Académique Documents

Professionnel Documents

Culture Documents

South Indian Bank: Performance Highlights

Transféré par

Pranay SinghDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

South Indian Bank: Performance Highlights

Transféré par

Pranay SinghDroits d'auteur :

Formats disponibles

1QFY2012 Result Update | Banking

July 15, 2011

South Indian Bank

Performance Highlights

ACCUMULATE

CMP Target Price

% chg (qoq) (7.5) (6.6) 0.9 1QFY11 167 104 58 % chg (yoy) 22.5 37.1 41.2

`24 `26 12 months

Particulars (` cr) NII Pre-prov. profit PAT

1QFY12 205 143 82

4QFY11 222 153 82

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Banking 2,734 1.0 30/17 10,59,469 1 18,562 5,581 SIBK.BO SIB@IN

Source: Company, Angel Research

For 1QFY2012, South Indian Bank (SIB) reported healthy net profit growth of 41.2% yoy (flat sequentially) to `82cr, slightly below our estimates of `86cr. However, NIM compression was higher than expected, which was compensated by higher treasury gains and lower-than-estimated provisions. Key highlights of the results were strong balance sheet growth but with substantial NIM compression and largely stable asset quality. We maintain our Accumulate recommendation on the stock. Healthy business growth but NIM disappoints: The banks business growth continued to register strong traction, with advances growth at 31.2% yoy (8.1% qoq) and deposits growth at 35.5% yoy (6.4% qoq). The banks CASA deposits grew by relatively lower 16.0%, leading to compression in CASA ratio to 21.5% from 25.1% in 1QFY2011. However, CASA ratio was stable on a sequential basis. CASA deposits and low-cost NRE deposits put together formed 26.1% of deposits. The asset quality was largely stable during 1QFY2012, with absolute gross and net NPAs rising by relatively lower 2.6% and 5.8% qoq, respectively, and provision coverage ratio excluding technical write-offs at a comfortable 73.1%. Slippages were flat sequentially at 0.8% (`43cr), which were largely compensated by higher recoveries. The banks capital adequacy remains healthy at 13.5%, with tier-I CAR of 10.9%. Outlook and valuation: SIB plans to raise ~`1,000cr during FY2012, which will enable it to maintain its strong growth, especially in its gold loan business. Currently, the stock is trading at moderate valuations of 1.2x FY13E ABV. In light of capital-raising and strong expansion plans, we value the bank at 1.35x FY13E ABV and maintain our Accumulate rating on the stock with a target price of `26.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 9.6 38.8 51.6

Abs. (%) Sensex SIB

3m (5.8) 4.1

1yr 3.6 28.4

3yr 46.4 200.2

Key financials

Particulars (` cr) NII % chg Net profit % chg NIM (%) EPS (`)* P/E (x) P/ABV (x) RoA (%) RoE (%) FY2010 568 8.7 234 20.0 2.5 2.1 11.7 1.9 1.0 17.0 FY2011 791 39.2 293 25.1 2.8 2.6 9.3 1.6 1.0 18.5 FY2012E 883 11.6 347 18.6 2.6 3.1 7.9 1.4 1.0 18.9 FY2013E 960 8.7 364 5.0 2.5 3.2 7.5 1.2 0.9 17.2

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Source: Company, Angel Research; Note: *Adjusted for face value split from `10 to`1

Please refer to important disclosures at the end of this report

South Indian Bank | 1QFY2012 Result Update

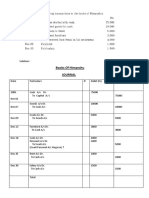

Exhibit 1: 1QFY2012 performance

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others Interest Expended Net Interest Income Other income Other income excl. treasury - Fee Income - Treasury Income - Others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies - Provisions for NPAs - Provisions for Investments - Provisions for Standard Assets - Other Provisions PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 769 610 144 15 564 205 52 37 9 15 27 257 113 69 44 143 21 3 4 14 0 122 40 82 32.6 704 557 132 15 482 222 60 47 11 14 36 282 129 76 53 153 26 (4) 9 6 15 127 45 82 35.5 9.2 9.6 8.8 0.1 16.9 (7.5) (14.6) (21.2) (11.5) 7.5 (24.1) (9.0) (12.0) (9.0) (16.2) (6.6) (21.1) (55.8) 131.6 (98.0) (3.5) (11.6) 0.9 (295)bp 540 421 110 9 373 167 42 32 8 9 24 209 105 67 37 104 17 11 0 2 3 88 29 58 33.4 42.3 44.8 31.5 56.1 51.2 22.5 23.9 13.1 15.5 62.0 12.3 22.8 8.4 2.3 19.6 37.1 24.8 (74.6) 1,430.8 526.4 (90.7) 39.5 36.1 41.2 (81)bp

