Académique Documents

Professionnel Documents

Culture Documents

NJTPC AG - Press7.25

Transféré par

greergirl20 évaluation0% ont trouvé ce document utile (0 vote)

26 vues1 pageBecause the evidence for massive destruction of the chain of title in residential mortgages is so compelling and costly to remedy, the State must not rush headlong into a quick settlement with banks, lenders, originators, or MBS pool sponsors that provides these players immunity. The State instead needs to act to protect the property rights of its citizens who are struggling to pay their mortgages, and whose title has been compromised through no fault of their own. The State also needs to reclaim potentially substantial filing fees and transfer taxes that were evaded.

NJ Tea Party Coalition urges NJ Attorney General Paula Dow NOT to sign on to global banking settlement. We calculated the revenue lost from banks who did not record assignments and pay transfer taxes. NJ may be owed $87 million filing fees; $6.8 billion transfer taxes; $3.6 billion Quiet Title Costs.

It is imperative that all bad actors in the massive fraud be held accountable. No seet-heart deals or immunity for executives who have plundered State Treasury, defrauded investors, clouded title on 60-80 million homes and illegally seized 5-7 million homes.

The truth must be told and the guilty punished.

Titre original

NJTPC_AG.Press7.25

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBecause the evidence for massive destruction of the chain of title in residential mortgages is so compelling and costly to remedy, the State must not rush headlong into a quick settlement with banks, lenders, originators, or MBS pool sponsors that provides these players immunity. The State instead needs to act to protect the property rights of its citizens who are struggling to pay their mortgages, and whose title has been compromised through no fault of their own. The State also needs to reclaim potentially substantial filing fees and transfer taxes that were evaded.

NJ Tea Party Coalition urges NJ Attorney General Paula Dow NOT to sign on to global banking settlement. We calculated the revenue lost from banks who did not record assignments and pay transfer taxes. NJ may be owed $87 million filing fees; $6.8 billion transfer taxes; $3.6 billion Quiet Title Costs.

It is imperative that all bad actors in the massive fraud be held accountable. No seet-heart deals or immunity for executives who have plundered State Treasury, defrauded investors, clouded title on 60-80 million homes and illegally seized 5-7 million homes.

The truth must be told and the guilty punished.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

26 vues1 pageNJTPC AG - Press7.25

Transféré par

greergirl2Because the evidence for massive destruction of the chain of title in residential mortgages is so compelling and costly to remedy, the State must not rush headlong into a quick settlement with banks, lenders, originators, or MBS pool sponsors that provides these players immunity. The State instead needs to act to protect the property rights of its citizens who are struggling to pay their mortgages, and whose title has been compromised through no fault of their own. The State also needs to reclaim potentially substantial filing fees and transfer taxes that were evaded.

NJ Tea Party Coalition urges NJ Attorney General Paula Dow NOT to sign on to global banking settlement. We calculated the revenue lost from banks who did not record assignments and pay transfer taxes. NJ may be owed $87 million filing fees; $6.8 billion transfer taxes; $3.6 billion Quiet Title Costs.

It is imperative that all bad actors in the massive fraud be held accountable. No seet-heart deals or immunity for executives who have plundered State Treasury, defrauded investors, clouded title on 60-80 million homes and illegally seized 5-7 million homes.

The truth must be told and the guilty punished.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

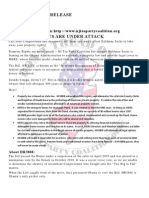

For Immediate Release: July 28 , 2011

Contact: njteapart ycoalition@yahoo .com; Visit us online at: www.njteapart ycoalition.org

