Académique Documents

Professionnel Documents

Culture Documents

Smep Brochure

Transféré par

Peter ChegeDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Smep Brochure

Transféré par

Peter ChegeDroits d'auteur :

Formats disponibles

OTHER LOANS School Fees Loan Booster Loan for special business orders Household Loan for home

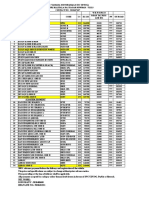

home beautification Asset Financing LOAN TERM Repayment period for working capital loans are for a maximum of two years repayable monthly through MPESA or in group meetings. FEES / CHARGES We levy a reasonable service charge for all loans advanced to our clients. HOW TO ACCESS SMEP LOAN PRODUCTS Potential clients who need access to SMEP loans must be members of a group that meet regularly. The group sizes vary from 15 to 30 people who are in a similar economic condition and enjoy mutual trust and confidence. These groups must be registered with the relevant government ministries. SMEP facilitates the formation of these groups. For urban clients who need high initial working capital, groups of 10 people can be considered. For individual clients, they just need to demonstrate an ability to repay the loan. A thorough loan appraisal will be undertaken and an agreeable collateral (security) is required. WAY FORWARD The company is currently exploiting marketing opportunities for agricultural produce for its clients to address the problem of market linkages. The organization is currently in transition from Credit-only to deposit taking microfinance institution under the Kenyan Microfinance Act 2006.

NAIROBI REGION

RIFT VALLEY REGION

MT. KENYA REGION

Mob. 0724-776233

Pay Your SMEP Loan through

WESTERN REGION

Tel: 020 357296 Mob. 0733-405838

COAST REGION

Mob. 0713-357791

Mob. 0720-930710 Tarner Barker Bldng Tel: 020-3572793 Mob. 0721-843332

Post Bank Building Tel: 020-2511849

Jiwa House, Prison Road

NYANZA REGION

MALINDI Majengo Central Tel: 041-2002150 Mob. 0728-794324

Mob: 0726 937 367

SMEP Fulfilling your dreams. SMEP Fulfilling your dreams.

INTRODUCTION SMEP is a leading Christian micro finance institution duly registered as company limited by guarantee as per the Kenyan law. Its overall objective is to improve the performance of low income entrepreneurs in the informal sector of the national economy through provision of financial and non financial services. HISTORICAL BACKGROUND The company started in 1975 as Small Scale Business Enterprise programme (SSBE), a small project under urban community improvement programme. (A brainchild of NCCK.) The project provided the urban poor in the slums with the minimum food requirements for survival. Later on the NCCK decided to establish a credit scheme to enable such people to obtain small scale loans without collateral to set up income generating micro enterprises. It is out of this credit scheme that the company SMEP was formed and became registered in 1999.

SMEP also offers financial education programmes to all its clients to enable them make sound financial business decisions. LOAN REPAYMENT METHOD SMEP has recently teamed up with Safaricoms MPESA to enable easier repayments by clients via MPESA. PROCEDURE Safaricom MPESA Paybill Business number - Loan repayment 777001, Hazina 777002, Akiba 777003, Hazina plus 777004. ACCOUNT NUMBER (comprises of two numbers: the group code and the client emerge ID). For demonstration purposes use 123456 Amount PIN number Confirm Amount and account number. Send. Thereafter, a feedback confirming that the amount is sent to SMEP is received.

SMEPS MISSION We are committed to improving the living standards of our clients, employees, and increase the value of other stakeholders by profitably providing high quality financial and non financial services, using efficient and effective technology. CORE VALUES SMEP is a Christian based organisation that upholds human dignity and worth, integrity, equal opportunity and participation, professionalism and stewardship. SMEP PRODUCTS AND SERVICES SMEP offers a very diverse loan product offerings tailor made for its target market and partners with other stakeholders for offer green products (solar power packs and water tanks). SMEP also offers Micro-health insurance (commonly referred to as Bima ya Jamii) to offer medical cover to its clients. SMEP lends from as little as 3,650 for medical insurance to our clients who need a peace of mind, and up to 3 million shillings for business expansion. Our loan products are either given as Group loans or Individual loans. Group loans range from 5,000 up to 3 million shillings. These loans are given to individuals who are in a group referred as KIWA (Kikundi Cha Wanabiashara).

SMEPS VISION

To be the preferred and model provider of high quality financial and non financial service in Kenya, in order to alleviate poverty and enhance a strong and equitable economy.