Exhibit 2: 1QFY2012 Actual vs. Angel estimates

Particulars (` cr) Net interest income Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 205 52 257 113 143 21 122 40 82

Estimates 227 48 275 120 155 28 127 41 86

% chg (9.7) 8.5 (6.6) (5.4) (7.5) (25.9) (3.4) (3.1) (3.6)

July 15, 2011

South Indian Bank | 1QFY2012 Result Update

Exhibit 3: 1QFY2012 performance analysis

Particulars Balance sheet Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) Current deposits (` cr) Saving deposits (` cr) CASA deposits (` cr) CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Cost of deposits Yield on advances Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%) Slippage ratio (%) Loan loss provision to avg. assets (%)

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 22,151 31,622 70.0 1,326 5,464 6,790 21.5 13.5 10.9 7.6 11.8 2.8 44.2 236 1.1 63 0.3 73.1 0.8 0.0 20,489 29,721 68.9 1,201 5,203 6,404 21.5 14.0 11.3 6.6 10.9 3.1 45.7 230 1.1 60 0.3 73.9 0.8 (0.1) 8.1 6.4 111bp 10.4 5.0 6.0 (7)bp (50)bp (41)bp 103bp 85bp (29)bp (148)bp 2.6 (4)bp 5.8 0bp (80)bp 6bp 8bp 16,886 23,331 72.4 1,138 4,714 5,852 25.1 16.0 13.1 6.4 10.8 2.8 50.1 223 1.3 65 0.4 71.0 0.2 31.2 35.5 (233)bp 16.5 15.9 16.0 (361)bp (248)bp (224)bp 117bp 98bp (6)bp (584)bp 6.0 (26)bp (2.0) (10)bp 217bp (14)bp

July 15, 2011

South Indian Bank | 1QFY2012 Result Update

Business growth continues to be strong

The banks business growth continued to register strong traction, with advances growth of 31.2% yoy (8.1% qoq) and deposits growth of 35.5% yoy (6.4% qoq). The banks CASA deposits grew by relatively lower 16.0% yoy, leading to compression in CASA ratio to 21.5% from 25.1% in 1QFY2011. However, on a sequential basis, CASA ratio was stable. CASA deposits and low-cost NRE deposits constituted 26.2% of total deposits. Bulk deposit constituted ~26.8% as of 1QFY2012.

Exhibit 4: Business growth remains healthy

Advances qoq growth (%,) 12.0 10.0 8.0 6.0 4.0 Deposits qoq growth (%)

Exhibit 5: CASA continues at lower levels

(%) 26.0 23.0 20.0 25.1 23.9 22.4 21.5 21.5

4.8

1.4

4.9

7.4

8.3

7.7

6.8

8.1

6.4

2.0 -

10.1

17.0 14.0

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Growth in gold loan portfolio continued to be healthy, registering an increase of 12.3% on a sequential basis. Share of gold loans in loan book has now gone up to 22.9%. On a sequential incremental basis, share of gold loans stood at over 33.5%. With rising interest rates and a larger share of higher-yielding gold loans, the bank was able to improve its yield on advances by 85bp qoq and 98bp yoy to 11.8%. However, the banks reported NIM dipped by ~30bp qoq to 2.8% due to a sharp spike in cost of deposits (103bp qoq and 117bp yoy). Consequently, the banks NII was ~10% lower than our estimates despite strong business growth.

Exhibit 6: NIM declines by 29bp sequentially...

(%) 3.10 3.0 3.1

Exhibit 7: ...due to jump in cost of deposits

(%) 8.00 7.6

3.0 2.8

2.90

7.00 2.8 6.00

6.4

6.3

6.4

6.6

2.70

2.50 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

5.00 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Company, Angel Research

Source: Company, Angel Research

We were expecting a decline in NIM on account of rising cost of funds for the system as a whole and the banks relatively low CASA ratio; however, NIM compression was higher than our expectations. Going forward, management expects the NIMs to inch closer to 3.0% mark as assets re-pricing kicks in.

