Académique Documents

Professionnel Documents

Culture Documents

KGR MarketRisk

Transféré par

Alejandro Julio Alvarez McCrindleDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

KGR MarketRisk

Transféré par

Alejandro Julio Alvarez McCrindleDroits d'auteur :

Formats disponibles

REUTERS/felix ordonez

KONDOR GLOBAL RISK

MARKET RISK

thoMson reUters recent MarKet recognition

nUMBer one risK technology ProVider 2009 & 2010 nUMBer one risK technology ProVider 2008, 2009 & 2010 Best Vendor for dealing technology Best trading systeM Vendor

MARKET RISK MANAGEMENT TODAYS CHALLENGES

financial institutions are seeking tools to improve transparency and to help manage their exposure to market risk more effectively. in the wake of the global financial crisis, market risk solutions need to address the following challenges:

GETTING THE RIGHT FIGuRES AT THE RIGHT TIME

Flexible reporting, with instant drill-down capability from the highest to the finest level of detail, at any time Economic capital calculation Instant simulation of the impact of new trades

SCALAbILITY AND OpENNESS

Managing rapid volume growth driven by scenarios and stress-testing as well as by business itself Quick, painless integration of new products, including exotics and hybrids

COST EFFICIENCY

Quick delivery and implementation More efficient use of existing skills and assets

traditional architectures relied on the replication of trades and valuation in the risk system. But in recent years this approach has proved to be too static and rigid to provide a satisfactory computation of enterprise-wide market risk. Building replication logic not only implies high development costs, because the type of data being replicated (trades) is so complex it also needs specialist staff dedicated to exception management and reconciliation tasks. and the constant addition of new instruments in the front office creates never-ending integration efforts Until now.

Kondor Global Risk 2

KondoR GLoBAL RISK

KONDOR GLObAL RISK

Thomson Reuters Kondor Global Risk (KGR) is a powerful real-time credit and market risk system that allows risk managers to monitor risk across the enterprise. KGR Market Risk provides a comprehensive enterprise-wide solution for measuring and managing market risks across all banking activities. Understanding the impact of market changes on the balance sheet allows firms to make more informed business decisions and gain a competitive edge through managing market risk.

MANAGE MARKET RISK ACROSS ALL ACTIvITIES

Kondor Global Risk (KGR) aggregates market risks from multiple front-office systems and multiple pricing tools. its open architecture leverages existing pricing functions in the front office, eliminating pricing inconsistencies between the front/middle office and risk management systems. its open architecture makes it easy to add new products and enables users to compute a consolidated view of market risk as well as manage limits globally. Kgr ensures that as business grows, risk management capability will scale up proportionately without any duplication in development effort.

KEY bENEFITS AT A GLANCE

SPEEd

Accurate real-time measurement of enterprise market risk faster and easier implementation minimum reconciliation Short time-to-market for new products

EffIcIEncy

Coherence between front-office systems and risk management as they share the same pricing engine cost efficient workflow operation Flexible out-of-the-box regulatory reporting

RoBUSTnESS

scalable architecture offers the ability to manage year-on-year volume growth ability to cope with the growing complexity of scenarios and number of risk factors

Kondor Global Risk 3

KondoR GLoBAL RISK

RELIAbLE ENTERpRISE-WIDE MARKET RISK

SCENARIO GENERATION Market data repository historical scenario generation based on stored historical data Monte Carlo-based scenario generation flexible scenario generation tool that offers the ability to set horizons and choose any risk factors

PRICING SIMULATION delegated pricing at front office level, orchestrated and controlled through KGRs graphical interface Pricing process, progress monitoring, and audit of all pricing inconsistencies or reported errors

RATE MANAGEMENT fill gaps, identify outliers and define proxies and adjustment factors, e.g. for corporate actions with time-series management features generate historical and stress test rate scenarios generated from historical data factors

KondoR GLoBAL RISK MARKET AnALyTIcS

REPORTING Var reporting tool consolidates all activity (Var per activity, per system, per geographical location any aggregation level) Var results are displayed by each risk class: ir, fx, equity, credit component Var, marginal Var, incremental Var calculations Var drill down from the scenario to risk factor causality for each aggregation level

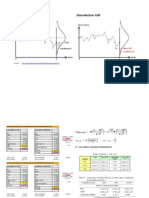

BACK TESTING loading of action and no action P&ls from external sources, triggered from KGRs graphical interface Back-test reports daily view of the Var figures against the P&l numbers for any period of time (100 days, 250 days) graphical representation of backtest results

STRESS TESTING risk calculation for stress events flexible Market rates shift definition scenario generation to represent market events of the worst case scenario

Kondor Global Risk 4

KondoR GLoBAL RISK

KGR: MASTER RISK

CONTROL ALL MARKET EFFECTS

Kondor global risk allows users to store and manage all the required figures for Var calculations. it provides all the required risk figures, from the individual risk factor values used in each simulation to the base (or horizon) portfolio value. Users can monitor the profit and loss distribution for any aggregation level (deal, country, industry, portfolio). Risk Factor drill-down can be employed to automatically isolate and independently calculate risks stemming from individual factor groups.

