Académique Documents

Professionnel Documents

Culture Documents

Financial Strategies of Beverages Industry: Kiran Raj R 0911371

Transféré par

Kiran RajDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Strategies of Beverages Industry: Kiran Raj R 0911371

Transféré par

Kiran RajDroits d'auteur :

Formats disponibles

5th Sem BBM D

Submitted by:

Kiran Raj R 0911371

CIA 2

[FINANCIAL STRATEGIES OF BEVERAGES INDUSTRY]

Financial Strategies of Beverages Industry

Financial Strategy of Hellenic

CIA 2

0911371

Page

Financial Strategies of Beverages Industry

Coca-Cola Hellenic was formed in 2000 as a result of the merger of the Athens-based Hellenic Bottling Company and the London-based Coca-Cola Beverages. Since then, their territory has expanded and currently extends from as far west as Galway, Ireland, to Petropavlovsk, the easternmost point of Russia. This breadth provides attractive growth opportunities and reduces their dependence on any particular market. In conducting operations across 28 countries, Coca-Cola Hellenic provides guidance, support and supervision to each operation while placing day-to-day management and operation in the hands of local employees with a deep familiarity of their own country, its business practices and community aspirations. Coca-Cola Hellenic is headquartered in Athens and currently listed on the Athens, New York and London stock exchanges. Their two major shareholders are the Kar-Tess Holding S.A., a private holding company, and The Coca-Cola Company. They produce, sell and distribute a wide range of non-alcoholic beverages. These include four of the worlds best selling brands, owned by The Coca-Cola Company: Coca-Cola, CocaCola Light (diet Coke), Fanta and Sprite. They produce, sell and distribute a wide range of non-alcoholic beverages In addition, our portfolio includes sparkling and still beverages, such as: iced tea juice and juice drinks natural mineral, table and flavored waters sports and energy drinks iced coffee

CIA 2

0911371

Page

Financial Strategies of Beverages Industry

Financial Strategies adopted by Coca-Cola Hellenic

Funding Strategy The Groups funding strategy in the debt capital markets is built around the following principles: to raise financing via our wholly owned Dutch financing subsidiary Coca-Cola HBC Finance B.V., except in the case of subsidiaries with joint control, or countries where certain legal or tax restrictions or advantages apply, in which case financing at lower levels in the organisation may be considered; to maintain our presence & profile in the international capital markets and where possible to broaden our investor base; to target specific investor segments through diversification of tenor and currency, although the euro is the most important funding currency of the Group; to maintain a well-balanced redemption profile, and to use our European Medium Term Note programme as well as our Global Commercial Paper programme as the main basis for our financing. Risk management policy The Group activities expose it to a variety of financial risks including currency risk, interest rate risk, credit risk and liquidity risk. The overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the Groups financial performance. They regularly use derivative products like forwards, options, caps and collars but these are solely used for the purpose of hedging underlying exposures to foreign currency exchange rate risk and interest rate risk. None of these financial instruments are leveraged, used for trading purposes or taken as speculative positions. Credit risk Credit risk is controlled by a restrictive policy as to the choice of potential counter parties for treasury transactions. Companys credit risk is managed by establishing approved counterparty and country limits, detailing the maximum exposure that we are prepared to

