Académique Documents

Professionnel Documents

Culture Documents

Media Release Results 07

Transféré par

Minh Pham DucDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Media Release Results 07

Transféré par

Minh Pham DucDroits d'auteur :

Formats disponibles

QANTAS ANNOUNCES PROFIT RESULT FOR YEAR ENDED 30 JUNE 2007 AND ON-MARKET SHARE BUY-BACK

HIGHLIGHTS Profit before tax of $1,032 million Net profit after tax of $720 million Revenue of $15.2 billion Earnings per share of 36.4 cents Operating cashflow of $2.4 billion Fully franked ordinary dividend of 15 cents per share, bringing the full year dividend to 30 cents per share On-market buy-back of up to approximately 10 per cent of Qantas shares

SYDNEY, 16 August 2007: Qantas today announced a record profit before tax of $1,032 million for the year ended 30 June 2007, a 53.8 per cent increase on the prior comparative year to 30 June 2006. The Chairman of Qantas, Ms Margaret Jackson, said the net profit after tax of $720 million was also a record, and that the company had generated a return above the cost of capital invested in all the businesses. The profit includes a provision of A$47 million announced on Monday, 13 August, against liabilities Qantas may incur in the United States for involvement in an alleged freight cartel. The Directors declared a fully franked ordinary dividend of 15 cents per share, bringing the full-year dividend to 30 cents per share an increase of 36 per cent and equivalent to a payout ratio of 82.7 per cent.

Qantas Airways Limited ABN 16 009 661 901 Further information and media releases can be found at the Qantas website: qantas.com

2 Ms Jackson said the Directors had also approved an on-market buy-back of up to approximately 10 per cent of Qantas shares which would, when completed, amount to a reduction of capital of over $1 billion. She said the companys cash position had improved by $461 million to $3.4 billion, providing surplus capital to make the share buy-back possible. Ms Jackson said Qantas would fund the buy-back from cash reserves and did not expect it to have an impact on Qantas current BBB+/Baa1 (negative outlook) unsecured credit ratings. We expect the process to commence in September 2007, and will announce the brokers who will undertake the share buy-back on behalf of Qantas shortly, she said. The duration of the buy-back will depend on market conditions and any governance issues that may arise during the buy-back. As well, we have significantly increased our dividend. We believe the dividend can increase further as the companys performance continues to improve. Ms Jackson said the past year had been unsettling for Qantas employees, customers and investors as a result of the Airline Partners Australia (APA) takeover bid. Throughout the bid period, our people operated with their usual high degree of professionalism and dedication. We have now moved on and are concentrating on future growth and opportunities. The Chief Executive Officer of Qantas, Mr Geoff Dixon, said the 2006/07 result and Qantas strong operating position was underpinned by the airlines two-brand strategy. Mr Dixon said the establishment of Jetstar in May 2004 had transformed the Qantas Group's flying businesses. We believe the transfer of 15 per cent of marginal domestic and trans-Tasman flying from Qantas to Jetstar, the transfer of Qantas capacity to better performing domestic routes and increased investment in the Qantas product has improved the Groups bottom line over the past three years by $250 million PBT. For example, Jetstar has realised a PBT of $112 million in 2006/07 from routes that in 2003/04 Qantas either lost money on or realised a very small profit. Similarly, Qantas PBT on the routes to which it transferred its capacity improved significantly. Mr Dixon said the performance of both the Jetstar and Qantas international operations since Jetstar commenced widebody overseas flying in November 2006 indicated the successful strategy will be replicated in the international market. Mr Dixon said the excellent performance of the Groups flying businesses Qantas, QantasLink and Jetstar in international, domestic and regional markets had led to a strong cashflow position. The two-brand strategy has also enabled us to successfully defend our position in the Australian domestic market, where we currently hold a market share of 67.1 per cent, and to offer customers the right mix of product and service.

