Académique Documents

Professionnel Documents

Culture Documents

FA 4 Chapter 4 - Q2

Transféré par

Vasant SriudomDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FA 4 Chapter 4 - Q2

Transféré par

Vasant SriudomDroits d'auteur :

Formats disponibles

Shot and Gun are two medium sized companies that want to amalgamate.

A new company named Shotgun is formed to acquire all the assets and liabilities of Shot and Gun. The authorised share capital of the new company is made up of 2,000,000 ordinary shares of RM1/each and 400,000 6% preference shares of RM1/- each. To register the new company RM50,000 ordinary shares are issued to the founders at par for cash. Given below are the balance sheets of Shot Bhd and Gun Bhd as at 31 December 2009 Shot RM 280,000 60,000 20,000 80,000 60,000 80,000 580,000 600,000 (100,000) 80,000 580,000 Gun RM 300,000 80,000 10,000 60,000 80,000 60,000 590,000 200,000 200,000 160,000 30,000 590,000

Land and building (cost) Plant and machinery (cost) Goodwill Current assets Inventories Trade receivables Bank

Ordinary shares of RM1/- each 10% preference shares of RM1/- each Profit and loss balance Trade payables

You are given the following information: It was agreed that: 1. The fair value of the assets is as follows: Shot RM 400,000 30,000 nil Book value Gun RM 500,000 40,000 70,000 Book value

Land and building Plant and machinery Goodwill Current assets

2. Fully paid ordinary shares in Shotgun to be issued to Shot to satisfy the ration. 3. Shot to be issued with 240,000 6% preference shares, and fully paid ordinary share at par in Shotgun. The preference shares issued by Shotgun are to be used to discharge the preference shareholders of Gun. 4. Both Shot and Gun are to be wound up. Liquidation expenses of RMI0,000 each for to be paid for by Shotgun.

Hak Milik Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

You are required to: a. Calculate the purchase price and state the consideration paid to Shot and Gun; b. Prepare ledger entries to close the books of Shot; c. Prepare journal entries to close the books of Gun; and d. Prepare the initial balance sheet of Shotgun. Answer a. Fair value of net assets acquired + Expenses incurred = Purchase price = Purchase consideration

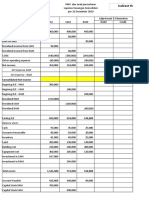

Net assets acquired: Shot RM Goodwill Land and building Plant and machinery Inventories Trade receivables Bank Trade payables Net assets at fair value = Purchase price 400,000 30,000 80,000 60,000 80,000 650,000 (80,000) 570,000 Gun RM 70,000 500,000 40,000 60,000 80,000 60,000 810,000 (30,000) 780,000 Total RM 70,000 900,000 70,000 140,000 140,000 140,000 1,460,000 (110,000) 1,350,000

Goodwill appearing in the individual books is ignored. A new value is adopted as per the agreement. Purchase consideration Shot RM 6% preference shares of RM1/- each Ordinary shares of RM1I- each Liquidation expenses Purchase price 560,000 10,000 570,000 Gun RM 240,000 530,000 10,000 780,000 Total RM 240,000 1,090,000 20,000 1,350,000

Hak Milik Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

Debit RM a. To record the purchase price Shotgun Realisation account (Being the agreed purchase price) b. Assets taken over Realisation account Goodwill Land and building Plant and machinery Inventories Trade receivables Bank (Being assets disposed off) c. Liabilities taken over Trade payable Realisation account (Being liabilities taken over by Shotgun) d. Realisation account Preference share capital Sundry members preference shareholders (Being amount payable to preference shareholders) e. Profit and loss account Ordinary share capital Sundry members ordinary shareholders (Being transfer of capital and reserve) f. Realisation Sundry members ordinary shareholders (Being profit on sale of business) g. Preference shares in Shotgun Ordinary shares in Shotgun Shotgun (Being purchase consideration received) h. Sundry members account preference shareholders Preference shares in Shotgun (Being settlement of amount due to preference shareholders) i. Sundry members account ordinary shareholders Ordinary shares in Shotgun (Being distribution of shares to ordinary shareholders) 770,000