Page CIA 2 0911371

Financial Strategies of Beverages Industry

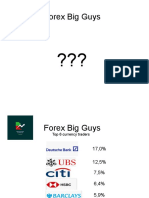

accept with respect to individual counterparties or countries. The limits are reviewed and monitored on a regular basis. Interest rate risk The Group is exposed to market risk arising from changing interest rates, primarily in the euro zone. Periodically we evaluate the desired mixture of fixed and floating rate liabilities and modify the interest payments based on the desired mixture of debt. We manage our interest rate costs using a combination of fixed and floating rate debt, interest rate swap and option cap agreements. Although we have no set target for the mixture of fixed to floating rate liabilities, historically we have been more exposed to floating rates as this has tended to act as a natural hedge against our overall business risk. Foreign exchange risk Given the Groups operating activities, they are exposed to a significant amount of foreign currency risk. Our foreign currency exposures arise from adverse changes in exchange rates between the euro, the US dollar and the currencies in our non-euro countries. Transaction exposures arise mainly from raw materials purchased in currencies such as the US dollar or euro which can lead to higher cost of sales in the functional currency of the country. Translation exposures arise as many of our operations have functional currencies other than euro, and any change in the functional currency against the euro impacts our consolidated income statement and balance sheet when results are translated into euro. Treasury policy requires the hedging of rolling 12-month forecasted transactional exposures within defined minimum (25%) and maximum (80%) coverage levels. Hedging beyond a 12month period may occur, subject to certain maximum coverage levels, provided the forecasted transactions are highly probable. Where available, we use derivative financial instruments to reduce our net exposure to currency fluctuations. These contracts normally mature within one year. Liquidity risk The companys general policy is to retain a minimum amount of liquidity reserves in the

Page

the form of unused committed facilities, to ensure that they have cost-effective access to

CIA 2 0911371

form of cash on their balance sheet while maintaining the balance of our liquidity reserves in

Financial Strategies of Beverages Industry

sufficient financial resources to meet our funding requirements. These include the day-to-day funding of their operations as well as the financing of our capital expenditure program. In order to mitigate the possibility of liquidity constraints, we endeavor to maintain a minimum of 250 million of financial headroom. Financial headroom refers to the excess committed financing available, after considering cash flows from operating activities, dividends, interest expense, tax expense, acquisitions and capital expenditure requirements.

CIA 2

0911371

Page

Financial Strategies of Beverages Industry

Financial Strategy of Coca Cola

CIA 2

0911371

Page

Financial Strategies of Beverages Industry

Coca Cola Company

The financial strategy of the company is adding value by allocating the funds in the activities and the projects that can generate the return increase of the share-owner value and the cost of capital. The major goal of the company is achieving the optimal capital structure that can provide the financial flexibility of the companys internal projects, appropriate priced acquisitions and the share repurchase. Its principal operating goal therefore is the increase of the long-term operating cash flow which can be profitable in the increases for its sales volume. The company has also the external factors for its capital that includes yet not limited to the bank borrowings, the issuance of private and public placement, and the issuance of the equity securities. The company also believes that the proper long-term resources can have the operating cash flows which are available in satisfying the maturities of the debt, income tax obligations, interest payments and the dividends payments for the share owners. The company has added to the availability of the equity market and it is the source of the longterm financing while registered in the debt securities to the Securities and Exchange Commission and under the shelf registration that can enable the company in issuing debt which is important in the amount that registered for the issuance. It had been recorded to have the $871 million of the shelf registration are remained to be unissued and can also be issued every time at the floating or fixed interest rate which was the selection of the company at the issuance of the time (Ibid). In the year 2007, the company had taken its first long-term debt for five years and borrowed $1.75 billion in helping to pay its recent purchase of the vitamin water maker Glaceau. This bond will replace the short-term debt commercial paper and taken from by the company while some of the proceeds of the bonds can be used to the general corporate purposes but unspecified. It maintains its level of debt and considers being base on prudence of the cash flow, percentage of the debt capital, and to the interest coverage. This had been use in lowering the entire cost of capital and to increase the capital of return in the equity of the shareowners. The long term debt of the company had been rated A+ which means that the capital structure and the financial policies of the company are considered. The issuance and the payments of the debt are included in the long term financing activities and recorded the $4,963 million in credits for the available facilities. The debt increase is primarily due to the

Page CIA 2 0911371

acquisition of the 18 German bottling as well as the distribution of the operations.

