Académique Documents

Professionnel Documents

Culture Documents

Internal Audit Manual

Transféré par

Anshul TyagiDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Internal Audit Manual

Transféré par

Anshul TyagiDroits d'auteur :

Formats disponibles

PRIVATE & CONFIDENTIAL

FOR INTERNAL CIRCULATION ONLY

INTERNAL AUDIT MANUAL ANDREW YULE & CO. LIMITED

INTETRNAL AUDIT MANUAL 1. INTRODUCTION 1.1 The concept of Internal Audit has drastically changed from a system of mere checking the arithmetical accuracy of accounting data as in former days to a system of appraisal of the effectiveness of accounting, financial and other operations and controls as an aid to Management to achieve its goals of maximising production a nd profits. 1.2 By constant review and appraisal of the workings of the systems and procedures introduced, Internal Audit enables Management to control and utilise widespread resources properly. It acts as eyes and ears of Management in implementing its plans and decisions since most Management decisions have financial implications on the Company's affairs. 1.3 It is meant to be an effective means for the rapid and simultaneous observation of multiple events and transient situations which, properly assembled, can give a reliable guide to the well-being of an organization, an advance warning of undesirable trends and an indication of corrective action. 1.4 The main purpose of having an Internal Audit System in an organisation is to verify and review the activities of all cost centres so as to assist them in seeing that the assets of the business are properly protected and accounted for, that current transactions are promptly and completely recorded, that faulty, inefficient or fradulent operations are revealed and that the business is adequately protected against waste, fraud and loss. The purpose of this form of control is to assure early detection and rectification of errors to minimise their recurrence in future, to achieve economy in expenditure and all-round efficiency. It ensures that various rules and procedures laid down by the Management are actually followed and acted upon by all the cost centres. 1.5 In view of the amendment of the Companies Act with a social audit concept in India, it has become a statutory obligation on the part of a Company having a paid-up capital of Rs. 25 lakhs and above to have an Internal Audit System as the Statutory Auditors are required to comment upon the size end soundness of the Internal Audit System of the Company. Statutory Auditors and Govt. Auditors rely much upon an efficient and effective system of Internal Audit during the course of audit of the Company. 1.6 With growing complexities and inter-relation of activities between various agencies, modern industries allover the world have realised the pressing need to have Internal Audit to help the Management at all levels in controlling the activities in the right direction.

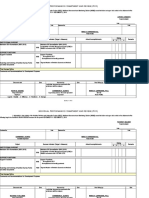

1.7 It is distinct from Statutory Audit as well as Govt. Audit. Statutory Audit is conducted by Auditors appointed under the Companies Act on behalf of shareholders of a Company and Govt. Audit is conducted by the Comptroller & Auditor General of India on behalf of the President of India where as Internal Audit is a part of the organisation and functions under the overall direction and control of its Management / Board and primarily responsible to it. 1.8 The function of Internal Audit in reviewing, appraising and reporting on established administrative policies, plans and procedures of the Company as an aid / assistance does not, however, in any way relieve the department / unit / tea estate / person concerned of responsibilities assigned to it / him. 2. ORGANISATIONAL STRUCTURE 2.1 The Internal Audit Department is under the overall charge of the General Manager (Inte rnal Audit) / Chief Internal Auditor who is responsible directly to the Chairman of the Company. He functions under the Director (Finance) through the Financial Controller. 2.2 Internal Audit Department - Organisational Structure of the Centralised Department of Andrew Yule & Co. Ltd. General Manager (Internal Audit) / Chief Internal Auditor

Sr. Manager (internal Audit) (vacant at present)

4 Asst. Managers (1 vacancy at present)

IAE

IAE

IAE

IAE

IAE

IAE

IAE

IAE

IAE means Internal Audit Executive.

2.3 The Internal Audit Department shall conduct audits of departments / units / tea estates of the Company and its subsidiaries as well as its Branches / Offices and / or Associate Companies as per direction of Chairman through Director (Finance) and / or Financial Controller.

3.

