Académique Documents

Professionnel Documents

Culture Documents

FORM-231 Oct To March 2010-Rem

Transféré par

Mrunali kadamTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FORM-231 Oct To March 2010-Rem

Transféré par

Mrunali kadamDroits d'auteur :

Formats disponibles

0 1 2

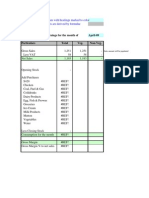

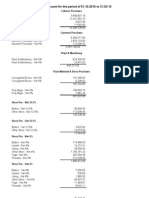

3 1 4 5 6 2. Personal Name of Dealer Name of Premises/Building/Village 7 Information BLOCK NO/ FLAT of the 8 STREET/ ROAD Area/ Locality 9 Dealer CITY jurisdiction over District Pin code sohan@aquariusindia.c having 10 place of business 01-Mazgaon E_mail id of Dealer om 11 12 Address Phone No Of Delar Registration 226668101 / New Package scheme 13 Type of Return (Select appropriate) Original dealer) No 3 14 Please package scheme period Or end of Select 15 Six-monthly package scheme period) No Periodicity of Return (Select appropriate) which ever 16 Period 17 Date Month Year Date Month Year Covered by Return From To 18 4 10 09 31 03 10 01 19 20 21 5 Amount ( Rs) Particulars Gross turnover of sales including, taxes as well as turnover of non 22 a) sales transactions like value of branch/ consignment transfers , job 48982077 Less:-Value ,inclusive of sales tax.,of Goods Returned including 23 Computatio b) work charges etc 0 reduction Tax amount (on account of rate difference in (a) above . Less:-Net of sales price Tax included in sales shown and discount 24 n of net c) 0 less Tax included in(b) above) turnover of Less:-Value of Branch Transfers / consignment transfers within 25 d) Less:-Sales u/s 8(1) i.e Inter state sales including Central Sales 0 sales liable the State If Tax is Paid by an Agent 26 to tax 45233179 Tax,Sales in the course of Imports, Exports and value of Branch Turnover of export sales u/s 5(1) and 5(3) the State Transfers of sales in the course of import Consignment Transfers outside 27 45233179 Turnover / Act 1956 included in Box (e) of the CST 28 e) u/s 5(2) of the CST Act 1956 included in 0 Less:-Sales of tax-free goods specified in Schedule" A" of MVAT 29 f) Box (e) 3748898 Act Less:-Sales of taxable goods fully exempted u/s. 8 other than sales 30 g) 0 under section 8(1) and and covered in ) Box 5(e) 31 h) Less:-Labour Charges/Job work charges 0 32 i) Less:-Other allowable deductions, if any 0 33 j) Balance: Net turnover of Sales liable to tax [a-(b+c+d+e+f+g+h+i)] 0 34 35 36 Rate of tax Turnover of sales liable to tax (Rs.) Tax Amount ( Rs) 37 a) 12.50% 0 0 38 6 b) 4.00% 0 0 Computatio c) 39 0 n of tax 40 payable d) 0 41 under the e) 0 42 M VAT Act f) 0 43 Total 0 0 44 45 6A Sales Tax collected in Excess of the Amount of Tax payable. 0 46 47 48 7 Amount ( Rs) Particulars Transfers/ Consignment Transfers received and Labour/ job work 49 .Computati a) charges 29985839 Less:-Value of goods return(inclusive of tax,including reduction of on of 50 b) Purchase price on account of rate difference and discount . 51 Purchases c) Less:-Imports (Direct imports) Eligible for 52 7515121 d) Less:-Imports (High seas purchases) Set-off 53 3903436 e) Less:-Inter-State purchases 54 f) Less:-Inter-State branch / consignment transfers received

VALID FORM_231 Ver 1.2.1 Return-cum-chalan of tax payable by a dealer under M.V.A.T.Act, 2002 (See Rule 17, 18 and 45) If Holding CST RC Please M.V.A.T. Separate Select R.C. No. 27810243215 V Yes Return Code Type Of Return Not Entered