Financial Strategies of Beverages Industry

Financial Strategy of Kingfisher

CIA 2

0911371

Page

Financial Strategies of Beverages Industry

Kingfisher

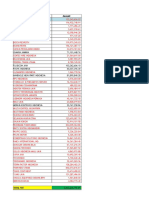

Beer is brewed in either the companys owned or non-owned Breweries, with certain Breweries set up for certain functions. This also reduces the cost and there is less treat of the suppliers. The company also has its franchise for the production of the beer. The best example is of the Taloja plant situated in Mumbai. The experience of Kingfisher brand since 1915 adds to the experience and efficiency of the firm. The in thing is also very clear from its balance sheet as the EBITDA of United Breweries is 2675.2 Millions which is 35.61% more than previous year (2007-2008). The owned plant also has reduced the switching cost of the suppliers of Kingfisher. Higher prices and short supply of key raw materials like malt, hops and barley can reduce the profit margin and affect operations. Barley and glass bottles constitute 12% and 40% of the total operating expense of UBL. Any price increase in these two commodities has a direct bearing in reducing the overall operating margin. Due to price increase of barley by over 33% and increase in bottling cost, during FY2008 the net profit margin fell by 26%. The 51% Equity stake in Maltex Malsters Limited, a manufacturer of malt, is also an initiative for vertical integration and excellence in inbound logistics.

In states like Uttar Pradesh, Rajasthan and Madhya Pradesh which, account for 80.34% of barley production in India, the area under cultivation is shifting to other crops like sugarcane. The barley production has declined by over 60% from 3135 KMT to 1220 KMT from 1975 to 2005. To hedge the risk on rising raw material prices, UBL has entered into long term arrangements for sourcing of the vital inputs. In addition it has extended its own contract farming initiatives in the state of Punjab.

CIA 2

0911371

Page

10

Financial Strategies of Beverages Industry

Financial Strategy of Nestle

CIA 2

0911371

Page

11

Financial Strategies of Beverages Industry

Nestle

We believe that to have long-term business success you must simultaneously create value for shareholders and for the public.

Nestle has indicated that the recession need not be all about cutting costs and keeping prices down, unveiling initiatives to tackle longer-term economic and social challenges, and create shareholder- and public-value. Even though Nestle said in February that it expects to see on-going growth in 2009, the depth of a recession may seem an odd place from which to launch new projects aimed at solving nutrition, water, and rural development issues around the globe. Peter Brabeck-Letmathe, chairman of Nestle, said: The financial crisis which has resulted in the current deep recession revealed once more a basic business axiom: if you fail to work on behalf of the public interest and rake shortcuts that place the public at risk, you will also fail your shareholders. The company said that long-term economic and social challenges cannot be solved by governments alone, and that companies must also take responsibility. Such issues include population growth, water resources and food security. The company claims that shared value for all involved in its manufacturing from farmers through to communities in which it operates has always been part of its strategy. However there is a major focus on sustainability in industry at the moment, as operators wake up to the need to secure a long-term future and demonstrate their responsibility to customers and shareholders. A Nestle forum that took place in New York this week, in cooperation with the United Nations, is setting for the launch of three specific new initiatives:

Nestle plans to extend its nutrition and physical activity education projects, under the Nestle Healthy Kids Global Programme, to more than 100 counties by 2011. The programme is double-pronged, aiming to help both malnutrition and rising obesity rates.

Page CIA 2 0911371

12

Financial Strategies of Beverages Industry

Nestle is opening a new research and development centre in Abidjan, Cte dIvoire which it says shows its commitment to rural development in Africa. The centre will focus on productivity and safety in local crops, like manioc, corn, millet, coffee, cocoa, and cereals, and tree propagation.

The Nestle Prize in Creating Shared Value, to be awarded every two years to give financial support of up to CHF 500,000 to individuals, NGOs, or small enterprises offering innovative solutions to nutritional deficiencies, access to clean water, or rural development.

