Académique Documents

Professionnel Documents

Culture Documents

FX Weekly Commentary Aug 14 - Aug 20 2011 Elite Global Trading

Transféré par

James PutraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FX Weekly Commentary Aug 14 - Aug 20 2011 Elite Global Trading

Transféré par

James PutraDroits d'auteur :

Formats disponibles

Aug 14th Aug 20th 2011

Volume 1, Issue 15

Elite Global Trading

Forex Weekly Commentary

Fundamental Outlook

day In these volatile markets with pressure coming off the US for now. Keep any eye in the Swiss Franc on a possibility target band or peg, so range may become tight in all CHF pairs, keep an eye on the data out of Switzerland, for all CHF pairs will be affected.

In this issue: USDCHF AUDUSD NZDUSD GBPCHF GBPUSD GBPJPY EURUSD EURJPY EURCHF Event Risk Contact Info Disclaimer 6 5 4 3 1 2

An economic outlook for the week with eyes on Spain and Italy debt and French CDS over the next few weeks in the Eurozone. In the US TIC on Monday some important numbers and Thursday is a big day for US data. The past few weeks have been extremely volatile with a calmer week ahead can be expected with no very critical data compared to the past few weeks. The change in focus happens day to

United States Dollar / Swiss Franc

USDCHF: The Swiss Franc reached a extreme high last week and has shown a strong weekly reversal in all its pairs. With mixed USD data this week expected to come out, this pair had a strong reversal weekly bar last week and is expected to continue its move towards major resistance at .8285 before it makes another move downwards following its long-term trend Bearish. A pullback is expected before this pair continues its bull move. Recommendation: Short term bullish, wait for pullback to enter this pair on the long and careful of congestion. A pullback to .7800 and .7730 is expected prior to long continuing. A further move down brings support at .7670, .7590 and .7490. Congestion is probable for this pair so be careful for what to expect with the moves when entering. Resistance on upside is at .7915, .7954, .8030 .8140. +

Aug 14th Aug 20th 2011

Volume 1, Issue 15

Elite Global Trading

Australian Dollar / United States Dollar

AUDUSD: Last week this pair reached a low of .9925. Last week the low happened on Tuesday and the week closed with the entire short move being retraced close to where the open was of the week. This gives us a weekly reversal candle that may indicate that the low of .9925 is in place for the month and a look higher is likely or congestion in current monthly range to the high of 1.1060. With this wide range to play in we have some levels to play both on long and short side. Current picture indicates to a move higher for the beginning of week. With RBA coming out with their Monetary Policy Meeting Min on Monday, current outlook shows that they may be looking to lower rates, if this is the case a bearish opportunity may present itself. A move towards 1.0500 is likely within the next 24 hours prior to event. Recommendation: Neutral, Monday evening will give us a stronger picture of the week after RBA comes out with their min, if a dovish outlook for economy then we will likely see a move lower, other wise we may see a move to higher resistance levels at 1.0500, 1.0680 and 1.0700. Support sits at 1.0366, 1.0250 1.0200 1.0110. Looking for plays on both long and short side.

New Zealand Dollar (Kiwi) / United States Dollar

NZDUSD: This pair has the same weekly bar from last week as the AUDUSD, also this pair came off its all time highs the previous week giving this pair a range of over 900 pips for the month. With last weeks weekly bar showing a doji, a move higher is probable for this pair as well. A move to .8400 and .8500 is very probable to start this week off, a pullback towards .8300 can be expected prior to the move up to these resistance levels. The only news on the docket this week to watch for is on Tuesday at 6:45pm, PPI, which is expected to be weaker which may turn this pair back to a short play to support levels. Recommendation: Neutral, Look higher to start the week off towards .8400-.8500 and stronger resistance at .8650 area. With Tuesday's numbers most likely weaker a move lower is probable and a short down to support may present itself. Support sits at .8308, .8280, .8214, .8170 and .8100. a break their will bring the low of .7960 into play.