Eligible for Set-off Less:-Within the State Branch Transfers /Consignment Transfers received where tax is to be paid by an Agent 55 g) Less:-Within the State purchases of taxable goods from un56 h) registered dealers dealers under MVAT Act, 2002 and which are not eligible for set57 i) off Less:-Within the State purchases of taxable goods which are fully 58 j) exempted from tax u/s 8 but not covered under section 8(1) in Less:-Within the State purchases of tax-free goods specified 59 12433939 k) Schedule "A" 60 Less:-Other allowable deductions, if any l) Balance: Within the State purchases of taxable goods from 61 6133343 m) registered dealers eligible for set-off [a-(b+c+d+e+f+g+h+i+j+k+l) ] 62 63 64 65 registered Rate of tax Net Turnover of purchases (Rs.) Tax Amount ( Rs) dealers 66 a) 12.50% 143238 17905 67 eligible for b) 4.00% 5742803 229397 set-off as 68 per box c) 69 7(m) d) 70 e) 71 Total 5886041 247302 72 73 74 9. Particulars Purchase Value(Rs.) Tax Amount (Rs.) Within the State purchases of taxable goods from 75 Computatio a) registered dealers eligible forprice ofas perC, D & E) 5886041 247302 the corresponding purchase set-off (Sch Box 8 76 n of set-off b) goodsReduction in the amount of set_off u/r 53(2) of Less: 77 claimed in the corresponding the amount of set-off under any Less: Reduction in purchase price of (Sch B) goods this return 78 c) other AdjustmentRule 53 Add: sub rule of on account of set-off claimed Short 79 d) in earlier return on account of set-off claimed Excess Less: Adjustment 80 e) in earlier return for the period of this return [a-(b+cSet-off available 81 247302 f) d+e)] 82 83 10. Computation for Tax payable along with return 84 Particulars Amount ( Rs) 85 A. Aggregate of a) Set off available as per Box 9 (f) 247302 86 credit available b) Excess credit brought forward from previous return 98015 for the period c) Amount alreadyany , as per Form 234 , to be adjustedE) 87 Excess Credit if paid ( Details to be entered in Box 10 against 88 covered under d) the liability as per Form 231 Maharashtra Tax on Entry of Adjustment of ET paid under this return 89 e) Goods into Local Areas Act 2002 Refund adjustment order No. ( Details to be entered in Box 10 90 f) F) 91 g) Total available credit (a+b+c+d+e+f) 345317 92 93 B Sales tax a) Sales Tax payable as per box 6 0 Adjustment on account of MVAT payable, if any as per Return 94 payable and b) Form 234 against the excess credit as peras per 231. for this Adjustment on account of CST payable Form return 95 adjustment of c) period Adjustment on account of ET payable under Maharashtra tax CST/ET 96 d) on Entryof Tax Collected in Excess of the amount of Sales Tax Amount of Goods into Local Areas Act, 2002 payable against 97 e) payable if any ( as per Box 6A) 0 available credit 98 f) Interest Payable credit =[10A(g)-10B(a)+10B(b)+10B(c)+ Balance: Excess 99 g) 10B(d)+ 10B(e)+ 10 B(f)] 10B(a)+10B(b)+10B(c)+ 10B(d) 345317 Balance:Tax payable= [ 100 h) +10B(e)+10 B(f)-10A(g)] 0 101 C Utilisation of a) Excess credit carried forward toin this return(Box10 B(g)- Box claimed as refund subsequent tax period 102 Excess Credit as b) 10 C(a)) 345317 103 per box 10B(g) 104 D. a) Amount paid as per revised return/fresh return ( Details to be Total Amount payable as per Box 10B(h) 0 105 Tax payable b) included paid as 10 E) Amount in Box per Revised /Fresh return ( Details to be 106 with returnc) entered in Box 10 E) 107 Cum-Chalan Chalan / CIN No Date 108 E. Details of Amount 109 Chalan CIN No 110

Paid along with this return and or Amount already Paid

Amount (Rs) Payment date Name of the Bank Branch Name

111 112 113 114 115 116 117 118 119 120 121 122

TOTAL

123 F. Details of RAO 124 RAO No Amount Adjusted( Rs) Date of RAO 125 126 127 128 129 130 TOTAL 0 131 132 133 134 G. The Statement contained in Box 1 to 10 are true and correct to the best of my knowledge and belief. 135 Date of Filing of Return Date 20 Month 05 Year 10 Place Mumbai 136 Name Of Authorised Person Arun Gawas Remarks 137 Designation Accounts Manager Telephone No 66608101 138 E_mail_id allwyn@aquariusindia.com 139 Instructions