Vous aimerez peut-être aussi

- Tameer BankDocument18 pagesTameer BankIhsan UllahPas encore d'évaluation

- SIDBIDocument12 pagesSIDBISuraj JayPas encore d'évaluation

- Oranization ReportDocument21 pagesOranization ReportRashed RehmanPas encore d'évaluation

- What Are Smes: As Defined by State Bank of Pakistan - Sme (Small and Medium Enterprise)Document20 pagesWhat Are Smes: As Defined by State Bank of Pakistan - Sme (Small and Medium Enterprise)Sadia SohailPas encore d'évaluation

- Non Bank Financial IntermediariesDocument53 pagesNon Bank Financial IntermediariesPuviin Varman100% (1)

- Sampath BankDocument8 pagesSampath BankPoornima UdeniPas encore d'évaluation

- HIS Act2Document5 pagesHIS Act2Nicole Anne De VillaPas encore d'évaluation

- NIC Bank 2012 Annual ReportDocument128 pagesNIC Bank 2012 Annual ReportGeorge MSenoir100% (1)

- Finance ReportDocument40 pagesFinance Reportkhae123Pas encore d'évaluation

- Sidbi: PRESENTED BY: Prabhdeep Singh RahulDocument20 pagesSidbi: PRESENTED BY: Prabhdeep Singh RahulPradyumnaAshritPas encore d'évaluation

- PRADHANA MANTRI MUDRA YOJANA-grp12Document22 pagesPRADHANA MANTRI MUDRA YOJANA-grp12Anaswara C APas encore d'évaluation

- The Strengthening of A Microfinance InstitutionDocument18 pagesThe Strengthening of A Microfinance InstitutionSam OdhiamboPas encore d'évaluation

- Peoplesbank (1) NewDocument16 pagesPeoplesbank (1) NewUditha JayamalPas encore d'évaluation

- Non Banking Financial Company: in IndiaDocument13 pagesNon Banking Financial Company: in IndiaRicha JainPas encore d'évaluation

- Rationale of The Study: Chapter: OneDocument22 pagesRationale of The Study: Chapter: OneHumayun KabirPas encore d'évaluation

- Chapter Four: Micro-Financing InstitutionsDocument16 pagesChapter Four: Micro-Financing InstitutionsBekele DemissiePas encore d'évaluation

- Giet University, Gunupur: School of Management Studies Topic - Loans RecoveryDocument9 pagesGiet University, Gunupur: School of Management Studies Topic - Loans Recoverykenguvamanojkumar013Pas encore d'évaluation

- Case Study On MicrofinanceDocument18 pagesCase Study On MicrofinanceTusharika RajpalPas encore d'évaluation

- Introduction To Sme, Micro Finance &: Khushhalibank LimitedDocument31 pagesIntroduction To Sme, Micro Finance &: Khushhalibank LimitedJM Saeed Ahmed CheemaPas encore d'évaluation

- ss1CRM SYNOPSISDocument51 pagesss1CRM SYNOPSISSatya SudhaPas encore d'évaluation

- John Keells Holdings PLCDocument22 pagesJohn Keells Holdings PLCIndika Jayaweera75% (4)

- RIC Business-PlanDocument9 pagesRIC Business-PlanValredPas encore d'évaluation

- Draft Plan For MF+ Business Activity: C C C C CDocument5 pagesDraft Plan For MF+ Business Activity: C C C C CAbhishek KumarPas encore d'évaluation

- "Credit Management of United Commercial Bank Limited" Which IsDocument17 pages"Credit Management of United Commercial Bank Limited" Which IsMahmud MishuPas encore d'évaluation

- Final Project ReportDocument81 pagesFinal Project Reportselvafantacy100% (1)

- Internship ReportDocument10 pagesInternship ReportSidra KhanPas encore d'évaluation

- Micro FinanceDocument36 pagesMicro FinanceWan NiePas encore d'évaluation

- Chapter Four: Micro-Financing InstitutionsDocument7 pagesChapter Four: Micro-Financing InstitutionsBekele DemissiePas encore d'évaluation

- MetLife Final SatishDocument24 pagesMetLife Final SatishSatish VermaPas encore d'évaluation

- Winter Internship ReportDocument18 pagesWinter Internship Reportshiv kumar0% (1)

- Lesson 3Document14 pagesLesson 3D A M N E R APas encore d'évaluation

- Report On SME Banking Scope in Bangladesh (Part-9) : FindingsDocument5 pagesReport On SME Banking Scope in Bangladesh (Part-9) : Findingsnahidul202Pas encore d'évaluation