CIA 2

0911371

Page

13

Financial Strategies of Beverages Industry

Financial Strategy of Amul

CIA 2

0911371

Page

14

Financial Strategies of Beverages Industry

Amul

AMULs business strategy is driven by its twin objectives of Long-term, sustainable growth to its member farmers, and Value proposition to a large customer base by providing milk and other dairy products a low price. Its strategy, which evolved over time Simultaneous Development of Suppliers and Customers F r o m t h e v e r y e a r l y s t a g e s o f t h e f o r m a t i o n o f A M U L, t h e c o o p e r a t i v e realized that sustained growth for the long-term was contingent on matching supply and demand. Further, given the primitive state of the market and the suppliers of milk, their development in a synchronous manner was critical for the continued growth of the industry. The organization also recognized that in view of the poor infrastructure in India, such development could not be left to market forces and proactive interventions were required. Accordingly, AMUL and GCMMF adopted a number of strategies to assure such growth. A M U L a n d o t h e r cooperative Unions adopted a number of strategies to develop the supply of milk and assure steady growth.

F o r t h e s h o r t t e r m , t h e p r o c u r e m e n t p r i c e s w e r e s e t s o a s t o provide fair and reasonable return. A w a r e o f t h e l i q u i d i t y p r o b l e m s , c a s h p a ym e n t s f o r m i l k s u p p l y w a s m a d e w i t h m i n i m u m o f d e l a y. F o r t h e l o n g - t e r m , t h e Unions followed a multi-pronged strategy of education and support.

For example, only part of the surplus generated by the Unions is paid t o t h e me mb ers i n t h e f o r m o f d i v i d e n d s . A s u b s t a n t i a l p a r t o f t h i s surplus is used for activities that promote growth of milk supply and improve yields. These include provision of veterinary services, support for cold storage facilities at the village societies etc.

Cost Leadership

CIA 2

0911371

Page

15

Financial Strategies of Beverages Industry

AMULs objective of providing a value proposition to a large customer base led naturally to a choice of cost leadership position. Given the low purchasing power of the Indian consumer and the marginal discretionary spending power, the only viable option for AMUL was to price its products as low as possible. This in turn led to a focus on costs and had significant implications for managing its operations and supply chain practices. Managing Third Party Service Providers

Well before the ideas of core competence and the role of third parti es in managing the supply chain were recognized and became fashionable, these concepts were practiced by GCMMF and AMUL. From the beginning, it was recognized that the core activity for the Unions lay in processing of milk and production of dairy products. Accordingly, the Unions focused efforts on these activities and related technology development. AMULs finance strategy is driven primarily by its desire to be self-reliant and thus depend on internally generated resources for funding its growth . This choice was motivated by the relatively underdeveloped financial markets with limited access to funds, and the reluctance to depend on Government support and thus be obliged to cede control to bureaucracy. AMULs financial strategy may thus be characteriz ed by two elements: 1. Retention of surplus to fund growth and development, and 2. Limited/ no credit, i.e., all transactions are essentially cash only. For example, payment f o r m i l k p r o c u r e d b y v i l l a g e s o c i e t i e s i s i n c a s h a n d w i t h i n 1 2 h o u r s o f procurement (most, however, pay at the same time as the receipt of milk).Similarly, no dispatches of finished products are made without advance payment from distributors etc. This was particularly important, given the limited liquidity position of farmer/suppliers and the absence of banki ng facilities in rural India. This strategy strongly helped AMUL implement its own vision of growth and development. It is important to mention that many of the above approaches were at variance with industry practices of both domestic and MNC

CIA 2

0911371

Page

16

competitors of AMUL.