July 15, 2011

South Indian Bank | 1QFY2012 Result Update

Non-interest income growth driven by treasury gains

Other income growth on a yoy basis for the bank was primarily driven the sharp 62.0% rise in treasury gains. Fee income growth lagged credit growth by almost half at 15.5% yoy. With interest rates having an upward bias, we expect lower treasury gains in future.

Exhibit 8: Break-up of non-interest income

Particulars (` cr) Fee income Treasury gains Profit on exchange transactions Others Non-interest income Excluding treasury

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 9 15 5 22 52 36.7 11 14 5 31 61 46.9 (11.5) 7.5 (8.7) (27.7) (15.1) (21.8) 8 9 4 20 42 32.5 15.5 62.0 19.3 10.6 23.8 13.0

Asset quality remains stable

The asset quality of the bank was largely stable during 1QFY2012, with absolute gross and net NPAs rising by relatively lower 2.6% and 5.8% qoq, respectively. Gross and net NPA ratios remained flat sequentially to 1.1% and 0.3%, respectively. The provision coverage ratio stood at 73.1% (73.9% in 4QFY2011) excluding technical write-offs. Slippages were flat sequentially at 0.8% (`43cr), which were largely compensated by recoveries of ~`36cr. The banks MFI exposure stood at `210cr (0.9% of advances) of which few accounts have gone for CDR. Overall, the management is not seeing any stress from a particular segment. The banks provision expenses rose by 24.8% yoy due to the `14cr provision on account of hike in standard assets provisioning requirement on restructured advances. Provisions for NPAs were sharply lower on a yoy basis at `3cr (`11cr in 1QFY2011), leading to credit costs of just 3bp vs. 17bp in 1QFY2011.

Exhibit 9: NPA coverage comfortable at 73%+

Gross NPAs (` cr) 300 225 150 71.0 70.5 Net NPA (` cr) 73.9 70.7 PCR (%, RHS) 73.1 75.0 70.0 65.0

Exhibit 10: Credit costs remain low

(bp) 30 20 10 2 (10) 1QFY11 2QFY11 3QFY11 (5) 4QFY11 1QFY12 17 26

223 65

228 67

254 74

230 60

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Company, Angel Research

236 63

75

60.0 55.0

Source: Company, Angel Research

July 15, 2011

South Indian Bank | 1QFY2012 Result Update

Operating costs under control

Operating expenses increased by 8.4% yoy, driven by a 19.6% increase in other operating expenses. Employee expenses were almost flat on a yoy basis despite providing `8cr towards amortisation of brought-forward liability towards second pension and gratuity. As a result of relatively better operating income growth and stable operating expenses, the cost-to-income ratio of the bank improved to 44.2% from 50.1% in 1QFY2011 and 45.7% in 4QFY2011. On the back of strong balance sheet growth, the opex to average assets ratio improved materially to 1.3% from 1.6% each in 1QFY2011 and 4QFY2011, respectively.

Exhibit 11: Opex to average assets improves materially

(%) 2.0 1.5 1.0 0.5 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 1.6 1.8 1.6 1.6 1.3

Exhibit 12: Cost to income ratio also improves

(%) 51.0 48.0 45.0 42.0 39.0 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 43.9 50.1 48.5 45.7 44.2

Source: Company, Angel Research

Source: Company, Angel Research

Healthy capital adequacy

The banks capital adequacy ratio (CAR) stood at healthy 13.5% as of 1QFY2012, with tier-I ratio at 10.9% (forming 80.4% of the total CAR). The bank has indicated a comfortable tier-I CAR level of 14.0%. The bank is planning to raise ~`1,000cr of equity capital during FY2012, which would further increase tier-I ratio, enabling the bank to achieve its growth targets. As the fund-raising timelines are not concrete yet, we have not factored the same in our estimates at present. However, if any QIP is done at the CMP, the book value as of FY2013E could see an increase of ~7.0%.