STRESS TESTING TAME EvENT RISK

in line with recent Basel ii guidelines concerning the revised framework for market risk, Kgr supports stress testing for better insight into potential impact of extreme scenarios. Using its flexible scenario generator, users can create all kind of scenarios (historical, stressed periods, stress-tests, Monte-Carlo). KGR can measure, analyze potential losses and clearly represent the impact of stress-test scenarios on any aggregation level.

FLExIbLE AND TRANSpARENT REpORTING

KGR reporting tool uses one-click slice and dice functionality for highly intuitive understanding and monitoring of market risk. it enables users to isolate all risk sources efficiently and compare market risk figures against previous results for the daily follow-up. The reporting tool also helps to ensure regulatory compliance for market risk.

DATA INTEGRATION

data quality is crucial for risk management, so Kgr leverages the thomson reuters enterprise Platform to offer a fully integrated enterprise risk solution. together these provide a powerful enterprise risk data and workflow platform that easily integrates with in-house data sources. Our solution efficiently orchestrates the loading, aggregation, cleansing and normalization of data from multiple sources used for risk computation.

Kondor Global Risk 5

REUTERS/ALESSIA PIERdoMEnIco

Kondor Global Risk 6

KondoR GLoBAL RISK

KONDOR GLObAL RISK

THE SOLuTION TO FIT YOuR NEEDS

FAST

TIME TO MARKET

the thomson reuters solution brings new trades under market risk control dramatically faster than traditional software. our generic data model and distributed pricing architecture requires only lightweight data integration and allows for on the fly introduction of new products, including complex structures. Once the front office receives a sign-off, risk management does not need to go through the same lengthy process. new trades, even complex structured ones, can be mapped and are included in all Kondor global risk reports in a matter of minutes.

STRONG

OpTIMIZED FOR TRuE ENTERpRISE vOLuMES

our solution is designed to manage the vast volumes of data associated with enterprise risk data management. it addresses the problem of manipulating high volumes of data at speed. the solution can quickly load data and provides impressive report generation performance with the capacity to archive simulations. Kondor global risk also supports configurable aggregation and purge tasks to manage historical archives, increase the speed of intraday reporting and consolidate global reporting across the enterprise.

RATIONAL

COST EFFICIENT

operating multiple data sources, each with its own proprietary data models and semantics, is expensive. a new, holistic approach to data management improves efficiency and reduces costs. Kondor global risk is cost efficient both to implement and to run. in Kgr, the deal repository is in the front office, so there is no need for costly trade replication. save time on ongoing reconciliation and exception management between the front offices and risk management.

Kondor Global Risk 7

KondoR GLoBAL RISK

THoMSon REUTERS REcEnT MARKET REcoGnITIon nUmbeR one RisK teCHnoLoGy PRovideR 2009 & 2010 RisK teCHnoLoGy RanKinGs 2010

number one overall Technology Vendor number one Trading Systems cross asset number one Trading Systems fx number one Pricing and Analytics inflation number one IAS compliance number one Pricing and Analytics fx number one Pricing and Analytics rates number one Risk Aggregation Market, credit, counterparty, liquidity, operational

nUmbeR one RisK teCHnoLoGy PRovideR 2008, 2009 & 2010 asia RisK teCHnoLoGy awaRds 2010

number one overall Technology Vendor number one Support Services implementation efficiency number one Trading Systems front-to-Back office foreign exchange number one Trading Systems front-to-Back office interest rates number one Risk Management Back office number one Risk Management credit risk Management number one Trading Systems front-to-Back office Hybrids/Cross-asset class number one derivatives Pricing and Risk Analytics interest rates number one derivatives Pricing and Risk Analytics Hybrid/Cross-asset class number one derivatives Pricing and Risk Analytics credit

best vendoR FoR deaLinG teCHnoLoGy FX weeK best banKs awaRds 2010

best tRadinG system vendoR RisK maGazine RisK 20 awaRds

AbOuT THOMSON REuTERS RISK MANAGEMENT thomson reuters is the largest provider of risk and trade management solutions globally, servicing over 700 financial institutions. our solutions offer sophisticated, tailored functionality at every step of the trade, from STP enabled front-to-back trading systems to enterprise wide risk management. We have the global reach and local expertise that is required of a long term strategic partner with more than 950 risk professionals worldwide. and with more than 20 years of experience, our customers can rely upon Thomson Reuters proven track record of delivering complex solutions to meet their exact requirements. for more information on thomson reuters risk Management solutions please take a look at financial.thomsonreuters.com/risk

thomson reuters 2011. all rights reserved. 48002690.