Vous aimerez peut-être aussi

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingD'EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingPas encore d'évaluation

- Financial Impact & FinancingDocument5 pagesFinancial Impact & FinancingJuanPas encore d'évaluation

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationD'EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationPas encore d'évaluation

- Letter ShareholdersDocument7 pagesLetter ShareholdersRich0087Pas encore d'évaluation

- Financial Plan of Coca ColaDocument3 pagesFinancial Plan of Coca ColaVivek Kedia100% (2)

- Business FinanceDocument17 pagesBusiness FinanceMohammed AwadPas encore d'évaluation

- Aviva 2012 Full Year Results PresentationDocument32 pagesAviva 2012 Full Year Results PresentationAviva GroupPas encore d'évaluation

- LP Laboratories CaseDocument4 pagesLP Laboratories CaseAkash GuptaPas encore d'évaluation

- Long Term Growth Fund Fact SheetDocument2 pagesLong Term Growth Fund Fact SheetmaxamsterPas encore d'évaluation

- Case StudyDocument8 pagesCase StudyTHE INDIAN FOOTBALL GUYPas encore d'évaluation

- Document 2Document3 pagesDocument 2Raj AgarPas encore d'évaluation

- Company's Financial StrategyDocument18 pagesCompany's Financial StrategyRahul100% (2)

- Module 7: Case Study - The Cash Flow StatementDocument8 pagesModule 7: Case Study - The Cash Flow StatementTHE INDIAN FOOTBALL GUYPas encore d'évaluation

- Econ and Account AssignmentDocument2 pagesEcon and Account Assignmentraffy.divina.gsbmPas encore d'évaluation

- Case StudyDocument6 pagesCase StudyMadCube gamingPas encore d'évaluation

- Executive Summary: The Planning EnvironmentDocument6 pagesExecutive Summary: The Planning EnvironmentJeloh Ashlea Mhie BatingalPas encore d'évaluation

- Investor PresentationDocument39 pagesInvestor PresentationhowellstechPas encore d'évaluation

- Capital Structure PolicyDocument7 pagesCapital Structure PolicymakulitnatupaPas encore d'évaluation

- DocumentDocument436 pagesDocumentStoica Crina ElenaPas encore d'évaluation

- Artículos en Ingles - Costos y PresupuestosDocument11 pagesArtículos en Ingles - Costos y PresupuestosPaolaPas encore d'évaluation

- BP Amoco CaseDocument37 pagesBP Amoco CaseIlayaraja DhatchinamoorthyPas encore d'évaluation

- Annual Report: 8th Floor, Dina House, Ruttonjee Centre, 11 Duddell Street, Central, Hong Kong SAR, ChinaDocument56 pagesAnnual Report: 8th Floor, Dina House, Ruttonjee Centre, 11 Duddell Street, Central, Hong Kong SAR, ChinaSmallCapAnalystPas encore d'évaluation

- Becoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Document13 pagesBecoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Sanchit AroraPas encore d'évaluation

- Unit VDocument9 pagesUnit VDr.P. Siva RamakrishnaPas encore d'évaluation

- Diageo Case Write UpDocument10 pagesDiageo Case Write UpAmandeep AroraPas encore d'évaluation

- CCCCC LTDDocument91 pagesCCCCC LTDAbhii46Pas encore d'évaluation

- Finance Question BankDocument10 pagesFinance Question BankSameer WablePas encore d'évaluation

- Olam Dismisses Muddy Waters Report FindingsDocument45 pagesOlam Dismisses Muddy Waters Report Findingsstoreroom_02Pas encore d'évaluation

- Ma Assignment # 7Document18 pagesMa Assignment # 7Aeron Paul AntonioPas encore d'évaluation

- B.M Collage of B.B.ADocument12 pagesB.M Collage of B.B.AnilamgajiwalaPas encore d'évaluation

- Task 2 Auditing AssignmentDocument10 pagesTask 2 Auditing AssignmentNaushal SachaniyaPas encore d'évaluation

- Goldman Sachs 2012 Annual ReportDocument244 pagesGoldman Sachs 2012 Annual ReportddubyaPas encore d'évaluation

- GoldmanDocument244 pagesGoldmanC.Pas encore d'évaluation

- Document 1Document16 pagesDocument 1Pravallika RavikumarPas encore d'évaluation

- At 815Document7 pagesAt 815bikash khanalPas encore d'évaluation

- 2007 ACE Limited Annual ReportDocument221 pages2007 ACE Limited Annual ReportACELitigationWatchPas encore d'évaluation

