Académique Documents

Professionnel Documents

Culture Documents

Husband of Americans For Prosperity Ohio Rep Rebecca Heimlich: "Forget Patriotism" (August 15, 2011)

Transféré par

ommozojDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Husband of Americans For Prosperity Ohio Rep Rebecca Heimlich: "Forget Patriotism" (August 15, 2011)

Transféré par

ommozojDroits d'auteur :

Formats disponibles

Subject: Forget Patriotism From: Phil Heimlich <philheimlich@routecauses.

com> Date: Mon, 15 Aug 2011 09:05:22 -0400 (EDT)

FEATURED VIDEOS

Protect Your Family From the Financial Crisis To Come

Preparing For The Coming Crash

Phil shares his testimony at a prayer breakfast

Is God a Conservative? (Short)

Is God a Conservative? (Full Length)

Im going to give you some financial advice. Here are my qualifications: none no Ph.D. in economics, no Nobel Prize, no leading government position. But the people with degrees in finance, teaching positions at Princeton and seats on the Federal Reserve Board led us astray or at least failed to protect us. Former Fed Chairman Alan Greenspan, once referred to as the maestro, kept interest rates artificially low, thus precipitating the real estate crash. Ben Bernanke, the current head, didnt have a clue about the bubble in housing prices, the risk in subprime mortgages or the collapse of derivatives. N.Y. Times columnist Paul Krugman, perhaps todays leading economic pundit, believes that more government borrowing and printing of money is the answer; which is ridiculous enough that even a guy with no academic credentials can recognize it. Im like you: somebody with a couple of IRAs who wants to survive (and even prosper). So heres my advice: forget patriotism. The government is $62 trillion in debt when you include the national debt, along with Medicare, Social Security and Medicaid commitments. The conservatives/Tea Party, etc. say this can be paid off by cutting spending, without tax increases. The liberals recognize the need to raise taxes but arent willing to cut the entitlements driving the country into bankruptcy. If you trust either side to reduce the deficit and balance the budget, then keep your assets in the usual investments. Presidential candidates always like to say Americas greatness is ahead of us. I disagree I think its behind us. Historically, governments that have run up this kind of debt the Roman Empire, post WWI Germany, among others end up printing money and imploding in a bout of hyperinflation.

Our nations success in World War II and the Cold War was due as much to our economic strength as our character. If China pulls the plug on loaning us dollars to keep the nation afloat, our currency will collapse, which means the U.S. wont have the means to pay for defense, welfare or anything else. Those who survive will be those who own foreign currencies, precious metals and other assets whose values arent dependent on policies out of Washington. I remember a course in law school called Law and Economics. The professor described something called the Lifeboat theory. Essentially it says that if the ship is going down, you better recognize it and get into the lifeboats because not everyone will make it. Thats why Im putting my retirement accounts in gold, real estate and foreign stocks. Maybe its unpatriotic, but Im more interested in protecting my family than in trusting Congress or the President to resolve the debt crisis.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Managerial EconomicsDocument15 pagesManagerial EconomicsDaniel KerandiPas encore d'évaluation

- Demand of Money: A Presentation by Sahil MirDocument14 pagesDemand of Money: A Presentation by Sahil MirSahil MirPas encore d'évaluation

- The International Lender of Last ResortDocument28 pagesThe International Lender of Last ResortchalikanoPas encore d'évaluation

- Small Inflation Model of Mongolia (Simom)Document28 pagesSmall Inflation Model of Mongolia (Simom)Baigalmaa NyamtserenPas encore d'évaluation

- 24-Measuring Cost of LivingDocument55 pages24-Measuring Cost of LivingEnrico Jovian S SPas encore d'évaluation

- Econjn-0060-PremCh 11 (24) Measuring The Cost of LivingDocument30 pagesEconjn-0060-PremCh 11 (24) Measuring The Cost of LivingLauren SerafiniPas encore d'évaluation

- International Fisher Effect and Exchange Rate ForecastingDocument12 pagesInternational Fisher Effect and Exchange Rate ForecastingRunail harisPas encore d'évaluation

- Basic Finance CH 8 - Financial SystemDocument28 pagesBasic Finance CH 8 - Financial SystemNicole AlegerPas encore d'évaluation

- Governance of The Bank: Liquidity ManagementDocument1 pageGovernance of The Bank: Liquidity ManagementJerald-Edz Tam AbonPas encore d'évaluation

- Inflation in PakistanDocument24 pagesInflation in PakistanTabish KhanPas encore d'évaluation

- Ch29 Chapter Answers AidDocument9 pagesCh29 Chapter Answers AidAshura ShaibPas encore d'évaluation

- Measure To Control InflationDocument16 pagesMeasure To Control InflationSneha Sharma100% (1)

- Financial MarketsDocument32 pagesFinancial MarketsArief Kurniawan100% (1)

- Introduction To Introduction To Introduction To Introduction To Monetary Accounts Monetary Accounts YyDocument30 pagesIntroduction To Introduction To Introduction To Introduction To Monetary Accounts Monetary Accounts YyHaris HandyPas encore d'évaluation

- Chapter 2 Topic 3 Discount Inflation and TaxDocument9 pagesChapter 2 Topic 3 Discount Inflation and TaxJoash Normie DuldulaoPas encore d'évaluation

- Adaptive Expectations HypothesisDocument5 pagesAdaptive Expectations Hypothesisz_k_j_vPas encore d'évaluation

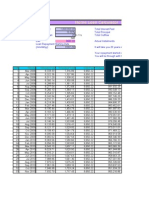

- Home Loan Repayment ScheduleDocument30 pagesHome Loan Repayment ScheduleN Rakesh100% (1)

- M1, M2,, M3 Money and BankingDocument6 pagesM1, M2,, M3 Money and BankingKhalil Ullah100% (1)

- 90 Fa 5 D 62071 D 65 C 8Document23 pages90 Fa 5 D 62071 D 65 C 8racha saPas encore d'évaluation

- Exchange Rate Regimes PDFDocument241 pagesExchange Rate Regimes PDFctijerinPas encore d'évaluation

- Amortization ChartDocument4 pagesAmortization ChartwkuserPas encore d'évaluation

- Fiscal Policy Monetary Policy Lesson PlanDocument24 pagesFiscal Policy Monetary Policy Lesson PlanZemona Sumallo0% (1)

- Ize y Yeyati (2003) - Financial DollarizationDocument25 pagesIze y Yeyati (2003) - Financial DollarizationEduardo MartinezPas encore d'évaluation

- An Idiots Guide To Central BankingDocument2 pagesAn Idiots Guide To Central BankingAsif AmeerPas encore d'évaluation

- Monetary Policy in ItalyDocument4 pagesMonetary Policy in Italygshah_20Pas encore d'évaluation

- Assignment 231 Engg EconomyDocument1 pageAssignment 231 Engg EconomyKristavilla OlavianoPas encore d'évaluation

- Simple InterestDocument8 pagesSimple Interestsathish14singhPas encore d'évaluation

- G11 Formative 2: (43 Marks)Document3 pagesG11 Formative 2: (43 Marks)Joshua MishaelPas encore d'évaluation

- Calculate CPI, inflation rates, and exchange ratesDocument8 pagesCalculate CPI, inflation rates, and exchange ratesNguyễn Long VũPas encore d'évaluation

- Macroeconomics - Quiz 1 KeyDocument5 pagesMacroeconomics - Quiz 1 KeykharismaPas encore d'évaluation