Vous aimerez peut-être aussi

- E Trade API Technical DocumentationDocument275 pagesE Trade API Technical DocumentationVictor Burnett0% (1)

- PRM Handbook IIIDocument416 pagesPRM Handbook IIIAilbhe Smith0% (1)

- Trade Life CycleDocument2 pagesTrade Life CycleNaren GokuPas encore d'évaluation

- Kobra Getting StartedDocument184 pagesKobra Getting Startedjmf4x9Pas encore d'évaluation

- SMARTS PlatformDocument19 pagesSMARTS Platformoli999Pas encore d'évaluation

- APPIA - FIX EngineDocument2 pagesAPPIA - FIX EngineNYSE TechnologiesPas encore d'évaluation

- CLS Currency Program Briefing BookDocument24 pagesCLS Currency Program Briefing BookNitin NagpurePas encore d'évaluation

- Unavista EMIR Faq v2.3Document59 pagesUnavista EMIR Faq v2.3Ant ArtPas encore d'évaluation

- Quantitative Asset Management: Factor Investing and Machine Learning for Institutional InvestingD'EverandQuantitative Asset Management: Factor Investing and Machine Learning for Institutional InvestingPas encore d'évaluation

- The Trade Lifecycle: Behind the Scenes of the Trading ProcessD'EverandThe Trade Lifecycle: Behind the Scenes of the Trading ProcessPas encore d'évaluation

- LVA, FVA, CVA, DVA Impacts On Derivatives ManagementDocument39 pagesLVA, FVA, CVA, DVA Impacts On Derivatives ManagementindisateeshPas encore d'évaluation

- Calypso IRD Pricing - Nonlinear Products SyllabusDocument3 pagesCalypso IRD Pricing - Nonlinear Products SyllabusEric LinderhofPas encore d'évaluation

- Market Risk: Strategy Tree and Scorecard DetailsDocument4 pagesMarket Risk: Strategy Tree and Scorecard DetailsmariosalPas encore d'évaluation

- Dfgsdstrade Life Scycle EweentsDocument5 pagesDfgsdstrade Life Scycle EweentsRana Prathap100% (1)

- What Exactly Is Fund Transfer Pricing?: Professor Jean DermineDocument2 pagesWhat Exactly Is Fund Transfer Pricing?: Professor Jean DermineJames BestPas encore d'évaluation

- Bombay Stock Exchage ProjectDocument283 pagesBombay Stock Exchage ProjectRajesh Kaatkar100% (1)

- Corporate Action Processing: What Are The Risks?: Sponsored By: The Depository Trust & Clearing CorporationDocument45 pagesCorporate Action Processing: What Are The Risks?: Sponsored By: The Depository Trust & Clearing CorporationMalcolm MacCollPas encore d'évaluation

- MIFID Best-Execution-Hot-TopicDocument8 pagesMIFID Best-Execution-Hot-TopicPranay Kumar SahuPas encore d'évaluation

- Calypso CertificationDocument4 pagesCalypso CertificationJames Best100% (1)

- Murex GPCDocument40 pagesMurex GPCLekshmi BibinPas encore d'évaluation

- Derivatives - Futures vs. Forwards: Characteristics of Futures ContractsDocument5 pagesDerivatives - Futures vs. Forwards: Characteristics of Futures ContractsSam JamtshoPas encore d'évaluation

- Trade Surveillance QADocument2 pagesTrade Surveillance QAManoj GuptaPas encore d'évaluation

- Calypso CoE PaperDocument3 pagesCalypso CoE Paperxler_rahulPas encore d'évaluation

- ERCM Solution Overview 01JUL14Document20 pagesERCM Solution Overview 01JUL14Katinti Yellaiah100% (1)

- MXMLDocument26 pagesMXMLBasava PrabhuPas encore d'évaluation

- MurexDocument44 pagesMurexYiğit KılıçPas encore d'évaluation

- Treasury Yield Curve MethodologyDocument1 pageTreasury Yield Curve Methodology남상욱Pas encore d'évaluation