- Tata Capital PresentationDocument34 pagesTata Capital PresentationAmol Mahajan0% (1)

- Group # 1: Rajendra Maneesh Kumar Sameer Ranjita Kinjal MeghaDocument32 pagesGroup # 1: Rajendra Maneesh Kumar Sameer Ranjita Kinjal Meghamanegagr2Pas encore d'évaluation

- SMEPDocument14 pagesSMEPstevePas encore d'évaluation

- Presentation For Viva: Miss. Akshata Anil MasurkarDocument64 pagesPresentation For Viva: Miss. Akshata Anil MasurkarAkshata MasurkarPas encore d'évaluation

- Canara BankDocument15 pagesCanara BankeswariPas encore d'évaluation

- Deposit Scheme Analysis of Exim BankDocument16 pagesDeposit Scheme Analysis of Exim Bankmamun khanPas encore d'évaluation

- Micro Finance Unit III & IVDocument13 pagesMicro Finance Unit III & IVSarath KumarPas encore d'évaluation

- Sme Final Project ReportDocument14 pagesSme Final Project ReportnwzashrafPas encore d'évaluation

- National Small Industries CorporationDocument12 pagesNational Small Industries CorporationMohith RajPas encore d'évaluation

- Internship Report Internship Report: Our MissionDocument30 pagesInternship Report Internship Report: Our MissionMaleeha YahyaPas encore d'évaluation

- Mauritius Housing Company LTDDocument18 pagesMauritius Housing Company LTDmegamind00100% (1)

- Sidbi BVB302Document17 pagesSidbi BVB302679shrishti SinghPas encore d'évaluation

- MicrofinanceDocument21 pagesMicrofinancegyanprakashdeb302Pas encore d'évaluation

- Schemes For Rural Entrepreneurs in India Schemes For Women Entrepreneurs in IndiaDocument20 pagesSchemes For Rural Entrepreneurs in India Schemes For Women Entrepreneurs in IndiaPrasadPas encore d'évaluation

- MCB Project ReportDocument18 pagesMCB Project ReportAyaan Muhammad0% (1)

- Raksha Micro Life Insurance: Jiyo BefikarDocument21 pagesRaksha Micro Life Insurance: Jiyo BefikarRajit Kumar KrishnaPas encore d'évaluation

- MSME Loan Eligibility & SchemesDocument17 pagesMSME Loan Eligibility & SchemesSathishPas encore d'évaluation

- Report - Meezan BankDocument13 pagesReport - Meezan BankMurtaza AliPas encore d'évaluation

- Philippine Financing ProgramsDocument129 pagesPhilippine Financing ProgramsRachelle Jacosalem100% (1)

- Sbi Summer Internship PresentationDocument12 pagesSbi Summer Internship PresentationPankaj SharmaPas encore d'évaluation

- Union Bank of IndiaDocument50 pagesUnion Bank of IndiaPrabu Prabhu100% (1)

- Product Review of Metrobank Direct Personal LoanDocument18 pagesProduct Review of Metrobank Direct Personal LoanMyra GarciaPas encore d'évaluation

- Lecture 3 4Document105 pagesLecture 3 4Abhishek PrasherPas encore d'évaluation

- Chapter 2: Overview of Mercantile Bank Ltd. (MBL)Document13 pagesChapter 2: Overview of Mercantile Bank Ltd. (MBL)angelPas encore d'évaluation

- Introduction Bop 2Document10 pagesIntroduction Bop 2muhammad umairPas encore d'évaluation

- SME Financing: Submitted To Mr. S. Clement September 17,2010Document29 pagesSME Financing: Submitted To Mr. S. Clement September 17,2010scribddddddddddddPas encore d'évaluation

- Credit Repair Unleashed: The Ultimate Guide to Starting Your Own BusinessD'EverandCredit Repair Unleashed: The Ultimate Guide to Starting Your Own BusinessPas encore d'évaluation

- The Functional Microfinance Bank: Strategies for SurvivalD'EverandThe Functional Microfinance Bank: Strategies for SurvivalPas encore d'évaluation

- Law of Corporate Finance - TATA CONSULTANCY SERVICES LIMITED V. CYRUS INVESTMENTS PVT. LTD. AND ORS.Document18 pagesLaw of Corporate Finance - TATA CONSULTANCY SERVICES LIMITED V. CYRUS INVESTMENTS PVT. LTD. AND ORS.Jinal ShahPas encore d'évaluation