Exhibit 13: Trends in CAR

(%)

20.0 16.0 16.0 12.0 8.0 4.0 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2.9 15.9 2.8 14.9 2.6 14.0 2.7 13.5 2.7 Tier-I CAR Tier-II CAR

13.1

13.1

12.3

11.3

10.9

Source: Company, Angel Research

July 15, 2011

South Indian Bank | 1QFY2012 Result Update

Investment arguments

Strong business growth

The bank grew its advances and deposits at a strong rate of 27.1% and 29.2% yoy, respectively, in FY2011. Business growth has further accelerated in 1QFY2012, with advances growing by 31.2% yoy and deposits rising by 35.5% yoy. Gold loan portfolio of the bank has increased at an 84% CAGR over FY200911 to reach `4,633cr. The gold loan portfolio has continued its pace in 1QFY2012 and now constitutes ~22.9% of the overall loan book. The bank had indicated plan to set up a gold loan NBFC to tap customers who are willing to pay higher interest rates in lieu of higher LTVs and faster service. For this, the bank was planning to deploy ~`300cr of the QIP proceeds towards the NBFC to capitalise on the opportunity currently being exploited by players such as Muthoot and Mannapuram. However the bank has put the gold loan NBFC plan on hold as of now, considering the uncertain regulatory environment for NBFCs. The `1,000cr QIP amounts to 59.0% of FY2011 net worth, which will provide the bank with substantial capital to maintain its strong growth. We have not factored in the impact of raising ~`1,000cr funds at present; however, if any QIP is done at the CMP, the book value as of FY2013E could see an increase of ~7.0%

Outlook and valuation

Due to the banks higher cost of funds and lower CASA, we have factored in NIMs of 2.6% for FY2012 compared to 2.8% in FY2011. Also, we believe that going forward, the asset quality of the bank may not sustain at current healthy levels and have conservatively factored in higher slippages for FY2012. That said, the bank plans to raise ~`1,000cr during FY2012, which will enable it to maintain its strong growth, especially in its gold loan business. Currently, the stock is trading at moderate valuations of 1.2x FY2013E ABV. In light of capital-raising and strong expansion plans, we value the bank at 1.35x FY2013E ABV and maintain our Accumulate rating on the stock with a target price of `26.

Exhibit 14: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Treasury gain/(loss) (% of investments)

Source: Company, Angel Research

Earlier estimates FY2012 18.0 14.0 21.8 2.6 5.2 7.5 15.0 1.1 0.3 FY2013 18.0 14.0 22.0 2.5 15.6 15.0 15.0 1.1 0.3

Revised estimates FY2012 20.0 14.0 21.8 2.6 6.4 7.5 15.0 1.1 0.3 FY2013 18.0 15.0 21.8 2.5 15.6 15.0 15.0 1.1 0.3

July 15, 2011

South Indian Bank | 1QFY2012 Result Update

Exhibit 15: Change in estimates

FY2012 Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

Earlier estimates

892 207 1,099 510 589 67 522 169 353

FY2013 Revised Earlier Revised Var. (%) Var. (%) estimates estimates estimates

883 209 1,092 510 582 68 514 167 347 (1.0) 1.2 (0.6) (1.2) 2.1 (1.6) (1.6) (1.6) 964 239 1,203 587 617 75 542 176 366 960 242 1,202 587 615 76 539 175 364 (0.5) 1.2 (0.1) (0.3) 1.1 (0.5) (0.5) (0.5)