UK Pound Sterling / Swiss Franc

GBPCHF: The Swiss Franc reached a extreme high last week and has shown a strong weekly reversal in all its pairs. The GBPCHF is coming off its all time low at 1.1459 last Tuesday and has driven to its most recent high at 1.2885 to start this week off. A test of some higher levels is likely before this pair goes back to its long term bearish bias. A pull back towards 1.2550 is likely prior to this bull move continues. Recommendation: Short Term Bullish Bias, looking for pull back towards 127.00-125.50, topside resistance levels to watch for where major resistance may be is at 1.3080 a break here will push towards 1.3160 1.3260 and 1.3300. With the strong 4 day recovery up to these highs a recovery pullback is expected prior to these resistance levels being tested. Support sits at 1.2770 1.2650 and 1.2549. If the 1.3080 level holds on upside a look to the short side may come into play. Take into consideration this pair has moved up from low of 1400 pips inside 3 days, which is indicative of an impulsive move.

Aug 14th Aug 20th 2011

Volume 1, Issue 15

Elite Global Trading

UK Pound Sterling / United States Dollar

GBPUSD: This pair has an economic focus on Tuesday with expected CPI numbers to come out with an increase which may push this pair higher with hopes the UK will raise rates sooner then later. With this months low sitting at 1.6100 and high at 1.6475 we are looking at a possible push higher from current levels to test 1.6475 again, but with the UK still standing firm with holding rates and most likely not to give an hint of when they will make a move the top of 1.6475 may stand strong and a new low may be more likely. Wednesday is the meeting min and most likely when a bear move will present itself. Recommendation: Neutral with a possibility on the long side prior to Wednesday, but with the UK meeting min on Wednesday morning, likely to continue the dovish outlook which will drive this pair lower, exposing a short opportunity to the lows. Highly probable for the pair to test highs at beginning of week and make a move lower after Wednesday. Economic outlook does not look strong enough to break highs.

UK Pound Sterling / Japanese Yen

GBPJPY: This pair similar to EURJPY with the BOJ possibility of intervention, if this were to happen this pair will also surge higher. Current outlook for this pair is lower to new lows. With the Pounds CPI numbers out Tuesday most likely giving strength to GBP pairs, this pair most likely to break higher to start week off, but will not last with weak outlook from UK on Wednesday. So look for some upward movement to start this week off in this pair but by Wednesday tops to be created and look to the bear side. Now this is subject to change based on BOJ to intervene, like I said before which would make this pair surge to highs above the 130s. Recommendation: Long term picture is Bearish, a move to resistance levels to start week off is expected, 126.20, 126.60 and strong resistance at 127.00 area. A break of these levels will most likely come from a BOJ intervention, if this does not happen then a push lower is likely after these levels are tested. Most likely a shift to bear side will come after Wednesday, which is when UK will give its rate outlook.

Aug 14th Aug 20th 2011

Volume 1, Issue 15

Elite Global Trading

Euro / United States Dollar

EURUSD: This pair has been in congestion between a low of 1.4050 and a high of 1.4450 for a few weeks now looking for a direction. Current pattern is a descending triangle with the top of triangle around 1.4430 and bottom around 1.4150. As we come closer to the apex of the triangle we are likely to see a break into a direction giving us a clearer picture of which way the trend will go. With the stability of the euro zone to be uncertain a bearish outlook from an economic standpoint stands strong. This week we have GDP numbers on Tuesday expected to show shrinking economic outlook in Germany, and CPI numbers on Wednesday. These two events are the focus of the week regarding economic data. A rally to the highs is likely to start the week off. Recommendation: Bearish Bias for longer term picture. Highest probability play will be on the short side after rally to top of downward trend line around 1.4330-1.4400. In order for a break up above those numbers we will need to see some economic support with a weaker USD dollar or a strong EUR. On the short side within the triangle we have support at 1.4201, 1.4150, a break below will be driven from an economic event and will most likely push to retest 1.4050 and 1.4000, a break lower will bring 1.3950 and 1.3840 into sight. On top side we have 1.4315, 1.4366, 1.4400 and 1.4450 as resistance. A break above this resistance will most likely happen with support from an economic event which does not look probable this week.