NJ Tea Party Coalition

Urge NJ Attorney General to Reject Bank Settlement

NJ m ay be owed $87 million filing fees; $6.8 billion transfer taxes; $3.6 billion Quiet Title Costs The New Jersey Tea Party Coalition met with senior members of the NJ Attorney Generals office, urging them not to join the proposed settlement with nations largest banks. The settlement is being considered by most state Attorneys General. Because the evidence for massive destruction of the chain of title in residential mortgages is so compelling and costly to remedy, the State must not rush headlong into a quick settlement with banks, lenders, originators, or MBS pool sponsors that provides these players immunity. The State instead needs to act to protect the property rights of its citizens who are struggling to pay their mortgages, and whose title has been compromised through no fault of their own. The State also needs to reclaim potentially substantial filing fees and transfer taxes that were evaded. Published reports estimate New Jerseys share of the $20 billion settlement to be in the $50 million range, which is miniscule compared to the damage wrought. We urge New Jersey AG Dow to follow the example set by Massachusettss AG Martha Coakley and refuse any settlement until a forensic audit of mortgages in the State is conducted to obtain full extent of the economic damage to the State and home-owners. The fraud is so deep and the scope is so wide that waivers for criminal and civil charges are unacceptable. We are calling for AG Dow, New Jerseys Chief Law Enforcement Officer, to restore the rule of law and hold the banking executives who are defrauding investors, home-owners and the state accountable. John OBrien, Registrar of Deeds for Southern Essex District Registry, had a forensic audit conducted by McDonnell Analytics to measure the number of unrecorded assignments. The results were startling. Three-quarters (75%) of the assignments were never recorded, breaking the chain of title and depriving the county clerk of millions of dollars in lost fees. Bergen Countys housing market is mature and broadly similar to that of Essex County in Massachusetts, so we have estimated the lost revenue and the cost to reassert clear title based on their forensic audit results. We calculated the amounts owed based on the US Census data for total dwelling units (DUs), percent owner occupied, and median values for both New Jersey and Bergen County. We further applied the national average of 68% for owner-occupied homes mortgaged, the Southern Essex Co MA figure of 75% missing assignments, and an assumed two assignments per mortgage missing (or not recorded) based on the typical standard for securitization. We also assumed that assignments were one page (average $36/each statewide, and $43/each for Bergen County). The transfer tax is calculated on the median value statewide and for Bergen, using the states formula, and the tax owed depends on the assignments not recorded.

New J er sey 3,52 6,45 3 2,3 66 ,2 50 $35 6, 80 0 1,6 18 ,5 15 1,2 13 ,8 86 2 $87 ,1 57 ,0 31 $3 ,64 1, 65 8, 693 $2 ,80 0 6,7 97 ,7 62, 89 4 Ber gen 351, 463 238 ,2 92 $48 2, 40 0 162 ,9 92 122 ,2 44 2 $10 ,5 12 ,9 63 $36 6, 73 1, 256 $4 ,00 6 $97 9, 41 6, 940

DUs o w ner occu pied med ia n value % m ort ga ged % mi s si ng a ss ig n me nt s n o of a s si g nme n t s m is s in g fili n g fee s o wed quiet t it le c o st tr a n sfer tax tr a n sfer tax owe d 68 % 75 %

Vous aimerez peut-être aussi

- Comprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedD'EverandComprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedPas encore d'évaluation

- Mark Ratterman-Valuation - by - Comparison - Second - EditionDocument177 pagesMark Ratterman-Valuation - by - Comparison - Second - EditionTeresa Jackson100% (1)

- Contract of Lease for Makati City Condo UnitDocument5 pagesContract of Lease for Makati City Condo UnitDominique Therese Antonio75% (4)

- Removing The Administrator of An EstateDocument5 pagesRemoving The Administrator of An EstateKenneth Vercammen, Esq.Pas encore d'évaluation

- CCX Scandal, Chicago Carbon ExchangeDocument4 pagesCCX Scandal, Chicago Carbon ExchangeKim HedumPas encore d'évaluation

- Team One Mortgage Solutions: How We Accomplish This!Document6 pagesTeam One Mortgage Solutions: How We Accomplish This!Kelly HutchinsonPas encore d'évaluation

- Letter For Register of Deeds Version2Document3 pagesLetter For Register of Deeds Version2Senka1992100% (1)

- Forensic AuditDocument4 pagesForensic AuditScarlett Singleton RogerPas encore d'évaluation

- First Sarmiento Property HoldingsDocument2 pagesFirst Sarmiento Property HoldingsAngela Senora100% (1)

- Interest CertificateDocument1 pageInterest Certificatebhagyaraju64% (14)

- Corpo Case Digest FinalsDocument73 pagesCorpo Case Digest FinalsLouie SalazarPas encore d'évaluation

- Questionaire Mock Exam Final (h1)Document31 pagesQuestionaire Mock Exam Final (h1)Eks Wai100% (2)

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaPas encore d'évaluation

- Partnership Deed Yug Spa & SalonDocument8 pagesPartnership Deed Yug Spa & SalonSanjayThakkar0% (1)