- UntitledDocument1 pageUntitledReplacement AccountPas encore d'évaluation

- Bug StrategyDocument13 pagesBug StrategySooraj Suresh100% (4)

- University of Delhi: Semester Examination TERM I MARCH 2023 Statement of Marks / GradesDocument2 pagesUniversity of Delhi: Semester Examination TERM I MARCH 2023 Statement of Marks / GradesDev ChauhanPas encore d'évaluation

- A Medium For Male Escort Jobs in MumbaiDocument5 pagesA Medium For Male Escort Jobs in MumbaiBombay HotboysPas encore d'évaluation

- The Basics of Capital Budgeting: Evaluating Cash FlowsDocument56 pagesThe Basics of Capital Budgeting: Evaluating Cash FlowsVinit KadamPas encore d'évaluation

- Aroma Recovery PDFDocument2 pagesAroma Recovery PDFAmlan BanerjeePas encore d'évaluation

- Mooe School Forms 2020Document48 pagesMooe School Forms 2020KrisPaulineSantuaPas encore d'évaluation

- Shercon Activity 3Document3 pagesShercon Activity 3Rochelle LumanglasPas encore d'évaluation

- HSBC v. Sps. Broqueza DigestDocument1 pageHSBC v. Sps. Broqueza DigestLayaPas encore d'évaluation

- PPG - Vigor ZN 302 SR - EnglishDocument5 pagesPPG - Vigor ZN 302 SR - EnglisherwinvillarPas encore d'évaluation

- Nov-Dec 2011Document9 pagesNov-Dec 2011Usuf JabedPas encore d'évaluation

- Porters Five For CKDocument3 pagesPorters Five For CKdishaPas encore d'évaluation

- Concept PaperDocument3 pagesConcept PaperJizelle Elaine GumaPas encore d'évaluation

- Solid Pin Conversion Kits: Equipment: Cat Loaders To Suit Machines: 990, 992C, 992G, 992K, 994C, 994D & 994FDocument2 pagesSolid Pin Conversion Kits: Equipment: Cat Loaders To Suit Machines: 990, 992C, 992G, 992K, 994C, 994D & 994FMax SashikhinPas encore d'évaluation

- Cap. 1 Hospitality Industry AccountingDocument25 pagesCap. 1 Hospitality Industry Accountingdianelys alejandroPas encore d'évaluation

- CHATTEL MORTGAGE (Articles 2140 To 2141)Document7 pagesCHATTEL MORTGAGE (Articles 2140 To 2141)Beya AmaroPas encore d'évaluation

- ProductsDocument7 pagesProductsDnyana RaghunathPas encore d'évaluation

- SWOT AnalysisDocument33 pagesSWOT Analysism MajumderPas encore d'évaluation

- 2021-12-02 Project Scheduling by PERT CPMDocument95 pages2021-12-02 Project Scheduling by PERT CPMAries Falag-eyPas encore d'évaluation

- Sample Business CaseDocument19 pagesSample Business CasepreetigopalPas encore d'évaluation

- U H "Eƒ ¡I" Beha Construction Y Ƒ° SÓKÝ TD Má Pî& Job Description Notes FormDocument2 pagesU H "Eƒ ¡I" Beha Construction Y Ƒ° SÓKÝ TD Má Pî& Job Description Notes FormAbrsh AbrshPas encore d'évaluation

- LAWDocument5 pagesLAWFrancis AbuyuanPas encore d'évaluation

- Held v. HeldDocument5 pagesHeld v. HeldKenneth SandersPas encore d'évaluation

- Coffee Shop Co CaseDocument3 pagesCoffee Shop Co Caserashmi shrivastavaPas encore d'évaluation

- Leveraging AI in Electronic CommerceDocument4 pagesLeveraging AI in Electronic CommerceNaman JainPas encore d'évaluation

- Diversifikasi Korporasi Dan Biaya Modal: Jurnal Siasat Bisnisvol.21 No. 2, 2017,181-198Document18 pagesDiversifikasi Korporasi Dan Biaya Modal: Jurnal Siasat Bisnisvol.21 No. 2, 2017,181-198sriintan09gmail.com intan99Pas encore d'évaluation

- New GDocument10 pagesNew GAkbar ShakoorPas encore d'évaluation

- Development in Legal Issues of Corporate Governance in Islamic Finance PDFDocument25 pagesDevelopment in Legal Issues of Corporate Governance in Islamic Finance PDFDwiki ChyoPas encore d'évaluation

- VRIO AnalysisDocument2 pagesVRIO AnalysisrenjuannPas encore d'évaluation