- Investment Banking Investment Banking2122Document16 pagesInvestment Banking Investment Banking2122vishal13889100% (2)

- Accounting and FinanceDocument16 pagesAccounting and FinanceMohit SoniPas encore d'évaluation

- Coles GroupDocument9 pagesColes GroupSubash UpadhyayPas encore d'évaluation

- Global StrategyDocument12 pagesGlobal StrategyBrian Kwaba (Sossy)Pas encore d'évaluation

- CadburryDocument8 pagesCadburryEunice FloresPas encore d'évaluation

- Financial Statements and Analysis: ̈ Instructor's ResourcesDocument24 pagesFinancial Statements and Analysis: ̈ Instructor's ResourcesMohammad Mamun UddinPas encore d'évaluation

- Chapter 3 Managerial-Finance Solutions PDFDocument24 pagesChapter 3 Managerial-Finance Solutions PDFMohammad Mamun UddinPas encore d'évaluation

- UNIT-IV-Financing of ProjectsDocument13 pagesUNIT-IV-Financing of ProjectsDivya ChilakapatiPas encore d'évaluation

- LEVERAGED BUYOUTS (LBOS), A KEY DRIVER TO M&A LANDSCAPE - Unifinn Global CapitalDocument9 pagesLEVERAGED BUYOUTS (LBOS), A KEY DRIVER TO M&A LANDSCAPE - Unifinn Global CapitalJurgenPas encore d'évaluation

- Paper Summary 2 PagesDocument3 pagesPaper Summary 2 PagesKawn SoniPas encore d'évaluation

- R&R 2014 AccountsDocument78 pagesR&R 2014 AccountsBadGandalfPas encore d'évaluation

- Cash ManagementDocument32 pagesCash ManagementVijeshPas encore d'évaluation

- Aviva PLC Investor and Analyst Update 5 July 2012Document45 pagesAviva PLC Investor and Analyst Update 5 July 2012Aviva GroupPas encore d'évaluation

- 10 Facts About BarclaysDocument12 pages10 Facts About BarclaysShu HuiPas encore d'évaluation

- Almarai Part B and CDocument14 pagesAlmarai Part B and CQusai BassamPas encore d'évaluation

- MAN Annual Report 2011Document138 pagesMAN Annual Report 2011Daniele Del MontePas encore d'évaluation

- FM 603 Unit 2Document7 pagesFM 603 Unit 2Ritik SinghPas encore d'évaluation

- Corporate Finance 18MBA-201 (Semester - 2nd) : Presented byDocument17 pagesCorporate Finance 18MBA-201 (Semester - 2nd) : Presented bySahil SharmaPas encore d'évaluation

- Financial Instruments: The Building BlocksDocument37 pagesFinancial Instruments: The Building BlocksAmmara NawazPas encore d'évaluation

- Coca Cola Risk ManagementDocument2 pagesCoca Cola Risk ManagementAgaphilaksmo Parayudha60% (5)

- Functions/Objectives of Financial ManagementDocument7 pagesFunctions/Objectives of Financial ManagementRahul WaniPas encore d'évaluation

- Financial Management IIBMDocument5 pagesFinancial Management IIBMcarnowalt100% (1)

- 4.financial Risk ManagementDocument3 pages4.financial Risk ManagementSsewa AhmedPas encore d'évaluation

- CokeannualDocument32 pagesCokeannualsaaaruuuPas encore d'évaluation

- True / False Questions: Risks of Financial InstitutionsDocument27 pagesTrue / False Questions: Risks of Financial Institutions姚依雯Pas encore d'évaluation

- Fis-Balaji Mba College - KadapaDocument97 pagesFis-Balaji Mba College - KadapaBhuvana AnalapudiPas encore d'évaluation

- XRP - Airdrop 26 09 21Document36 pagesXRP - Airdrop 26 09 21Yaldesse CHORFAPas encore d'évaluation