SCOPE & FUNCTIONS 3.1 The scope of Internal Audit is very wide and cannot be laid down precisely. However, broadly Internal Audit is concerned with any phase of business activity which can be the basis of service to Management. 3.2 Internal Audit can focus the factors responsible for loss, failure or inefficiency so that they are rectified immediately, if possible, or measures can be taken to avoid their recurrence in future. 3.3 The main duties and functions of Internal Audit, inter alia, are broadly classified as under : i) Systems Audit ii) Operational Audit including Efficiency Audit iii) Management Audit 3.4 Since Internal Audit is a Management tool, its object is to assist the Management at various levels by providing it in time with objective analysis, appraisals, pertinent comments and recommendations in respect of the Company's affairs to enable the Management to take timely remedial action. Simplification of procedures, setting up of effective and efficient co-ordination between departments, gearing up of internal controls, cost reduction by minimisation of wastages in various operations, revenue augmentation by proper inventory controls and maximum utilisation of machines, materials and manpower are same of the areas where Internal Audit can assist Management. 3.5.1 Systems Audit : Ensuring that the rules and procedures as laid down by the Company from time to time are properly understood, correctly interpreted and complied with by the concerned personnel of the departments/units/tea estates of the Company is Systems Audit. The audit involves verification as to whether each deportment/unit/tea estate is maintaining proper records and having a reasonable system of recording receipts, issues end consumption of materials and stores and the system provides for proper allocation of the materials consumed, man hours spent and overheads incurred to the relative jobs. Improvements over the existing procedures need also be suggested, whenever necessary. When a change in the system is felt, only general recommendations should be indicated leaving the detailed system to the concerned departments / unit's / tea estate's personnel. 3.5.2 Operational Audit including Efficiency Audit : The functions of operational audit is to ensure that Management controls are functioning effectively and efficiently in all the business activities of the Company and all the operations are in

tune with its objectives. This audit includes review of organisational structure, manufacturing processes, production planning and scheduling, adherence to prescribed technicalities in purchasing and other functions as apply to Govt. Companies to bring about overall efficiency. Audit examines that the broad and accepted principles of commercial accounting and practice have been consistently followed and any deviation from them is properly authorised and disclosed in the relevant statements. It sees that all transactions carried out are authorised and substantiated by proper vouchers / documents. 3.5.3 Management Audit : It is basically an audit of Management's policies and the Department's / Unit's / Tea Estate's adherence to the same, its performance and efficiency and measuring of the profitability and productivity of capital invested. The main function of Management Audit is to review the efficiency or otherwise of all operations and see that the affairs of the Company are conducted on healthy lines. Other important areas in which this type of audit is applied are inventory controls, investment planning and decision making, optimum utilization of capacity and reduction and control of various costs and the like. 3.6 For conducting audit effectively and efficiently, the Internal Audit Department shall study thoroughly the systems and procedures followed by the company's various departments, units And tea estates and their nature of work before commencing the audit. As the extent and type of checks to be applied In audit depend largely upon the nature of operations carried out, study of these systems and operations is of prime importance. The existing departmental checks / controls need also to be studied for the purpose and it should be ensured that they are adequate enough to bring to light any errors and frauds automatically in the normal course of carrying out operations in different departments / units / tea estates. 3.7 The General Manager (Internal Audit) / Chief Internal Auditor would keep proper record of all the decisions of the Board / Management and relevant Govt. Notifications etc. 3.8 For discharging the above functions, Internal Audit Department shall have full and free access to all departmental / Unit's / Tea Estate's records including those considered confidential and copies of minutes of Board Meetings, Management Committee Meetings, Management Circulars, Management Decisions and Orders, Govt. Circulars and Orders. Important orders/circulars/procedures issued by the Management find various Govt. departments shall invariably be endorsed to the General Manager (Internal Audit) / Chief Internal Auditor. Copies of all queries raised by Statutory / Govt. Auditors shall also be endorsed to Internal Audit. Confidential records / documents shall, however, be examined by the General Manager (Internal Audit) / Chief Internal Auditor only.