Exhibit 16: P/ABV band

Price (`) 35 30 25 20 15 10 5 0 0.5x 0.8x 1.1x 1.4x 1.7x

Apr-06

Apr-07

Apr-08

Apr-09

Apr-10

Oct-06

Oct-07

Oct-08

Oct-09

Oct-10

Apr-11

Source: Company, Angel Research

July 15, 2011

Oct-11

South Indian Bank | 1QFY2012 Result Update

Exhibit 17: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI CanBk CentBk CorpBk DenaBk IDBI# IndBk IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk Reco. Buy Accumulate Neutral Buy Accumulate Neutral Accumulate Accumulate Buy Buy Neutral Reduce Buy Buy Neutral Accumulate Buy Neutral Accumulate Accumulate Buy Buy Neutral Buy Accumulate Neutral CMP (`) 1,268 457 509 1,060 24 325 206 135 880 405 519 128 517 88 135 223 144 855 343 1,141 2,471 118 90 304 97 68 Tgt. price (`) 1,650 483 1,355 26 222 145 1,017 498 112 640 107 255 166 392 1,235 2,845 139 357 107 Upside (%) 30.2 5.9 27.8 8.0 7.4 7.4 15.6 22.9 (12.3) 23.7 21.7 14.3 15.4 14.3 8.2 15.2 17.4 17.2 10.9 FY2013E P/ABV (x) 2.0 1.2 3.4 1.9 1.2 2.1 1.0 0.9 1.2 1.1 1.0 0.9 0.8 0.6 0.8 0.9 0.9 0.9 0.8 1.3 1.8 0.8 1.0 1.1 0.8 0.9 FY2013E Tgt P/ABV (x) 2.7 1.3 2.5 1.4 1.1 1.0 1.4 1.3 0.8 1.0 0.8 1.0 1.0 0.9 1.4 2.1 0.9 1.3 0.9 FY2013E P/E (x) 10.5 9.2 17.7 15.3 7.5 10.9 5.8 5.6 6.7 6.0 5.6 5.8 4.8 4.3 6.2 4.7 5.4 5.7 5.1 6.5 9.1 4.9 5.0 6.4 6.5 6.6

#

FY2011-13E EPS CAGR (%) 21.0 20.2 30.4 24.5 11.6 19.2 9.2 3.1 10.5 21.6 1.0 (10.9) 6.1 5.1 14.3 10.4 23.5 8.8 13.7 11.7 44.2 14.6 18.9 21.0 6.1 8.6

FY2013E RoA (%) 1.5 1.3 1.7 1.5 0.9 1.3 0.9 1.0 1.1 0.8 1.0 0.5 0.9 0.8 0.7 1.4 0.7 1.2 1.0 1.1 1.1 0.7 0.6 0.8 0.5 0.5

FY2013E RoE (%) 21.0 14.1 20.9 15.6 17.2 20.6 17.8 16.8 19.5 18.5 18.1 15.1 17.9 15.7 14.5 20.4 16.6 17.0 15.8 21.3 22.6 17.0 17.6 18.1 12.5 12.8

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), Without adjusting for SASF

July 15, 2011

South Indian Bank | 1QFY2012 Result Update

Income statement

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. and Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY07 368 18.5 122 68.1 489 27.9 219 (1.4) 270 68.4 124 41.5 146 100.7 42 28.9 104 89.5 FY08 394 7.2 143 17.3 537 9.7 248 13.4 289 6.8 57 (54.0) 232 58.3 80 34.6 152 45.6 FY09 523 32.7 164 15.2 687 28.0 328 32.4 359 24.3 57 0.7 301 30.0 107 35.4 195 28.4 FY10 568 8.7 208 26.9 777 13.0 366 11.5 411 14.5 43 (24.5) 367 21.9 134 36.4 234 20.0 FY11 791 39.2 197 (5.6) 988 27.2 463 26.3 525 27.9 80 84.4 446 21.3 153 34.3 293 25.1 FY12E 883 11.6 209 6.4 1,092 10.6 510 10.3 582 10.8 68 (14.2) 514 15.3 167 32.4 347 18.6 FY13E 960 8.7 242 15.6 1,202 10.0 587 15.0 615 5.7 76 10.8 539 5.0 175 32.4 364 5.0

Balance sheet

Y/E March (` cr) Share Capital Reserve & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash balances Bank balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY07 70 654 27.8 33 174 483 700 1,246 3,430 24.3 90 268 26.1 FY08 90 1,071 23.8 28 155 590 974 729 4,572 32.0 113 249 25.2 FY09 113 1,191 19.4 257 155 571 998 1,038 6,075 13.3 136 284 19.2 FY10 113 1,372 27.2 1 330 706 1,391 597 7,156 33.6 153 415 25.3 FY11 113 1,734 29.2 25 265 962 1,828 638 8,924 29.5 357 585 28.5 FY12E 113 2,009 33,882 14.0 29 302 1,080 37,415 2,202 748 8,805 24,586 20.0 407 667 37,415 14.0 FY13E 113 2,294 38,964 15.0 33 347 1,275 43,027 2,533 861 9,388 29,012 18.0 468 767 43,027 15.0