3 Jetstar has grown domestic leisure travel and quickly established itself in overseas leisure markets, enabling Qantas to concentrate more on business markets with a significant yield premium. Mr Dixon said Qantas position as Australias premium carrier had been enhanced by major investment in new product across its domestic and international aircraft, at airports and in new First class lounges in Sydney and Melbourne. Our new international ground and inflight product is outstanding, and will reinforce the airlines position amongst the worlds best premium airlines. Our continued focus on customer service throughout the year saw customer satisfaction ratings continue to reach high levels. Qantas was named among the top five airlines in the world for the fifth consecutive year in this years Skytrax Awards, which is the worlds largest passenger survey, with Jetstar named the worlds best low cost airline. This is a great achievement for the Group and a tribute to our people, he said. In recognition of the contribution by all our staff to our strong result, the Board has approved granting $1,000 worth of shares and a cash bonus of $1,000 to all eligible employees. Mr Dixon said the main contributions to the full-year result, apart from the success of the two-brand strategy, were: the robust economic environment, domestically and internationally, with high levels of demand in both business and leisure markets leading to a 6.9 per cent yield improvement and a 3 percentage point improvement in seat factor to 79.9 per cent; a significant improvement in international operations and continuing improvement in domestic operations, driven by high yields and loads; and continued pressure on the cost base, with unit costs improving by 1.9 per cent following a further $753 million in efficiencies achieved by the Sustainable Future Program. Mr Dixon said fuel costs remained an enormous challenge for aviation, with costs rising by over $500 million between 2005/06 and 2006/07. Our fuel bill for the year totalled $3.3 billion a 19.1 per cent increase on the prior year. We are also facing increasing levels of competition, with State-owned Middle East hub carriers poised to increase significantly their Australian capacity, new low cost labour entrants Tiger Airways and Air Asia X, and Virgin Blue commencing trans-Pacific services in 2008. Mr Dixon said the considerable gains Qantas had made since privatisation in 1995 had enabled it to build a base from which to meet the increasing competitive challenges. However, it was important that the airline continued to contain costs and increase flexibility to support a $25 billion investment in aircraft for future growth. We are on track to achieve our Sustainable Future target of $3 billion by June 2008 and remain focused on costs as we grow by using lower cost production schedules and developing our shared services model to drive greater efficiencies, he said.

4 Mr Dixon said that going forward, the extension of the companys successful business segmentation program a process that had been accelerated following the APA bid would be a major focus. We believe we can unlock further value from our individual businesses and work is underway across the company most notably in our Frequent Flyer, Freight, Fleet and Holiday divisions. We are looking at potential new ownership structures and strategic acquisitions. We expect to make announcements during the current financial year on the future direction of these businesses. Mr Dixon said the process included: finalising the review of the Frequent Flyer program, which was aimed at identifying options to drive greater customer benefits including a broadening of program partners, offering any seat redemption and including a Jetstar loyalty program; working towards separation of Qantas freight and logistics operations, which would focus on growth in Australia and Asia; evaluating alternatives for creating a separate vehicle to finance some or all of the Qantas Group fleet; and continuing to evaluate potential partnership or consolidation opportunities with US, European and Asian airlines. Mr Dixon said key areas of interest over the coming year would include: the continued aggressive growth of Jetstar, which would take delivery of nine A320 aircraft between December 2007 and March 2009 for domestic growth and additional A330s by September this year for its international operations, taking its A330 fleet to six ahead of its first B787 in 2008; Jetstars Asian expansion in association with Jetstar Asia and Pacific Airlines, in which Qantas recently acquired an important stake; investment in key Qantas growth routes of China and India, as well as an enhanced focus on major business routes to the USA, UK, Hong Kong and South Africa and development of a new route to South America; growing capacity on key QantasLink regional services through the delivery of two additional new Q400 aircraft in January 2008; and the development of shared services initiatives such as the new Qantas pilot training facility, which would open by the end of 2007 and train pilots for the airlines across the Group. Mr Dixon said that following the settlements reached recently by British Airways and Korean Airlines with the US Department of Justice regarding freight and passenger surcharge investigations, Qantas had provided US$40 million for a potential settlement in that jurisdiction. He said Qantas was continuing to cooperate with regulators in other countries concerning similar investigations in those jurisdictions. These investigations and outcomes could extend for several years.