4. INTERNAL AUDIT PROCEDURE 4.1 As the operations and records to be audited era multifarious and varied in nature, it is not possible to lay down within the frame of this manual a comprehensive set of instructions / procedures for carrying out the audit. However, relevant instructions / procedures for carrying out audit will be issued from time to time to Internal Audit personnel by the General Manager (Internal Audit) / Chief Internal Auditor, depending on the nature of each assignment. 4.2 Internal Audit is usually conducted by means of test checks of items selected on the basis of random sampling or on percentage basis or specified monetary limits that may be decided upon from time to time depending on the situation. The degree of test checks may be varied according to the findings of audit. If audit reveals more irregularities, checking /verification will be strengthened. Audit coverage of all departments / units / tea estates and transactions is subject to availability of Audit personnel. 4.3 The extent of examination of individual transactions would depend upon the system of controls in each department/unit/tea estate and its operation in practice and the measures instituted by Management for the protection of Company's properties / interest. In case these controls and measures are working effectively, a test chock of the records may be resorted to instead of detailed checking. However, depending upon each case, past experience and Statutory and Govt. Auditors observa tions, audit may be carried out either in depth or by test checking. 5. AUDIT PROGRAMME & REPORTS 5.1 For conducting internal audit effectively and systematically, a programme of audit for a year will be prepared well in advance and got duly approved by the Chairman. The Internal Audit Year normally commences on 1st July and ends on 30th June. This may be changed as and when found necessary. For drawing up such annual internal audit programme, the available working days in such internal audit year would be worked out. From this, privilege leave days (at present, 30 days) and an estimated number of days for sick leave (at present estimated at 10 days) would be deducted. The net figure of working days would be multiplied by the number of executives in the Internal Audit Dept. to arrive at the man days available in the Internal Audit Year. 10% of this would be set aside for contingencies and the balance man days would be allocated over suitable number of jobs to cover areas in each of the Departments / Units / Tea Estates in such a manner that over a period of 3 years all areas of each Dept. / Unit / Tea Estate would be covered in audit at least once. For conducting outstation audits, transit time would have to be provided. 5.2 Care should be taken while drafting the programme to include all important areas for review, and depending upon the strength of the Audit personnel, as many departments / units / tea estates as possible should be covered in the audit programme. To minimise objection of Statutory / Govt. Auditors on the Company's

accounts, their previous observations and objections should be kept in view while preparing the programme. 5.3 The audit work will be allotted among the Internal Audit personnel by the General Manager (Internal Audit) / Chief Internal Auditor. Internal Audit Department, as far as practicable, should adhere to the approved programme. Any deviation from the approved annual audit programme found necessary will be made with the concurrence of the Chairman, Director (finance) / Financial Controller. 5.4 Normally prior intimation of the probable dates of audit would be sent to the concerned Chief Executive / General Manager / Superintendent and operational heads of departments / units / tea estates so that they can give necessary instructions to relevant officers to make available the requisite documents, files and records for audit. However, in cases where the audit is to be conducted by surprise or urgently on the instructions of Management, prior notice is not necessary. 5.5 The following procedure should normally be followed by the Internal Audit Department for clearing the audit queries and drafting the final reports : a) As far as possible, the queries arising during course of audit would be discussed personally by the Internal Audit personnel working on the respective assignments with the concerned department/unit/tea estate and settled then and there. b) Where a query is of such nature which requires further investigation by the concerned department / unit / tea estate and thus cannot be replied immediately, an audit memo would be issued which invariably is to be replied by the auditee department / unit / tea estate within 7 days of the receipt of the memo. This time span should not be exceeded unless special circumstances warrant more time which will be mutually agreed upon between the audittee department / unit / tea estate and the Internal Audit personnel. c) If any matter requires immediate attention and cannot wait till the final report, then the same shall, after obtaining comments from the Chief Executive / General Manager / Superintendent and operational heads of the department / unit / tea estate, be reported in the form of a progress / interim report. d) When the audit of a particular department/unit/tea estate is concluded, the Internal Audit personnel who conducted the audit will put up to the General Manager (Internal Audit) / Chief Internal Auditor through Senior Manager (Internal Audit) a draft report on audit findings using the time earmarked in each job for the same. Normally this will be done within 7 days of completion of the audit. Matters which require further enquiry and / or discussion shall be deferred for inclusion in a supple mentary report, or if necessary, shall be deferred for next visit of Internal Audit to the department / unit / tea estate.