Euro / Japanese Yen

EURJPY: This pair is coming off its low last week of 108.00 from the high of April at 123.30. With the BOJ looking to step in to weaken it's currency we may start to see a further recovery up in the weeks to come. The current trend on this pair is Bearish from a longer term view. The long plays are currently limited until we get further confirmation. The short plays need to be played with caution to the BOJ and their interest to intervene on its currency the YEN. If an intervention happens the pair will certainly make a sharp move higher. Recommendation: Bearish Bias, step a side on the short plays until we get confirmation that the BOJ will NOT intervene anymore. Only play here will be bull plays which are still early and dangerous, depending on your entries and exits. Support at 109.48, 109.24, 108.80 108.40 and low at 108.00. Resistance on upside is 110.30, 110.70, 111.10 and 111.40. Currently waiting for pull back prior to entry on long side. Unless we get strength in the EURO this week to break higher, or the BOJ intervenes on the YEN to push this pair up, the upside may be capped and another push lower may occur and can not be ruled out.

Aug 14th Aug 20th 2011

Volume 1, Issue 15

Elite Global Trading

Euro / Swiss Franc

EURCHF: The Swiss Franc reached a extreme high last week and has shown a strong weekly reversal in all its pairs. With the EUR in a tight range now we may see the EURCHF pair make small move higher and start to congest in current range. A strong resistance level on the upside is 1.1653, below this we are looking at a long term bearish bias. This pair as the other CHF pairs has a weekly reversal bar from last week indicating a possible direction change, which may give this pair a look higher. Prior to going higher a pullback is expected towards 1.1150-1.1080. Congestion can be expected with this pair, so small moves on bull or bear can be made, favoring short term bull moves, need to keep in mind the longer term is still bearish on all CHF pairs except CHFJPY and need to keep that in mind on the profit side when in a long position. This pair has a range of 1400pips this month giving opportunity to both the bull and bear side, keep in mind the strengthof the CHF and an economic changes for the SWISS FRANC.

Recommendation: Short term bullish bias with taking in consideration the long term Bear outlook. Looking for a pullback to occur towards 1.1150-1.1080. Possible entry on the bull side taking into consideration the levels on the way up and strength in the move. A reversal sign to short side will give a longer term play to some lows, with support at 1.0978, 1.0828, 1.0680 and 1.0537.

Weeks Event Risk

Monday: USD: TIC Long Term Purchases 9am AUD: Monetary Policy Meeting Min 9:30pm Thursday: Tuesday: EUR: German CPI 2am GDP: CPI 4:30am EUR: Flash GDP 5am USD: Building Permits 8:30am USD: Capacity Utilization 9:15am NZD: PPI Output 6:45pm Friday: EUR: German PPI 2am Wednesday: EUR: Current Account 4am GBP: MPC Meeting Min 4:30am EUR: CPI/Core CPI 5am GBP: Public Sector Borrowing 4:30am CAD: Core CPI 8:30am GBP: Retail Sales 4:30am USD: Core CPI 8:30am USD: Unemployment Claims 8:30am USD: Existing Home Sales 10am USD: Philly Fed Manufacturing Index 10am USD: PPI 8:30am JPY: Trade Balance

Elite Global Trading

News letter Authors: Anthony Rousseau

arousseau@eliteglobaltrader.com

Follow the latest company and market information at the links below:

www.eliteglobaltrader.com Www.Twitter.com/elitepipmaker Www.Facebook.com/eliteglobaltrading Www.linkedin.com/company/elite-global-trading

James Putra

jputra@eliteglobaltrader.com

Tel: 786-759-0348 E-mail:

info@eliteglobaltrader.com

The Premier Algorithmic Trading Technology Firm

Elite Global Trading

Disclaimer

The information contained in this newsletter is for general information purposes only. The information is provided by Elite Global Trading and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the newsletter or the information, products, services, or related graphics contained on the newsletter for any purpose.

Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this newsletter.

** Keep a close eye on US Debt Ceiling Vote, Tuesday & Wednesday

Vous aimerez peut-être aussi

- FX Weekly Commentary Aug 21 - Aug 27 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary Aug 21 - Aug 27 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary - Aug 28 - Sep 03 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Aug 28 - Sep 03 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly - Sep 4 - Sep 10 2011Document5 pagesFX Weekly - Sep 4 - Sep 10 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - Oct 30 - Nov 05 2011Document5 pagesFX Weekly Commentary - Oct 30 - Nov 05 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - Sep 11 - Sep 17 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Sep 11 - Sep 17 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary June 12 - June 18 2011Document1 pageFX Weekly Commentary June 12 - June 18 2011James PutraPas encore d'évaluation

- FX Weekly Commentary July 3-9 2011Document4 pagesFX Weekly Commentary July 3-9 2011James PutraPas encore d'évaluation

- FX Weekly July 10 - 16 2011 Elite Global TradingDocument4 pagesFX Weekly July 10 - 16 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary - Sep 18 - Sep 24 2011Document5 pagesFX Weekly Commentary - Sep 18 - Sep 24 2011James PutraPas encore d'évaluation

- FX Weekly Commentary June 5-10 2011Document1 pageFX Weekly Commentary June 5-10 2011James PutraPas encore d'évaluation

- FX Weekly Commentary July 17 - July 23 2011 - Elite Global TradingDocument4 pagesFX Weekly Commentary July 17 - July 23 2011 - Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary July 24 - July 30 2011 - Elite Global TradingDocument4 pagesFX Weekly Commentary July 24 - July 30 2011 - Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary - Nov 06 - Nov 12 2011Document5 pagesFX Weekly Commentary - Nov 06 - Nov 12 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - Oct 9 - Oct 15 2011Document5 pagesFX Weekly Commentary - Oct 9 - Oct 15 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary - Nov 13 - Nov 19 2011Document5 pagesFX Weekly Commentary - Nov 13 - Nov 19 2011James PutraPas encore d'évaluation

- FX Weekly Commentary June 26 - July 2 2011Document1 pageFX Weekly Commentary June 26 - July 2 2011James PutraPas encore d'évaluation

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Forex Market Report 25 July 2011Document4 pagesForex Market Report 25 July 2011International Business Times AUPas encore d'évaluation

- Forex Market Insight 15 June 2011Document3 pagesForex Market Insight 15 June 2011International Business Times AUPas encore d'évaluation

- Strategic Technical Themes: Weekly Outlook and Technical HighlightsDocument36 pagesStrategic Technical Themes: Weekly Outlook and Technical HighlightstimurrsPas encore d'évaluation

- Forex Market Report 26 July 2011Document4 pagesForex Market Report 26 July 2011International Business Times AUPas encore d'évaluation

- Paul Gallacher, Technical Analysis, November 3Document64 pagesPaul Gallacher, Technical Analysis, November 3api-87733769Pas encore d'évaluation

- Daily Markets UpdateDocument38 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Strategic Technical Themes: Weekly Outlook and Technical HighlightsDocument35 pagesStrategic Technical Themes: Weekly Outlook and Technical HighlightstimurrsPas encore d'évaluation

- U.S. Dollar vs. Indian RupeeDocument4 pagesU.S. Dollar vs. Indian RupeeVinoth RokzPas encore d'évaluation

- Not An Oracle 1Document7 pagesNot An Oracle 1abanceritPas encore d'évaluation

- Jul 16 DJ Charting EuropeDocument2 pagesJul 16 DJ Charting EuropeMiir ViirPas encore d'évaluation

