fax (66 2) 658 1470

JAKARTA

PT BNP Paribas Securities Indonesia Grand Indonesia, Menara BCA, 35/F JI. M.H. Thamrin No. 1 Jakarta 10310 Indonesia Tel (62 21) 2358 6586 Fax (62 21) 2358 7587

KUALA LUMPUR

BNP Paribas Capital (Malaysia) Sdn. Bhd. Suite 21.03 Level 21 Menara Dion 27 Jalan Sultan Ismail 50250 Kuala Lumpur Malaysia Tel (60 3) 2050 9928 Fax (60 3) 2070 0298

MUMBAI

BNP Paribas Securities India Pvt Ltd 6/F, Poonam Chambers B-Wing, Shivsagar Estate Dr Annie Beasant Road, Worli Mumbai 400 018 India Tel (91 22) 6628 2300 Fax (91 22) 6628 2455

SEOUL

BNP Paribas Securities Korea Co Ltd 22/F, Taepyeongno Building 310 Taepyeongno 2-ga Jung-gu, Seoul 100-767 Korea Tel (82 2) 2125 0500 Fax (82 2) 2125 0593

SINGAPORE

BNP Paribas Securities (Singapore) Pte Ltd (Co. Reg. No. 199801966C) 20 Collyer Quay #08-01 Tung Centre Singapore 049319 Tel (65) 6210 1288 Fax (65) 6210 1980

TAIPEI

BNP Paribas Securities (Taiwan) Co Ltd 72/ F, Taipei 101 No. 7 Xin Yi Road, Sec. 5 Taipei, Taiwan Tel (886 2) 8729 7000 Fax (886 2) 8101 2168

TOKYO

BNP Paribas Securities (Japan) Ltd GranTokyo North Tower 1-9-1 Marunouchi, Chiyoda-Ku Tokyo 100-6740 Japan Tel (81 3) 6377 2000 Fax (81 3) 5218 5970

NEW YORK

BNP Paribas The Equitable Tower 787 Seventh Avenue New York NY 10019, USA Tel (1 212) 841 3800 Fax (1 212) 841 3810

BASEL

BNP Paribas Aeschengraben 26 CH 4002 Basel Switzerland Tel (41 61) 276 5555 Fax (41 61) 276 5514

FRANKFURT

BNP Paribas Mainzer Landstrasse 16 60325 Frankfurt Germany Tel (49 69) 7193 6637 Fax (49 69) 7193 2520

GENEVA

BNP Paribas 2 Place de Hollande 1211 Geneva 11 Switzerland Tel (41 22) 787 7377 Fax (41 22) 787 8020

LONDON

BNP Paribas 10 Harewood Avenue London NW1 6AA UK Tel (44 20) 7595 2000 Fax (44 20) 7595 2555

LYON

BNP Paribas Equities France Socit de Bourse 3 rue de L Arbre Sec 69001 Lyon France Tel (33 4) 7210 4001 Fax (33 4) 7210 4029

MADRID

BNP Paribas SA, sucursal en Espana Hermanos Becquer 3 PO Box 50784 28006 Madrid Spain Tel (34 91) 745 9000 Fax (34 91) 745 8888

MILAN

BNP Paribas Equities Italia SIM SpA Piazza San Fedele, 2 20121 Milan Italy Tel (39 02) 72 47 1 Fax (39 02) 72 47 6562

PARIS

BNP Paribas Equities France Socit de Bourse 20 boulevard des Italiens 75009 Paris France Tel (33 1) 4014 9673 Fax (33 1) 4014 0066

ZURICH

BNP Paribas Talstrasse 41 8022 Zurich Switzerland Tel (41 1) 229 6891 Fax (41 1) 267 6813

MANAMA

BNP Paribas Bahrain PO Box 5253 Manama Bahrain Tel (973) 53 3978 Fax (973) 53 1237

www.equities.bnpparibas.com

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Securities America, Inc.: Brokercheck ReportDocument145 pagesSecurities America, Inc.: Brokercheck ReportWai DaiPas encore d'évaluation

- Exchange CodesDocument14 pagesExchange CodesnalyatPas encore d'évaluation

- Greenberg Hunton Suarez ComplaintDocument172 pagesGreenberg Hunton Suarez ComplaintJSmithWSJPas encore d'évaluation

- Testing The Financial Literacy PDFDocument6 pagesTesting The Financial Literacy PDFPramendra7Pas encore d'évaluation