For Submission Of Forms

140 1.All The Fields

In red Colour are Mandatory 2.After Filling The Fields Please Press The Validate Button 141 142 3.Please Correct The Mistakes Pointed Out By Validate Function 143 4.You Can Save The Form For Submission if validate Function Returns The same Message 144 5. Please Check the ERRORS Excel Sheet for Any Errors. 145 6.Remarks if anyValidate " Button is not operative , please ensure that MICRO SECURITY 7. If " Press To (V1)

146 in 147 148 149

TOOLs menu of Excel Sheet has set at MEDIUM or LOW

Vous aimerez peut-être aussi

- Royal Stationery & Xerox: Santosh CorporationDocument8 pagesRoyal Stationery & Xerox: Santosh CorporationMrunali kadamPas encore d'évaluation

- Party Name Total OutstandingDocument16 pagesParty Name Total OutstandingMrunali kadamPas encore d'évaluation

- Rajesh Rajput-01 KDocument1 pageRajesh Rajput-01 KMrunali kadamPas encore d'évaluation

- Format of Relieving LetterDocument1 pageFormat of Relieving LetterSatheesh Kumar61% (18)

- Chapter No: 1 Introduction-SalaryDocument23 pagesChapter No: 1 Introduction-SalaryMrunali kadamPas encore d'évaluation

- HARESHDocument3 pagesHARESHMrunali kadamPas encore d'évaluation

- Format of Relieving LetterDocument1 pageFormat of Relieving LetterSatheesh Kumar61% (18)

- BillsDocument18 pagesBillsMrunali kadamPas encore d'évaluation

- 100 Journal EntriesDocument10 pages100 Journal Entriessahilsingh664% (42)

- 22 Hotel Stores InventoryDocument75 pages22 Hotel Stores InventoryMrunali kadamPas encore d'évaluation

- 59 P L Format With InventoryDocument5 pages59 P L Format With InventoryMrunali kadamPas encore d'évaluation

- Auto Calculation of DepreciationDocument3 pagesAuto Calculation of DepreciationMrunali kadamPas encore d'évaluation

- To 31032014 (3729)Document62 pagesTo 31032014 (3729)Mrunali kadamPas encore d'évaluation

- AccountingDocument80 pagesAccountingAbbas SiddiquiPas encore d'évaluation

- Kishore More.: ResumeDocument2 pagesKishore More.: ResumeMrunali kadamPas encore d'évaluation

- Checklist For Finalisation Ver1Document1 pageChecklist For Finalisation Ver1Mrunali kadamPas encore d'évaluation

- Name of Function Categori: Marksheet0Document26 pagesName of Function Categori: Marksheet0pj56Pas encore d'évaluation

- BankbooksheetDocument2 pagesBankbooksheetMrunali kadam100% (1)

- Use of Vlook Up in Two Dimension by CA Hitesh BansalDocument4 pagesUse of Vlook Up in Two Dimension by CA Hitesh BansalMrunali kadamPas encore d'évaluation

- 51 All Dates For Payments of TaxsDocument13 pages51 All Dates For Payments of TaxsMrunali kadamPas encore d'évaluation

- Form 231 Working From DhananjayDocument3 pagesForm 231 Working From DhananjayMrunali kadamPas encore d'évaluation

- Vat CalculationDocument12 pagesVat CalculationMrunali kadamPas encore d'évaluation

- Working FROM KRMDocument1 pageWorking FROM KRMMrunali kadamPas encore d'évaluation

- Form 231Document9 pagesForm 231Pushkar JoshiPas encore d'évaluation

- Ack No. 2426106 01.04.2009 To 30.09Document1 pageAck No. 2426106 01.04.2009 To 30.09Mrunali kadamPas encore d'évaluation

- Form 231 Working From DhananjayDocument3 pagesForm 231 Working From DhananjayMrunali kadamPas encore d'évaluation

- Acknowledgement Sept To March 2010 Return 231Document1 pageAcknowledgement Sept To March 2010 Return 231Mrunali kadamPas encore d'évaluation

- R Systems Solution Inc.: 5000 Windplay DRIVE Suite 5 El Dorado Hills California 95762 USADocument41 pagesR Systems Solution Inc.: 5000 Windplay DRIVE Suite 5 El Dorado Hills California 95762 USAMrunali kadamPas encore d'évaluation

- Bill CaulDocument5 pagesBill CaulMrunali kadamPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- TestertDocument10 pagesTestertjaiPas encore d'évaluation