Credit RM

770,000

590,000 10,000 300,000 80,000 60,000 80,000 60,000

30,000 30,000 40,000 200,000 240,000 160,000 200,000 360,000 170,000 170,000 240,000 530,000 770,000 240,000 240,000 530,000 530,000

Hak Milik Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

Goodwill Land and building Plant and machinery Inventories Trade receivables Bank Sundry members preference shareholders Sundry members account

Realization Account RM 10,000 Shotgun 300,000 Trade payable 80,000 60,000 80,000 60,000 40,000 170,000 800,000

RM 770,000 30,000

800,000

Realisation account

Shotgun RM 770,000 Shares in Shotgun - Preference shares Ordinary shares 770,000

RM 240,000 530,000 770,000

Share in Shotgun Preference shares Ordinary shares

Sundry Members Account Preference Ordinary RM RM Share capital 240,000 Profit and loss account 530,000 Realisation account 240,000 530,000

Preference RM 200,000

Ordinary RM 200,000 160,000 170,000 530,000

40,000 240,000

Liquidator Trade payables

Shot RM000 560 80

Bank- liquidation expenses

10 650

Business Purchase Gun RM000 770 Goodwill 30 Land and building Plant and machinery Inventories Receivables 10 Bank 810

Shot RM000 400 30 80 60 80 650

Gun RM000 70 500 40 60 80 60 810

Hak Milik Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

Shotgun Balance sheet as at 31 December 2009 RM Land and building Plant and machinery Goodwill (50,000 + 47,000) Current assets Inventories Trade receivables Bank Issued and paid up capital: 700,000 ordinary shares Share premium Profit and loss account Non-current liabilities 8% debentures Current liabilities Trade payables RM 600,000 150,000 97,000 847,000

100,000 120,000 28,000

248,000 1,095,000 700,000 125,000 100,000 925,000 120,000 50,000 1,095,000

Hak Milik Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

Vous aimerez peut-être aussi

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKD'EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKPas encore d'évaluation

- Series 6 Exam Study Guide 2022 + Test BankD'EverandSeries 6 Exam Study Guide 2022 + Test BankPas encore d'évaluation

- Unit 5-People Should Manage Nature-Ts-Planning Guide-Grade 5Document1 pageUnit 5-People Should Manage Nature-Ts-Planning Guide-Grade 5api-457240136Pas encore d'évaluation

- Consolidated Financial StatementDocument6 pagesConsolidated Financial StatementUdit RajPas encore d'évaluation

- Balance Sheet of Adani Power: - in Rs. Cr.Document7 pagesBalance Sheet of Adani Power: - in Rs. Cr.bpn89Pas encore d'évaluation

- The Definitive Guide On How To Build A High Status Social CircleDocument46 pagesThe Definitive Guide On How To Build A High Status Social CircleCecilia Teresa Grayeb SánchezPas encore d'évaluation

- Assigment Project Far450Document8 pagesAssigment Project Far450karlzelPas encore d'évaluation

- General Journal: Date Description DR CR (RS.) (RS.)Document8 pagesGeneral Journal: Date Description DR CR (RS.) (RS.)Sunny AhmadPas encore d'évaluation

- AcctsDocument63 pagesAcctskanchanthebest100% (1)

- FA 4 Chapter 3 - Q1Document3 pagesFA 4 Chapter 3 - Q1Vasant SriudomPas encore d'évaluation

- FA 4 Chapter 2 - Q4Document5 pagesFA 4 Chapter 2 - Q4Vasant SriudomPas encore d'évaluation

- Advance Financial Accounting Past Paper 2016 B Com Part 2Document5 pagesAdvance Financial Accounting Past Paper 2016 B Com Part 2dilbaz karimPas encore d'évaluation

- Fianl AccountsDocument10 pagesFianl AccountsVikram NaniPas encore d'évaluation

- 59 IpcccostingDocument5 pages59 Ipcccostingapi-206947225Pas encore d'évaluation

- FA 4 Chapter 2 - Q3Document5 pagesFA 4 Chapter 2 - Q3Vasant SriudomPas encore d'évaluation

- Conso Sofp - Chapter 10Document23 pagesConso Sofp - Chapter 10bibijamiatun08Pas encore d'évaluation