5 Outlook The first six weeks of 2007/08 have been very strong for all our flying businesses and forward bookings are equally buoyant through to the end of the calendar year. As a result, and subject to no major deterioration in market conditions, we are expecting another good profit in 2007/08, which we are currently expecting to be around 30 per cent higher than the 2006/07 profit before tax result. Group Revenue Total revenue for the full-year was $15.2 billion, an increase of $1.5 billion or 11.0 per cent on the prior year compared to capacity growth, measured in Available Seat Kilometres (ASK), of 3.4 per cent. Net passenger revenue including fuel surcharge recoveries increased $1.4 billion or 13.4 per cent to $11.9 billion. Traffic, measured in Revenue Passenger Kilometres (RPK), increased by 7.4 per cent while yield improved by 6.9 per cent. Excluding unfavourable foreign exchange rate movements, net passenger revenue was up 13.7 per cent, with yield improving 7.2 per cent. Other revenue categories increased by $82 million or 3.6 per cent and included the $97 million in liquidated damages from Airbus and a 1.7 per cent improvement in freight revenue from stronger freight yields. Expenditure Total operating expenditure increased by 8.2 per cent or $931 million to $12.3 billion, excluding borrowing costs and future ineffectiveness on open derivatives. Total fuel costs increased by $535 million to $3.3 billion. The increase included $555 million due to fuel price rises after hedging, reflecting an average into-plane fuel price rise of 19.8 per cent. A 2.9 per cent increase in consumption from activity growth increased costs by $93 million while favourable foreign exchange rate movements reduced fuel costs by $126 million. Manpower and staff related costs increased by $13 million or 0.4 per cent. Capacity growth, EBA wages and salary increases were offset by cost saving initiatives and productivity improvements of $238 million under the Sustainable Future Program (SFP). Business restructuring costs increased by $45 million to a total of $152 million, including an additional $39 million in redundancy costs under SFP with a total of 1,487 managed redundancies effected or announced during the period. Aircraft operating variable costs increased $91 million or 3.6 per cent to $2.6 billion, reflecting higher activity and price related increases, particularly domestic airport charges, offset by cost saving initiatives and capitalised maintenance costs as required under A-IFRS. Financing charges including depreciation, non-cancellable operating lease rentals and net interest increased by 8.0 per cent or $133 million. Depreciation expense included an additional $15 million on new aircraft deliveries, spares and leasehold improvements, $45 million from a change in aircraft modification depreciation policy and $59 million in depreciation on capitalised maintenance costs as required under A-IFRS. The increase in operating lease charges largely reflects the full year effect of Jetstars A320 aircraft. Net interest costs decreased $40 million due to higher average cash balances. Open hedge positions resulted in ineffective derivative losses of $54 million for the current year ($81 million variance to the prior year) due to timing differences from the recognition of future hedge instruments under A-IFRS.

6 Net Impact of Foreign Exchange Rate Movements The net effect of foreign exchange rate movements on overall profit before tax was a favourable impact of $2 million (after recognition of a $20 million provision due to the adverse impact of foreign exchange rate movements on the future return value of leased aircraft). Sustainable Future Program The Sustainable Future Program is on track to achieve its $3 billion target by June 2008. Benefits delivered across the Group under the Program totalled $753 million for the year. These benefits comprised labour savings of $238 million, distribution savings of $192 million and $323 million in fleet, product and overhead initiatives. Restructuring costs associated with the Sustainable Future Program totalled $221 million, including $134 million in redundancy payments and provisions. Group Unit Costs Net expenditure cost per ASK increased by 8.1 per cent. Much of these higher costs were driven by fuel price increases, the costs of restructuring under the Sustainable Future Program, provisions for potential penalties relating to freight cartel investigations and accounting changes. Adjusting for these items unit costs rose 0.9 per cent. Qantas has continued to focus on its premium passengers, investing heavily in product which led to a significant yield improvement. After adjusting for product and load related costs, costs fell by 1.9 per cent. Qantas Brands PBT for Qantas Brand operations (including QantasLink and Australian Airlines) totalled $773 million, an increase of $233 million or 43 per cent on the prior year. The Qantas Brands result includes the $221 million in restructuring costs, the $81 million open derivative ineffectiveness, the A$47 million freight investigation provision and the $97 million in compensation for the late delivery of aircraft. Adjusting for these items, the Qantas Brands underlying result was $993 million, a 77 per cent increase on the prior year. Qantas International experienced a significant turnaround during the year. In addition, QantasLinks results showed a twofold improvement. Passenger revenue increased by 11.5 per cent, including fuel surcharge recoveries, reflecting an 8.4 per cent improvement in yield and a 3.4 point increase in seat factor to 80.6 per cent. Net expenditure increased by 9.6 per cent, predominantly due to the impact of fuel price increases. Jetstar Brands Jetstar A320 operations, which include domestic Australia, Trans-Tasman and short-haul international, achieved a PBT of $112 million or a four-fold increase on the comparative year result of $23 million. Passenger revenue increased by $269 million or 42.9 per cent on a 33.7 per cent increase in capacity reflecting the expansion of the Jetstar domestic network, twelve months of Trans-Tasman flying and the transition to an all A320 fleet.