- Big Picture by FMaggioniDocument7 pagesBig Picture by FMaggioniFrancesco MaggioniPas encore d'évaluation

- File 1 SiteDocument1 pageFile 1 Siteapi-320651226Pas encore d'évaluation

- Daily Technical Analysis Report 20/october/2015Document14 pagesDaily Technical Analysis Report 20/october/2015Seven Star FX LimitedPas encore d'évaluation

- Global Macro Roundup & Preview (26 July, 2017)Document8 pagesGlobal Macro Roundup & Preview (26 July, 2017)ahmadfz1Pas encore d'évaluation

- Daily Technical Analysis Report 23/october/2015Document14 pagesDaily Technical Analysis Report 23/october/2015Seven Star FX LimitedPas encore d'évaluation

- Weekly Markets UpdateDocument33 pagesWeekly Markets Updateapi-25889552Pas encore d'évaluation

- GBP/USD Technical Analysis: Key Support and Resistance LevelsDocument2 pagesGBP/USD Technical Analysis: Key Support and Resistance LevelsPayal GoyalPas encore d'évaluation

- 2011 12 06 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 06 Migbank Daily Technical Analysis ReportmigbankPas encore d'évaluation

- Faros Morning Update 081110Document1 pageFaros Morning Update 081110api-31029184Pas encore d'évaluation

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Forex Weekly UpdateDocument4 pagesForex Weekly Updatemyisis2uPas encore d'évaluation

- Daily FX Technical Strategy: Chart of The Day: AUD OutperformsDocument4 pagesDaily FX Technical Strategy: Chart of The Day: AUD OutperformsGlobalStrategyPas encore d'évaluation

- G10 FX Roadmap: Strategic ViewsDocument7 pagesG10 FX Roadmap: Strategic ViewsParab ElhencePas encore d'évaluation

- Edition 25 - Chartered 4th March 2011Document8 pagesEdition 25 - Chartered 4th March 2011Joel HewishPas encore d'évaluation

- GBPUSDDocument10 pagesGBPUSDjunemrsPas encore d'évaluation

- EUR poised to recover, DXY pullback | Trading plans Jan 2023Document14 pagesEUR poised to recover, DXY pullback | Trading plans Jan 2023Hồng NgọcPas encore d'évaluation

- Daily Markets UpdateDocument32 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Forex Market Insight 10 June 2011Document3 pagesForex Market Insight 10 June 2011International Business Times AUPas encore d'évaluation

- Edition 26 - Chartered 17th March 2011Document7 pagesEdition 26 - Chartered 17th March 2011Joel HewishPas encore d'évaluation

- Forex Market Insight 09 June 2011Document3 pagesForex Market Insight 09 June 2011International Business Times AUPas encore d'évaluation

- May 24 DJ Charting ForexDocument4 pagesMay 24 DJ Charting ForexMiir ViirPas encore d'évaluation

- Faros Morning Update 082510Document1 pageFaros Morning Update 082510api-31029184Pas encore d'évaluation

- Daily Markets UpdateDocument28 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- FX 20140417Document2 pagesFX 20140417eliforuPas encore d'évaluation

- 2011 12 05 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 05 Migbank Daily Technical Analysis ReportmigbankPas encore d'évaluation

- May-28-Dj Asia Daily Forex OutlookDocument3 pagesMay-28-Dj Asia Daily Forex OutlookMiir ViirPas encore d'évaluation

- Daily Markets UpdateDocument34 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Jul-22-Dj Asia Daily Forex OutlookDocument3 pagesJul-22-Dj Asia Daily Forex OutlookMiir ViirPas encore d'évaluation

- Top Trading Opportunities 2017Document35 pagesTop Trading Opportunities 2017Max KennedyPas encore d'évaluation

- 16 Mars 2010Document31 pages16 Mars 2010api-25889552Pas encore d'évaluation

- Jul-26-Dj Asia Daily Forex OutlookDocument3 pagesJul-26-Dj Asia Daily Forex OutlookMiir ViirPas encore d'évaluation