- Solution Corporate Reporting Strategy Nov 2008Document17 pagesSolution Corporate Reporting Strategy Nov 2008samuel_dwumfourPas encore d'évaluation

- AR and Inventory Management QuizDocument2 pagesAR and Inventory Management QuizSOEDIV OKPas encore d'évaluation

- Cpa Aditional CorlynDocument34 pagesCpa Aditional CorlynAlexaMarieAliboghaPas encore d'évaluation

- Tutorial 4 Questions (Chapter 4)Document4 pagesTutorial 4 Questions (Chapter 4)jiayiwang0221Pas encore d'évaluation

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsIrfanPas encore d'évaluation

- NumericalsDocument10 pagesNumericalsswapnil tiwariPas encore d'évaluation

- Gat Prin & Pract of Fin Acct Nov 2006Document10 pagesGat Prin & Pract of Fin Acct Nov 2006samuel_dwumfourPas encore d'évaluation

- Chapter Internal ReconstructionDocument4 pagesChapter Internal ReconstructionAnonymous mTZsMOjPas encore d'évaluation

- Final Account QuestionsDocument52 pagesFinal Account QuestionsAhmad Taimoor RanjhaPas encore d'évaluation

- Account Question 12Document5 pagesAccount Question 12Kapildev SubediPas encore d'évaluation

- AmalgamationDocument6 pagesAmalgamationSnehal ShahPas encore d'évaluation

- FA 4 Chapter 3 - Q2Document3 pagesFA 4 Chapter 3 - Q2Vasant SriudomPas encore d'évaluation

- Department of Business AdministrationDocument9 pagesDepartment of Business AdministrationKannan NagaPas encore d'évaluation

- College of The Immaculate ConceptionDocument6 pagesCollege of The Immaculate ConceptionDexter Saguyod ApolonioPas encore d'évaluation

- Mid-Semester Examination: (November 2010 Session)Document8 pagesMid-Semester Examination: (November 2010 Session)alicia darwinPas encore d'évaluation

- RTP Financial Reporting CapiiiDocument39 pagesRTP Financial Reporting CapiiiManoj ThapaliaPas encore d'évaluation

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocument25 pagesPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Advance AccountingDocument16 pagesAdvance AccountingMicro MaxxPas encore d'évaluation

- Indirect Holding 2Document8 pagesIndirect Holding 2Sella FriskaPas encore d'évaluation

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- BAC1634 - Tutorial 5 & 6 QDocument18 pagesBAC1634 - Tutorial 5 & 6 QLee Hau SenPas encore d'évaluation

- FA 4 Chapter 1 - AllDocument5 pagesFA 4 Chapter 1 - AllVasant SriudomPas encore d'évaluation

- Financial ReportingDocument7 pagesFinancial ReportingDivyesh TrivediPas encore d'évaluation

- Sanjay Industries Ltd. Balance Sheet and Income StatementDocument5 pagesSanjay Industries Ltd. Balance Sheet and Income Statementramki073033Pas encore d'évaluation

- Ca Ipcc May 2011 Qustion Paper 5Document11 pagesCa Ipcc May 2011 Qustion Paper 5Asim DasPas encore d'évaluation

- Business CombinationDocument4 pagesBusiness CombinationA001AADITYA MALIKPas encore d'évaluation

- Final Accounts QuestionDocument12 pagesFinal Accounts QuestionIndu Gupta33% (3)

- Buy Back of SharesDocument32 pagesBuy Back of SharesMehul SesodiyaPas encore d'évaluation

- Illustration 9: Balance Sheet Preparation: Less: DepreciationDocument2 pagesIllustration 9: Balance Sheet Preparation: Less: DepreciationMilton StevensPas encore d'évaluation

- Cost of Capital Part 4 - WACCDocument22 pagesCost of Capital Part 4 - WACCGowthami 20 MBAPas encore d'évaluation

- Comprehensive CasesDocument80 pagesComprehensive CasesAyush PurohitPas encore d'évaluation

- Auditing Problem For Shareholder's EquityDocument14 pagesAuditing Problem For Shareholder's Equityblack hudiePas encore d'évaluation