- Trade Life Cycle - The Process of Buying & SellingDocument10 pagesTrade Life Cycle - The Process of Buying & Sellingamitabhsinghania100% (1)

- Trade Initiation Stage Trade Execution Stage Trade Capture Stage Trade EnrichmentDocument5 pagesTrade Initiation Stage Trade Execution Stage Trade Capture Stage Trade EnrichmentNitish JhaPas encore d'évaluation

- Cross Currency RiskDocument21 pagesCross Currency RiskManish AnandPas encore d'évaluation

- Collateral Management Interview Q A 1682767124Document9 pagesCollateral Management Interview Q A 1682767124Mandar mahadikPas encore d'évaluation

- Trade Surveillance and Monitoring Technology An Expanding LandscapeDocument19 pagesTrade Surveillance and Monitoring Technology An Expanding LandscapezoombadosPas encore d'évaluation

- Rder Anagement Ystems: Chris Cook Electronic Trading Sales 214-978-4736Document26 pagesRder Anagement Ystems: Chris Cook Electronic Trading Sales 214-978-4736Pinaki MishraPas encore d'évaluation

- Training BNPFI Day5 AMDocument50 pagesTraining BNPFI Day5 AMJames BestPas encore d'évaluation

- MXML ARAA 0.2 PDFDocument47 pagesMXML ARAA 0.2 PDFIanDolan0% (1)

- ICELink Regulatory Reporting EMIRDocument15 pagesICELink Regulatory Reporting EMIRvenkatesh1130% (1)

- Seven Competitive Advantages of The Modern Trea SurerDocument10 pagesSeven Competitive Advantages of The Modern Trea SurerImran KhanPas encore d'évaluation

- Choudhry FTP Principles Jan 2018Document133 pagesChoudhry FTP Principles Jan 2018James BestPas encore d'évaluation

- Introduction To Securities Trade LifecycleDocument8 pagesIntroduction To Securities Trade LifecycleSandra PhilipPas encore d'évaluation

- ICE Trade Vault White PaperDocument16 pagesICE Trade Vault White PapersenapatiabhijitPas encore d'évaluation

- Presentation To The CFTC Technology Advisory Committee (TAC)Document7 pagesPresentation To The CFTC Technology Advisory Committee (TAC)kambi78Pas encore d'évaluation

- Datascope Reference DataDocument3 pagesDatascope Reference DataGurupraPas encore d'évaluation

- OTC DerivativesDocument114 pagesOTC DerivativesSwapnil PotdukhePas encore d'évaluation

- SS&C GlobeOp - FA ModuleDocument34 pagesSS&C GlobeOp - FA ModuleAnil Dube100% (1)

- Mifid ClassificationDocument57 pagesMifid ClassificationfizzPas encore d'évaluation

- FinnacleDocument8 pagesFinnaclesamjoechandyPas encore d'évaluation

- Mt54x Swift GuideDocument30 pagesMt54x Swift GuideirfanPas encore d'évaluation

- Axiom SL IRRBB Whitepaper 091216Document12 pagesAxiom SL IRRBB Whitepaper 091216Avinash GanesanPas encore d'évaluation

- Fund - Transfer - Pricing - E&Y PDFDocument24 pagesFund - Transfer - Pricing - E&Y PDFsreeks456Pas encore d'évaluation

- Know About Calypso's Capital Market SolutionsDocument2 pagesKnow About Calypso's Capital Market SolutionsCalypso TechnologyPas encore d'évaluation

- Understand The Trade Settlements and Over ViewDocument4 pagesUnderstand The Trade Settlements and Over ViewChowdary PurandharPas encore d'évaluation

- OTC Derivatives ModuleDocument7 pagesOTC Derivatives ModulehareshPas encore d'évaluation

- Cleared Swap Handbook: Derivative Processing Under The Dodd-Frank Act and European Market Infrastructure Reform (Emir)Document16 pagesCleared Swap Handbook: Derivative Processing Under The Dodd-Frank Act and European Market Infrastructure Reform (Emir)senapatiabhijitPas encore d'évaluation

- Collateral Management & CSA DiscountingDocument45 pagesCollateral Management & CSA Discountingshih_kaichihPas encore d'évaluation

- Introduction of DerivativesDocument23 pagesIntroduction of DerivativesBhavani Singh RathorePas encore d'évaluation

- MX.3 For FX Cash TradingDocument2 pagesMX.3 For FX Cash TradingSibashis Mishra100% (1)