- IFM - 5 SolutionsDocument25 pagesIFM - 5 SolutionsVy YếnPas encore d'évaluation

- ACI Dealing Certificate New Version: SyllabusDocument15 pagesACI Dealing Certificate New Version: Syllabuslayth TawilPas encore d'évaluation

- BSP Circular 1107Document7 pagesBSP Circular 1107Maya Julieta Catacutan-EstabilloPas encore d'évaluation

- Swiss AutoindexDocument6 pagesSwiss AutoindexAlex PchelyakovPas encore d'évaluation

- Chapter 4Document39 pagesChapter 4FaisalAltafPas encore d'évaluation

- Coopbank Annual Report EnglishDocument120 pagesCoopbank Annual Report Englishabayneshkeno99Pas encore d'évaluation

- Payment IDR - Mega - Januari 2009 - UPdatedDocument115 pagesPayment IDR - Mega - Januari 2009 - UPdatedirfanafiffudinPas encore d'évaluation

- Financial Markets (Beginner Module)Document98 pagesFinancial Markets (Beginner Module)gauravPas encore d'évaluation

- Lecture 14Document57 pagesLecture 14Billiee ButccherPas encore d'évaluation

- SLK Software Services Private LimitedDocument3 pagesSLK Software Services Private LimitedSaimadhav MamidalaPas encore d'évaluation

- How Much Is Dollar To Naira Today - Google SearchDocument1 pageHow Much Is Dollar To Naira Today - Google SearchMondaychukwu101Pas encore d'évaluation

- Butcher 10121055 ThesisDocument608 pagesButcher 10121055 ThesisRafa LegionensePas encore d'évaluation

- Caiib - 2 BFM Quick BookDocument124 pagesCaiib - 2 BFM Quick BookMansi Sheth100% (2)

- Bir RR 12-2003Document10 pagesBir RR 12-2003HjktdmhmPas encore d'évaluation

- Foreign Exchange MarketDocument20 pagesForeign Exchange MarketQuansimah BonsuPas encore d'évaluation

- Bbmf2073 Forex and Derivatives: Ms 41 Swap 46 Option Stra 57 Option PrisingDocument74 pagesBbmf2073 Forex and Derivatives: Ms 41 Swap 46 Option Stra 57 Option PrisingAIN NASUHAPas encore d'évaluation

- Banking and Financial Service Law in Ghana 2018-2Document78 pagesBanking and Financial Service Law in Ghana 2018-2kevin tagoe100% (1)

- Foreign Exchange MarketDocument3 pagesForeign Exchange MarketJayesh BhandarkarPas encore d'évaluation

- An Assignment On TFO UCBLDocument15 pagesAn Assignment On TFO UCBLFahim Dad KhanPas encore d'évaluation

- Foreign Exchange Market P P TDocument35 pagesForeign Exchange Market P P TsejalPas encore d'évaluation

- 5 6066639093691842662Document16 pages5 6066639093691842662rakaPas encore d'évaluation

- EcoMatrix KKDocument5 pagesEcoMatrix KKKunal KumarPas encore d'évaluation

- Providing Liquidity To The non-LIQUID Crypto Economy: Whitepaper Version 1.9 October 30, 2017Document73 pagesProviding Liquidity To The non-LIQUID Crypto Economy: Whitepaper Version 1.9 October 30, 2017Info CosmodotPas encore d'évaluation

- Kpop Dance Competition Smartfren ProposalDocument6 pagesKpop Dance Competition Smartfren ProposalSekar Nadya SiswokoPas encore d'évaluation

- Financial Planning For Individual InvestorDocument83 pagesFinancial Planning For Individual Investorrathodsantosh101100% (2)

- Robot Forex Nps (Non Profit Sharing) Information CenterDocument11 pagesRobot Forex Nps (Non Profit Sharing) Information CenterThomas CHATELPas encore d'évaluation

- Foreign Currency Transactions2019Document6 pagesForeign Currency Transactions2019Jeann MuycoPas encore d'évaluation