- FinAcc Vol. 3 Chap3 ProblemsDocument26 pagesFinAcc Vol. 3 Chap3 ProblemsGelynne Arceo33% (3)

- Appliances LTD January WORKING FILEDocument27 pagesAppliances LTD January WORKING FILEWaqarPas encore d'évaluation

- Sample Paper Class XII Subject-Accountancy Part ADocument5 pagesSample Paper Class XII Subject-Accountancy Part AKaran BhatnagarPas encore d'évaluation

- PTCL Accounts 2009 (Parent)Document48 pagesPTCL Accounts 2009 (Parent)Najam U SaharPas encore d'évaluation

- QuestionsDocument7 pagesQuestionsMyra RidPas encore d'évaluation

- FM 4Document4 pagesFM 4Elizabeth RayPas encore d'évaluation

- Problems On Cash Flow StatementsDocument12 pagesProblems On Cash Flow StatementsAnjali Mehta100% (1)

- Appendix Scanner Gr. I GreenDocument25 pagesAppendix Scanner Gr. I GreenMayank GoyalPas encore d'évaluation

- Astral: Audited Annual Financial Results and Dividend DeclarationDocument1 pageAstral: Audited Annual Financial Results and Dividend DeclarationKristi DuranPas encore d'évaluation

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryD'EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsD'EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsPas encore d'évaluation

- 21St Century Computer Solutions: A Manual Accounting SimulationD'Everand21St Century Computer Solutions: A Manual Accounting SimulationPas encore d'évaluation

- Bod Suad 3Document1 pageBod Suad 3Vasant SriudomPas encore d'évaluation

- Bod Suad 1Document17 pagesBod Suad 1Vasant SriudomPas encore d'évaluation

- Notes Chapter 1 FA 3Document5 pagesNotes Chapter 1 FA 3Vasant SriudomPas encore d'évaluation

- Bod Suad 4Document4 pagesBod Suad 4Vasant Sriudom0% (1)

- FA 4 Chapter 3 - Q4Document4 pagesFA 4 Chapter 3 - Q4Vasant SriudomPas encore d'évaluation

- FA 4 Chapter 3 - Q3Document2 pagesFA 4 Chapter 3 - Q3Vasant SriudomPas encore d'évaluation

- FA 4 Chapter 3 - Q2Document3 pagesFA 4 Chapter 3 - Q2Vasant SriudomPas encore d'évaluation

- FA 4 Chapter 3 - Q2Document3 pagesFA 4 Chapter 3 - Q2Vasant SriudomPas encore d'évaluation

- FA 4 Chapter 3 - Q3Document2 pagesFA 4 Chapter 3 - Q3Vasant SriudomPas encore d'évaluation

- Notes Chapter 1 FA 3Document5 pagesNotes Chapter 1 FA 3Vasant SriudomPas encore d'évaluation

- FA 4 Chapter 1 - AllDocument5 pagesFA 4 Chapter 1 - AllVasant SriudomPas encore d'évaluation

- FA 4 Chapter 2 - Q3Document5 pagesFA 4 Chapter 2 - Q3Vasant SriudomPas encore d'évaluation

- Presentation Audit - Legal LiabilityDocument29 pagesPresentation Audit - Legal LiabilityVasant Sriudom100% (1)

- Introduction of Resume: 1 © Hak Milik Sant Sahabat Dan Kawan-Kawan. Dibenarkan Untuk Tujuan Pembelajaran SahajaDocument18 pagesIntroduction of Resume: 1 © Hak Milik Sant Sahabat Dan Kawan-Kawan. Dibenarkan Untuk Tujuan Pembelajaran SahajaVasant SriudomPas encore d'évaluation

- Full Assignment Tax RPGTDocument19 pagesFull Assignment Tax RPGTVasant SriudomPas encore d'évaluation

- Soalan Assignment Tax Bab 7 Sem 6Document9 pagesSoalan Assignment Tax Bab 7 Sem 6Vasant SriudomPas encore d'évaluation

- Investigation Report 1Document3 pagesInvestigation Report 1Vasant SriudomPas encore d'évaluation

- Soalan Presentation FA 3Document12 pagesSoalan Presentation FA 3Vasant SriudomPas encore d'évaluation