7 Net operating expenditure increased by $180 million or 29.8 per cent which was largely attributable to higher fuel prices and aircraft lease costs. Total expenditure per ASK for A320 operations was 7.53 cents, a reduction of 4.1 per cent on the prior year. Jetstar International commenced operations with an interim fleet of A330-200s on 23 November 2006 with the inaugural flight from Melbourne to Bangkok followed by services to Phuket commencing on 24 November 2006 and Sydney-Ho Chi Minh City operations from 30 November. In December 2006, Jetstar International commenced flying to Bali and Honolulu and in March 2007 commenced services to Osaka. Jetstar International contributed a small profit of $3 million in its first year of operations (excluding start up costs). Market Share Total Qantas Group international market share was 31.2 per cent based on the latest Bureau of Transport and Regional Economics (BTRE) statistics for the April 2007 year to date period, a 0.1 point increase on the prior year. Total Qantas Group domestic market-share for the 11 months to May 2007 as reported by the BTRE was 67.1 per cent, a 0.9 point increase on the prior year. Qantas Holidays Qantas Holidays reported a full year PBT of $47 million, which represents a $2 million improvement on the prior year. The continued trend of consumers to unbundle domestic and point-to-point international travel resulted in lower passenger volumes, although these have been offset by a recovery in key outbound destinations, including Thailand and Hong Kong, stronger inbound volumes and a growth in reseller volumes. Bookings through the Ready Rooms on-line channel have also seen substantial growth, increasing over 60 per cent on the prior year. Qantas Flight Catering Group Qantas Flight Catering (QFC) achieved a PBT of $33 million, 11 per cent down on the prior year. This reflected lower client volumes, including the cessation of services on behalf of Malaysia Airlines and lower Qantas volumes from the transfer of some domestic services to Jetstar. The reduced activity resulted in lower material costs and labour savings. QFC has begun a change management program at its Sydney facilities, which is expected to take up to two years, that will see the establishment of a client only facility at Caterair Sydney with Qantas only volumes being delivered from the existing QFCL facility. Cash Flow and Balance Sheet Net cash held at 30 June 2007 was $3,363 million, an increase of $461 million compared to 30 June 2006. Cash flow from operations totalled $2,353 million, an increase of $327 million or 16.2 per cent, which largely reflects increased after-tax earnings.

8 Net capital expenditure totalled $1,236 million and included the purchase of three new Bombardier Dash 8-Q400 aircraft, progress payments on A380, A330, B738 and B787 aircraft, modifications, spares and related equipment. Net cash outflows from financing activities totalled $672 million, and included $414 million in dividend payments and net debt repayments of $260 million. The book debt to equity ratio (including operating leases and the hedge reserve) at 30 June 2007 was 39.61 compared to 45:55 at 30 June 2006. Earnings per share (EPS) was 36.4 cents per share. Final Dividend The full year dividend of 30 cents per share reflects a fully franked dividend yield of 8.1 per cent (based on yesterdays share price of $5.28). The final ordinary dividend of 15 cents per share is payable on Wednesday, 26 September 2007 with a record date (books close) of Friday, 31 August 2007. The Dividend Reinvestment Plan will remain suspended.