- Infocus - Pros - and - Cons - of - Cryptocurrency - InvestmentDocument7 pagesInfocus - Pros - and - Cons - of - Cryptocurrency - InvestmentAanchal aroraPas encore d'évaluation

- Merrill Lynch Pierce Fenner & Smith Inc. v. Cheryl Schwarzwaelder, 3rd Cir. (2012)Document13 pagesMerrill Lynch Pierce Fenner & Smith Inc. v. Cheryl Schwarzwaelder, 3rd Cir. (2012)Scribd Government DocsPas encore d'évaluation

- Eric Beckwith BrokercheckDocument10 pagesEric Beckwith BrokercheckZerohedgePas encore d'évaluation

- Wells Fargo Advisors v. Evan A. SallDocument5 pagesWells Fargo Advisors v. Evan A. SallChase CarlsonPas encore d'évaluation

- Issue of Prospectus2023Document16 pagesIssue of Prospectus2023TasminePas encore d'évaluation

- Disparate Regulatory Schemes For Parallel Activities - HazenDocument75 pagesDisparate Regulatory Schemes For Parallel Activities - HazenCervino InstitutePas encore d'évaluation

- How To Choose 2021Document56 pagesHow To Choose 2021The DispatchPas encore d'évaluation

- AML Template 5983002Document58 pagesAML Template 5983002Strategy GamePas encore d'évaluation

- Manual 25Document606 pagesManual 25mature26Pas encore d'évaluation

- China Industrials: Rail Juggernaut: CSR-CNR Merger AnnouncedDocument8 pagesChina Industrials: Rail Juggernaut: CSR-CNR Merger AnnouncedethandanfordPas encore d'évaluation

- Lecture Corporate Governance and Ethics - Chapter 11 Roles and Responsibilities of Other Corporate Governance Participants - 1013887Document12 pagesLecture Corporate Governance and Ethics - Chapter 11 Roles and Responsibilities of Other Corporate Governance Participants - 1013887hieuvu2000Pas encore d'évaluation

- Merrill Lynch, Pierce, Fenner v. Whitney, 10th Cir. (2011)Document25 pagesMerrill Lynch, Pierce, Fenner v. Whitney, 10th Cir. (2011)Scribd Government DocsPas encore d'évaluation

- Street Hype Newspaper - December 1-18,2016Document24 pagesStreet Hype Newspaper - December 1-18,2016Patrick MaitlandPas encore d'évaluation

- Indonesia Morning CuppaDocument8 pagesIndonesia Morning Cuppaalvin maulana.pPas encore d'évaluation

- MicroCap Review Summer/Fall 2014Document96 pagesMicroCap Review Summer/Fall 2014Planet MicroCap Review MagazinePas encore d'évaluation

- Morning India 20210323 Mosl Motilal OswalDocument8 pagesMorning India 20210323 Mosl Motilal Oswalvikalp123123Pas encore d'évaluation

- Most Market Roundup: Dealer'S DiaryDocument7 pagesMost Market Roundup: Dealer'S DiaryAnkur RohiraPas encore d'évaluation

- BDA Advises Synophic On Its Acquisition by ProdaptDocument3 pagesBDA Advises Synophic On Its Acquisition by ProdaptPR.comPas encore d'évaluation

- 3 2 11 (Keating)Document7 pages3 2 11 (Keating)diversified1100% (3)

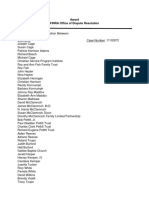

- Award FINRA Office of Dispute ResolutionDocument13 pagesAward FINRA Office of Dispute ResolutionshreveporttimesPas encore d'évaluation

- Christian A Marquez - Resume 2017Document2 pagesChristian A Marquez - Resume 2017Charles StewartPas encore d'évaluation

- Blue SkyDocument23 pagesBlue SkyscarbojcPas encore d'évaluation

- CCM - Directory of Service Providers - 11-2011Document13 pagesCCM - Directory of Service Providers - 11-2011Stelu OlarPas encore d'évaluation

- OCBC Research Report 2013 July 9 by MacquarieDocument6 pagesOCBC Research Report 2013 July 9 by MacquarietansillyPas encore d'évaluation

- Cash Management Account Application TrustDocument20 pagesCash Management Account Application TrustVinod BCPas encore d'évaluation