- FX Weekly - Jan 22 - Jan 28 2012Document5 pagesFX Weekly - Jan 22 - Jan 28 2012James PutraPas encore d'évaluation

- FX Weekly Commentary - Nov 13 - Nov 19 2011Document5 pagesFX Weekly Commentary - Nov 13 - Nov 19 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - Oct 16 - Oct 22 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Oct 16 - Oct 22 2011 Elite Global TradingJames Putra100% (1)

- FX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary - Sep 18 - Sep 24 2011Document5 pagesFX Weekly Commentary - Sep 18 - Sep 24 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - Nov 06 - Nov 12 2011Document5 pagesFX Weekly Commentary - Nov 06 - Nov 12 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - Oct 23 - Oct 29 2011Document5 pagesFX Weekly Commentary - Oct 23 - Oct 29 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - Oct 9 - Oct 15 2011Document5 pagesFX Weekly Commentary - Oct 9 - Oct 15 2011James PutraPas encore d'évaluation

- FX Weekly Commentary Aug 7 - Aug 13 2011 - Elite Global TradingDocument5 pagesFX Weekly Commentary Aug 7 - Aug 13 2011 - Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary - Oct 2 - Oct 8 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Oct 2 - Oct 8 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary July 24 - July 30 2011 - Elite Global TradingDocument4 pagesFX Weekly Commentary July 24 - July 30 2011 - Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary July 17 - July 23 2011 - Elite Global TradingDocument4 pagesFX Weekly Commentary July 17 - July 23 2011 - Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary July 31 - Aug 6 2011 - Elite Global TradingDocument5 pagesFX Weekly Commentary July 31 - Aug 6 2011 - Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly July 10 - 16 2011 Elite Global TradingDocument4 pagesFX Weekly July 10 - 16 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary June 12 - June 18 2011Document1 pageFX Weekly Commentary June 12 - June 18 2011James PutraPas encore d'évaluation

- FX Weekly Commentary June 26 - July 2 2011Document1 pageFX Weekly Commentary June 26 - July 2 2011James PutraPas encore d'évaluation

- FX Weekly Commentary July 3-9 2011Document4 pagesFX Weekly Commentary July 3-9 2011James PutraPas encore d'évaluation

- FX Weekly Commentary May 29 - June 3 2011Document1 pageFX Weekly Commentary May 29 - June 3 2011James PutraPas encore d'évaluation

- FX Weekly Commentary June 5-10 2011Document1 pageFX Weekly Commentary June 5-10 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - May 5 2011Document1 pageFX Weekly Commentary - May 5 2011James PutraPas encore d'évaluation

- FX Weekly Commentary - May 15 2011Document1 pageFX Weekly Commentary - May 15 2011James PutraPas encore d'évaluation

- FX Weekly Commentary May 23-27 2011Document1 pageFX Weekly Commentary May 23-27 2011James PutraPas encore d'évaluation

- Display Kit GuideDocument9 pagesDisplay Kit GuidemfabianiPas encore d'évaluation

- Homework 7 Traffic Accident Data AnalysisDocument5 pagesHomework 7 Traffic Accident Data AnalysisRagini P0% (1)

- Understanding Value at Risk with F&S Investments PortfolioDocument16 pagesUnderstanding Value at Risk with F&S Investments Portfolio7aadkhan100% (2)

- Brightspot Training ManualDocument97 pagesBrightspot Training ManualWCPO 9 NewsPas encore d'évaluation

- 1 ComplaintDocument6 pages1 ComplaintIvy PazPas encore d'évaluation

- 4geeks Academy FullDocument20 pages4geeks Academy Fulljohanmulyadi007Pas encore d'évaluation

- ERP ImplementationDocument47 pagesERP Implementationattarjaved100% (1)

- Access User GuideDocument49 pagesAccess User GuideShivaji JagdalePas encore d'évaluation