12,239 15,156 18,092 23,012 29,721

13,653 17,090 20,379 25,534 32,820

7,919 10,454 11,848 15,823 20,489

13,653 17,090 20,379 25,534 32,820

July 15, 2011

10

South Indian Bank | 1QFY2012 Result Update

Ratio Analysis

Y/E March Profitability ratios (%) NIMs Cost to Income ratio RoA RoE B/S ratios (%) CASA ratio Credit/Deposit ratio Net worth/ Assets CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages NPA prov / avg. assets Provision Coverage Per Share Data (`) EPS ABVPS (75% cover) DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis NII (-) Prov. Exp. Adj NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage RoE 3.0 1.0 2.0 0.3 2.2 0.7 3.0 1.8 1.2 0.3 0.9 18.2 15.5 2.6 0.4 2.2 0.2 2.4 0.7 3.1 1.6 1.5 0.5 1.0 16.6 16.4 2.8 0.3 2.5 0.2 2.7 0.7 3.4 1.8 1.6 0.6 1.0 15.4 16.0 2.5 0.2 2.3 0.3 2.6 0.6 3.2 1.6 1.6 0.6 1.0 16.7 17.0 2.7 0.3 2.4 0.1 2.6 0.5 3.1 1.6 1.5 0.5 1.0 18.4 18.5 2.5 0.2 2.3 0.1 2.4 0.5 2.9 1.5 1.5 0.5 1.0 19.2 18.9 2.4 0.2 2.2 0.1 2.3 0.5 2.8 1.5 1.3 0.4 0.9 19.0 17.2 16.4 2.4 1.0 14.4 1.9 1.2 14.0 2.2 1.2 11.7 1.9 1.7 9.3 1.6 2.1 7.9 1.4 2.3 7.5 1.2 2.5 1.5 10.0 0.2 1.7 12.6 0.3 1.7 10.8 0.3 2.1 12.9 0.4 2.6 15.0 0.5 3.1 16.9 0.6 3.2 19.4 0.6 3.9 1.0 2.2 0.7 75.8 1.8 0.3 0.7 0.1 82.0 2.2 1.1 1.6 0.1 48.4 1.3 0.4 1.5 0.2 70.8 1.1 0.3 0.7 0.1 73.9 0.9 0.3 1.1 0.1 72.5 0.8 0.2 1.1 0.1 72.1 23.9 64.7 18.2 11.1 8.8 24.1 69.0 16.6 13.8 12.1 23.8 65.5 15.4 14.8 13.2 23.1 68.8 16.7 15.4 12.4 21.5 68.9 18.4 14.0 11.3 21.8 72.6 19.2 12.9 10.6 21.8 74.5 19.0 12.8 10.6 3.1 44.8 0.9 15.5 2.6 46.2 1.0 16.4 2.9 47.8 1.0 16.0 2.5 47.1 1.0 17.0 2.8 46.8 1.0 18.5 2.6 46.7 1.0 18.9 2.5 48.8 0.9 17.2 FY07 FY08 FY09 FY10 FY11 FY12E FY13E

July 15, 2011

11

South Indian Bank | 1QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

South Indian Bank No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

July 15, 2011

12

Vous aimerez peut-être aussi

- Beginners Guide To Market ManipulationDocument53 pagesBeginners Guide To Market ManipulationAnderson Bragagnolo100% (10)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Statement 2023 1Document5 pagesStatement 2023 1ArmaanPas encore d'évaluation

- HDFC Result UpdatedDocument12 pagesHDFC Result UpdatedAngel BrokingPas encore d'évaluation

- Yes Bank: Performance HighlightsDocument12 pagesYes Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Dena Bank Result UpdatedDocument11 pagesDena Bank Result UpdatedAngel BrokingPas encore d'évaluation

- State Bank of India: Performance HighlightsDocument15 pagesState Bank of India: Performance HighlightsRaaji BujjiPas encore d'évaluation

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Central Bank of India Result UpdatedDocument10 pagesCentral Bank of India Result UpdatedAngel BrokingPas encore d'évaluation

- Corporation Bank: Performance HighlightsDocument10 pagesCorporation Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Bank of IndiaDocument12 pagesBank of IndiaAngel BrokingPas encore d'évaluation

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- Bank of India, 4th February, 2013Document12 pagesBank of India, 4th February, 2013Angel BrokingPas encore d'évaluation

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Icici Bank: Performance HighlightsDocument15 pagesIcici Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Union Bank of India Result UpdatedDocument11 pagesUnion Bank of India Result UpdatedAngel BrokingPas encore d'évaluation