Such draft report will be forwarded to the respective Chief Executive / General Manager / Superintendent by the General Manager (Internal Audit) / Chief Internal Auditor and within 10 days of the date of receipt of the same, comments shall have to be given by the respective Chief Executive / General Manager / Superintendent and / or by the operational heads of the departments / units / tea estates or a discussion shall be held on the draft report, minutes of which shall be drawn up, signed and dated. In the case of outstation audits (Tea Estates and Branches), 21 days will be given from the date of despatch (to take care of the transit time etc.) for comments to be received by Audit. If within 10 days or 21 days, as the case may be, comments are not obtained / discussion is not held, the General Manager (Internal Audit) / Chief Internal Auditor will finalise the report on the basis of audit findings in the draft stage. Comments of the Chief Executive / General Manager / Superintendent and / or operational heads of departments / units / tea estates, if subsequently received, shall be given due cognisance in the follow-up on the report. e) Should the Chief Executive / General Manager / Superintendent and operational heads of the departments / units / tea estates hold any views which are net in consonance with the Internal Audit findings and / or feel that further clarification is to be given, the matter may be referred by them to the Chairman with a copy to the General Manager (Internal Audit) / Chief Internal Auditor for Chairman's final disposal. f) The final report in which will be incorporated the outcome of comments / discussion referred in (d) above shall be submitted by the General Manager (Internal Audit) / Chief Internal Auditor to the respective Chief Executive / General Manager / Superintendent and operational heads of the departments / units / tea estates with a copy to the Chairman, Director (Finance) and Financial Controller highlighting the final results of audit. g) In order to make the audit report more clear and simple, and to convey what exactly it intends to convey and serve a useful purpose, the following main points should be borne in mind while drafting audit reports : i. Report must be simple and brief but comprehensive ; ii. It should contain appropriate headings ; iii. In the report will be incorporated all irregularities & objections which have not been replied or replied unsatisfactorily and those replied satisfactorily but have financial implications which were found during personal discussions or as per memos issued ; iv. Where Audit is satisfied with its findings on examination of any area during the course of a particular audit assignment, mention will be made of the same in the report ;

v. The matter shall be presented according to significance i.e. most important points will be highlighted; vi. Suggestions, where necessary, shall be given by Internal Audit ; vii. The report shall be timely ; viii. Where possible, a summary of corrective action to be taken would be submitted along with the report; h) It is the responsibility of Chief Executive / General Manager / Superintendent and operational heads of the departments / units / tea estates to give adequate consideration of, and take effective action on audit findings and recommendations. The respective Chief Executive / General Manager / Superintendent / the operational heads of the departments / units / tea estates are normally required to implement the accepted suggestions within 3 months (90 days) of the date of receipt of the final report. The time span should not be exceeded and all efforts/ steps shall be taken by the operational heads of the auditee departments / units / tea estates to maintain the target date for implementation. Should some special circumstances or matter beyond one's control arise, extension of time shall be sought in writing clearly indicating the reasons and a revised date of implementation be given. i) Internal Audit will assess the implementation of accepted suggestions of the final report during its next visit to the department / unit / tea estate. In case the accepted suggestions are not implemented within the time span of 3 months or the revised date, as the case may be, the same shall be reported to the Chairman by General Manager (Internal Audit) / Chief Internal Auditor with copies to Director (Finance) and Financial Controller through periodical reports. 5.6 The remarks or observations if any of the Chairman / Director (Finance) / Financial Controller on the final audit report will be communicated to the concerned Chief Executive / General Manager / Superintendent and operational heads of the concerned departments / units / tea estates for information and necessary corrective action under intimation to the General Manager (Internal Audit) / Chief Internal Auditor. 6.1 The General Manager (Internal Audit) / Chief Internal Auditor is expected to maintain evidence of work done by him and his internal audit teams by means of well designed working sheets or notes containing, inter alia, the nature of work done, the extent of checking done, names of individuals who have carried out the work with their initials, details of various important points observed, important queries raised in the course of audit and the clarifications obtained.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- StandardsDocument6 pagesStandardssikandar kumarPas encore d'évaluation

- 1-02 Leadership Impact For The Execution of Project Towards SustainableDocument75 pages1-02 Leadership Impact For The Execution of Project Towards SustainableAssfaw FeredePas encore d'évaluation