- International Standard: Iso/Iec 7816-2Document16 pagesInternational Standard: Iso/Iec 7816-2Anwar MohamedPas encore d'évaluation

- Semi Formal Asking To Borrow BooksDocument75 pagesSemi Formal Asking To Borrow BooksPei Cheng WuPas encore d'évaluation

- Cutting Conics AsDocument3 pagesCutting Conics Asbabe09Pas encore d'évaluation

- GFN Cired PaperDocument8 pagesGFN Cired PaperSukant BhattacharyaPas encore d'évaluation

- Report Liquid Detergent BreezeDocument12 pagesReport Liquid Detergent BreezeDhiyyah Mardhiyyah100% (1)

- NTCC Project - Fake News and Its Impact On Indian Social Media UsersDocument41 pagesNTCC Project - Fake News and Its Impact On Indian Social Media UsersManan TrivediPas encore d'évaluation

- R820T Datasheet-Non R-20111130 UnlockedDocument26 pagesR820T Datasheet-Non R-20111130 UnlockedKonstantinos GoniadisPas encore d'évaluation

- Namma Kalvi 10th English Pta Model Question Papers 217163Document36 pagesNamma Kalvi 10th English Pta Model Question Papers 217163609001Pas encore d'évaluation

- Case For Overhead and DistributionDocument2 pagesCase For Overhead and DistributionBhargav D.S.Pas encore d'évaluation

- Assignment ProblemDocument3 pagesAssignment ProblemPrakash KumarPas encore d'évaluation

- Heat TreatmentDocument14 pagesHeat TreatmentAkhilesh KumarPas encore d'évaluation

- Tes - 29 October 2021 UserUploadNetDocument120 pagesTes - 29 October 2021 UserUploadNetTran Nhat QuangPas encore d'évaluation

- Department of Mechanical Engineering: Er. Nipesh RegmiDocument30 pagesDepartment of Mechanical Engineering: Er. Nipesh RegmiRosina AdhikariPas encore d'évaluation

- Science 10 FINAL Review 2014Document49 pagesScience 10 FINAL Review 2014Zara Zalaal [Student]Pas encore d'évaluation

- Lesson Plan 2 BasketballDocument3 pagesLesson Plan 2 Basketballapi-313716520100% (1)

- Hitachi VSP Pricelist PeppmDocument57 pagesHitachi VSP Pricelist PeppmBahman MirPas encore d'évaluation

- Lecture 3: Bode Plots: Prof. NiknejadDocument26 pagesLecture 3: Bode Plots: Prof. Niknejadselaroth168Pas encore d'évaluation

- Iecex Bas 13.0069XDocument4 pagesIecex Bas 13.0069XFrancesco_CPas encore d'évaluation

- CH 11 International TradeDocument20 pagesCH 11 International TradeSANTU GHORAIPas encore d'évaluation

- 1623 Asm2Document21 pages1623 Asm2Duc Anh nguyenPas encore d'évaluation

- Case AnalyzerDocument19 pagesCase AnalyzeranuragPas encore d'évaluation

- Sample Minutes of MeetingDocument3 pagesSample Minutes of MeetingMohamad AzmeerPas encore d'évaluation

- Seminar ReportDocument15 pagesSeminar ReportNipesh MAHARJANPas encore d'évaluation

- Parkinson Hoehn and Yahr ScaleDocument3 pagesParkinson Hoehn and Yahr ScaleCarol Artigas GómezPas encore d'évaluation

- WCDMA19 Prfile Descriptions W19P8 08A APPRDocument254 pagesWCDMA19 Prfile Descriptions W19P8 08A APPRoaguilar83Pas encore d'évaluation

- Building Interactive AppsDocument17 pagesBuilding Interactive AppsJRoman OrtizPas encore d'évaluation

- Nonlinear Robust Control of High-Speed Supercavitating Vehicle in The Vertical PlaneDocument10 pagesNonlinear Robust Control of High-Speed Supercavitating Vehicle in The Vertical Planesamsaptak ghoshPas encore d'évaluation

- GE2410 Student Booklet (UpdatedDec27)Document88 pagesGE2410 Student Booklet (UpdatedDec27)markhoPas encore d'évaluation