- 1 s2.0 S1350630720317192 MainDocument16 pages1 s2.0 S1350630720317192 MainmaximPas encore d'évaluation

- NFL 101 Breaking Down The Basics of 2-Man CoverageDocument10 pagesNFL 101 Breaking Down The Basics of 2-Man Coveragecoachmark285Pas encore d'évaluation

- Biju Patnaik University of Technology MCA SyllabusDocument18 pagesBiju Patnaik University of Technology MCA SyllabusAshutosh MahapatraPas encore d'évaluation

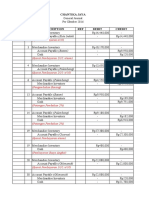

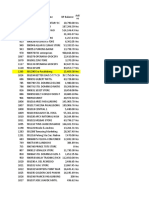

- PT Amar Sejahtera General LedgerDocument6 pagesPT Amar Sejahtera General LedgerRiska GintingPas encore d'évaluation

- Course 1 Introduction To SIMS: Student Information Management System (SIMS) Office of The RegistrarDocument28 pagesCourse 1 Introduction To SIMS: Student Information Management System (SIMS) Office of The RegistrarWeijia WangPas encore d'évaluation

- Hydro Skimming Margins Vs Cracking MarginsDocument78 pagesHydro Skimming Margins Vs Cracking MarginsWon Jang100% (1)

- Political Internet Memes On Corruption Issue Surrounding The Philippine Health Insurance CorporationDocument9 pagesPolitical Internet Memes On Corruption Issue Surrounding The Philippine Health Insurance CorporationFeline Joy SarinopiaPas encore d'évaluation

- Material Safety Data Sheet "Cut Back Bitumen": Section 1: Product and Company IdentificationDocument4 pagesMaterial Safety Data Sheet "Cut Back Bitumen": Section 1: Product and Company IdentificationPecel LelePas encore d'évaluation

- Sreeja.T: SR Hadoop DeveloperDocument7 pagesSreeja.T: SR Hadoop DeveloperAnonymous Kf8Nw5TmzGPas encore d'évaluation

- Module 1 - Segunda Parte - Key To Activities - 1Document7 pagesModule 1 - Segunda Parte - Key To Activities - 1Elias GallardoPas encore d'évaluation

- DRS User ManualDocument52 pagesDRS User Manualwmp8611024213100% (1)

- OBURE Understanding How Reits Market WorksDocument3 pagesOBURE Understanding How Reits Market WorksJohn evansPas encore d'évaluation

- Data Sheet Sylomer SR 28 ENDocument4 pagesData Sheet Sylomer SR 28 ENlpczyfansPas encore d'évaluation

- Tinbridge Hill Overlook Final PlansDocument22 pagesTinbridge Hill Overlook Final PlansEzra HercykPas encore d'évaluation

- Erasmo WongDocument3 pagesErasmo WongGabriel GutierrezPas encore d'évaluation

- 947 - Apperntiship Adani Airport - 31-08-2023Document2 pages947 - Apperntiship Adani Airport - 31-08-2023Deep PatelPas encore d'évaluation

- Forces and Motion Chapter ExplainedDocument11 pagesForces and Motion Chapter ExplainedMaridjan WiwahaPas encore d'évaluation

- Appraising and Managing PerformanceDocument20 pagesAppraising and Managing PerformanceAnushkar ChauhanPas encore d'évaluation

- Approved Term of Payment For Updating Lower LagunaDocument50 pagesApproved Term of Payment For Updating Lower LagunaSadasfd SdsadsaPas encore d'évaluation

- Page 34-45 BLK PicDocument12 pagesPage 34-45 BLK PicMihir MehraPas encore d'évaluation

- North Imenti Agents UpdatedDocument15 pagesNorth Imenti Agents UpdatedMuriira AntonyPas encore d'évaluation

- Mazda2 Brochure August 2009Document36 pagesMazda2 Brochure August 2009Shamsul Zahuri JohariPas encore d'évaluation