- B B B B: RRRR RRRRDocument24 pagesB B B B: RRRR RRRRAnonymous TeF0kYPas encore d'évaluation

- ColceruM-Designing With Plastic Gears and General Considerations of Plastic GearingDocument10 pagesColceruM-Designing With Plastic Gears and General Considerations of Plastic GearingBalazs RaymondPas encore d'évaluation

- Family Decision MakingDocument23 pagesFamily Decision MakingNishant AnandPas encore d'évaluation

- The Malacca Strait, The South China Sea and The Sino-American Competition in The Indo-PacificDocument21 pagesThe Malacca Strait, The South China Sea and The Sino-American Competition in The Indo-PacificRr Sri Sulistijowati HPas encore d'évaluation

- Performance Appraisal System-Jelly BellyDocument13 pagesPerformance Appraisal System-Jelly BellyRaisul Pradhan100% (2)

- Medical Secretary: A. Duties and TasksDocument3 pagesMedical Secretary: A. Duties and TasksNoona PlaysPas encore d'évaluation

- Radial ReliefDocument4 pagesRadial Reliefapi-316485458Pas encore d'évaluation

- 2007.01 What Does Jesus Think of Science?Document2 pages2007.01 What Does Jesus Think of Science?William T. PelletierPas encore d'évaluation

- Customer ExperienceDocument9 pagesCustomer ExperienceRahul GargPas encore d'évaluation

- Second and Third Round Table Conferences NCERT NotesDocument2 pagesSecond and Third Round Table Conferences NCERT NotesAanya AgrahariPas encore d'évaluation

- SoapDocument10 pagesSoapAira RamoresPas encore d'évaluation

- Pier Cap Corbel 30m SGDocument3 pagesPier Cap Corbel 30m SGSM ConsultantsPas encore d'évaluation

- CS3 Backup 2023 01 31 02 41Document1 pageCS3 Backup 2023 01 31 02 41Fans Page1Pas encore d'évaluation

- Etsi en 300 019-2-2 V2.4.1 (2017-11)Document22 pagesEtsi en 300 019-2-2 V2.4.1 (2017-11)liuyx866Pas encore d'évaluation

- Bos 22393Document64 pagesBos 22393mooorthuPas encore d'évaluation

- Articles About Gossip ShowsDocument5 pagesArticles About Gossip ShowssuperultimateamazingPas encore d'évaluation

- English File: Grammar, Vocabulary, and PronunciationDocument4 pagesEnglish File: Grammar, Vocabulary, and PronunciationFirstName100% (2)

- The Old Rugged Cross - George Bennard: RefrainDocument5 pagesThe Old Rugged Cross - George Bennard: RefrainwilsonPas encore d'évaluation

- LPP-Graphical and Simplex MethodDocument23 pagesLPP-Graphical and Simplex MethodTushar DhandePas encore d'évaluation

- A1 - The Canterville Ghost WorksheetsDocument8 pagesA1 - The Canterville Ghost WorksheetsТатьяна ЩукинаPas encore d'évaluation

- Solar SystemDocument3 pagesSolar SystemKim CatherinePas encore d'évaluation

- Grade 11 Stem Group 2 Practical Research 1Document19 pagesGrade 11 Stem Group 2 Practical Research 1Roi Vincent Cuaresma BlasPas encore d'évaluation

- Body ImageDocument7 pagesBody ImageCristie MtzPas encore d'évaluation

- Abb PB - Power-En - e PDFDocument16 pagesAbb PB - Power-En - e PDFsontungPas encore d'évaluation

- Movie ReviewDocument2 pagesMovie ReviewJohanna Gwenn Taganahan LomaadPas encore d'évaluation

- A Detailed Lesson Plan - The Fundamental Law of ProportionDocument10 pagesA Detailed Lesson Plan - The Fundamental Law of ProportionPrincess De LeonPas encore d'évaluation

- CHAPTER 2-3 LipidDocument20 pagesCHAPTER 2-3 LipidDaniel IsmailPas encore d'évaluation

- Monologues For Danimations - Adam SorrellDocument2 pagesMonologues For Danimations - Adam SorrellCharlie Smith-McMahonPas encore d'évaluation

- Indian Retail Industry: Structure, Drivers of Growth, Key ChallengesDocument15 pagesIndian Retail Industry: Structure, Drivers of Growth, Key ChallengesDhiraj YuvrajPas encore d'évaluation