- Vijaya Bank, 1Q FY 2014Document11 pagesVijaya Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- Axis Bank Result UpdatedDocument13 pagesAxis Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Corporation Bank Result UpdatedDocument11 pagesCorporation Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Andhra Bank: Performance HighlightsDocument10 pagesAndhra Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- South Indian BankDocument11 pagesSouth Indian BankAngel BrokingPas encore d'évaluation

- Vijaya Bank Result UpdatedDocument11 pagesVijaya Bank Result UpdatedAngel BrokingPas encore d'évaluation

- State Bank of IndiaDocument16 pagesState Bank of IndiaAngel BrokingPas encore d'évaluation

- South Indian Bank, 1Q FY 2014Document12 pagesSouth Indian Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- Bank of India: Performance HighlightsDocument12 pagesBank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- ICICI Bank, 4th February, 2013Document16 pagesICICI Bank, 4th February, 2013Angel BrokingPas encore d'évaluation

- Central Bank, 4th February, 2013Document10 pagesCentral Bank, 4th February, 2013Angel BrokingPas encore d'évaluation

- Bank of Baroda Result UpdatedDocument12 pagesBank of Baroda Result UpdatedAngel BrokingPas encore d'évaluation

- South Indian Bank Result UpdatedDocument12 pagesSouth Indian Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of Baroda: Performance HighlightsDocument12 pagesBank of Baroda: Performance HighlightsAngel BrokingPas encore d'évaluation

- UnitedBoI-1QFY2013RU 10 TH AugDocument11 pagesUnitedBoI-1QFY2013RU 10 TH AugAngel BrokingPas encore d'évaluation

- Indian Bank: Performance HighlightsDocument11 pagesIndian Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- State Bank of India: Performance HighlightsDocument14 pagesState Bank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Indian Bank: Performance HighlightsDocument10 pagesIndian Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Icici Bank: Performance HighlightsDocument16 pagesIcici Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- HDFC Bank Result UpdatedDocument13 pagesHDFC Bank Result UpdatedAngel BrokingPas encore d'évaluation

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Axis Bank Result UpdatedDocument13 pagesAxis Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of BarodaDocument12 pagesBank of BarodaAngel BrokingPas encore d'évaluation

- Yes Bank: Performance HighlightsDocument12 pagesYes Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Andhra Bank: Performance HighlightsDocument11 pagesAndhra Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Bank of Baroda, 1Q FY 2014Document12 pagesBank of Baroda, 1Q FY 2014Angel BrokingPas encore d'évaluation

- Dena Bank Result UpdatedDocument10 pagesDena Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of Maharashtra Result UpdatedDocument11 pagesBank of Maharashtra Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of Maharashtra: Performance HighlightsDocument11 pagesBank of Maharashtra: Performance HighlightsAngel BrokingPas encore d'évaluation

- Jyoti Structures: Performance HighlightsDocument10 pagesJyoti Structures: Performance HighlightsAngel BrokingPas encore d'évaluation

- Union Bank of India: Performance HighlightsDocument11 pagesUnion Bank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Punjab National Bank Result UpdatedDocument12 pagesPunjab National Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Syndicate Bank: Performance HighlightsDocument11 pagesSyndicate Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Allahabad Bank Result UpdatedDocument11 pagesAllahabad Bank Result UpdatedAngel BrokingPas encore d'évaluation

- HDFC Bank Result UpdatedDocument13 pagesHDFC Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Vijaya Bank: Performance HighlightsDocument12 pagesVijaya Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Indian Overseas BankDocument11 pagesIndian Overseas BankAngel BrokingPas encore d'évaluation

- Punjab National Bank: Performance HighlightsDocument12 pagesPunjab National Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Market Outlook 3rd November 2011Document7 pagesMarket Outlook 3rd November 2011Angel BrokingPas encore d'évaluation

- IDBI Bank Result UpdatedDocument13 pagesIDBI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosD'EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosPas encore d'évaluation

- Petty Cash Summary FillableDocument7 pagesPetty Cash Summary FillableLukman HakimPas encore d'évaluation

- Romualdez Vs Civil Service CommissionDocument1 pageRomualdez Vs Civil Service CommissionFrancis Gillean OrpillaPas encore d'évaluation

- Administered Interest Rates in IndiaDocument17 pagesAdministered Interest Rates in IndiatPas encore d'évaluation