Issued by Qantas Corporate Communication (Q3639) Media inquiries: Belinda de Rome Tel 02 9691 3762

Vous aimerez peut-être aussi

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Calgary Newcomers Guide EnglishDocument5 pagesCalgary Newcomers Guide EnglishyycalexhuPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 5140c BrochureDocument8 pages5140c BrochurealexPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Master of Commerce: 1 YearDocument8 pagesMaster of Commerce: 1 YearAston Rahul PintoPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Pedido LFDocument81 pagesPedido LFgonzalo rodriguezPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Coal Trader InternationalDocument18 pagesCoal Trader InternationalI Gede Artha WijayaPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Scooptram ST14Document4 pagesScooptram ST14LEMAPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Pakistan Railway1Document48 pagesPakistan Railway1Sam's CollectionPas encore d'évaluation

- PronPack3 Worksheet 3-1Document5 pagesPronPack3 Worksheet 3-1BryonyPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Ntorq Cat 21 3 18Document39 pagesNtorq Cat 21 3 18David ManjgaladzePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Chapter 5 - TrafficDocument10 pagesChapter 5 - TrafficMercy Temblor LibrePas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Lrs 3Document1 pageLrs 3Ken Lee100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- International Bank for Reconstruction & Development - Project Appraisal Document on a proposed loan in the amount of US$50M to the Republic of FIji for a Transport Infrastructure Investment Project - 05 Feb 2015Document79 pagesInternational Bank for Reconstruction & Development - Project Appraisal Document on a proposed loan in the amount of US$50M to the Republic of FIji for a Transport Infrastructure Investment Project - 05 Feb 2015Seni NabouPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- C10752595 PDFDocument208 pagesC10752595 PDFmohamedIGCMO100% (1)

- ExportDocument32 pagesExportSumit KumarPas encore d'évaluation

- Traffic Survey Manual and User GuideDocument37 pagesTraffic Survey Manual and User Guidephanna0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Craftsman Garden Tractor Owners Manual L0901647 PDFDocument72 pagesCraftsman Garden Tractor Owners Manual L0901647 PDFFrank SnyderPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Electronic Governor System: Main BenefitsDocument2 pagesElectronic Governor System: Main Benefitsredchaoz0% (1)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Nautical Institute's NavigatorDocument12 pagesNautical Institute's NavigatorClaudine UnianaPas encore d'évaluation

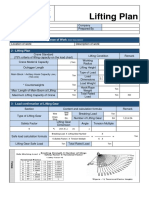

- Lifting PlanDocument2 pagesLifting PlanDoo PLTGU86% (37)

- Ashok Leland Produce Varius VehiclesDocument37 pagesAshok Leland Produce Varius VehiclesRiddhesh PatelPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Port ClearanceDocument98 pagesPort Clearanceduckerz28Pas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Case Study 8.6: Transformation in The Automobile IndustryDocument4 pagesCase Study 8.6: Transformation in The Automobile IndustryUmar100% (1)

- BMW DrivesDocument7 pagesBMW DrivesJay ShahPas encore d'évaluation

- Hoval Compactgas (700-2800) : Technical Information Installation InstructionsDocument32 pagesHoval Compactgas (700-2800) : Technical Information Installation InstructionsSegaran SickenPas encore d'évaluation

- Dynapac F1200C FW1200CSDocument296 pagesDynapac F1200C FW1200CSPilaf1100% (1)

- MVP Health Care Chapter20 ExternalCausesMorbidityDocument55 pagesMVP Health Care Chapter20 ExternalCausesMorbidityAnonymous OOJjtp86F50% (1)

- Streetscape PPT 1wc6ztdDocument24 pagesStreetscape PPT 1wc6ztdNikhil Nandakumar100% (1)

- Notification - Painting Competition - 125 YearsDocument3 pagesNotification - Painting Competition - 125 Yearsvandana PanwarPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Travel 6Document177 pagesTravel 6daeng anchakPas encore d'évaluation

- Bulletin 15Document815 pagesBulletin 15Shahid ShabirPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)