- Contract Law IDocument28 pagesContract Law Irajeshmishra8888100% (5)

- Katigbak Vs - TAI HING CO - DigestDocument6 pagesKatigbak Vs - TAI HING CO - DigestJoseph MacalintalPas encore d'évaluation

- Foreclosure0815 PDFDocument8 pagesForeclosure0815 PDFNick ReismanPas encore d'évaluation

- Mortgage Settlement FundsDocument3 pagesMortgage Settlement FundsThe Council of State GovernmentsPas encore d'évaluation

- Affordability Crisis: New YorkDocument14 pagesAffordability Crisis: New YorkrkarlinPas encore d'évaluation

- 2-9-2012 Eric Schneiderman On The Foreclosure Settlement - TAKING CARE OF NEW YORKERSDocument4 pages2-9-2012 Eric Schneiderman On The Foreclosure Settlement - TAKING CARE OF NEW YORKERS83jjmackPas encore d'évaluation

- case study 2 - lane 1Document9 pagescase study 2 - lane 1api-737534119Pas encore d'évaluation

- Affordable Housing Application for Saddle BrookDocument5 pagesAffordable Housing Application for Saddle BrookyadyPas encore d'évaluation

- Foreclosure 11211Document8 pagesForeclosure 11211Nick ReismanPas encore d'évaluation

- Affordable Housing Application for ONE 500 in TeaneckDocument5 pagesAffordable Housing Application for ONE 500 in TeaneckyadyPas encore d'évaluation

- A Roadmap To BetterDocument16 pagesA Roadmap To BetterTexas Comptroller of Public AccountsPas encore d'évaluation

- Court Files $25B Mortgage SettlementDocument3 pagesCourt Files $25B Mortgage SettlementRazmik BoghossianPas encore d'évaluation

- Local Market Trends: The Real Estate ReportDocument4 pagesLocal Market Trends: The Real Estate ReportSusan StrousePas encore d'évaluation

- Local Market Trends: The Real Estate ReportDocument4 pagesLocal Market Trends: The Real Estate Reportsusan5458Pas encore d'évaluation

- Local Market Trends: The Real Estate ReportDocument4 pagesLocal Market Trends: The Real Estate ReportSusan StrousePas encore d'évaluation

- Executive Summary: Scope of Registry AuditDocument73 pagesExecutive Summary: Scope of Registry AuditR. Ethier100% (1)

- Town of Holden Beach: "Unofficial" Minutes & CommentsDocument17 pagesTown of Holden Beach: "Unofficial" Minutes & Commentscutty54Pas encore d'évaluation

- Negative Equity and Foreclosure: Theory and Evidence From MassachusettsDocument36 pagesNegative Equity and Foreclosure: Theory and Evidence From MassachusettsВафля СольPas encore d'évaluation

- 285519-35126-30-case-studyDocument12 pages285519-35126-30-case-studyapi-737834018Pas encore d'évaluation

- PR MortgageFraudDocument1 pagePR MortgageFraudgreergirl2Pas encore d'évaluation

- Buying A House Math 1030-1Document3 pagesBuying A House Math 1030-1api-341229603Pas encore d'évaluation

- 7.23.13 CED Report PDFDocument12 pages7.23.13 CED Report PDFRecordTrac - City of OaklandPas encore d'évaluation

- The Republic of Argentina Unsolicited Ratings Lowered To 'CCC+/C' On Increasing Legal Risks Outlook NegativeDocument7 pagesThe Republic of Argentina Unsolicited Ratings Lowered To 'CCC+/C' On Increasing Legal Risks Outlook Negativeapi-227433089Pas encore d'évaluation

- 2017 DAASNY Budget Letter Body CamsDocument9 pages2017 DAASNY Budget Letter Body CamsrkarlinPas encore d'évaluation

- May 2010 Charleston Market ReportDocument38 pagesMay 2010 Charleston Market ReportbrundbakenPas encore d'évaluation

- Education Reformers ShowDocument1 pageEducation Reformers ShowAlia MalikPas encore d'évaluation

- Property Tax Cap - 745pm PDFDocument16 pagesProperty Tax Cap - 745pm PDFjspectorPas encore d'évaluation

- AG Settlement TemplateDocument3 pagesAG Settlement Templatechunga85Pas encore d'évaluation