- Comparison of Shariah Concepts in Am Met Lifetakaful and Other Takaful SchemesDocument4 pagesComparison of Shariah Concepts in Am Met Lifetakaful and Other Takaful SchemesIman JasminPas encore d'évaluation

- III.j-solid Builders v. China Banking, 695 SCRA 101Document2 pagesIII.j-solid Builders v. China Banking, 695 SCRA 101Jerwin Cases TiamsonPas encore d'évaluation

- Daily Cash Flow Template ExcelDocument60 pagesDaily Cash Flow Template ExcelPro ResourcesPas encore d'évaluation

- Customer Relationship ManagementDocument1 pageCustomer Relationship ManagementYamini Katakam0% (1)

- Hkicl - Disclosure For HKD ChatsDocument40 pagesHkicl - Disclosure For HKD ChatsLawrence TamPas encore d'évaluation

- Indicative Profit Rates: Savings Accounts Term DepositsDocument1 pageIndicative Profit Rates: Savings Accounts Term DepositsHammad HaseebPas encore d'évaluation

- Books of Himanshu JournalDocument4 pagesBooks of Himanshu Journalrakesh19865Pas encore d'évaluation

- B 2Document35 pagesB 2Anonymous Ei6ZuOhDoFPas encore d'évaluation

- Hotel Details Check in Check Out Rooms: Guest Name: DateDocument1 pageHotel Details Check in Check Out Rooms: Guest Name: DateAARTI AHIRWARPas encore d'évaluation

- Principles of ConveyancingDocument13 pagesPrinciples of ConveyancingAtif RehmanPas encore d'évaluation

- Central Bank of India Analyst Presentation ReviusedDocument29 pagesCentral Bank of India Analyst Presentation ReviusedAkshay V SalunkhePas encore d'évaluation

- Month Wise Checklist For Submission of Various ReturnsDocument3 pagesMonth Wise Checklist For Submission of Various Returnsadith24Pas encore d'évaluation

- Bank Statement 1 Fusionn 1 PDFDocument6 pagesBank Statement 1 Fusionn 1 PDFBenny BernicePas encore d'évaluation

- NIC Account BenefitsDocument4 pagesNIC Account BenefitsAnkit UpretyPas encore d'évaluation

- Stockbridge Company (Billing and Cash Receipts) Solutions (See Note On Pg. 11-4) P11-1 ANS. A. Table of Entities and Activities For Stockbridge Company (Billing and Cash Receipts)Document33 pagesStockbridge Company (Billing and Cash Receipts) Solutions (See Note On Pg. 11-4) P11-1 ANS. A. Table of Entities and Activities For Stockbridge Company (Billing and Cash Receipts)NuriAisyahHikmahPas encore d'évaluation

- Environment and Land Case 941 947 of 2016 ConsolidatedDocument10 pagesEnvironment and Land Case 941 947 of 2016 ConsolidatedSkarra Adebolaye AbayomiPas encore d'évaluation

- 2 - Globalization of World EconomicsDocument12 pages2 - Globalization of World EconomicsMargie Musngi ValerioPas encore d'évaluation

- RBI Guidelines Compiled From 01.01.2020 To 30.06.2020Document144 pagesRBI Guidelines Compiled From 01.01.2020 To 30.06.2020Natarajan JayaramanPas encore d'évaluation

- BOC Main Branch ContactDocument3 pagesBOC Main Branch ContactshakecokePas encore d'évaluation

- Tables: Calculators: Approved Calculators May Be Used. Stationary: Yellow Answer BookletDocument9 pagesTables: Calculators: Approved Calculators May Be Used. Stationary: Yellow Answer BookletMinh LePas encore d'évaluation

- KeemekDocument3 pagesKeemekAshwani KhandelwalPas encore d'évaluation

- Nacha FormatDocument14 pagesNacha FormatPradeep Kumar ShuklaPas encore d'évaluation

- DiruDocument84 pagesDirudhiru_hadiaPas encore d'évaluation

- Engels SEM1 SECONDDocument2 pagesEngels SEM1 SECONDJolien DeceuninckPas encore d'évaluation

- Policy For Settlement of Claims in Respect of Deceased Account HoldersDocument52 pagesPolicy For Settlement of Claims in Respect of Deceased Account HoldersAaju KausikPas encore d'évaluation