- OPAN ManualDocument450 pagesOPAN Manualapi-3842245Pas encore d'évaluation

- MiFID and Systematic InternalizationDocument18 pagesMiFID and Systematic InternalizationshravancmuPas encore d'évaluation

- Mindtree Brochures Murex Datamart Performance OptimizationDocument4 pagesMindtree Brochures Murex Datamart Performance Optimizationindianviks100% (1)

- Managing Credit Risk in Corporate Bond Portfolios: A Practitioner's GuideD'EverandManaging Credit Risk in Corporate Bond Portfolios: A Practitioner's GuidePas encore d'évaluation

- The Advanced Fixed Income and Derivatives Management GuideD'EverandThe Advanced Fixed Income and Derivatives Management GuidePas encore d'évaluation

- Three Essays On Mutual FundsDocument181 pagesThree Essays On Mutual FundsIGift WattanatornPas encore d'évaluation

- Bruce KovnerDocument12 pagesBruce KovnerNavin Ratnayake100% (1)

- Jurnal Inter Internasional Manajemen RisikoDocument12 pagesJurnal Inter Internasional Manajemen RisikogedeutamaPas encore d'évaluation

- UG Course ChapterDocument724 pagesUG Course ChapterPhenyoRatsiePas encore d'évaluation

- Business Risk Case Study Ba31Document13 pagesBusiness Risk Case Study Ba31SandipPas encore d'évaluation

- Moorad Choudhry Anthology: Reader's Guide: January 2020Document33 pagesMoorad Choudhry Anthology: Reader's Guide: January 2020Mr ThyPas encore d'évaluation

- 3) From - SF - To - VaRDocument48 pages3) From - SF - To - VaRDunsScotoPas encore d'évaluation

- CVaR Vs CDaRDocument25 pagesCVaR Vs CDaRcuenta 2Pas encore d'évaluation

- Risk Aggregation and ECDocument22 pagesRisk Aggregation and ECaminiotisPas encore d'évaluation

- Bivariate Lower and Upper Orthant Value-At-riskDocument37 pagesBivariate Lower and Upper Orthant Value-At-riskMahfudhotinPas encore d'évaluation

- Non-Life Insurance Mathematics (Sumary)Document99 pagesNon-Life Insurance Mathematics (Sumary)chechoPas encore d'évaluation

- Intra-Horizon VaR and Expected Shortfall Spreadsheet With VBADocument7 pagesIntra-Horizon VaR and Expected Shortfall Spreadsheet With VBAPeter Urbani0% (1)

- OCC's Quarterly Report On Bank Trading and Derivatives Activities Third Quarter 2011Document36 pagesOCC's Quarterly Report On Bank Trading and Derivatives Activities Third Quarter 2011eatmenowPas encore d'évaluation

- Credit Recovery ManagementDocument75 pagesCredit Recovery ManagementSudeep Chinnabathini75% (4)

- D4 - Richard Bulmer and Peter EnglandDocument32 pagesD4 - Richard Bulmer and Peter EnglandmarhadiPas encore d'évaluation

- Bloomberg VaR 2064580Document11 pagesBloomberg VaR 2064580KhoyaPas encore d'évaluation

- Planning, Tracking, and Reducing A Complex Project's Value at RiskDocument15 pagesPlanning, Tracking, and Reducing A Complex Project's Value at RiskDaniel DíazPas encore d'évaluation

- Applied Quantitative Finance 5Document423 pagesApplied Quantitative Finance 5rraghavus100% (3)

- 2015 Book InnovationsInQuantitativeRiskMDocument434 pages2015 Book InnovationsInQuantitativeRiskMSam AlexanderPas encore d'évaluation

- Python Financial Modelling PDFDocument54 pagesPython Financial Modelling PDFAmit KumarPas encore d'évaluation

- Chapter 1: Creating SAS Data Sets - The BasicDocument78 pagesChapter 1: Creating SAS Data Sets - The BasicJacky PoPas encore d'évaluation

- Christoffersen (1998)Document28 pagesChristoffersen (1998)Victor RoosPas encore d'évaluation

- Intro To Credit Metrics - JP MorganDocument36 pagesIntro To Credit Metrics - JP MorganHaivaanPas encore d'évaluation

- Risk Management Index OrderedDocument34 pagesRisk Management Index OrderedShruthi SPas encore d'évaluation

- Financial Markets and Institutions: Abridged 10 EditionDocument45 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Thesis Financial Risk ManagementDocument8 pagesThesis Financial Risk Managementsummeryoungnorthlasvegas100% (2)