- Final Report Data Analysis Example 1 TemplateDocument9 pagesFinal Report Data Analysis Example 1 Template周姿馨Pas encore d'évaluation

- Senate Hearing, 111TH Congress - Current Trends in Foreclosures and What More Can Be Done To Prevent ThemDocument135 pagesSenate Hearing, 111TH Congress - Current Trends in Foreclosures and What More Can Be Done To Prevent ThemScribd Government DocsPas encore d'évaluation

- NJ Forensic Analysis SampleDocument77 pagesNJ Forensic Analysis Sampleagold73Pas encore d'évaluation

- Stegman (2007)Document23 pagesStegman (2007)ChinCeleryPas encore d'évaluation

- Buying A HouseDocument3 pagesBuying A Houseapi-242207683Pas encore d'évaluation

- Chase False Claim - 87,000 Homeowners Helped February 21, 2013Document1 pageChase False Claim - 87,000 Homeowners Helped February 21, 2013larry-612445Pas encore d'évaluation

- Chase False Claim - 87,000 Homeowners Helped February 21, 2013Document1 pageChase False Claim - 87,000 Homeowners Helped February 21, 2013larry-612445Pas encore d'évaluation

- Conway Release Aug 21Document4 pagesConway Release Aug 21mgreenPas encore d'évaluation

- Cutting RD Loan Assistance Devastating Blow To Affordable Housing in El PasoDocument16 pagesCutting RD Loan Assistance Devastating Blow To Affordable Housing in El PasoTedEscobedoPas encore d'évaluation

- CXC It Sba 2015Document6 pagesCXC It Sba 2015Wayne WrightPas encore d'évaluation

- SF Chronicle - Modified Mortgages - Lenders Talking, Then BalkingDocument5 pagesSF Chronicle - Modified Mortgages - Lenders Talking, Then BalkingTA WebsterPas encore d'évaluation

- The Impact of Foreclosure On San DiegoDocument12 pagesThe Impact of Foreclosure On San DiegoCPISanDiegoPas encore d'évaluation

- Underwood To Denerstein Letter 1.13.14Document15 pagesUnderwood To Denerstein Letter 1.13.14Casey SeilerPas encore d'évaluation

- Finance AssignmentDocument3 pagesFinance Assignmentapi-289243802Pas encore d'évaluation

- Racial Inequalities in Property TaxationDocument83 pagesRacial Inequalities in Property TaxationMichaelRomainPas encore d'évaluation

- Goodwin, Shepard & Sloan, Police BrutalityDocument40 pagesGoodwin, Shepard & Sloan, Police BrutalityGJMO100% (1)

- SSRN-Stabilize Housing Market and All Will FollowDocument3 pagesSSRN-Stabilize Housing Market and All Will FollowMartin AndelmanPas encore d'évaluation

- John Berlau - The 400 Percent LoanDocument7 pagesJohn Berlau - The 400 Percent LoanCompetitive Enterprise InstitutePas encore d'évaluation

- Complaint 122209Document6 pagesComplaint 122209Edward WernerPas encore d'évaluation

- States Fall Short On Help For HousingDocument14 pagesStates Fall Short On Help For HousingForeclosure FraudPas encore d'évaluation

- 11 24 2018 Scana and Sceg Settle Class Action LawsuitDocument3 pages11 24 2018 Scana and Sceg Settle Class Action LawsuitAnonymous APOdqtnGcK100% (1)

- Article - Realty Trac ErrorsDocument2 pagesArticle - Realty Trac Errorshklahr2385Pas encore d'évaluation

- 3-6 CertiorarisDocument4 pages3-6 Certiorarisapi-261762676Pas encore d'évaluation

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransD'EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransPas encore d'évaluation

- Perpetuating American Greatness After the Fiscal Cliff: Jump Starting Gdp Growth, Tax Fairness and Improved Government RegulationD'EverandPerpetuating American Greatness After the Fiscal Cliff: Jump Starting Gdp Growth, Tax Fairness and Improved Government RegulationPas encore d'évaluation

- The King Takes Your Castle: City Laws That Restrict Your Property RightsD'EverandThe King Takes Your Castle: City Laws That Restrict Your Property RightsPas encore d'évaluation

- Hiding in Plain Sight - Jesinoski and The Consumer-S Right of RescDocument19 pagesHiding in Plain Sight - Jesinoski and The Consumer-S Right of Rescgreergirl2Pas encore d'évaluation