- Beyond Diversity Training - A Social Infusion For Cultural InclusionDocument20 pagesBeyond Diversity Training - A Social Infusion For Cultural InclusionJACKSON MEDDOWSPas encore d'évaluation

- Week 2 - An Introduction To IMCDocument54 pagesWeek 2 - An Introduction To IMC11 ChiaPas encore d'évaluation

- In-House Training Program BrochureDocument1 pageIn-House Training Program BrochureCFE International Consultancy GroupPas encore d'évaluation

- Sriram KesavanDocument4 pagesSriram KesavanvarunPas encore d'évaluation

- NCM 107Document264 pagesNCM 107Jyra Mae TaganasPas encore d'évaluation

- Organizational Development PDFDocument1 pageOrganizational Development PDFMohammed Razwin K P0% (1)

- Cost Results and FindingsDocument5 pagesCost Results and FindingsRomlan Akman DuranoPas encore d'évaluation

- MGMT Ad MCQ 2ndDocument10 pagesMGMT Ad MCQ 2ndHiraya ManawariPas encore d'évaluation

- Recruitment and Selection Process of Wipro: Done by Allen Ritz 16-UBU-160 3 Year Bba - B SecDocument10 pagesRecruitment and Selection Process of Wipro: Done by Allen Ritz 16-UBU-160 3 Year Bba - B SecRenu AshwinPas encore d'évaluation

- Resume Himanshu JaimanDocument3 pagesResume Himanshu JaimanHimanshu JaimanPas encore d'évaluation

- Advertising and Integrated Brand Promotion 8th Edition Oguinn Test BankDocument41 pagesAdvertising and Integrated Brand Promotion 8th Edition Oguinn Test Banklilykeva56r100% (37)

- Maintenance Management: Assignment - 2Document2 pagesMaintenance Management: Assignment - 2Deepak KumarPas encore d'évaluation

- Client Acceptance: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 5Document20 pagesClient Acceptance: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 5Tenesha ReynoldsPas encore d'évaluation

- Final Placement Report - Aug 22Document59 pagesFinal Placement Report - Aug 22Sahil SarodePas encore d'évaluation

- Assessing HR Programmes:: UNIT-06 Creating HR ScorecardDocument9 pagesAssessing HR Programmes:: UNIT-06 Creating HR ScorecardAppu SpecialPas encore d'évaluation

- ACI Pharmaceuticals LimitedDocument19 pagesACI Pharmaceuticals LimitedMAJORAFSOSPas encore d'évaluation

- Financial ControllershipDocument21 pagesFinancial ControllershipInnah MayPas encore d'évaluation

- Complaint Management policy-AMBULANCEDocument20 pagesComplaint Management policy-AMBULANCEgenzizuPas encore d'évaluation

- LeanIX Whitepaper Nine Key Use Cases Solved With EADocument15 pagesLeanIX Whitepaper Nine Key Use Cases Solved With EAEduardo ManchegoPas encore d'évaluation

- Chapter 3 PDFDocument11 pagesChapter 3 PDFAnonymous HUovc6ROH100% (2)

- Software Life Cycle Process Models: Pradeep TomarDocument31 pagesSoftware Life Cycle Process Models: Pradeep Tomartushar umraoPas encore d'évaluation

- Manufacturing Overhead Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMDocument5 pagesManufacturing Overhead Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMJacob ChinyokaPas encore d'évaluation

- Culturally Competent School-GuidelinesDocument6 pagesCulturally Competent School-GuidelinesClaire Aguinaldo BeronillaPas encore d'évaluation

- Midterm Strategy FormulationDocument17 pagesMidterm Strategy FormulationEricca Joyce AndradaPas encore d'évaluation

- The Management Process PlanningDocument19 pagesThe Management Process PlanningHowardPas encore d'évaluation

- Individual Performance Commitment and Review (Ipcr)Document4 pagesIndividual Performance Commitment and Review (Ipcr)Lorvin CrisantoPas encore d'évaluation

- PMP Application SpreadsheetDocument50 pagesPMP Application SpreadsheetaangelbrightPas encore d'évaluation

- PSWDocument1 pagePSWIonut EduardPas encore d'évaluation