- Who's Your Lender? What Amount Do You Really OweDocument19 pagesWho's Your Lender? What Amount Do You Really Owegreergirl2Pas encore d'évaluation

- Mortgage Securitization: What Was Supposed To HappenDocument5 pagesMortgage Securitization: What Was Supposed To Happengreergirl2Pas encore d'évaluation

- MERS Eregistry Legal OpinionDocument8 pagesMERS Eregistry Legal Opiniongreergirl2Pas encore d'évaluation

- Mortgage Fraud - AG v2Document21 pagesMortgage Fraud - AG v2greergirl2100% (1)

- Mortgage Flow.3Document5 pagesMortgage Flow.3greergirl2Pas encore d'évaluation

- Mortgage Fraud - AG v2Document21 pagesMortgage Fraud - AG v2greergirl2100% (1)

- NJTPC HR3808.PRDocument2 pagesNJTPC HR3808.PRgreergirl2Pas encore d'évaluation

- Mortgage Fraud FinalDocument20 pagesMortgage Fraud Finalgreergirl2Pas encore d'évaluation

- NJTPC HR3808.PRDocument2 pagesNJTPC HR3808.PRgreergirl2Pas encore d'évaluation

- PR MortgageFraudDocument1 pagePR MortgageFraudgreergirl2Pas encore d'évaluation

- Cash Flow Statement Disclosures A Study of Banking Companies in Bangladesh.Document18 pagesCash Flow Statement Disclosures A Study of Banking Companies in Bangladesh.MD. REZAYA RABBIPas encore d'évaluation

- Glaski - Appellant's Reply Brief-1Document22 pagesGlaski - Appellant's Reply Brief-183jjmackPas encore d'évaluation

- National Bank of Pakistan LimitedDocument22 pagesNational Bank of Pakistan Limitedrani_pscs641350% (4)

- Property Cases TITLE IIDocument294 pagesProperty Cases TITLE IIflilanPas encore d'évaluation

- Federal Home Loan Mortgage Corporation (Freddie Mac) (Form - 8-k)Document3 pagesFederal Home Loan Mortgage Corporation (Freddie Mac) (Form - 8-k)Foreclosure FraudPas encore d'évaluation

- Basics of Credit Ratings and AnalysisDocument8 pagesBasics of Credit Ratings and AnalysisPavan ValishettyPas encore d'évaluation

- Stock Statement FormatDocument9 pagesStock Statement FormatArpan Goel0% (1)

- Influence of Microfinance On Small Business Development in Namakkal District, TamilnaduDocument5 pagesInfluence of Microfinance On Small Business Development in Namakkal District, Tamilnaduarcherselevators100% (1)

- Gloria Zaiger ReportDocument6 pagesGloria Zaiger Reporttheracefor64bPas encore d'évaluation

- 1907 Notes Receivable and Loan ImpairmentDocument4 pages1907 Notes Receivable and Loan ImpairmentCykee Hanna Quizo Lumongsod100% (2)

- HDFC - Customer Satisfaction in New Generation BanksDocument10 pagesHDFC - Customer Satisfaction in New Generation Banksupendra89Pas encore d'évaluation

- Econ 601 f14 Workshop 5 Answer Key PDFDocument7 pagesEcon 601 f14 Workshop 5 Answer Key PDFюрий локтионовPas encore d'évaluation

- Land Titling and Administration Best PracticesDocument26 pagesLand Titling and Administration Best PracticeskinshuksPas encore d'évaluation

- Article 1206Document2 pagesArticle 1206CG WitchyPas encore d'évaluation

- Annexure I: Service Charges for Large/Mid AdvancesDocument11 pagesAnnexure I: Service Charges for Large/Mid AdvancesBharat ChatrathPas encore d'évaluation

- Collocation HouseDocument3 pagesCollocation HouseMinh KhoaPas encore d'évaluation

- Equitable Mortgage UpheldDocument1 pageEquitable Mortgage UpheldabbywinsterPas encore d'évaluation

- 7 - Pure and Conditional Obligations (1) Classification of ObligationsDocument4 pages7 - Pure and Conditional Obligations (1) Classification of Obligationskeuliseutel chaPas encore d'évaluation

- Financial StressDocument26 pagesFinancial StressHannah NovioPas encore d'évaluation